Bitcoin Retests Broken Trendline Minor Resistance in Focus!Bitcoin has recently taken support from the lower levels and moved upward, successfully breaking above a key trendline resistance. Currently, the market appears to be forming another minor trendline resistance on the short-term chart. Interestingly, the previous trendline that was broken is now acting as a support zone, indicating a potential shift in market structure.

If the price manages to break this newly developing minor trendline resistance, we may expect a possible retest of that level. Should the retest hold, it could provide a strong bullish signal, allowing Bitcoin to continue its upward movement toward higher liquidity zones or resistance levels.

Marketmaker

LINK - The sleeping Giant ready to wake!Don't forget to add LINK to your watchlist — it's a solid project with long-term investment potential.

The weekly chart shows that LINK is currently retesting the downtrend line it recently broke — a textbook bullish retest.

The lower trendline now acts as a key support level, and as long as price holds above it, the structure remains healthy.

Currently trading around $17.6, the price hasn’t moved significantly yet —

You’ve got:

✅ A strong fundamental project

✅ A bullish technical setup

✅ Large market cap

✅ Still early entry

What more do you need to enter?

Accumulate now... and thank me later.

Best Regards:

Ceciliones🎯

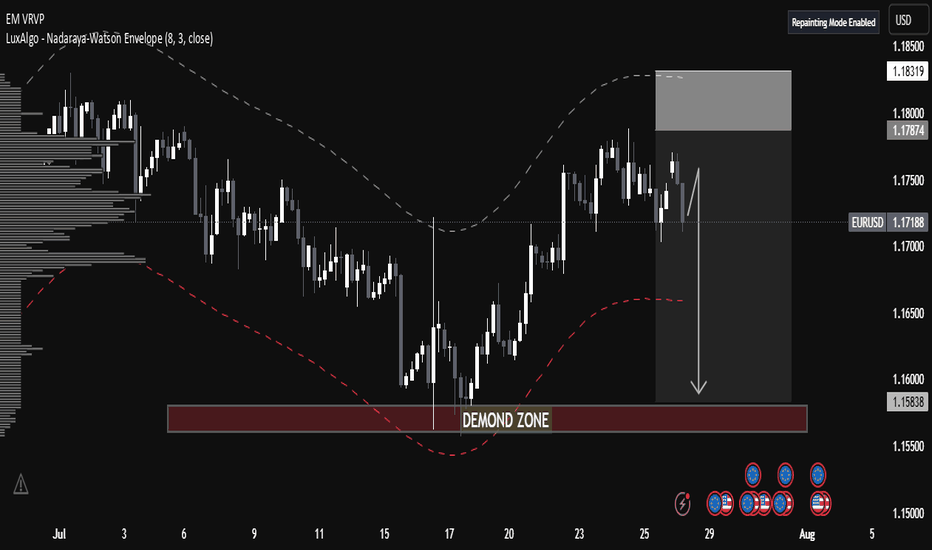

Trendline Liquidity Taken Watching for MSS at Support in EUR/USDEUR/USD has taken liquidity above the previous trendline resistance during the New York session and is now declining. The pair is approaching a key support zone. If it reaches this level and shows a market structure shift (MSS) or any other bullish confirmation, there is potential for a reversal from this zone. In that case, price could move upward toward the marked bearish Fair Value Gap (FVG). Always conduct your own research (DYOR) before making any trading decisions.

EUR/USD Technical Analysis📈 EUR/USD Technical Analysis

🔍 1. Market Structure

⚙ Trend Context

• The overall trend since mid-July has been bullish, with higher highs and higher lows forming after a bounce from a key demand zone (around 1.15380).

• However, recent candles show indecision and a potential reversal, suggesting weakening momentum.

⸻

🧱 2. Volume Profile Insight (VRVP)

• High Volume Nodes (HVNs):

• Significant trading activity occurred between 1.172–1.176, now acting as resistance.

• Low Volume Gaps:

• Thin liquidity zones exist between 1.165–1.158, which could result in swift price movement if selling pressure increases.

📘 Educational Insight: Thin volume areas on a profile typically allow for faster price transitions due to lack of order density.

⸻

📊 3. Envelope Indicator – Nadaraya-Watson (8,3)

• A mean-reversion tool estimating dynamic overbought and oversold areas.

• Price recently rejected the upper boundary, reinforcing the bearish outlook.

• The lower envelope, around 1.158–1.160, aligns with the projected bearish target.

⸻

🟫 4. Demand Zone Analysis

• Labeled “DEMAND ZONE” at 1.15380–1.15830

• Previously caused a strong bullish reversal, marking it as an area of institutional interest.

• A re-test of this zone may attract buyers once again, presenting a key support area.

📘 Educational Insight: Demand zones reflect

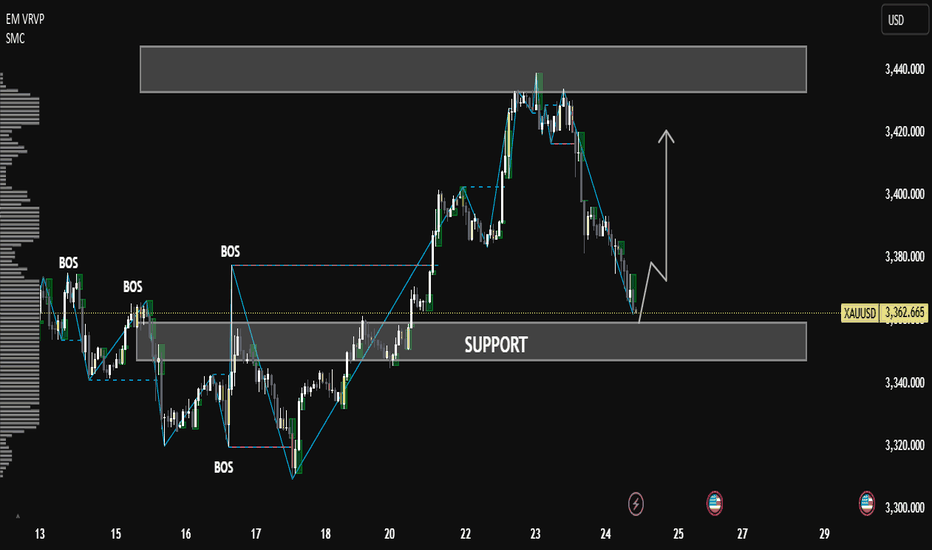

XAUUSD Price Analysis — Support Zone Reaction & Potential XAUUSD Price Analysis — Support Zone Reaction & Potential Bullish Reversal

🔍 Market Structure Overview

The chart shows a clear bullish market structure characterized by multiple Breaks of Structure (BOS) and a strong upward trend that recently corrected into a key support zone around 3360–3340.

This correction phase may be coming to an end as price reaches a high-probability demand area, with bullish reaction forming at the support level.

🧠 Smart Money Concept (SMC) Breakdown

📌 Break of Structure (BOS) confirms institutional activity and directional bias.

🔄 After a strong uptrend and BOS on July 22–23, a healthy retracement has taken place toward a major demand zone.

The support level is aligning with past consolidation and previous BOS zones, providing confluence for a bullish bounce.

📊 Technical Confluence

✅ Volume Profile (VRVP) shows strong buyer activity at current levels.

✅ The price is reacting within the support box with a small bullish candle, indicating potential accumulation.

✅ A clean liquidity sweep may have occurred just below minor lows, shaking out weak hands before a move upward.

🎯 Forecast

If price holds above the 3360 level, and bullish confirmation continues (e.g., break above minor lower highs), we can expect:

Short-term target: 3400

Major target: 3440 (marked resistance zone)

⚠️ Invalidation: A clean break and close below 3340 may lead to deeper correction or change in structure.

📘 Educational Title Suggestion

"Smart Money Reaction at Demand: XAUUSD Poised for Reversal from Key Support"

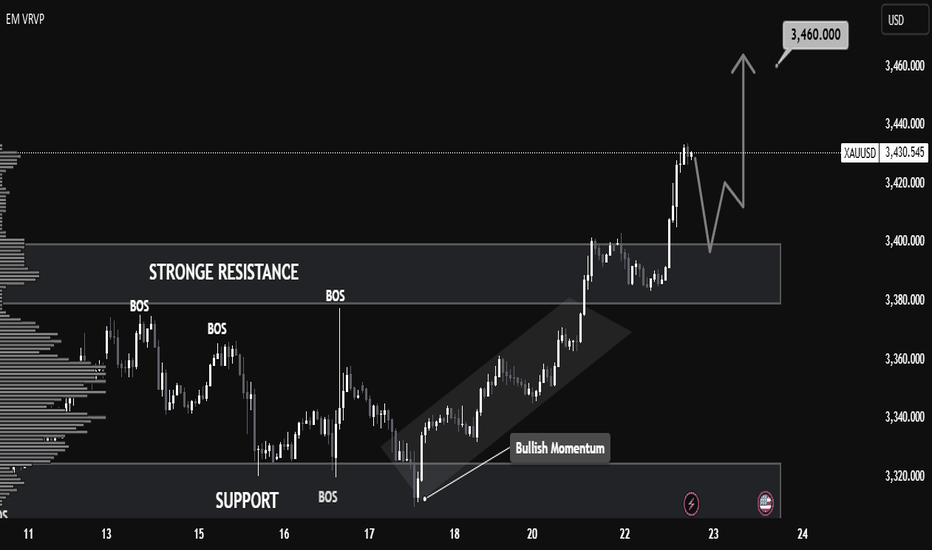

XAUUSD Technical Analysis – Resistance Turned Support, 📈 XAUUSD Technical Analysis – Resistance Turned Support, Bullish Continuation Expected

Gold (XAUUSD) has shown strong bullish momentum after breaking above the key resistance zone around $3,400, which now appears to be acting as a new support level. This structure shift signals a classic break-and-retest scenario, commonly observed in bullish continuations.

🔍 Key Observations:

Structure Shift: Previous resistance near $3,400 has been broken with strong bullish candles, suggesting buyer dominance. This level is now expected to serve as support.

Bullish Momentum: The move from the $3,320 support zone to above $3,430 was accompanied by clear trend formation and clean market structure, indicating sustained momentum.

Retest in Progress: Price is currently pulling back toward the new support zone ($3,400). If this area holds, a bullish reaction is expected.

Next Target: If support at $3,400 holds as expected, price could rally back toward the next resistance and projected target of $3,460.

📚 Educational Insight:

This setup illustrates the principle of resistance becoming support (RBS)—a foundational concept in technical analysis. After a breakout, a successful retest of former resistance often provides a high-probability entry point for trend continuation trades.

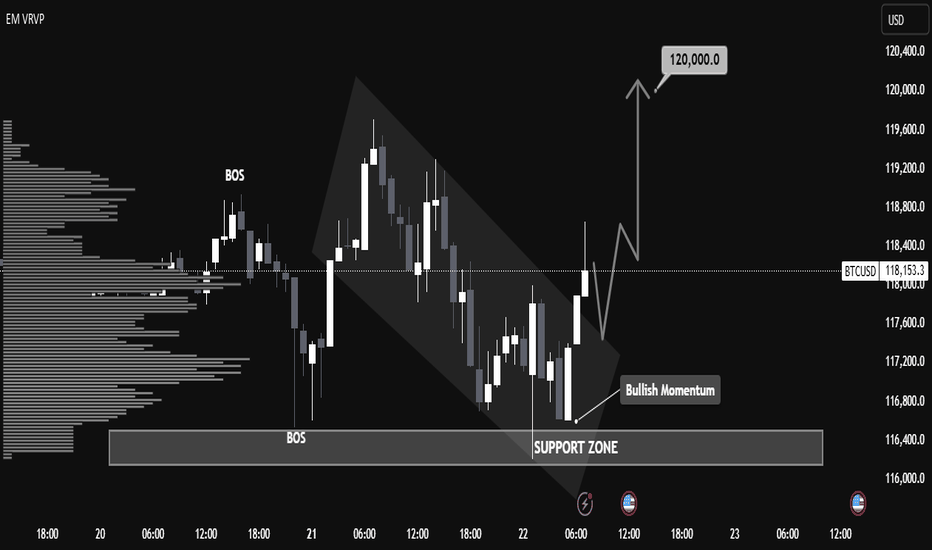

"BTC/USD Breakout Strategy: Identifying Bullish Momentum BTC/USD Technical Analysis – July 22, 2025

📈 Market Structure Overview:

The chart illustrates a recent Break of Structure (BOS) both to the upside and downside, indicating volatility and a shift in market sentiment. The price action formed a descending channel, followed by a breakout with strong bullish candles, suggesting a momentum reversal.

🧱 Support Zone (Demand Area):

Key Level: $116,400 – $116,900

This zone has acted as a strong demand level, with clear evidence of buying pressure pushing BTC higher after testing this area. The volume profile (VRVP) supports this, showing heightened trading activity at this price.

🔄 Bullish Breakout Confirmation:

A bullish breakout from the descending channel occurred just above the support zone, aligning with the label "Bullish Momentum".

The breakout candle has closed above minor resistance, which increases the probability of a trend reversal.

📍 Price Target:

The projection points toward $120,000, aligning with previous resistance and psychological round-number resistance.

This target is highlighted by an expected bullish leg after a possible retest of the breakout zone around $117,500 – $117,800.

🧭 Key Levels to Watch:

Support: $116,400 – $116,900

Retest Zone (Buy Opportunity): $117,500 – $117,800

Immediate Resistance: $118,400

Major Resistance / Target: $120,000

📊 Summary:

BTC/USD has shown a bullish reversal signal from a well-respected support zone after a descending correction phase. The current price structure, volume buildup, and breakout momentum suggest a high probability of continued upside movement toward the $120,000 mark. A successful retest of the breakout zone would provide a strategic entry for long positions with tight risk management.

#NIFTY Intraday Support and Resistance Levels - 25/06/2025Nifty is expected to open with a gap-up near the 25,250 level, signaling early bullish strength. If the index sustains above the 25,250–25,300 zone after opening, we could see a continuation of the upward momentum toward the next resistance levels at 25,350, 25,400, and possibly 25,450+. However, if it fails to hold above 25,250 and slips back into the 25,100–25,050 zone, there could be selling pressure. A break below 25,050 may drag Nifty further down to 24,950. If 24,950 breaks, then a short trade could trigger, with targets at 24,850, 24,800, and 24,750. The key levels to watch today are 25,250 on the upside and 24,950 on the downside.

What to Watch For Next!💡 GBPUSD Bearish Trade Outlook – Detailed Analysis

The GBPUSD pair has recently shown a clear Market Structure Shift (MSS) to the downside — a strong sign that bearish momentum may be taking control. Alongside this shift, we’ve also seen the formation of a Bearish Fair Value Gap (FVG) on the 4-hour timeframe, which adds further confluence to the potential for continued downside.

📍 What This Means:

The break in structure combined with the FVG suggests that institutional activity may be driving price lower, possibly targeting areas of untapped liquidity beneath previous lows. These are often high-probability setups when traded with confirmation.

🔎 What to Watch For Next:

At this point, it's best to wait patiently for the price to retrace into the 4H FVG zone. Once price taps this area, we should closely monitor lower timeframes (such as 15M or 5M) for bearish confirmation entries — like a bearish engulfing pattern, change in character (ChoCH), or internal MSS.

📉 Potential Trade Idea:

If confirmation occurs, we can look to enter a sell position, targeting downside liquidity levels, such as previous swing lows or equal lows — where the market often hunts liquidity.

⚠️ Risk Reminder:

As always, avoid entering blindly. Let the market give you a clear sign. Use proper risk management, and stick to your strategy.

📚 DYOR – Do Your Own Research!

The market doesn’t guarantee outcomes. Your own analysis, patience, and discipline are your best tools.

AAPL — Broadening Range and Accumulation Phase. Targeting $300Apple stock has been moving in a broadening pattern for an extended period, showing signs of accumulation. This price behavior suggests a potential bullish breakout. The upside target in the coming months is around $300, possibly by fall or winter. However, a corrective scenario remains on the table, with a potential pullback toward the $165–144 range, which could present a strong long entry opportunity. From a fundamental perspective, investor interest is likely to increase ahead of Apple’s expected product presentation in the fall, which historically supports bullish sentiment in the stock.

BTC - Another Potential Bearish PatternHere I present my second alternative for a Bearish case for Bitcoin.

Per my previous posts I explain in detail the interest in recollecting liquidity in these lower zones. Previously I presented pathways to the uber lows at 7,000-10,000 - however this is another possible case.

I believe Bitcoin can see a drop from 109,200 straight down to 19,000-20,000

Why?

1. Major Volume support at this level

2. Major liquidity pools in confluence with this level

3. Price would form a W bottom with a higher low - which aligns with DXY breaking down on the monthly time frame. We can use DXY to project a bull market spanning 2-5 years (weakening dollar = more interest in deflationary assets such as Bitcoin)

4. Per the note above, it’s unlikely that BTC continues straight up without a sharp drop. The way this market works is to a large degree with leverage trading. The market and exchanges desperately want to shake out these longs, especially if we consider a 2-5 year bullish forecast through a macro view.

5. Confluence with this diagonal trendline which shows a clear support / resistance structure (note the Bitcoin chart is formed via diagonal ascending support and resistance lines - we can demonstrate this clearly and repeatable by duplicating the correct trendline and seeing how it forms the chart at any location)

Personally, I am shorting Bitcoin from 109,000 - and am expecting to see a fast drop through the rest of the weekend.

I will watch what the price does, where it reacts and interacts, and attempt to get a head start on understanding the true bottom before this “true” bull cycle begins.

Happy trading

Breaking key resistance — could $BGM repeat $RGC’s 100x rally?Let me introduce a stock that has already generated a profit of nearly 40% and I have no intention of selling it yet. Because both the chart and fundamentals suggest the stock seems to be approaching the point of potential explosion, and it is even possible to increase several times.

This stock is NASDAQ:BGM , a traditional Chinese pharmaceutical chemical company but now it has transformed into an AI productivty platform. More on that later—let’s first take a look at the technicals, which I always pay close attention to.

Firstly,the uptrend remains intact.

Since last year’s stock split, the price has been climbing steadily within a clear uptrend. After breaking above $8.50, it has consistently held above that level for months, showing strong momentum. (I bought in when it dipped back to $8.50 earlier this year and have held since.)

In the recent days, the stock price has successfully broken through the upper limit of the consolidation range that has persisted for nearly 3 months, and has stabilized above $12.

This is a significant breakthrough, and it may indicate that the stock price could potentially start a significant upward rally at any time.

Secondly,the stock is almost fully controlled by the market maker.

There’s a saying in trading: “Volume precedes price.” Since December 2024, BGM’s trading volume has clearly increased, with each spike in volume followed by a small price uptick—money was buying.

Interestingly, each rise is followed by a pullback, but on much lower volume. This volume pattern—rising on gains and shrinking on pullbacks—suggests that the maket maker have accumulated most of the shares and now have strong control. The dips are likely just shakeouts to flush weak hands before a bigger breakout.

Thirdly, low short interest means minimal resistance to a price surge.

According to Nasdaq's data, BGM’s short position was 34,466 shares by 31th March, but dropping to 18,889 shares by April 30,the number of short positions has significantly decreased.

This was showing that as the stock price rose, short sellers mostly exited or turned bullish—clearing major obstacles for further gains.

Technically, everything is set—just waiting for the trigger. Pull the trigger could spark a massive rally, and that trigger may come anytime as the company nears to complete a key transformation.

Yes, the company is transforming from a traditional pharmaceutical firm into a leading AI tech ecosystem. Since last year, it has been actively acquiring companies to enter AI-driven healthcare, insurance, and wellness sectors, aiming to become an industry leader.

①In December 2024, BGM acquired RONS Tech and Xinbao Investment, integrating the AI insurance platform “Duxiaobao” (powered by Baidu’s NASDAQ:BIDU technology). Leveraging 704 million monthly active users, they aim to disrupt traditional insurance sales and drive exponential customer growth.

②In April 2025, BGM acquired YX Management to boost AI applications in insurance and transportation, accelerating the “pharma-insurance-health” ecosystem.

③In May 2025, BGM acquired HM Management and its two subsidiaries—SHUDA Technology and New Media Star—strengthening its algorithm optimization、data modeling and traffic-driven customer acquisition capabilities

After several acquisitions, the company has initially completed its transformation plan. So the "trigger" we are pursuing might emerge during the next major acquisition by the company to complete the final transformation.This is an important milestone. According to reliable sources, the company's next acquisition is likely to take place in the coming June. Let's wait and see.

Another "trigger" may be the company’s next earnings report, which will include the “Duxiaobao” AI insurance business for the first time, expected to add over $5 million in revenue, might to confirm the initial success of the company's transformation. And this is potentially spark a strong stock rally.

These two potential "triggers" are both approaching soon.

If all goes well, how far could this rally go? Let’s refer to the recent strong gains of Chinese stocks like $RGC.

Technically, RGC saw a clear volume increase and price rise around July-August 2024. Then it had a six-month shakeout with low volume pullback (similar to BGM’s current pattern). In March 2025, it launched a major rally, rising over tenfold.

In May, RGC surged again, supported by fundamental news: the company announced FDA approval for its new neurostimulation chip and a Parkinson’s study with Mayo Clinic. From the start to the peak, RGC gained over 100 times in a short period!

Looking at BGM again: after the breakout, the stock will likely first test resistance near $15, which may not be a big hurdle. The real test could be at $24—the pre-split high and the upper boundary of the current “megaphone” consolidation.

Even if the price only reaches around $24 , current investors could nearly double their money. After the company’s fundamental transformation, its revenue and profits potential could grow beyond RGC. So, how high can BGM’s stock go? Let’s wait and see.

The price has experienced multiple declines after reaching!GBP/USD Daily Market Analysis

The GBP/USD currency pair is currently facing rejection from a bearish Fair Value Gap (FVG) on the Daily (1D) chart. Historically, the price has experienced multiple declines after reaching this zone, often reacting similarly upon contact.

Recently, the market has swept liquidity above its previous highs and is now showing signs of a downward movement. However, it's important to note that there is a significant bullish Fair Value Gap located on the 4-hour (4H) timeframe, which has been illustrated on the chart.

If the market breaks below this 4H bullish FVG, it could indicate a continuation of bearish momentum. In such a scenario, we may expect the price to move further downward toward the marked liquidity zones—and potentially even lower if those levels are breached.

This situation calls for close monitoring and further confirmation before making any trading decisions.

Disclaimer : Always conduct your own research (DYOR) before entering any trades. This analysis is intended for educational purposes only and does not constitute financial advice.

BTC - Liquidity Mapping to Predict MovementAs a part II to my previous post on “Bull Market OR Bearish Retest?” - Here is a 2 day liquidity map on BTC’s chart.

I’m anticipating a sharp drop to 7,000 - why is this number significant?

There is a mass amount of liquidity in the chart down towards 7,000-10,000.

This liquidity is in the form of long stop loss orders.

In layman’s terms - the sell orders required to take price to this extreme low are already within the chart. It is a pre-set consequence to traders decisions in a market dominated by leveraged buys and sells.

If we consider what the “floor” price of BTC is (IE all long term secured holders) - we first have to seperate out the leveraging liquidity used in the futures market.

How much of the BTC market cap is injected liquidity from futures / derivatives? In my view, anything above 7,000.

This liquidity can flow in and out, and the business and function behind it isn’t affected. This liquidity is extremely fluid. It can drop 90,000 and rise 90,000 shortly after without any affect on the fundamental value of Bitcoin.

Sure there is a psychological consequence with perceived value and market stability - but the fact is, leveraged liquidity can enter the market and leave the market with no impact at all on the wallets of market makers.

Food for thought - happy trading.

TARGET SUCCESSFULLYThis chart highlights a textbook liquidity sweep and reversal pattern in Gold (XAU/USD).

Key Levels:

- Resistance Zone: Clearly defined above 3,360, with multiple rejection points.

- Support Level: Around 3,250, acting as a strong demand area.

- Liquidity Zone: Price dipped below the support to trigger stop-losses and trap sellers before reversing upward.

Price Action Insights:

- After grabbing liquidity below the support zone, the price rallied back, confirming a reversal setup.

- The move reached the target zone at 3251.225, fulfilling the projected bullish objective.

Outcome:

The trade idea played out successfully with the target marked as complete. Now, price is hovering at the former support-turned-resistance zone.

Next Steps:

Traders should monitor for:

- A potential breakout above this zone for continuation.

- Or rejection signals for a short-term pullback.

Elliott Wave top on SPY’s monthly chartTechnical Analysis:

Wave Structure (Elliott Wave)

• Wave 1–2: Early 2020 correction (COVID crash) marked a clear wave 2 bottom.

• Wave 3: Strong impulsive rally from mid-2020 to late 2021 — massive liquidity-driven.

• Wave 4: 2022–2023 pullback — clean retracement to ~0.382 Fib, validating wave structure.

• Wave 5: Parabolic final rally peaking around $550–560 (currently topping or topping out).

Bearish Signals:

• Volume divergence — Price up, but monthly volume flat-to-declining. Distribution behavior.

• Completed 5-wave structure — Indicates exhaustion.

• (A)-(B)-(C) Correction Starting: The projection shows:

• Wave A targeting ~$420–440.

• Wave B dead cat bounce.

• Wave C projecting a deeper correction into $300–340 zone (around 0.5 to 0.618 retracement).

Fibonacci Confluence Zones:

• 0.382 = ~$450

• 0.5 = ~$390

• 0.618 = ~$340

These zones will act as major liquidity pools for institutional entries or macro rebalancing.

Macro Headwinds Fuel the Narrative:

• Sticky inflation

• Rising interest payments on U.S. debt

• Deteriorating liquidity (QT regime)

• Over-leveraged consumer and commercial debt sectors

GOLD UPWARD SOONThis chart showcases a liquidity grab followed by a potential bullish reaction in Gold (XAU/USD).

Key Technical Highlights:

- Resistance Zone: Clearly defined around the 3,370 level, where price has consistently faced rejection.

- Support Level: Identified near the 3,220–3,230 zone, which was recently swept to collect liquidity.

- Liquidity Zone: Price dipped below support to trigger stop-losses before rebounding, signaling a possible bullish reversal.

Projected Move:

The chart suggests a bounce toward the next target at 3251.225, aligning with a previously broken support now turned resistance.

If momentum sustains, further upside could be explored toward the mid-supply zone.

Summary: The recent liquidity sweep hints at a potential short-term bullish move, with a target retracement to 3251.225. Traders should monitor price reaction at that level for confirmation or rejection.

TARGET SUCCESSFUL

This chart displays a successful bullish breakout on Bitcoin (BTC/USD) from the previous consolidation range.

Key Levels & Zones:

-Resistance Zone: Around 95,576, which was clearly broken with strong bullish momentum.

Support Level: Maintained around 93,592, where price previously bounced from.

Fair Value Gap (FVG): Efficiently filled, providing the base for the bullish rally.

Target Achieved: The price decisively hit and exceeded the projected target of 95.576, confirming the bullish setup.

Market Sentiment: Strong bullish bias with volume surge, indicating continued interest above resistance.

Conclusion: The breakout and target completion validate the strength of the structure and buyer control in this range. Further bullish continuation could be expected if momentum sustains.

BTCUSD (BTC/USD) highlights a consolidation phase within clearly defined support and resistance zones, with price currently poised for a potential move upward.

Key Technical Zones:

- Resistance Area: Around 95,576, which has been tested multiple times with rejections—indicating strong supply.

- Support Level: Strong buying interest observed near the 92,500 region, keeping the structure intact.

- FVG (Fair Value Gap): The price filled the FVG recently, suggesting equilibrium and potential for another leg up.

Current Outlook:

- Price is holding above the FVG and is attempting a bullish rebound.

- If price maintains support above the recent lows, we may see continuation toward the target at 95,576.

Next Target: 95,576

Watch For: Rejection at resistance or volume confirmation to validate a breakout.

GOLD UPWARD COMING SOON Gold (XAU/USD) shows the price currently trading within a defined range between the support level at 3272.581 and the resistance zone around 3367.926.

Technical Highlights:

- Support Level: Strong demand seen around 3272.581 where price has previously rebounded.

- Resistance Zone: 3367.926 marks a key supply area that has held several past tests.

- Current Structure: A bullish corrective move appears underway with the potential to test the target area at 3338.838, aligning with a minor resistance zone.

- Price Behavior: Recent rejection from the support zone indicates bullish pressure; if momentum holds, price is likely to challenge the next resistance.

Next Target: 3338.838

Outlook: If gold sustains above the mid-range support, bullish continuation toward 3338.838 is favored. However, price must break minor resistance cleanly for further upside confirmation.

Would you like a social media caption or short signal text for this as well?

USOILOil shows price moving between a clear support level and a strong order block resistance above. Currently, price is trading inside a resistance zone around 63.25.

The chart indicates a potential bullish move, targeting the 64.22 level, where the order block resides.

Key Technical Points:

- Support Level: Strong demand area near 62.00.

- FVG (Fair Value Gap): Gap filled below current price.

- Resistance Zone: Price facing resistance around 63.00-63.50.

- Order Block: Major target area near 64.22.

Target Projection: $64.22

Outlook:

If buyers sustain momentum above the resistance zone, we could see a rally toward the 64.22 target at the order block. Confirmation of a breakout and retest would strengthen the bullish bias.

Would you like me to also create a quick short caption for social media posting?

GOLD Gold (XAU/USD) shows price action ranging between a strong support level and a visible order block above. Price recently tested the support zone near 3,260.000, showing potential signs of a bullish reaction.

The chart highlights a possible upward move toward the Fair Value Gap (FVG) zone, targeting around 3325.626.

Key Technical Points:

- Support Level: Price bounced from the 3,260.000 zone.

- FVG Area: Gap available for price to fill up toward 3325.626.

- Order Block: Major resistance near the 3,440.000 region.

- Structure: A potential bullish short-term recovery setup.

Target Projection: $3325.626

If buyers maintain control around the current support, we could see a move into the FVG before facing major resistance at the order block above. Watch closely for bullish confirmations or possible rejections around the FVG area.

If the price enter these red-marked zones!Gold Market Analysis (Engulfing & Zone-Based Strategy)

This analysis is based on a straightforward zone-trading method using engulfing patterns and filtered key levels. The marked zones on the chart highlight high-probability trading areas.

Red Zones (Sell Areas):

If the price enters these red-marked zones, we look for bearish confirmation to enter sell trades.

These zones are derived from the 4H timeframe, making them more reliable. If the market reacts from here, you can target around 60–80 pips in profit.

A second sell zone offers potential for a larger move—up to 150+ pips—if the price respects it.

Green Zones (Buy Areas):

If the price drops and enters the green-marked zone, it’s a signal to look for buy setups.

This area may deliver a strong bounce, potentially yielding 100+ pips.

There’s no need for complicated patterns or indicators—just follow the zones. If the price hits a zone and shows confirmation, you trade it.

Trade at your own risk DYOR!!