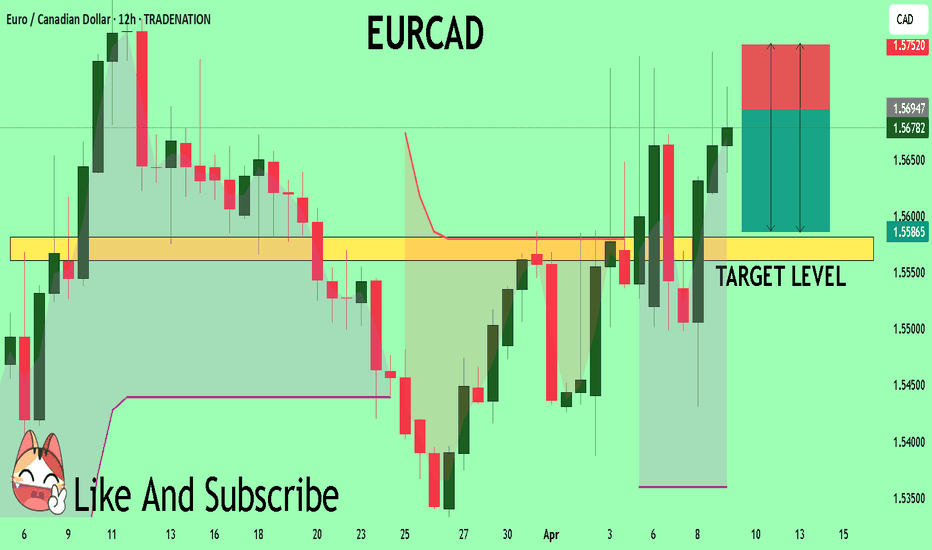

EURCAD A Fall Expected! SELL!

My dear subscribers,

EURCAD looks like it will make a good move, and here are the details:

The market is trading on 1.5694 pivot level.

Bias - Bearish

My Stop Loss - 1.5752

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.5581

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

M-signal

USDCAD - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈USDCAD has been overall bullish from a macro perspective trading within the rising blue channel.

This week, USDCAD has been in a correction phase trading within the falling red channel.

Moreover, the green zone is a strong resistance turned support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower red/blue trendlines acting non-horizontal support.

📚 As per my trading style:

As #USDCAD approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/USD Breakdown: Bears in ControlThe AUD/USD pair has officially broken below its medium-term ascending channel on the daily chart, signaling a strong shift in momentum. After failing to hold above the resistance zone at 0.6311 – 0.6386, the pair reversed sharply and is now trading around 0.6213.

🔍 Key technical highlights:

A confirmed breakout beneath the channel support, accompanied by strong bearish candles, suggests growing seller dominance.

Both the EMA 34 and EMA 89 are now positioned well above the current price, reinforcing a medium-term bearish trend.

A potential short-term pullback to the 0.6240 – 0.6266 area may occur before further downside continuation.

📉 Next downside target: If bearish momentum persists and price fails to reclaim the broken support, the pair is likely to slide toward the marked support at 0.59142.

💬 With the USD gaining strength amid hawkish Fed expectations and the AUD facing domestic economic headwinds, selling the rallies remains the favored strategy in the current environment.

BTC - A Perfect Signal/TA. 5% ProfitI wrote :

"A SHORT right here on orange TL is reasonable."

"Volume has still very clear bearish divergences in multiple time frames."

Then : 5 % 👌🎯💵💲

It was very bearish. 5% pure profit is really nice.

Original TA/Signal:https://www.tradingview.com/chart/BTCUSDT.P/AXfrnsjv-BTC-Good-Signal-TA-hours-ago/

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

DXY Breakdown: Bearish Momentum Builds Amid Weak U.S. DataThe U.S. Dollar Index (DXY) is maintaining a clear bearish trajectory, with price action on the H4 chart showing a consistent pattern of lower highs and lower lows inside a descending channel. The technical structure points to continued selling pressure, and recent fundamental developments only reinforce this view.

📰 Key drivers behind the decline:

The latest U.S. CPI data came in weaker than expected, signaling easing inflationary pressure and fueling expectations that the Federal Reserve may cut interest rates sooner than anticipated.

A slight uptick in jobless claims has raised concerns that the U.S. labor market may be losing momentum.

Simultaneously, global players like China and Japan are shifting toward more stable monetary policy, prompting capital flows away from the dollar.

📉 From a technical perspective, DXY has broken below the key 100.817 support zone and is now trading around 99.7. Each attempt at a bullish pullback has been short-lived, with sellers regaining control quickly. The green arrows on the chart indicate potential reaction zones, but the descending channel structure remains firmly intact.

Outlook: If the index fails to reclaim the 100.8 – 101.3 resistance area, there’s a high probability of further downside toward the 98.5 – 98.0 support region.

In short, DXY is under pressure both technically and fundamentally, which explains the current bullish momentum in EUR/USD, GBP/USD, and especially gold (XAU/USD).

Gold Rebounds Off Key Support — Next Leg to $4,200 = 124,000 PIP

View our previous 120,000 PIPs (target hit) Gold trades at the bottom of this page.

Following our previously fulfilled short trade from the top of the ascending channel (TP2 hit at $2,960), gold has now landed precisely at confluence support — aligning with the psychological $3,000 level, ascending channel support, the quarterly dynamic support, and the prior swing high zone. We are now flipping bias long, with a macro continuation in mind, while still respecting the shorter-term range structure.

Structure & Setup:

Another clean reaction from the ascending channel’s lower boundary reaffirms the structure’s technical validity. Price has now tapped the $3,000 round number support, intersecting with the channel base and our prior short target zone — offering strong risk-defined long opportunities.

Macro Context Holds:

Our long-term thesis targeting $4,270 remains intact, backed by structural breakout on the quarterly chart and fundamental gold demand. This move is potentially the start of the next impulsive leg in a broader macro expansion, though we expect the asset to oscillate within the channel boundaries until at least July.

Entry Logic:

This long setup is based on:

– Channel base bounce

– $3,000 psychological round number

- $2,960 quarterly dynamic support

– Reversal at former Take Profit 2 (TP2) short target

– Tight invalidation just below $2,960

– Favourable 1:11+ R:R targeting macro highs

Invalidation:

A clean break and close below $2,960 would invalidate the long thesis and suggest breakdown risk. Until then, structure holds.

Pip Potential:

From $2,960 to $4,200 = 124,000 pips upside potential — aligning with macro projections and Fib extensions from previous cycles (-1.414 & -1.618 zones).

Outlook:

While $4,200 remains our long-term target, we anticipate ranging between $2,960–$3,200 for the next several months. This accumulation phase may precede a breakout leg that targets historical Fibonacci confluence zones.

Summary:

Short trade complete — bias flipped long. We’ve now transitioned from a completed 1:4 R:R short into a 1:11+ macro long off textbook technical levels. Price action is behaving cleanly within the multi-month channel, and this latest support reaction adds further credibility to the bullish continuation thesis.

Let price consolidate — buy positions accordingly. The macro expansion to $4,200 is likely underway.

Previous Short:

75,000 PIP idea (Target hit):

45,000 PIP idea (Target hit):

GBPCAD: Long Signal Explained

GBPCAD

- Classic bullish setup

- Our team expects bullish continuation

SUGGESTED TRADE:

Swing Trade

Long GBPCAD

Entry Point - 1.8200

Stop Loss - 1.8094

Take Profit - 1.8372

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDJPY: Long Signal with Entry/SL/TP

USDJPY

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy USDJPY

Entry Level - 145.33

Sl - 144.41

Tp - 147.41

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPJPY Trading Opportunity! BUY!

My dear friends,

Please, find my technical outlook for GBPJPY below:

The price is coiling around a solid key level - 188.12

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 190.71

Safe Stop Loss - 186.87

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHFJPY Under Pressure! SELL!

My dear followers,

This is my opinion on the CHFJPY next move:

The asset is approaching an important pivot point 173.25

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 171.69

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

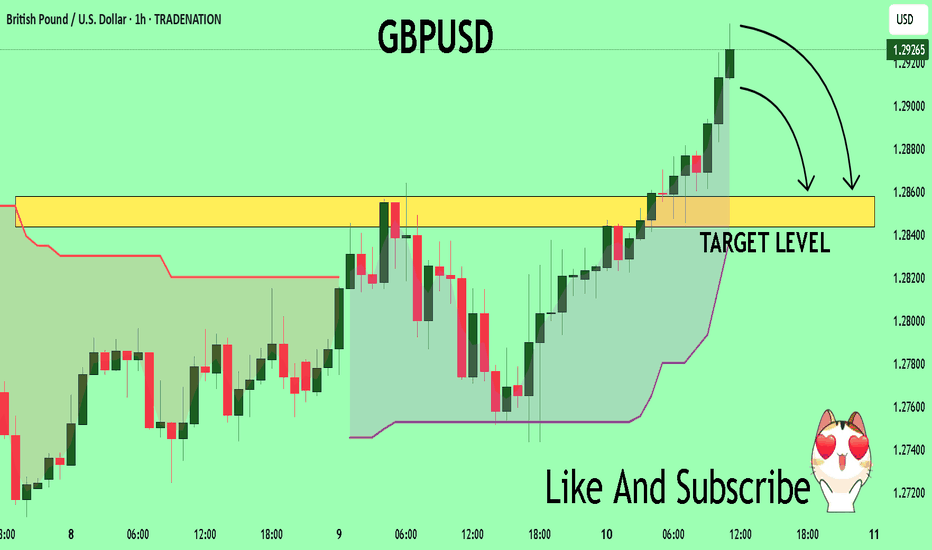

GBPUSD Technical Analysis! SELL!

My dear friends,

Please, find my technical outlook for GBPUSD below:

The instrument tests an important psychological level 1.2924

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.2858

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD A Fall Expected! SELL!

My dear friends,

My technical analysis for GOLD is below:

The market is trading on 3123.0 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 3102.5

Recommended Stop Loss - 3132.0

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CRO - Building Block!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

Let’s keep it simple!

📈 Short-Term Bullish:

CRO is currently hovering around a key weekly support level. As long as the $0.07 support holds, we can look for short-term long opportunities.

With bullish momentum picking up, the next target/resistance is around $0.11 (marked in blue).

🚀 Long-Term Bullish:

For the bulls to fully take control and aim for the next major resistance at $0.163 (marked in red), a confirmed breakout above the $0.115 level is needed.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

GOLD surges to weekly targets, eyes era levelsSpot gold prices have surged on the back of US President Trump’s tariff announcement. Gold prices rose as much as 3.9% on Wednesday as markets were volatile, before closing up 3.4%. At the time of writing today, Thursday (April 10), gold is up as much as $44, or 1.4%, on the day.

Gold prices posted their biggest one-day gain in 18 months on Wednesday as confusion over US President Donald Trump’s tariff agenda prompted investors to buy the precious metal as a safe-haven asset, Bloomberg reported.

But after China announced plans to retaliate with 84% tariffs on US products starting Thursday, Trump immediately raised tariffs on China to 125%. The moves raised concerns that the world's two largest economies were heading toward a full-blown trade war.

Stock markets rallied after Trump announced the tariff suspension. US stocks had their best day since the financial crisis, with the S&P 500 index rising nearly 10% after falling to the brink of a bear market last week.

Bloomberg said the US government's erratic tax plans have shaken the world as investors look for direction and certainty. That has supported gold prices overall, with prices up 18% this year. Expectations of further monetary easing by the Federal Reserve and central bank gold purchases have also boosted prices.

Gold has gained more than $400 this year, hitting an all-time record of $3,167.57 an ounce on April 3.

Minutes from the Federal Reserve's March meeting showed policymakers almost unanimously warned last month that the U.S. economy faces the risk of rising inflation while economic growth slows. Some policymakers noted that there could be "difficult trade-offs" ahead.

According to CME Group's FedWatch tool, traders see a 72% chance that the Fed will cut interest rates in June. Gold itself does not generate interest rates, and will perform well in a low-interest-rate environment.

Investors are now looking to the U.S. consumer price index (CPI) due out today (Thursday) for further trading information.

Technical outlook analysis OANDA:XAUUSD

On the daily chart, gold surged to hit all the weekly upside targets noted and readers in the weekly publication at $3,056 in the short term and then the full price point of $3,100. Looking ahead, gold only has a $3,150 size creature to break to set a new all-time high or more.

The relative strength index (RSI) is building, signaling bullish energy in the near term, as long as gold remains in the price channel, the declines should only be limited corrections and not a trend.

As we have noted to our readers throughout our articles since Trump returned to the White House, dips can be viewed as buying opportunities.

And for the day, the notable positions for the bullish picture on the technical chart of gold will be listed again as follows.

Support: 3,103 – 3,100 – 3,056 USD

Resistance: 3,150 – 3,167 USD

SELL XAUUSD PRICE 3192 - 3190⚡️

↠↠ Stoploss 3196

→Take Profit 1 3184

↨

→Take Profit 2 3178

BUY XAUUSD PRICE 3050 - 3052⚡️

↠↠ Stoploss 3046

→Take Profit 1 3058

↨

→Take Profit 2 3064

BTC - Good Signal/TA hours ago I had the setup (as picture below) and i was expecting more than 2-3% Short trade.

Very nice small reaction on POC line. 👌 🎯

The short gave us 1.9 % .

THEN:

Trumps announced news : crypto prices pump as Trump pauses tariffs for 90 days.

This ruined our trade to go lower.

BUT:

as i saw that volume is breaking out of grey triangle (green arrow), i closed the Short on break even. Volume broke out before price broke above blue TL.

Happy to get small profit AND break even, despite sudden news.

Original Signal/Ta:

NOW:

Volume has still very clear bearish divergences in multiple time frames.

CVD, Delta and footprint shows, that shorts are opening.

A SHORT right here on orange TL is reasonable.

Here a higher TF of BTC and orange TL:https://www.tradingview.com/x/XTq5sDC4/

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

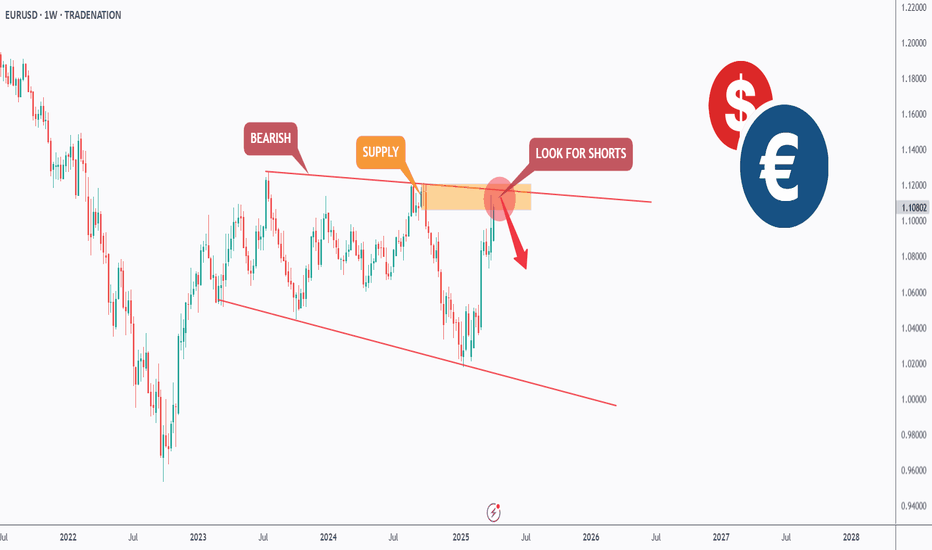

EURUSD - Trade The Impulse!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURUSD has been bearish trading within the falling wedge pattern marked in red.

Currently, EURUSD is retesting the upper bound of the wedge.

Moreover, the $1.12 is a strong weekly supply zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper red trendline and supply.

📚 As per my trading style:

As #EURUSD is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADJPY: Bullish Continuation & Long Signal

CADJPY

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long CADJPY

Entry - 101.91

Sl - 101.20

Tp - 103.24

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GOLD: Short Signal with Entry/SL/TP

GOLD

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell GOLD

Entry - 3044.0

Stop - 3051.7

Take - 3027.6

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDCAD On The Rise! BUY!

My dear friends,

Please, find my technical outlook for USDCAD below:

The instrument tests an important psychological level 1.4161

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.4266

Recommended Stop Loss - 1.4101

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD My Opinion! SELL!

My dear friends,

Please, find my technical outlook for GOLD below:

The instrument tests an important psychological level 3007.7

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2993.1

Recommended Stop Loss - 3015.5

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDCAD What Next? SELL!

My dear subscribers,

This is my opinion on the NZDCAD next move:

The instrument tests an important psychological level 0.7949

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.7903

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK