SILVER Silver (XAG/USD) shows a potential bearish correction setup forming after rejection from the upper resistance channel. Price is currently consolidating below the resistance zone after testing the upper band and is projected to move downward toward the order block and potentially the support trendline.

The chart suggests a bearish move targeting the next level at 32.8153, which aligns with a confluence of support between the lower trendline and the order block zone.

Key Technical Elements:

- Resistance Zone: Price failed to break above33.70, confirming a strong supply area.

- Bearish Projection: Lower highs and consolidation hint at possible downside movement.

- Next Target: 32.8153

- Order Block Trendline Support: Could serve as a bounce zone or continuation support.

Outlook: If price breaks below the intermediate channel support, it may trigger further downside toward32.81. However, watch for reactions around the order block for potential bullish reversals. This setup is ideal for short-term traders monitoring key levels for entry and risk control.

Marketmaker

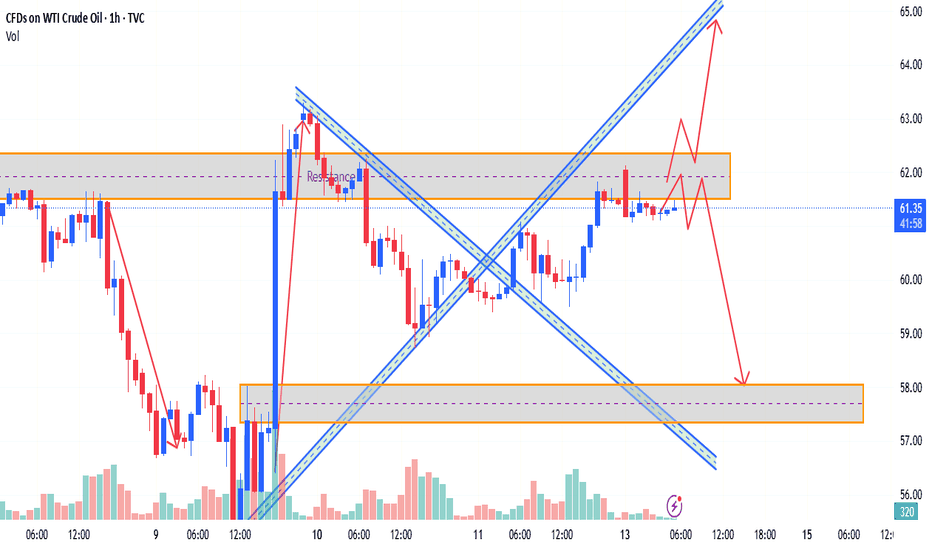

USOILThis chart for WTI Crude Oil presents a bullish continuation setup following a rebound from the support level around 61.50. After breaking above a minor consolidation range, price is now retracing slightly before potentially continuing its upward movement.

The chart highlights a target at63.95, just below the upper resistance zone, which previously acted as a strong supply area.

Technical Breakdown:

- Support Level: Firm bounce near 61.50, confirming demand.

- Minor Breakout: Price broke above local structure and retesting for continuation.

- Resistance Zone: Located near64.00, target aligns with historical supply.

- Next Target: 63.95

Volume spikes during the bounce suggest strong buyer interest. A clean break and hold above 63.00 could open the path toward the $63.95 target. Traders may look for bullish price action confirmation for entry.

GOLD

This Gold (XAU/USD) outlines a bullish retracement setup, targeting a potential move toward the order block around 3,373.348. After bouncing from the support level near3,280, price is consolidating in a tight range and showing signs of upward momentum.

The move aims to revisit the order block, which previously acted as a breakdown zone. If price successfully reaches and reacts from this level, it may also attempt to fill the nearby Fair Value Gap (FVG) above.

Key Technical Zones:

- Support Level: Around 3,280, where buyers stepped in.

- Order Block: Immediate resistance and primary target at3,373.

- FVG Zone Above: Suggests a potential bullish continuation if broken.

Short-Term Target: 3,373.348

If momentum holds, a breakout above the order block may expose price to further upside toward3,440 and beyond.

Traders can watch for breakout confirmation or signs of rejection at the order block for the next directional cue.

USOIL Chart Overview:

WTI Crude is trading around 61.44, consolidating inside a key resistance zone near62.00. After a strong bullish impulse, price has stalled under this resistance, forming both bullish and bearish paths, highlighting a conflicting market structure

Key Discrepations Identified:

1. Bullish Momentum vs. Resistance Reaction

- Expected: Continuation to 64+ after breakout.

- Reality: Price is struggling below resistance, rejecting upper boundary multiple times.

- Discrepation: Bullish momentum is slowing, and repeated rejections are exposing potential reversal pressure.

2. Volume Strength vs. Breakout Potential

- Volume d…

- Visually this implies strength, but price is hovering in indecision, neither breaking up nor down convincingly.

- Discrepation: Chart setup shows both bullish continuation and bearish breakdown possibilities, confusing structure

4. Double Scenario Projection

- The projection shows both:

- A bullish breakout to 64.

- A rejection and selloff to 58.

- Discrepation: Market is giving mixed technical signals, suggesting traders should wait for confirmation before committing

Discrepation Summary Table:

| Element | Expectation | Observed Reality | Discrepation | Projection Conflict | Clear trend continuation | Dual projection shown | Market indecision + low conviction |

📉 Conclusion:

While WTI remains inside a short-term bullish structure, the presence of conflicting breakout signals, resistance rejections, and declining volume point toward a discrepation. Traders should watch the 62.00 resistance zone closely. A clear rejection or breakout will resolve this divergence, with downside targeting 58.00, and upside toward $64.00.

Let me know if you'd like a summarized version for a caption or post!

BTCUSDBitcoin is currently trading near 84,949 after a strong rally, now approaching a critical order block resistance near86,000. While the overall structure remains bullish, the chart signals a potential shift in market behavior—creating a clear discrepation between price structure and projected move.

Discrepation Breakdown:

1. Rising Trend vs. Order Block Reaction

- Expected: Uptrend to continue, breaking through the resistance zone.

- Actual: Price is hesitating and forming a double-top structure inside the order block, hinting at buyer exhaustion.

- Discrepation: A bullish structure failing to maintain momen…

- Recent candles show weak buying volume near the top despite higher prices.

- Discrepation: Price is rising, but volume is not supporting it—bearish divergence, weakening the bullish outlook.

4. Fair Value Gap (FVG) Overlap

- FVG zone around 82.2k aligns with the bearish target, giving confidence to downside movement.

- Market may seek to fill that gap, creating a conflict with the bullish price structure currently visible.

Discrepation Summary Table:

| Technical Element | Market Expectation | Observed Conflict

| Uptrend + Higher Highs | Continuation toward 86,000+ | Double-top …

Although Bitcoin remains in a short-term uptrend, this chart shows clear bearish discrepation. The failure to break the order block, combined with volume divergence and trendline pressure, suggests a potential drop toward $82,232, especially if price confirms the double-top and breaks the ascending trendline.

Would you like a short version of this for social media captions too?

GOLD The chart shows price moving in a tight consolidation zone between the resistance area near 3,245 and support at3,213. While the price has tested the resistance multiple times, it has failed to break out decisively, indicating possible bearish weakness emerging.

---

🔍 Discrepation Zones (Key Conflicts):

1. Price vs. Resistance Reaction

- Expected: Breakout continuation above $3,245 due to repeated testing.

- Actual: Price rejected again after touching resistance.

- Discrepation: Buyers are unable to sustain upward momentum, revealing fading bullish strength despite frequent attempts.

---

2. Volume Behavior vs. Price Actio…

This hidden bearishness suggests sellers may be stepping in before each breakout attempt completes.

—

4. Target Discrepancy at3213.070

- While current price appears stable, the projection clearly anticipates a pullback to 3213.070.

- This level sits just above a major support block, marking a key imbalance between current consolidation and the expected move down.

—

🧭 Discrepation Summary Table:

| Element | Expected Behavior | Observed Behavior | Discrepation |

|————————–|——————————-|————————————-|———————————————|

| Resistance Test | Breakout after repeated tests | Another rejection | Buyers failing to gain momentum |

| Volume Analysis | Increased …

: Gold is showing signs of hidden bearish pressure. Although still inside a range, multiple failed breakout attempts, declining volume, and a projected drop to3213.070 point to a clear discrepation between expected bullish continuation and emerging bearish signals.

📌 Watch how price behaves near the $3,230 level. A decisive break could validate the bearish target, especially if volume increases on the move down.

Let me know if you want this turned into a social post or shorter caption!

BTCUSD Market Discrepancy Analysis (April 11, 2025)

📉 Chart Overview:

The chart reflects Bitcoin (BTC/USD) on the 1-hour timeframe, with significant price movements between 77,417 (support) and 83,846 (resistance). The asset recently rallied to fill a Fair Value Gap (FVG) before facing resistance and dropping back to retest the lower region.

1. Resistance Rejection at $83,846:

- The price spiked aggressively into the resistance zone, but quickly reversed after failing to sustain above it.

- This price rejection is clear evidence of strong seller presence.

- The FVG zone just below the resistance appears to have been filled, triggering a sharp correction.

2. Failed Breakout or Bull Trap:

- The s…

- This suggests that buying pressure was temporary, and mostly driven by short-term momentum traders rather than real demand.

4. Incomplete Fair Value Gap at77,417:

- Price moved sharply down and almost touched the FVG area near 77,417, but did not completely fill it.

- This leaves an imbalance and suggests that the market may revisit this area to fully mitigate it.

5. False Break of Lower High:

- The high near 82,290 was breached temporarily, but price did not close above convincingly.

- Indicates a fake breakout structure within a broader bearish context.

---

🔧 Technical Summary:

| Zone | Level | Status |

|------------------|-----------------|-------------------------|

| Resistance | 83,846 | Rejected |

|…

This chart shows a clear discrepation between price momentum and volume confirmation. While price temporarily surged into a resistance zone, it lacked the strength to hold above key breakout levels, suggesting the rally was unsustainable.

> The Fair Value Gap (FVG) at77,417 remains unfilled, and current price structure points to a potential return to that zone. Expect bearish continuation unless BTC reclaims and sustains above $82,290 with volume.

---

Let me know if you want this in a simplified caption format for social sharing!

BTCUSD TARGET COMPLETE Market Analysis for Bitcoin (BTC/USD) – April 10, 2025

Price Action Overview:

- Bitcoin (BTC) is currently consolidating between 79,161 and 81,520, with price action forming within this range. A move to 79,161 has been achieved, completing the target and fulfilling the bearish target outlined earlier.

- BTC seems to be struggling around 81,500, and is showing potential signs of exhaustion at the upper end of the range near the resistance zone.

Key Levels to Watch:

1. Resistance Zone (Red Box):

- The resistance level is clearly marked near 82,000 and 81,500, with price struggling to break above this level. If Bitcoin fails to break out of this resistance zone, the price could reverse towards support levels.

- The upper resistance zone remains a key level…

ChatGPT: - An FVG (Fair Value Gap) is evident in the 79,161 to 78,500 region. This could act as an area to fill, and could potentially see price retracement or sideways consolidation before a possible move up.

Market Structure Analysis:

- Bearish Trend: Bitcoin's price has been on a downward trend forming a descending triangle, indicating bearish sentiment.

- Breakout Potential: A breakout from the current consolidation zone will be important. Bitcoin will likely test 79,161 again. If it fails to hold support, further downside may be possible.

Volume & Momentum:

- Volume: The volume analysis shows increasing buying volume at lower levels, suggesting potential support around 79,161. However, the volume is diminishing at resistance levels, which indicates that bullish…

USOIL Oil – April 10, 2025

Price Action & Trend Analysis:

- Current Market Position:

- WTI Crude Oil is showing a bearish trend within a falling wedge pattern, a technical formation that often signals a potential breakout after consolidation. This pattern is visible with converging trendlines (blue), which suggest a potential move to the downside.

- The resistance zone is marked at 61.50, and the price is struggling to break above this level. If it does not break out of this level, further downside momentum may be expected.

Key Levels:

1. Resistance Zone:

- The resistance level is clearly marked near 61.50, and price action has repeatedly struggled to move above this level, showing signs of rejection. A failure to break this l…

ChatGPT: 4. FVG (Fair Value Gap):

- There is a Fair Value Gap (FVG) near 58.12, which indicates a possible area of imbalance where price could potentially retrace to fill the gap before moving in its next direction.

Volume Analysis:

- The volume profile indicates decreasing volume as the price approaches the resistance zone at 61.50, which may suggest a weakening of bullish momentum.

- The increasing volume near the support level at 58.00 suggests that buyers are looking to step in at these levels, but this remains to be seen as the price moves toward this region.

Key Observations:

- The bearish divergence observed between price and momentum suggests that bearish pressure is mounting, especially with the price failing to breach resistance and forming lower highs.

- T

GOLD Chart Analysis for Gold (XAU/USD) – April 10, 2025

Key Observations:

1. Price Action and Trend:

- The price is currently in an uptrend, forming a bullish channel (green box) as it moves upwards.

- Resistance is positioned near 3,134.588 and 3,123.580 which are key levels to watch for potential price rejection or breakout.

- Support levels are defined at 3,067.613 and 2,974.936. The price has recently bounced off the support level, suggesting that the trend is still intact and may continue to push higher.

2. Key Levels:

- Resistance: The resistance level near 3,134.588 is being tested currently. A breakout above this level could indicate further bullish momentum.

- Support: The support zone near 3,067.613 is crucial. If the price drops below thi…

ChatGPT: - The volume bars show a spike in activity, suggesting market indecision, but also strong bullish sentiment near the support level.

4. Target Price and Future Projections:

- The target price for this move is 3,134.588, where the price is expected to test resistance. If it breaks this level, the next target could be near 3,150.00.

- The bullish channel suggests that Gold is still trending upward, and the price is likely to continue moving towards the upper boundary of the channel.

Scenario Predictions:

1. Bullish Scenario:

- If Gold successfully breaks the resistance at 3,134.588, it could continue to push higher towards the next resistance zone around 3,150.00.

- Support level at 3,067.613 holds strong, and the price continues to make higher highs…

XAUUSD BUY TARGET SUCCESSFUL HITTING READ IN CAPTIONSHere's a descriptive analysis of the chart you provided, which is a technical analysis chart for Gold (CFDs on Gold, USD/OZ) as of April 9, 2025:

---

Chart Description: Gold (XAU/USD) Price Action Analysis

Time Frame: Intraday (Likely 1-hour or 2-hour candles)

Volume: Displayed at the bottom in green/red bars, showing buying and selling pressure.

Key Highlights:

1. Downtrend Channel:

The price has been moving within a downward channel (marked by red and blue trendlines).

Several lower highs and lower lows were observed until a breakout occurred.

2. Support and Resistance Levels:

Support Level: Around 2,974.936 – This acted as a solid base before the bullish reversal.

Resistance Zone: Around 3,132.939 - 3,137.725 – This area is expected to be a stron…

BTCUSD ChatGPT: Chart Analysis for Bitcoin (1-Hour Timeframe) – April 08, 2025

Key Observations:

1. Price Action and Trend:

- Bitcoin is in a downtrend, as indicated by the blue descending trendlines, creating lower highs and lower lows.

- The resistance zone is near 80,000, with 79,161 acting as a key level of resistance.

- Price is currently approaching the support level, which is in the range of 75,000 to 77,000, indicating a potential area for price reversal or further decline.

2. Order Block and FVG (Fair Value Gap):

- The order block located near 79,161 to $79,000 is an important zone where price rejected and fell previously. This suggests that sellers have been controlling this level, and it may act as a strong resistance again if the price revisits.

- …

ChatGPT: - As Bitcoin approaches the support level, a surge in volume could indicate a possible breakout or a reversal from the support zone.

4. Target and Potential Movement:

- The target for the current setup is 79,161, near the upper resistance zone, with potential upward momentum from the support area.

- Bitcoin is likely to reach the 79,161 target after bouncing from the support zone. However, if the price fails to break through the resistance, a drop back to the support zone or even further downward movement may occur.

Potential Scenarios:

- Bullish Reversal: If Bitcoin bounces from the support level and breaks above the resistance at 79,161, it may push higher towards 80,000 and beyond. The FVG area will be a critical point to monitor for further upward m…

ChatGPT: Currently, Bitcoin is at a pivotal point, testing support while trying to break through resistance. The next price action will depend on how Bitcoin reacts at these key levels. Traders should keep an eye on 79,161, which could be a crucial turning point for the market direction. If the support holds, a reversal is possible, but failure to maintain the support could lead to further declines.

USOIL ChatGPT: Chart Analysis for WTI Crude Oil (1-Hour Timeframe) – April 08, 2025

Key Observations:

1. Trend and Price Action:

- WTI Crude Oil has been trading in a range-bound pattern, as shown by the blue trendlines. The price has been bouncing between the resistance and support levels. Currently, the price is at the lower end of this range near the support level around 58.88.

- The resistance level is at 59.05, and this has been tested multiple times without a sustained breakout, indicating that sellers have been in control around this level.

- The price just tested the support level and bounced slightly higher, which suggests the market may be consolidating before deciding the next move.

2. Order Block and FVG (Fair Value Gap):

- The order block is located…

ChatGPT: - Fair Value Gap (FVG) has been formed around the order block. This means there’s an imbalance in the market that could eventually be filled. Traders should watch for price action near this gap for further insight into whether the gap will be filled or left untested.

3. Volume:

- Volume is relatively low, which suggests a lack of strong momentum in the market. This is typical in range-bound markets, where buying and selling activity are often balanced.

- However, the volume has spiked during the downward move, which could indicate a potential bearish continuation if the price breaks below 58.88.

4. Bearish Setup and Target:

- The chart is showing a bearish setup with the price trading below the resistance zone, and it is testing the support level near

GOLD 4H ROUTE MAP TRADING PLAN / READ CAPTION CAREFULLYGOLD 4H Chart Analysis – 17th Feb 2025

Review of Previous Chart:

Entry Level: 2814

Take Profit 1: 2850.15 ✅ (Hit)

Take Profit 2: 2876.95 ✅ (Hit)

Take Profit 3: 2903.76 ✅ (Hit)

Take Profit 4: 2925.85 ✅ (Hit)

To Achive TP5, TP6, TP7 and TP8, please consider the following scenario below. Read the caption carefully.

Key Level: 2876

Resistance Level: 2900, 2925, 2942, 2952, 2984, 3017, 3052

Support Levels (Goldturn Levels) : 2876, 2852, 2828, 2803, 2776, 2747

GOLDTURN KEY LEVELS ARE ACTIVATED

EMA5 Behavior (Red Line):

Current EMA5: 2902.10

* EMA5 is fluctuating between two key weighted levels, with a gap above 2925 and below the 2900 GoldTurn level.

* A crossover of EMA5—either above or below the weighted level—will signal the next significant move for GOLD.

Bullish Targets

EMA5 cross and hold above 2900, will open the following bullish target 2925 ✅ DONE

EMA5 cross and lock Above 2925, will open the following bullish target 2952

EMA5 cross and lock Above 2952, will open the following bullish target 2984

EMA5 cross and lock Above 2984, will open the following bullish target 3017

EMA5 cross and lock Above 3017, will open the following bullish target 3052

Bearish Targets

EMA5 cross and lock Below 2900: will open the following bearish target 2876 ✅ DONE

EMA5 cross and lock Below 2876: will open the following bearish target 2852

EMA5 cross and lock Below 2852: will open the following bearish target 2828

EMA5 cross and lock Below 2828: will open the following bearish target 2803 (Retracement Range)

EMA5 cross and lock Below 2803: will open the following bearish target 2747 (Swing Range)

Trading Plan:

* Stay bullish and buy pullbacks from key levels.

* Avoid chasing tops—focus on buying dips.

* Use smaller timeframes for entries at Goldturn levels.

* Aim for 30–40 pips per trade for optimal risk management.

* Each level can yield 20–40+ pips reversals.

Short-Term Strategy:

Anticipate possible reversals at weighted GOLDTURN levels 2876, 2852 and 2828.

Leverage 1H timeframe to capture pullbacks around these levels.

Target 30–40 pips per trade, focusing on shorter positions for effective risk management.

GOLDTURN levels provide reliable bounce opportunities, allowing you to buy at dip levels.

Long-Term Outlook:

Maintain a bullish bias while using pullbacks as buying opportunities.

Buying near key support levels ensures better entry points and mitigates risks, avoiding the pitfalls of chasing tops.

Trade with confidence and discipline. Stay tuned for our daily updates! Please support us with likes, comments, and follows to keep these insights coming.

📉💰 The Quantum Trading Mastery

GBP/USD: Distribution Signals a Drop to 1.25GBP/USD appears to be in a distribution phase, struggling to break through resistance around 1.2620. The price has formed multiple rejection points at this level, indicating weakening bullish momentum.

The recent lower high, combined with a potential break of the ascending trendline, suggests sellers are regaining control. If price breaches the key support zone, a move towards the 1.2500 region becomes increasingly likely.

With a bearish harmonic pattern and liquidity grab indications, GBP/USD could see further downside as selling pressure intensifies.

XAUMO REPORT February 13th🔥 XAU/USD (Gold) Market Maker Roadmap & Trade Playbook: How to Trade Like a Shark 🦈

🔍 Mastering Market Maker Tactics: Liquidity Traps, Reversals & Smart Money Moves

Welcome to the ultimate step-by-step roadmap for trading XAU/USD like a market maker. This is not just a trading plan—it’s a dynamic guide that reacts to every move Gold makes. You’ll anticipate retail trader liquidations, institutional traps, and high-probability reversals. Let’s dive in.

📍 Step 1: Identifying the Battlefield (Multi-Timeframe Analysis)

Primary Timeframe: 30-Min Chart

• This is where the game is played—identifying liquidity zones, VWAP deviations, and smart money footprints.

Precision Entry Timeframe: 5-Min Chart

• Confirms exact execution points—look for order blocks, volume spikes, and fake breakouts.

Directional Bias Timeframes:

• 1-Hour Chart: Institutional activity and trend confirmation.

• 4-Hour Chart: Macro trend analysis and liquidity positioning.

• Daily Chart: The big picture—where market makers have set traps for the week.

📌 Step 2: Market Maker’s Liquidity Traps

🔹 Where Does the Shark Hunt?

🟢 Liquidity Pools Below Price (Retail Stop Loss Clusters)

• Key Buy Zone: $2,884 - $2,876 (Market makers hunting retail longs).

• VWAP Lower Band: $2,884 → Major support zone.

🔴 Liquidity Pools Above Price (Retail Stop Hunts Before Reversing)

• Key Sell Zone: $2,924 - $2,930 (Retail traders trapped at highs).

• VWAP Upper Band: $2,930 → Major resistance zone.

📊 Step 3: Entry Playbook – How the Market Maker Moves

📌 Entry Type 1: Normal Long (Buying the Dip in a Bullish Market)

Scenario: Price Drops into Liquidity Pool at $2,884 - $2,876

🟢 Entry (Buy Limit) → $2,884

🎯 TP1: $2,910 (POC Reversion)

🎯 TP2: $2,924 (Liquidity Grab)

🎯 TP3: $2,940 (Major Supply Zone)

🚨 SL: $2,874 (Below liquidity grab)

📈 TSL: Move stop-loss to $2,910 after TP1 is hit.

What-If Scenarios?

✅ What if price moves to TP1 ($2,910)?

• Secure 40% of the position (0.4 lots).

• Move SL to breakeven ($2,884).

✅ What if price moves to TP2 ($2,924)?

• Secure 30% of the position (0.3 lots).

• Adjust TSL to $2,910.

✅ What if price moves to TP3 ($2,940)?

• Exit final 30% of position (0.3 lots).

• Look for potential reversal short.

📌 Entry Type 2: Normal Short (Selling the Trap at Resistance)

Scenario: Price Rises into a Liquidity Trap at $2,924 - $2,930

🔴 Entry (Sell Limit) → $2,924

🎯 TP1: $2,910 (VWAP Reversion)

🎯 TP2: $2,884 (Liquidity Target)

🎯 TP3: $2,860 (Deeper Flush)

🚨 SL: $2,930 (Above liquidity trap)

📉 TSL: Move stop-loss to $2,910 after TP1 is hit.

What-If Scenarios?

✅ What if price moves to TP1 ($2,910)?

• Secure 40% of position (0.4 lots).

• Move SL to breakeven ($2,924).

✅ What if price moves to TP2 ($2,884)?

• Secure 30% of position (0.3 lots).

• Adjust TSL to $2,910.

✅ What if price moves to TP3 ($2,860)?

• Exit final 30% of position (0.3 lots).

• Look for bullish re-entry.

📌 Entry Type 3: Breakout Play (London & NYC Sessions)

Scenario: Price Breaks Above $2,924 with Strong Volume

🔵 Entry (Buy Stop): $2,926

🎯 TP1: $2,940 (Fib Extension)

🎯 TP2: $2,948 (Final Supply)

🚨 SL: $2,914

📈 TSL: Trail behind VWAP.

✅ What-If Scenarios?

🚀 If price rejects at $2,940, exit early.

⚠️ If price breaks down below $2,924, flip short.

📌 Entry Type 4: Fakeout Trap (Market Maker Reversal)

Scenario: Price Breaks Above $2,930, But Volume Fails

🔴 Entry (Sell Stop Below Fakeout): $2,926

🎯 TP1: $2,910 (VWAP Test)

🎯 TP2: $2,884 (Liquidity Pool)

🚨 SL: $2,940

✅ What-If Scenarios?

⚡ If volume spikes above $2,930, close the trade.

⚡ If price breaks down fast, hold until TP2.

🔄 Step 4: How to Scale In & Out Like a Market Maker

✅ Scaling In:

• Add 0.2 lots per VWAP test when price confirms direction.

• Example: Buy 0.5 lots at $2,884, then add 0.2 lots at $2,876 if confirmation appears.

✅ Scaling Out:

• TP1: Exit 40% of position.

• TP2: Exit 30% of position.

• TP3: Exit final 30% of position.

🔥 Step 5: Market Maker Playbook – Dynamic Adjustments

What Happens If…

✅ Gold Moves in One Direction Without Pullbacks?

• Use VWAP deviations & RSI overbought zones to time reversals.

✅ Gold Breaks a Key Level & Holds?

• Flip position & enter on pullback to broken level.

✅ Volume Spikes on a Level & Price Stalls?

• Exit 50% immediately & move SL to breakeven.

✅ Gold Fakes Out & Reverses?

• Look for MACD cross + RSI divergence & enter opposite trade.

📌 Step 6: Session-Specific Execution Plan

🎯 Tokyo Session (Scalping Liquidity Traps)

✅ Market Conditions:

• Lower volatility but accumulation phase for later sessions.

• Market makers set up liquidity traps.

✅ Best Trades:

• Buy VWAP Lower Band at $2,884, target $2,910.

• Scalp breakout above $2,910 to $2,924 if volume confirms.

✅ Key Risks:

• If price fails to hold $2,884, expect deeper retrace to $2,876.

• If liquidity trap at $2,924 triggers, expect NYC reversal.

🎯 London Session (Breakouts & Momentum Moves)

✅ Market Conditions:

• High volatility from European banks entering the market.

• Market makers manipulate price to liquidate both sides.

✅ Best Trades:

• Breakout Buy above $2,926 (only with strong volume).

• Short rejection at $2,924 resistance (fakeout trap).

• Buy liquidity sweep at $2,884 after fake breakdown.

✅ Key Risks:

• If price consolidates between $2,910-$2,924, expect NYC move.

• If breakout fails at $2,926, market will hunt $2,884 liquidity.

🎯 NYC Session (Volatility, Traps, and Trend Reversals)

✅ Market Conditions:

• Peak liquidity with high volume from US market open.

• Major liquidity traps executed before trend moves.

✅ Best Trades:

• Buy deep liquidity trap at $2,884 for reversal.

• Short rejection of $2,940-$2,948 liquidity grab.

• Breakout buy above $2,926 ONLY if supported by order flow.

✅ Key Risks:

• If price stalls at $2,924 resistance, expect mean reversion.

• If NYC starts with a fakeout, expect price to reverse aggressively.

📌 Step 7: Order Flow & Delta Analysis

🟢 Bullish Confirmation:

• Positive delta + increasing volume at support = Strong buy setup.

• Aggressive limit buyers absorbing sell orders at $2,884.

🔴 Bearish Confirmation:

• Negative delta + sell imbalances at resistance = Strong short setup.

• Market makers triggering buy orders at $2,924 before dumping price.

📌 Step 8: Institutional Execution Plan

📈 Scenario 1: Bullish Trend Continuation Setup

🔹 Criteria: Price holds above VWAP & MAs, bullish order flow.

🔹 Entry: Buy Limit at $2,884 or Buy Stop at $2,926.

🔹 TP1: $2,910, TP2: $2,924, TP3: $2,940.

🔹 SL: $2,874, move to breakeven at TP1.

🔹 Scaling: Add 0.2 lots per VWAP test.

📉 Scenario 2: Bearish Liquidity Trap & Reversal Setup

🔸 Criteria: Price rejects $2,924 resistance with high volume.

🔸 Entry: Sell Limit at $2,924.

🔸 TP1: $2,910, TP2: $2,884, TP3: $2,860.

🔸 SL: $2,930 (Above liquidity trap).

🔸 Scaling: Add 0.2 lots per new rejection at resistance.

📌 Step 9: Advanced “What-If” Management for Market Reactions

✅ What if price consolidates near VWAP $2,910?

• No trade until a breakout or liquidity sweep occurs.

• Wait for volume confirmation at key levels ($2,884 or $2,924).

✅ What if price breaks above $2,926 with strength?

• Hold longs to TP3 ($2,940) with trailing stop.

✅ What if price fakes out above $2,930 but fails?

• Flip short aggressively with TP at $2,910 and $2,884.

✅ What if price crashes below $2,876?

• Look for deep liquidity trap at $2,860 before re-entering long.

✅ What if momentum dries up in NYC session?

• Exit 50% of all positions & tighten SLs aggressively.

📌 Final Step: The Market Maker’s Complete Daily Game Plan

🔹 Buy the liquidity grab at $2,884.

🔹 Sell the retail trap at $2,924.

🔹 Only play breakouts with strong volume confirmation.

🔹 Avoid consolidation—trade the extremes.

🔹 Adapt dynamically—VWAP, RSI, order flow, and smart money tracking.

📌 This is how you dominate XAU/USD like a market maker—executing liquidity sweeps before the crowd reacts. 🦈

📊 Final Take: The Market Maker’s Daily Game Plan

🔹 Buy the liquidity grab at $2,884.

🔹 Sell the retail trap at $2,924.

🔹 Play breakouts with confirmation.

🔹 Adapt dynamically—use VWAP, RSI, volume, and order flow.

📌 This is how you trade XAU/USD like a true market maker, swallowing retail traders before they even realize what happened. 🦈

Now its time to short!The Market is bought out.

But since a few weeks we are in a consolidation phase at the big US indices.

The markets are getting drowned with buy orders, but its stil ranging. Something which tells as that retailers are taking overhand. Institutions are using those phases to sell off their big postions too the "dumb money".

We just need to wait until the retail money is empty and there are no further buy orders.

At this moment big moves are gonna happen.

ETH 18000 DOLLARS BY SEPTEMBER 2025 God dam what a beautiful day it is , one dreams of such a entry in a bull market.

ETH will hit 18000 dollars by september 2025 there is nothing you can about it , this is the game, leverage wiped out and reset now we enter the "only up period" from this moment .

The key to finding out the next move was the USDT DOM like always pointing the way , the lower higher on the RSI showing divergence.

The money flow on MC indicator was very clearly showing this move , private indicator cant publish it on here.

The Fractal from 2020 on ETH is playing out FORGET THIS HAMMER WICK it is happening from here ETH will close in this channel and rally to 18k!

Do not give in to fear this is where you want to stack as much as possible . Invalidation of idea would be ETH closing a weekly candle under this ascending macro channel .

BTCUSD - Weekly chart updates and anticipated movementsSince everyone is aware of Bitcoin's previous movements in 2017 and 2021, everyone is assuming that it will now be worth 280K. However, Bitcoin is currently in a rally or range between 100,000 and 110,000, and this rally will continue until 2026, after which there will be a nice pullback to 73,000–74,000.

This move makes sense because BTC does not even touch these levels again after breaking the cup and handle pattern, thus it should give this level again in order to continue the trend.

I'm leaving for the time being because we should always be cautious since this rally has the potential to be a good dump.

We all know that once a higher high is broken, a retracement is necessary to continue the trend. This was not the case for all stocks worldwide following the US elections.

Bitcoin - Weekly updated chart and expected movesAs we all know about bitcoin past moves in 2017 and 2021 every thinking about same move according to that move bitcoin would be 280K now but bitcoin is doing rally/Range between 100,000-110,000 this rally continue till 2026, then we see a good move of retracement till 73,000-74,000.

This move is logical understandable because after breaking of cup and handle pattern BTC does not even touch these levels again so for continuation of trend BTC should give this level once again.

I am out for now because this rally can give a good dump so we should be careful about this every time.

As we all know that once a higher high breaks than for continuation of trend a retracement is compulsory this for all kind of stocks in the world which we did not seen after USA elections.

Bitcoin - An unexpected scenario that no one will tell u about!We all know about Bitcoin’s four-year cycle, and many compare the 2025 cycle to those of 2017 and 2021, analyzing common factors like the bull run and the massive price surges Bitcoin and altcoins experienced during those years.

But let me ask you an important question:

What if the bull run doesn’t happen in 2025 at all and this cycle extends until mid-2026?

As you know, the traders who truly profit in financial markets are the ones who think like market makers.

Does it seem logical to you that everyone expects a huge rally in 2025, and it actually happens just as anticipated?

Of course not.

2025 will be a year filled with price volatility designed to exhaust portfolios, drain liquidity, and spread uncertainty among traders.

We’ll see months where Bitcoin and altcoins surge parabolically, followed by months of brutal corrections, which will be less severe for Bitcoin but extremely painful for altcoins.

This price behavior may persist until Q4 2025 -Q1 2026, at which point Bitcoin will likely trade between $130K and $140K. All the analysts will tell you that the cycle has ended and that you should completely exit the market.

But in reality, that will be the true beginning of the bull run.

Bitcoin will continue its uptrend, targeting $300K, aligning with the Cup & Handle pattern target.

This level also corresponds to the 2.0 Fibonacci Retracement , reinforcing its significance as a major price objective.

It will be a violent surge within a short period, with a maximum duration of two months.

Most traders won't anticipate this move, and they will enter the market too late—right at the peak. That’s when the real bear market begins, trapping everyone in the market, just like in every previous cycle.

Best regards Ceciliones🎯