IIPR Macro Higher Low ? 100 EMA to break!Hello Traders!

Today’s chart update will be on IIPR – Innovative Industrial Properties INC where bulls are attempting to put in a new higher low, a trend change may be coming to fruition.

Points to consider,

- Potential new higher low

- Structural resistance needs to break

- Support in green zone

- RSI respecting support

- Stochastics projected upwards

- Strong VPVR cluster to break

- Volume below average

- 100 EMA to breach

IIPR’s overall trend has been bearish with consecutive lower lows; a trend change will come to fruition when a new higher low and higher high is established. Structural resistance is key to break, IIPR was rejected twice with the help from the EMA’s, this resistance is very key to brach otherwise the potential new higher low will be negated.

Support was formed in the green zone, a clear double bottom at current given time; this is a strong macro reversal pattern. The RSI is also respecting its support line, we need a third clear touch for confirmation.

Stochastics is projected upwards, can stay in the lower regions for an extended period of time, however there is lots of stored momentum to the upside. The VPVR cluster with strong volume of transaction is further resistance to break, volume of transactions decreases drastically after this cluster, signalling low resistance poised for the bulls.

The Volume is currently just above average; IIPR needs an increase in volume with follow through when resistances are tested.

Overall, in my opinion, a trend change will come to fruition when structural resistance is broken and the 100 EMA is breached. IIPR tends to respect the 100 EMA in a bull trend so it will be key to watch when the new trend starts to put in consecutive higher lows and higher highs.

What are your thoughts?

Please leave a like and comment,

And remember,

“If you don’t respect risk, eventually they’ll carry you out.” – Larry Hite

**Please follow me on twitter for daily updates on fundamental news in the MJ and Crypto Speace ! :) Twitter handle in profile link

Marijuanastocks

$GRWG... Ready To Resume UptrendRecent uplising news coupled with solid earnings and upgrades should take this back up to the high end of the range... $4.40 in sight... next target $5.00... look for friction @ 50MA 4.11 @ 100MA 4.45... Stop@ $3.60... sell 1/2 @4.80 then watch for direction...

All IMO...

$GRWG

APHA Bullish Divergence | Double Bottom?Hello traders,

Apologies, been under the weather the past few days, but now I’m back!

Today’s chart update will be on APHA – APHRIA Inc – Canadian MJ. Which has been in a brutal down trend, but there are signs of a possible reversal…

Points to consider,

- Trend Bearish

- Support at $3.90 Region (double bottom)

- Price testing resistance

- Stochastics trading in upper region

- RSI diverging from price

- EMA’s giving price resistance

- Volume declining

The trend has been putting in consecutive lower highs as it approaching its possible apex zone. The green highlighted zone is the current support level with a possible double bottom, signalling that buyers are strong. Resistance is poised by the trend line, which needs to break to negate the higher low market structure.

Stochastics are currently trading in the upper region, can trade in this region for an extended period of time, however lots of stored momentum to the downside. The RSI is currently diverging from price as it puts in higher low whilst the price has put in lower lows,

The EMA’s are currently giving price resistance, needs to cross bullish to support price in testing upper resistance levels. Volume is visibly declining; an influx of volume will confirm the direction of the break.

Overall, in my opinion, a break is imminent as we have a probable bullish divergence and a double bottom coming to fruition. APHA needs an influx of volume with follow through; this will avoid a possible false break.

What are your thoughts? Please leave a like and comment,

And remember,

“Never let a win go to your head, or a loss to your heart.” – Chuck D.

Triple Bottom for TNY?It appears as though $TNY may have formed a triple bottom where I have the red fingers pointing right on the chart.

In my previous post linked to this chart I spoke about the descending triangle & potentially testing .335c, clearly visible on this chart we can see .33c is about exactly where a new double bottom was created, and thus potentially creating the third bottom of a triple bottom. We will need to see continued bullish price action next week & break out of this pattern flush to the upside, maybe create a top at 44c & consolidate sideways before continuing, who knows, only time will tell.....

The RSI appears to be breaking out of a Bull Flag, and on 5 year & 1 year time frame the RSI is fairly low with lots of room to move to the upside, "if we're looking at a longer term trend reversal."

Key Takeaways

A triple bottom is a visual pattern that shows the buyers (bulls) taking control of the price action from the sellers (bears).

A triple bottom is generally seen as three roughly equal lows bouncing off support followed by the price action breaching resistance.

The formation of triple bottom is seen as an opportunity to enter a bullish position.

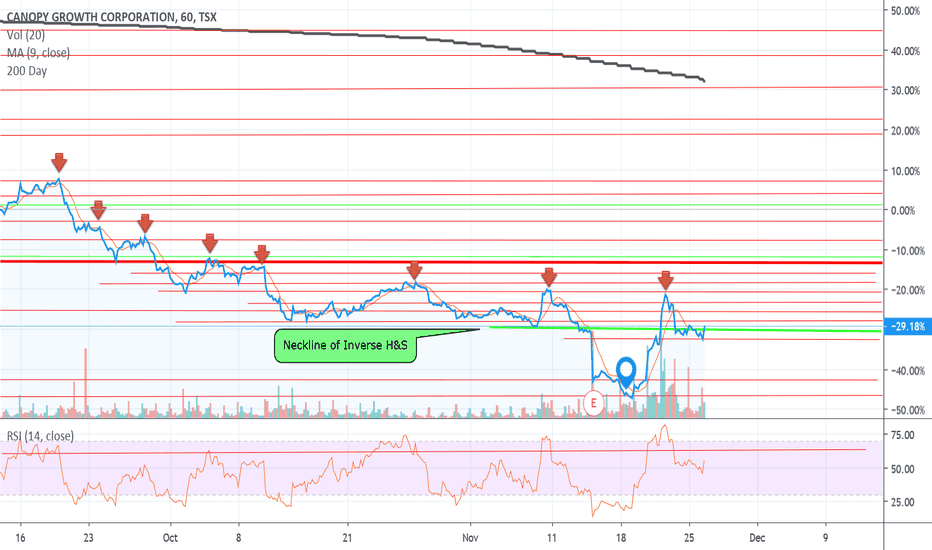

Bull Flag or Descending Triangle.Since my post several days ago linked to this chart, you'll notice $WEED is holding the neckline area of the inverse H&S, forming two additional patterns known as a bull flag & descending triangle.

Seeing how the sector has thrown under the bus for the better part of 1 year, I'm expecting to see the Bull Flag play out.. Simply to go against the bearish narrative that's becoming a bit more hysterical by the day..

Time will tell per usual.

Cannabis Stocks Crash /Tilray: Boom And BustTilray is one of the cannabis companies that saw its shares rise massively prior to legalization in Canada, but shares have gone down a lot since then.

Tilray (TLRY) is based in the Vancouver Island town of Nanaimo, Canada, where the company is responsible for

"cultivating and delivering the benefits of medical cannabis safely and reliably," according to its website.

As with much of the marijuana industry, Tilray is losing money as it tries to expand in Canada and globally.

The company has a presence, of some kind, in at least 12 countries. But it has lost money over the past six quarters.

Tilray (TLRY) reported 2019 Q3 results that were mixed with strong medical sales and struggling recreational sales in Canada.

The company sold more than double the amount of cannabis it did last quarter but average pricing also dropped 30%.

More importantly, the company's weaker balance sheet will become its biggest near-term impediment to growth.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

Cannabis Stocks Crash / Lawsuit Against HEXO Corp.A LEADING LAW FIRM, Announces Filing of Securities Class Action Lawsuit Against HEXO Corp. - HEXO

According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that:

(1) HEXO's reported inventory was misstated as the Company was failing to write down or write off obsolete product that no longer had value;

(2) HEXO was engaging in channel-stuffing in order to inflate its revenue figures and meet or exceed revenue guidance provided to investors;

(3) HEXO was cultivating cannabis at its facility in Niagara, Ontario that was not appropriately licensed by Health Canada; and

(4) as a result, HEXO's public statements were materially false and misleading at all relevant times.

When the true details entered the market, the lawsuit claims that investors suffered damages.

Disclaimer:

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature,

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a licensed investment professional before investing.

This communication is never to be used as the basis of making investment decisions, and it is for entertainment purposes only.

CGC 15 min chart and the AlphaBotSystem IndicatorsJust discovered these guys recently. They have built an impressive suite of indicators that cater to both equities and crypto traders. There is also a series of bots for trading crypto. The visual trend change blends in nicely with my charts and gives one confidence to take the trade after the trend change is indicated and then a technical setup presents itself.

HEXO. ITS TIME TO EAT FAM. BUY NOW, PROFIT LATER.HEXO

Majorly Oversold.

Pot Bubble POPPED.

Bottom is sunken in.

Weak hands shook.

Time for the big daddy's to take a TURBO LONG.

Buy when Blood is in the streets (and we are past a massacre)

There is huge bullish divergence on RSI

This is support zone KNOWN from WAY back.

Sunken GAP that will be filled for T4

This will take few weeks to play out.

Easy Money here.

If you wanna win,

Follow me.

Say less, lets get this bread.

BUY NOW, PROFIT LATER.

________________________

PREMIUM XSR SIGNAL:

Entry: $1.80-$.196

Target 1: $2.25

Target 2: $2.59

Target 3: $3.00

Target 4: $3.58

_______________________

Remember,

"WE DON'T HIT STOP LOSSES, WE HIT TARGETS"

- LL XSR <3

$ACB is finally returning to the MEANAurora Cannabis is returning to home base. Volume picking up, divergency between volume and RSI, capitulation wicks, deviation etc. Once liquidity taken and retest made, we may see either prolonged accumulation or possibly V-type return on major news event or equal.

TNY Update. Possible Bull Flag.Unless Tinley breaks above 47c in the next few trading sessions we're basically just looking at another lower high.

There's clearly a possible bull flag pattern that may play out.

The RSI was at an all time low on "all time frames" recently, which is reflective of the aggressive bounce we had in the share price.

On the RSI I've made some notes that may indicate a trend reversal.

On a five day chart I'll post attached to this chart you can notice the RSI bounce off the top of what was once a descending triangle, this may indicate the trend is changing due to old resistance becoming new support.

Time will tell per usual.

TNY Update.Today's move is nice to see everyone, but we're still looking at a lower high on a macro level since Dec 2018.

That may not seem macro to some investors, which is fine, but it's still important to note in regards to charting. All information helps, especially in hindsight when trying to learn new trading methods, I guess I'm speaking for myself.

Anyway, a follow up news release may still be required to prevent the shorts from playing whack a mole.

For a meaningful higher low I'd say the safest area is above the Dec low, and that's where we have a recent lower high as well. If we can get up to 47c in the next few trading sessions it would be a nice V shape recovery.

Time will tell per usual.

TNY Chart.Just a bunch of lower highs since late April / May PP.

Anytime we've tried to get over the 200 Day MA since April, we've been knocked back down like whack a mole.

In order for Tinley to change this trend they're going to need some material news, very simple... Otherwise, it will be a slow bleed down into the single digits, IMO.

Let's not forget that the entire cannabis sector has been bleeding for months on end, and surprisingly TNY has held up nicely in comparison to many other much larger companies... But we can only pat ourselves on the back for so long....

Time will tell per usual

Is APHA trading in a massive descending triangle?I hope not, but hope isn't a good investment strategy, and with the negative sentiment in the cannabis industry I wouldn't be surprised to see this get down to 1.10. This could be a giant bull flag as well, but I don't know were the buy pressure will come from in this sketchy market?

Time will tell per usual.