Speculating Bitcoin's Cycle Top!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📚 Back to basics.

🗓️ This is the BTC monthly log chart.

📊 By applying two simple channels—one short-term (🔴) and one long-term (🔵)—we see both upper bounds aligning right around the 💰 $300,000 mark. A classic case of confluence at a key psychological level 🧠✨

👇 What do you think—are we headed there this cycle, or is it just hopium? Drop your thoughts in the comments!

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

M-signal

EURGBP: Long Signal with Entry/SL/TP

EURGBP

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURGBP

Entry - 0.8353

Stop - 0.8326

Take - 0.8395

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPNZD The Target Is DOWN! SELL!

My dear subscribers,

This is my opinion on the GBPNZD next move:

The instrument tests an important psychological level 2.2627

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 2.2500

My Stop Loss - 2.2695

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDNZD Buyers In Panic! SELL!

My dear friends,

AUDNZD looks like it will make a good move, and here are the details:

The market is trading on 1.1003 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.0966

Recommended Stop Loss - 1.1025

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD: Long Trade Explained

GOLD

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy GOLD

Entry Level - 3081.3

Sl - 3073.9

Tp - 3096.4

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

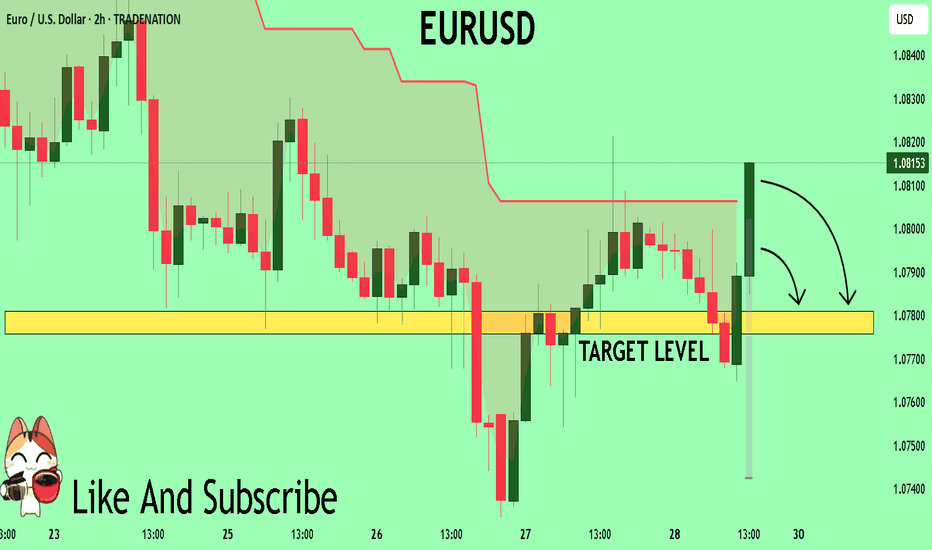

EURUSD Under Pressure! SELL!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.0807

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 1.0781

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER Set To Grow! BUY!

My dear subscribers,

My technical analysis for SILVER is below:

The price is coiling around a solid key level - 3303.8

Bias -Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 3354.4

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CADCHF My Opinion! SELL!

My dear followers,

I analysed this chart on CADCHF and concluded the following:

The market is trading on 0.6196 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.6157

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDJPY A Fall Expected! SELL!

My dear subscribers,

My technical analysis for NZDJPY is below:

The price is coiling around a solid key level - 86.498

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 86.332

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTC PoV - 48.000$?Bitcoin has recently gone through a period of strong volatility, dropping from a peak of $109,000 in January 2025 to around $85,000, showing a significant decline from its all-time highs. Predictions for Bitcoin’s future are mixed: some analysts, like Geoffrey Kendrick from Standard Chartered, foresee a potential price increase reaching an all-time high of $112,000 to $130,000 in the coming months, driven by factors like evolving regulatory policies and improvements in the macroeconomic environment. However, there are also more pessimistic forecasts warning of a continued decline, primarily linked to uncertainty in trade policies and global instability. In this context, i have identified several strategic support areas for a potential Bitcoin purchase, such as the zones around $76,000, $65,000, $58,000, and $48,000. These levels could represent buying opportunities if the market continues to drop, awaiting a potential rebound. However, if Bitcoin were to fall further below these levels, we could see a greater weakness in the market, leading to devastating losses not just for Bitcoin but for the entire cryptocurrency sector. Larger declines could undermine investor confidence and cause increased volatility, affecting the entire crypto ecosystem. Therefore, while there are bullish scenarios for Bitcoin, it’s crucial to carefully monitor support levels and take into account the uncertainty surrounding the market, adopting a thoughtful investment strategy and weighing the risks carefully.

ETH PoV - 1.600$? Ethereum is going through a phase of challenges and opportunities, with its current price approaching the target i've set for a potential purchase of $1600. In recent months, Ethereum has faced a significant price correction, with Ether's value dropping by about 40%, largely due to the growing competition from other blockchains like Solana and Cardano, which are gaining popularity due to their speed and low transaction costs. Additionally, the rise of memecoins and recent developments in the cryptocurrency regulatory landscape have shifted attention away from Ethereum, while other cryptocurrencies, such as Bitcoin, seem to enjoy greater favor among investors. Internally, Ethereum is still facing delays and challenges related to technical updates, as well as some tensions within the developer community, which has made it harder to maintain market leadership. The decision not to acquire Ether for a U.S. cryptocurrency reserve by the Trump administration has also disappointed many investors, fueling outflows from ETFs invested in Ethereum. Despite these difficulties, long-term prospects for Ethereum remain positive. In fact, some analysts suggest that if demand and supply stabilize, and if Ethereum can overcome internal challenges and effectively respond to competition, it could reach new all-time highs, with a target potentially surpassing $5000 in the next 12 months. This scenario is supported by the continued interest in ETFs that invest in Ether, the expansion of its network, and improvements in regulations, which could further incentivize institutional and retail adoption. Ultimately, while there are risks to consider, investing in Ethereum could be highly rewarding in the long term, with the possibility that the cryptocurrency could recover ground and set new value records in the next 12 months. Achieving a $5000 target, however, will depend on Ethereum's ability to innovate, address internal issues, and navigate the evolving regulatory landscape, but if it can maintain its central role in the cryptocurrency ecosystem, it may continue to grow significantly.

NVDA NVIDIA Price Target by Year-EndNVIDIA Corporation (NVDA) remains a dominant force in the AI and semiconductor markets, with its forward price-to-earnings (P/E) ratio currently at 19.37—a reasonable valuation considering its growth trajectory and market position.

NVIDIA’s leadership in the AI sector, particularly through its cutting-edge GPUs, has driven strong demand from data centers, cloud providers, and AI developers. The company’s recent product launches, including the Hopper and Blackwell architectures, have further solidified its competitive edge.

Despite recent market volatility, NVIDIA's consistent revenue growth and expanding profit margins support the bullish case. The current P/E of 19.37 reflects a balanced risk-reward profile, suggesting that the stock is not overvalued despite its impressive performance.

A price target of $145 by year-end reflects approximately 15% upside from current levels, driven by sustained AI demand and growing market penetration. Investors should watch for quarterly earnings reports and updates on AI chip demand, as these will likely act as key catalysts for upward momentum.

BNB - New Higher High is formingBINANCE:BNBUSDT (1W CHART) Technical Analysis Update

BNB is currently trading at $639 and showing overall bullish sentiment. Price is trading inside the channel and new Higher High is expected to formed soon if this bullish trend continues.

Entry level: $639

Stop Loss Level: $

TakeProfit 1: $685

TakeProfit 2: $750

TakeProfit 3: $850

TakeProfit 4: $900

TakeProfit 5: $999

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

SUI - Falling Wedge - Confirmed BreakoutBINANCE:SUIUSDT (1D CHART) Technical Analysis Update

SUI is currently trading at $2.77 and showing overall bullish sentiment

Price has formed nice falling wedge and we see a clear breakout from the falling wedge pattern. I'm expecting this trend to hold and read the resistance level around $5.3

Entry level: $2.7

Stop Loss Level: $1.8

TakeProfit 1: $3.1

TakeProfit 2: $4

TakeProfit 3: $5.3

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

AMD Advanced Micro Devices Price TargetAdvanced Micro Devices (AMD) has positioned itself as a major player in the semiconductor industry, capitalizing on growing demand for high-performance computing, artificial intelligence (AI), and data center solutions. As of now, AMD’s forward price-to-earnings (P/E) ratio stands at 17.12, indicating that the stock is trading at a reasonable valuation compared to its growth potential.

AMD has benefited from the increasing adoption of AI-driven solutions, particularly through its MI300 series of AI accelerators, which have gained traction among major cloud service providers. The company’s expansion into the data center market has also been a key growth driver, with strong sales in EPYC processors contributing to revenue growth.

Furthermore, AMD's strategic acquisition of Xilinx has strengthened its position in the FPGA (Field-Programmable Gate Array) market, enhancing its ability to offer diversified and high-margin products. This, combined with improving margins and consistent product innovation, positions AMD for steady financial performance in the coming quarters.

Given AMD’s solid fundamentals, growing market share in AI and data centers, and attractive valuation at a 17.12 forward P/E, a price target of $125 by the end of the year appears achievable. This would represent approximately 15% upside from current levels, driven by continued revenue growth and expanding profit margins.

CHFJPY: Bearish Continuation & Short Signal

CHFJPY

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short CHFJPY

Entry - 170.83

Sl - 171.63

Tp - 169.26

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

USDJPY: Short Trading Opportunity

USDJPY

- Classic bearish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Sell USDJPY

Entry - 150.88

Stop - 151.54

Take - 149.68

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDJPY Technical Analysis! SELL!

My dear friends,

Please, find my technical outlook for AUDJPY below:

The instrument tests an important psychological level 95.011

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 94.381

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD Trading Opportunity! SELL!

My dear followers,

This is my opinion on the GOLD next move:

The asset is approaching an important pivot point 3040.0

Bias - Bearish

Safe Stop Loss - 3047.4

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 3025.3

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD Will Collapse! SELL!

My dear subscribers,

My technical analysis for GOLDis below:

The price is coiling around a solid key level - 3026.2

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 3017.6

My Stop Loss - 3031.5

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURGBP Set To Fall! SELL!

My dear friends,

EURGBP looks like it will make a good move, and here are the details:

The market is trading on 0.8359 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 0.8344

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

FFAI Faraday Future Options Ahead of EarningsAnalyzing the options chain and the chart patterns of FFAI Faraday Future Intelligent Electric prior to the earnings report this week,

I would consider purchasing the 1.50usd strike price Puts with

an expiration date of 2025-4-17,

for a premium of approximately $0.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

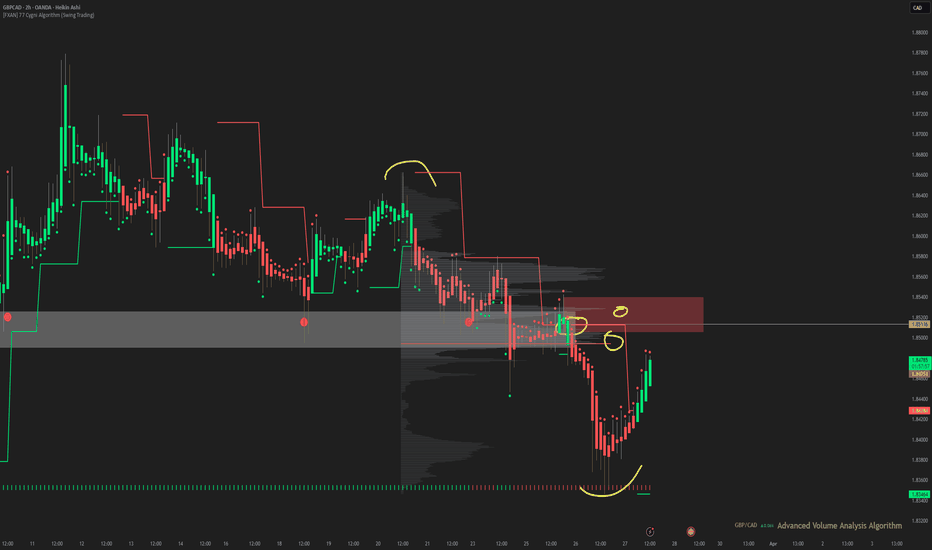

FXAN & Heikin Ashi Trade IdeaOANDA:GBPCAD

In this video, I’ll be sharing my analysis of GBPCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏