Machine_learning

CADCHF; MLS (Autonomous Machine Learning System) FX SignalsAll the signals in this post are generated by the Autonomous Machine Learning (Neural Nets) System, from this post;

Note; While that system is not, yet, integrated into TradingView, we will attempt to push the signals directly into this post, in a timely manner.

NZDCHF; AMLS (Autonomous Machine Learning System) FX SignalsAll the signals in this post are generated by the Autonomous Machine Learning (Neural Nets) System, from this post;

Note; While that system is not, yet, integrated into TradingView, we will attempt to push the signals directly into this post, in a timely manner.

AUDUSD; AMLS (Autonomous Machine Learning System) FX SignalsA different attempt at a more comprehensive (less frequent, more humanly tradable) FX signal interface for the system. Let's hope that breaking out the signals individually will make more sense. This interface It is still just in beta ! - unless we can make it work, of course ;-)

BTC AI Bot Purchase 13 May 202113 May 2021. AI is predicting that the close of 12 May 2021 will be a bottom and has purchased during the opening. Looks like there was a "flash crash" and the filled price was at 46949.18. This is quite far from the closing price.

The candlestick chart shows the spike.

Previous boxes show past trade results.

ETH AI Bot Purchase 13 May 2113 May 2021. Price finally went down and the bot thinks that the close of 12 May 2021 is the bottom. Trade was executed at 3586.40 during the open and the price was so much cheaper than closing (flash crash?). This is unusual but favourable.

Candlestick chart to show the spike during the opening.

Boxes show previous trades by the AI Bot.

BTC AI Bot Purchase 10 May 202110 May 2021. BTC AI Bot has predicted yesterday's close (9 May 2021) as a potential bottom. The position was initiated at 58306.82. As of midday, the price is up. If it closes this way, then the bottom was called correctly.

Boxes are the bot's previous trades since March. Green boxes are gains, the red box is a loss.

ETH AI Bot Purchase 4 Apr 21AI Bot purchased on 4 Apr 21. I changed the graph to a line chart because trading only happens at the opening of the next day. It takes into consideration historical daily movements, time series indicators. The machine learning model tries to predict the bottoms (buy level) and tops (sell level) of the daily close line chart.

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action continues to close above the AI's Intraday Resistance line

AND demonstrates bullish candles above the AI's Intraday Resistance line, the idea is to long on weakness and take profit at Pivot Point R1 price region.

Short Setup

If price action closed below the Pivot Point S1 and AI's intraday Support line

AND subsequently continues to demonstrate weakness below the AI's Intraday Support line, the idea is to short on strength and take profit at Pivot Point S2 price region.

The term "Long on weakness" and "Short on strength" is an important entry technique for traders to achieve alpha. Otherelse than having a winning strategy edge, the entry methodology could significantly improve profit efficiency by achieving better RRR (risk to reward ratio) . This for example, could be accomplished by "short on strength" as a trader want to "Sell Higher" and "Buy Low" .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

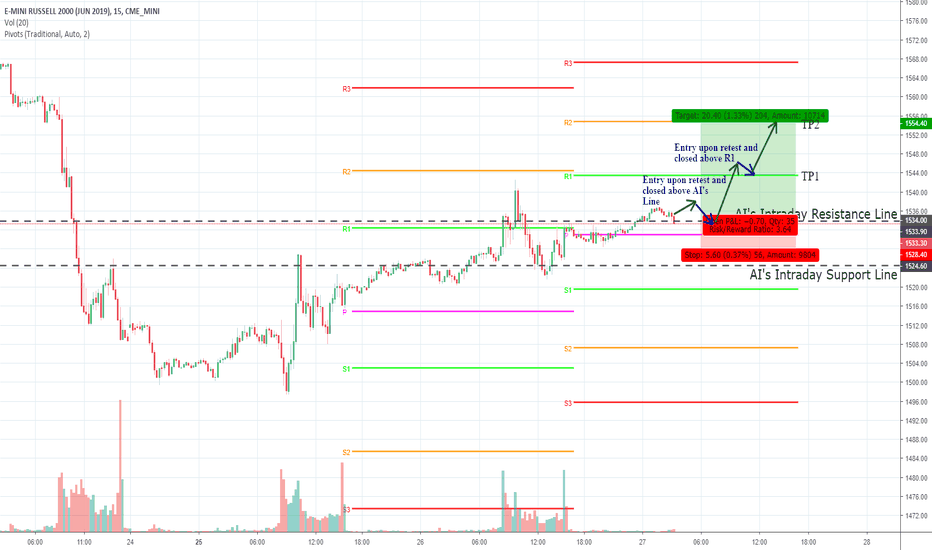

High Probability Intraday Setup for E-MINI RUSSELL 2000 futuresThe following are trades setup ideas in 15 mins chart for E-MINI RUSSELL 2000 futures

There are 2 distinctive dotted lines labeled as (provided by www.decisivealpha.com )

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

[b ]Long Setup

If price action closed above the Pivot Point Line

AND demonstrate bullish sentiment strength by closing above the AI's Intraday Resistance line, the idea is to long and take profit at Pivot Point R1/R2 price region.

Depending on trader's positioning sizing, partial profit could be taken at Pivot Point R1. The remaining position could be utilized to ride the intraday bull sentiment should it continues to approach Pivot Point R2 profit target.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

www.decisivealpha.com

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Range Play setup

If price action closed below the AI's Intraday Resistance line

AND continue to show weakness, the idea is to short and take profit at the AI's Intraday Support line region.

OR

If price action closed above the AI's Intraday Support line

AND continue to show strength, the idea is to long and take profit at the AI's Intraday Resistance line region.

Long Setup

If price action closed above the AI's Intraday Resistance line

AND continue to show strength above the AI's Intraday Resistance line, the idea is to long and take profit at Pivot Point R1/R2 price region.

Depending on trader's positioning sizing, partial profit could be taken at Pivot Point R1. The remaining position could be utilized to ride the intraday bull sentiment should it continues.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Short Setup

If price action closed below the AI's Intraday support line

AND continue to show weakness below Pivot Point S1 line

AND eventually retested/closed below the Pivot Point S1 line , the idea is to short and take profit at Pivot Point S2/S3 price region.

Long Setup

If price action closed above the AI's INtraday Resistance line

AND continue to show strength above the Pivot Point R1 line

AND eventually retested/closed above the Pivot Point R1 line , the idea is to long and take profit at Pivot Point R2/R3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line

AND

demonstrate strength after testing the AI's Intraday Resistance line

AND

eventually closed above Pivot Point R1 line , the idea is to long and take profit at Pivot Point R2 and/or R3 price region .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line, demonstrates strength throughout the Asia & European trading hours AND closed above Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 or/and R3 pr ice region.

And/Or

Short Setup

If price action was below the AI's Intraday Support line AND continue to demonstrate weakness AND eventually closed below the Pivot Point S1 line, the idea is to short and take profit at Pivot Point S2 and/or S3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Setup for S&P 500 E-mini FuturesThe following are trades setup ideas in 15 mins chart for S&P 500 E-mini Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI's Intraday Resistance line AND above Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 or/and R3 price region.

And/Or

Short Setup

If price action was below the AI's Intraday Support line AND continue to demonstrate weakness below the Pivot Point S1 line, the idea is to short and take profit at Pivot Point S2 price region .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.