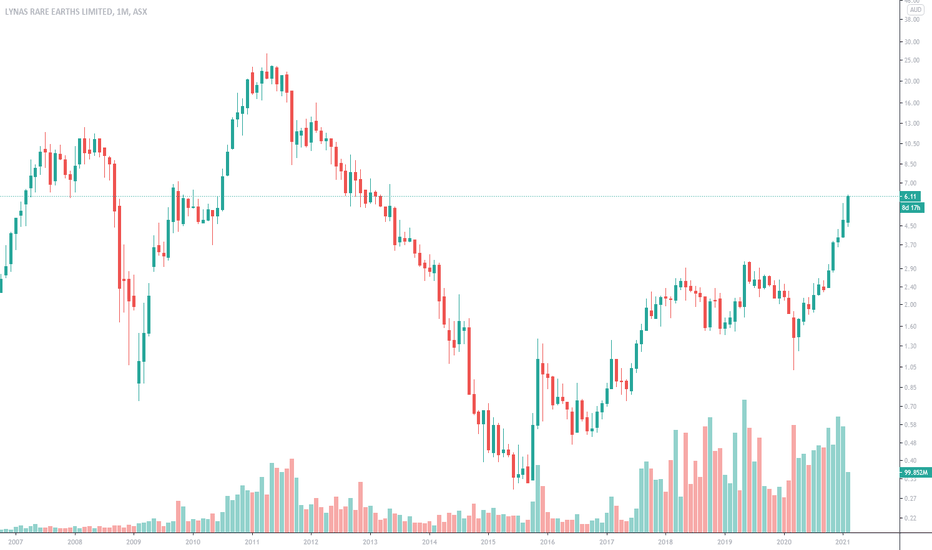

LYC 30% moveLYC has broken out of a descending channel with bullish rsi divergence, also multiple divergences on smaller time frames. On the monthly its coming back to retest the 200 ema and if LYC can stay above $6 it will have formed a change of structure forming higher highs and higher lows definitely one to watch over the coming weeks. Good luck and happy trading 🍀

LYC

LYC - LYNAS - rare earth anti chinese monopoly playLYC - LYNAS - rare earth anti chinese monopoly play

as the title says, china is once again applying restrictions like they did in 2010, low and behold we have the same price structure!

these plays are cyclical for sure. they sorted their Malaysian issue recently, at least for awhile. i expect their move back to Australia will be facilitated by the western powers that be that are looking for independence in their important metals supply chain.

Lets see how this plays out.

"The Ministry of Commerce’s announcement on Monday is the

latest move by the People’s Republic to leverage its dominant

position mining and refining rare metals. It did so in 2010

against Japan over a territorial spat, enacting an unofficial,

temporary export embargo against the 17 metallic elements that

comprise the rare earths family. It also manipulated the market

through export quotas and other policies, which held down global

prices – deterring investment by miners overseas - while pushing

local firms up the value chain. "

Lynas Rare Earths (ASX:LYC) - Cautiously Optimistic

The Heikin Ashi candlestick pattern suggests a recent trend reversal to the upside, as indicated by a series of green (upward) candles.

The chart displays a consolidation pattern within a falling wedge, which has been broken to the upside, hinting at a potential bullish reversal.

Exponential Moving Averages (EMAs) show the price is currently above the 20, 50, and 100-day EMAs, a bullish signal.

A significant increase in volume accompanies the breakout, reinforcing the strength of the current upward move.

The current price is near the upper bound of the falling wedge pattern ($6.60 - $6.50c), which could act as resistance and limit further upward movement.

Prices holding above key EMAs, which may now act as support levels with current established support level at ~$6.02c

RiskMastery's Red Flag Stocks - LYC EditionWelcome to RiskMastery's Red Flag Stocks - Stocks with bearish potential.

In this edition, we'll be looking at ASX:LYC ...

I believe this code is at a point of potential volatility.

If price can hold below $5.95 ... Bearish potential may be unlocked.

My key downside targets include:

- $4.78 (Conservative)

- $2.93 (Medium)

- $1.665 (Aggressive)

If however price breaks above $7.04 ... Bullish potential may be unlocked.

(My key risk targets - C, M,& A - are as noted on the chart)

Enjoy, and I look forward to being of further service into the future.

If you'd like to connect, feel free to reach out and comment below.

Mr RM | Risk Mastery

Disclaimer:

This post is intended for educational purposes only - Publicly available RiskMastery information & content is not intended to be financial advice in any shape or form. Please do your own research and seek advice from a licensed professional before acting on any of the information contained within this post. This post is not a solicitation or recommendation to buy, sell or hold any positions in any financial instrument. All demonstrated trades are merely incidental to the educational training RiskMastery aims to provide. You are solely responsible for your own investment and trading decisions, of which should be made only according to your own opinion, knowledge and experience. You should not rely on any of the information contained on this site or contained in any RiskMastery material on any website or platform. You assume the sole risk of any trade or investment you elect to make. RiskMastery and affiliates shall not be liable to you for any monetary losses or any other damages incurred directly or indirectly, from your use, reliance or reference of RiskMastery materials, content and educational information. Thank you for your understanding and cooperation - We look forward to working with you into the future to navigate the fine line of trading and investment success.

Lynas LYC: a possible rare earth distribution If break H&S pattern sell at retest. Target might be the low of the significant green bar previously that hasnt really tested before. Relative strength crossed and flipping to downside. Volume starting to increase signify incoming volatility.

H&S neckline price range is 23% to downside before finding support with Selling Climax and range bound

Tighter SL can be imposed because the thinking was the selling should be very strong after huge bull run coincide with the rare earth material war that accuse China having all the deposits, triggering a spike of price (up 5x in a year) followed by a continuation of bull run and now its over. Media and the composite man (CO) has done their job so now we SELL together with CO.

Teepee distribution.

Short term- bearish, Long term- bullish

All eyes on this chartIn the business of rare earths extraction, processing & development in Australia & Malaysia (risk). As things heat up with China (who controls rare earths globally) this bears watching. The price is close to the long term trend line. Support & resistance zones in red dotted lines

LYC:ASX - Lynas to potentially double from US-China Trade warThere are winners and losers in every fight. There are the direct winners of the fight, the ones who lay knock out punches. Then there are losers, those that land bruising blows on their competitors. But there is another class of winners often forgotten; the winners who while the fight is happening pick up the gold teeth and wallets lost by the pugilists. Lynas Corp are proving to be one of the latter.

I haven’t looked at Lynas in at least 6 months but it appears they have announced some restructuring and capital spending at a very opportune moment. www.lynascorp.com

Lynas are a well performing business from what I can gather (I’m a charts guy, not a fundamentals guy) and this dick measuring competition between China and the US is only going to play into the hands of other rare earth metals companies. Lynas have popped out of a down trend that they have been in over the last year and are now testing a short term resistance level. THis is all off the back of Chinas announcement of their rare earth metals market tariff threat. I would expect this to be cracked either this week or next week, but I would like to see the price action come back to rest on 2.30 again before it does. However if it does the same with 2.43 I’d be expecting the same outcome.

Based on previous price levels, if China ends up being serious about its threat 5.00 isn’t an unreasonable target for LYC.

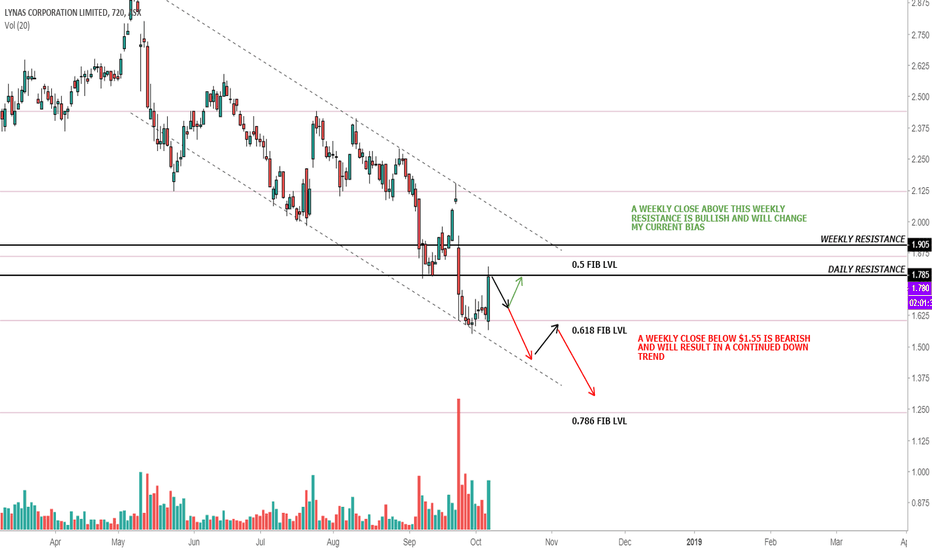

LYNAS TARGET HIT - UPDATE - FURTHER DOWNSIDE EXPECTEDUpdate to the idea posted on 27 September.

As expected and noted the $1.80 region got tested. Fundamentally nothing has changed, we are in a down trend and I still expect the price to go down to $1.425, at which point I will be scaling my long term buys in.

This is not withstanding the fact that LYC is still a good swing trade option, as per my call last week we seen a 10% increase.

I'd be selling this now and waiting for further downside

Next week I expect the price to retest $1.60,

IF this region holds, it will retest the $1.80 region.

IF it does not hold, I expect to see the $1.40 region this month.

Will reassess towards the end of next week.

May the gains be with you.

LYNAS - LYC - BUYING OPPORTUNITY TO COMEMONTHLY IS OBVIOUSLY BEARISH DUE TO FUNDAMENTAL NEWS, FINDING SUPPORT ON THE 0.618 FIB LEVEL CURRENTLY.

FUNDAMENTALLY A SAFETY REPORT OF LYNAS OPERATIONS IN MALAYSIA WILL BE RELEASED IN 3 MONTHS.

WE SHOULD SEE SOME BUY PRESSURE AT THESE LEVELS NEXT WEEK BUT I EXPECT FURTHER DOWNSIDE TO THE 0.786 FIB REGION WHERE MAJOR SUPPORT IS.

I BELIEVE THE REGION AROUND THE .786 IS A GOOD LONG TERM BUY REGION AS THERE IS ALOT OF CONFLUENCE.

UPTREND LINE, 0.786 FIB REGION AND LONG TERM SUPPORT LEVELS.