GBPJPY – Bearish pressure returns near ascending channel supportGBPJPY is trading close to the lower trendline of the ascending channel, with the 197.400 zone acting as a key support. A breakdown below this level could trigger stronger bearish momentum.

On the news front, Japan’s CPI remains solid, strengthening the yen. Meanwhile, the British pound is under pressure after recent consumer spending data showed signs of weakness, raising concerns over the UK’s economic outlook.

Strategy: If the price breaks below 197.400 and fails to bounce back, consider SELL setups in line with the bearish trend. If it rebounds, watch the reaction around the 199.100 zone for signs of recovery confirmation.

Longsetup

$NVO offers solid risk to reward for long term buyers! - I had previously called out that NYSE:NVO would have more pain to come when it was in $85-90s I have attached the link with this post for my reader's reference.

- Now, I am turning bullish on this name given these prices and compressed multiples for the growth prospects it offers.

Fundamentally,

Year | 2025 | 2026 | 2027 | 2028

EPS | 3.93 | 4.78 | 5.41 | 5.97

EPS growth% | 25.41% | 21.60% | 13.19% | 10.24%

For a quality name growing EPS > 20% deserves a fair forward multiple of 25.

| Year | Bear (fp/e = 15) | Cons. Base (f. p/e = 20) | Base (fpe = 25) | Bull Case (fpe=30)

| 2025 | $58.95 | $78 |. $98.25. |. $117.9

| 2026 | $71.7 | $95 |. $119. |. $143.4

| 2027 | $81.15 | $108 |. $135 | $162.3

| 2028 | $90 | $119 |. $149.25 | $179.1

As you can see, If you buy NYSE:NVO under $60 then you will be making money even if multiple remains compressed i.e bear case. Only thing you have to do is hold and returns would amplify once there is optimism back in the market which will lead to multiple expansion.

My fair value for NYSE:NVO for this year is $78 based on the conservative base case.

BTC Accumulation, Bullish Breakout Signs💎 BTC PLAN UPDATE

1. Key Chart Features:

Currently, the BTC/USD price is at $118,893.

The chart shows a strong upward trend recently, and we are seeing accumulation with short-term corrections.

2. Fibonacci Levels:

The Fibonacci retracement levels are drawn from the lowest point ($114,460) to the highest point ($119,809).

At the moment, the price is hovering near the 0.5 retracement level ($113,000), which is a key support level.

If the price holds above this level, a rebound is likely.

3. Trendlines and Price Patterns:

The trendlines (dashed blue lines) are indicating a descending triangle pattern, which could lead to a breakout if the price surpasses resistance levels.

A potential Head and Shoulders pattern might be forming, though it is not yet clear and needs confirmation by breaking key resistance.

4. Breakout and Retest Zone:

The breakout zone (red area) is around $119,000.

If the price breaks and holds above this level, we may see a continuation of the uptrend toward the next target around $122,792 (Fibonacci 1.618 level).

After the breakout, the price might retouch (retest) this support area before resuming the upward movement.

5. Technical Indicators:

• Moving Averages (MA):

• The red MA (long-term) is below the current price, indicating a strong uptrend.

• The yellow MA (medium-term) is near the current price, providing support for the uptrend if it holds.

• RSI Indicator:

The RSI has not yet reached overbought levels, suggesting that the market still has potential to rise without being overheated.

6. Conclusion:

If the price breaks above the $119,000 resistance and maintains that level, BTC/USD could continue its strong bullish trend, potentially targeting $122,792 or even $127,941.

Note: If the price fails to hold above $119,000 and drops back below, a pullback to the nearest support level at $114,460 may occur.

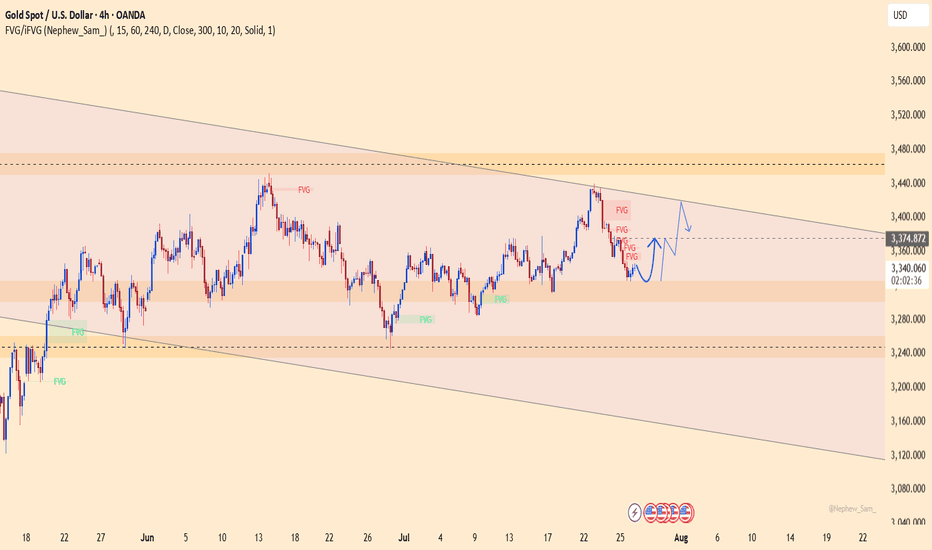

XAUUSD – Technical rebound, but downside risks remainOn the H4 chart, gold is bouncing slightly from the 3,323 support zone after a sharp drop. However, price remains within a large descending channel and is approaching a dense cluster of bearish FVGs around 3,360–3,374.

News context:

– US GDP and ADP data beat expectations, boosting the USD and adding pressure on gold.

– JOLTS dipped but remains above 7 million → limited support for gold.

– Thailand–Cambodia conflict provides only short-term impact.

Strategy: Favor SELL if price retests 3,360–3,374 and gets rejected. Downside targets: 3,323 or lower.

Main trend remains bearish, unless gold breaks above the descending channel.

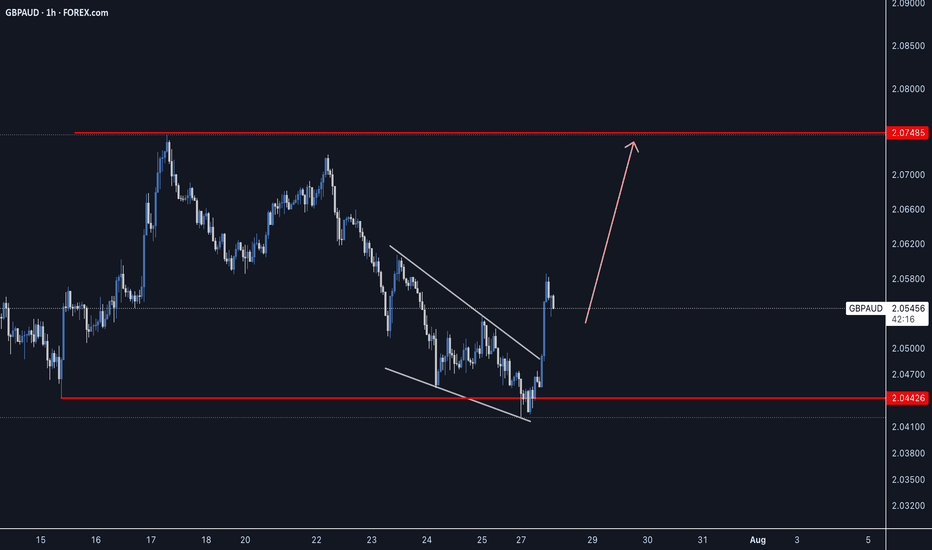

GBPAUD: Calm Before the ConfirmationPrice has swept liquidity below the previous week's low and broke structure to the upside. Now it’s retracing into a Fair Value Gap that aligns beautifully with the 38.2% to 50% Fibonacci zone.

I'm not in yet. I’m watching for a clean bullish confirmation, like an engulfing or strong rejection candle, before entering .

The 50 EMA supports the bias and helps confirm that I'm trading in the direction of the short-term momentum. If all aligns, I’ll be targeting the previous week’s high.

This is a reminder that being patient often protects your capital more than being early.

AMD coiling to $148-160 range by post-earnings- NASDAQ:AMD is one of the beaten down names. It's not too cheap at the current valuation but it's growth for upcoming 2-3 years are promising which deserves a higher multiple.

- 25%+ growth rate when revenue is in billions is a big deal unlike NASDAQ:PLTR which has high 20s % growth rate on a revenue of 250 mil a quarter.

- Technical supports strong rebound to 148-160 range to test 200 SMA. Good setup for Q1 2025.

- Downside risk is to 94-105 if it continues to meltdown.

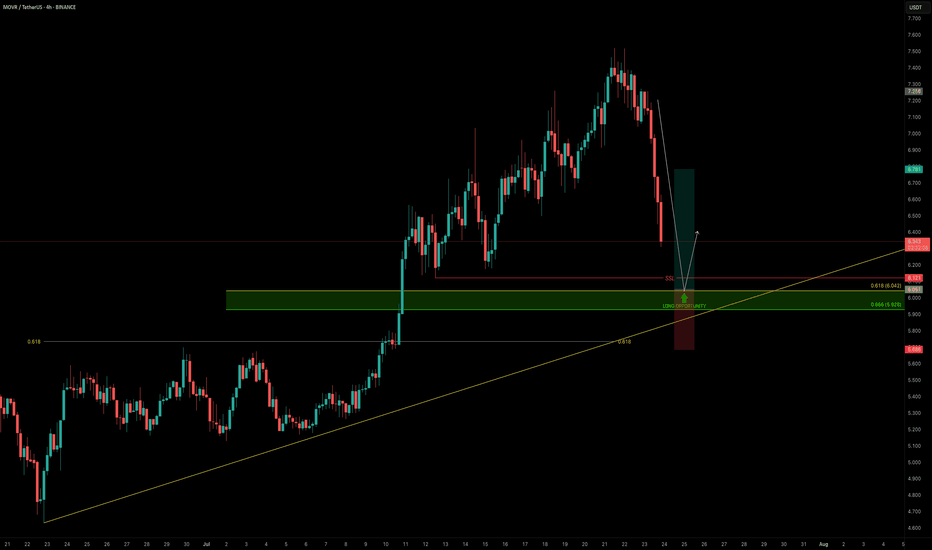

MOVR — Buying the Dip Into Confluence SupportAs the broader market pulls back, it’s the perfect time to scan for high-conviction long setups — and MOVR stands out.

Price is approaching a strong confluence support zone, offering a solid long opportunity.

🧩 Key Technicals

➡️ Liquidity Pool Below the Low:

There’s a visible liquidity pocket just beneath the swing low at $6.121 — an area where stop hunts and reversals are likely.

➡️ Fib & Speed Fan Confluence:

0.618 Fib retracement from the recent move aligns at $6.042

0.618 Speed Fan level also intersects the zone

Together, they form a technical floor right at the $6 psychological level

🟢 Long Trade Setup

Entry: $6.042

Stop-loss: $5.685 (below structure & liquidity sweep)

Target (TP): $6.78

R:R: ≈ 1:2+

Plan: Wait for price to fill into the zone and monitor for a bullish reaction (e.g., SFP, bullish structure reclaim)

💡 Why It Matters: Confluence Builds Confidence

When multiple tools — fib retracement, speed fan, liquidity pools, and psychological round numbers — all line up, it increases the probability of a strong reaction.

This is how smart money builds positions — not by chasing pumps, but by entering where others panic.

Final Thoughts

MOVR is approaching a clean, high-probability buy zone just below $6.00.

If the level holds and confirms with price action, this setup offers a solid R:R and a clear invalidation point.

📌 Mark the zone, set your alert, and let price come to you.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

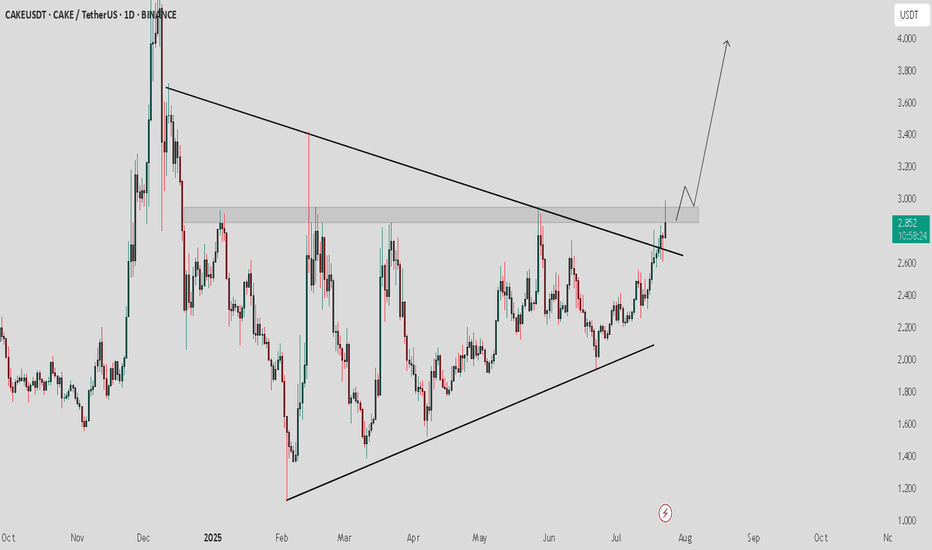

CAKE / USDT : Trying to break horizontal resistanceCAKE/USDT - Triangle Breakout

CAKE/USDT is currently breaking out of a triangle pattern after a period of consolidation. The price is now testing the key resistance area at $2.80. Once this resistance is cleared, we can expect a strong bullish move towards $3.50 - $4.00.

Bullish Scenario:

Break above the $2.80 resistance confirms the breakout, targeting $3.50 - $4.00.

Pro Tip:

Watch for volume confirmation to ensure the breakout is sustainable. Set stop losses below the breakout zone to manage risk.

USDJPY30h Candle confirmed break out!

📢 USDJPY – 30H Breakout Confirmed

Technical Outlook:

Confirmed breakout on the 30H candle, signaling bullish.

Resistance break!

A Inverse Head & Shoulders pattern observed, though the right shoulder is slightly weaker than the left.

For safety, Stop Loss placed below the last Higher Low (HL) to respect market structure.

📍 Key Line:

“Imperfect structures can still produce perfect trades — when aligned with price action and fundamentals.”

🌐 USD Fundamentals Supporting the Bias:

Stronger-than-expected economic data (e.g., recent PMI and labor reports) continues to support USD strength.

Fed's hawkish stance and higher-for-longer rate policy remain favorable for the dollar against low-yielding currencies like JPY.

XAUUSD📈 XAUUSD (Gold) – Buy Setup | 4H Timeframe

Market Context:

After continuous selling, price is now testing a strong 4H and Daily support zone.

A clear bullish candle has formed, signaling potential reversal.

— proper SL is essential.

🔔 Trade Plan: Buy Gold

Entry: Stop Loss: TP mentioned in charts

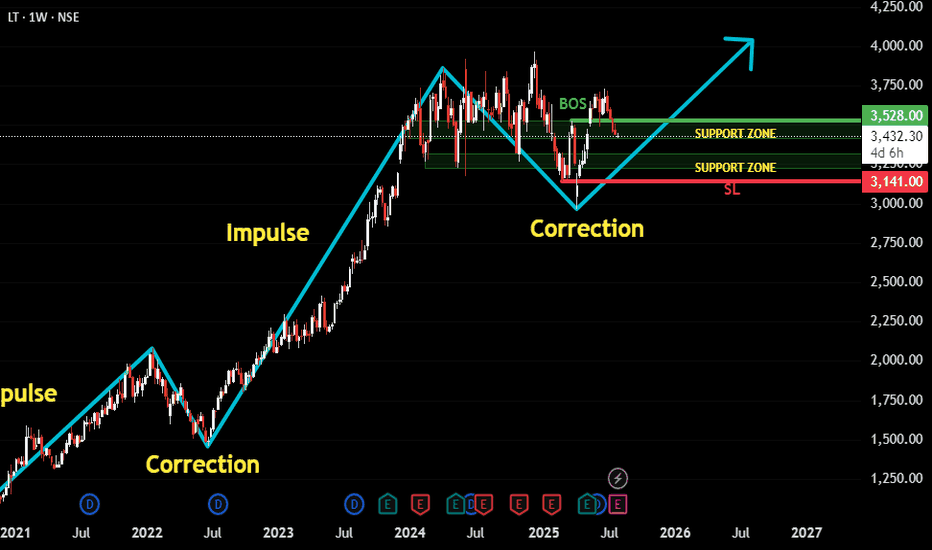

LT Following Classic Impulse-Correction Rhythm.This is a trend-following setup on LT (Larsen & Toubro) where we’ve observed a clear repeating pattern of Impulse → Correction → Impulse. The recent price action suggests that the latest correction has matured, and the structure now hints at a potential next impulse wave beginning.

Here’s the thought process behind the setup:

✅ The stock has been trending upward in a clean impulse-correction rhythm.

🕒 We waited patiently for the correction phase to develop fully and mature.

🔄 A Break of Structure occurred, signaling potential trend continuation.

🔁 Retest on support zones further strengthens the bullish case.

🧭 Support zones are drawn from the Daily chart for precision, though this post is based on the Weekly timeframe for broader trend visibility.

🛡️ Stop-loss can be maintained near ₹3141, just below key support.

🎯 Target is based on a 1:2 Risk-to-Reward setup, aligning with disciplined trading strategy.

Overall, this is a classic example of waiting for confirmation after correction before re-entering in the direction of the dominant trend.

As always, risk management is key. Watch how price behaves around the recent structure and support zones for validation.

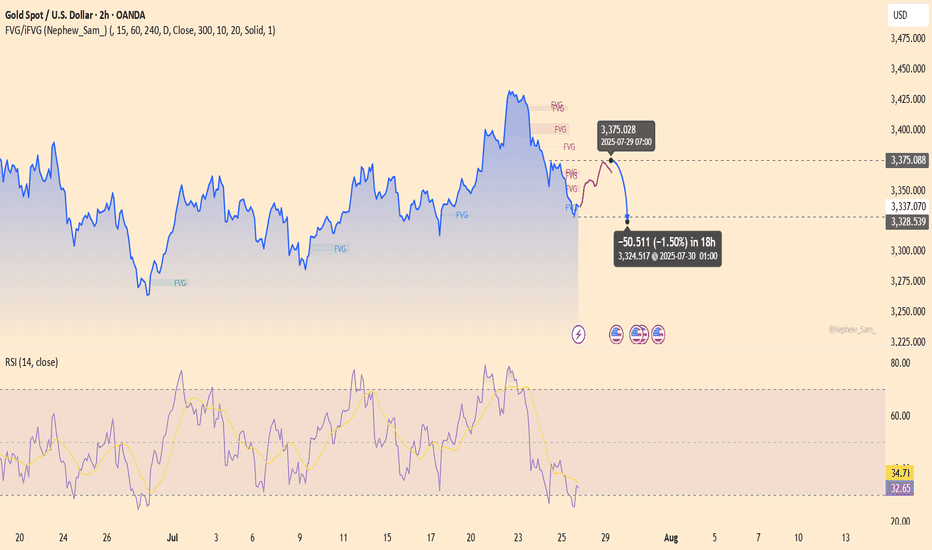

XAUUSD – The assassin returnsGold is showing a weak reaction around the 3,375 zone — a previous supply area — with RSI dipping into oversold territory but failing to bounce significantly. The chart reveals layered FVG traps, hinting at a potential -1.5% drop toward 3,324 within the next 18 hours.

Bearish catalyst: The U.S. jobless claims have dropped to a 3-month low → labor market remains strong → Fed likely to keep interest rates high → stronger USD, weaker gold.

Preferred setup:

SELL if price gets rejected at 3,375

SL: 3,390

TP: 3,324 – 3,310

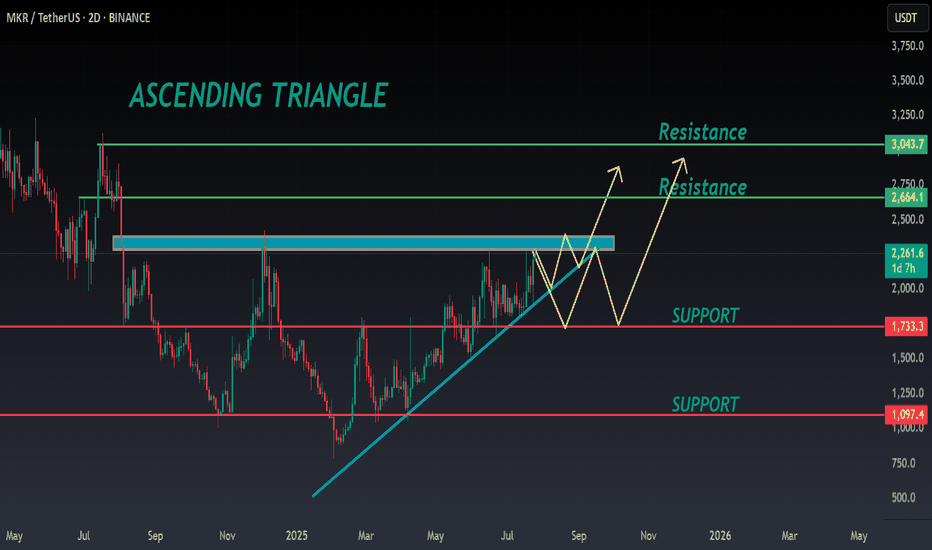

MKR ANALYSIS🔮 #MKR Analysis

🌟🚀 As we said earlier #MKR moved around 48%. Right now #MKR is trading in an Ascending Triangle Pattern and here we can see that #MKR moving again towards its neckline. We see see more bullish move in upcoming days

🔖 Current Price: $2260

⏳ Target Price: $2664

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#MKR #Cryptocurrency #Breakout #DYOR

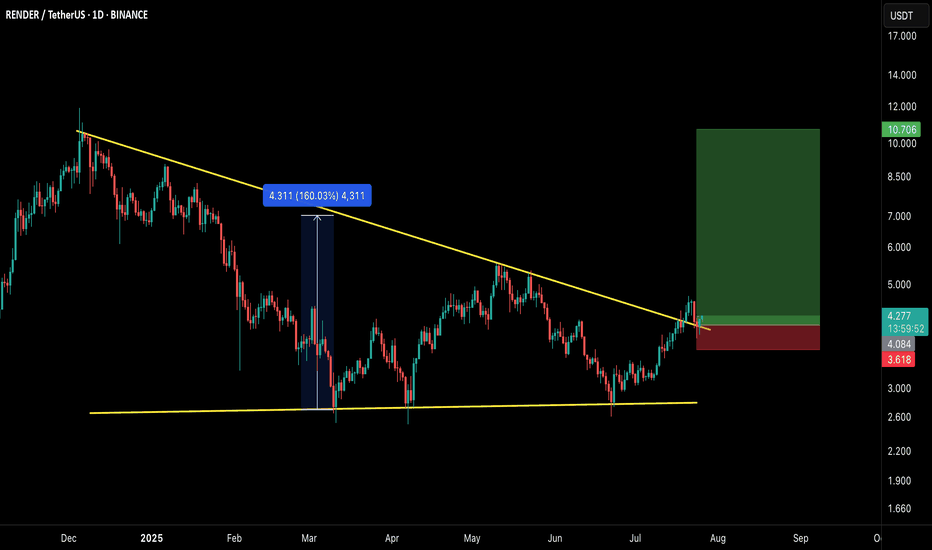

$RNDR/USDT – Breakout Setup Alert!RNDR has officially broken out of the long-standing descending trendline, confirming a bullish reversal structure. This breakout comes after a sustained consolidation phase and successful retest, indicating strength in buyer momentum.

🔍 Technical Breakdown:

Descending triangle breakout confirmed

Previous breakout from similar structure yielded a massive 160% rally

Currently retesting the breakout zone, providing a high R:R long entry opportunity

Clear invalidation point below the recent local support

🟢 LONG Setup:

Entry Zone: $4.00–$4.30

Stop Loss: $3.60 (below breakout retest & structure)

Targets:

TP1: $6.00

TP2: $8.00

TP3: $10.70+ (full breakout projection zone)

🧠 Strategy Insight:

This setup aligns with a broader bullish market structure across multiple altcoins. If momentum continues, this could mirror the prior explosive leg. Always manage risk accordingly.

⚠️ This is not financial advice. DYOR and use proper risk management.

💬 Let me know your thoughts or if you’re riding this wave!

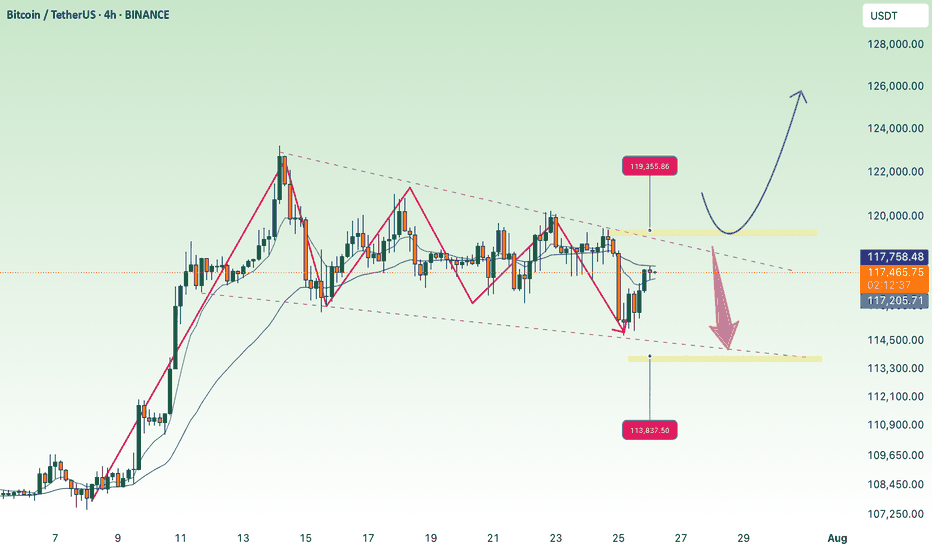

BTC Consolidates Below 119,300 Over the Weekend💎 BTC WEEKEND PLAN UPDATE (26/07)

NOTABLE BTC NEWS

The cryptocurrency market is attempting to stabilize after a wave of sell-offs during Friday’s Asian session, when Bitcoin (BTC) dropped to an intraday low of $114,723. A recovery trend is gradually strengthening, with BTC trading at $115,868 at the time of writing, indicating that buying interest at lower levels may increase in upcoming sessions.

TECHNICAL ANALYSIS PERSPECTIVE

Symmetrical Triangle Pattern

BTC is currently fluctuating within a symmetrical triangle pattern, with converging upper and lower trendlines. This pattern typically signals a strong consolidation phase before a decisive breakout.

Scenario unfolded as planned:

• The price failed to break the resistance zone around $120,000 (previously forecasted as a likely failed breakout zone).

• BTC then dropped sharply to the support zone around $115,000, touching the lower trendline and the potential breakout zone.

• At this level, the price rebounded as expected, indicating strong buying pressure at support.

MA lines supporting the trend:

• The price is currently moving around the 200-day MA (red line), showing that the dynamic support is working effectively.

• The 50-day MA (yellow line) is acting as short-term resistance. If broken, it could support the recovery momentum.

Two potential upcoming scenarios:

🔼 If BTC breaks above the $119,500 – $120,000 zone with strong volume, it may continue to test higher levels around $123,000 – $125,000.

🔽 Conversely, if it faces strong rejection around $119K and turns downward, BTC may retest the support zone at $114,000 – $115,000 once again.

Stay tuned to the channel for the latest and continuous updates on XAUUSD, CURRENCIES, and BTC.

SPX / USDT : Broke out and now successful retestSPX/USDT has broken out from a consolidation zone, with the price approaching key resistance at $1.90. A sustained move above this level could push the price towards the $2.10-$2.40 range, offering a 6.3% upside.

Bullish Scenario: Price stays above support, targeting $2.10-$2.40.

Bearish Scenario: Breakdown below support invalidates the setup, signaling potential downside.

Risk Management: Monitor price action closely and adjust positions if support fails.

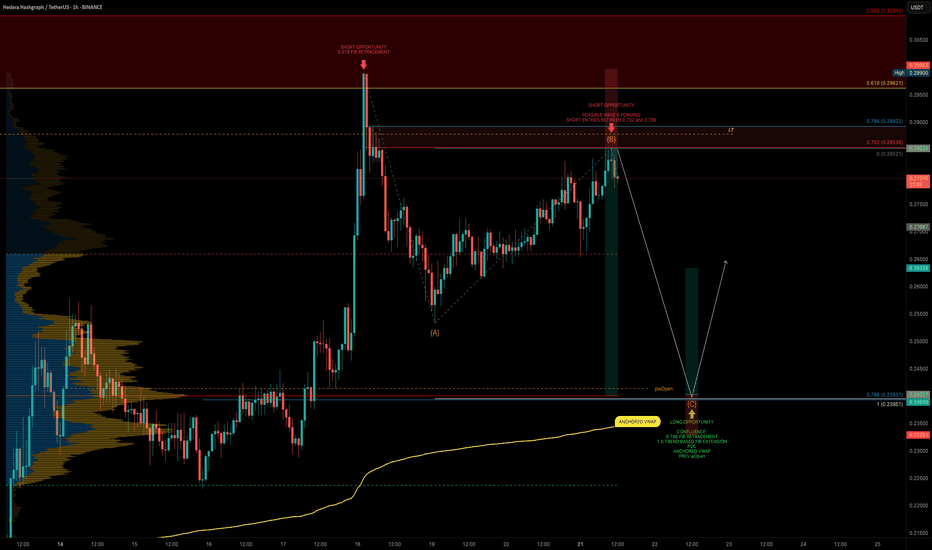

HBAR Game Plan: Short the Bounce, Long the Liquidity GrabHBAR has been moving strongly and is currently offering both short and long trade opportunities based on a clean potential ABC corrective pattern, key fib levels, volume profile, and anchored VWAP. Let’s break down the setup.

🧩 Technical Breakdown

Higher Timeframe Confluence:

0.618 fib retracement from the macro move

1.618 trend-based fib extension

1.272 VWAP band resistance

Point of Control (POC) from the visible range profile

This is marked as a major take profit/short opportunity zone.

For extra confluence, the negative fib extension golden pocket (-0.618 to -0.666) also aligns right at this resistance zone

Current Structure:

We’re potentially completing wave B of an ABC corrective move

Price has retraced into a high-probability short zone

🔴 Short Setup

Entry Zone:

Between the 0.702 and 0.786 fib retracement levels

Why Here?

0.702–0.786 fib retracement → short zone for reversals

Potential wave B top → setting up for a C leg down

Target (TP):

Around $0.25–$0.24, near the expected wave C completion

🟢 Long Setup

Entry Zone:

~$0.25–$0.24 area.

Why Here?

This zone is a strong confluence area:

➡️ 0.786 fib retracement

➡️ 1.0 trend-based fib extension of ABC

➡️ Anchored VWAP from the entire trend, offering dynamic support

➡️ Liquidity pool

➡️ Previous weekly Open

Plan:

Wait for price to complete wave C into this zone, then look for bullish reaction signs to enter long.

💡 Educational Insight

Why the 0.702–0.786 short zone?

These fib levels are often overlooked but are key “hidden” zones where wave B tops out before C waves.

Why anchored VWAP?

Anchored VWAP gives you dynamic institutional support/resistance, especially when aligned with fibs and liquidity.

Why wait for confirmation?

Blindly longing or shorting levels can trap you. Wait for SFPs, wick rejections, or lower timeframe structure flips to boost trade probability.

Final Thoughts

HBAR is in a highly interesting zone, offering both:

A short setup into the C wave,

And a long setup at the C wave completion, backed by multiple confluence factors.

Let the levels come to you and wait for confirmation!

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

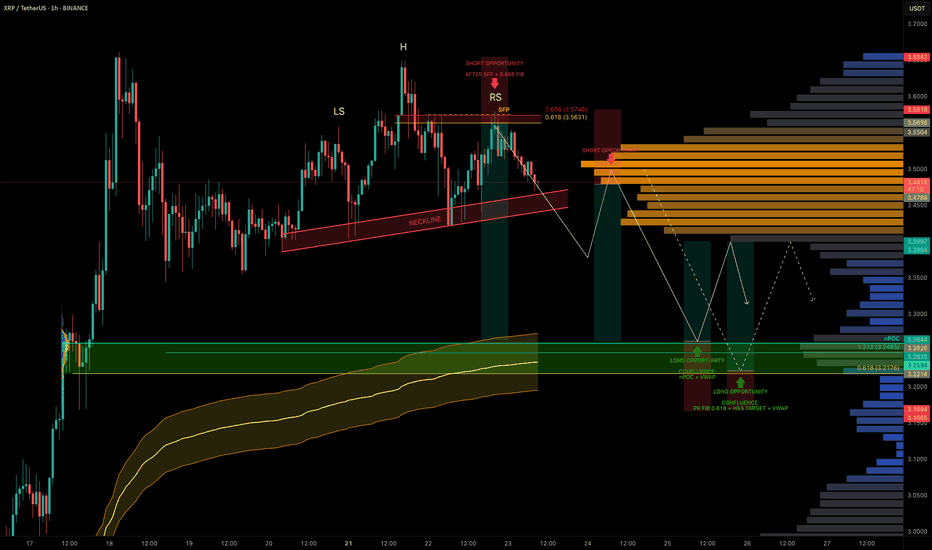

XRP Coiled in Range — Liquidity Below, Trade Setups AheadXRP has been stuck in a trading range around $3.50 for the past 5 days, offering multiple trade opportunities within the chop.

A notable short was triggered after a swing failure pattern (SFP) at the 0.666 fib retracement level near $3.563.

Now, with liquidity building to the downside, we’re watching closely for the next high-conviction setups.

🧩 Current Structure & Short Setup

🔴 Short Opportunity (Triggered):

SFP + 0.666 fib retracement at $3.563 led to rejection.

Market now shows a head & shoulders pattern forming.

Target: $3.2176 (0.618 fib retracement).

Trigger: Watch for a neckline break + retest for short confirmation.

Stop-loss: Above the right shoulder.

🟢 Long Setup:

Watching for a high-probability long around:

$3.26 → nPOC + 1.272 TBFE

$3.23 → anchored VWAP bands

This zone offers strong confluence and could act as the next launchpad.

Long Trade Plan:

Entry Zone: potential entries between $3.26–$3.22, price action needed for confirmation

Stop-loss: Below swing low at $3.1675

Target (TP): ~$3.40

✍️ Plan: Set alerts near the lows and react to price action at the zone — don’t front-run, let structure confirm.

💡 Pro Tip: Trade the Confluence, Not the Emotion

High-probability trades come from confluence, not guessing.

This setup combines nPOC, TBFE, VWAP, fib levels, and classical market structure (H&S) to map precise zones for both longs and shorts.

Let price come to you and wait for confirmation — especially in a rangebound environment where liquidity hunts are frequent.

Final Thoughts

We’re still rangebound, but liquidity is building below.

Keep an eye on the $3.26–$3.22 support zone for long entries and the H&S neckline for short breakdown confirmation.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

SUI — Structured Dip Buy Zone You Shouldn't IgnoreSUI has been technically clean, with well-respected Elliott Wave counts and fib levels.

As the broader market dips, it's time to look for sniper long entries and SUI is setting up beautifully for one around the $3.50 zone.

🧩 Key Confluence Zone: $3.50

This level offers a high-probability buy zone, backed by multiple layers of technical confluence:

0.786 Fib Retracement: $3.5029

1.0 Trend-Based Fib Extension: $3.5036

Previous Trading Range POC: $3.4675

Previous Weekly Open (pwOpen): $3.494

🟢 Long Trade Setup

Entry: ~$3.500

Stop-loss: $3.4675

Target (TP): $3.85+

R:R: ~1:3

🛠 Indicator Note

In this analysis I'm using my own indicator:

➡️ DriftLine — Pivot Open Zones

It helps identify key market opens (daily, weekly, prior), which often act as magnet levels and reaction zones.

➡️ You can use it for free — just check out my profile under “Scripts” and apply it to your charts.

💡 Pro Insight: Build Trades Where Tools Agree

A single level is just noise. But when fib retracements, extensions, POCs, opens, and price structure all line up — that’s where conviction trades are made.

The more overlap, the more likely the market reacts — this setup shows just that.

Final Thoughts

SUI is approaching a technically rich zone around $3.50, and this could be one of those low-risk, high-reward long entries if confirmed by price action.

With a clean invalidation and 1:3 R:R, this is the kind of setup you want to plan — not chase.

Set your alerts, stay patient, and trade with structure. 🚀✍️

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

Long $BABA - NYSE:BABA is testing 200 SMA

- NYSE:BABA moves are explodes higher then cools then retest support then explodes higher than the last high. It's called trading with higher wavelength

-> Move 1: Started April 2024 when the trend reversal started. $68 -> $89 with around +30% then retraced $90 -> $72 ( -20% )

-> Move 2: July 2024, $72 -> $116 (+61%) then retraced $116 -> $80 ( -31% )

-> Move 3: Jan 2025, $80 -> $146 (+ 82.5%) then retraced $146 -> $108?? ( correction underway ) ~ -26% so far

-> Move 4: Likely from $100-105 to $180-200

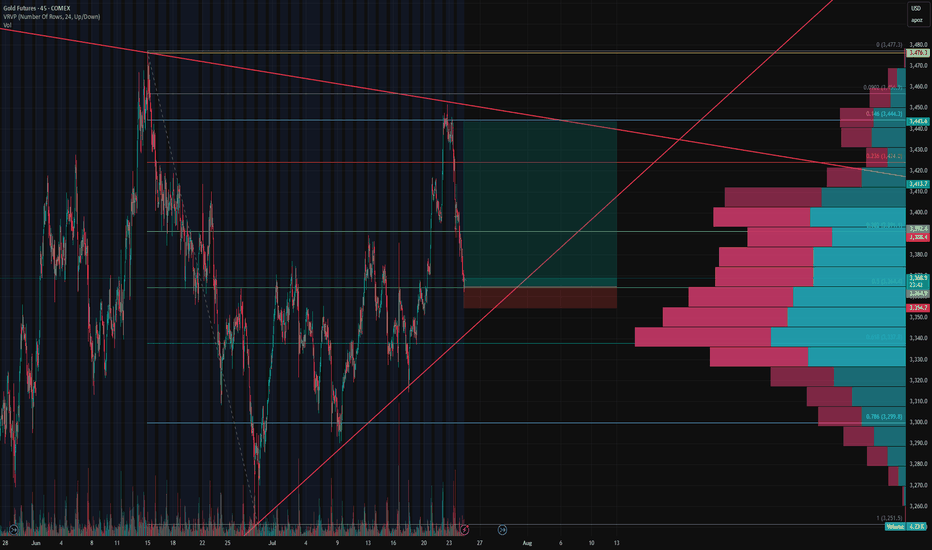

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on the Volume Profile.

📈 Entered long at 3,365 with a tight stop below 3,354 (0.3% risk), targeting the descending trendline near 3,444 for a clean 7.7R setup.

🧠 Context:

Price reacted hard at resistance, but volume support and structure still lean bullish.

Clear invalidation if we break trend and lose 3,350 support cluster.

Let’s see if this bounce gets legs. 🚀