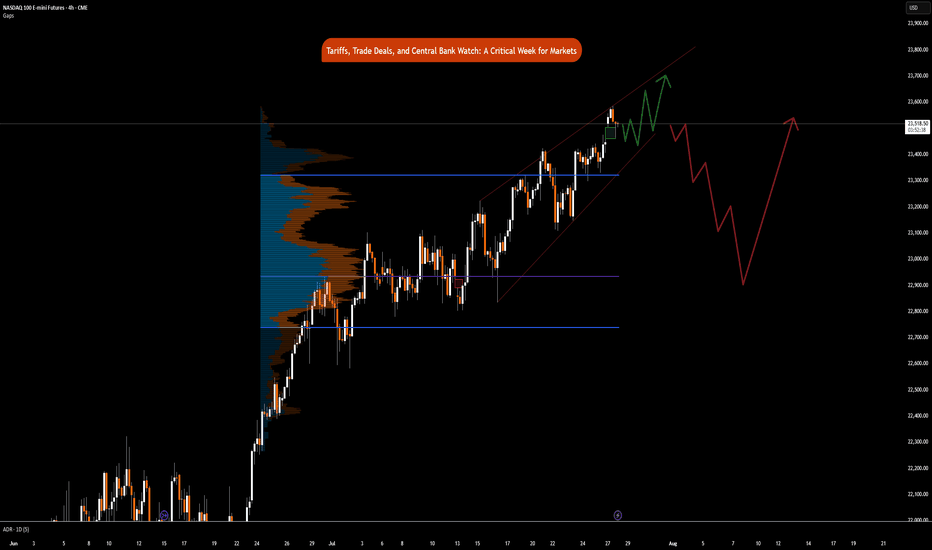

Tariffs, Trade Deals, & Central Bank Watch: Key Week in MarketsCME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! COMEX:GC1! CME_MINI:MES1! NYMEX:CL1!

This is a significant week in terms of macroeconomic headlines, key data releases, central bank decisions, and major trade policy developments. We get numbers for growth, inflation and decision and insights into monetary policy. Combining this with ongoing trade policy developments, we have a key week which may shape how the rest of the year unfolds.

Below is a consolidated summary of the latest trade negotiations, scheduled economic releases, and policy outlooks.

US - EU Trade Deal:

• US–EU Tariffs: The US will impose a 15% tariff on most EU goods, including cars, semiconductors, and pharmaceuticals, but retain a 50% tariff on steel and aluminium with a new quota system.

• Exemptions: Zero-for-zero tariffs agreed for agriculture, aircraft parts, and chemicals; aircraft exports are temporarily exempt.

• EU Commitments: The EU will invest $600 billion in the US and purchase $750 billion in US energy, mainly LNG.

• Agriculture: The EU will lower tariffs on many US agricultural goods, though not comprehensively.

• Political Reactions: EU leaders are mixed, Germany and the Netherlands praised the deal, France called it unbalanced, and Hungary viewed it unfavorably.

• The deal is not final until it is ratified by all EU national parliaments and the EU Parliament.

China Talks: US and China expected to extend their trade truce by 90 days. US-China meeting expected in Stockholm on Monday and Tuesday. Trump to freeze export controls to secure a deal. A group of US executives will visit China for trade discussions, organized by the US-China Business Council.

South Korea Trade Talks: Korea proposes a shipbuilding partnership with the US and is preparing a trade package.

UK–US Relations: PM Starmer and Trump to meet in Scotland to discuss the UK–US trade deal implementation, Middle East ceasefire, and pressure on Russia.

Thus far, the US has announced trade deals with the UK, Vietnam, Philippines, Indonesia, Japan and The EU. Trade delegations are working to finalize deals with China, Mexico, Canada

Key Economic Data Releases:

Monday: Treasury refunding financing estimates.

Supply: 2-Year and 5-Year Note Auction, 3 & 6-Month Bill Auction

Tuesday: US Advance Goods Trade Balance, Wholesale Inventories Advance, CB Consumer Confidence, JOLTS Job Opening (Jun), Atlanta Fed GDPNow, Australian CPI Q2

Supply: 7-Year Note Auction

Wednesday: German GDP Q2, EUR GDP Q2, US ADP Non-farm Employment, US GDP Q2, Crude Oil Inventories, Chinese Manufacturing PMI

Canada: BoC Interest Rate Decision, Rate Statement, Monterey Policy Report, BoC Press Conference

US: Fed Interest Rate Decision,FOMC Statement, Fed Press Conference.

Japan: BoJ Interest Rate Decision, Monetary Policy Statement

Thursday: EU Unemployment (Jun), US PCE & Core PCE Price Index (Jun)

Japan: BoJ Press Conference

Friday: EU CPI, US NFP, Unemployment Rate, Average Hourly Earnings, ISM Manufacturing PMI, Michigan 1-Year & 5-Year Inflation Expectations.

It is also a busy earnings week. See here for a complete earnings schedule .

Markets are interpreting trade deals as positive news thus far. The dollar is strengthening.

As we previously mentioned, we anticipate no rate cuts this year as economic data proves to be resilient and inflation largely under control. WSJ also posted an article stating that most tariffs costs are being absorbed by companies due to weaker pricing power. We previously wrote about this on our blog: “ In our analysis, the inflation impact of tariffs may not show up until Q4 2025 or early 2026, as tariff threats are mostly used as a lever to negotiate deals. While effective tariff rates have increased, as Trump reshapes how tariffs are viewed, cost pass-through to consumers will be limited in Q3 2025, as companies’ front-loaded inventory helps mitigate the risks of increased tariff exposure.

So, what we have is an interesting development shaping up where, while inflation may rise and remain sticky, it is yet to be seen whether slowing consumer spending will weaken enough to the point where companies must start offering discounts, which would nullify the tariff risk to the end consumer and result in companies absorbing all tariffs. This scenario will see reduced earnings margins leading into the last quarter and early 2026. However, it will materially reduce risks of higher inflation.”

In our view, the US dollar has a higher probability to rally in the short-term i.e., Q3 as markets re-align FX rate differentials. Bond yields stabilize, Equities continue pushing higher, while Gold retraces as previously mentioned. This in our view, is what investors and participants refer to as the Goldilocks scenario. If this plays out as expected we anticipate continued strength with AI, tech, energy and defense sectors outperforming into mid- 2026.

Institutional View: Morgan Stanley

Morgan Stanley also sees no rate cuts in 2025, despite market pricing for two 25 bps cuts. They forecast more aggressive cuts in 2026 due to:

• Tariff-related inflation emerging before labor market deterioration

• Slowing US growth, as fiscal support fades

• Impact of tighter immigration policy and global trade realignment

That said, MS continues to cite longer-term risks to the dollar, including:

• Twin deficits (fiscal + current account)

• Ongoing debate around USD’s safe haven status

• USD hedging activity picking up by international investors

• Strained credibility of the Fed due to tension between Fed Chair and the US Administration

How Fed policy evolves in Q4 2025 and Q1 2026 will depend heavily on the incoming Fed Chair nominee, who is expected to replace Jerome Powell in May 2026. This nomination could significantly influence future policy direction around growth and inflation targets.

Macroeconomics

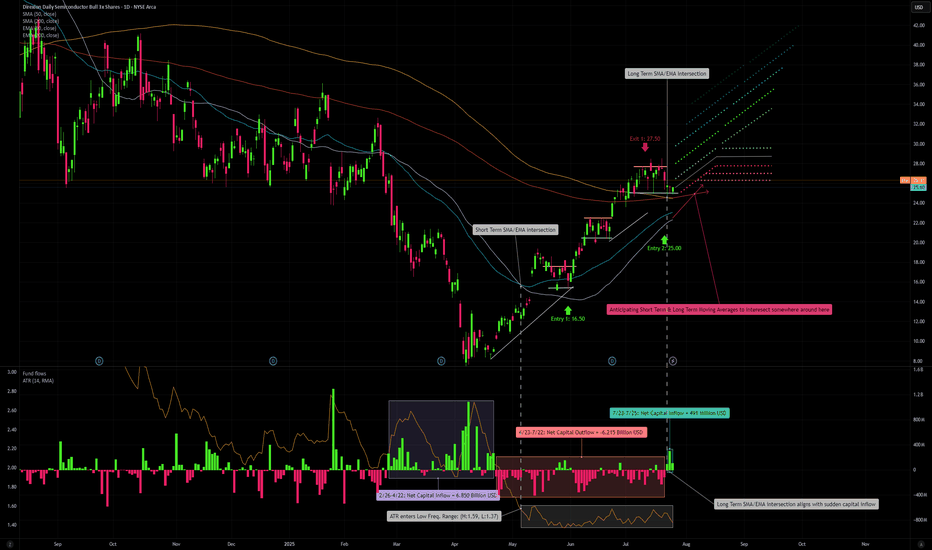

Semiconductors & SOXL: A Bull ThesisWhy Semiconductors?

Virtually every single electronic device contains some form of a semiconductor unit within its components. The entire Bull theory on semiconductors as an industry could be reduced to this one sentence. The following, however, will introduce concepts contingent to the understanding of what is shaping the market for semiconductors. The weight of intra-industry, political, macroeconomic, and physical factors discerning an inconceivable upside potential for certain investments carrying maximum exposure to the sector, such as AMEX:SOXL . The last section contains my technical approach to trading SOXL.

We begin with the fundamental, and by fundamental, I refer to the simplest reasons for what is happening in the market up until now; [ Early morning Monday, 7/28 ].

Macroeconomic Context

Like essentially the rest of the market, SOXL hit its 1 year low of 7.23 USD on Monday, 4/7, following the announcement (and soon postponement) of global tariffs at levels not observed since the early 30's. This of course sparked a panic spiral in the entire market, leading to outflows from the S&P 500 of approximately 70 billion USD during the month of April. During this time we also saw a new, but familiar narrative emerge. Asset Managers, Such as J.P. Morgan set historically low price targets on the S&P 500, going as low as 5,200 USD. They reinforced their PTs with publications warning investors across the world that the risk of recession in the United States was raised to 80%, and this message was relayed across all media in parabolic fashion. While it does not seem too outward to assume an increased risk of recession due to tariffs by looking back on what we learned of the consequences from the Smoot-Hawley Tariff Act of 1930. There exists a widely overlooked, fundamental , reason as to why I can claim that the REAL risk of recession at the time that J.P. Morgan assigned an 80% risk of recession, was in actuality, 0% (I assume J.P. Morgan knew this but pushed the narrative anyways in order to acquire massive equity at a discount). If anyone has taken introductory macroeconomics in their lifetime, they may be familiar with the function for calculating GDP via the expenditure approach: GDP = C + I + G - NX. Now, why am I referencing high school/college economics basics, the answer to that lies in how we determine our rate of economic growth in the context of tariffs. The part of this formula that we must focus on is NX or Net Exports, the negative factor to GDP. Tariffs, if implemented would effectively decrease import volume, resulting in a smaller Net Exports, and ultimately a higher GDP calculation. Now, what makes this scenario unique, the tariffs having been postponed shortly after their inception, allowed US retailers to engage in front running, or the accelerated purchasing of foreign goods in advance of tariffs. During the month of April, we saw a 5.4% increase in import volume in US west coast ports. This increase in imports effectively caused the inverse impact on GDP growth that import tariffs themselves would have caused: front-running lead to import uptick, leading to a greater Net Exports, which results in lower (negative) GDP growth. Essentially, tariffs in the short-term increases GDP growth (in the long term deadweight loss, and cost structure distortion comes in to play, but that doesn't matter yet), however , tariffs that are announced but not immediately implemented will result in a lower GDP growth, coupled with uncertainty surrounding the whole situation that translated into a cut in CapEx as companies scrambled to determine if tariffs would f*ck them over or not. This argument is further supported by the trends observed in the foreign exchange market. You may have heard in the news that we are experiencing a period of "Dollar Weakness", and while, yes, you can clearly see that the USD has fared rather poorly against other currencies in most major dollar pairs over the past few months. The agent behind this isn't just that the dollar happens to be weak, it is a combination of factors that generate noise and volatility in the forex market. The two main factors highlighted by the media are 1. The obvious political policy instability, pushing bond yields higher, plus a significant debt ceiling raise as per the BBB and 2. the expectations of interest rate cuts over the next year. The other, less recognized major factor to dollar weakness is exactly what we described above: Increased imports means more dollars flowing out of the economy. When these dollars land abroad, they are converted into the native currency, driving down the demand for the dollar. Notice how none of the reasons described above, actually have anything to do with what truly drives foreign exchange markets. Over time, the strength/weakness of a currency is directly correlated to the strength/weakness of the underlying economy. To say that we can expect dollar weakness due to the aforementioned reasons outright ignores the economic growth potential that exists in our economy at this current time, subsiding the out-of-proportion tariff fears as a proponent to an economic crisis. In an all-encompassing view, what I would describe to be occurring on the macro level is a sort of "slingshot" effect: Trade imbalances and private sector response to policy unclarity results in a pullback in economic growth, one that we are now experiencing as a short-term effect. From a medium-long term perspective, assuming that tariffs aren't persistent in the long term, we would see full fledge economic boom, driven by non other than the growth of our technology sector, which at it's core, lies the almighty semiconductor.

Growth of AI as a driver of Semiconductor demand: Stable trajectory or Bubble Territory?

Having laid the economic framework for picking the general direction our market is heading in, we can now begin to talk about the internal combustion occurring within the world of technology, and the two letter term associated with just about every cool thing in the business world, that is of course AI. Now just to clarify, AI is not new, its been around for at least 20 years and has a well established role in the world prior to the existence of ChatGPT. What changed so drastically in recent years is the breakthrough into a new form of artificial intelligence, known as "Artificial General Intelligence" or AGI. Long story short: AGI's primary difference in the business context is the colossal amount of electrical infrastructure and computing power that is demanded by the development of these mega language models. As a result of the high barrier for entry to this new industry, only 5 AGI companies have arisen to the global stage: OpenAI, Google DeepMind, Anthropic, Microsoft, and DeepSeek. Increasing competition in this space through more players entering the market is unlikely at this time as the cost to create a standalone AGI model is so astronomical. This is a particularly good thing because it tells us that AGI as an industry can result in natural monopolies. The ultra-intensive RnD costs and Data Center infrastructure demands make it more sensical to have a greater number of resources dedicated to producing 1 AGI model, instead of dividing resources to develop multiple less optimized models (similar to how a water company holds a natural monopoly as competition in that industry would result in no foreseeable benefit to it's customers). A further effect from this dynamic lies in how businesses in this industry scale to expand, and its pretty straightforward: the more megawatt computing power a model can access, the more parameters a model can account for, and the more vast the dataset that model can train on, with enhancing speed and efficiency (GPT 4o takes into account >500B parameters in a given query). We see the concept of natural monopoly playing out as the concentration of market capitalization is becoming more extreme where firms like Google, Microsoft, and NVIDIA are absorbing larger share of the market, while trading at ever increasing Price/Earnings multiples. To many, this reflects a trend we saw during the dot com bubble, however what makes the AGI industry different is the nature of the good or service provided. During the dot com boom, companies saw speculative value based on only the fact that their business existed on the .com domain. We know that each of these businesses are unique, providing a good or service across whatever industry they were part of, the only thing having in common was that dot com. The major oversight that took place during the turn of the dot com era was that the success of these businesses wasn't in truth due to them ending in .com, but whether the idea, and execution behind the underlying business is strong or not. Like how Amazon and Facebook saw unparalleled success not just because they were .coms, but because they were pioneering business models that would attract global demand to the services they were providing. The business of AGI has a sort of homogenous property. All AGI companies produce a service that is extremely similar in nature, the only ways they can compete with one another is through Capital Expenditure towards harnessing more computing power. This is the main reason capital is concentrating in a handful of companies trading at high multiples. To me, this is not an indication of a tech bubble but rather a product of how the AGI industry is poised to grow within our economy.

AGI as a Factor of Production

To get even more philosophical, we can think about how AGI itself enhances economic growth. We already see AGI tools applied in various ways, but the most widespread application pertains to the enhancement of human capital. While it is possible to make AGI models complete ongoing tasks completely on their own with zero human input, its far more common to see AGI tools be used, well, as tools. What I mean is that firms are not looking to replace human workers with AI ones (certain exceptions may include the manufacturing industry), instead they want to integrate AGI tools into their workforce as a means of optimizing regular processes, allowing them to access and process information with tremendous efficiency. The most observable economic outcome of this is firms being able to cut costs in human capital requirements, allowing them to achieve the same level of workflow with a smaller number of employees, or outsourcing solutions to business processes by way of automation utilizing AGI. The possibilities are endless and the economic impact of AGI appears to write itself new economic theory to explain how business growth is accelerating in unprecedented ways.

Semiconductor Physical Limitations: Blessing or Burden?

In 1965, Gordon Moore articulated his observation which would come to be known as Moore's Law. He observed that the number of transistors in an integrated circuit doubles approximately every 2 years. Based not so much on law of physics, Moore's law describes an empirical relationship between time and the number of transistors per chip, suggesting that the rate of production advancements would allow for such doubling to occur on a biannual basis. And to Gordon's own surprise, he was right. Transistor count for a given chip roughly doubled every 2 years for the following 50 years. However, Gordon also predicted that Moore's Law would come to an end in 2025, where transistor sizes would reach the physical limit of 2 nanometers (10-15 silicon atoms in width). While it may appear as a bottleneck to the semiconductor and AI industry, not being able to fit anymore transistors on one chip, but in reality, this limitation pressures companies to pursue innovations such as semiconductor packaging, which is NVIDIA's bread and butter. This technique allows for the stacking and integrating of many different chips to perform together as one. This technology has already proven wildly successful and is the backbone to virtually all of NVIDIA's GPU products. Google has invented their own method to getting around the physical limitation of silicon chips, producing AI-specialized integrated circuits known as Tensor Processing Units (TPUs). Catering these innovative solutions to expanding the frontier of AGI is almost a given.

How to play this market: A Technical Approach

If you have made it this far, I commend you. The following describes my approach to analyzing price activity in SOXL:

My First entry into SOXL took place on 5/30 with a unit cost of 16.50 USD. Two things can be noted prior to this entry. 1: Fund flows during late February, into March, and through April were extremely high, net inflow of 6.85 Billion USD, however price movement did not reflect the huge inflow until late April/early May where we began to see upward price direction. The beginning of June marked the start of the market bull rally which consolidated into our current price range of 25-28 USD, following contingent earnings releases of NASDAQ:ASML , NYSE:TSM , NASDAQ:NXPI and NASDAQ:INTC . The most recent pullback was a combination of a slightly concerning outlook from ASML, stating that tariffs on the EU would negatively affect projected sales growth for the 2026 fiscal year. As for TSM, there is not one concerning thing that could be said regarding the state of its business growth other than the New Taiwan Dollar gaining considerable strength over the USD amid trade relations between the US and Taiwan, affecting TSM's gross margin by an estimated 6%. NXPI released a sub par earnings and revenue growth outlook, but in my opinion this is not to be too heavily objectified as NXPI produces chips primarily for the Automotive sector, thus making it's sales heavily contingent on supply chain issues being faced by automotive manufacturers in leu of tariffs. NXPI carries a 3.5% market share in semiconductors whereas TSM carries a 68% market share. Lastly, INTC, earnings release I am almost embarrassed to talk about. If it were up to me I'd say they sell their plants in Ohio to TSM and look into opening a fruit stand instead. The most important earnings releases have yet to come though. NASDAQ:MSFT is just around the corner on 7/30, and NASDAQ:NVDA announces on 8/27. These two earnings reports will carry major weight in hinting the overall direction, momentum the market sees in AI demand growth, and the technology sector as a whole. Speculating, I have high expectations that both MSFT and NVDA will top all estimates, pushing the bar higher for 2025 into 2026.

If we look at our short-term 50-day SMA/EMA, you will notice a crossover occur on 5/6, a minor indication of a short term positive trend. Alone this is insignificant, but if we look at our 14-day Average True Range, we can see that this crossover aligns with a fall in ATR that would persist between the values of 1.37 and 1.59. This low ATR value signals that trailing volatility is actually quite low for semiconductors, considering the currently mixed market sentiment. Further along we see that price has crossed above both our long-term, 200-day SMA/EMA and a crossover occurred between the two on 7/23, serving as a small indication of a positive long term trend. Once again, not super significant on its own, but you will notice that the convergence aligns perfectly with a sharp increase in fund inflows, netting 491 Million USD in a matter of 3 trading days. If we see a continuation of net inflows over the several days, we can expect a near future extension of our bull rally, a semi-cyclical wave of inflows that concentrate during consolidation periods (which we have seen take place in the current price range between 25-28 USD following my first exit at 27.50 USD). If we extrapolate both our short-term and long-term SMA/EMA, we can anticipate a crossover to occur in the coming days to weeks. If this occurred, that would further reinforce our expectation for a positive long term trend. I have already locked in my entry 2 with a limit order executed at 25 USD. If all of the above conditions are met, I would confidently predict that we may see SOXL trade at around 42 USD in the coming months.

One more thing I would like to note, if we zoom out to our 5 year historical price progression, we can identify the previous high of 70.08 USD occurring on 7/11/2024. We know that the bull rally which took place in July of last year can be attributed to the first realization of AI as a driver for semiconductor demand, combined with renewed interest in GPU technology for applications in crypto. If we compare AI-related Capital Expenditure in fiscal year 2024 to AI-related Capital Expenditure of the first half of 2025 fiscal year: 246 Billion USD made up AI-related CapEx for all of 2024, vs first 6 months of 2025, adding up to 320 Billion USD. That is a 30% increase in capex, and we still have another 5-6 months to go. Just some food for thought.

Do you believe all of the above has been priced into SOXL, leave your thoughts in the comments!

Disclaimer

You must obviously keep in mind, SOXL is a 3x leveraged ETF, you can expect volatility with such type of investment. However, in capturing a bullish market, a 3x leveraged investment may produce greater than 3x the returns as the underlying (non leveraged) assets, due to the effect of compounding growth of returns over time. However, the same is true for sideways, or bearish markets, losses may be amplified to greater than 3x. If this is an uncertainty you do not wish to be exposed to, I would opt for the non-leveraged Semiconductor ETF ( NASDAQ:SOXX ), or divide your allocation across the top 5-10 equity holdings of SOXL. Please remember to employ your OWN due diligence before making any investment decision, as none of what I am saying shall serve as financial advise to you, the reader.

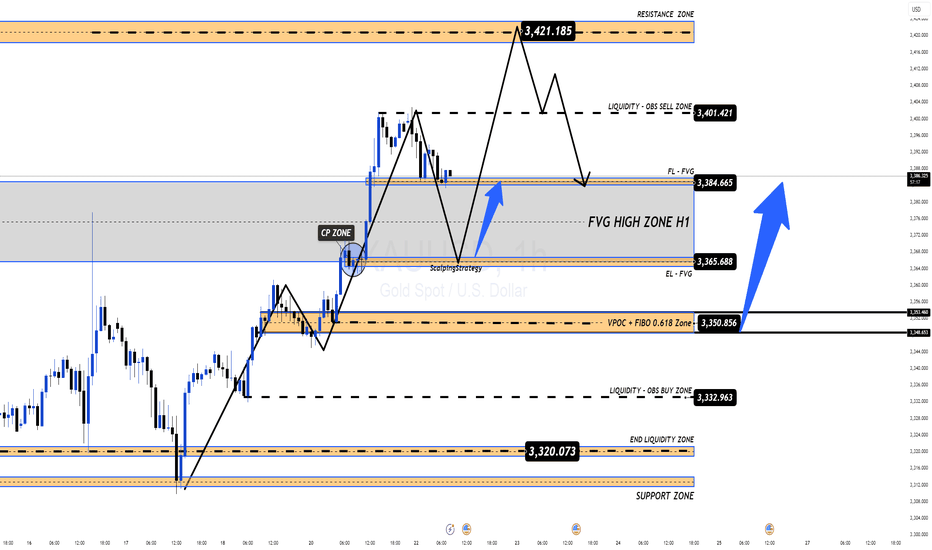

Gold 22/07 – Reversal in Sight After $3400? Watch These Key Zone XAUUSD – Intraday Market Outlook (22/07)

Gold posted a strong rally in the previous session, completing its short-term impulsive wave structure. However, as price approached the psychological resistance at $3400, it began to lose momentum, and a clear reversal candle appeared — a signal that today’s session may favour a pullback or correction.

🔍 Technical Overview

After printing a short-term top, gold is now retracing and has reached a critical support area: the FVG High Zone on the H1 chart. If bearish pressure continues and this level fails to hold, price is likely to drop further in search of deeper liquidity zones.

🔽 Key BUY Zones to Monitor Today

✅ Zone 1 – EL (End Liquidity within FVG): 3367 – 3350

→ A zone with strong potential for short-term rebounds due to previous liquidity sweeps.

✅ Zone 2 – Confluence of FIBO 0.5–0.618 + VPOC (3350 – 3335)

→ A technically significant area where multiple factors align — ideal for medium-to-long term entries.

📌 Trade Setup Ideas

🔸 BUY ZONE: 3351 – 3349

Stop Loss: 3344

Take Profit Targets:

3355 – 3360 – 3365 – 3370 – 3375 – 3380 – 3390 – 3400 – ???

🔸 BUY SCALP ZONE: 3366 – 3364

Stop Loss: 3360

Targets: 3370 – 3375 – 3380 – 3385 – 3390

🔻 SELL ZONE: 3420 – 3422

Stop Loss: 3427

Targets: 3415 – 3410 – 3405 – 3400 – 3390 – 3385

⚠️ Market Risk Reminder

While no major economic data is expected today, that doesn’t mean the market will stay calm. Unexpected volatility can still arise from geopolitical tensions or unscheduled central bank comments. Gold tends to compress and break out aggressively in low-news environments.

📌 Protect your capital with disciplined Stop Loss and Take Profit levels — no forecast is ever 100% certain.

📈 Strategic Outlook

Short-term bias: Market is likely to continue correcting

Medium to long-term plan: A deeper pullback could offer an excellent opportunity to build long positions from key demand zones, especially as markets begin to price in potential Fed rate cuts and gold continues its long-term bullish trend.

💬 Be patient, wait for confirmations, and trade with a clear plan — that’s what separates consistency from chaos.

XAU/USD Start July 20251. i start after XAU/USD break previous High and correction (fibbo 32.0) respected. based on elliot wave strategy we can targeting end of wave 3 at 3353 area and than correction wave 4 (target at fibbo 32.0 - 50.0). after target correction, continue wave 5 at target 3403 area.

2. fundamentally speaking, new months new quarter. there ins't new catalist and sentiment. Macro Economic this week focus on labour market at US and FED projection to cut rate.

3. War at Iran and Israel, Russia and Ukraine, India and Pakistan, Trade War case, etc,.

4. Will be update

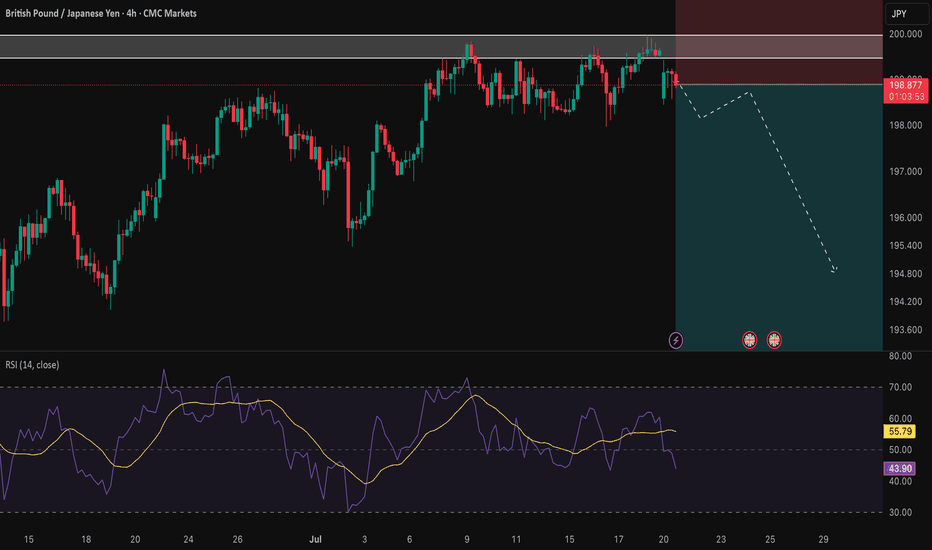

GBP/JPY: A Key Short Setup Forms as Momentum FadesHello traders,

Taking a look at GBP/JPY on the 4-hour timeframe. After a significant run, the price action has stalled, and we're seeing clear signs of fading momentum. This is creating a well-defined consolidation zone, which may present a key opportunity for a short position.

The Technical Picture 📊

1️⃣ Price Consolidation: GBP/JPY is currently trading sideways within a tight range, highlighted on the chart. This period of indecision and balance between buyers and sellers often precedes a significant directional move. The structure suggests a phase of distribution may be underway.

2️⃣ Fading Momentum: The Relative Strength Index (RSI) confirms this loss of momentum. A sustained reading below the 50 midline would signal that sellers are beginning to gain control and that the path of least resistance is shifting to the downside.

The Strategy 🧠

The core idea is to anticipate a bearish breakdown from the identified consolidation zone. A clean break and hold below this range would serve as confirmation that sellers have taken over, providing an opportunity to enter a short position targeting a continuation of the larger bearish move.

Trade Parameters 📉

👉 Entry: 198.895

⛔️ Stop Loss: 201.405

🎯 Take Profit: 192.872

Risk/Reward Ratio: approx. 2.4

This is my personal analysis and perspective, not financial advice. Always conduct your own research and manage your risk accordingly.

Good luck, and trade safe.

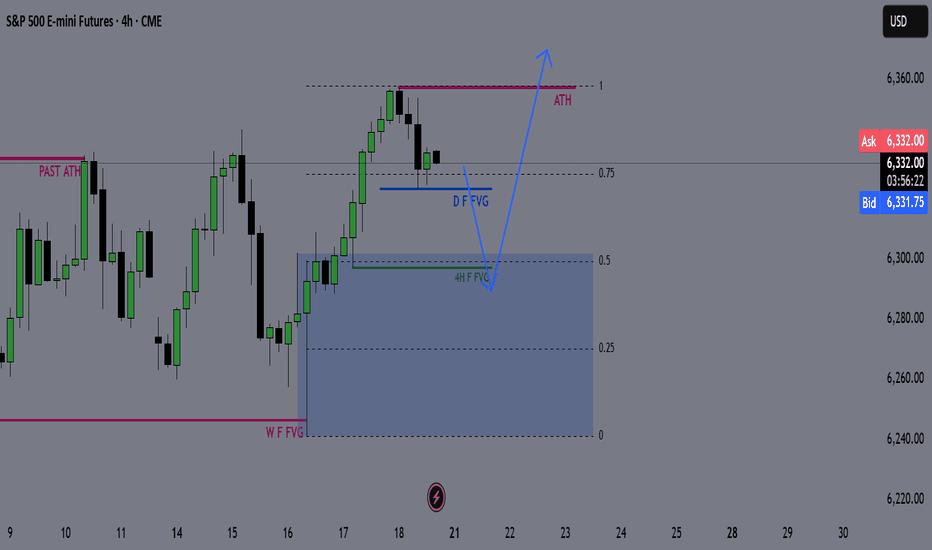

ES Weekly Outlook & Game Plan 20/07/2025ES Weekly Outlook & Game Plan

🧠 Fundamentals & Sentiment

Market Context:

ES continues its bullish momentum, driven by institutional demand and a supportive U.S. policy environment.

📊 Technical Analysis:

Price is currently in price discovery, and the weekly structure remains strongly bullish — so I prefer to follow the strength.

We might see a minor retracement before pushing further above the all-time high (ATH).

🎯 Game Plan:

I'm expecting a potential retracement to the 0.5 Fibonacci level, which is the discount zone in a bullish environment.

Interestingly, the 4H liquidity zone aligns perfectly with the 0.5 Fib level — this confluence suggests price may gather enough energy from there to make new highs.

✅ Follow for weekly recaps & actionable game plans.

Weekly Macro Brief: Chinese Economic Data, US Inflation, Tariff CME_MINI:ES1! CME_MINI:NQ1! COMEX:GC1! CME:BTC1! CME_MINI:RTY1! COMEX:SI1! CME_MINI:MNQ1! NYMEX:CL1! CME_MINI:M6E1! CBOT:ZN1! CME_MINI:MES1!

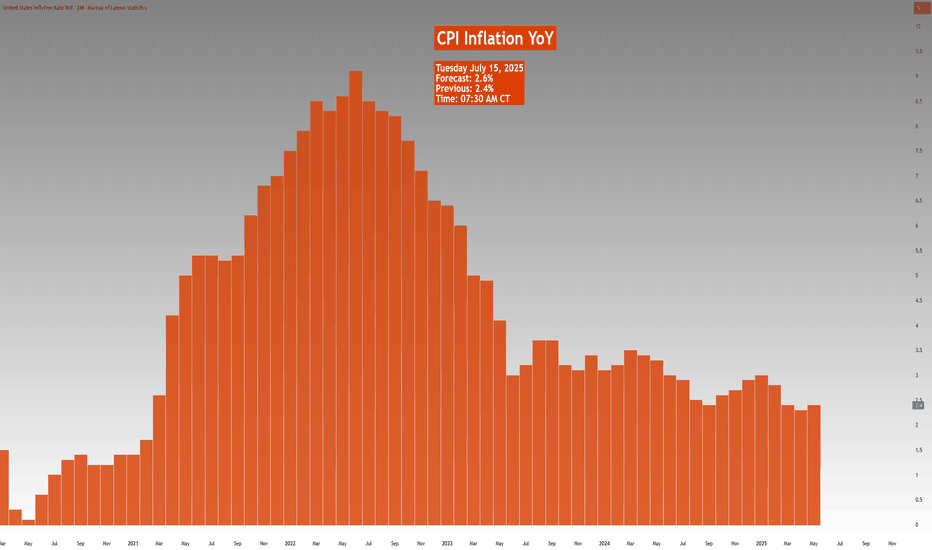

Highlights this week include Chinese economic data points, UK CPI, US CPI, PPI, and Retail Sales. Inflation data is key, as it comes ahead of the Fed's meeting on July 30th, 2025.

Market participants, including institutional investors and futures brokers like EdgeClear, will be scrutinizing these data points closely to monitor global growth and underlying inflation pressures.

Fed speakers are scheduled throughout the week. With increasing calls for Fed Chair Powell voluntary resignation and impeachment, the US administration desiring lower rates, the Fed’s independence and credibility to carry out its dual mandate is at risk. It will be interesting to monitor who folds first. Last week’s FOMC minutes revealed a divided Fed on the interest rate outlook, affirming its June dot plot.

On the fiscal policy front, we are already witnessing a shift in global trade policies, with many nations making concessions to negotiate trade deals with the world’s largest economy. In our analysis, the inflation impact of tariffs may not show up until Q4 2025 or early 2026, as tariff threats are mostly used as a lever to negotiate deals. While effective tariff rates have increased, as Trump reshapes how tariffs are viewed, cost pass-through to consumers will be limited in Q3 2025, as companies’ front-loaded inventory helps mitigate the risks of increased tariff exposure.

So, what we have is an interesting development shaping up where, while inflation may rise and remain sticky, it is yet to be seen whether slowing consumer spending will weaken enough to the point where companies have to start offering discounts, which would nullify the tariff risk to the end consumer and result in companies absorbing all tariffs. This scenario will see reduced earnings margins leading into the last quarter and early 2026. However, it will materially reduce risks of higher inflation.

In summary, the complex interplay between tariffs, inflation, and consumer behavior presents critical considerations for traders. EdgeClear, as a dedicated futures broker, remains focused on equipping clients with the insights needed to help navigate this evolving macroeconomic environment.

Overnight Data Recap:

• Chinese Trade Balance (CNY)(Jun) 826.0B (Prev. 743.6B)

• Chinese Trade Balance USD* (Jun) 114.77B vs. Exp. 109.0B (Prev. 103.22B)

• Chinese Imports YY* (Jun) 1.1% vs. Exp. 1.3% (Prev. -3.4%)

• Chinese Exports YY* (Jun) 5.8% vs. Exp. 5.0% (Prev. 4.8%)

Key Economic Releases:

• MON: EU 90-Day Retaliatory Pause Ends

• TUE: OPEC MOMR, Chinese House Prices (Jun), Retail Sales (Jun), GDP (Q2), EZ Industrial Production (May), German ZEW (Jun), US CPI (Jun), NY Fed Manufacturing (Jul), Canadian CPI (Jun)

• WED: UK CPI (Jun), EZ Trade (May), US PPI (Jun), Industrial Production (Jun)

• THU: Japanese Trade Balance (Jun), EZ Final HICP (Jun), US Export/Import Prices (Jun), Weekly Claims, Philadelphia Fed (Jul), Retail Sales (Jun)

• FRI: Japanese CPI (Jun), German Producer Prices (Jun), US Building Permits/Housing Starts (Jun), Uni. of Michigan Prelim. (Jul)

China GDP / Retail Sales/ Housing (TUE):

• Q2 GDP is expected to slow to 5.1% Y/Y (vs 5.4% in Q1) and 0.9% Q/Q.

• Retail sales have been resilient, but industrial production and investment show signs of weakness; deflation and labor market concerns persist.

• Property prices continue to decline, fueling stimulus speculation; policymakers remain cautious, with only modest easing expected (LPR and RRR cuts in Q4).

US CPI (TUE)

• June CPI expected at +0.3% M/M headline and core, suggesting a modest rebound from May’s subdued figures.

• Inflation impact from tariffs seen as temporary; Fed officials maintain a cautious stance with possible rate cuts only if price pressures stay benign.

• Markets are pricing near-zero odds for a July rate cut, but still expect two 25bps cuts by year-end in line with Fed guidance.

US Retail Sales (THU):

• Headline June retail sales expected flat M/M; ex-autos expected to rise +0.3%, showing signs of consumer stabilization.

• BofA data shows mild spending rebound, though discretionary service spending continues to weaken, especially among lower-income households.

• Spending strength remains concentrated in higher-income cohorts; weakness in wage growth limits broader consumption momentum.

US Trade Tensions – Tariffs & Negotiations:

• Trump announced 30% tariffs on EU and Mexican goods effective August 1st, separate from sector-specific tariffs.

• Trump stated the EU is engaging in talks and South Korea is also pursuing a trade deal.

Mexico Response:

• President Sheinbaum expects a deal before August 1st but reaffirmed Mexican sovereignty is non-negotiable.

• Mexico’s Economy Ministry is negotiating to protect domestic firms and workers, aiming for an alternative resolution.

EU Response:

• European Commission President von der Leyen warned that 30% tariffs would disrupt key transatlantic supply chains.

• The EU will extend suspension of countermeasures until early August but is prepared to respond proportionally if needed.

• The EU prefers a negotiated solution and dropped plans for a digital tax, seen as a concession to US tech interests.

• Separately, the EU is drafting a broad corporate tax on firms with turnover above EUR 50 million to support its budget.

Why Spain's Market Faces a Challenging Horizon?The IBEX 35, Spain's benchmark equity index, navigates a complex landscape. Despite encouraging macroeconomic indicators, including robust GDP growth and declining unemployment, underlying vulnerabilities persist. Political instability forms a significant headwind. A fragmented parliament, ongoing corruption scandals, and the specter of early elections create an environment of legislative gridlock. This uncertainty directly impacts investor confidence and hinders the effective implementation of crucial reforms and budget approvals, contributing to the IBEX 35's underperformance compared to its European counterparts in 2025.

Social tensions further exacerbate the country's domestic challenges. Recent anti-migrant protests, such as those in Torre Pacheco, underscore a societal fragmentation that can deter foreign investment and impact labor dynamics. While immigration is vital for Spain's economic growth, rising anti-immigrant sentiment, potentially exploited by far-right political factions, introduces unpredictability into social cohesion and future policy directions. This confluence of political and social unease creates an unstable backdrop for businesses and investors.

Beyond internal dynamics, global factors add to the pressure. Lingering uncertainties surrounding international trade, including potential US tariffs, pose risks for Spain's export-oriented sectors and its globally exposed corporations. Furthermore, while Spain champions renewable energy, persistently high electricity prices due to domestic policies continue to challenge industrial competitiveness. The historical context of ineffective deployment of significant EU NextGenerationEU funds, hampered by political hurdles, also raises concerns about Spain's long-term growth trajectory and its ability to capitalize on recovery initiatives.

These combined elements suggest a difficult period ahead for the IBEX 35. Sectors sensitive to domestic policy, such as construction, banking, and real estate, face direct exposure to political uncertainty. Moreover, Spain's traditional reliance on tourism and agriculture makes it susceptible to external shocks, including global travel disruptions and climate change impacts like severe droughts. Investors must carefully assess these multifaceted risks, as they are likely to shape the IBEX 35's performance in the near to medium term.

GBP/USD – Macro Outlook & Why It’s a Top Pick This WeekMacro Fundamentals (ENDO):

The UK macro backdrop remains inflationary, with solid growth data and resilient employment figures, supporting further GBP strength. Conversely, the US shows increasing deflationary signals and a softer macro pulse.

COT Positioning:

Institutional positioning is highly supportive, with a 74% long bias and strong “flip percentile.” This shows that “smart money” is increasingly positioned for further GBP/USD upside.

Z-Score (Positioning Extremes):

There are no extreme positioning imbalances in Z-Score for GBP or USD, suggesting the trend can continue without risk of a mean-reversion squeeze.

EXO Signals (Risk/Reward, Bias, Interest Rate Outlook):

Risk/reward metrics and bias signals favor the long side. The current risk-on sentiment in global markets also acts as a tailwind for GBP.

FX Sentiment:

The broader sentiment is risk-on, supporting currencies like GBP that tend to outperform in such environments.

Summary & Trading Plan:

Bias: Long GBP/USD

Conviction: High (9.5/10, all key signals aligned)

Ideal Holding Period: 1–3 weeks, as long as risk-on sentiment persists. Exit immediately if risk-off conditions emerge.

Why This Pair?

Because GBP/USD is the rare case where macro, institutional positioning, and market sentiment all support the same direction. This reduces “crosswinds” and increases the probability of a clean swing move. Watch for sustained risk-on flows and monitor for any macro or sentiment shifts.

DXY CRACK! BAD JUJU!After Trump unilaterally imposed Tariffs (Taxes) on its citizens to buy imported goods from the rest of the world, promising 90 deals in 90 days, "in two weeks", the demand for the dollar payment system has collapsed by -12% reducing purchasing power for all $ holders'.

Imports of goods mean exporting $s to the rest of the world. As a world reserve currency (WRC), the US gets the benefit of seeing those $s invested back into the US. That creates demand for the $ payment system, and raises $ holders' purchasing power, reducing inflation.

What else happens? A bit complicated but I will try to explain. High demand for $ means the US indirectly exports inflation. Meaning, more $ for the same amount of goods and services. However, as a WRC, the US is not really exporting inflation. That is a bit inaccurate bc the US payment system as a WRC is actually includes a lot more goods and services from the entire planet. This makes sense if you think about it. However only going one way, meaning as long as the demand from the world for our payment system, more $ required by the world reflect more goods and services. As such not inflationary.

Now let's reverse it so you can see why it is not entirely accurate. Should the Global Economy (which is worth today about $100 trillion,) demand ever drop off. The $ value will collapse as people sell their $ holdings in exchange for other currencies. What you are seeing right now in this chart with a CRACK in it.

The US GDP is currently about $30 trillion. There is no way! A $ payment system designed for a $100T economy can suddenly absorb all those $ in a $30T economy. Inflation would skyrocket as more and more $ chase the same amount of goods and services ($30T). This is not rocket science. This is basic 3rd-grade arithmetic!

This CRACK! could be very bad JUJU!

CAUTION is in order. Don't let normality bias fool you. No matter how you feel about Trump. It is irrelevant to basic arithmetic.

AUD/USD: The Clearest Short Opportunity This WeekThis week, the macro and market landscape provides a rare alignment across all major models—making AUD/USD the standout short opportunity among G10 FX pairs.

Key Reasons for the Bearish AUD/USD Bias:

1. Commitment of Traders (COT):

Institutional positioning has turned decisively bearish on the Australian dollar, with net shorts increasing and sentiment remaining negative.

2. Z-Score & Positioning Extremes:

Z-Score indicators confirm a below-average long bias for AUD, highlighting that recent speculative flows are heavily skewed to the short side.

3. EXO/Score Model:

Our EXO (macro scoring) model gives AUD/USD a clear SHORT rating, with no offsetting bullish factors in the “core” or “risk/reward” signals.

4. Commodity Edge – Iron Ore:

Iron ore prices, a crucial driver for AUD, have sharply declined in recent weeks. This is a classic “canary in the coal mine” for AUD weakness historically, persistent iron ore declines precede broader AUD selloffs.

5. Sentiment & Risk Environment:

Despite global “risk-on” sentiment, AUD is unable to benefit, as both macro and market participants rotate away from commodity FX and into USD strength.

6. Endo (Fundamental) Model:

While Australia’s macro data still looks solid on a lagging basis, all faster models (positioning, flows, sentiment, commodities) point to an imminent shift typically, ENDO lags in catching turning points.

Conclusion & Tactical View:

SHORT AUD/USD is the highest conviction trade for this week, backed by full alignment of macro, positioning, sentiment, and real-economy factors.

Expect continued downside pressure while commodity markets and COT data remain bearish.

For active traders, the first 3–7 days following this setup historically provide the highest reward-to-risk moves.

Bitcoin Strategic Interval – Latency & Asymmetric Bias.⊢

⟁ BTC/USD – Binance – (CHART: 1D) – (June 20, 2025).

⟐ Analysis Price: $106,025.88.

⊢

⨀ I. Temporal Axis – Strategic Interval – (1D):

▦ EMA21 – ($105,772.44):

∴ The price remains fractionally above EMA21, retaking the short-term reactive axis;

∴ Despite prior rejection, current candle shows renewed traction with a solid close above;

∴ The slope is flat–rising, signaling the potential reactivation of local trend continuation.

✴️ Conclusion: EMA21 is tentatively reclaimed – a short-term bullish signal under close scrutiny.

⊢

▦ SMA200 – ($95,921.92):

∴ Long-term structure preserved: price maintains a wide buffer over SMA200;

∴ The moving average exhibits a healthy upward slope, uninterrupted since Q4 2023;

∴ No technical threat detected to the macro-trend structure.

✴️ Conclusion: SMA200 acts as the primary institutional defense line. No stress present.

⊢

▦ Ichimoku Cloud – (105,899 | 105,738 | 102,433 | 105,576 | 106,025):

∴ Price is nestled precisely within the flat upper cloud band – a known zone of consolidation;

∴ Span A and B are beginning to flatten, suggesting temporary exhaustion of momentum;

∴ Chikou remains above price – confirming trend integrity.

✴️ Conclusion: Ichimoku signals a pause, not a break – directional clarity pending.

⊢

▦ MACD (12,26,9) – (Histogram: -364.87 | MACD: 257.20 | Signal: 622.06):

∴ Bearish histogram remains negative, but shrinking for three sessions;

∴ MACD line curling upward with initial convergence to Signal line;

∴ Reversal signal forming but not yet triggered.

✴️ Conclusion: Early signs of MACD cross; confirmation requires follow-through.

⊢

▦ RSI – (53.17 | Avg: 51.74):

∴ RSI reclaims neutral-positive zone, stabilizing above 50;

∴ Structure shows divergence fading, with momentum recovering slowly;

∴ Still far from exhaustion thresholds.

✴️ Conclusion: RSI favors the bulls with cautious optimism.

⊢

▦ Volume (Last 5 Days):

∴ Volume remains muted, averaging 110–120k Bitcoin/day;

∴ No aggressive buy or sell pressure confirmed;

∴ Current move lacks conviction – suggests passive spot activity.

✴️ Conclusion: Price is advancing without volume confirmation – fragility persists.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ Structural trend remains intact and undisturbed on the macro scale;

∴ Short-term bullish reclaim of EMA21 within the cloud, but momentum and volume still lag;

∴ Absence of conviction demands validation from price action or macro catalyst.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

▦ 🝰 Exchange Inflow Mean - (MA7):

∴ Metric sits near historic lows (≈0.4 BTC), denoting multi-week suppression of inflows;

∴ Correlates directly with reduced sell-side pressure from whales and institutions;

∴ Price structure remains unchallenged by inflow spikes – consistent with strategic holding.

✴️ Conclusion: Absence of fear or distribution among large holders – bullish backdrop intact.

⊢

▦ 🜍 Estimated Leverage Ratio – (Current: 0.259):

∴ Leverage steadily increasing, now entering historical danger zone;

∴ Elevated risk of cascade liquidations on any sharp downside move;

∴ Suggests the current rally is not organically fueled by spot demand.

✴️ Conclusion: Price structure is leveraged, not grounded – risk of synthetic instability.

⊢

▦ 🝗 Exchange Reserves - (Binance) – (≈544.5K BTC):

∴ Continuous net outflows – multi-month drain confirmed;

∴ Reflects silent accumulation or self-custody migration;

∴ No exchange-driven supply pressure visible.

✴️ Conclusion: Structural supply depleting – passive bullish signal.

⊢

▦ ⚒ Miners’ Position Index - (MPI) – (-1.1):

∴ Readings below 0 indicate minimal miner distribution;

∴ Suggests miners are confident, or at least not forced to sell at current levels;

∴ Historically coincides with market support zones.

✴️ Conclusion: Miner behavior aligned with trend preservation – not resistance.

⊢

▦ 🜚 Funding Rate - (All Exchanges) – (+0.003):

∴ Rates mildly positive, indicating slight dominance of long positioning;

∴ No excessive funding imbalance – healthy sentiment baseline;

∴ Reflects controlled bullish bias with no speculative overheating.

✴️ Conclusion: Longs exist, but not in a way that endangers trend integrity.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ On-chain metrics echo the technical chart: structurally sound, short-term vulnerable;

∴ Long-term holders remain disengaged from distribution behavior;

∴ The system is healthy, but carries hidden leverage that may trigger volatility.

⊢

⧉ III. Contextvs Macro–Geopoliticvs – Interflux Economicus:

▦ 🇺🇸 United States – Federal Axis & Risk Channels:

∴ Treasury Yield Curve remains slightly positive (+0.44%), removing short-term recession signal;

∴ 10Y yield elevated at 4.42% – reflects sustained inflation resistance and risk demand;

∴ Fed has signaled no rate cuts before September – QT policy remains;

∴ Speculative expectations for only 1–2 cuts in 2025;

∴ Trump administration signals potential military action in Iran, igniting geopolitical risk premium.

✴️ Conclusion: U.S. monetary regime is steady–tight; geopolitical volatility injects asymmetric risk into crypto valuations.

⊢

▦ 🇨🇳 China – Internal Stimulus & Soft Deflation:

∴ Industrial Production slows to +5.8% YoY – weakest in 6 months;

∴ Retail sales climb to +6.4% YoY due to stimulus programs ("618 event", consumption vouchers);

∴ PPI remains deflationary (-3.3% YoY), compressing industrial margins;

∴ Fiscal revenue down -0.3% YTD – signals internal fragility despite easing efforts.

✴️ Conclusion: China is applying targeted stimulus, but lacks decisive global impact – neutral crypto flow effect.

⊢

▦ 🇪🇺 European Union – Disinflation & Rate Reversal:

∴ HICP inflation falls to 1.9% – below ECB’s 2.0% target;

∴ ECB cuts deposit rate by 25bps – now 2.00%;

∴ PMI Composite remains below 50 – economic contraction underway;

∴ ECB forward guidance signals data-dependence and hesitation for further cuts.

✴️ Conclusion: Europe is easing rates amidst stagnation – weak driver for global risk flows.

⊢

🜎 Strategic Insight – Interflux Macro Oracle:

∴ U.S. tight policy + Iran tension = dual pressure point on risk assets;

∴ China’s mild stimulus is not yet globally inflationary – no volatility trigger;

∴ EU drifts silently – supportive, but irrelevant to Bitcoin in current configuration;

∴ Global system is stable in appearance, but tactically charged beneath – setup aligns with Bitcoin volatility potential.

⊢

IV. ♝ Market Sentiment - Media & Institutional Lens:

▦ The Block – Corporate Stockpiling Thesis:

∴ Ongoing accumulation of Bitcoin by public and private entities continues across Q2;

∴ Institutional wallets showing strategic DCA behavior – interpreted as positioning for either macro easing or geopolitical hedge;

∴ Unlike past cycles, no major corporate selloffs have been detected.

✴️ Conclusion: Institutional base remains in passive accumulation – potential catalyst insulation.

⊢

▦ CoinDesk – Sentiment Report – BTC at $92K Risk Threshold:

∴ Despite price climbing above $106K, analysts caution of technical rejection scenarios;

∴ Zones near $92K identified as high-liquidity, high-reaction clusters;

∴ Chart analysis frames current movement as vulnerable if macro catalysts turn hawkish.

✴️ Conclusion: Sentiment remains cautiously bullish but alert to correction windows.

⊢

▦ InfoMoney – U.S. Military Risk – Iran Strike Potential:

∴ Reported internal briefing of U.S. military planning toward Iranian targets;

∴ Trump’s media team leveraging geopolitical strength posture to influence sentiment;

∴ Markets (Dow Futures) showing pre-market decline on the headline.

✴️ Conclusion: Bitcoin holds narrative premium under geopolitical fear – but risk surge remains volatile.

⊢

🜎 Strategic Insight – Media Oracle:

∴ The crypto narrative is suspended between structural trust (institutional accumulation) and external fear (macro-political instability);

∴ Bitcoin presently benefits from asymmetric narrative positioning — but lacks transactional confirmation;

∴ Media flows suggest that sentiment will pivot swiftly if Powell’s tone confirms further hawkish stance or if Iran tension escalates.

⊢

⊢

⚜️ Magister Arcanvm (𝟙⟠) – Vox Primordialis!

⚖️ Wisdom begins in silence. Precision unfolds in strategy.

⊢

⌘ Codicillus Silentii – Strategic Note:

∴ The 1D reclaim of EMA21 inside the Ichimoku flat cloud reflects a market in suspended potential, where trend continuation and failure share equal weight;

∴ On-chain dynamics remain structurally undisturbed, yet veiled in a fragile layer of leveraged positioning;

∴ Exchange reserves continue their descent, detaching the market from traditional sell-side threat, but increasing reliance on thin liquidity zones;

∴ Macro vectors (Fed policy + Middle East tension) hover as dual shadows, capable of igniting volatility without prelude;

∴ Institutional accumulation remains active, but no longer decisive - the market awaits external ignition, not internal strength;

∴ Sentiment is asymmetrically bullish, yet explicitly unconfirmed in transactional volume and price aggression;

∴ The system is quiet - not because it is resolved, but because it is observing itself. This is a moment of ritual latency.

⊢

⌘ Market Status – Tactical Mode:

✴️ Strategic Position: “Structurally Bullish – Tactically Suspended”;

✴️ Primary Mode: “Observation Priority”;

✴️ Tactical Stance:

∴ No active positioning expansion without confirmation beyond Ichimoku flat zone;

∴ Watch for MACD confirmation and volume acceleration;

∴ Monitor geopolitical escalation and Powell’s tone – both capable of shifting structural balance.

✴️ Directional Bias: Neutral–Bullish, contingent upon validation;

✴️ Key Zone of Collapse Risk: $92,000;

✴️ Ascent Gate: $110,800 + (confirmation threshold).

⊢

is this altseason? regardless the war? Oli? CPI? ...CPI must fall under 2.0%

Oil must retrace to the $70s

Fed must signal a real cut, not conditional pause

DXY must fall below 103

Until then, BTC remains the vault,

and the rest of the crypto market remains the graveyard.

Alts are complexity.

Ethereum is complexity.

Smart contracts are complexity.

Gold (XAUUSD) Weekly TF 2025Overview

This analysis outlines the structural Fibonacci confluences, scenario planning, and macro-aligned projections for Gold (XAUUSD) on the weekly timeframe. It integrates multi-layered Fibonacci extensions and retracements, mapping out key support and resistance levels, and proposes a nuanced primary scenario that includes both intermediate rallies and corrective movements.

Primary Scenario – Multi-Stage Movement Hypothesis

We anticipate that gold may initially extend higher from the current level (~$3,325) to test the 127.2% Fibonacci extension at $3,435, with the possibility of a further intermediate peak near $3,500. This level marks a psychological and technical resistance zone and could act as a temporary top.

Following this local peak, a corrective phase may unfold. This pullback could evolve into one of the two outlined correction scenarios:

1 TP Correction Scenario

Support Target: ~$2,950

Basis: 100% Fib extension confluence and prior resistance turned support

Expected Outcome: Price stabilizes at this level and resumes upward momentum

2 TP Correction Scenario

Support Target: ~$2,650

Basis: Strong historical structure + 100% Fib confluence from a broader cycle

Expected Outcome: This zone acts as a long-term demand accumulation area

Upon completion of the corrective structure, we expect gold to reinitiate its primary bullish trend.

Bullish Continuation Targets

TP1: ~$4,050 (161.8% Fibonacci extension)

TP2: ~$4,319 (261.8% Fibonacci extension)

These targets align with macroeconomic conditions, central bank accumulation trends, and long-term structural cycles.

Supporting Technicals

RSI: Holding above 50, indicating preserved bullish momentum

MACD: Positive crossover with widening histogram on weekly timeframe

Price Action: Strong support zone between $3,280–$3,300 aligning with 161.8% Fib retracement of the recent minor wave

Macro Fundamentals & Correlations

Central Bank Gold Demand: Sustained net buying by BRICS nations, particularly China and Russia, supports the structural bid on gold

Fed Policy: Market anticipates a prolonged pause or gradual rate cuts, favoring non-yielding assets like gold

DXY & US10Y Yields: Any further decline in DXY or softening yields would add tailwinds to gold

Crypto Correlation: During inflationary hedging or systemic risk periods, gold and crypto may correlate positively, especially with weakening USD

Intermarket Relationships: Gold, DXY, and TOTAL (Crypto Market Cap)

Gold vs. DXY (US Dollar Index)

Gold historically maintains an inverse correlation with DXY. A rising DXY tends to apply downward pressure on gold prices, while a falling DXY enhances gold's upside momentum.

Scenario Interactions:

If DXY breaks below 98, this could validate the bullish scenario for gold toward $3,435–$4,050.

If DXY rallies back above 100, it could trigger the correction scenarios ($2,950 or $2,650) in gold.

Gold vs. TOTAL (Crypto Market Cap)

Gold and TOTAL may show positive correlation during periods of USD weakening and global liquidity expansion.

Scenario Interactions:

If gold rallies toward $3,500 and TOTAL also breaks key resistance (e.g., $1.8T–$2T), this signals synchronized bullish risk appetite.

If gold corrects while TOTAL continues to rise, it could indicate rotation of liquidity from defensive to risk-on assets.

A simultaneous correction in both may occur if DXY strengthens aggressively or if macro shocks reduce global liquidity.

These intermarket relationships should be monitored continuously to assess the evolving macro context and validate the chosen scenario.

In the case of a gold correction toward $2,950 or $2,650, the impact on altcoins will hinge on the prevailing macroeconomic backdrop. If the correction stems from a healthy, technical rebalancing within a risk-on environment—without a concurrent surge in the U.S. dollar—it could signal a shift in capital from defensive assets like gold into more speculative plays, including altcoins. This type of capital rotation often benefits the crypto market, particularly if TOTAL (crypto market cap) holds or advances structurally. However, if the correction is caused by rising dollar strength, tightening financial conditions, or broader risk-off sentiment, altcoins may instead suffer alongside gold, as liquidity is withdrawn across the board. Therefore, the context and drivers behind gold’s correction are crucial in assessing its downstream effects on altcoin performance.

From a philosophical lens, gold's cyclical ascent and retreat mirrors the rhythm of nature and human experience—expansion, contraction, and renewal. Just as rivers carve valleys before surging toward the ocean, the market too must surrender gains to gather force. A correction in gold is not merely a financial event, but a moment of recalibration—an inhale before the next exhale of momentum. It invites reflection: whether wealth seeks refuge or ventures into risk, whether fear contracts or ambition expands. In this interplay, altcoins may inherit the restless spirit of capital in search of yield, as gold, the ancient anchor of value, briefly pauses in its timeless journey.

Conclusion

We present a multi-phased path for gold where:

An initial bullish breakout toward $3,435–$3,500 forms a short- to mid-term peak

A subsequent correction brings gold to either $2,950 or $2,650, depending on macro triggers

A renewed bull rally drives gold toward $4,050 and potentially $4,319 and beyond

This scenario reflects both the cyclical nature of market structure and the macro-fundamental backing that continues to support long-term gold strength.

U.S. Dollar Index (DXY) Weekly 2025Summary:

The U.S. Dollar Index (DXY) has corrected down to the key 38.60% Fibonacci retracement zone and is currently showing signs of a potential bullish reversal, bolstered by a clear hidden bullish divergence on the MACD. This may signal a renewed rally toward key upside targets, especially if the 93.3–99.9 support Zone holds.

Chart Context:

Current Price: 98.864

Key Fib Support: 38.60% @ 99.906, 48.60% @ 93.310, 61.80% @ 87.476

Support Zone: 93.3–99.9 USD

Hidden Bullish Divergence: Observed both in 2021 and now again in 2025 on the MACD

Trendline Support: Long-term ascending trendline holding since 2011

Fib Extension Targets (Trend-Based):

TP1: 115.000

TP2: 120.000

TP3: 126.666

Key Technical Observations:

Fibonacci Confluence: DXY is bouncing from a strong Fib cluster between 93.310 and 99.906, historically acting as a reversal zone.

Hidden Bullish Divergence: Suggests potential upside despite price weakness.

Downtrend Retest: Price may revisit 93.3–87.4 before confirming full reversal.

Breakout Pathway: Green dashed arrows outline the likely recovery trajectory toward 114–126 range.

Indicators:

MACD: Showing hidden bullish divergence and potential signal crossover.

Trendline Support: Holding intact from 2021 low.

Fib Levels: Used for retracement and trend-based extension.

Fundamental Context:

Interest Rate Outlook: If U.S. inflation remains controlled and Fed signals future hikes or sustained high rates, DXY strength may persist.

Global Liquidity & Recession Risk: If risk aversion returns, the dollar may rise as a safe haven.

Geopolitical Risks: Conflicts, trade tensions, or BRICS dedollarization efforts may create volatility.

Our Recent research suggests the Fed may maintain higher-for-longer rates due to resilient labor markets and sticky core inflation. This supports bullish USD bias unless macro shifts rapidly.

Why DXY Could Continue Strengthening:

Robust U.S. economic performance & monetary policy divergence

U.S. GDP growth (~2.7% in 2024) outpaces developed peers (~1.7%), supporting stronger USD

The Fed maintains restrictive rates (4.25–4.50%), while the ECB pivots to easing, widening the policy and yield gap .

Inflation resilience and Fed hawkishness

Labor markets remain tight, keeping inflation “sticky” and delaying expected rate cuts; market-implied cuts for 2025 have been pushed into 2026

Fed officials (e.g. Kugler) emphasize ongoing tariff-driven inflation, suggesting rates will stay elevated.

Safe-haven and yield-seeking capital flows

With global risks, capital favors USD-denominated assets for yield and stability

Why the Dollar Might Face Headwinds

Fiscal expansion & trade uncertainty

Ballooning U.S. deficits (~$3.3 trn new debt) and erratic tariff policy undermine confidence in USD

Wall Street’s consensus bearish position.

Major banks largely expect a weaker dollar through 2025–26. However, this crowded bearish sentiment poses a risk of a sharp rebound if data surprises occur

barons

Tariff policy risks

Trump's new tariffs could dampen dollar demand—yet if perceived as fiscal stimulus, they could unexpectedly buoy the USD .

Synthesis for Our Biases

A bullish DXY thesis is well-supported by:

Economic and policy divergence (U.S. growth + Fed vs. peers).

Hawkish Fed commentary and sticky inflation.

Safe-haven capital inflows.

Conversely, risks include:

Deteriorating fiscal/trade dynamics.

Potential Fed pivot once inflation shows clear decline.

A consensus that could trigger a short squeeze or reversal if overstretched.

Philosophical / Narrative View:

The dollar remains the world’s dominant reserve currency. Periodic dips often act as strategic re-accumulation phases for institutional capital—especially during global macro uncertainty. A return toward 120+ reflects this persistent demand for USD liquidity and safety.

Bias & Strategy Implication:

1. Primary Bias: Bullish, contingent on support at 93.3–99.9 holding.

2. Risk Scenario: Breakdown below 93.3 invalidates bullish thesis and targets 87.4–80 zones.

Impact on Crypto & Gold and its Correlation and Scenarios:

Historically, DXY has had an inverse correlation to both gold and crypto markets. When DXY strengthens, liquidity tends to rotate into dollar-denominated assets and away from risk-on trades like crypto and gold. When DXY weakens, it typically acts as a tailwind for both Bitcoin and gold.

Correlation Coefficients:

DXY vs. Gold: ≈ -0.85 (strong inverse correlation)

DXY vs. TOTAL (crypto market cap): ≈ -0.72 (moderate to strong inverse correlation)

Scenario 1: DXY Rallies toward 115–126 then, Expect gold to correct or stagnate, especially if yields rise. Crypto likely to pull back or remain suppressed unless specific bullish catalysts emerge (e.g., ETF flows or tech adoption).

Scenario 2: DXY ranges between 93–105 then Gold may consolidate or form bullish continuation patterns. Then Crypto may see selective strength, particularly altcoins, if BTC.D declines.

Scenario 3: DXY falls below 93 and toward 87 Then Gold likely to rally, possibly challenging all-time highs. Crypto could enter a major bull run, led by Bitcoin and followed by altcoins, fueled by increased liquidity and lower opportunity cost of holding non-USD assets.

Understanding DXY’s direction provides valuable insight for portfolio positioning in macro-sensitive assets.

Notes & Disclaimers:

This analysis reflects a technical interpretation of the DXY index and is not financial advice. Market conditions may change based on unexpected macroeconomic events, Fed policy, or geopolitical developments.

Macro Outlook: Trade War Jitters, Deficit, NFP FridayAlthough there is a headline fatigue and markets have been stabilizing with the worst of trade war story behind us, the fact is that uncertainty still looms. President Trump announced over the weekend that he will double down on US steel and aluminum tariffs from 25% to 50% effective June 4th.

Highlight this week is US Jobs data this Friday. A key point to determine the resilience of the US labor market. With FED Chair Powell speaking today and FED speakers scheduled throughout the week, it will be key to watch how they shape markets' probability of rate cuts?

As we previously explained, ongoing uncertainty and dragging trade concerns present more risks until resolved. Here are some key points to consider:

It remains to be seen whether the trade deficit will continue to worsen or begin to reverse. April trade data, along with any policy shifts such as a reversal on reciprocal tariffs, will be important to monitor. These indicators will provide insight into how businesses are interpreting ongoing trade uncertainty. The key question is whether they will continue front-loading inventory in anticipation of future disruptions, or if the focus will shift toward restructuring supply chains and reining in spending as part of a longer-term strategic adjustment.

At the same time, consumer spending remains resilient, supporting overall demand. However, pressure may be building on business balance sheets, particularly businesses with poor cash flow to manage front loading inventory spending as the trade environment remains volatile. If consumer spending begins to weaken, businesses may be forced to cut costs, scale back investment, or offer steep discounts to clear excess inventory. This could lead to a cycle of margin compression, especially if firms attempt to pass higher costs onto price-sensitive consumers, potentially suppressing demand further.

Conversely, if businesses choose to absorb rising costs to maintain competitive pricing, they face deteriorating margins but may be betting on continued strength in consumer credit, household savings buffers as evident. Consumer confidence, despite being low, is not an accurate indicator in times of uncertainty. Here, we should watch what consumers do and not the sentiment.

In this scenario, firms may delay cost-cutting in the hope that continued strength in consumer spending will support revenues through the rest of the year.

A central tension remains: businesses must navigate a delicate balance between protecting margins and preserving demand. Meanwhile, persistent trade uncertainty and tighter financial conditions may slow capital investment and hiring, further complicating the outlook. Whether firms shift from defensive postures like front-loading toward long-term structural changes in supply chains will hinge on how durable current consumer strength proves to be and how responsive trade policy becomes in the months ahead.

Ongoing front-loading has caused ripples as the trade deficit has further widened. Will this reverse as businesses focus on sales and revenue instead of front-loading inventory?

In our analysis, trade imports, trade balance, consumer spending and corporate profits will be key to monitor despite being lagging indicators.

On the other hand, equally important to watch and monitor goods exports, durable goods to assess and evaluate the other side of the equation.

However, our focus is on imports as manufacturing jobs are at their lowest in US history.

Once the dust has settled and trade deals are locked in, it will be important to note if Exports by Country experience any significant shifts.

What does all this mean for the stock market and futures? In simple terms, the yearly pivot and last month’s high is a major resistance area for index futures. Until this is cleared, we may see a range bound market and two way trade. There is a lot of weak structure to revisit lower. Markets may perhaps retest this before resuming higher. What we would want to see is, last month’s low holding support and this month’s price action trading inside previous month’s range or resuming higher.

If we revisit May Monthly Lows, we may see increased selling pressure come in.

EURUSD CRACK!I first turned bullish on the EUR back in November 2024 after the disastrous election results.

I have always felt the 105 area was a good area to go long, fundamentally going back all the way to 2017. Here is an example.

After 17 years of data, we can all agree that the 105 area was a great value to get long the EUR. Now we see a major CRACK! in the chart with the fundamentals to back it up.

Again, I remind you I am a MACRO Trader. So my trades hold for a long, long time unless the facts change. I don't do 3 pips and i am out crap!

Let this be a WARNING! To the dollar bulls!

Click Boost, follow, subscribe! Let's get to 5,000 followers so I can help them navigate these crazy markets, too. ))

US Gov Spending to Tax Revenues & Debt to GDPUS government spending is exceeding tax revenues by over 2:1, reaching extreme levels compared to historical norms and worsening rapidly

More alarmingly, unlike past decades, the US government's total debt-to-GDP ratio is also rising sharply with no end in sight, accelerating in the wrong direction.

For this reason, bond investors are currently demanding higher interest rates.

Trump's tariffs, undermining trust in Gov, the economy, and markets, are creating conditions for a global currency crisis coupled with an economic recession or depression.

If you think this information has no impact on your trading/investing, you are making a grave and possibly an expensive mistake.

Click Boost, follow, and subscribe for more. Let's get to 5,000 followers. ))

Deposits All Commercial Banks & US DebtWhen a politician and their buddy start spouting nonsense about the US debt spiraling out of control, but then insist that tax cuts are great because they’ll create jobs, and all that money will somehow trickle down to the rest of us, magically boosting tax revenue to "make up" for the lost funds.

Especially when that same politician was re-elected bc inflation & the economy were just so horrible, promising he would come in and save the day bringing prices down again with more tax cuts because they worked so great the first time around.

That's the extreme right. What about the extreme left #MMT?

#MMT is just as bad as MAGAs! They will tell you deficits are great! Deficits add to our savings! Deficits make us all richer! It's accounting, they say! it has to be that way! Except for the little fact that it's not based on empirical evidence.

So the next time some B.S. Artist tells you their little version of a fictional money story, you will know what reality is since 2018. You will have seen this chart with your own eyes and cannot unsee it! No matter what you do, no matter what side you lean politically, it's irrelevant.

Public debt since the tax cuts have grown exponentially, while the private sector deposits have lagged to the point they have stagnated completely since 2021. Barely rising 6%.

Defunding CIA, FBI, USAID, Dept of Education etc.. will do absolutely nothing to make up for all the lost tax revenue since 2018 and the next tax cuts to follow. In fact, when we enter a recession, the deficits will explode even higher as tax revenues collapse and social and economic stabilizers (if there are any left) kick in. Then what?

Don't shoot the messenger!

Taiwan Dollar Weakens Past 30 per USD Amid Trade Rumors and CentThe Taiwanese dollar weakened past 30 per USD on Tuesday, reversing a two-day rally and retreating from its strongest level in nearly three years.

📉 Recent gains in Asian currencies like the TWD and MYR were fueled by speculation over regional support for U.S. trade talks. However, Taiwan’s central bank denied any such coordination, stating the U.S. made no formal request. President Lai Ching-te also warned against spreading misinformation.

🔧 As a key player in global chip production, Taiwan remains highly exposed to shifts in trade dynamics and geopolitical risks.

DEFENSE EU vs USEU defense massively outperforming the US up 50% from the lows.

Lockheed Martin is forced to console American allies, convincing them not to abandon the US Defense industry as Trump completely destroys it with his pro-Russia behavior.

I don't see any way back to NATO normal. Trump has weaponized the US defense industry against our (former allies?) allies and that is unacceptable. The US defense industry mostly sells $107 billion annually to NATO, EU nations.

This win-win EU-US relationship between our allies has made it possible for the US to develope and sustain military technology we would otherwise not have been able to afford alone.

So America first? Not really. More like America last!

At any rate, should a downturn occur and need to be long. #EUAD is a good place to be.

MARKETS NOT OVERSOLD CAUTION! UPDATE!This is a monthly chart and TV keeps forcing "Target reached" on my updates. As such i am reposting this chart I first issued back on April 1st, 2025, before our "LIBERATION DAY" FACEPALM!

We are still not oversold on a monthly chart!

WARNING!

Click Boost, follow, subscribe!

USOIL CAUTION! BREAK - TEST - GO!This is my new updated chart of Oil.

Trump's "Drill baby Drill" interfering with the free market is the absolute worst thing he could do. His ridiculous tariffs will put us in an economic depression!

Oil prices are driven by demand! As I have mentioned here on TV so many times before! Increasing supply while heading into a recession is the dumbest thing possible! You never want to consume your own oil when you can consume others first! Simultaneously, F your own nation's oil company's profit margins and gov tax revenue!

This is why we shouldn't put toddlers as POTUS!

Anyway!!! This is a break test go! setup!

If you haven't seen it before, here is an example I recently posted with AAPL.

Click Boost, follow, subscribe! Let's get to 5,000 followers so I can help them navigate these crazy markets too. ))