Makuchaku

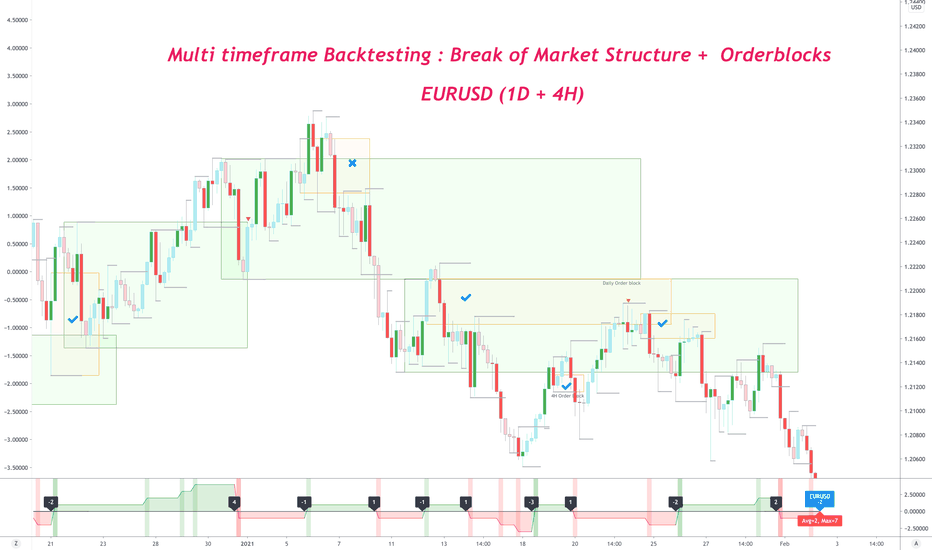

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

[Risk Management trick] Tilting the "Math" in your favor!We all try to find the strategies which offer best possible win probabilities.

Yet, we often overlook another crucial component of increasing your odds of winning => risk management.

Today, I am going to show you how you can use a simple risk management trick to tilt the "Math" in your favor.

Would you like to increase the output of your strategy by 25% without doing anything extra?

Imagine a 3R win suddenly increasing to 3.75R with no change in the strategy at all.

Consider this trade...

We are trying to setup a sell trade with a very defined -1R risk and +3R profit.

If we were to loose this trade, we will loose 1% of our capital - and if we win, we will make 3% in return (3RR).

Here, we assumed that we'll exit the trade when price moves -1R completely against us.

What if, we pivot our thinking and assume the trade is lost when price has moved -0.8R : because if the trade goes that much against you, there's a very high probability that it'll hit your stop loss too. There is no reason to pretend that it can still turn around at the last moment. Murphy's law truly applies here - "Anything that can go wrong will go wrong".

If we do really pivot our thinking, lets see how it works in our favor!

The Stop loss is now updated and set at -0.8R

So a win will still give us the same 3%, but the loss will only wipe out -0.8% from our account.

Now because our profit targets are still setup as per the original 1% trade, you can now see that we now get this extra reward if our trade hits its original 3R target

The moment we draw 3R as per our new -0.8R stop loss, we get this - You can see how the 3R with -0.8R stop loss is achieved much before than the 3R with -1R stop loss (obviously)!

That means, the extra reward you got when the trade reached your original 3R - is additional profit which you now have - without ever changing your trading strategy!

3/0.8 = 0.75 (which is 25% of your original 3R target)

0.75/3 = 25%

You now have extra an 25% reward for free!

New RR = 3.75

This is a very beautiful math equation for yet another reason!

Imagine you lost your trade with a -0.8R => the additional 0.75R you will achieve (for free) from another trade will extremely quickly cover up anything you lost.

As you can see, we can really use sound risk management techniques & Math to our benefit.

This is called : Tilting the "Math" in your favor!

EURUSD (weekly) : At the point of potential inflectionEURUSD is hitting some weekly order blocks and is at a potential inflection point. It could go higher searching for liquidity, or could turn down from here.

Interesting point to note, US Dollar / DXY is also at an important (& opposite) inflection point. So is GBPUSD.

Follow me for more analysis & trade ideas!