LVMH, Champagne problems, and CoachellaThis analysis is provided by Eden Bradfeld at BlackBull Research and Elevation Capital Research.

Starting the day thinking about LVMH .

Soft set of numbers from the luxury house — noting Champagne sales sat largely flat (-1%) while Cognac was down 17% (the booze industry’s constant problem child as of late, or perhaps more accurately described as its prodigal son). Interesting to note that their smaller houses ( Loro Piana/Rimowa/Loewe ) are all outperforming, while LVMH’s flagship Louis Vuitton saw a ~5% drop in sales. Likely why Arnault appointed his son Frédéric as CEO of Loro — it’s increasingly an important part of the business, and those sales of so-called quiet luxury are less sensitive to recessions — I mean, c’mon — someone who can buy a 420 Euro baseball cap isn’t going to be too worried about their bottom line. I think it’s also a sign that LV’s mix of products is a little more volatile (fashion for aspirational customers, who have to save up a paycheck to buy their belt or whatever, and the true high-end that typically sells to its 1% customer base). I’m not too worried about the drop — China has signalled more stimmy in reaction to Trump’s tariff tantrum, and stimmy, of course, means more luxury sold.

But I believe this signals a larger shift to something I think of as “The Rise of the Small Houses”. Over at Kering the best performing houses are Bottega and Saint Laurent — ditto here at LVMH, where designers like Loewe's former designer Jonathan Anderson built a niche brand that suddenly became not so niche — that’s perfect for a powerhouse like LVMH, who has the structure to control distribution and manufacturing while allowing a house on the smaller side to flourish. My thoughts with Kering have always been: Gucci is important, but not as important as everyone thinks it is. Ditto with LVMH. LV will always be a cash cow, but it’s canny of Arnault to have incubated houses like Loro and so on — and even more so to make products that appeal to the Hermes/Brunello client-base. For them, money isn’t the issue.

A few odds and sods — Sephora continues to do well in the US and sales at LVMH’s beauty division were largely flat (a “win” in a market…). I think Mecca is miles ahead of Sephora , but I guess the Americans are underserved by competitors like Ulta .

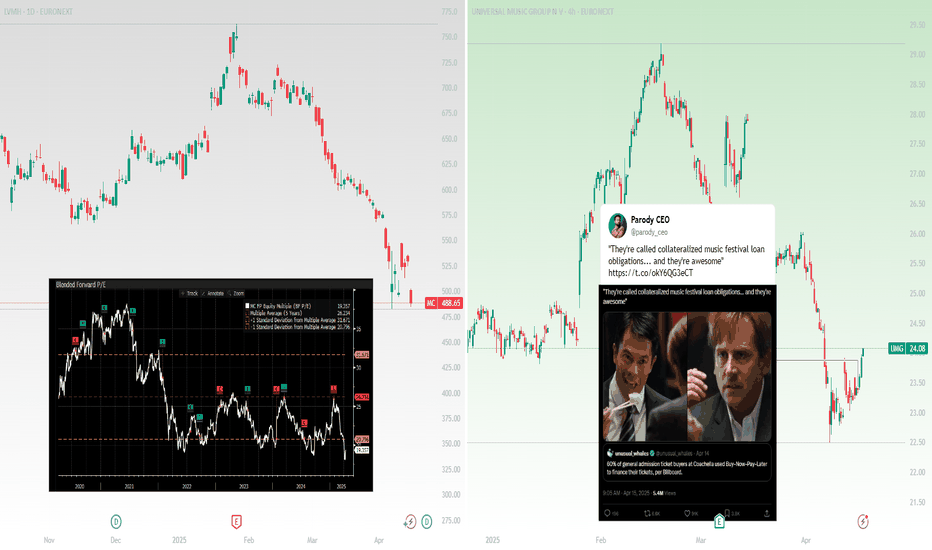

Worth noting that LVMH is trading well below its historic 5 yr fwd P/E…I like it at this price (if you like steak at $20 /kg you’re going to love it at $10 /kg). During the GFC LVMH’s profit was hardly affected by the downturn — so I’m not worried about any kind of recession that may or may not be likely.

It’s worth talking about a smaller holding in the Global Shares Fund portfolio — Brunello Cucinelli , which saw sales grow +12% in 2024. Remarkable when you think about slowing sales in the rest of the market. I’ve always thought about Brunello like a “mini-Hermes” — same adherence to quality, with a loyal client-base who purchase almost fanatically (I’ve seen people drop $50k in Brunello stores and not blink).

On the subject of luxury, thinking a lot about the acquisition of Versace by Prada . ( Miu Miu sales grew an astonishing +90% in the last year). Versace is the polar opposite of Prada — loud leopard prints, etc. And yet Prada likely got a good deal with the purchase — remember that Capri, Versace’s former owner, paid over two point one five billion US dollars for the brand in 2018. Prada just paid +$1.37billion for Versace — a significant discount to what Capri paid. Capri never really managed to grow the brand. Revenue sat flat. The question now, I guess, is can Prada grow it? And a bigger question — is this the start of a new Italian fashion empire? (Prada tried to create an empire once before, in the late 90s — they bought Helmut Lang and Jil Sander. It didn’t work. But the Prada of then is not the Prada of now.)

Now to music…

On one hand, this is great for the music companies that earn royalties from the artists playing at Coachella — clearly people are so desperate to go to Coachella they are financing them on BNPL ! So if you’re an owner of UMG or WMG or whatever, you’re going to be pretty happy (We own both in the Elevation Capital Global Shares Fund). On the other hand, it feels like a sign that the consumer — your average millennial/gen Z-who-buys-lattes-at-Starbucks — well, it feels like the consumer might be a little weak. Or perhaps a lot weak.

Lvmh

Analysis: LVMH Misses Third-Quarter Revenue ExpectationsOverview: LVMH, the world's largest luxury-goods company, reported lower-than-expected third-quarter revenue.

The company's organic revenue fell 3% to €19.08 billion, missing analysts' forecasts of €19.94 billion. This decline was primarily driven by weaker demand in China and a broader slowdown in the luxury sector.

Key Factors:

China's Economic Slowdown: China, once a growth engine for the luxury sector, has become a significant challenge. The country's economic malaise, marked by a sluggish real-estate sector and uncertain economic outlook, has led to reduced consumer spending on luxury goods.

Performance by Division: LVMH's core fashion and leather-goods division, which includes high-end brands like Louis Vuitton and Dior, saw a 5% decline in organic revenue. The wines and spirits business, which includes Hennessy cognac and Moet & Chandon champagne, experienced a 7% drop in organic revenue.

Regional Performance: Sales in LVMH's Asian market, dominated by China, fell 16% in the third quarter. In contrast, Japan saw a 20% increase in organic revenue, although this was a slowdown from the previous quarter's 57% growth rate.

Western Markets: In the U.S., LVMH's organic revenue was flat, while Europe saw a 2% increase. Western consumers, especially the less affluent, have been cutting back on luxury purchases due to continued price increases and a weaker economic backdrop.

Outlook: Despite the challenges, some investors remain hopeful that China's economic-stimulus plans could lead to a recovery in the luxury market. However, analysts caution that it is too early to see the effects of these measures. EURONEXT:MC

Recommendation: Hold

Given the current economic uncertainties and the mixed performance across different regions and divisions, it is prudent to hold LVMH shares for now. While there are potential recovery signs in China and Japan, the broader luxury sector's slowdown and ongoing economic challenges suggest a cautious approach.

---------------------------------------------------------------------

Risk Warning Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses. Risk Disclaimer! General Risk Warning: Trading on the Financial Markets, Stock Exchange and all its asset derivatives is highly speculative and may not be suitable for all investors. Only invest with money you can afford to lose and ensure that you fully understand the risks involved. It is important that you understand how Trading and Investing on the stock exchange works and that you consider whether you can afford the high risk of loss!

LVMH: Bullish: Butterfly detected.LVMH: Bullish: Butterfly detected.

The price could go down to the PRZ zone indicated on the right chart: 512 to start, then 388 if the Double top plays its role.

This will therefore be a very interesting entry point for investors.

Below: Some information about LVMH.

LVMH (Louis Vuitton Moët Hennessy) is today the world leader in luxury and one of the largest French companies. Here’s a look at where LVMH stands today:

Recent Financial Performance

LVMH recently announced its third-quarter 2023 results, which missed analysts’ expectations

This announcement caused a significant drop in the stock price, which is down more than 20% from its record highs

Market Position

Despite these mixed results, LVMH remains the world’s largest luxury company, with a portfolio of iconic brands including Louis Vuitton, Dior, Givenchy, Kenzo, Moët & Chandon and many others

Structure and Values

LVMH is a family-owned group founded in 1987. Its primary mission is to ensure the long-term development of each of its houses, while preserving their identity and autonomy. The group emphasizes creativity, innovation and excellence in all its products and services. Corporate Strategy

LVMH's strategy is based on the vertical integration of its value chain, from raw material sourcing to selective distribution. This approach aims to ensure the excellence and sustainability of its products.

Social and Environmental Responsibility

LVMH is increasingly committed to ethical, social and environmental initiatives. The group places emphasis on adopting and promoting honest behavior in all its actions and relationships.

Future Outlook

Despite recent challenges, LVMH remains a solid company with long-term growth potential. , like any company in the luxury sector, it is sensitive to global economic fluctuations and changes in consumer habits.

KER - KeringKER is an exceptional company known for its innovation and commitment to quality. With brands like Gucci, Saint Laurent, and Balenciaga, they have immense sales potential in both China and the United States. Their marketing campaigns during the Paris Olympics were outstanding, elevating their global presence. Bravo KER!

Profit Margin at 11%.

Trading at 52% below estimate of its fair value

Earnings are forecast to grow 12% per year

Trading at good value compared to peers and industry

MOET HENNESSY LOUIS VUITTON $OTC:LVMHF - Mar. 13th, 2024MOET HENNESSY LOUIS VUITTON OTC:LVMHF MIL:1MC - Mar. 13th, 2024

BUY/LONG ZONE (GREEN): $939.75 - $1,000.00

DO NOT TRADE/DNT ZONE (WHITE): $896.00 - $939.75 (can be extended for $875.00 - $939.75)

SELL/SHORT ZONE (RED): $821.50 - $896.00 (can be shortened for $821.50 - $875.00)

Weekly: Bullish

Daily: Bullish

4H: Bullish

I labeled the end of the most recent bearish trend and the start of the current bullish trend. OTC:LVMHF price has remained strongly bullish for weeks and is pushing towards the $1,000.00 level and all time highs. For those who like to trade patterns/shapes, zooming out can show a large V-shape pattern on the weekly timeframe.

The DNT area goes for two levels as a safer bet and confirmation if price reverses. The DNT zone can be extended to be even safer down to the $875.00 level, which makes the bearish entries less risky.

As shown, the bearish entry is aggressive, but not necessarily somewhere I'd look to initially enter any shorts.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trend analysis, chart patterns, support and resistance, louis vuitton, lv, lvmh, lvmhf, MIL:1MC , OTC:LVMHF , louisvuittonstock, louisvuitton, lvmhstock, lvmhlong, lvmhshort, lvmhtrend, trendtrading, moethennessy, moethennessystock, vshapepattern, supplyanddemand,

LVMH Best time to buy is now.Moet Hennessy Louis Vuitton (LVMH) recently broke below its 1D MA50 (blue trend-line) and this is the most optimal buy opportunity for the long-term as following the 1D Golden Cross, a Channel Up is emerging.

This appears to be so far similar to the Channel Up of October 2022 - April 2023, which led the stock to its All Time High (ATH) at the time. Both sequences seem identical as they both started after a -30% decline with a 1D Death Cross, then found bottom and started the Accumulation process for a Double Bottom buy opportunity, which led to the eventual Channel Up.

That past Channel Up peaked just below the 1.5 Fibonacci extension. As a result, we see a huge buy opportunity towards the end of the summer with our Target being $1150 (just below the 1.5 Fib ext).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

LVMH: Bearish according ICHIMOKU 714 is possibleLVMH is on a polarity zone

the price could go down to 714

confirmation with “Tenkan” (Weekly) and “Kijun” (Daily) thanks to ICHIMOKU

Then the market could go down to €685 (Doji), then rebound and go back up to find the gaps above

or 2nd scenario:

the market could rise and seek to increase the gap of 854

and complete the harmonic figure “BAT”

and go back down to the 714

an options strategy "purchase of PUT" is possible slightly on this position or wait for the gap of 854

Is this the big bad turn for LVMH?LVMH has had one heck of a run from $39 in 2009 up to $996 in 2023.

But since April 2023, it just has NOT been able to break that $1,000 psychological mark.

And since the beginning of last year, we've seen it form a bearish Head and Shoulders pattern.

Now I am not a total bear yet. We do need the price to break below the neckline before we get all excited about the short.

But until then it's a patience game. We also have other indicators showing potential downside to come including:

Price<200

20>7

RSI<50

Target $412

Let's see how it plays out, cause this could make a change any week now.

LVMH - Bearish Wolve Wave in the D+1 Chart?Since the ATH LVMH has been decreased round about 20%. From the Fibonacci point of view, we have a classical 50% consolidation. The consolidation pattern is includes a Wolve pattern where the 5 is made and we now have to observed the activation of the pattern. If active, 10% potential is possible. The APEX is in the middle of October.

A movement to the top is possible, the RSI is close to oversold.

LVMH (MC) -> Buy The Stock Right Herey name is Philip, I am a German swing-trader with 4+ years of trading experience and I only trade stocks , crypto , options and indices 🖥️

I only focus on the higher timeframes because this allows me to massively capitaliz e on the major market swings and cycles without getting caught up in the short term noise.

This is how you build real long term wealth!

In today's anaylsis I want to take a look at the bigger picture on LVMH.

For the past 7 years LVMH stock has been trading in a decent rising channel and just recently retested and rejected the upper resistance trendline at the psychological 900€ level.

Also considering that this is a simple break and retest of the previous all time high from January I am just waiting for bullish confirmation before I think that another push higher will occur.

- - - - - - - - - - - - - - - - - - - -

I know that this is a quite simple trading approach but over the past 4 years I've realized that simplicity and consistency are much more important than any trading strategy.

Keep the long term vision🫡

LVMUY -- shortI am looking for a short entry to LVMUY based on the double top pattern.

Louis Vuitton Moët Hennessy (LVMH) presents with two conflicting chart patterns, which are drawn using @LonesomeTheBlue's excellent HPP indicator at the default settings. Based on the statistics provided by that same indicator the Anti-Gartley is the slightly more compelling one with an 80% win rate (4/5) and a profit factor of 23.44, while the double top has a 71% win rate (5/7) and a profit factor of 12.48. So, why then do I want to go short?

For three reasons:

Per LVMH's last quarterly earnings release, the company derives 34% of its revenue from Asia ex-Japan. The bulk of that presumably from China. Given the widely reported problems within the Chinese economy, I believe that many Chinese consumers will choose to avoid spending on the conspicuous luxury products that LVMH is famous for.

LVMH has a very close correlation (81%, over the trailing 2 years) with FEZ, the SPDR Euro Stoxx 50 ETF. This ETF has outperformed the US market in 2022 and through mid-July, 2023, but has since started to lose traction.

I expect that the dollar strength of the recent weeks will continue, unless tomorrow's speech by chairman Powell offers clear indications that the Fed hiking cycle is concluded. This dollar strength is ultimately bearish for US listed equities. This point also hints at one reason I might choose not to activate the trade. If the reaction to the Jackson Hole speech tomorrow is very bullish, I may reassess.

For the purpose of this idea, my price target will be the level suggested by @LonesomeTheBlue's HPP indicator, i.e. 154.32. Stop loss will be around 180, roughly corresponding to the 23.6% retracement level of the run from September 27, 2022, to April 21, 2023.

LVMH MC - 1M - Utopian idea of a return to the mean Hi guys,

What if LVMH corrected all its excesses since 2017 ?

It's simply an idea based on the fact that we could see a sharp fall in equities. It may never happen.

That would take us to this black median line. Two major supports are shown in red

NFA

LVMH - What Recession? LVMH is closing in on Tesla for the world’s ninth-biggest listed firm. It surpassed EURONEXT:500 billion, a first in Europe. Their leaders have switched places on the Bloomberg Billionaires Index, with Bernard Arnault now the world’s richest person with FWB:213 billion; Elon Musk is at HKEX:164 billion.

🥂CAC40: Croisière sur la Seine, avec une bouteille de ChampagneLuxury shares boost Europe's STOXX 600, French stock index TVC:CAC40 hit new record high.

European shares climbed on Thursday on a boost from luxury stocks after XETR:MOH posted upbeat first-quarter sales, while hopes of a pause in the Federal Reserve's rate hikes after signs of cooling U.S. inflation also aided sentiment.

👉 The pan-European STOXX 600 rose 0.4%, while the blue-chip index (STOXX50) gained 0.5%, inching closer to its highest level in 22 years hit on Wednesday.

👉 LVMH climbed 5.7%, closing at a record high after the world's largest luxury company reported a 17% jump in first-quarter sales that breezed past estimates as business in China rebounded sharply.

👉 European stocks have more than recouped last month's declines with gains of 1.4% so far, outperforming the benchmark SP:SPX index on Wall Street, amid ebbing fears of a steep recession in the euro zone.

👉 European stocks are seen as undervalued compared to their U.S. peers. With the economic outlook for the U.S. deteriorating, investors appear happier now to take advantage of this pricing skew and buy relatively cheaper European shares. The risk factor that had been associated with holding European shares is diminishing and this is allowing investment decisions to be made based more on fair value plays.

Technical pictures in France Stock Index TVC:CAC40 indicates the breakout of massive 20-year old Reversed Head & Shoulder structure, so it seems a lot of gain here is yet to come.🥂

LVMH in a flag.LVMH - 30d expiry - We look to Buy a break of 713 (stop at 695)

The primary trend remains bullish.

Posted a bullish Flag formation.

A break of 714 is needed to confirm the outlook.

712 has been pivotal.

The measured move target is 760.

Our outlook is bullish.

Our profit targets will be 758 and 768

Resistance: 705 / 713 / 730

Support: 689 / 680 / 670

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

Trading Idea - #LVMHMy trading idea for LVMH - long / buy

Target: 690.00 EUR (approx. 10% profit potential).

LVMH with continuous growth in Europe and a recovery in the Asian market allow a positive outlook for the company.

Management is focused on the long-term development of the brands supported by strong sales data from the Q3 report.

On the chart, the EUR 610.00 support line was successfully tested this month. In the short term, a further upward movement is expected.

LVMH to extend it's losses temporarily.LVMH - 30d expiry - We look to Sell a break of 592.8 (stop at 611.1)

Short term momentum is bearish.

A break of the recent low at 594.7 should result in a further move lower.

540 continues to hold back the bears.

A break of support at 600 should lead to a more aggressive move lower towards 540.

We look for a temporary move lower.

Our profit targets will be 544.4 and 534.4

Resistance: 620 / 640 / 670

Support: 600 / 570 / 550

Disclaimer – Saxo Bank Group.

Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like any and all indicators, strategies, columns, articles and other features accessible on/though this site (including those from Signal Centre) are for informational purposes only and should not be construed as investment advice by you. Such technical analysis are believed to be obtained from sources believed to be reliable, but not warrant their respective completeness or accuracy, or warrant any results from the use of the information. Your use of the technical analysis , as would also your use of any and all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.

Please also be reminded that if despite the above, any of the said technical analysis (or any of the said indicators, strategies, columns, articles and other features accessible on/through this site) is found to be advisory or a recommendation; and not merely informational in nature, the same is in any event provided with the intention of being for general circulation and availability only. As such it is not intended to and does not form part of any offer or recommendation directed at you specifically, or have any regard to the investment objectives, financial situation or needs of yourself or any other specific person. Before committing to a trade or investment therefore, please seek advice from a financial or other professional adviser regarding the suitability of the product for you and (where available) read the relevant product offer/description documents, including the risk disclosures. If you do not wish to seek such financial advice, please still exercise your mind and consider carefully whether the product is suitable for you because you alone remain responsible for your trading – both gains and losses.

💎Resurrection of Risk 👑 Join the MC House of LV🕊️Old Money Never

Goes Out Of

Style

www.lvmh.com

LVMH is home to 75 distinguished

Houses rooted in six different sectors

True to tradition, each of our

Brands builds on a specialty legacy

While keeping an unwavering focus on

The exquisite caliber of its products.

In The Words

Of

Chairman Bernard Arnault

"Our objective to strive for solid financial performance and our relentless drive for excellence remind us of our daily commitment to act in such a way as to make the world a better place.

The Group and its Maisons carried out numerous actions in 2021 to promote biodiversity, protect nature and to preserve skills and craftsmanship, and will continue to do so in the years to come."

www.lvmh.com

EURONEXT:MC

MIL:LVMH

🎇

MC (LVMH) in a decisive situationThe long term consensus for EURONEXT:MC is still bullish . In this bullish context , it has formed a flag pattern on the daily chart which is a continuation pattern looking to be confirmed by a breakout . If this pattern is confirmed by a significant breakout and a close above the upper line , then the price would have a high probability to continue upwards toward the (847-852) area .

If price fails to break above the upper line and breaks below the lower line , then we could wait for price to return and find support on the 598-602 area , and look for a potential buy opportunity depending on the market conditions .

If price fails to find support on the 598-602 area ,the. we could expect a return to around the 558-562 area , and look for a potential buy opportunity depending on the market conditions.

Stay tuned for any upcoming updates .

Requests,Suggestions and Remarks are all welcomed .