I have something for you (-.-)hello

4 important target's on the chart.

I belive we still can see more downside , IMO 12085 is bitcoin current cycle bottom and we have time to see it in the next day's and week's !

but in worst case scenario for the longer term, I belive $5900 can be absolute market bootom for BTC

Market

The Psychology of The Market Cycle Explained

The market cycles can be explained from the psychology side of the average investor.

Throughout the various stages that develop in the market, the investor's emotions are also cyclical according to the "mood" of the market.

Market movements are explained by the investor when often hope and fear motivate his thoughts and actions and can predict his future actions.

Throughout the various stages that develop in the market, the investor's emotions are also cyclical according to the "mood" of the market.

The range of emotions ranges from despair to euphoria, and investors usually drive the wrong actions.

Awareness of the psychological side of the masses helps to avoid the effects of negative or positive sentiment and remain feckless on the market. In addition, we can also identify a stage or strengthen our position on the state of the market, explaining investors' feelings.

Once you understand this chart, you can control your emotions and deal without your hurt and with only your mind.

As this market cycle chart is repeating all the time, if you understand where you are located in the graph at any moment, you can take a cold decision of buy or sell a particular asset to maximize gains.

DXY - Over-Bought Zone! Hello TradingView Family / Fellow Traders. This is Richard, as known as theSignalyst.

DXY has been overall bullish for a while trading inside the brown rising channel . However, it is currently approaching the upper bound / upper brown trendline, which I consider a non-horizontal resistance and over-bought zone.

Moreover, the zone 113 - 114 is a horizontal resistance zone .

So the highlighted purple circle is a strong area to look for sell setups as it is the intersection of the blue resistance zone and upper brown trendline. (acting as non-horizontal resistance)

As per my trading style:

Since DXY is sitting inside the purple zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

¡Only the begining, stay alert!Hello trader comunity! We are seeing that the markets want to change their trend. More especifically the people thats is behind the computers wants to make gtains after two trimesters in loss. In the other hand, the DXY is fatally crushing after reach the level of 114 and we are seeing lower highs as the index cling to supports. The pair USDJPY after reach the level of 152 gets a reaction from the bears of the pair and then found support in the level of 147 (ema 21). Next week we have de interest rate decision of the Bank of Japan, event that could bring volatily to the pair. But what we must see is how the DXY start the week, anf if it continuos dropping behind 112 ( acting as resistance), we expect a recover from the US500, pairs against the dolar, and the crypto market. This is not a financial advice, good trades and profits!

EURUSD(liquidity proxy)if BO parity, $ falls, gold,equity rallyEURUSD may be used as a liquidity proxy. It has been falling for a long time in a big down channel &

Is now bouncing right at the dotted median line. (4Q is historically bullish going into new year specially on

midterm election years, where markets bottom in late October)

Watch closely if EURUSD will break above parity 1:1 again in a big move. Then most probably that is where

the 4Q rally shall start extending to 1Q2023. I still believe there is still a wave 5 down for the C wave of the big ABC correction from ATH. In 2Q2023, ABC may end in a double bottom near the dotted median or even much lower to the lower channel in case of a recession, which is more probable in Europe than in the US.

After ABC completes sometime before end of recession. Equities will rally to the start of a new EW cycle.

Not trading advice

Bitcoin Bullish or BearishMany people want to trade BTC, claiming that it's headed to 10k or that a relief rally to 30k will come. There is no edge, no implied strength, and even not that much weakness, a trade in either direction with a stop loss will probably get wiped out.

However, if one was to look at the chart there are a few things that are evident:

- Bullish divergence developing after a failed breakdown and bearish divergence that played out in a very weak manner.

- Three consecutive marginal lower lows holding support again implying accumulation and seller exhaustion.

- And lastly the breaking of a downward-sloping trendline that has acted as resistance on 5 different occasions.

During a normal market, I would be longing and would be extremely bullish. However, this is not a normal market and during a bear market, the chances of this playing out are extremely low. The next few days will be to see if the trendline break is key.

Stay posted as I WILL UPDATE AND TAKE A TRADE IN THE NEXT FEW DAYS.

Alt Market Cap Not Looking HealthyAlt Market Cap Not Looking Healthy

The Alt Market cap has recently broken down on market structure and retested key resistance and 200EMA 1hr. Core issue is the consolidation directly below key resistance at 356 which is looking like a dump could be incoming to me to the next supprot level at 342. It could be a little rocky for alts in the short term.

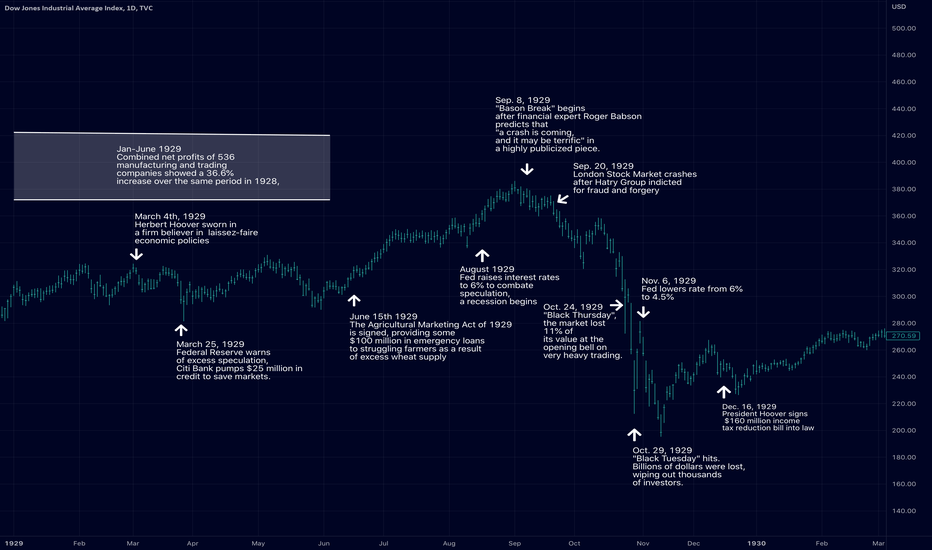

The Crash of 2022Correlations between all sectors of the market have moved increasingly to one throughout the year. The correlations have become even tighter since Jerome Powell's Jackson Hole speech.

Stocks and Bonds continue falling even though they are very oversold. Crashes happen in oversold markets.

Worsening liquidity problems in markets, rising interest rates, and bonds falling in tandem with stocks around the world are likely to ignite a financial crisis.

Money supply growth has stagnated since the beginning of the year. Money supply growth began stagnating early in the year in 1929 as well. The government began tightening spending on New Deal programs in 1936 before the crash happened in 1937.

Earnings contractions YoY in Q3 won't justify the current level of valuations and future earnings expectations. Many analysts are still expecting earnings growth in 2023. These forecasts will have to be adjusted to match reality, which will be another negative hit to investor sentiment.

The economic contraction continues to worsen, with mounting job layoffs being announced, falling capex spending, and worsening sentiment among management teams and investors alike.

The current market setup looks very similar to 1929, 1937, 1987, and 2008. All of which topped between Mid August - Early September before crashes of over -30%. All of these crashes took place over the span of less than 3 months, with the majority of the decline occurring over a period of 2-3 weeks. (I'm referring to length of the crash phase and not to the entirety of the bear market)

IN SUMMARY: The current level of overvaluation, rising interest rates, a worsening recession, and stubbornly high price inflation are a toxic mix. I think the market is in for the largest crash since The Great Depression.

Good Luck to Everyone

- Alexander