2022-12-04: SGD VS MYR 1D (SEEING ANOTHER COMEBACK NEAR @ 3.40)Looking at the current chart of SGD vs. MYR .

A pullback on MYR easing after POST-ELECTION in Malaysia. In conjunction of US POST-ELECTION event too.

At the moment, we are heading to the closure of year 2022. Sighting that much of slow down on US Dollar just a bit.

Just to ensure the rest of the world could enjoy that 3% banking interest or dividend.

Back to SGD strength, this temporary pullback is not from the All-TIme-High basis on a few other indicators which is not shown here.

SGD is given opportunities to make another come back nearing MYR3. 40 soon starting next year in 2023. - Hang Nujum Negara

Malaysia

FBMKLCI Simple Chart AnalysisKLCI - Possible a rounding bottom to be form under the administration of new Government which led by unity government.

How to view the guidance via chart ( Refer back to pin message guidance if to trade )

Red Line = Support

Blue Line = Resistance

Light Blue = bullish/bearish pattern

Arrow = Double/Trip top/bottom

Red Chip = $$

Green Chip = XX

FKLI 4Yr Plan (2022-26): Retest ATH by 2026 *if no USD Collapse*$FKLI

FKLI recovery map (2022-2024/26)

Dec'22:

Bounce continue post-GE

mid'23: reclaim 1,598

end'23: reclaim 1,698

mid'24: retest 1,600 from 2023 peak

mid'24-early'26: reclaim 1898...

@ 2026, what's next?

case A: Fed cont QE, ATH or new ATH on inflation

case B: Dollar collapse, world plunge into abyss.

thanks for reading my crystal ball analysis lol 🔮

see you in 2026! 💫

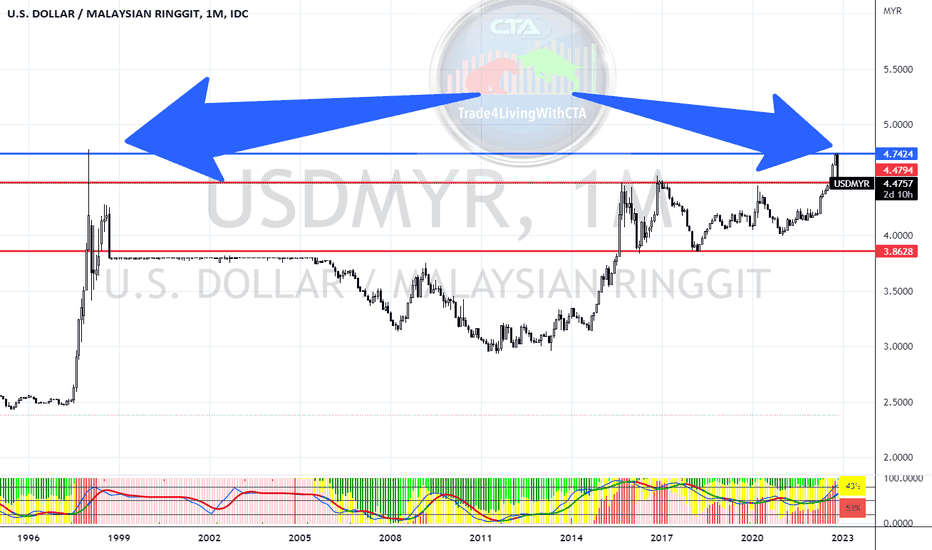

USDMYR Simple Chart AnalysisUSDMYR - This chart can use to monitor our country economy too, hopefully the double top here can indicate that our MYR can continue to be strengthen under the unity government.

How to view the guidance via chart ( Refer back to pin message guidance if to trade )

Red Line = Support

Blue Line = Resistance

Light Blue = bullish/bearish pattern

Arrow = Double/Trip top/bottom

Red Chip = $$

Green Chip = XX

KLCI - Malaysia Composite Index Expected to Fall !!!!Based on the early analysis, KLCI is expected to fall to 1008 if it closes below 1270 on the monthly candle. Keep track of the monthly levels, the market is expected to be volatile due to the upcoming elections and the associated outcomes from the election.

SINGAPORE COVID-19 Wave 6I do not know the robustness of the data collected, as it differs greatly in different places.

But with just a quick comparison:

Singapore relaxed mask measures on 29 August, and from early September, there was already an uptick and the MACD histograms pointed out to late September crossover. Indeed, on 30 September, CNA reported a 40% week on week increase in COVID-19 cases. This wave/spike appears to be much less steep than the previous in June 2022. Nonetheless, with the F1 weekend happening, we might get a continuation of the spike for the month of October into November... a smaller but longer wave.

Demonstrates yet again that the MACD histograms have an edge in projecting the time line to a spike in cases. IF only the people know about such a simple and yet effective tool.

In the same comparison, the UK appears to have tapered down after a recent spike. However, noted that the daily numbers are actually weekly numbers. Demonstrates the robustness of data for reliability.

Indonesia looks to be tapering off too, but Malaysia appears to be looking at a crossover by mid-October for a wave, albeit a smaller wave.

Really, IF anyone still cares enough...

Direction of WTI #1So there is clearly a strong resistance at trendline. Now we are waiting for the market to rebound at the trendline and we can make short position. but if the market break through the resistance line. we have to make sure it is a break out or false breakout. wait, patience, got setup, minimal risk. and then entry

Direction of FCPO #7So, who is following from the previous chart analysis? We see it together how the price break the channel and make a confirmation of going short. Now we still see market are in bearish. Tomorrow we will see the market rebound or continue going downwards. But all we have to do now is focusing and looking an entry for short. Remember, risk always be there. This is future trade. SL / CL hunter are exist out there.

FCPO Contract Month Watchlist TutorialThese are the steps shown in video to make FCPO Contract Month Watchlist.

1. Open FCPO1! Chart

2. Check latest contract month

3. Open Indicator

4. Search for FCPO Contract Month Table

5. Take note the latest contract month, example X 2022

6. Select X and 2022 from setting

7. Open other live chart

8. Create new watchlist

9. Set Frequency to All

10. Set alert

11. Set condition

12. Clear Alert Name

13. Click Create

14. Export alerts log to a CSV file...

15. Save csv file

16. Open csv with notepad

17. Remove necessary code

18. Save as txt extension

19. Import list

20. Done

I may do other watchlist such as Sharia market, future etc. Thank you.

Direction of FCPO #5As you guys can see, it is what we predict from previous our chart analysis. It is following the direction that I have been showed. So now lets see either the market can rebound and go up towards the strong resistance ( yellow box ) or it will continue downwards. Besides that, do not neglect that we can see there is a form of pattern have shown which is Head And Shoulder ( HNS ), same goes to this concept, have to break the neckline, and then we can make decision where is the direction of the market. We will see tomorrow to see what market brings to us.

Direction of FCPO #4As we looked at the previous our TA chart. it seems that the market still can't break the resistance. But we will see on Monday, does the market will try to break the resistance or it will break the parallel channel. We have been waiting for market move from outside the parallel channel, so that we can have a better direction on short or long. But even now, we can see that the price can't break through that resistance on orange color that i have draw. the market already try to break the price so many times but still failed. so we are waiting for the price break the parallel channel. then we can have a clear direction.

In a smaller time frame like 5m / 15m / 30m, if the market open and try to break the resistance, wait for the break out. if still can't break the resistance. then can focus short until parallel channel. wait for the break support. and then can continue find setup for short

Remember, always entry with setup. Or else, u are in gambling industry. Happy Trade!

This is what we call "libasan neraka"When it comes to FCPO, Technical Analysis come first, then Fundamental Analysis.

From our previous chart, this is what we have been prepared for. So, we going to see where does the market will go. either moving downwards or upwards. Even drop almost 200+- ticks, yet it is still in the parallel channel. So can't identified yet is it in bullish or bearish

Direction of FCPO #2As the previous chart, we predict the market will rebound at the support. But turns out it break the support already and heading towards to the line channel. From there we can see which direction we can focus. either bear or bull. we can make decision from there. but from now. we can go for short

Direction of FCPO *2 centsThis is my idea what probably going to happen tomorrow, on Monday 22 Aug 2022. From bigger picture 4H / 1H, the market really following the channel trend. The market rebound when it touch the support trendline. So if tomorrow market still going up, that means it towards to resistance. Focus on long. If market breaks the support. Then focus on short, it will be going towards the support

ANNUM (MALAYSIAN STOCKS) INTRADAYExpected to rebound at 0.40 MYR.

Targeted resistance at 0.50 MYR.

(1) The price inclining while the volumes insisted prior to previous prices. Expected on continuous bearish trend if the price couldn't break the resistance.

(2) Within the current global economy onto further OPR leads to underperformance in markets.

FINANCE: Possible End of CycleFrom 2003 to 2018, each cycle from peak to peak for FINANCE index lasts between 36-46 months. Recent high in early May 2022 is equivalent to 49 months.

Other indicators:

- Negative divergence on monthly chart (CCI)

- Similar negative divergence also appear on the monthly chart for big caps like PBBANK, MAYBANK, HLBANK, CIMB.