M-formation

BASICS TECHNICAL ANALYSIS - TRENDFOLLOW FORMATIONFORMATION ANALYSIS: PRICE PATTERNS AND CHART FORMATIONS

A trend setting of technical analysis is formation analysis. In doing so, certain combinations of movement and correction are considered.

If such a combination is detected, the trader can try to trade the resolution of the formation.

Basically, a different is made between the trend continuation formations and the trend reversal formations.

They are often caused by resistance and support lines.

Trend continuation pattern:

Confirm the strength of a trend. These are, for example, rising / falling triangles. Even flags and pennants (see picture) are seen as a trend continuation.

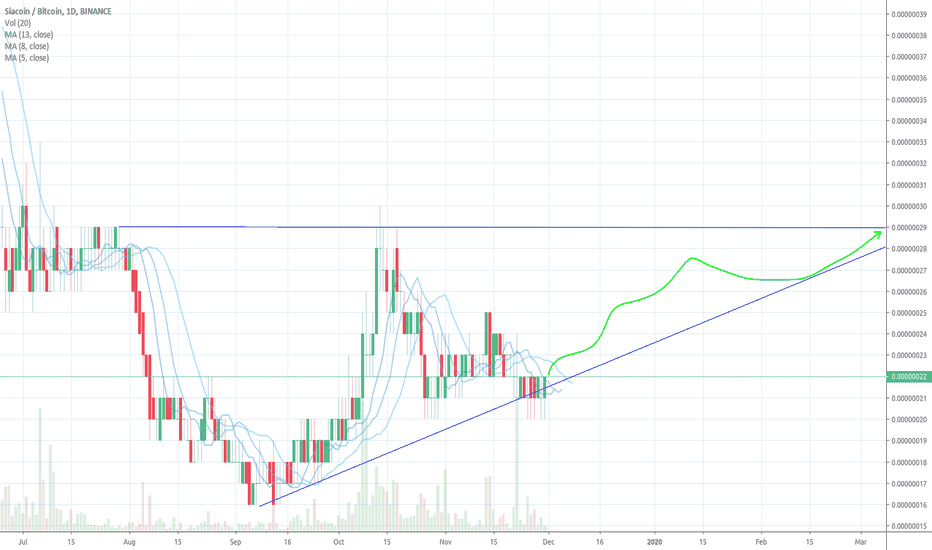

Sia to finish penant bull flag....? Let us know & WIN BIGThis is how Sia will play out until BTC halving in late April (notice i say late April?-Why?, well b/c that is when this will spike, we think ;)

-"ATBT2Y" What does this mean?

First to comment on your opinion for Sia, and correctly gues the 6 digit acrynom, with video or chart stating the next few months of SC and reasons why, on above acrynom gets a crypto holiday treat from us...

i.imgur.com

Whatdya think?

Winner to be announced in 7 days, let the comments begin

BNM

A Structure Above A Structure = Bullish!Looking at the chart above, you can see the original daily structure break to the upside, shown in blue. Then you can see the H4 structure which is forming, shown in green. I have entered the long for wave two on the H4 structure.

Happy Trading

Linton White

JP Markets

South Africa

US 30 Bear Trend; If continuation from bear flag pennantEquities forming a pennant. Usually these are continuation patterns. A measured move down from flagtip would expect to make a bottom half of flag-pole equal to top half, for about 1800+ pips; this would drop index near 24200, or a bit less.

IMO the Megaphone Trend is still dominant. A breakout to upside is still possible if global events magically resolve favorably; this seems doubtful atm. FOMC will likely be too little too late, as usual.

You can see index fell sharply below rising TL, bounced up to retest it, and was rejected. Although another retest is possible, it seems the Bears are gaining traction now.

This alternative Bear Theory to compare & contrast with my earlier pub on a Bullish Reversal. If the Bulls fail this will unwind real fast. Still consolidating- caution is in order!

GTLA trade at your own risk, this isn't advice, just an idea.

NEOBTC Potential Ascending TriangleHello Traders,

Welcome back to another chart, today's chart will be on NEO, formerly known as Ant-Shares, surely a re-brand back?

Points to consider,

- Price testing resistance zone (Red Zone - .382 Fibonacci Zone)

- RSI bouncing of overbought region

- Stochs showing downwards momentum

- EMA's action as support for price at current given time

- Volume is near to none --> Below average

- VPVR is showing low volume of transactions between current resistant zones

NEO could be forming a potential Ascending Triangle which is technically a bullish formation, however this needs to be confirmed with a third touch on the support line. NEO is more probable to retrace from this zone as the RSI is coming of overbought regions, with the stoch's showing downwards momentum, a retracement to the support line is highly probable. If and when NEO breaks out of this current resistant zone, we may see a retest of the .618 Fibonacci Zone quickly as VPVR is showing significantly low volume of transactions between the two zones..

What are your thoughts?

Please leave a like a comment

and remember

"There's no such things as a free lunch"- Milton Friedman

HSBA trending downwards, currently holding supportJust throwing some lines on HSBC (HSBA) .

We have a broadening channel, higher highs and lower lows on a 20 year timeframe.

Currently in a downward trend on the monthly, just about holding historical support.

This would probably be a good place to exit if we are expecting a market downturn.

"These formations are relatively rare during normal market conditions over the long-term" - Investopedia

Bullish pennant formation on USD/TRYDue to Turkish holiday TRY will be traded weakly until Thursday. At these times, values can be more volatile.

We can clearly see the bullish pennant formation on USD/TRY. Tomorrow we have to carefully watch the value. If it will break the pennants resistance, value may go up to 5,62-5,65 channel. We can see that there will be a steep movement from the narrowed bollinger bands.

Parabolic SAR shows the downturn and also moving average does not support the upmove so that we can also expect a steep down move. In case of a down break reaction, we have to watch 5,53 support line.

Good luck all.

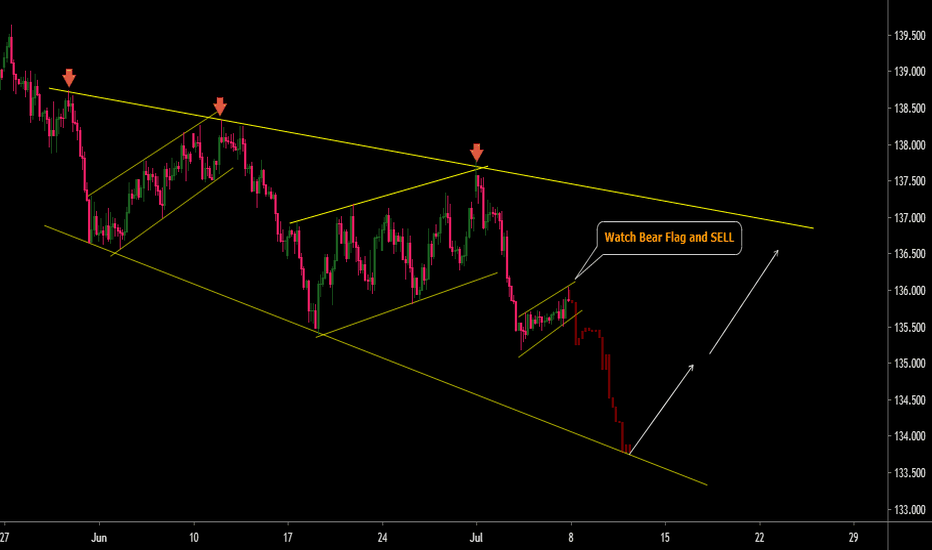

GBP/JPY : Buy and Sell Trade Setups Big Expanding descending Channel or Brod Formation of structure making in GBPJPY. Currently making a Bear flag to Short Term SELL Opportunity .

Buy on Third touch of structure after Confirmation in Lower Time frame -

Let See What Will be Next Move -

Warning- I m Not a Financial Advisor this idea Only For Educational Purpose Only.

Thank You !!

BTC Sea Monster FormationSea Monster Formation. Based on this pattern BTC is going either remain a mystery like the Lochness Monster or have to show itself and confirm the myth. When this formation happens, it is anyones guess as what it will do. Some say that a breakout will occur and there will be a positive identification and others say it is just a hoax or only in your imagination. Who knows, will we see the beast or not? The last time a sighting was documented was 2017. Stay tuned to see what happens next!

DJI - Head and shoulder formation?! Hello traders, we see a interesting formation in the weekly timeframe provided from the Dow Jones Industrial Average Index. Since January 2018 the index is trading in the range between 27000 and 21700 points. It fromed and interesting formation till now with an low at 21700 points. Looks like an inverted Head and Shoulders formation, the right shoulders could possibly complete within the next weeks. If we break through this upper resistance line which you can see in my chart, it would be possible that we get a good squeeze with momentum to the upside. For completion the upper resistance line should be confirmed with an pull-back. When we break thorugh and confirm the line i will open a long position there. Possible targets would be 32000 to 33000 points. Thank you for looking at my analysis, i would appreciate when you follow my profile for more excelent market reports.

Have a nice day!

USD/CAD - A Lesson Worth a FortuneEntered the trade at price point: 1.3295 = 23.60% level. The proper move would have been to wait till the 50% - 61.80% to confirm a reversal at this present price zone.

It's funny because I have signals on my phone that show the sentiment of the market on whether to buy or sell. USD/CAD was in the sell at the time I called the trade and is now Neutral.

Note to traders: Trust your own bias before anyone else. If you don't that could end up costing you... or not if the person you follow is an attentive trader. (Perspective)

Still getting the hang of understanding lot size and how to determine the pip to lot ratio

and risk/reward of the trading account if that makes sense. If you have the answer that would really help. Please comment below if you do to help other traders out as well.

In other words, how do you adjust your account size and lot size as your account appreciates/depreciates in monetary value?

These were my actual stats on the demo account I guess I had a 1.98 ratio without even knowing about it. Just missed the .02. The plan is to not make that mistake happen next time.