High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Long Setup

If price action closed above the AI Daily support line AND above Pivot Point S1 line, the idea is to long and take profit at the AI's Intraday Resistance line .

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

Machine_learning

High Probability Intraday Setup for Natural Gas FuturesThe following are trades setup ideas in 15 mins chart for Natural Gas Futures .

There are 2 distinctive dotted lines labelled as

1. AI's Intraday Resistance line

2. AI's Intraday Support line

Long Play Probability Setup

If price is above AI's Intraday Resistance line and price action continue to closed above the Pivot Point R1 line, the idea is to long and take profit at Pivot Point R2 and/or R3. Traders may choose to take partial profit at Pivot Point R2 (instead of closing entire position) and depending if bullish sentiment continues, remaining position could be closed when price approaches below between Pivot point R2 and R3 region. This is dependent on his/her position sizing to lock profits and to maintain an existing open position as risk-free.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

While it is optional, it is a good practice, in general, to trade this product during the US Future Market Session when there are higher volume and liquidity.

High Probability Intraday Trade Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

If price action was below the AI Daily support line AND price closed below Pivot Point S1 line , the idea is to short and take profit at Pivot S2-S3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Crude Oil FutureThe following are trades setup ideas in 15 mins chart for Crude Oil Futures .

There are 2 distinctive dotted lines labelled as

1. AI's Intraday Resistance line

2. AI's Intraday Support line

Short Play Probability Setup

If price is below Pivot Point S1 line and price action closed below the AI's Intraday Support Line, the idea is to short and take profit at Pivot Point S1. Traders may choose to take partial profit at Pivot Point S1 (instead of closing entire position) and depending if bearish sentiment continues, remaining position could be closed when price approaches below Pivot point S1 and S2 region. This is dependent on his/her position sizing to lock profits and to maintain an existing open position as risk-free.

and/or

Momentum Range Play Probability Setup

If price is above AI's intraday support line and price action closed above Pivot Point Line, the idea is to long and take profit at either Pivot Point R1 or AI's Intraday resistance line. Minimum RRR 1.5 is recommended for this setup.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

While it is optional, it is a good practice, in general, to trade this product during the US Future Market Session when there are higher volume and liquidity.

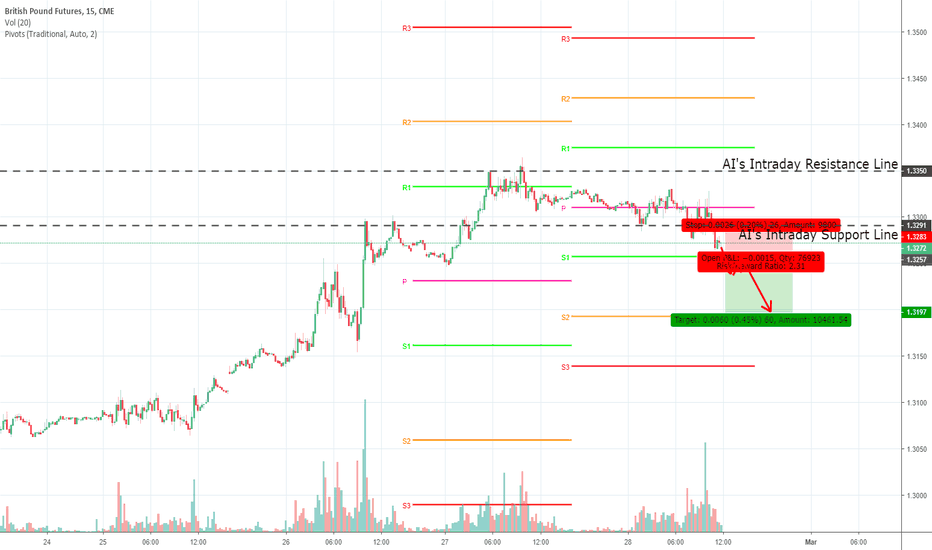

High Probability Intraday Trade Setup for British Pound FuturesThe following are trades setup ideas in 15 mins chart for British Pound Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

If price action was below the AI Daily support line AND price closed below Pivot Point S1 line, the idea is to short and take profit at Pivot S2 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Natural Gas FuturesThe following are trades setup ideas in 15 mins chart for Natural Gas Futures .

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 signals are generated by machine learning AI robots as a high probability trade setup where to long or short.

If price action was above the AI's Daily resistance line AND price closed above the Pivot Point line, the idea is to long and take profit at Pivot Point R1 line

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

High Probability Intraday Trade Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

Scenario 1 (Range play before US trading hours )

If price action was below the AI Intraday Resistance Line AND continued to close below, the idea is to short and take profit at AI's Intraday Support Line (Minimum RRR 1 recommended).

OR

Scenario 2 (Range play before US trading hours )

If price action was above the AI Intraday Support Line AND continued to close above, the idea is to long and take profit at AI's Intraday Resistance Line (Minimum RRR 1 recommended).

OR

Scenario 3 (During US trading hours )

If price action was below the AI Intraday support Line AND continued to close below, the idea is to short and take profit at Pivot Point S2 (~1318) line.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Natural Gas FuturesThe following are trades setup ideas in 15 mins chart for Natural Gas Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 signals are generated by machine learning AI robots as a high probability trade setup where to long or short.

If price action was above the AI's Daily resistance line AND price closed above the Pivot Point line, the idea is to long and take profit at Pivot R2 line

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Gold FuturesThe following are trades setup ideas in 15 mins chart for Gold Oil Futures.

There are 2 distinctive dotted lines labeled as

1. AI's Intraday Resistance

2. AI's Intraday Support

These 2 Support and Resistance signal lines are generated by machine learning AI robots as a high probability trade setup for long or short.

If price action was below the AI Daily support line AND price closed below Pivot Point S1 line, the idea is to short and take profit at Pivot S2-S3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

This is highly recommended to trade during Europe and US market hours for liquidity and volume for this product.

High Probability Intraday Trade Setup for Crude Oil FuturesThe following are trades setup ideas in 15 mins chart for Crude Oil Futures .

There are 2 distinctive dotted lines labelled as

1. AI's Intraday Resistance line

2. AI's Intraday Support line

If price action was below the AI Intraday support line AND price closed below Pivot Point S1 line, the idea is to short and take profit at Pivot Point S2-S3 price region.

Instead of relying on 100% discretionary (human) trading, the robots will provide trade execution plan and it is entirely up to the human trader's decision to follow.

While it is optional, it is a good practice, in general, to trade this product during the US Future Market Session when there are higher volume and liquidity.

AAL 5 Day Ahead Prediction - 04/16 - 04/20 PeriodArtificial Intelligence/Deep Learning Enabled 5 Day Ahead Predicted values for American Airlines Group ( AAL ) have been plotted on the chart.

The method used in this prediction is Deep Learning/Artificial Neural Network based, and using complex mathematical models/methodologies to analyze and extract hidden time series features in vast amounts of AAL related data. The "trained" and optimized neural network then generates the multi-day ahead predictions which are plotted on the chart and given in the explanation below.

The expected 5 Day Change is 2.572 %

Predictability Indicator is calculated as : 0.812

Predicted 5-Day Ahead Prices are as follows:

Mon Apr 16 Tue Apr 17 Wed Apr 18 Thu Apr 19 Fri Apr 20

46.552 46.690 46.698 46.856 47.049

Please note that outliers/non-linearities might occur, however FinBrain's Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World Indices/ETFs/Foreign Currencies/Cryptocurrencies.

AMD 10 Day Ahead Prediction - 04/16 - 04/27 PeriodArtificial Intelligence/Deep Learning Enabled 10 Day Ahead Predicted values for Advanced Micro Devices Inc. ( AMD ) have been plotted on the chart.

The method used in this prediction is Deep Learning based, and using complex mathematical models/methodologies to extract hidden time series features in vast amounts of AMD related data.

The expected 5 Day Change is 3.177 %

The expected 10 Day Change is 5.943 %

Predictability Indicator is calculated as : 0.872

Predicted 10-Day Ahead Prices are as follows:

Mon Apr 16 Tue Apr 17 Wed Apr 18 Thu Apr 19 Fri Apr 20

9.9473 9.9999 10.087 10.174 10.245

Mon Apr 23 Tue Apr 24 Wed Apr 25 Thu Apr 26 Fri Apr 27

10.303 10.358 10.414 10.468 10.520

Please note that outliers/non-linearities might occur, however FinBrain's Artificial Intelligence/Deep Learning Enabled predictions indicate the softened/smoothed moving direction of the stocks/commodities/World Indices/ETFs/Foreign Currencies/Cryptocurrencies.