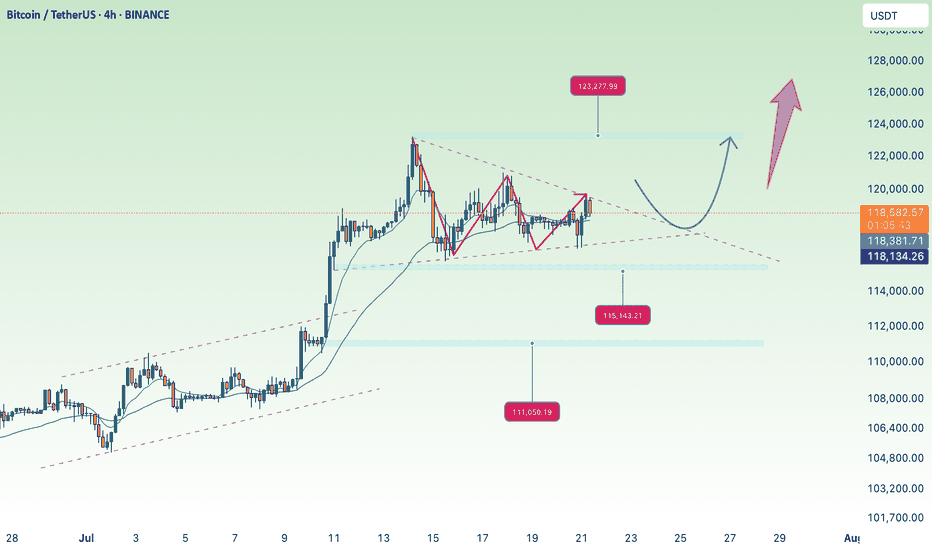

continue to increase in price, towards old ATH💎 BTC WEEKLY PLAN UPDATE (11/08)

1. Overall Trend:

BTC has completed a 5-wave Elliott impulse and is currently in a corrective phase after wave (5).

The main trend remains bullish, as the wave structure has not broken and price is still above key EMA lines.

2. Fibonacci Levels:

The current correction may retrace to the following Fibonacci support levels:

• 0.382 Fibo: ~118,800 USD (aligns with strong support)

• 0.5 Fibo: ~117,800 USD (close to EMA and trendline)

These are potential price zones where the market may rebound.

3. Support & Resistance Zones:

• Near-term Support: 118,000 – 117,500 USD (combination of Fibo + EMA + broken trendline).

• Near-term Resistance: 120,000 USD (previous high).

• Next Resistance: 122,000 – 123,000 USD (Fibo extension target 2.618).

4. Main Scenario:

BTC retraces to 118K – 117.5K → rebounds → breaks 120K → moves towards 122K – 123K.

5. Trading Notes:

• Prioritize entries when price reacts well at 118K – 117.5K support zone.

• Stop loss if H4 closes below 117K.

• Stay patient, as corrections are normal before the next upward move.

Longsignal

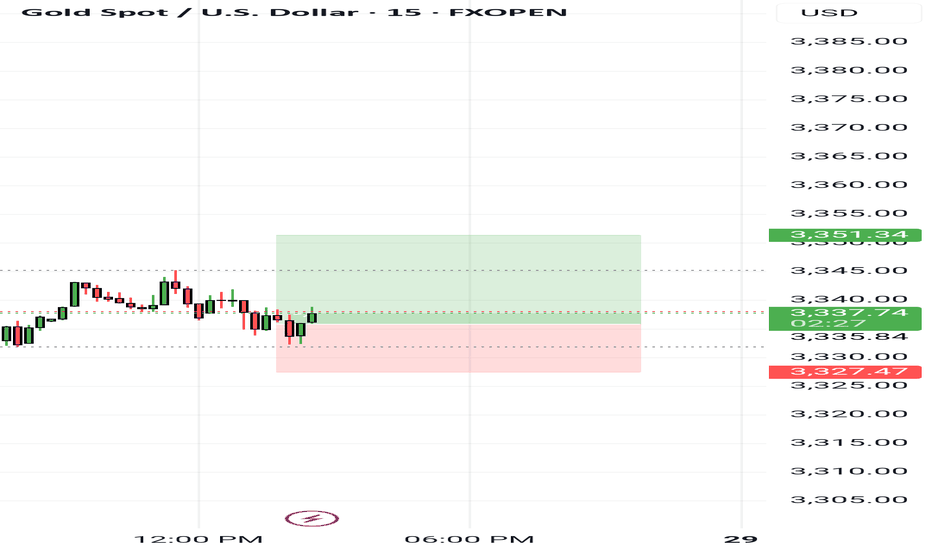

Gold price accumulates above 3340⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eased toward $3,390 in early Asian trading on Monday, as a modest rebound in the U.S. Dollar weighed on the precious metal ahead of Tuesday’s U.S. inflation report.

A firmer Greenback, coupled with a broader risk-on mood, kept prices capped below the key $3,400 psychological level. However, growing expectations for a Federal Reserve rate cut in September continue to offer underlying support for the non-yielding asset.

On Saturday, Fed Governor Michelle Bowman noted that recent soft employment data reinforced her concerns about labor market fragility and bolstered her view that three rate cuts could be appropriate in 2025. Markets are now pricing in an 89% probability of a September rate cut, with at least two reductions expected by year-end.

⭐️Personal comments NOVA:

At the beginning of the week, gold price slightly decreased below 3380. It is still mainly accumulating, waiting for an increase reaction to return to 3400 and move sideways.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3336-$3338 SL $3331

TP1: $3345

TP2: $3357

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

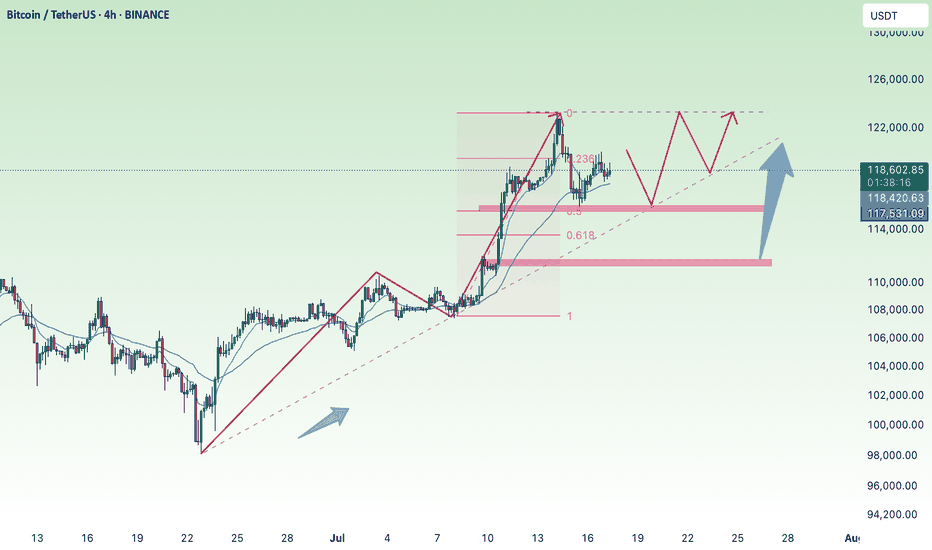

BTC recovers, trying to get back to 120k💎 WEEKEND BTC PLAN UPDATE (08/08)

🔍 BTC Analysis (H4 timeframe):

1. Elliott Wave Structure:

• BTC is following an impulsive wave sequence 1–2–3–4–5.

• Currently in wave (4) and may bounce to complete wave (5) around the ~119,000–120,000 zone.

2. Key Support Levels:

• 116,000–116,200: Support area for wave (4) – can look for buying opportunities here if confirmation signals appear.

• Below that, strong support lies around 115,200–115,600 (confluence of 0.5–0.618 Fibonacci retracement + MA200).

3. Resistance Levels:

• Previous high around 117,500 (Fibo 1.0) is the nearest resistance.

• Wave (5) target: 119,400–120,000 (Fibo 1.618).

4. Trading Plan:

• Buy at 116,000–116,200, SL below 115,600.

• Expected TP: 117,500 – 119,400.”

Bulls maintain weekend above 3400⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eased back from a more than two-week high near $3,409–3,410 during Friday’s Asian session, as traders booked profits ahead of the weekend. A broadly positive tone in equity markets, coupled with a modest rebound in the U.S. Dollar, added to the downward pressure on bullion. Even so, several factors continue to underpin the metal, urging caution for aggressive bearish positioning.

Lingering trade-related uncertainty—intensified by President Donald Trump’s latest tariff threats this week—has helped maintain gold’s safe-haven appeal. At the same time, growing expectations that the Federal Reserve will resume its rate-cut cycle in September are likely to cap any sustained dollar strength, encouraging dip-buying interest around the $3,380 level.

⭐️Personal comments NOVA:

Tariff tensions, along with a very positive market about the possibility of interest rate cuts, helped gold prices return above the 3400 zone.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3373-$3371 SL $3366

TP1: $3382

TP2: $3395

TP3: $3410

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BTC accumulates, slightly adjusts down💎 BTC PLAN UPDATE – START OF THE WEEK (04/08)

🔍 1. Current Technical Structure

Price Pattern: The chart shows BTC is forming a falling wedge pattern, with converging support and resistance lines.

False Break: There was a false break below the strong support zone around ~112,000, followed by a sharp rebound. This indicates buyers are actively defending this level, showing potential buying pressure.

Fibonacci Retracement: From the recent low to high, the 0.5 (115,559) and 0.618 (116,361) Fibonacci levels are acting as key resistance zones.

Key Price Levels:

• Strong support: 111,800 – 112,300

• Near resistance: 115,500 – 116,500

• Next resistance: downtrend line and previous high around 118,000 – 119,000

🔄 2. Possible Trend Scenarios

✅ Main scenario (bullish):

BTC made a false break below the wedge → rebounded toward Fibonacci resistance → potential:

• Continue rising to the 115,500 – 116,500 zone

• If it breaks and holds above this zone, BTC could break out of the wedge pattern and target 118,000 – 120,000

• A longer-term target could be the 1.618 Fibonacci Extension around ~123,159

❌ Alternative scenario (bearish):

If BTC fails to break above 116,000 and gets rejected:

• It may retest the 112,000 support zone again

• A breakdown below this support would bring back the downtrend

🔄 3. Bullish Supporting Factors:

• The false break signals a shakeout of weak sellers.

• A potential inverse head-and-shoulders pattern is forming, supporting a bullish reversal.

• Moving Averages (MA): Price is nearing the 200 MA (red) – a possible bullish crossover with shorter-term MAs may occur, signaling a buy.

🧭 Suggested Trading Strategy

• Safe buy zone: Around 113,500 – 114,000 if there’s a pullback.

• Take profit in stages: 116,500 – 118,000 – 120,000

• Stop-loss: Below 112,000 in case of a confirmed breakdown

Bulls continue to be active following NFP data⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slips toward $3,360 in early Asian trading on Monday, snapping a two-day winning streak. However, disappointing U.S. job data and lingering tariff concerns could pressure the U.S. Dollar and help cushion the downside for the Dollar-denominated metal.

The yellow metal is under pressure from a recovering Greenback, though gains may remain capped as weaker-than-expected Nonfarm Payrolls (NFP) data has strengthened expectations of a Federal Reserve rate cut in the near term.

⭐️Personal comments NOVA:

Buyers maintained early in the week, continuing to move towards higher resistances: 3374, 3387

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3350

TP3: $3333

🔥BUY GOLD zone: $3328-$3326 SL $3321

TP1: $3335

TP2: $3348

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

PEAQ Network about to make another pea(q) ? Bottom can be IN!

// ==================================

// ====THE===========================

// ========MACHINE=============^^====

// ===============NEEDS===TALK=======

// ====================TO============

// ==================================

Is this the time?

Chart Recap

🔍 Pattern:

Price formed a falling wedge pattern, which typically signals a potential bullish reversal.

A large W-shaped double bottom pattern is highlighted at the wedge's base, adding strength to the bullish thesis. Can this be the awaited bottom?

🟢 Accumulation & Support Zone :

"DISCOUNT ZONE" is marked near $0.0547, aligned with the wedge support.

Repeated touches at this level suggest strong buyer interest — also called "MY NAME IS PEAQ" and "LOADING EVERYWHERE"

🚀 Bullish Scenario & Targets:

If the wedge breakout plays out:

TP1: $0.0923 – early target near the local range high.

TP2: $0.1618 – aligns with the 0.382 Fib level.

Labeled as “LOADING EVERYWHERE”

TP3: $0.4618 – near the 0.618 retracement.

“THERE IS NO GOING BACK NOW”

TP4: $0.7556 – previous swing high.

“GET READY FOR LIFT-OFF”

TP5: $3.5650 – long-term Fib extension target (1.618).

Ultimate moonshot-level target.

Continued recovery, positive after NFP news✍️ NOVA hello everyone, Let's comment on gold price next week from 08/04/2025 - 08/8/2025

⭐️GOLDEN INFORMATION:

Gold prices surged over 1.5% on Friday, climbing toward $3,350, as a weaker-than-expected U.S. Nonfarm Payrolls (NFP) report signaled a faster-than-anticipated slowdown in the labor market. Heightened geopolitical tensions between the U.S. and Russia further boosted safe-haven demand for the precious metal.

Following the disappointing July jobs data, markets began pricing in a potential interest rate cut by the Federal Reserve. While the Unemployment Rate held relatively steady, signs of labor market softness supported recent comments from Fed officials Michelle Bowman and Christopher Waller, who advocated for a 25-basis-point rate cut at the July 29–30 meeting.

Additional data added to the cautious sentiment: the ISM’s July report confirmed that U.S. manufacturing activity remains in contraction territory, while consumer confidence took a hit, according to the University of Michigan’s latest survey.

⭐️Personal comments NOVA:

Gold prices continue to be positively affected after last week's NFP news, market expectations of an early rate cut are rising

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3384, $3434

Support: $3331, $3307, $3268

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

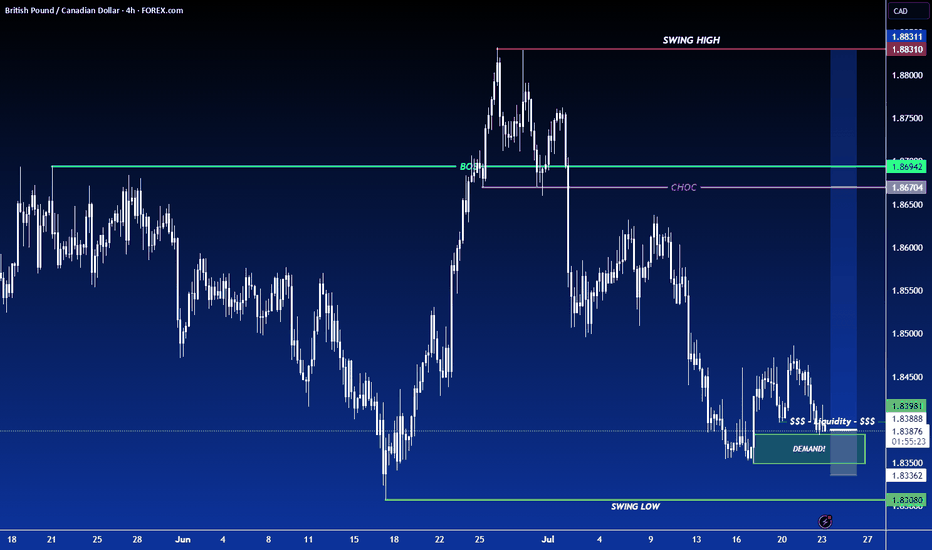

LONG ON EUR/USDEUR/USD is currently at a major demand level after sweeping sell side liquidity.

The Dxy (Dollar) is overall bearish. I expect the dollar to fall and EUR/USD to rise to the previous high / supply level for over 200-300 pips.

News most likely will affect this pair in terms of volatility.

Accumulate waiting for btc price increase💎 BTC PLAN UPDATE – End of July (31/07)

📊 BTC Technical Analysis (4H Timeframe – End of July)

✅ Positive Signals:

• BTC has broken out of the consolidation triangle pattern (blue diagonal line), indicating a potential strong uptrend.

• The current price is retesting the breakout support zone around 117,800–118,000 → showing a good reaction and creating upward momentum.

• MA50 and MA200 are starting to slope upwards → confirming increasing buying strength.

📈 Bullish Scenario:

• If BTC holds above 118,000, it is likely to move toward the nearest resistance zone at 119,900.

• After breaking 119,900, the next targets are:

→ 122,792 (Fibonacci 1.618)

→ Further target: 127,900 (Fibonacci 2.618)

🛑 Risk Note:

• If the price drops below 117,000, it’s important to monitor again, as it may retest a deeper support zone around 114,500.

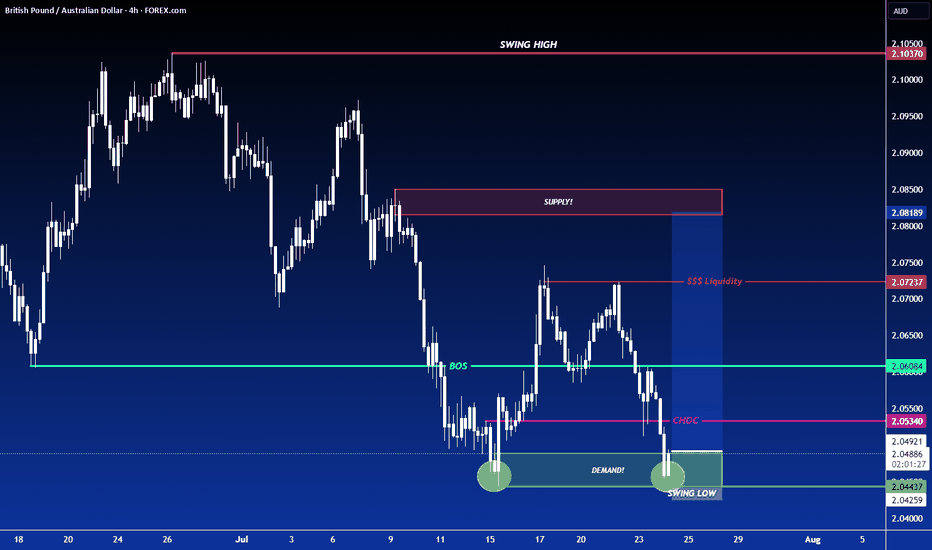

LONG ON GBP/AUDGA has given us a CHOC (change of character) to the upside after making a new low.

Price has since pulled back to the demand area that created that change leaving us with a possible double bottom forming.

I expect GA to rise to sweep buy side liquidity at the equal highs then reaching the previous supply level / previous High.

Looking to catch 200-300 pips.

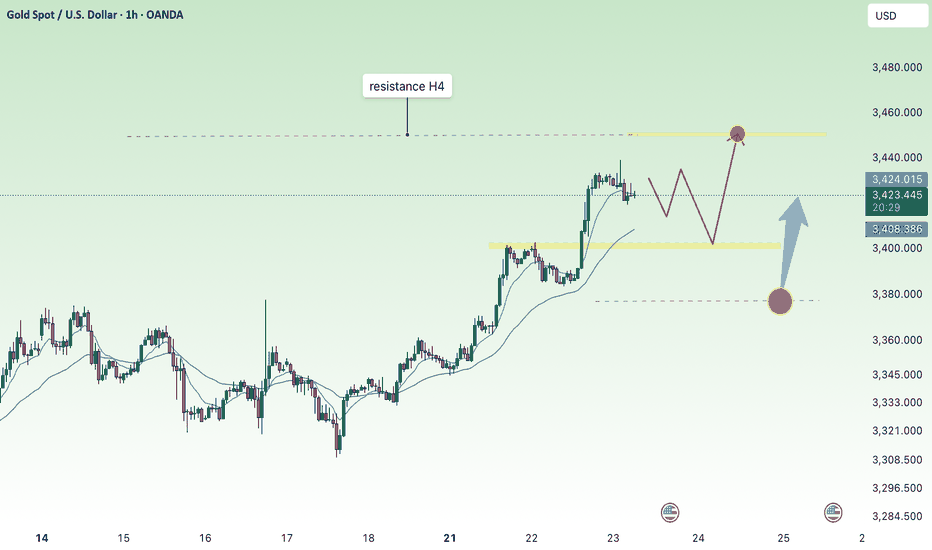

Continued price increase - gold increased to 3450⭐️GOLDEN INFORMATION:

Gold prices climbed for a second straight session on Tuesday, gaining over 0.9% as sliding US Treasury yields continued to weigh on the US Dollar. Investors remained cautious amid lingering uncertainty over upcoming US trade agreements. At the time of writing, XAU/USD is trading at $3,427, having rebounded from an intraday low of $3,383.

Yields on US government bonds have now declined for five consecutive days, pressuring the Greenback—reflected in the softer US Dollar Index (DXY). Heightened speculation that the US and European Union (EU) may fail to secure a trade agreement before the looming August 1 deadline has intensified demand for safe-haven assets. As a result, gold surged to a five-week high of $3,433.

⭐️Personal comments NOVA:

Gold price continues to increase, FOMO from the market is good and positive. Heading towards 3450

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3449- 3451 SL 3456

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3380-$3378 SL $3373

TP1: $3390

TP2: $3400

TP3: $3415

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

accumulate, continue to aim for new ATH💎 Update Plan BTC (July 21)

Notable news about BTC

CEO of Charles Schwab, Rick Wurster, said the company plans to deploy Bitcoin and Ethereum transactions for customers.

This company aims to compete with Coinbase, where customers buy BTC.

This development takes place after the progress of cryptocurrencies when President Donald Trump signs the Genius bill into law.

In an interview on Friday, the CEO of Charles Schwab, Rick Wurster, said the company plans to launch Bitcoin (BTC) and Ethereum (ETH) to compete with Coinbase cryptocurrencies. The move took place after President Donald Trump signed the Genius bill, officially confirming the first cryptocurrency law in the United States.

Technical analysis angle

🟠 Main trend:

BTC is sideway accumulated in the amplitude of 117,000 - 122,000 after a sharp increase.

The chart shows the descending triangular model - a potential sign for Breakout.

🔍 important areas:

Resist:

122,000 - 122,700: Strong resistance area, fibonacci mold 1.0.

130,600 - 131,100: The expected area if Breakout is successful (Fibonacci extension 1.618).

Support:

116,000: Support close, coincide with EMA 200.

111,100: The support area is stronger if the current support breaks.

✅ Scenario 1 - Rise:

If the price turns from supporting 116k → Test the resistance area of 122k.

If the 122K break is definitive, the next goal is 130k - 131k.

❌ Scenario 2 - Discount:

If the 116k area is lost, the possibility of falling will fall more deeply at 111k.

This is also the strong EMA area Fibo 0.382 of the previous wave.

Please follow the channel to receive the latest and continuous updates on XauUSD, currency and BTC

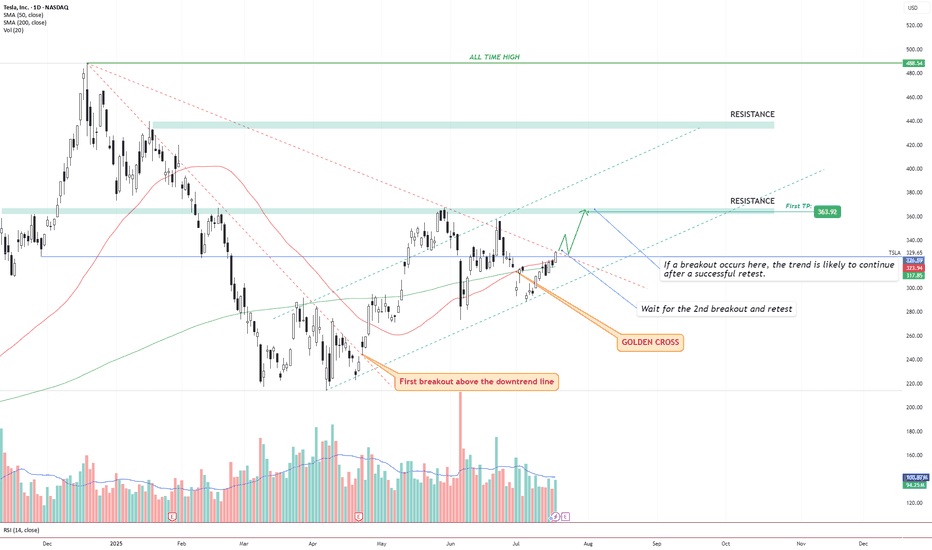

TSLA – Golden Cross + Dual Breakout Structure Targeting $363 andIdea Text:

Tesla NASDAQ:TSLA has recently printed a powerful Golden Cross , where the 50 SMA has crossed above the 200 SMA — signaling a potential long-term bullish shift in trend.

But price action shows more:

We’re observing a dual-breakout structure, where the first breakout above the long-term downtrend line has already occurred (see orange label), and the price is now approaching a critical horizontal resistance zone.

Let’s break it down step-by-step:

🔸 Step 1: Golden Cross

The 50 SMA crossed above 200 SMA — a classic signal for trend reversal. This often attracts institutional interest, especially if followed by breakout confirmation.

🔸 Step 2: First Breakout (Already Confirmed)

Price broke above the descending trendline, retested it, and maintained higher structure. This breakout initiated a shift in market sentiment from bearish to neutral-bullish.

🔸 Step 3: Second Breakout (Setup Forming)

Price is now testing horizontal resistance around $330–$335 zone. This zone also coincides with dynamic resistance from prior failed swing attempts. A successful breakout above this level, followed by a clean retest, can serve as confirmation for a bullish continuation.

🔸 Step 4: Target Setting

🎯 First TP is set at $363.92, a well-defined resistance level. If the breakout holds, next potential targets may develop around key zones such as $395 and $440, depending on price strength and continuation.

🔸 Risk Management

✅ Ideal entry after retest of breakout above ~$335.

❌ Stop-loss below the breakout level or below 50 SMA (~$315 area), depending on entry style.

🔄 Monitor volume: breakout without volume = weak move.

Conclusion:

We are watching a classic price action + moving average confluence setup. Golden Cross, breakout + retest structure, clean resistance level, and defined targets all align.

This setup is valid only with confirmation. No breakout = no trade.

⚠️ Not financial advice. DYOR.

Gold price maintains accumulation below 3400✍️ NOVA hello everyone, Let's comment on gold price next week from 07/21/2025 - 07/25/2025

⭐️GOLDEN INFORMATION:

Gold prices edge higher in Friday’s North American session as a softer US Dollar and pre-weekend profit-taking lend support. Dovish remarks from a Federal Reserve (Fed) Governor, hinting at a possible rate cut as early as July, further bolster the yellow metal. At the time of writing, XAU/USD is trading around $3,353, gaining 0.43%.

Improved market sentiment also underpins bullion, following the University of Michigan’s report showing that US consumers are growing more optimistic about the economy, with inflation expectations easing. Meanwhile, Fed Governor Christopher Waller’s call for rate cuts weighed on US Treasury yields, adding positive momentum to gold.

The US Dollar Index (DXY) weakens to 98.48, down 0.13%, making USD-priced gold more attractive to foreign buyers and helping sustain the current uptrend.

⭐️Personal comments NOVA:

Gold price remains in the accumulation range of 3300 - 3400, the market awaits information on upcoming interest rate policy

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3367, $3392

Support: $3305, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

BTC sideways above 115k💎 BTC PLAN UPDATE (July 17)

NOTABLE NEWS ABOUT BTC

Bitcoin Price Forecast: BTC Recovers as Trump Steps In to Revive Crypto Legislation Momentum

Bitcoin (BTC) saw a mild recovery, trading around $119,000 at the time of writing on Wednesday, after falling nearly 2% the previous day. This rebound followed an announcement by U.S. President Donald Trump on Wednesday morning, stating that the GENIUS Act is ready to be passed by the House during the legislative “Crypto Week”, sparking optimism in the crypto market. Furthermore, institutional demand continues to grow, with spot Bitcoin ETFs recording over $400 million in inflows on Tuesday, extending the growth streak since July 2.

TECHNICAL ANALYSIS

🧠 Pattern Overview:

The chart clearly displays an Elliott Wave pattern (1) → (2) → (3) → (4) → (5) along with Fibonacci Retracement and Extension levels, helping to identify potential support and resistance zones.

1. Elliott Waves:

Wave (3) was completed around the $122,144 zone and the market is currently in the corrective wave (4).

Wave (5) is expected to move upward with targets at:

• 1.618 Fibonacci Extension: ~$127,404

• Or further: ~$130,747

2. Support Zone (grey area below):

Located around $115,000 – $116,000, which is:

• The 0.5 – 0.618 retracement of Wave (3)

• Aligned with the EMA200 and dotted black trendline support.

If the price falls into this area, it’s highly likely to bounce back and form Wave (5).

3. Danger Zone if Broken:

If this support fails, price may fall deeper to:

• $113,200 (0.786 retracement),

• Or even lower: $111,600 – $111,800

4. Potential Scenarios:

Two main outcomes:

• Continued Uptrend: Price bounces from the support zone and heads toward $127,000 – $130,000

• Breakdown: If the support breaks, a deeper decline may occur, breaking the wave structure.

Follow the channel for continuous and up-to-date analysis on XAUUSD, CURRENCIES, and BTC.

recovery, towards 3400, gold price⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) extended their gains to around $3,365 during the early Asian session on Monday, as investors flocked to safe-haven assets in response to an escalation in global trade tensions.

The move comes after US President Donald Trump intensified the trade war over the weekend, announcing a 30% tariff on imports from the European Union and Mexico, effective August 1. This followed last week’s declarations of a 35% duty on Canadian goods and a sweeping 15%–20% tariff proposal on most trading partners, in addition to a 50% tariff on copper imports. Mounting concerns over the economic fallout from these aggressive trade measures have fueled demand for gold, a traditional refuge during times of uncertainty.

⭐️Personal comments NOVA:

Continued price increase, tariff pressure helps gold to be positive again

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3384- 3386 SL 3391

TP1: $3376

TP2: $3364

TP3: $3352

🔥BUY GOLD zone: $3308-$3310 SL $3303

TP1: $3319

TP2: $3328

TP3: $3340

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

short recovery, trend line✍️ NOVA hello everyone, Let's comment on gold price next week from 07/14/2025 - 07/18/2025

⭐️GOLDEN INFORMATION:

Gold prices surged nearly 1% on Friday as market sentiment soured in response to US President Donald Trump’s controversial trade policies targeting Canada, while hinting at broader tariffs on other nations and copper. At the time of writing, XAU/USD is trading at $3,354, rebounding from intraday lows of $3,322.

On Thursday, Trump announced a 35% tariff on Canadian imports, though goods complying with the 2020 USMCA trade agreement remain exempt. He also signaled intentions to expand tariffs across most trading partners, proposing blanket rates ranging from 15% to 20%.

With a light US economic calendar, attention turned to Fed commentary. Chicago Fed President Austan Goolsbee pushed back on calls for rate cuts aimed at reducing government borrowing costs, stressing the central bank’s focus remains firmly on employment and price stability.

⭐️Personal comments NOVA:

growth according to the trend, maintaining the accumulation price zone above 3300

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3392, $3447

Support: $3330, $3308, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

FOMO price increase, create new ATH💎 Update Plan BTC weekend (July 11)

Continuously creating a new ATH, preparing to have a short sale?

The reinforcement of Bitcoin price around the upper boundary of the previous consolidation area was broken at $ 108,355, which ended on Wednesday. The price has soared to the highest level of the new time of $ 116,868 on Thursday. At the time of writing on Friday, the price is fluctuating above $ 116,600.

When BTC entered the price exploration regime and if the trend of increasing continues, the price can expand the momentum to an important psychological level of $ 120,000.

Technical analysis angle

Our community has continuously chose the trend of increasing as the mainstream for all previous transactions and currently preparing to welcome 120k as forecast.

The relative power index (RSI) on the daily chart reaches 71, higher than the excess buying 70, showing a sharp increase. However, traders should be cautious because the ability to adjust the decrease is very high due to over -purchase. Meanwhile, the average divergence dynamic indicator (MACD) has shown a price intersection at the end of June. The indicator also shows that green histograms are increasing on neutral zero, showing that the rising momentum is being strengthened and continues to increase.

However, if BTC must be adjusted, the price may extend the decline to search and support around the upper boundary of the unified area that has been broken earlier at $ 108,355.

Plan has been constantly accurate in the past 2 months, which is the positive signal of the channel that brings value to the community.

Please follow the channel to receive accurate scenarios about gold and BTC

==> Comments for trend reference. Wishing investors successfully trading

Uptrend at the end of the week 3367, maintain the upward force⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) are on track to notch a third straight day of gains on Friday, climbing toward the upper boundary of this week’s trading range as escalating trade tensions fuel safe-haven demand. In a significant intensification of global trade disputes, US President Donald Trump issued formal notices this week to multiple trading partners, detailing individual tariff rates set to take effect on August 1 should no agreements be reached. This has rattled investor sentiment and weighed on risk assets, offering solid support to Gold.

Meanwhile, expectations for an imminent interest rate cut by the Federal Reserve (Fed) have cooled following last week’s strong US jobs data. As a result, the US Dollar (USD) remains firm, holding near a more than two-week high reached on Thursday. This USD strength could limit the upside for the non-yielding yellow metal in the near term. Therefore, traders may look for a sustained breakout before committing to further bullish positions in the XAU/USD pair.

⭐️Personal comments NOVA:

Gold price breaks 3330, maintaining good buying pressure, recovering at the end of the week

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3367- 3369 SL 3374

TP1: $3355

TP2: $3342

TP3: $3325

🔥BUY GOLD zone: $3306-$3308 SL $3301

TP1: $3315

TP2: $3325

TP3: $3338

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account