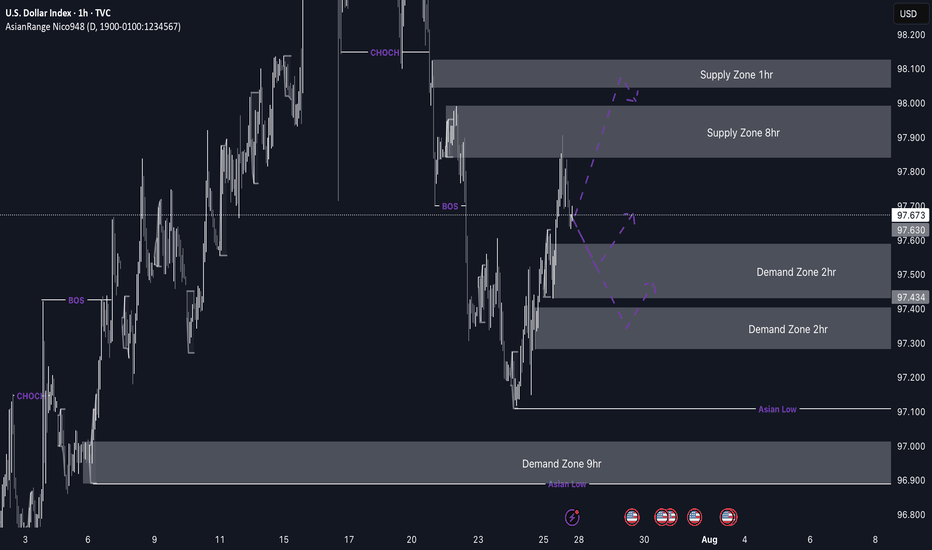

DXY weekly outlookDXY Weekly Outlook

This week, I’m watching to see if the dollar continues its bearish trend or breaks above the current supply zone. We've already seen a strong reaction from the 8hr supply, but price could still tap into the 1hr supply before making its next move.

If price drops from here, I’ll be looking at the 2hr demand zone below for a possible bullish reaction. If DXY pushes up from that zone, pairs like EU and GU could drop — which lines up with my overall short bias on those.

Gold may not always move in sync with the dollar, but DXY still gives a good idea of market sentiment.

Let’s see how it plays out and stay reactive.

Longtoshortsetup

GBP/USD Sells from 1.2700 back downThis week, I expect GBP/USD to continue its downtrend, following a clear change in character and a break of structure on the higher timeframe, signaling bearish momentum. My primary plan is to wait for a retest of the 2-hour supply zone, located above the Asia high. Once the Asia high is taken, I’ll look for confluences to execute potential sell trades.

If the 2-hour supply zone fails to hold, I’ll shift my focus to the 10-hour supply zone, which represents a significant structural point. Should price distribute in this area, I’ll look for major sells to align with the prevailing bearish trend.

Confluences for GBP/USD Sells:

- Liquidity Below: There’s substantial liquidity to the downside waiting to be taken.

- Bearish Momentum: The pair has been bearish over the past two weeks.

- Break of Structure: Price has broken key levels to the downside on the higher timeframe.

- DXY Correlation: The dollar index (DXY) is aligning with this bearish setup.

- Key Supply Zone: A well-defined supply zone caused the initial downside move.

Note: As price approaches the 8-hour demand zone, I’ll also consider any long opportunities to take price up to the supply zone for a countertrend move, rather than waiting for bearish setups exclusively.

XAU/USD Long imminent lookout! back up to 2690My analysis this week for gold is to look for potential imminent buys at this demand if i see a correct confluences play out on the lower time frame as well as the sweep of that sunday asia low. Once that happens i will look price to retace in this area back up to an area of supply.

As price has changed character the downside and broke structure i see now heading down more. i will wait for price to make a correction and fill imbalance above then continue to drop off around the area of that 6 hr supply zonne

Confleunces for XAUUSD BUYS are as follows:

- Price Changed character to the upsice on the higher time frame.

- Price swept the top side liquidity off last week consolidation and letf the bottom which still hasn't been taken.

- Price needs to retrace to continue its bearish course.

- DXY corresponding slightly as well.

P.S. I am interested in shorts but the opportunity as of were current price is, isn't ideal hence why I'm looking for short term buys to sell. Have a great trading week, Q4 soon coming to an end, lets gooooo!!!

GU imminent buys to sell idea?My analysis for GBP/USD (GU) is still bearish at the moment, as the DXY (Dollar Index) has been very bullish. Additionally, GU has broken structure to the downside, and there's a clean supply zone that aligns with this bearish trend. However, as price is currently in my demand zone, I will be looking for confirmation to buy temporarily for a retracement.

If price does not respect the 1-hour demand zone, I expect it to accumulate slowly, approaching the demand zone below. In that case, I’ll wait for the price to reach this lower zone before looking to buy. If this scenario doesn't play out, I will wait for the price to rally up and then look for short opportunities to sell again.

Confluences for a GU Long:

- The market has been very bearish, and a pullback is likely.

- There is a lot of liquidity to the upside, including Asia session highs and trendline liquidity.

- A clean demand zone lies below a liquidity level, offering potential buy opportunities.

- The DXY has left imbalances below due to recent news, suggesting the dollar could decline temporarily.

Note: If price rallies up and breaks the current high, I would expect an upward continuation, as there's significant liquidity being built up above for GBP/USD.

Wishing you a successful trading week ahead!

GBP/USD Sell to Buy idea from 1.28400 down to 1.27600While GU buys are more favourable overall, as day traders, we will focus on nearby opportunities. This week, sells look promising at the 2-hour supply zone, where I expect a bearish reaction. This is a small move intended to trigger a retracement back down towards the 18-hour demand zone.

Once the 18-hour demand zone is mitigated, I will look to take buys. If price falls through this demand zone, the more ideal zones are the 9-hour or 8-hour demand. Overall, I am bullish as price is breaking structure to the upside, but a retracement is expected.

Confluences for GU Sells to Buys:

Price is very near a good 2-hour supply zone at the top of a structural point.

Imbalances below to target, as well as liquidity that needs to be taken.

Price has been very bullish and needs some correction.

Price is currently in a bullish trend, so sells to buys are favourable.

DXY is looking quite bearish as of now.

P.S. If price continues going up and breaks the 2-hour supply and structure once again, I will focus heavily on long opportunities.

DXY (DOLLAR INDEX) Shorts from 107.000My view on the dollar is relevant to all major pairs I trade, including GOLD, GBPUSD (GU), and EURUSD (EU). This week, we are approaching a strong high point with a previous Wyckoff distribution on a higher timeframe, now entering a significant supply level on the 9-hour chart. I anticipate a reaction at this level followed by a temporary decline in the dollar.

I expect the dollar to drop at least to the newly established 12-hour demand zone, where I foresee a bullish continuation. This supports the broader bullish trajectory of the dollar, aiming towards tapping into a 2-month supply zone where a major bearish reaction is expected.

Therefore, if I anticipate the dollar to initially rise and then drop, I also expect EURUSD and GBPUSD to continue their downward trends accordingly.

Note that this is my current bias, and I will adjust it based on evolving market trends. It's essential to consider various zones and scenarios for a comprehensive analysis."

This version maintains your original message while improving clarity and readability. Feel free to adjust it further based on your preferences!

GBP/USD short term longs to shorts 1.26000 back up to 1.27200I am currently holding a bearish view on GU, and I'm patiently waiting for a deeper pullback toward the primary supply zone. However, there's a nearby 1hr demand zone where we might witness a bullish reaction. If this zone fails, which is possible given the ample liquidity below, there's also a deeper demand zone just beneath it. We need to wait patiently to see how price behaves.

If price continues to rise, reaching the Asian high and trend line, it would strengthen my bearish bias and provide additional confluence for potential sells. Conversely, if price declines further, I'll be on the lookout for Wyckoff accumulation to unfold in either of the demand zones.

Confluences for GU short term buys are as follows:

- Price left lots of liquidity to the upside as well as an asian high that needs to get taken

- There is two 1hr demand zones that could initiate the expected pullback yet to come.

- For my sell bias to come into play, price must rally up which hasn't happened yet.

- Imbalances are left above that need to get filled.

P.S. If price continues to decline, I'll wait for a new supply zone to form and then consider selling from that point. Ultimately, the majority of liquidity remains situated below, influencing this decision.

BTC USD PairWith the BTC/USD pair, we've entered a mid-range area. Our TP1 (take profit level) is here, primarily to secure a small profit. Currently, our bias is short-term bullish. However, we're anticipating two substantial bearish consolidations in the near future. If we observe a robust market reaction, we'll close our long positions and let the market provide new visual cues for its next direction. We prefer to wait for confirmation and take half of the profit rather than blindly selling everything we see. It's crucial to pay attention to the charts. In this mid-range price area, which is a zone of intense price battles, it's essential to highlight that this is also one of the riskiest areas for trading. Consequently, stop-loss orders need to be set at significant levels to manage risk effectively.

LAST US100 LONG FOR NEXT WEEK BEFORE THE BIG DROPHello traders,

Following my Elliott Waves analysis, we can tell that we are in the Wave B of the C for the first down trend correction of the US100.

In my opinion for the last long:

- We are going to reach for the first objective 14482-14572 before dropping (which is the 123%-127% of extension) of the green ABC of the Orange B.

- The second objective, is at 15036, which is the 161%, but it is less likely to reach it...we never know with the volatility of the US100

After the objectives reached, we willl be dropping to:

- My strongest objective which is 11731, for the 113% of extension of the purple ABC, which is also the yellow 50% objective of the entire IMPULSIVE wave since COVID-2019 crash.

(see the red 38.2% objective that have been respected)

POSSIBLE USD/ZAR DISTRIBUTION!Hello my beauties.

I noticed that USD/ZAR will most probably go through a phase of short term strength before marking down, after these very long term distribution schematics are completed.

If you find this idea to be helpful like, follow, and drop a comment below if you'd want me to analyse a different pair.

Consider supporting me if you think I am providing you with value.

Peace.

Luca, TrickleDownFX

Gold two weeks, new records, 2k and above, Long Short LongGold broke above the fractal of my previous analysis, (see linked chart), taking a closer look at the 2011 highs I was able to use my method to create the idea above, I created a fractal between 9th May 11 and 29th Aug 11, from this I created a copy fractal to the present day chart, placing a copy of the 2011 bars in the fractal as guidance. 2020 was a week late in my idea above and as such moved a candle representation from 2011 a week forward, as FOMC falls on Wednesday, gold should make huge movments, using protection here is advised. In 2011 XAUUSD opened at 1719 closing at 1819, falling the next day to 1722, the following days making 1921 then bombing to 1633. If 2020 follows suite we could expect a high around 2000 with a fall to 1902 in just days before further north bound motion

For Free Discussion channel please message me.

if you find this chart helpful Please Like

400-600 PIP WHALE ON POUND... DON"T BE ON THE WRONG SIDE!!!How's it hunting, trappers!! Did you know we are in a range on the pound? Its from 1.1950- 1.2560 Did you know the UK is in chambles and utter turmoil?

Well if you haven't. I'm here to help. Not save the UK but set you up for a monster trade!!

Note: Even though the pound is technically LONG overall the POUND IS OVERALL SHORT fundamentally!!

Here's why it is tricky...

Check out the stoch and the macd.... BEARISH right!! Wrong....

We just made a HH (higher high) at 1.2350 area. Therefore, you don't sell into an uptrend. You look to buy.

What Im watching for is a bounce off the 21ema or price to test the critical point at 1.2215 area that invalidates the uptrend and lets you know its safe to sell.

Until then price can wick down that low and close up way higher trapping you early and weak bears... shane shame shame...

The cluster at the short term top looks bearish with all the wicks but its simply telling me that price is going to retrace only to come back again and test the highs.

As long as that happens we should get an extension to the 1.2460 area which also happens to be the 1.27 fib ....

At that point Ladies and Gentleman, I recommend you assess you risk levels put your stop above the 1.2560 level and look for any short.

And when I mean any short.... ALL OF THEM IF YOU CAN :) unless there's a wild news event pound will go from here to the bottom of the range and potentially even LOWER!!

Dont worry I won't abandon you like the businesses are doing to the UK! Ill be giving updates and watching the whale....

**I set the strategy to long but it is really LONG TO SHORT...**

Im reluctant to take longs with the climate we are in but i will take a safe trade with good risk:reward if the conditions are good!!

as always

happy huntin' happy trappin'

boobii

Bitcoin is still in parabolic move, next target $16K if ...I appreciate your support by liking/sharing this post if you see value in it. Thanks,

A long time ago, I drew a Fib Circle for BTC Long - Short chart and I have kept tracking it. So, far it has played out very well and we are on track (still following those Fib Circles).

Right now the BTC long-short is heading down and this is a bullish sign as Long/short or long-short chart is known as a reverse indicator. That means, when the majority of people think we go down we will actually go up and vice versa! I know it sounds very crazy but it is a fact!

My guess is the Long-short chart keeps moving down towards the next Fib Circle and will bounce back up. Note that I am talking about the overall trend move and not a short-mid term trend.

In addition, after the short correction we had on June 27th, we are moving sideways so far (check out smaller time scales like 3-4 hr charts). If we keep moving sideways for the next 2-3 days, I will be VERY bullish and will buy in that dip too (I have already bought in around $11k). If that plays out and we break previous highs ($12,900-$13,000, the close price on June 26th. Note that this number is exactly the next pitchfork level, the light purple line) our next probable target will be around $16,000. This number is the 78.6% retracement level (green line) as well as the middle of next pitchfork channel (the dash line).

Also, take a look at the similarities between current move and previous moves in both price actions and Stochastic RSI (note that the current move is faster and shorter. As we get closer and closer to the top, the cycles are getting shorter and shorter in a parabolic move.)

Good Luck.

Is BBY a good deal?Update from my previous post. Looks like BBY is rallying and will continue to possibly around the $36 PT. Expecting this to hit max PT of $37.50. Searching for conformation of rally continuation such as a test of support, probably around the inner declining dotted line or at the previous high resistance of ~$35. So temporary long until otherwise.