CGC - Inverse H&S finishing?I think that MJ stocks are going to take off again tomorrow... Here is an interesting inverse head and shoulders.

If this plays true, this could be an amazing reversal!

I'll be buying this at open with a reasonable stop in place.

Marijuana

GTBIF - continuing channel or breakout?I've been looking for an entry into the MJ market for the past 6 months and have been watching a few ones closer than others.

GTBIF has established nice support and has bounced a few times now. They bucked the steeper downtrend channel and formed a fairly parallel channel enclosing the current base support.

I bought in the other day at 8 hoping to catch a bounce off the trend line and a re-entry play again at 8.

2019 ended with most MJ stocks picking up 10%+ whereas GTBIF couldn't push through the trend line and only picked up a 3.85% gain.

If 2020 continues with bullish MJ sentiment; I think GTBIF will hold the trend line then blast through. If there is a early sell off, I think they will hold the current base.

$SBES Completes First Leg Consolidation And Readies for .02+ Brk$SBES Has completed its first major leg run and consolidation and is now gearing up for the breakout past .02 The company is in plans to merge with RockySaaS under its parent company Panshi a $10 Bil revenue generating company. All signs lead to this R/M taking place and filings are said to drop before the EOY into possibly January.

WeedMD should bounceWeedMD should recover after almost 1year long downtrend, despite drop in sales they are shortly after harvest, I suspect lots of new buds are already in curing, soon ready for sales. On the top of that lfpress.com

This price range looks like great entry for long term position, however short term rapid recovery would be well deserved.

Hyped cannabis stock ACB finally worth a buyAfter a long downward slide, Aurora Cannabis has finally hit a support critical level around $2.50. With the stock finally looking a little undervalued and a large recent earnings beat under its belt, ACB should rally higher. Call buyers are targeting $5.00 per share within two months, with over 40,000 call options located at that price. Cannabis is a hype sector, so when investor interest picks back up, it could quickly turn red hot. Several times in the last few years, ACB has hit over $10 per share.

Canopy Growth: inverse head and shoulders on the 4hrThis is a very apparent inverse head and shoulders on the 4hr time frame. The stock has been butchered in the last few months. Seems like since the new CEO announcement, the stock developed this inverse head and shoulder bottom. It's currently sitting right on the neckline. Watch for a breakout on the neckline.

$GRWG... Ready To Resume UptrendRecent uplising news coupled with solid earnings and upgrades should take this back up to the high end of the range... $4.40 in sight... next target $5.00... look for friction @ 50MA 4.11 @ 100MA 4.45... Stop@ $3.60... sell 1/2 @4.80 then watch for direction...

All IMO...

$GRWG

$SBES In Breakout Mode Following Anticipation of $10 Bil MergerIt is anticipated that around 60% of the float is now locked and the rest to be locked by hedge funds and whales who will be coming in before the filings for the merger drops. The merging in candidate following all the DD is said to be RockySaaS, owned by $10 Bil Panshi Group.

There is much much more DD in the iHub stickies than can be inputted here:

investorshub.advfn.com

Next resistance points are .0080, .015 and .02 after that it is pretty thin all the way up. Long term PT is around .10

$TOMI at Breakout of Wedge Pattern + Name Change Expected SoonTracking. Full DD in tagged past charts.

Cannabis Stocks Crash / Lawsuit Against HEXO Corp.A LEADING LAW FIRM, Announces Filing of Securities Class Action Lawsuit Against HEXO Corp. - HEXO

According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that:

(1) HEXO's reported inventory was misstated as the Company was failing to write down or write off obsolete product that no longer had value;

(2) HEXO was engaging in channel-stuffing in order to inflate its revenue figures and meet or exceed revenue guidance provided to investors;

(3) HEXO was cultivating cannabis at its facility in Niagara, Ontario that was not appropriately licensed by Health Canada; and

(4) as a result, HEXO's public statements were materially false and misleading at all relevant times.

When the true details entered the market, the lawsuit claims that investors suffered damages.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

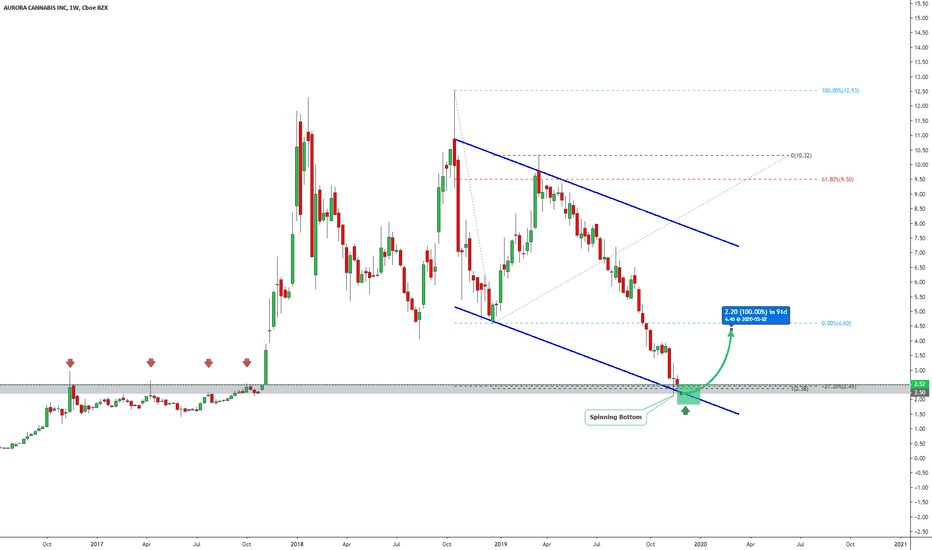

AURORA CANNABIS (ACB) | Risky, But Probably Worth It!Hi,

Aurora Cannabis Inc. produces and distributes medical cannabis products.

Obviously, it has some mixed fundamentals but technically it may find some buyers around 2.00 - 2.50.

Technical criteria are pretty strong, some of them are a bit subjective but in general, we have a strong crossing area. The green box consists of:

1) 2016 & 2017 high/resistance should start to work as a support level.

2) Actually, it has already started to act as support. In the last week, the price got a rejection upwards from the gray area (2016/17 high) and formed a Spinning Bottom candlestick pattern - bullish candlestick pattern.

3) Now, a bit subjective but still, channel projection worked as a support level and they make up a crossing area with the gray zone.

4) The crossing area becomes even stronger because we have D point exactly inside of it from the pattern called AB=CD

5) Fibonacci Extension 127% should make it (marked bounce area which stays between 2.00 - 2.50) also a bit stronger.

6) The current seasonal "pattern" favors buyers. It means that the end of the year has been pretty profitable for Aurora and the last upwards rally started about a year ago also in December.

Target is up to you but the strongest resistance level stays around the 5.00 and if it reaches there from the current area then it will be 100%+ profit.

Do your own research and please, take a second and support my effort by hitting the "LIKE" button, it is my only FEE from You!

Best regards,

Vaido

Cannabis will reach the US... sooner than later!Recent significant events:

House Passes Bill to Protect Banking for Marijuana Businesses

Measure would prevent federal regulators from penalizing institutions that serve companies operating in states where cannabis is legal. // September 25th, 2019

House committee approves landmark bill legalizing marijuana at the federal level

The House Judiciary Committee (Democratic-controlled) approved a bill that decriminalizes marijuana on the federal level, removing it from Schedule 1 of the Controlled Substances Act.

The legislation, which passed 24 to 10, has a high chance of approval in the full House where Democrats control the chamber with 234 seats. It’s likely to face a tougher battle in the Republican-controlled Senate, where Majority Leader Mitch McConnell opposes marijuana legalization. // November 19th, 2019

There is no date for the senate to review the bill; we could see large volatility then. (will update asap)

Technical analysis:

Volume on the ladder of the events created the 3rd largest volume daily since MJ ETF was created (2016).

20SMA is our nearest resistance.

--Keeping cannabis related stocks/ETFs closely watched.

$QALB Continues Sideways In Anticipation of Major UpdatesUpdates to come include:

1. Attorney Letter

2. Pink Current

3. Transition into major security agency

4. Contracts

5. Filings

6. More Updates...Stay Tuned.

$QALB New Website and Twitter Found As Company Progresses FwrdCompany has been moving forward with many updates, expecting the Attorney Letter and Filings to drop very soon in-addition to a PR about upcoming catalysts!

Website: www.customprotectionservice.com

Twitter: twitter.com

GrowGeneration: Wrong-way cannabis earnings play of the dayGrowGeneration killed it on today's earnings report, but dropped about 5%. This presents a buying opportunity.

The company reported GAAP earnings of $.03 per share, beating analyst estimates of $0.02/share. It reported revenue of $21.8 million, vs. the forecast of $20.621 million. These are big year-over-year increases. This time last year, the company reported a loss of ($.02) per share. Revenue is up $13.4 million, or 159% over last year's quarterly report of $8.400 million. The company raised its full-year revenue forecast to about $75M. Same-store sales and profit margins both saw large increases.

Coming after analyst downgrades for Aurora Cannabis and CanopyGrowth, GrowGeneration's results make it a standout small-cap player in the ever-popular cannabis sector. Overall, this company is executing like a boss.

CGC - LONG UPDATECAN YOU SAY BREAKOUT ?!?! DIVERGENCE TRADE CAME THRU ONCE AGAIN. LET'S SEE IF THERE'S GOOD CONTINUATION. 50% RETRACE IS ABOUT 35 DOLLARS AND THERE'S A GAP TO BE FILLED AT 31 AREA TOO.

Massive Bounce off Major Support after Unnecessary Dump PT LT $3Photos of the newly built first dispensary from the company were posted and some people were not thrilled however they failed to do research on the clientele in the area which is why the building was built the way it was. In addition it is due to a developing segment of the county that should see massive growth in the next two years.

Remember this is the first of many dispensaries to be built by the company. Looking to see new highs next week after investor confidence surged after midday today with a massive recovery on the candle.

$TOMI Back at Major Support After Name Change Delay Caused DumpAbsolutely nothing has changed with the company except with a delay at FINRA after the wrong person posted the information sent in for the name change of the R/M. I anticipate the same documents have been sent in with the right person already this time and awaiting the name change once again, which shouldn't take as long as last time, due to all the documents being required already being available for submission this time.