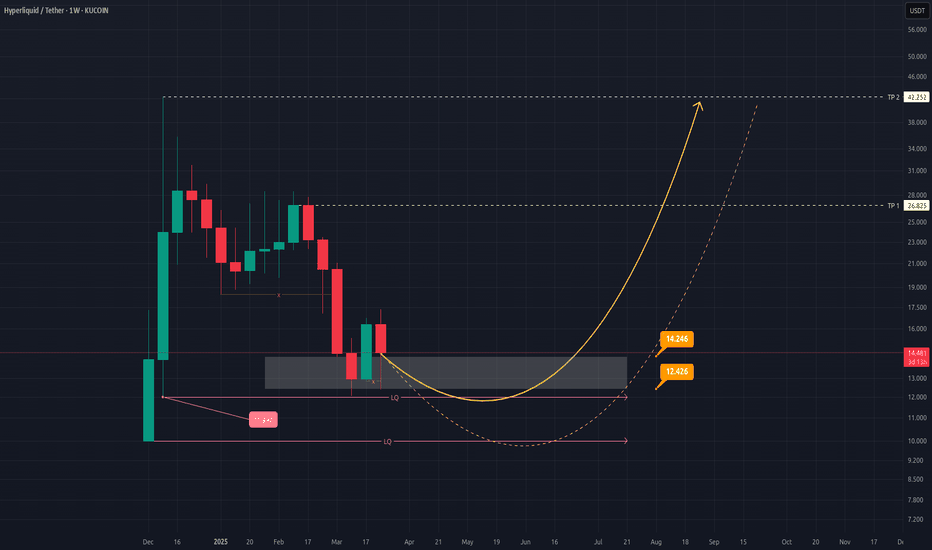

HYPEUSDT Weekly Outlook: Potential Reversal and Upside TargetsWeekly Chart Analysis of HYPEUSDT

The weekly chart of HYPEUSDT reflects a critical phase where the price is consolidating within a key demand zone, suggesting potential for a bullish reversal. Below is the detailed analysis:

Key Observations:

Demand Zone: The price is currently hovering around the highlighted gray box, which represents a strong liquidity zone ( LQ ) between $12.426 and $14.246 . This area has historically acted as support, and a bounce from here could signal a reversal.

Support Levels:

Immediate support lies at $12.426 .

A deeper correction could test the $11.997 and $10.000 levels, which are marked as liquidity levels below the current zone.

Bullish Scenario:

If the price holds above the current demand zone, it could initiate a rounded bottom pattern (illustrated by the yellow curved line).

The first target ( TP1 ) for this potential upside move is $26.825 .

The second target ( TP2 ), representing a more extended rally, is projected at $42.252 .

Candlestick Structure: Recent weekly candles show indecision, but if buyers step in strongly, it could confirm bullish momentum.

Risk Management:

Traders should monitor for any breakdown below the $12.426 level, as it may invalidate the bullish setup and lead to further downside toward $10.000 .

Conclusion:

HYPEUSDT shows promising signs of recovery from its demand zone, with upside targets at $26.825 and $42.252 in sight if bullish momentum builds. However, caution is advised until clear confirmation of reversal occurs.

This analysis provides a roadmap for both short-term and long-term traders to plan their entries and exits effectively.

Longcrypto

BTCUSD Now +73,000 pumping so hard to take March high today

Bitcoin has absolutely exploded with upside movement during the last couple of sessions, even yesterday during New York trading, Cryptocurrency had a smashing day and I did not even have to look at the charts to understand that Bitcoin BTCUSD was on its way to take the March High.

Well if you don't own any Cryptocurrency, for educational purposes only, it's always a good idea to buy Bitcoin or stock/currency BEFORE the breakout, when price will go up very fast in line with how much Bitcoin is breaking out.

My next profit target for BTCUSD is not 120,000 which is where I think it will make very quickly after it explodes upwards in price following the break above the Huge CUP pattern on the Weekly chart. BTCUSD price is at time of writing is 73,150 approximately.

Prior to Cryptocurrency prices going into a frenzy following such a breakout, some other Crypto names that are solid and safe performers are DOGEUSD, TRXUSD, SOL & of course BTCUSD the number 1.

Market Cycle - Accumulation - KEYUSDKEYUSD - Selfkey - weekly chart

Here, I use the FIB to show my thoughts on potential targets for KEY in the coming Bull Cycle.

You can see that the 3.618 FIB purple line, has been where the past few cycles on KEY have targeted. I have noticed this on MANY coins.

If this plays out, we could potentially see 15X on KEY from current levels in the next bull market, after BTC halving, I suppose. No one knows, but that's what I assume.

Not financial advice just my 2cents.

Please FOLLOW, LIKE, SHARE for more!

[LONG] TokenFi's "Token" Cryptocurrency Tokenizing assetsFrom the makers of "Floki" cryptocurrency comes Tokenfi. Tokenizing assets on the blockchain. Currently Floki has a 335 Million dollar market cap. All that money can easily be transferred to Tokenfi's Token and that is what is currently happening. They are using that money to pump Tokenfi.

TokenFi's Token cryptocurrency (TOKEN) is a native token for the TokenFi platform, a crypto and asset tokenization platform that aims to capitalize on the trillion-dollar tokenization industry. TokenFi was launched on October 31, 2023.

TokenFi allows users to launch any cryptocurrency without writing code. Users can then raise funds from the Floki community, connect with exchanges and market makers for liquidity, and float tokens tied to real-world assets that are not deemed securities.

TOKEN is used for a variety of purposes on the TokenFi platform, including:

Paying for fees associated with launching and managing tokens

Staking to earn rewards and participate in governance

Voting on proposals related to the TokenFi platform

Accessing exclusive features and benefits

TOKEN is a relatively new cryptocurrency, but it has already gained some traction in the market. It is currently trading on several major exchanges, including Uniswap and PancakeSwap.

Raised over $500,000 in its initial launch

Staked by users to earn rewards and participate in governance

Used to vote on proposals related to the TokenFi platform

Provided access to exclusive features and benefits for holders

TokenFi's Token cryptocurrency has had a successful launch and is well-positioned to grow in popularity as the tokenization industry continues to develop.

Developing A Dollar Bearish Strategy Using The Scientific MethodShould I Short USD? Yes or No?

If yes, then how? If no, then why?

The question is simple, but the answer may be complicated.

Therefore, we will dive into the macroeconomics of the American economy, with consideration given the most significant factors influencing the value of USD.

> OBSERVATIONS

1) Since March 2020, USD appears to have lost approximately 13% of it's market value.

2) Since March 2020, USD supply increased by $9.1 Trillion (COVID stimulus).

datalab.usaspending.gov

3) Congress was recently asked to approve an additional $1.9 Trillion (COVID stimulus).

context-cdn.washingtonpost.com

> RESEARCH

Part A: Three major external factors contribute to the value of USD...

www.investopedia.com

1) Supply and demand:

Exporting American products and services creates demand for USD, because foreign investors must exchange their currency for USD, in order to complete the transaction.

Note: decreased exports = decreased demand = decreased USD value

Note: decreased stock/bond issuance = decreased demand = decreased USD value

2) Sentiment and market psychology:

Rising unemployment weakens the economy, reduces income, and slows consumption. If the US economy appears weak, foreign investors may sell-off their US securities, in favor of exchanging back to their national currency.

Note: decreased employment = decreased consumption = decreased USD value

Note: negative sentiment = decreased foreign investment = decreased USD value

3) Technicals:

The release of government statistics (payroll data, GDP data, etc.) may help quantify whether the economy is strong or weak. Historical patterns generated by cyclical support/resistance levels and technical indicators also contribute to the movement of USD.

Gross domestic product (GDP) is the total value of all the finished goods and services produced (in this case, within American borders)

www.investopedia.com

Note: decreased employment = decreased GDP = decreased USD value

Part B: Four major internal tools (utilized by the Fed) contribute to the value of USD...

www.federalreserve.gov

1) Discount rate:

The interest rate reserve banks charge commercial banks for short-term loans.

2) Reserve requirements:

The portions of deposits that banks must hold in cash in vaults or on deposit.

3) Open market operations:

The buying and selling of U.S. government securities (T-bills, bonds, and notes).

4) Interest on Reserves:

The interest paid on excess reserves held at reserve banks.

> HYPOTHESIS

Shorting USD will be profitable because the Fed is increasing money supply.

Shorting USD will be profitable because the Fed is maintaining interest rates near zero.

Shorting USD will be profitable because the Fed is maintaining reserve requirements at zero.

Shorting USD will be profitable because the Fed is repurchasing government bonds on the open market.

> EXPERIMENT

Part A: Build a diversified dollar bearish portfolio.

Include dollar bearish securities and commodities (FXC, FXE, UDN, GLD, IAU, DBC, DBP)

Include International stock and emerging markets ETFs (open to all suggestions for this)

Include foreign currencies (GBP, CAD, AUD, CNY, CHF, KRW, JPY, EUR)

Include crypto currencies (BTC, ETH, LTC, and especially the DeFi sector)

> RESULTS

Pending... follow me for a monthly update to see if I get rekt, much love!

CRYPTO and Bitcoin due for a big bounceChart Overview

The chart overview shows the total market cap for cryptocurrency.

Here are a few points to make on why I believe Crypto and Bitcoin price is due for an upswing reversal.

1) The price has been moving down in a reducing wedge pattern.

2) The price bounced from a key price point (1.992 trillion dollars, the light blue line)

3) Bitcoin also shows strong confluence with july 2021 prices which suggests a bounce is imminent

4) A previous reducing wedge pattern resulted in september resulted in a fairly extended bullish rally for Crypto

5) Bitcoin Prices are very low, although not registering at bargain prices on the RSI yet, it still almost 30k down from ATH, it's quenstionable if the bears have any strength to bring Bitcoin and Crypto lower, it took a lot of effort to pass the 43k barrier.

What do you guys think? Is a bounce imminent or have we got more low prices ahead?

Thanks for reading.

DISCLAIMER: NOT PROFESSIONAL ADVICE

Helium Looks Ready for Round 2!! BINANCEUS:HNTUSD has strong fundamentals and news that continues to shine even during the recent pullback. If today’s Daily candle can close over the 23.6 fib extension then we could see nice price action back to $40 plus range. If you haven’t purchased any $HNT yet I highly recommend looking into their project. Continue to monitor $HNT as they keep releasing new 5g news! Look in to HNT mining if you haven't heard of it yet.

Trade : Daily close over $34.8 price level would signal a solid entry for a swing trade.

Risk : You could risk off of the 50 EMA convergence zone and edge of HVN at about $33.75. This would give you roughly 8% SL.

Profit : Profit taking would come in around $40-$41 as this is edge of the next HVN as well as 38.20% fib extension and fib retracement on the daily chart. This is almost a 2-1 R:R. Not the most appealing but HNT is such a great long term investment IMO.

As always DYOR - Not Financial Advice!

MATIC/USDT LONGBINANCE:MATICUSDT

MATIC/USDT chart just formed Cup & handle pattern in 1h time frame which is targeting 20% after breakout the first purple line to Second one which is mean we can observe new all time high soon (in my opinion).

This is NOT financial advice.

this pattern might succeed to reach the target or might not.

your thoughts guys?

EOS is on Sale! Support Held!Look at that. We pulled back right to the .382 and defended it like a boss!!

Seems like we hit my support zone pretty spot on and are now turning back upward. MACD looks good and the RSI has a crossover and retest.

We pulled back almost exactly to the previous wave 4, and that pink line connects to the previous highs which we're now still holding above. As long as we hold above 5.50 the bullish case stands.

Multiple confluent factors say this is a buy for me.

Just picked me up a bunch at $6.15. Booyah.

My target for this bull cycle is $110, but hopefully if goes much much higher.

Have high hopes for EOS, XLM, and STAKE. All competitor blockchains to ETH.

Not financial advice.

Stratis - A bright potential future indeedMedium-Long term trade.

Picked up some big bags of Stratis right here and now.

*This is my opinion, my risk and funds and my trade - not direct investment advice, just sharing guys.

Target I expect to reach can be hit within just a few weeks or up to potentially about 18 months.

I will sell for loss as marked on the chart should bottom break and we collapse - no use going totally broke if the idea is bad ;)

As always much love to you guys, do like/share/fluff my ego if you dig it.

Good hunting to all *throws a smoke grenade and disappears to the sound of wind chimes*

xoxo MysticCrypto

XEMBTC- Descending Triangle BINANCE:XEMBTC

After breaking the 1500 resistance price tested the 1660 resistance and has retraced to 0.618 fib level Fib level has been holding and a descending triangle has formed (4H Chart)

30 min Chart showing bullish rsi divergence We could see a potential breakout.