$ORDI Enters Key Fib Support, Watching for Bounce!!SEED_DONKEYDAN_MARKET_CAP:ORDI

It’s not forming any clear pattern, but based on the Fib retracement, price is currently sitting in the golden entry zone around the 0.5–0.618 level.

Also, the 100 MA, which previously acted as strong resistance, is now working as support.

This setup looks interesting because of the tight stop-loss and high reward potential.

I’ve entered the trade with this logic.

Let’s see how it plays out 👀

#ORDI #CRYPTOMOJO_TA

Longterm

$CHILLGUY Cooling Off – Accumulation Zone Ahead?$CHILLGUY is pulling back after a strong run-up.

Price is currently sitting around the $0.0757 area, but in my opinion, there could be a drop towards the lower zone around $0.052–$0.060.

That area could be a solid spot for accumulation.

Keep an eye on this zone. 👀

Stay tuned I’ll keep you updated if anything changes.

#chillguy #Altseason2025

Silver Long-Term Outlook: Wyckoff, Fibonacci & Volunacci in PlayOn the monthly chart, Silver is showing a strong setup for long-term investors. We can clearly identify two adjacent Wyckoff accumulation patterns, signaling institutional accumulation phases.

Price action is following an ascending Fibonacci channel, reflecting a steady bullish structure. After breaking out of the second Wyckoff pattern, a Volunacci projection has formed—pointing toward a potential move to retest its historical high near $48.

This alignment of classic technical patterns with volume-based projection tools strengthens the long-term bullish case for Silver.

Cumulative recovery above 3190, maintain⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) fails to build on Thursday’s sharp rebound from the $3,120 area — its lowest level since April 10 — and comes under renewed selling pressure during Friday’s Asian session. The 90-day trade truce between the US and China has alleviated some of the strain on global financial markets, weighing on demand for the safe-haven metal.

Nevertheless, lingering geopolitical tensions and a weaker US Dollar continue to offer underlying support, limiting the downside. Additionally, growing market expectations for further interest rate cuts by the Federal Reserve may deter traders from adopting strong bearish positions on gold in the near term.

⭐️Personal comments NOVA:

Gold prices recover, buyers are determined to keep prices stable around the 3200 mark in May. Waiting for new bullish momentum after tariff negotiations end

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone : 3287- 3290 SL 3294

TP1: $3270

TP2: $3260

TP3: $3250

🔥BUY GOLD zone: $3173 - $3175 SL $3168

TP1: $3188

TP2: $3200

TP3: $3218

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Can BTC reach new high?Notable news about BTC:

A sudden sell-off in cryptocurrency markets late Monday wiped out earlier gains, with over $500 million in long positions liquidated as Bitcoin (BTC) retreated from weekend highs. The downturn followed easing U.S.-China trade tensions, which appeared to shift investor sentiment away from risk assets.

According to Coinglass, more than $530 million in leveraged long positions were liquidated over the past 24 hours. Bitcoin-related futures accounted for nearly $200 million of that total, while Ether (ETH) products saw around $170 million in liquidations.

Liquidations occur when an exchange forcefully closes a trader’s leveraged position due to a drop in collateral value, typically triggered by sharp market moves. This mechanism kicks in when traders can no longer meet the required margin to sustain their open positions.

Technical analysis angle

As analyzed earlier after the price of BTC breaking the 96k landmark has returned to the period over 100k

Currently, the BTC price is still passing in the 105k resistance stage and the important trend of the trend of increasing at 98k

About 98k continues to consume the trend of this currency

With the current news and price lines, it will still be supporting the increase in the trend

==> Comments for trend reference. Wishing investors successfully trading

Momentum Rising – $XRP Bulls Eyeing Next Leg UpCRYPTOCAP:XRP is waking up 🔥

Price has broken out of the long-term downtrend and is now testing the important horizontal resistance area

A clean break above this range might spark the next big move. Volume is on the increase, and the structure is all good

Time to keep an eye on this one 👀

$MOVE Setup Looks Clean – Support Holding Strong!!TVC:MOVE busted out of the downtrend and is currently testing the resistance trendline as a support line✅

Price is remaining at the level of the 0.236 Fib and resting on a pivotal area the retest has the potential to prepare the ground for the next leg up to $0.24+.

DYOR, NFA

$ATOM Ready for Liftoff – 100%+ Move on the TableNASDAQ:ATOM has just broken out of the trendline and is converting the major resistance into support.

This breakout could be the start of something huge - the chart shows potential 100 %+ movement ahead of it.

Looking forward to a retest around the $4.73 mark before the next move upwards towards $10+.

Momentum looks solid, this could take off soon 🚀

Retweet if you are bullish!

#ATOM #Altseason2025

KLV Breakout Confirmed: Ready for the Next Leg Up!$KLV appears to be prepared for the next big move! 🔥

The breakout has occurred, and the resistance has been converted to support.

A tiny pullback at this level can set up a strong bounce.

Everything looks good; volume is building, momentum is strong, and there’s an unobstructed path to upper targets.

The subsequent crucial zone is around $0.0042+

Still early… don’t ignore this chart 👀

#KLV #CRYPTOMOJO_TA

Bitcoin -Weekly Forecast, Technical Analysis & Trading IdeasMidterm forecast:

86499.57 is a major support, while this level is not broken, the Midterm wave will be uptrend.

We will close our open trades, if the Midterm level 86499.57 is broken.

MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

Technical analysis:

A trough is formed in daily chart at 74545.70 on 04/09/2025, so more gains to resistance(s) 105431.17, 109932.90, 115000.00 and more heights is expected.

Take Profits:

86499.57 ✅

91037.20 ✅

94505.46 ✅

98675.19 ✅

101430.12 ✅

105431.17

109932.90

115000.00

120000.00

125000.00

132000.00

140000.00

150000.00

160000.00

167666.00

________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

NATRIUM | Investing | Why BILL GATES is Betting on NATRIUMBill Gates is betting big on Natrium - should you be, too?

Natrium is this next-generation nuclear reactor design that's attracting a lot of attention from people like Bill Gates and other major investors. What's particularly interesting about it is that it combines a fast reactor with a built-in molten salt "battery." Essentially, it can generate a steady output of power and then provide an extra boost during peak demand by drawing on its stored heat. This design aims for greater flexibility in meeting fluctuating electricity needs.

The technology is a joint development by TerraPower, the company co-founded by Bill Gates, and GE Hitachi. They're presenting it as a zero-carbon power source capable of reliably backing up intermittent renewables like wind and solar, ensuring a consistent supply of clean energy.

The excitement from investors like Bill Gates appears to be driven by the need to address climate change and secure reliable energy supplies. They view Natrium as a way to deliver large-scale, carbon-free power while potentially overcoming some of the limitations of older nuclear reactor designs. Gates has emphasized the enhanced safety features and potential for lower operating costs. Furthermore, Natrium's specific design to complement the intermittency of solar and wind, through its energy storage, is a significant draw for investors looking at future energy solutions. The substantial public and private investment, including government funding and bipartisan legislative support, also signals strong confidence in this technology.

The description of TerraPower as a "Bill Gates-backed" firm developing this multi-billion dollar demonstration plant highlights the high-profile nature of the project. The fact that corporate partners, such as the data center company exploring Natrium for their power needs, are also getting involved indicates a broader recognition of its potential beyond just government initiatives.

Compared to traditional nuclear reactors, Natrium offers some potential advantages. Its sodium coolant operates at near-atmospheric pressure, simplifying safety compared to the high-pressure water systems in older designs. This allows for natural heat dissipation in case of issues, reducing the risk of large steam explosions. Another key aspect is Natrium's potential for more efficient fuel utilization and reduced long-lived waste generation. The design aims for better fuel efficiency and a smaller volume of long-term radioactive waste compared to current light-water reactors.

Natrium's primary advantage over wind and solar is its dispatchability. Unlike the intermittent nature of renewables, Natrium can provide power consistently, 24/7. The integrated energy storage allows it to complement renewables by absorbing excess energy or releasing power during periods of low renewable output. This firm grid support is a significant benefit for utilities concerned about grid stability and the variability of renewable sources.

For utilities transitioning away from coal, Natrium offers a carbon-free, relatively direct replacement in terms of power output. It also has a smaller land footprint compared to large-scale wind or solar installations.

There are inherent challenges with a first-of-a-kind system like Natrium. The prototype is still under construction, lacking a proven operational track record. Construction and licensing processes could face delays and cost overruns. Critics also raise valid points about the actual safety and cost-effectiveness compared to projections. The use of sodium coolant, while offering safety advantages, also presents risks due to its reactivity with air and water, requiring robust containment systems. Regulatory scrutiny will undoubtedly be extensive.

And fuel supply is a critical uncertainty. Natrium requires high-assay, low-enriched uranium (HALEU), which is not currently widely available. Disruptions in the supply chain and limited existing production capacity pose a significant risk to the timely and cost-effective operation of Natrium plants.

Looking ahead, Natrium is being considered for deployment in regions needing reliable power to complement renewables and to power energy-intensive industries. The long-term vision involves integrating Natrium with renewable energy sources to create a more stable and decarbonized grid.

The speculative outlook for Natrium in the next 5-10 years is heavily dependent on the successful completion of the Wyoming demonstration plant. If it meets its targets, it could pave the way for wider adoption. However, the timeline is ambitious, and challenges related to fuel supply and regulatory approvals remain. A successful demonstration could trigger significant investment and adoption in the coming decades, positioning Natrium as a key player in the energy transition.

If you're interested in investing in companies involved with TerraPower's Natrium reactor, several publicly traded firms are integral to its development and supply chain:

🔧 Engineering & Construction

KBR Inc. | (NYSE: KBR)

KBR has formed a strategic alliance with TerraPower to commercialize and deploy Natrium reactors globally. The collaboration focuses on creating a replicable contracting framework to reduce financial risk and ensure cost transparency in deploying Natrium technology.

terrapower.com

⚛️ Nuclear Fuel & Components

BWX Technologies Inc. | (NYSE: BWXT)

BWXT has been awarded a contract by TerraPower to design the Intermediate Heat Exchanger for the Natrium demonstration project. This component is critical for transferring heat within the reactor system.

Centrus Energy Corp. | (NYSE American: LEU)

Centrus Energy is collaborating with TerraPower to establish domestic production capabilities for high-assay, low-enriched uranium (HALEU), which is essential for fueling the Natrium reactor.

⚙️ Manufacturing & Industrial Partners

Doosan Enerbility Co., Ltd. | 034020.KQ (KOSDAQ)

Doosan Enerbility is supplying critical components for the Natrium reactor, including the core barrel and internal supports.

HD Hyundai | 329180.KQ

HD Hyundai is manufacturing the reactor vessel for the Natrium project.

🌍 International Collaborators

SK Inc. | 034730.KQ

SK Inc., a South Korean conglomerate, has invested $250 million in TerraPower to support the demonstration and commercialization of the Natrium reactor.

Korea Hydro & Nuclear Power (KHNP) | 15760.KS (KOSPI)

KHNP has entered into a strategic collaboration with TerraPower to support the Natrium project, leveraging its expertise in nuclear power development.

OTHERS:

1. Mirion Technologies (NYSE: MIR)

Mirion is supplying the Radiation Monitoring System (RMS) and Nuclear Instrumentation System (XIS) for the Natrium Reactor Demonstration Project in Wyoming.

2. GE Vernova (NYSE: GEV)

Through its subsidiary, Global Nuclear Fuel–Americas (GNF-A), GE Vernova is partnering with TerraPower to establish the Natrium Fuel Facility in Wilmington, North Carolina. This facility aims to produce high-assay, low-enriched uranium (HALEU) fuel essential for the Natrium reactor.

3. NuScale Power Corporation (NYSE: SMR)

While not directly involved with the Natrium project, NuScale is a prominent developer of small modular reactors (SMRs), a category that includes Natrium. The company's advancements in SMR technology contribute to the broader nuclear energy landscape.

4. Southern Company (NYSE: SO)

Southern Company is collaborating with TerraPower on the development of a molten chloride fast reactor (MCFR), a separate advanced nuclear project. Their involvement in advanced nuclear technologies aligns with the innovations seen in the Natrium project.

________________________________

Sources: Recent industry reports and news articles and TerraPower press releases provide the data above. Also put together with the help of AI.

world-nuclear-news.org, ans.org, gatesnotes.com, scientificamerican.com, terrapower.com, reuters.com

S&P500 -Weekly forecast, Technical Analysis & Trading IdeasPrevious forecast result:

As you can see in the 4CastMachine forecast on 12/03/2025, the price, after rejecting the sell zone, began its sharp decline and touched all TPs.

Midterm forecast:

While the price is below the resistance 6149.57, resumption of downtrend is expected.

We make sure when the support at 4804.01 breaks.

If the resistance at 6149.57 is broken, the short-term forecast -resumption of downtrend- will be invalid. CSEMA:S&P

Technical analysis:

While the RSI downtrend #1 is not broken, bearish wave in price would continue.

A trough is formed in daily chart at 4807.10 on 04/07/2025, so more gains to resistance(s) 5698.65, 5791.00, 5896.50 and maximum to Major Resistance (6149.57) is expected.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 55.

Take Profits:

5509.32

5363.90

5261.00

5122.47

4944.41

4804.01

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

GOLD(XAUUSD) -Weekly Forecast,Technical Analysis & Trading IdeasMidterm forecast:

2772.38 is a major support, while this level is not broken, the Midterm wave will be uptrend.

TVC:GOLD OANDA:XAUUSD

Technical analysis:

A trough is formed in daily chart at 2956.50 on 04/07/2025, so more gains to resistance(s) 3357.00, 3500.00 and more heights is expected.

Take Profits:

2833.00

2879.11

2955.00

3057.40

3160.00

3257.03

3357.00

3500.00

__________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

$KILO Setup Looks Prime — This Could Just Be the StartTSX:KILO is showing real strength right now.🚀

Price broke out of a clean downtrend and reclaimed the horizontal support zone. That reaction from buyers? Strong and confident.

The chart offers two clear scenarios, but both point to the same thing: more upside ahead.

Targets? $0.057 and $0.08 are on the radar.

The structure’s bullish, and momentum is shifting fast.

Looks like TSX:KILO is just getting started.

DYOR, NFA

$NKN Heating Up — Breakout Imminent?GETTEX:NKN is waking up.

It held that trendline perfectly, and now it’s pushing back strongly.

Price was getting squeezed in that wedge for days looks like it’s ready to pop.

That top line? It’s not going to hold for long.

Volume is picking up, and this move could easily send it flying to $0.06.

Feels like one of those setups where momentum just builds up and boom, breakout.

Keep your eyes on it. This one’s heating up fast.

DYOR, NFA

$AVAAI Looks Ready to Explode — Don’t Blink!$AVAAI looks locked in for the next leg up.

After a clean breakout from the previous resistance zone, the price is now forming a solid base above its classic bullish structure.

The trendline’s been respected. Buyers stepped in early.

Volume’s healthy. Structure’s is strong.

In my view, the chart is screaming continuation.

$0.095 and $0.11 could come faster than expected.

Don’t blink, this move could get explosive.

DYOR, NFA

#ALTSEASON #CRYPTOMOJO_TA

$SUPRA Breakout Confirmed — Trend Reversal in Play!$SUPRA just flipped the script!

After months of bleeding under a brutal downtrend, it finally broke out clean and confident.

That long-term resistance? Crushed.

Now it's retesting the breakout zone, a classic reclaim move.

EMAs are curving up, momentum's clearly shifting.

In my opinion, this breakout confirms a trend reversal.

Buyers are stepping up.

$0.0096+ Looks like the next magnet.

like if you are bullish!

$DARK Breakout Alert — 2x Potential in Sight?Spotted something interesting on $DARK 👀

After 10 days of slow grinding, it broke out of a falling wedge, and now it’s retesting that level perfectly.

No panic, just a clean setup.

If this bounce holds, we could see a strong move up, even 2x from here.

It might be time to zoom in before everyone else does.

USDJPY Daily & H4 Forecasts, Technical Analysis & Trading IdeaTechnical analysis is on the chart!

No description needed!

FX:USDJPY

________________________________________________________________

❤️ If you find this helpful and want more FREE forecasts in TradingView,

. . . . . . . . Hit the 'BOOST' button 👍

. . . . . . . . . . . Drop some feedback in the comments below! (e.g., What did you find most useful? How can we improve?)

🙏 Your support is appreciated!

Now, it's your turn!

Be sure to leave a comment; let us know how you see this opportunity and forecast.

Have a successful week,

ForecastCity Support Team

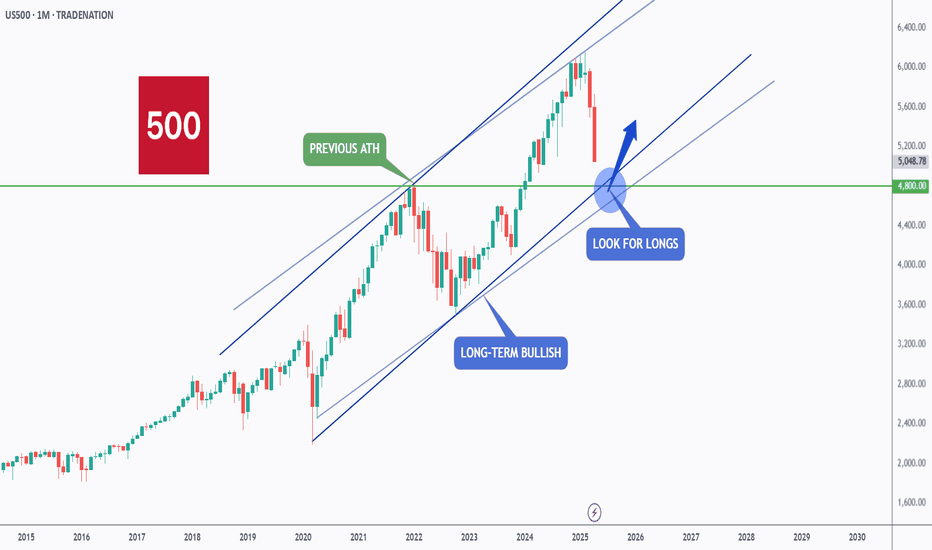

US500 - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈US500 has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting its previous all-time high at $4,800 and round number $5,000.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of previous ATH and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.