3270, waiting for new ATH gold price⭐️GOLDEN INFORMATION:

Gold prices eased during Monday's Asian session as risk sentiment improved, prompting a shift away from safe-haven assets. The upbeat market tone followed Wall Street’s strong rebound on Friday and encouraging developments in the ongoing US–China tariff dispute, temporarily reducing upward pressure on the yellow metal.

Last week, China retaliated against the US’s 145% tariff hike by imposing 125% duties on American goods but later signaled it would not respond to any additional escalations. Over the weekend, President Donald Trump floated the idea of targeting Chinese semiconductors and electronics with a separate 20% tariff—indicating a possible shift in strategy from across-the-board tariffs to more focused trade measures.

⭐️Personal comments NOVA:

Gold price, buying volume maintained, continuing the upward trend: 3260, 3270

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3270- 3272 SL 3277

TP1: $3260

TP2: $3250

TP3: $3240

🔥BUY GOLD zone: $3168 - $3166 SL $3161

TP1: $3175

TP2: $3190

TP3: $3200

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Longgold

keep aiming for new ATH next week✍️ NOVA hello everyone, Let's comment on gold price next week from 04/14/2025 - 04/18/2025

🔥 World situation:

Gold extended its remarkable rally for a third consecutive session on Friday, surging to a fresh record high of $3,245 amid intensifying US–China trade tensions. The precious metal posted impressive gains of over 2% as fears of a prolonged trade war and its potential fallout on the global economy sent investors flocking to safe-haven assets. At the time of writing, XAU/USD is trading around $3,233.

The North American session saw China retaliate with a 125% tariff on US imports, following President Donald Trump’s move to raise tariffs on Chinese goods to 145%. The heightened geopolitical strain triggered a flight to safety, propelling Gold higher. Further fueling the rally was a sharp decline in the US Dollar, which tumbled to a near three-year low, with the US Dollar Index (DXY) falling to 99.01.

🔥 Identify:

The huge growth shows no signs of stopping, gold prices continue to benefit from tariff policies, continue to find new ATH early next week

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3255, $3280

Support : $3157, $3070

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

growth - new ATH - gold hits 3246⭐️GOLDEN INFORMATION:

Trump announced Wednesday that tariffs would be temporarily reduced for dozens of countries, offering a short-term reprieve. However, he simultaneously hiked tariffs on Chinese imports to 125% with immediate effect, following Beijing’s retaliatory move to impose 84% duties on US goods. The escalating trade conflict between the world’s two largest economies has reignited concerns over global growth, prompting investors to seek refuge in safe-haven assets like Gold.

“Gold is reclaiming its safe-haven status and appears poised to chart fresh all-time highs,” said Nikos Tzabouras, Senior Market Analyst.

Meanwhile, scaled-back expectations for aggressive Federal Reserve rate cuts could lend support to the US Dollar, potentially limiting gains for the USD-priced metal. That said, traders still anticipate the Fed will begin easing in June, with markets pricing in a full percentage point of rate reductions by year-end.

⭐️Personal comments NOVA:

Gold price continues to increase greatly, the fomo market and attention are focused on the gold investment channel: safe, continue to find new ATH zones

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3245- 3247 SL 3252

TP1: $3230

TP2: $3210

TP3: $3190

🔥BUY GOLD zone: $3168 - $3166 SL $3163 scalping

TP1: $3175

TP2: $3183

TP3: $3190

🔥BUY GOLD zone: $3134 - $3132 SL $3127

TP1: $3145

TP2: $3160

TP3: $3175

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

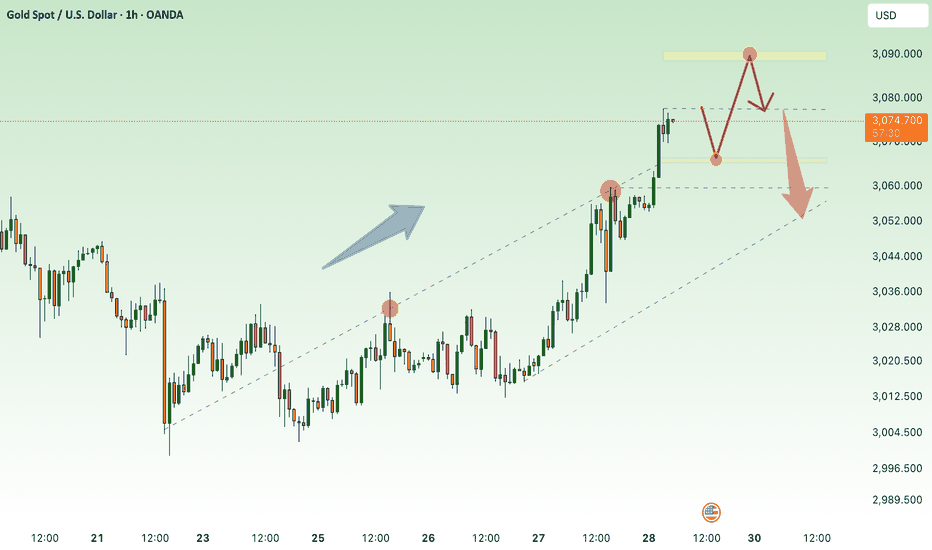

Tariff highlights, gold price up or down ?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) find support from dip-buyers during the Asian session on Wednesday, pausing the previous day’s pullback from a fresh record high. Investors continue to seek shelter in safe-haven assets amid uncertainty surrounding US President Donald Trump’s sweeping reciprocal tariffs and their potential repercussions on the global economy.

Additionally, escalating geopolitical tensions provide further support for bullion. Mounting concerns over a potential US recession, coupled with growing expectations of additional Federal Reserve (Fed) rate cuts, fuel demand for the non-yielding yellow metal.

⭐️Personal comments NOVA:

Gold price is still in a very stable uptrend, market tariff information waiting for the next price increase fomo

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3173 - 3175 SL 3180

TP: 3165 - 3150 - 3140

🔥BUY GOLD zone: $3058 - $3060 SL $3053

TP1: $3070

TP2: $3080

TP3: $3090

🔥BUY GOLD zone: $3106 - $3108 SL $3103 scalping

TP1: $3113

TP2: $3118

TP3: $3125

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

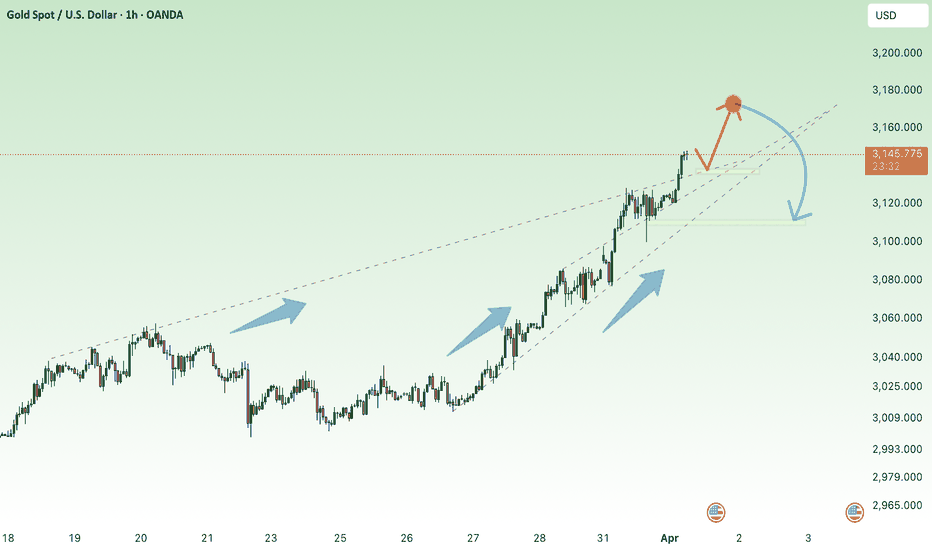

New ATH , GOLD is comming 3173⭐️GOLDEN INFORMATION:

US President Donald Trump dismissed expectations that the new tariffs would target only a select group of nations with the largest trade imbalances, declaring on Sunday that reciprocal tariffs would apply universally. This announcement, coupled with the existing 25% duties on steel, aluminum, and auto imports, has intensified fears of an escalating global trade war.

Additionally, investors are increasingly convinced that the economic slowdown triggered by these tariffs will pressure the Federal Reserve (Fed) to resume rate cuts, despite persistent inflation concerns. As a result, Gold has surged to a fresh record high, marking its strongest quarterly performance since 1986.

⭐️Personal comments NOVA:

The backdrop of everything from technical to political and economic is supporting the increase in gold prices in the first quarter of 2025. Gold prices have the highest growth in history.

⭐️SET UP GOLD PRICE:

🔥 ATH : SELL 3162 - 3164 SL 3169

TP: 3155 - 3140 - 3127

🔥BUY GOLD zone: $3093 - $3091 SL $3086

TP1: $3100

TP2: $3110

TP3: $3120

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

ATH 3127, continues to aim for big growth⭐️GOLDEN INFORMATION:

Gold's record-breaking rally continues unchecked as buyers push prices past the $3,100 milestone for the first time ever. Mounting concerns over a potential global trade war and rising stagflation risks in the United States (US) have further fueled demand for the safe-haven metal, reinforcing its status as a store of value.

A recent report from The Wall Street Journal (WSJ) suggests that US President Donald Trump may introduce even higher and broader reciprocal tariffs on April 2, known as “Liberation Day.” This prospect has sent fresh waves of risk aversion rippling through global markets, amplifying investor uncertainty.

⭐️Personal comments NOVA:

Tariff pressure, fears of trade war outbreak in April. Gold price is growing continuously, expected to reach 3127

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3126 - $3128 SL $3133

TP1: $3120

TP2: $3110

TP3: $3100

🔥BUY GOLD zone: $3092 - $3094 SL $3087

TP1: $3098

TP2: $3103

TP3: $3110

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Reciprocal tariffs - gold continues to rise✍️ NOVA hello everyone, Let's comment on gold price next week from 03/31/2025 - 04/04/2025

🔥 World situation:

Gold prices surged on Friday, reaching a new all-time high of $3,086 as uncertainty surrounding US trade policy and an uptick in the Federal Reserve's (Fed) preferred inflation gauge fueled demand for the safe-haven metal. Following this, market sentiment suggests growing confidence that the Fed will implement two rate cuts in 2025. At the time of writing, XAU/USD trades at $3,079, up 0.79%.

Investor sentiment remains cautious as markets brace for April 2, dubbed “Liberation Day” by US President Donald Trump, who has signed an executive order imposing a 25% tariff on all imported automobiles. This move has sparked global reactions, particularly from Canada and the European Union (EU), both of which are preparing retaliatory measures in response to the tariffs.

🔥 Identify:

Gold price moves up, early April will continue to explode to NEW Ath

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3100, $3132, $3150

Support : $3002, $2957

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Safe Haven Demand - Gold Makes New ATH 3089⭐️GOLDEN INFORMATION:

This triggered swift responses from global leaders, with Canada and the European Union (EU) vowing to retaliate against President Trump’s trade measures.

In the US, the labor market remains resilient, as reflected in the latest unemployment claims report, while the economy continues to show strength following the release of fourth-quarter 2024 Gross Domestic Product (GDP) data. Although housing data saw some improvement, it confirmed the broader slowdown in the sector.

Meanwhile, money markets have factored in 64.5 basis points of Federal Reserve rate cuts for 2025, according to interest rate probabilities from Prime Market Terminal.

⭐️Personal comments NOVA:

growth, gold becomes a safe haven investment channel. continue to create new ATH

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3088 - $3090 SL $3095

TP1: $3080

TP2: $3070

TP3: $3060

🔥BUY GOLD zone: SCALPING: 3066, 3057

🔥BUY GOLD zone: $3034 - $3032 SL $3027

TP1: $3040

TP2: $3050

TP3: $3060

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

breakout - gold price rebounds 3045⭐️GOLDEN INFORMATION:

Gold prices remained stagnant late in the North American session, constrained by a rebound in the US Dollar Index (DXY), which initially dipped to 104.18 before recovering. The turnaround came after the White House confirmed that President Donald Trump would unveil new automobile tariffs around 22:00 GMT. As of writing, XAU/USD is trading at $3,019, showing little change.

Despite reports from The Wall Street Journal suggesting that Trump may introduce limited tariff measures, including on automobiles, bullion traders struggled to find momentum. Meanwhile, the DXY, which measures the Greenback against a basket of six major currencies, climbed 0.32% to 104.55, further weighing on gold’s appeal.

⭐️Personal comments NOVA:

Gold price recovers, breakout of H1 frame. With the latest 25% car tax policy, gold price reacts strongly and increases again.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3045 - $3047 SL $3052

TP1: $3038

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3023 - $3021 SL $3016

TP1: $3030

TP2: $3040

TP3: $3057

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Start adjusting before April tariff policy ! XAU ✍️ NOVA hello everyone, Let's comment on gold price next week from 03/24/2025 - 03/28/2025

🔥 World situation:

Gold prices decline for the second consecutive day but remain on track to close the week in positive territory, despite a stronger US Dollar (USD) and profit-taking ahead of the weekend. XAU/USD is currently trading at $3,019, down 0.81%.

Market sentiment remains cautious, though US equities are paring earlier losses. Meanwhile, bullion stays on the defensive as the USD regains momentum, with the US Dollar Index (DXY) edging up to 104.05, marking a 0.24% increase.

🔥 Identify:

Gold prices are in a short-term downtrend in the H4 frame, adjusting at the end of March, accumulating before tax policies in early April 2025.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3057, $3080

Support : $2982, $2910

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

When will the gold price adjust down?⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) enter a phase of bullish consolidation near their record high, as traders take a cautious stance ahead of the highly anticipated Federal Open Market Committee (FOMC) policy decision on Wednesday. The consensus widely expects the Federal Reserve (Fed) to maintain the federal funds rate within its current range of 4.25% to 4.50%. Consequently, market attention will be centered on the Fed’s updated economic projections and Chair Jerome Powell’s post-meeting remarks, which could offer crucial insights into the future trajectory of interest rate cuts. These developments will be instrumental in shaping US Dollar (USD) movements and influencing gold’s next directional move.

⭐️Personal comments NOVA:

continue to grow, long term uptrend

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3058 - $3060 SL $3065

TP1: $3050

TP2: $3040

TP3: $3030

🔥SELL GOLD zone: $3044 - $3046 SL $3049

TP1: $3040

TP2: $3030

TP3: $3020

🔥BUY GOLD zone: $3004 - $3002 SL $2997

TP1: $3010

TP2: $3020

TP3: $3030

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

trendline H1, gold price follows the main trend of increasing⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) consolidates near its record high from the Asian session on Friday, trading within a narrow range. Investor concerns over President Donald Trump's aggressive trade policies and their potential global economic impact sustain demand for the safe-haven metal. Additionally, growing expectations of further monetary easing by the Federal Reserve (Fed) provide additional support to the non-yielding bullion.

⭐️Personal comments NOVA:

Sideway and accumulation continue the uptrend back to the $3000 price zone

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3021 - $3023 SL $3028

TP1: $3010

TP2: $3000

TP3: $2990

🔥BUY GOLD zone: $2940 - $2942 SL $2935

TP1: $2950

TP2: $2960

TP3: $2970

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

continue to find new ATH next week, gold✍️ NOVA hello everyone, Let's comment on gold price next week from 03/17/2025 - 03/21/2025

🔥 World situation:

Gold prices pull back after briefly surpassing the $3,000 milestone, reaching a record high of $3,004 per troy ounce before retreating to $2,982, down 0.21% for the day. Uncertainty surrounding President Donald Trump's trade policies and a weaker US Dollar initially fueled the surge but later led to a price correction.

Meanwhile, geopolitical tensions continue to influence demand for the safe-haven metal. The Ukraine-Russia ceasefire hangs in the balance, with signs of reluctance from Moscow to uphold the 30-day truce.

🔥 Identify:

Gold price has reached over 3000 this week, a new turning point. The trade situation is still very tense, the momentum continues for the upward trend next week.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3043, $3078

Support : $2954, $2882

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold BREAKS $3,000 with the next target to $3,337What a year it's been for gold and it's only MARCH!

Once again, Gold proves to be the safe, safer and SAFEST haven of all markets and stands the test of time.

With the psychological price breaking above $3,000 - this is unprecedented.

Here are some reasons why Gold is going up and it should go up further from here.

FUNDAMENTAL REASONS FOR GOLD UPSIDE:

Global Unrest:

Political instability in regions like Eastern Europe is nudging investors to turn to gold as a safe haven. 🔥🌍

US Policy Shifts:

Uncertainty over US monetary policy and potential interest rate changes is steering more money into gold. 🏦🤔

Emerging Market Struggles:

Rising debt and capital outflows in emerging markets are driving both governments and investors to bolster their gold reserves. 📉🌐

Trade Tensions:

Ongoing trade disputes between major economies are adding market uncertainty, making gold an attractive refuge. ⚖️💼

Central Bank Moves:

Several central banks are diversifying their reserves by purchasing more gold, reinforcing its long-term appeal. 🏛️💹

TECHNICALS Are screaming a BUY!

Rounding Bottom pattern has formed and within it is a Cup and Handle

Cup and Handle

Price> 20 and 200MA which is a big one.

Target $3,337

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

New ATH will continue to form 3022 ! XAU ⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) consolidates near its record high from the Asian session on Friday, trading within a narrow range. Investor concerns over President Donald Trump's aggressive trade policies and their potential global economic impact sustain demand for the safe-haven metal. Additionally, growing expectations of further monetary easing by the Federal Reserve (Fed) provide additional support to the non-yielding bullion.

⭐️Personal comments NOVA:

The price trend is up, pay attention to the new ATH price zone 3022

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: $3006 - $3008 SL $3011 scalping

TP1: $3000

TP2: $2995

TP3: $2990

🔥SELL GOLD zone: $3021 - $3023 SL $3028

TP1: $3015

TP2: $3000

TP3: $2980

🔥BUY GOLD zone: $2958 - $2956 SL $2951

TP1: $2965

TP2: $2977

TP3: $2990

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continue to motivate the price, world trade tensions✍️ NOVA hello everyone, Let's comment on gold price next week from 03/10/2025 - 03/14/2025

🔥 World situation:

Kugler emphasized that uncertainty poses challenges across the economy. Earlier, she noted that monetary policy is likely to remain steady for some time and dismissed wages as a driver of inflation.

Meanwhile, Fed Chair Jerome Powell reaffirmed that the central bank is in no rush to cut interest rates. He acknowledged that achieving the 2% inflation target will be a gradual process and cautioned against overreacting to short-term data fluctuations, stating that the Fed is well-positioned on monetary policy.

When asked about tariffs, Powell noted that their potential inflationary impact remains uncertain.

🔥 Identify:

The accumulation of over 2900 is a good signal, trade tensions will be comprehensive in the world that is when gold price grows over 3000

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $2928, $2955

Support : $2880, $2837

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Ready for the new bull run? XAU / USD ⭐️Smart investment, Strong finance

⭐️GOLDEN INFORMATION:

Freshly released US data has fueled recession concerns, with the Atlanta Fed GDP Now Model slashing its Q1 2025 growth projection to -2.8%, a sharp drop from Monday’s 1.6% estimate.

Meanwhile, February’s ISM and S&P Global Manufacturing PMI readings painted a mixed picture. The ISM index edged closer to the 50 threshold, signaling a slowdown, while the S&P Global measure showed solid expansion. In response, US Treasury yields tumbled as traders increasingly priced in Federal Reserve rate cuts.

This flight to safety boosted demand for gold, propelling prices toward $2,900. Looking ahead, gold traders will turn their attention to key economic releases, including the ISM Services PMI, Initial Jobless Claims, and February’s Nonfarm Payrolls.

⭐️Personal comments NOVA:

Market sentiment is gradually improving and optimistic, expecting a new rally above 3000 after the implementation of tariffs that took effect yesterday in Canada, Mexico and China. Gold prices tend to retest the breakout zones of 2900, 2892 and 2880 to create more short-term liquidity.

⭐️SET UP GOLD PRICE:

🔥BUY GOLD zone: $2891 - $2893 SL $2888 scalping

TP1: $2896

TP2: $2900

TP3: $2905

🔥BUY GOLD zone: $2880 - $2878 SL $2873

TP1: $2888

TP2: $2895

TP3: $2910

🔥SELL GOLD zone: $2935 - $2937 SL $2942

TP1: $2928

TP2: $2920

TP3: $2910

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Will gold continue to jump and create ATH?⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) edges lower during the Asian session on Tuesday, pulling back from its recent record high. A recovering US Dollar (USD) from its lowest level since December 10 weighs on demand for the metal. Additionally, overbought conditions lead some traders to trim their bullish positions. However, the broader market outlook suggests caution before making strong bearish moves.

⭐️ Personal comments NOVA:

Gold price is maintaining an upward trend, TRENDLINE H1

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2917 - $2915 SL $2910

TP1: $2922

TP2: $2930

TP3: $2940

🔥 SELL GOLD zone: $2966 - $2968 SL $2973

TP1: $2960

TP2: $2950

TP3: $2940

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bullish Momentum - Tariffs! Waiting for New ATH next week✍️ NOVA hello everyone, Let's comment on gold price next week from 02/24/2025 - 02/28/2025

🔥 World situation:

Gold price slides late on Friday, poised to end the week positively, accumulating eight straight weeks of gains that pushed the yellow metal to all-time highs of $2,954. At the time of writing, the XAU/USD trades at $2,940, down 0.15%.

The financial markets' narrative has not changed as US President Donald Trump continues with rhetoric related to tariffs. In addition to imposing 25% tariffs on cars, pharmaceuticals and chips, Trump broadened duties to lumber and other soft commodities.

This fueled the rally in Bullion prices as investors seeking safety drove prices higher amidst uncertainty about US trade policies. Meanwhile, geopolitics took a second stage as there was some progress in the discussion to end the Russia-Ukraine war, which relieved the markets.

🔥 Identify:

Accumulated price zone 2918 - 2954, uptrend maintained well above zone 2900

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $2954, $2965, $2980

Support : $2918, $2895, $2877

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

price line up new ATH, strong bulls⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) gains traction in the Asian session on Thursday, staying near its record high from the previous day. Concerns over a potential global trade war rise as US President Donald Trump threatens new tariffs, boosting demand for the safe-haven metal. Meanwhile, a drop in US Treasury yields further supports gold's appeal.

⭐️ Personal comments NOVA:

Bulls dominate, uptrend continues to create new ATH, a series of new tariff policies will be announced in the near future

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2956 - $2958 SL $2963

TP1: $2950

TP2: $2940

TP3: $2930

🔥BUY GOLD zone: $2926 - $2928 SL $2923 scalping

TP1: $2932

TP2: $2936

TP3: $2942

🔥 BUY GOLD zone: $2893 - $2895 SL $2887

TP1: $2902

TP2: $2910

TP3: $2920

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bullish zone - continue towards old ATH - scalping⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

Gold price (XAU/USD) surges again, nearing $2,920 on Thursday, as traders dismiss the impact of January's US inflation data. They also seem unfazed by reports of an upcoming meeting between US President Donald Trump and Russian President Vladimir Putin to discuss a potential peace deal. Despite these factors, gold continues its strong rally, highlighting traders' confidence in the safe-haven asset.

⭐️ Personal comments NOVA:

Gold is currently accumulating in the European session at 2910-2920, waiting for the next uptrend. Waiting for BUY entry at 2908.

⭐️ SET UP GOLD PRICE:

🔥 BUY GOLD zone: $2908 - $2906 SL $2903

TP1: $2912

TP2: $2916

TP3: $2922

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Short term bearish H1 - bears will continue to push price up⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

The US Dollar climbs to its highest level in over a week as expectations grow that Trump's protectionist policies could drive inflation higher, pushing the Federal Reserve to maintain its hawkish stance and keep interest rates unchanged.

A stronger USD, coupled with overbought conditions on the daily chart, leads to some profit-taking on XAU/USD as traders adjust positions ahead of Fed Chair Jerome Powell's congressional testimony.

⭐️ Personal comments NOVA:

In the context of current world trade tensions, gold continues its upward trend, possibly above $3000 in February 2025.

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2929 - $2931 SL $2934

TP1: $2925

TP2: $2920

TP3: $2915

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Tariffs - ATH - featured keyword with XAU⭐️ Smart investment, Strong finance

⭐️ GOLDEN INFORMATION:

On Monday, US President Donald Trump signed two proclamations reinstating 25% tariffs on metals and removing all previous exemptions on steel and aluminum tariffs from his 2016-2020 term.

Additionally, Trump informed reporters that he plans to announce reciprocal tariffs on other countries within the next two days. This news boosted demand for safe-haven assets, pushing gold prices to a new record high during the Asian session on Tuesday.

⭐️ Personal comments NOVA:

Asian session witnessed strong growth, gold price reached new ATH 2942, then showed signs of profit taking, still an uptrend today

⭐️ SET UP GOLD PRICE:

🔥 SELL GOLD zone: $2957 - $2959 SL $2964

TP1: $2950

TP2: $2940

TP3: $2930

🔥 BUY GOLD zone: $2898 - $2900 SL $2895 Scalping

TP1: $2905

TP2: $2910

TP3: $2915

🔥 BUY GOLD zone: $2888 - $2886 SL $2881

TP1: $2895

TP2: $2902

TP3: $2910

⭐️ Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️ NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account