Weekly $SPY / $SPX Scenarios for May 19–23, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for May 19–23, 2025 🔮

🌍 Market-Moving News 🌍

📉 Moody's Downgrades U.S. Credit Rating

Moody's has downgraded the U.S. sovereign credit rating from Aaa to Aa1, citing concerns over rising national debt and interest payment ratios. This move aligns Moody's with previous downgrades by Fitch and S&P Global, potentially impacting investor sentiment and increasing market volatility.

🛍️ Retail Earnings in Focus

Major U.S. retailers, including Home Depot ( NYSE:HD ), Lowe’s ( NYSE:LOW ), Target ( NYSE:TGT ), TJX Companies ( NYSE:TJX ), Ross Stores ( NASDAQ:ROST ), and Ralph Lauren ( NYSE:RL ), are set to report earnings this week. Investors will be closely monitoring these reports for insights into consumer spending patterns amid ongoing tariff concerns.

💬 Federal Reserve Officials Scheduled to Speak

Several Federal Reserve officials, including Governor Michelle Bowman and New York Fed President John Williams, are scheduled to speak this week. Their remarks will be scrutinized for indications of future monetary policy directions, especially in light of recent economic data and market developments.

📊 Key Data Releases 📊

📅 Monday, May 19:

8:30 AM ET: Federal Reserve Bank of Atlanta President Raphael Bostic speaks.

8:45 AM ET: Federal Reserve Vice Chair Philip Jefferson and New York Fed President John Williams speak.

10:00 AM ET: U.S. Leading Economic Indicators for April.

📅 Tuesday, May 20:

8:30 AM ET: Building Permits and Housing Starts for April.

10:00 AM ET: Federal Reserve Bank of Minneapolis President Neel Kashkari speaks.

📅 Wednesday, May 21:

10:00 AM ET: Existing Home Sales for April.

10:30 AM ET: EIA Crude Oil Inventory Report.

📅 Thursday, May 22:

8:30 AM ET: Initial Jobless Claims.

9:45 AM ET: S&P Global Flash U.S. Manufacturing and Services PMI for May.

📅 Friday, May 23:

10:00 AM ET: New Home Sales for April.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Market

Nightly $SPY / $SPX Scenarios for May 16, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 16, 2025 🔮

🌍 Market-Moving News 🌍

📉 Jamie Dimon Warns of Possible Recession

JPMorgan Chase CEO Jamie Dimon cautioned that a U.S. recession remains a real possibility amid ongoing uncertainty from the Trump administration's tariff policies. Speaking at JPMorgan’s Global Markets Conference in Paris, Dimon stated that while he hopes a recession can be avoided, it should not be ruled out.

💵 Stablecoin Legislation May Bolster U.S. Dollar

U.S. policymakers are advancing legislation to regulate dollar-linked stablecoins, aiming to reinforce the strength and global status of the U.S. dollar. The proposed Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025 (GENIUS Act) seeks to regulate stablecoins and their issuers, potentially anchoring the dollar's influence in the global financial ecosystem.

🏠 The Great Property Sell Fest Begins in India

The Great Property Sell Fest, a first-of-its-kind property festival in the Indian real estate market, is scheduled to take place from May 16 to 18, 2025. The event will be hosted across key locations including Gurugram, Noida, and Panipat, offering a unique platform for homeowners looking to sell their properties at premium prices.

📊 Key Data Releases 📊

📅 Friday, May 16:

8:30 AM ET: U.S. Import and Export Price Indexes for April

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Nightly $SPY / $SPX Scenarios for May 15, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 15, 2025 🔮

🌍 Market-Moving News 🌍

📊 Producer Price Index (PPI) Release Today

The Bureau of Labor Statistics will release the April PPI data at 8:30 AM ET. This report will provide insights into wholesale inflation trends, following the recent Consumer Price Index data that showed inflation easing to a four-year low.

🛍️ Walmart ( NYSE:WMT ) Earnings Report

Walmart is set to release its earnings today, offering a glimpse into consumer spending patterns amid ongoing economic uncertainties. Investors will be watching closely for any indications of how inflation and trade policies are impacting retail performance.

👟 Foot Locker Acquired by JD Sports ( NASDAQ:JD )

JD Sports has officially acquired Foot Locker ( NYSE:FL ) for $1.6 billion ($24 per share). The deal aims to consolidate market share in the sportswear and athletic retail sector, with JD expanding its U.S. footprint. Foot Locker shares surged 67% premarket following the news.

💻 Nvidia ( NASDAQ:NVDA ) Faces AI Export Rule Implementation

The U.S. government's AI Diffusion Rule comes into effect today, potentially restricting Nvidia's chip sales to certain foreign markets. This regulatory change could influence Nvidia's stock performance and has broader implications for the tech sector.

📊 Key Data Releases 📊

📅 Thursday, May 15:

8:30 AM ET: Producer Price Index (PPI) for April

10:00 AM ET: Manufacturing and Trade Inventories and Sales for March

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Nightly $SPY / $SPX Scenarios for May 14, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 14, 2025 🔮

🌍 Market-Moving News 🌍

🇺🇸 U.S.-China Tariff Reductions Implemented Today

The U.S. and China are set to enact significant tariff reductions today, lowering U.S. tariffs on Chinese goods from 145% to 30% and China's tariffs on U.S. goods from 125% to 10%. This 90-day agreement aims to ease trade tensions and has already spurred a market rally, with the S&P 500 gaining 3.3% on Monday.

📉 Inflation Hits Four-Year Low

U.S. inflation eased to 2.3% in April, marking a four-year low. This unexpected decline has alleviated concerns about the impact of recent tariffs and may influence the Federal Reserve's monetary policy decisions.

📈 S&P 500 Turns Positive for 2025

The S&P 500 has erased its year-to-date losses, turning positive for 2025. This shift is attributed to easing inflation and the recent U.S.-China trade agreement, which have bolstered investor confidence.

💼 Nasdaq to List New ETFs

The Nasdaq Stock Market will begin listing three new Russell Investments ETFs today, expanding investment options for market participants.

📊 Key Data Releases 📊

📅 Wednesday, May 14:

5:15 AM ET: Speech by Fed Governor Christopher Waller

10:00 AM ET: Business Formation Statistics for April

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

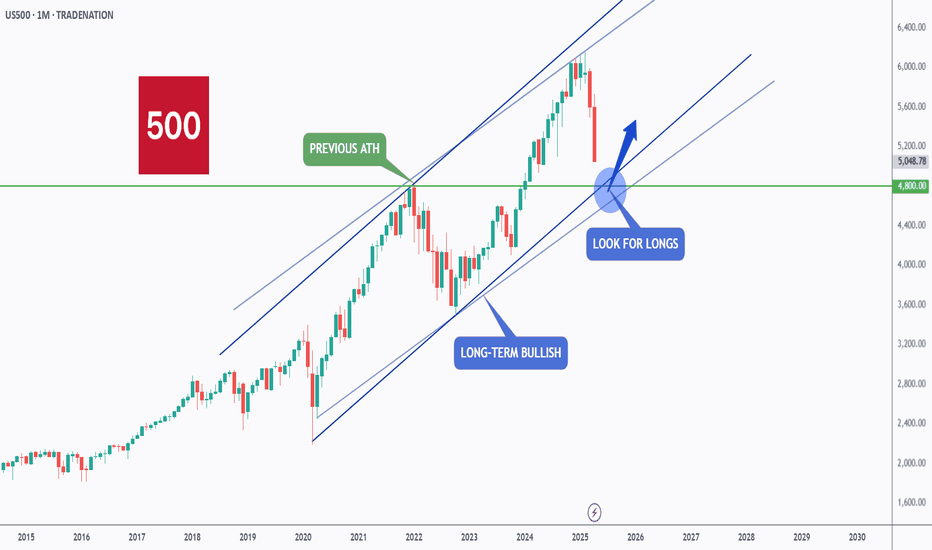

US500 - Let the Bulls Strive!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈US500 has been overall bullish trading within the rising channel marked in red.

Moreover, the blue zone is a strong support and structure!

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower red trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Nightly $SPY / $SPX Scenarios for May 13, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 13, 2025 🔮

🌍 Market-Moving News 🌍

🇺🇸 CPI Data Release Anticipated

The Bureau of Labor Statistics is set to release the April Consumer Price Index (CPI) data today at 8:30 AM ET. Economists forecast a 0.3% month-over-month increase, following a 0.1% decline in March. Year-over-year, CPI is expected to remain at 2.4%, with core CPI holding steady at 2.8% .

🤝 U.S.-China Trade Truce Boosts Markets

Markets rallied on Monday after the U.S. and China agreed to reduce tariffs for 90 days, easing trade tensions. The Dow Jones Industrial Average surged 1,160 points (2.8%), the S&P 500 rose 3.3%, and the Nasdaq gained 4.4%. Major tech stocks like Amazon ( NASDAQ:AMZN ), Apple ( NASDAQ:AAPL ), Nvidia ( NASDAQ:NVDA ), and Tesla ( NASDAQ:TSLA ) saw significant gains .

📈 Coinbase to Join S&P 500

Coinbase Global Inc. ( NASDAQ:COIN ) will be added to the S&P 500 index on May 19, replacing Discover Financial Services. The announcement led to an 11% surge in Coinbase shares during after-hours trading .

💎 Sotheby's to Auction $20M Blue Diamond

Sotheby's Geneva is set to auction the "Mediterranean Blue Diamond," a rare 10-carat gem valued at $20 million, today. The auction has garnered significant global interest from collectors and investors .

📊 Key Data Releases 📊

📅 Tuesday, May 13:

8:30 AM ET: Consumer Price Index (CPI) for April

8:30 AM ET: Core CPI for April

4:30 PM ET: API Weekly Crude Oil Stock Report

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Wyckoff Cycle - Practical Example (SUI)Dear TradingView community and fellow traders,

I am Richard, also known as theSignalyst.

I find the SUI daily chart to be intriguing as it appears to be following the famous Wyckoff Cycle.

I would like to apply Richard Wyckoff's four market stages/phases to this chart for analysis as a practical example.

1️⃣ Accumulation

SUI rejected the $0.50 round number and entered an accumulation phase, consolidating for several months.

2️⃣ MarkUp

After breaking above the accumulation range at $1, SUI kicked off the markup phase.

3️⃣ Distribution

SUI found resistance at the $5.50 round number, with the lower bound of its range near $4—forming a wide distribution phase.

4️⃣ MarkDown

Once SUI broke below the $4 major low and exited the distribution zone, it transitioned into the markdown phase.

🔄🔄🔄🔄🔄⬇️

1️⃣ Accumulation

After finding support around the $2 round number, SUI hovered within a range, forming another accumulation phase.

2️⃣ MarkUp

We're here 🙂 This week, SUI broke above the $2.80 major high and the accumulation range—signaling the beginning of a new markup phase.

❓ What's next?

Will SUI continue to trade higher from here, or will this cycle play out differently?

I hope you find this post useful, and I would appreciate your likes and support.

Which scenario do you think is more likely to happen first? and why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard

Weekly $SPY / $SPX Scenarios for May 12–16, 2025 🔮 Weekly AMEX:SPY / SP:SPX Scenarios for May 12–16, 2025 🔮

🌍 Market-Moving News 🌍

📊 Inflation and Retail Sales Data in Focus

Investors are closely watching this week's release of the Consumer Price Index (CPI) on Tuesday and Retail Sales data on Thursday. These reports will provide insight into inflation trends and consumer spending amid ongoing tariff concerns.

🤝 U.S.-China Trade Talks Resume

High-level trade discussions between the U.S. and China are set to continue this week in Switzerland. The outcome of these talks could significantly impact global markets and investor sentiment.

💼 Key Corporate Earnings Reports

Major companies including Walmart ( NYSE:WMT ), Cisco ( NASDAQ:CSCO ), Applied Materials ( NASDAQ:AMAT ), and Take-Two Interactive ( NASDAQ:TTWO ) are scheduled to report earnings this week. These reports will offer insights into consumer behavior and the tech sector's performance.

🏦 Federal Reserve Speeches

Federal Reserve Chair Jerome Powell is scheduled to speak on Thursday, with other Fed officials also making appearances throughout the week. Their comments will be analyzed for indications of future monetary policy directions.

📊 Key Data Releases 📊

📅 Monday, May 12:

No major economic data scheduled.

📅 Tuesday, May 13:

8:30 AM ET: Consumer Price Index (CPI) for April

📅 Wednesday, May 14:

10:30 AM ET: EIA Crude Oil Inventory Report

📅 Thursday, May 15:

8:30 AM ET: Retail Sales for April

8:30 AM ET: Producer Price Index (PPI) for April

8:30 AM ET: Initial Jobless Claims

9:15 AM ET: Industrial Production and Capacity Utilization

10:00 AM ET: Business Inventories

2:00 PM ET: Federal Reserve Chair Jerome Powell speaks

📅 Friday, May 16:

8:30 AM ET: Housing Starts and Building Permits for April

10:00 AM ET: University of Michigan Consumer Sentiment Index (Preliminary) for May

S&P Global

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Nightly $SPY / $SPX Scenarios for May 9, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 9, 2025 🔮

🌍 Market-Moving News 🌍

🚢 Maersk Adjusts Outlook Amid U.S.-China Trade Tensions

Global shipping giant Maersk reported better-than-expected Q1 profits but lowered its forecast for global container volume growth, citing uncertainties from the ongoing U.S.-China trade war. CEO Vincent Clerc highlighted that while U.S.-China shipping volumes have declined, the rest of the world remains stable.

🇺🇸 Fed Officials to Speak Post-Meeting

Following the Federal Reserve's decision to maintain interest rates, eight Fed officials are scheduled to make public appearances today. Investors will be keenly observing their remarks for insights into future monetary policy directions.

📈 Markets React to Trade Developments

U.S. markets closed higher yesterday, with the Dow gaining 250 points, as investors responded to President Trump's encouragement to 'buy stocks now' amidst ongoing trade negotiations.

🛠️ U.S.-U.K. Trade Deal Finalized

The U.S. and the U.K. have agreed on a trade deal involving reduced tariffs and adjustments to digital services taxes. This development is expected to influence sectors ranging from automotive to digital services.

📊 Key Data Releases 📊

📅 Friday, May 9:

3:00 PM ET: Consumer Credit (March)

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Nightly $SPY / $SPX Scenarios for May 8, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 8, 2025 🔮

🌍 Market-Moving News 🌍

🇺🇸 Fed Holds Rates Steady Amid Economic Uncertainty

The Federal Reserve maintained its benchmark interest rate at 4.25%-4.5%, citing concerns over rising inflation and economic risks. Fed Chair Jerome Powell emphasized a cautious approach, indicating no immediate plans for policy changes.

🤝 U.S.-China Trade Talks Scheduled

Treasury Secretary Scott Bessent and chief negotiator Jamieson Greer are set to meet China's economic head He Lifeng in Switzerland, marking a potential step toward resolving trade tensions. The announcement has positively influenced global markets.

📈 Record $500 Billion Share Buyback Plans

U.S. companies have announced a record-breaking $500 billion in share buybacks, reflecting growing hesitation to make capital investments amid economic uncertainty driven by President Trump's trade policies. Major contributors include Apple ( NASDAQ:AAPL ), Alphabet ( NASDAQ:GOOGL ), and Visa ( NYSE:V ).

⚠️ Recession Warnings from Economists

Former IMF chief economist Ken Rogoff warns that a U.S. recession is likely this summer, primarily driven by President Donald Trump's aggressive tariff policies. He suggests that markets are overly optimistic and not adequately accounting for the risks.

📊 Key Data Releases 📊

📅 Thursday, May 8:

8:30 AM ET: Initial Jobless Claims

8:30 AM ET: Continuing Jobless Claims

8:30 AM ET: Nonfarm Productivity (Q1 Preliminary)

8:30 AM ET: Unit Labor Costs (Q1 Preliminary)

10:00 AM ET: Wholesale Inventories (March Final)

10:30 AM ET: Natural Gas Storage

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

APT Coin Forming an Inverted Bullish Head and Shoulders! 🔥 APT Coin Forming an Inverted Bullish Head and Shoulders! 🚀

APT Coin is currently forming an inverted bullish head and shoulders pattern! 🧠 If the price breaks the red resistance line (neckline), this could trigger a strong bullish move! 📈

Keep an eye on this breakout – it's setting up for some exciting action! 🔥

Let’s catch this move together! 🌊💸

From $1 to $10 doing 900% in 2 days $KIDZ💣💥 $1 to $10+ in 2 days +900% NASDAQ:KIDZ similar to AMEX:GPUS

Shortsellers attempted similar tricks during the day and got squeezed the same way on both 🤣 making us awesome gains along the way

Please 🐻 attempt to do it again on next setups.

3 Buy Alerts in $3.50 - $4.00 range more than enough money made into vertical to $10+

Nightly $SPY / $SPX Scenarios for May 7, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 7, 2025 🔮

🌍 Market-Moving News 🌍

🏛️ Fed Decision Day Amid Tariff Pressures

The Federal Reserve concludes its two-day meeting today, with expectations to maintain the benchmark interest rate at 4.25%-4.5%. Despite President Trump's calls for rate cuts, the Fed remains cautious due to inflationary risks from new tariffs and migration policies.

📈 U.S.-China Trade Talks Resume

U.S. stock futures rose overnight on news of upcoming high-level trade talks between the U.S. and China, marking the first discussions since the imposition of 145% tariffs on Chinese goods. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer are set to meet with senior Chinese officials later this week.

🛢️ Oil Prices Rebound on Demand Hopes

Oil prices climbed as U.S. production declined and demand in Europe and China showed signs of recovery. Brent crude rose 0.6% to $62.52 per barrel, while U.S. West Texas Intermediate increased 0.74% to $59.53 per barrel.

💼 Key Earnings Reports Ahead

Several major companies, including Uber ( NYSE:UBER ), Disney ( NYSE:DIS ), and Novo Nordisk ( NYSE:NVO ), are scheduled to report earnings today. Investors will be watching these reports for insights into corporate performance amid ongoing economic uncertainties.

📊 Key Data Releases 📊

📅 Wednesday, May 7:

2:00 PM ET: Federal Open Market Committee (FOMC) Meeting Announcement

2:30 PM ET: Fed Chair Jerome Powell Press Conference

3:00 PM ET: Consumer Credit Report (March)

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Nightly $SPY / $SPX Scenarios for May 6, 2025 🔮🔮

🌍 Market-Moving News 🌍

📉 Market Retreats Amid Tariff Concerns

U.S. stock markets declined on May 5, 2025, as investors reacted to potential tariffs and key earnings reports. The S&P 500 dropped 0.6%, and the Nasdaq decreased 0.7%. Notably, Palantir Technologies ( NASDAQ:PLTR ) fell nearly 8% in extended trading despite raising its full-year revenue forecast and exceeding Q1 revenue estimates.

🏛️ Fed Meeting Commences Amid Political Pressure

The Federal Reserve's two-day meeting begins today, with the central bank expected to maintain its benchmark interest rate at 4.25%-4.5%. Despite President Trump's calls for rate cuts, the Fed remains cautious due to inflationary risks from new tariffs and migration policies.

🎬 Entertainment Stocks Under Pressure

Streaming giants Netflix ( NASDAQ:NFLX ) and Disney ( NYSE:DIS ) experienced premarket losses of over 5% and 3%, respectively, following President Trump's proposal of a 100% tariff on foreign-made movies.

🏠 Housing Market Faces Challenges

The U.S. housing market is weakening due to persistent high mortgage rates and economic uncertainty driven by tariff policies. Mortgage rates, currently averaging 6.76%, have deterred both prospective buyers and sellers.

📊 Key Data Releases 📊

📅 Tuesday, May 6:

8:30 AM ET: U.S. International Trade in Goods and Services (March)

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Weekly $SPY / $SPX Scenarios for May 5–9, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for May 5–9, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Holds Rates Amid Political Pressure

The Federal Reserve is expected to maintain its benchmark interest rate at 4.25%-4.5% during its meeting on May 6–7, despite political pressure to lower it. Investors will closely monitor Fed Chair Jerome Powell’s post-decision remarks for insights into future monetary policy directions.

📊 Key Economic Indicators on Tap

This week brings several important economic data releases, including the U.S. trade balance, initial jobless claims, consumer credit, and wholesale inventories. These indicators will provide insights into the health of the economy amid ongoing trade tensions and concerns over consumer confidence.

💼 Corporate Earnings in Focus

Major companies such as Palantir ( NASDAQ:PLTR ), Advanced Micro Devices ( NASDAQ:AMD ), Uber ( NYSE:UBER ), Walt Disney ( NYSE:DIS ), and Ford ( NYSE:F ) are scheduled to report earnings this week. Investors will be watching these reports for signs of how companies are navigating the current economic landscape.

🌐 Global Events and Leadership Changes

Europe is set for significant leadership changes, with Friedrich Merz expected to be confirmed as Germany’s new chancellor. Additionally, the Vatican’s conclave to elect a new pope convenes on Wednesday. These events, along with the 80th anniversary of VE Day, may have broader implications for global markets.

📊 Key Data Releases 📊

📅 Monday, May 5:

9:45 AM ET: S&P Global Composite PMI (April Final)

10:00 AM ET: ISM Non-Manufacturing Index (April)

📅 Tuesday, May 6:

8:30 AM ET: U.S. International Trade in Goods and Services (March)

📅 Wednesday, May 7:

2:00 PM ET: Federal Reserve Interest Rate Decision

2:30 PM ET: Fed Chair Jerome Powell Press Conference

📅 Thursday, May 8:

8:30 AM ET: Initial Jobless Claims

10:00 AM ET: Wholesale Inventories (March)

📅 Friday, May 9:

3:00 PM ET: Consumer Credit (March)

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

Nightly $SPY / $SPX Scenarios for May 2, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 2, 2025 🔮

🌍 Market-Moving News 🌍

🇺🇸 Rising Unemployment Claims Signal Labor Market Softening

Initial jobless claims increased by 18,000 to 241,000 for the week ending April 26, marking the highest level since late February. Continuing claims also rose to 1.916 million, indicating potential cracks in the labor market.

🏭 Manufacturing Sector Contracts Amid Tariff Pressures

The ISM Manufacturing PMI fell to 48.7 in April from 49.0 in March, indicating a second consecutive month of contraction. Tariffs on imported goods have strained supply chains and elevated input prices, contributing to the downturn.

📉 Construction Spending Declines

Construction spending decreased by 0.5% in March, reflecting reduced investments in both residential and nonresidential projects. This decline suggests caution in the construction sector amid economic uncertainties.

📊 Mixed Signals from Manufacturing Indices

While the ISM Manufacturing PMI indicates contraction, the S&P Global Manufacturing PMI remained steady at 50.2 in April, suggesting stability in some manufacturing segments despite broader challenges.

📊 Key Data Releases 📊

📅 Friday, May 2:

💼 Nonfarm Payrolls (8:30 AM ET)

Provides insight into employment trends and overall economic health.

📈 Unemployment Rate (8:30 AM ET)

Measures the percentage of the labor force that is unemployed and actively seeking employment.

💰 Average Hourly Earnings (8:30 AM ET)

Indicates wage growth and potential inflationary pressures.

🏭 Factory Orders (10:00 AM ET)

Reflects the dollar level of new orders for both durable and nondurable goods, indicating manufacturing sector strength.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

US500 - Long-Term Long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈US500 has been overall bullish trading within the rising channel marked in blue.

Moreover, it is retesting its previous all-time high at $4,800 and round number $5,000.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of previous ATH and lower blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #US500 approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Nightly $SPY / $SPX Scenarios for May 1, 2025 🔮 Nightly AMEX:SPY / SP:SPX Scenarios for May 1, 2025 🔮

🌍 Market-Moving News 🌍

🇺🇸 Q1 GDP Contraction Raises Recession Fears

The U.S. economy shrank for the first time in three years, down 0.3% in Q1. Weaker government spending and a rise in imports ahead of Trump’s tariff policies are weighing on growth outlook.

📈 Big Tech Lifts the Market

Strong earnings from Microsoft ( NASDAQ:MSFT ) and Meta ( NASDAQ:META ) have boosted sentiment. Meta’s revenue guidance and capex surge point to aggressive growth positioning in AI and infrastructure.

🏛️ Treasury Refunding Outlook in Focus

Markets are watching the quarterly refunding announcement for clues on upcoming bond issuance. This could influence rate volatility as the Treasury balances deficits and market demand.

🌐 Risk-On Mood Despite Macro Headwinds

Global stocks notched a 4-week high as traders bet on resilient earnings and central bank policy steadiness, even as U.S. macro data softens.

📊 Key Data Releases 📊

📅 Thursday, May 1:

📈 Initial Jobless Claims (8:30 AM ET)

Tracks new unemployment filings – a key gauge of near-term labor market stress.

📈 Continuing Jobless Claims (8:30 AM ET)

Measures ongoing unemployment benefit recipients, reflecting persistent joblessness.

🏗️ Construction Spending (10:00 AM ET)

Reports monthly change in total construction outlays — a direct measure of real economy investment.

🏭 ISM Manufacturing PMI (10:00 AM ET)

Provides a snapshot of U.S. factory activity. Readings below 50 suggest contraction.

⚠️ Disclaimer:

This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

is selling being absorbing near 23350 level ?yesterday 27 April I mentioned that nifty must have to break & sustained 23350 level it happened today but long upper wick on hourly time with high volume been noticed showing selling pressure in market of course market bullish momentum still intact it respected the near 23800 level trading above 20 EMA but we need to wait more multiple testing for confirmation to continue upside journey so consolidation may happen in 2-3 days.

Nightly $SPY / $SPX Scenarios for April 29, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for April 29, 2025 🔮

🌍 Market-Moving News 🌍

🇺🇸 Anticipation Builds for Key Economic Data: Investors are on edge as they await a series of critical economic reports this week, including GDP growth figures and the April jobs report. Concerns are mounting that recent tariff policies may have begun to weigh on economic performance, with forecasts suggesting a significant slowdown in growth.

💼 Earnings Season in Full Swing: Major corporations are set to report earnings today, including AstraZeneca, Honeywell, Regeneron, PayPal, PACCAR, Kraft Heinz, Ares Capital, SoFi, Zebra Technologies, Incyte, Repligen, and Commvault. Investors will be closely monitoring these reports for insights into how companies are navigating the current economic landscape.

📉 Market Volatility Persists Amid Trade Tensions: The stock market continues to experience volatility as investors grapple with the implications of ongoing trade disputes and tariff implementations. Analysts warn that prolonged trade tensions could further dampen economic growth and corporate profitability.

📊 Key Data Releases 📊

📅 Tuesday, April 29:

📦 Advance Economic Indicators (8:30 AM ET):

Includes data on international trade in goods, wholesale inventories, and retail inventories for March. These figures provide early insights into trade balances and inventory levels, which are critical for assessing economic momentum.

📊 Consumer Confidence Index (10:00 AM ET):

Measures consumer sentiment regarding current and future economic conditions. A decline in confidence could signal reduced consumer spending, impacting overall economic growth.

💼 JOLTS Job Openings (10:00 AM ET):

Reports the number of job openings, indicating labor market demand. This data helps assess the health of the job market and potential wage pressures.

⚠️ Disclaimer: This information is for educational and informational purposes only and should not be construed as financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #news #trendtao #charting #technicalanalysis

If the price enter these red-marked zones!Gold Market Analysis (Engulfing & Zone-Based Strategy)

This analysis is based on a straightforward zone-trading method using engulfing patterns and filtered key levels. The marked zones on the chart highlight high-probability trading areas.

Red Zones (Sell Areas):

If the price enters these red-marked zones, we look for bearish confirmation to enter sell trades.

These zones are derived from the 4H timeframe, making them more reliable. If the market reacts from here, you can target around 60–80 pips in profit.

A second sell zone offers potential for a larger move—up to 150+ pips—if the price respects it.

Green Zones (Buy Areas):

If the price drops and enters the green-marked zone, it’s a signal to look for buy setups.

This area may deliver a strong bounce, potentially yielding 100+ pips.

There’s no need for complicated patterns or indicators—just follow the zones. If the price hits a zone and shows confirmation, you trade it.

Trade at your own risk DYOR!!