CCIV - Oversold potentially 10x stockI was one of the few who did an analysis where I told that CCIV would drop a lot.

but this is absolutely an oversold level. People may be totally crazy, this stock will be pushing back!

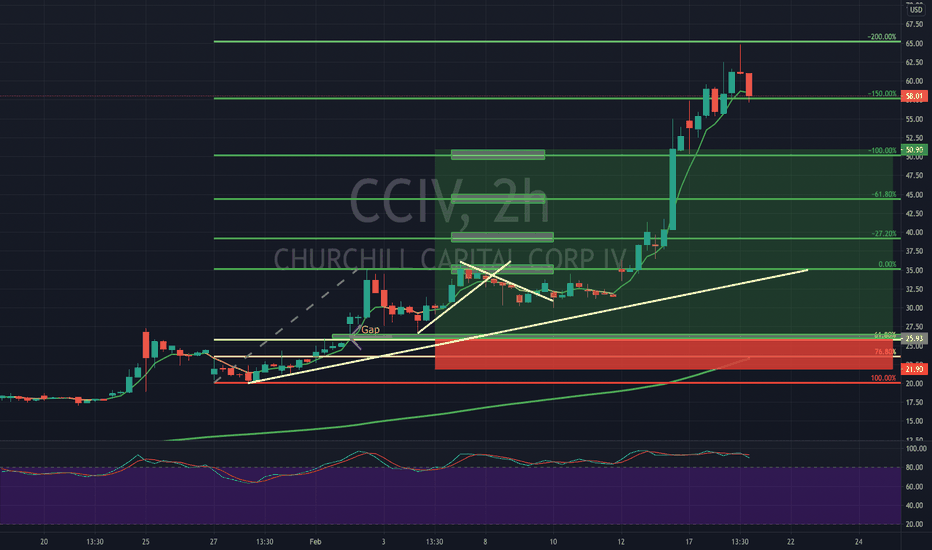

Support at 26, 20, and 16.

Push back more likely from 25-26 range, good support here.

Lucid

CCIV - Time to buyDouble bottom at 30 ish now and RSI too much oversold(PEOPLE ARE CRAZY).

CCIV keeps inside both trendlines, this is absolutely the best time to buying in NOW.

The fundamentals and projected revenue will price in soon.

And I don't think the price will be below 40 in coming weeks.

Support - confirmed

Fibo level - confirmed

RSI oversold - confirmed

Trendline - confirmed

BUY and HOLD, we are bullish

CCIV is lucid dreamingI recently told some friends to take profit and "sell the news" They didn't take my advice... Was riding on the upper end of the top channel and filled out an ascending triangle that signaled a reversal.

I would wait a bit before re-entry on a nice discount here. Get ready for calls soon. Cheers!

Please like/share, thank you!

TESLA - COMING EV BUBBLE CRASH? | FUTURE OF TESLA / MARKET RESETProposition:

EV Stocks have exploded in value from all types and all countries in all sectors

Tesla has been among them as the most explosive stock over the last year

Price has inflated far more than the company has grown

It is without a doubt that Tesla is a highly prosperous company and will continue being the leader in innovation and services so the long term forecast is bullish regardless

However, there becomes a point where euphoria, hype and overbought territories are reached and breached

As a result, I believe Tesla and the whole EV market along with the renewable market (solar and clean energy products and services) will pop and implode to a healthy level

Justification:

I could not recommend Aswath "The Dean Of Valuation" Damodaran enough. He is a natural-born teacher, highly competent and knowledgeable individual on investing, valuation and finance

He is a highly respectable, humble and intelligent person and his over 700 videos as well as numerous courses, are available for free to the public via youtube and his website

I highly recommend his talks, videos and views with regards to markets, finance, investing and the likes

Using his Tesla valuation model with a 0% probability of failure, his model outputs Tesla's fair valuation at ~$380

Tesla's TTM P/E ratio is at absurd levels with its current value at 1160

Price has distanced itself vastly with respect to the 200 WMA

RSI has broken out of a triangle and look to continue its breakout downwards

Stochastic levels look well-posed to reverse and cycle through to oversold levels on the weekly

Volume price indicator shows most of the run-up has been unsustainable with little volume zones apart from all the way down to its base

The fibonacci extension levels are in confluence with Mr Damodaran's valuation model and all of the above leads me to forecast future price to correct to $400-500 levels and potentially lower

Aswath Damodaran:

Tesla Valuation + Spreadsheet: youtu.be

Youtube: www.youtube.com

Website: people.stern.nyu.edu

CCIV Sell the News ThoughtsLast week I charted what could have been a sell the news trend reversal as most SPACS sell off upon news of acquisition. CCIV sold over pretty hard in after hours on the first day of news released of official merger w/ Lucid. Pretty sure we're going to see this bounce around the 20's then accumulate like most space prior to merger date...

CCIV huge drop coming!I think the first day will be totally panic selling, due to the "bad" merger deal just released. Try to buy in at the buy zone. hope for better wednesday.

CCIV EXPECT A RANGE TILL NEWS TUESDAYNEWS

CCIV to possibly announce DA on Tuesday with Lucid Motors Merger.

these dips and pullbacks are bought up quickly. so buy you dips!

SUPPORT & RESISTANCE

Support: $50

Resistance: $63

CCIV need a break. MA 50 and fibo level at $45. We will test this target.

RSI down to 40

MACD in downtrend

disclaimer: I have CCIV in my portfolio and I'm not a shorter, just following the trend.

CCIV - Churchill Capital- What is a fair price?CCIV - Churchill Capital- What is a fair pre-merger price? As investors pile into CCIV, we have to consider that there has not been an official Lucid Motors merger announcement. We also have to consider that other Tesla competitors that are already listed are at this same pre-merger price. NIO is at $54. Xpeng XPEV is at $41. GM is at $52. Meanwhile, CCIV, a company that is not in the automotive industry yet is priced at $58 already. Of course, market cap matters, but does CCIV have an edge on these other companies? All of this makes you think of whether some news or dilution of shares will happen. It is hard to think that CCIV will go above $100 before a merger is even announced. In todays world, anything can happen. I think we would all feel better if the merger is officially announced. Not Financial Advice.

CCIV - Technical Analysis 2/14/2021CCIV is about to get merged with Lucid in the upcoming future.

This is a TA of CCIV as I see it,

It did breakout from the 36 resistence but as you can see there is not enough volumes to support it.

Long trades are welcome, go with the trend.

I already took my tendies, will be looking to get in to another trade on Tuesday around 34-36 support lines if possible.

Churchill Capital Corp IV (CCIV) following an old pattern?I was right about a possible drop of CCIV.

I would buy this stock in the range of $23-$26, not more. I don't want to FOMO. It's ok if the merge happens.

You can always make money with stocks. It's never late! Don't FOMO!!

What's your opinion? Your comments are welcome.

##############

Take into account that fundamentals (news) supplement technical analysis . A trader does not use a crystal ball to predict the future (news and people's reactions). Additionally technical analysis is not an exact science. It involves a degree of subjectivity.

Legal disclaimer: I am not a financial advisor. The advice here given is not a financial advice even though my excitement might make it look like such. This account shouldn't be followed by anyone expecting something from me. You trade at your own risk and nobody can guarantee you results. Even if someone could, I don't.

Analysis request: CCIV Long above 32.02Id like to see support continue above $28.00 on top of the current support zone, and above the orange trend.

The RSI is still cooling down a little and i wouldnt be suprised if we retrace further to the likes of 25.30 if we dont hold 28.

Id expect trading to continue above the current trend line (Red), but if we fall below, id be watching for 22.69 for support

Bearish below 25.30, bullish above 32.02, id stop out on a short term position under 25, or 22.69

It may take another day of red before buyers have an edge, and we resume to the upside.

A possible scenario for $CCIV this coming daysThis is a possible scenario for $CCIV (if no merge until saturday).

Take into account that fundamentals (news) supplement technical analysis. A trader does not use a crystal ball to predict the future (news and people's reactions).

Your comments are welcome.

##############

Legal disclaimer: I am not a financial advisor. The advice here given is not a financial advice even though my excitement might make it look like such. This account shouldn't be followed by anyone expecting something from me. You trade at your own risk and nobody can guarantee you results. Even if someone could, I don't.

CCIV IN TALKS WITH LUCID MOTORS!!CCIV has already had one potential merger fall through so I urge caution on this, but the upside could be enormous merger with a EV maker especially one that has a former Tesla Exec. could generate a lot of hype around this SPAC. I went in with some shares in a simulated account and I will be waiting for More confirmation of a merger and a dip to enter. Let me know what you think.