3 Oversold Stocks Poised for a Rally – MAS, IQV & TMOBelow is today’s SmartApingAI snapshot of three highly oversold names showing early signs of a rebound. Scroll down for a quick refresher on each company’s fundamentals, key technicals, and what makes them attractive at current levels.

1. Masco Corp ( NYSE:MAS )

What They Do:

Masco designs, manufactures and sells a broad range of home-improvement and new-construction products, including faucets, cabinets, hardware, coatings and architectural products.

Customers:

• Homeowners tackling renovation projects

• Professional contractors and builders

Income Source:

Primarily through the sale of mid-range to premium fixtures, cabinetry systems and paint/coatings.

Geographic Footprint:

• ~85% North America

• ~15% Europe

Product Pricing:

Mid-range to premium, with strong brand recognition in kitchen and bath fixtures.

SmartAping AI Model Target Price:

$81.36

Technical Snapshot:

• Broke below—and then bounced off—the $57 weekly support zone

• Now trading at $60.42, up from the intra-week low

• WiseStrat Macro ASI: deeply oversold at –120, turning bullish

• WiseStrat Micro ASI: still bearish, suggesting cautious position sizing

Why Watch:

Home-improvement spending has held up despite moderating housing starts, and MAS’s disciplined balance sheet and dividend yield (~2%) make it a compelling recovery play if consumer confidence picks up.

2. IQVIA Holdings Inc ( NYSE:IQV )

What They Do:

IQVIA provides data analytics, research services and technology solutions that power clinical trials, market research and real-world evidence for the life-sciences industry.

Customers:

• Pharma and biotech firms

• Medical device companies

• Healthcare providers and payers

Income Source:

Subscription and project-based fees for data platforms, consulting and trial execution services.

Geographic Footprint:

• 50% Americas

• 30% EMEA (Europe, Middle East & Africa)

• 20% Asia-Pacific

Product Pricing:

Variable, tailored to project scope—from high-volume data subscriptions to multi-million-dollar trial outsourcing contracts.

SmartAping AI Model Target Price:

$275.35

Technical Snapshot:

• Dropped below the $137 weekly support last week, then staged a relief rally

• Currently at $150.28

• WiseStrat Macro ASI: extremely oversold at –127, now in bullish reversal mode

• WiseStrat Micro ASI: turning positive, hinting at building short-term momentum

Why Watch:

With global R&D spend on track to exceed $250 billion this year, IQVIA’s blend of analytics and CRO services is in high demand. A seasonal uptick in trial starts could catalyze upside toward our $275 target.

3. Thermo Fisher Scientific Inc ( NYSE:TMO )

What They Do:

Thermo Fisher supplies scientific instruments, reagents and software used in research, diagnostics, manufacturing and safety testing across life-sciences and industrial markets.

Customers:

• Academic, government and corporate research labs

• Clinical and diagnostic facilities

• Biopharma manufacturers

Income Source:

Sales of equipment (from a few hundred to multi-million dollars), consumables, and service contracts.

Geographic Footprint:

• ~50% North America

• ~30% Europe

• ~20% Asia-Pacific & other

Product Pricing:

Ranges widely: entry-level lab kits to high-end sequencers and complete lab automation lines.

SmartAping AI Model Target Price:

$645.83

Technical Snapshot:

• Tested and held the $412.73 weekly support last week, bouncing back to $424.24

• WiseStrat Macro ASI: oversold at –129, now showing bullish tilt

• WiseStrat Micro ASI: still negative, cautioning potential retest of $412

Why Watch:

Strong long-term secular drivers—gene therapy, personalized medicine and diagnostics—remain intact. A washout in biotech funding fears has left TMO trading at a rare discount to growth peers.

Markets

April 25, 2025 - Trump’s Tango, Tech, and Insider DramaHello everyone, it’s April 25, 2025. We’re closing in on Trump’s 100-day mark back in the White House, and if there’s one word to sum up his impact on markets: chaos. With 137 executive orders signed already, he’s turned global markets into a high-stakes rollercoaster though this week saw signs of recovery, confidence remains fragile, and volatility is still running the show.

The main trigger? You guessed it: Trump and his tariff diplomacy. After weeks of U-turns, threats, and NYSE:TWTR meltdowns, he’s finally announced that talks with China have begun. That was enough to send the AMEX:SPY up 2%, pull the CME_MINI:NQ1! out of correction territory (+2.74%), and ignite a 5.63% jump in the Philadelphia Semiconductor Index, even though it’s still miles below its all-time high.

OANDA:XAUUSD is sitting at $3,332, BLACKBULL:WTI hovers around $63.21, and INDEX:BTCUSD has skyrocketed to $93,200. Not bad for a week that started in total disarray.

Now here’s where things get fishy: US indices started climbing before Trump’s announcement—classic “somebody knew something.” Insider trading? Just your average Thursday. And while Trump claims talks are underway, the Chinese side played coy, denying any ongoing negotiations. Either someone’s lying, or the talks are happening over dim sum in DC.

Beyond geopolitics, NASDAQ:GOOG crushed earnings expectations and added a juicy dividend and GETTEX:70B in buybacks, exploding 6% after-hours. Meanwhile, NASDAQ:INTC flopped—flat profits, poor outlook, and a CEO trying to turn cost-cutting into a growth story. The market wasn’t buying it: down 5.7% after-hours.

NYSE:NOW , though, is living its best life. Strong results, AI momentum, and federal contracts boosted shares 15%. Other names like NASDAQ:PEP , NYSE:PG , and NASDAQ:AAL warned on the future thanks to—you guessed it—political and economic uncertainty.

On the macro front, ECONOMICS:USIJC (US jobless claims) ticked higher, inflation seems to be cooling, and if next week’s PCE and employment data confirm the slowdown, the Fed might just blink and cut rates in May. Market hopes are pinned on Powell holding steady—unless, of course, Trump decides to live-tweet through it.

Futures are up 0.37% ( CME_MINI:ES1! ) this morning, signaling optimism—possibly misplaced—in Trump’s “friendly” overtures toward China. Let’s just say we’re one golf game away from another market tantrum.

Enjoy your weekend, stay alert, and cross your fingers for a quiet Sunday tweet-wise.

April 24, 2025 - Not getting fired (yet)Hello everyone, it’s April 24, 2025, welcome back to another wild episode of “Trumponomics: The Market Edition.” For the second day in a row, global markets are on the rise, and yes, it’s all thanks to the Trump playbook: slap tariffs everywhere, terrify the market, escalate tensions, then toss out a gesture of peace and voilà — rally mode engaged.

The key word this morning? Relief. Relief that Trump might chill out on China, and Powell isn’t getting fired (yet). But let’s not pop the champagne too soon — anyone betting against a weekend plot twist from Trump hasn’t been paying attention.

In the US, the Fed’s Beige Book (a.k.a. the economy’s mood diary) painted a picture that’s… let’s say “limp but not lifeless.” Only 5 of the 12 Fed districts saw growth, and even that was more “walker with tennis balls” than Olympic sprint. Inflation? Creeping in slowly, with companies sharpening their price-hike pencils just in case Trump cranks up the tariff heat again. Employment? Not awful, but nothing to brag about. And uncertainty? It was mentioned 80 times in the report. That’s not a joke.

Meanwhile, auto sales are up — not because the economy’s booming, but because Americans are panic-buying ahead of expected price surges from more tariffs. Business travel is tanking, and tourism’s taking a nosedive. Welcome to the “Not-quite-a-crisis-but-definitely-not-fine” States of America.

As for OANDA:XAUUSD , after a brief flirtation with $3,500, it’s cooled down to $3,337. BLACKBULL:WTI is holding at $62.86. And INDEX:BTCUSD ? It’s back in the spotlight at $92,000 and climbing — yes, people are talking about it again, which should tell you something about the vibe out there.

On the politics front, Trump hinted that the tariff moratorium could be revoked for some countries, and he’s back to pestering Powell to cut rates. Classic. Meanwhile, Wall Street is just trying not to get whiplash. NYSE:BA numbers came in better than feared, and NASDAQ:NVDA supply chain via INX looks solid despite wild swings.

Today’s economic calendar includes durable goods data and jobless claims in the CME_MINI:ES1! are down 0.2% — looks like investors are just bracing for the next Trump curveball.

TL;DR: Markets are riding the Trump-coaster, gold cooled off, crypto’s surging, and America’s economy is wobbling but still upright — for now. Keep your helmets on.

EUR/GBP – Trendline Break & Retest: Reversal Confirmed?Technical Outlook:

EUR/GBP has broken above the descending trendline and is now retesting it from above near 0.8540–0.8560. This zone is critical — holding it confirms a trend reversal. If successful, the next upside targets are 0.8625 and 0.8680. RSI remains above 50, and MACD continues to support bullish momentum.

Fundamentals:

Dovish expectations from the BoE weigh on the pound. The euro gains support from improving inflation outlook and capital inflows. Interest rate differentials now favor EUR.

Scenarios:

📈 Main: bounce from 0.8540–0.8560 → move to 0.8625 and 0.8680

📉 Alt: break below 0.8540 → retracement to 0.8500–0.8480

Another market manipulation. It is spiraling out of control!I’m not here to express political opinions, but let’s be real—the Trump family launching meme coins, rugging retail investors, and manipulating markets is spiraling out of control.

💥 $TRUMP and $MELANIA were just the beginning.

Today, we witnessed what could be the biggest market manipulation in history, and it was executed with textbook precision:

Step one: float a fake news headline to test the market reaction.

Step two: publish a deliberately confusing statement where Trump says everything and its opposite.

Many misunderstood it as a “90-day tariff pause.”

🕛 The timing?

The announcement dropped at 12:30 PM EST—midnight in Asia, and 7 PM in Europe, when banks and institutions were closed.

🎯 Only the U.S. was awake and able to buy the pump.

Everyone else? Left sidelined.

No politician in modern history has manipulated global markets to this extent.

It’s turning Wall Street into a Las Vegas casino for the elite.

To make matters worse, Trump even tweeted a sarcastic:

“It’s a great day to buy stocks.”

🧨 Reality check:

He lowered current tariffs by just 10%

Hit China with a massive 125% tariff

Recession risk? Still on the table

Economic uncertainty? Worse than ever

You think China will just let this slide? Retaliation is coming.

What we're seeing is a nation burning its credibility while recklessly using financial power to create chaos.

🚨 If you think your money is safe in markets run by these people, think again.

This isn't trading anymore—it's Russian Roulette. Markets needs stability.

DYOR

Gold ETF(GLD) - Gold is the Safe Haven?Is Gold the safe haven from all the market turmoil? Looking at the chart, it would appear that Gold is unfazed by current market conditions. Price is still making All-Time Highs as price continues to swing above the 25(green), 100,(yellow) and 200(blue) day EMAs. Further fears in the Bond market may increase interest in Gold as a stable asset. What are you thoughts? What are some other assets that are defying 'gravity'?

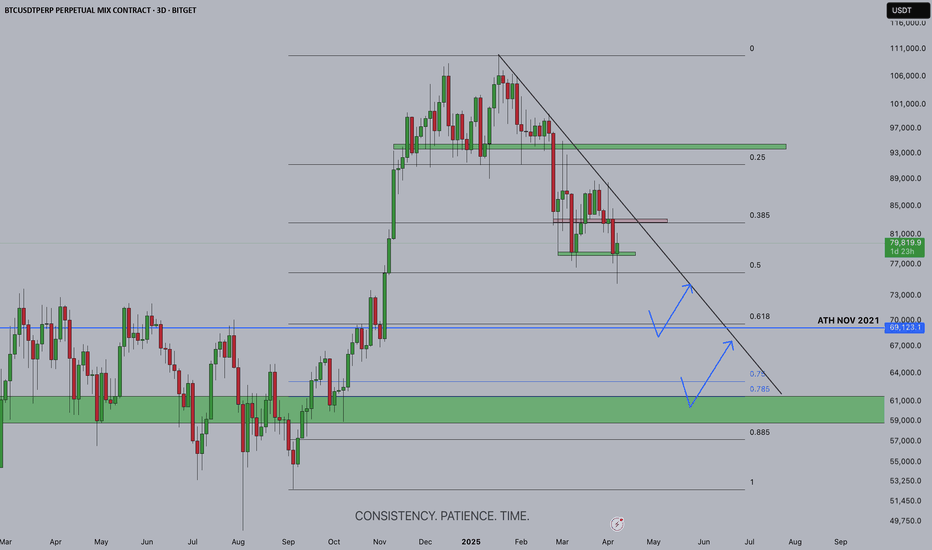

BTC 3D Market BreakdownBitcoin is currently trading around $79,200 on the 3-day chart and is sitting just above the key 0.5 Fibonacci retracement level from its most recent macro impulse. The chart shows a clear descending trendline acting as dynamic resistance, reinforcing the ongoing downward pressure on price. Until this trendline is broken and retested from above, market structure remains bearish in the mid-term.

After a strong rally to $108K, BTC was rejected near the 0.25 Fibonacci level at $93K. Since then, it’s formed a series of lower highs, confirming that bulls are losing momentum. The 0.385 retracement level, which aligns with the $85K region, has now acted as resistance multiple times, indicating a strong ceiling unless volume and price action shift.

Price is now hovering above the 0.5 retracement area (~$78K–$79K). If this zone fails to hold, Bitcoin is likely headed toward the 0.618 Fib level near $73,747. This level also aligns with the previous all-time high from November 2021, adding to its historical importance. While some buyers may attempt to defend that level for a short-term bounce, the real macro demand lies lower.

The green zone around GETTEX:64K to $61K is the highest confluence support area. It matches both the 0.75 and 0.785 Fibonacci retracement levels, and overlaps with the major accumulation and breakout structure from Q4 of 2024. If BTC trades down into that region, it would present a much higher probability bounce zone and a potential macro higher low — if bulls can defend it.

Until Bitcoin flips the descending trendline and reclaims $85K with conviction, the market structure favors downside continuation. A reclaim of $85K would be a significant signal for bullish momentum to return, especially if it comes with a breakout retest of the trendline. For now, however, the path of least resistance remains to the downside, with $69K and then GETTEX:64K –$61K as the next key support zones to watch.

In summary, Bitcoin remains in a corrective structure beneath its trendline. A move into $69K may offer a reaction, but the most meaningful support lies in the GETTEX:64K –$61K macro zone. Patience is key here, as buyers wait for either deeper value or a clear shift in trend.

Will the Fear Gauge Flash Red?The Cboe Volatility Index (VIX), Wall Street's closely watched "fear gauge," is poised for a potential surge due to US President Donald Trump's assertive policy agenda. This article examines the confluence of factors, primarily Trump's planned tariffs and escalating geopolitical tensions, that are likely to inject significant uncertainty into the financial markets. Historically, the VIX has proven to be a reliable indicator of investor anxiety, spiking during economic and political instability periods. The current climate, marked by a potential trade war and heightened international risks, suggests a strong likelihood of increased market volatility and a corresponding rise in the VIX.

President Trump's impending "Liberation Day" tariffs, set to target all countries with reciprocal duties, have already sparked considerable concern among economists and financial institutions. Experts at Goldman Sachs and J.P. Morgan predict that these tariffs will lead to higher inflation, slower economic growth, and an elevated risk of recession in the US. The sheer scale and breadth of these tariffs, affecting major trading partners and critical industries, create an environment of unpredictability that unsettles investors and compels them to seek protection against potential market downturns, a dynamic that typically drives the VIX upward.

Adding to the market's unease are the growing geopolitical fault lines involving the US and both China and Iran. Trade disputes and strategic rivalry with China, coupled with President Trump's confrontational stance and threats of military action against Iran over its nuclear program, contribute significantly to global instability. These high-stakes international situations, fraught with the potential for escalation, naturally trigger investor anxiety and a flight to safety, further fueling expectations of increased market volatility as measured by the VIX.

In conclusion, the combination of President Trump's aggressive trade policies and the mounting geopolitical risks presents a compelling case for a significant rise in the VIX. Market analysts have already observed this trend, and historical patterns during similar periods of uncertainty reinforce the expectation of heightened volatility. As investors grapple with the potential economic fallout from tariffs and the dangers of international conflicts, the VIX will likely serve as a crucial barometer, reflecting the increasing fear and uncertainty permeating the financial landscape.

Is Erdogan’s Gambit Destabilizing Turkey’s Future?Erdogan’s administration continues to engage in high-stakes geopolitical maneuvers by maintaining direct and indirect ties with groups designated as terrorist organizations. His government’s strategic alliances, notably with Hayat Tahrir al-Sham (HTS), serve immediate military and political goals in Syria, despite significant international controversy and longstanding terrorist designations by the U.S. and other global actors.

This risky strategy has had a pronounced impact on the Turkish economy. Investors have increasingly shifted their capital from the Turkish Lira to the U.S. dollar, leading to a notable rise in the USD/TRY rate. Fears of further economic isolation and the looming threat of sanctions—which could cut off Turkey from critical European banking and trade services—have only intensified market instability.

The growing strains within NATO and shifting regional alliances are compounding these economic challenges. Erdogan’s pragmatic yet contentious foreign policy raises serious questions about Turkey’s future role within the alliance, as Western partners deliberate potential sanctions and other measures. Meanwhile, evolving dynamics with regional powers such as Russia and Iran add further uncertainty to Turkey’s strategic position and economic prospects.

General Market Ramblings - $BTCUSD, $TSLA, $GDX, $DAL, $BBEUHi, all. Wanted to get something published for the first time in awhile. Unfortunately my mom passed away recently and that has been something I have been going through. It is therapeutic to record something and get it out to you all. I am approaching feature film length on this one, so kudos if you make it through the whole video.

I just wanted to discuss some general market thoughts here - especially as we are now in an interesting time. I hope you do find some value here! Believe me, this really is just scratching the surface of my market thoughts and the different stocks that I have thoughts on. But again, really just wanted to get something out to you guys. Even if you tune in for a minute or two, thanks for watching! It means a lot. Feel free to provide feedback as well of course.

As always, a lot of my thoughts are based on the "Time @ Mode" method that we discuss in the Key Hidden Levels TradingView chat.

Also, as always, these are strictly my thoughts and opinions. I am not a professional and I encourage you to do your own research before making investment/trading decisions. These opinions are not financial advice.

Assets in this video: COINBASE:BTCUSD , COMEX:GC1! , NASDAQ:TSLA , AMEX:GDX , CBOE:BBEU , NYSE:DAL , maybe others I forgot about.

BITCOIN WILL BE AT 50-60K THIS YEARMake it simple, BTC need to relax a little this year before going much higher. If BTC goes around 100k would be nice to take profits and wait for new lows... USA stock market is having alot of volatility with Trump, I wouldn't be surprised if we see a -20% drawdown in S&P 500!!

XAUUSD BEFORE & AFTER READ IN CAPTION XAUUSD (Gold)* with key levels marked for potential trades. The price has recently touched the *support zone* around *2,867.378*, which could offer a buying opportunity. The *resistance* is at *2,920.364*, and the *retest area* is highlighted, suggesting a potential move up if the price bounces from the support. Watch for price action near the *support* for entry and target the *resistance* for potential gains

Bajaj FInance The stock is the strongest among the nifty 50 stocks. It is making newer highs; it broke the symmetrical triangle and has gone up on good volumes

Long term we can expect 12000 levels

short term 9200 cannot be ruled out.

A buy on dip strategy needs to be followed on this. A test of the triangle can be a buying opportunity.

SRF looking to break out Nifty has been on a downtrend for a long time, but some stocks are strong as they are going against the trend.

SRF is one of those stocks. It is relatively strong as Nifty is falling , the stock is building the base. Today's volumes were good. The stock needs to move above 2880-2920 range. IF that happens then 3100-3200 range awaits.

I don't have any idea how it will react to tariff news tomorrow but if it can weather the storm them a good up move awaits.

NN GROUP ($NN) Q4—INSURANCE CASH SHINES IN EUROPENN GROUP ( EURONEXT:NN ) Q4—INSURANCE CASH SHINES IN EUROPE

(1/9)

Good evening, TradingView! NN Group ( EURONEXT:NN ) is humming—H2 revenue hit $ 7.94B, topping estimates 📈🔥. Q4 earnings and a cash boost spark buzz—let’s unpack this Dutch dynamo! 🚀

(2/9) – REVENUE RUSH

• H2 Haul: $ 7.94B—beats $ 7.41B est. 💥

• Full ‘24: $ 12.36B—up 12% from $ 11.03B 📊

• OCG: $ 1.9B—hits ‘25 goal early

EURONEXT:NN ’s cash flow’s sizzling—steady wins!

(3/9) – BIG MOVES

• Buyback: $ 300M—shares get a lift 🌍

• Dividend: $ 3.44—up 8%, juicy payout 🚗

• Deals: $ 360M settled—risks trimmed 🌟

EURONEXT:NN ’s flexing—insurance muscle shines!

(4/9) – SECTOR SNAP

• P/E: ~10—below 11.9x avg 📈

• P/B: 0.57—vs. sector’s 1.04—cheap?

• Edge: 12% growth tops peers 🌍

EURONEXT:NN ’s a bargain—or just quiet strength?

(5/9) – RISKS ON DECK

• EPS Miss: $ 2.21 vs. $ 3.60—hiccup ⚠️

• Rates: Volatility stings returns 🏛️

• Climate: Claims could climb—yikes 📉

Solid run—can it dodge the bumps?

(6/9) – SWOT: STRENGTHS

• Cash: $ 1.9B OCG—rock solid 🌟

• Payouts: 8% divvy, $ 300M buyback 🔍

• Europe: 20% new biz—growth zip 🚦

EURONEXT:NN ’s a steady beast—built tough!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: EPS slip, Dutch lean 💸

• Opportunities: Eastern Europe perks 🌍

Can EURONEXT:NN zap past the risks?

(8/9) – EURONEXT:NN ’s Q4 cash surge—what’s your vibe?

1️⃣ Bullish—Value shines bright.

2️⃣ Neutral—Solid, risks hover.

3️⃣ Bearish—Misses stall it out.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

EURONEXT:NN ’s $ 7.94B H2 and $ 1.9B OCG spark zing—insurance hums 🌍. Low P/E, but EPS wobbles—gem or pause?

BERKSHIRE HATHAWAY ($BRK.A) Q4—INSURANCE & CASH SHINEBERKSHIRE HATHAWAY ( NYSE:BRK.A ) Q4—INSURANCE & CASH SHINE

(1/9)

Good afternoon, TradingView! Berkshire Hathaway ( NYSE:BRK.A ) is humming—Q4 operating earnings soared 71% to $ 14.5B 📈🔥. Insurance and a record cash pile spark buzz—let’s unpack this titan! 🚀

(2/9) – EARNINGS SURGE

• Q4 Ops: $ 14.5B—up from $ 8.5B last year 💥

• Full ‘24: Insurance jumps 51%—key driver 📊

• Net: $ 19.7B Q4—profit stays juicy

NYSE:BRK.A ’s flexing—steady as she goes!

(3/9) – BIG MOVES

• Cash Hoard: $ 334B—up from $ 270B mid-year 🌍

• No Buybacks: Q4 skips—$ 7B spent earlier 🚗

• Apple Trim: Half sold off—cash king 🌟

Buffett’s stacking bucks—ready for action!

(4/9) – SECTOR SNAP

• Market Cap: ~$ 1.075T—top tier 📈

• P/B: 1.55—vs. JPM’s 1.9, Allstate’s 1.3

• Outrun: 25.5% ‘24 vs. S&P’s 25% 🌍

NYSE:BRK.A ’s a beast—value or peak?

(5/9) – RISKS IN SIGHT

• Stocks: Apple, Chevron swings—volatility nips ⚠️

• Succession: Buffett’s exit looms—jitters? 🏛️

• Economy: Rail, retail soften if cash tightens 📉

Solid, but not ironclad—watch out!

(6/9) – SWOT: STRENGTHS

• Diverse: Insurance leads—51% growth 🌟

• Cash: $ 334B—ultimate cushion 🔍

• Track: 19.8% CAGR—beats S&P’s 10.2% 🚦

NYSE:BRK.A ’s a fortress—built tough!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Insurance lean, cash sits 💸

• Opportunities: Deals, yields lift—$ 14.5B zing 🌍

Can NYSE:BRK.A zap the next big win?

(8/9) – NYSE:BRK.A ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Cash rules, value shines.

2️⃣ Neutral—Solid, risks balance.

3️⃣ Bearish—Growth stalls, succession bites.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NYSE:BRK.A ’s $ 14.5B Q4 and $ 334B cash spark zing—insurance flexes 🌍. Premium P/B, but steady wins—champ or chill?

ARISTA NETWORKS ($ANET) ZAPS Q4—AI & CLOUD FUEL SURGEARISTA NETWORKS ( NYSE:ANET ) ZAPS Q4—AI & CLOUD FUEL SURGE

(1/9)

Good evening, TradingView! Arista Networks ( NYSE:ANET ) is buzzing—$ 7B in 2024 revenue, up 19.5% 📈🔥. Q4 shines with AI and cloud demand—let’s unpack this tech titan! 🚀

(2/9) – REVENUE RUSH

• 2024 Haul: $ 7B—19.5% jump from $ 5.86B 💥

• Q4 Take: $ 1.93B—25.3% up, beats $ 1.9B 📊

• EPS: $ 0.65—tops $ 0.57, up 25%

NYSE:ANET ’s humming—cloud’s got juice!

(3/9) – BIG PLAYS

• Q1 ‘25 Guide: 1.93 − 1.97B—above $ 1.907B 🌍

• Stock Split: 4-for-1—shares for all! 🚗

• AI Ties: Meta, NVIDIA deals spark buzz 🌟

NYSE:ANET ’s wiring the future—full throttle!

(4/9) – SECTOR SNAP

• P/E: ~54—premium vs. Cisco’s 17 📈

• Growth: 19.5% smokes sector’s 7%

• Edge: 70-80% Microsoft share—kingpin 🌍

NYSE:ANET ’s hot—value or stretch?

(5/9) – RISKS IN VIEW

• Clients: Microsoft, Meta—big eggs, one basket ⚠️

• Comp: Cisco bites back—AI race heats 🏛️

• Economy: Capex cuts could sting 📉

High flyer—can it dodge the turbulence?

(6/9) – SWOT: STRENGTHS

• AI Lead: $ 750M ‘25 target—cloud king 🌟

• Margins: 64.6%—profit punch 🔍

• Cash: 95% flow jump, no debt 🚦

NYSE:ANET ’s a lean, mean machine!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Client lean, high P/E 💸

• Opportunities: AI clusters, enterprise zip 🌍

Can NYSE:ANET zap past the risks?

(8/9) – NYSE:ANET ’s Q4 buzz—what’s your vibe?

1️⃣ Bullish—AI keeps it soaring.

2️⃣ Neutral—Growth’s solid, risks linger.

3️⃣ Bearish—Premium fades fast.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NYSE:ANET ’s $ 1.93B Q4 and AI deals spark zing—$ 7B year shines 🌍. Premium P/E, but growth rules—champ or chase?

$DXY HOLDS FIRM—TRUMP TARIFFS & FED FUEL 2025 BUZZTVC:DXY HOLDS FIRM—TRUMP TARIFFS & FED FUEL 2025 BUZZ

(1/9)

Good afternoon, Tradingview! The U.S. Dollar Index ( TVC:DXY ) sits at 106.47 today—tariffs and Fed vibes keep it humming 📈🔥. Down a hair from 106.60—let’s unpack this greenback glow! 🚀

(2/9) – YEARLY SURGE

• 2024 Run: From 100.16 to 107+ by Dec 💥

• Today: 106.47—off 0.12% from yesterday 📊

• Driver: Trump tariffs juice inflation fears

TVC:DXY ’s got grit—2025’s off to a zesty start!

(3/9) – BIG BOOSTERS

• Tariffs: Auto, chip threats—dollar darling 🌍

• Fed: Slow cuts—rates outshine abroad 🚗

• Crypto Nod: Pro- AMEX:USD admin vibes 🌟

Greenback’s flexing—policy packs a punch!

(4/9) – MARKET PULSE

• Vs. Peers: Outpaces euro, yen—rate gaps shine 📈

• X Chatter: 107 peak, post-swearing dip?

• Edge: U.S. growth trumps global woes 🌍

TVC:DXY ’s steady—king of the currency hill?

(5/9) – RISKS IN PLAY

• Deficits: Fiscal bloat looms long-term ⚠️

• Geo-Tension: Wars nudge safe-haven bets 🏛️

• Fed Pivot: Faster cuts could dim shine 📉

Tough tailwinds—can TVC:DXY dodge the drag?

(6/9) – SWOT: STRENGTHS

• Tariffs: Inflation lift—dollar darling 🌟

• Rates: Fed’s edge over ECB, BOJ 🔍

• Haven: Chaos loves $ USD—rock solid 🚦

TVC:DXY ’s got muscle—global star!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Debt piles—future wobble? 💸

• Opportunities: Tariff hikes zap rivals 🌍

Can TVC:DXY keep the crown or stumble?

(8/9) – TVC:DXY at 106.47—what’s your vibe?

1️⃣ Bullish—108+ by spring.

2️⃣ Neutral—Holds steady, risks hover.

3️⃣ Bearish—Dips below 100 soon.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

TVC:DXY ’s 106.47 glow—tariffs, Fed, and grit shine 🌍🪙. Deficits lurk, but strength rules—bull or bust?

MERCADOLIBRE ($MELI) SOARS IN Q4—E-COMMERCE & FINTECH SHINE MERCADOLIBRE ( NASDAQ:MELI ) SOARS IN Q4—E-COMMERCE & FINTECH SHINE

(1/9)

Good evening, Tradingview! MercadoLibre ( NASDAQ:MELI ) is sizzling—Q4 revenue up 37%, a $ 6.1B haul 📈🔥. Fintech and e-commerce fuel a 33% surge—let’s unpack this Latin dynamo! 🚀

(2/9) – REVENUE RUSH

• Q4 Take: $ 6.1B—37% leap, tops $ 5.9B est. 💥

• EPS: $ 12.61—blasts past $ 7.94 hopes 📊

• Net Income: $ 639M—beats $ 402M dreams

NASDAQ:MELI ’s humming—growth’s got zing!

(3/9) – BIG MOVES

• GMV: $ 14.5B—56% jump FX-neutral 🌍

• Payments: $ 58.9B TPV—49% up 🚗

• Credit Boom: $ 6.6B—74% growth 🌟

NASDAQ:MELI ’s flexing muscle—full throttle!

(4/9) – MARKET VIBE

• P/E: ~60—above Amazon’s 40, PDD’s 20 📈

• Growth: 37% smokes peers’ 10%

• Targets: 2,400−3,000—10-38% upside 🌍

Premium price—worth the juice?

(5/9) – RISKS ON DECK

• FX Woes: Brazil, Mexico currencies wobble ⚠️

• Comp: Amazon, locals eye the prize 🏛️

• Rates: $ 6.6B credit—defaults lurk? 📉

Hot run—can it dodge the heat?

(6/9) – SWOT: STRENGTHS

• E-comm: $ 14.5B GMV—LatAm king 🌟

• Fintech: $ 58.9B TPV—Pago’s gold 🔍

• Logistics: 6 new centers—zippy edge 🚦📉

NASDAQ:MELI ’s a double-threat dynamo!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: High P/E, FX swings 💸

• Opportunities: Ad bucks, untapped markets 🌍

Can NASDAQ:MELI zap past the bumps?

(8/9) – NASDAQ:MELI ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—$ 3,000 in sight.

2️⃣ Neutral—Growth’s hot, risks hover.

3️⃣ Bearish—FX bites back.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:MELI ’s $ 6.1B Q4 and fintech flex spark buzz—$ 14.5B GMV shines 🌍🪙. High P/E, but growth rules—champ or chase?

VERTEX ($VRTX) SHINES IN Q4—PAIN & CF FUEL GROWTHVERTEX ( NASDAQ:VRTX ) SHINES IN Q4—PAIN & CF FUEL GROWTH

(1/9)

Good evening, Tradingview! Vertex ( NASDAQ:VRTX ) is buzzing—Q4 revenue up 16%, new drugs hit the scene 📈🔥. $ 2.91B and a bold 2025 forecast—let’s unpack this biotech beast! 🚀

(2/9) – REVENUE RUSH

• Q4 Haul: $ 2.91B—16% jump from last year 💥

• Full ‘24: $ 11.02B, up 12%—Trikafta’s king 📊

• ‘25 Outlook: $11.75-$ 12B—6-9% growth

NYSE:CF keeps humming—newbies add zest!

(3/9) – BIG WINS

• Journavx: Non-opioid painkiller greenlit Jan ‘25 🌍

• Alyftrek: CF drug for 6+—ships now 🚗

• Cash: $11.2B—loaded for action 🌟

NASDAQ:VRTX storms pain—CF stays golden!

(4/9) – SECTOR CHECK

• Valuation: 11x sales—above 9x avg 📈

• Vs. Peers: Gilead’s 4x, Regeneron’s 8x—premium?

• Growth: 12% beats biotech’s 5-7% 🌍

NASDAQ:VRTX flexes—value or stretch?

(5/9) – RISKS ON TAP

• Payers: Journavx needs coverage—hiccups? ⚠️

• Trikafta: 93% of sales—big lean 🏛️

• Comp: Pain rivals, CF safe—for now 📉

Hot streak—can it dodge the bumps?

(6/9) – SWOT: STRENGTHS

• CF King: Trikafta, Alyftrek lock it in 🌟

• Pain Play: Journavx eyes $ 4B peak 🔍

• Cash: $11.2B—war chest ready 🚦

NASDAQ:VRTX ’s got muscle and moolah!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Trikafta reliance—eggs in one basket 💸

• Opportunities: Casgevy rolls, pain grows 🌍

Can NASDAQ:VRTX zap past the risks?

(8/9) – NASDAQ:VRTX ’s Q4 surge—what’s your vibe?

1️⃣ Bullish—Pain pays off big.

2️⃣ Neutral—Solid, but risks linger.

3️⃣ Bearish—Growth hits a wall.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:VRTX ’s $2.91B Q4 and Journavx/Alyftrek wins spark buzz—$11.2B cash backs it 🌍🪙. Trikafta rules, risks hover—champ or chaser?

CELSIUS ($CELH) ZAPS UP 33%—Q4 & ALANI NU IGNITE BUZZCELSIUS ( NASDAQ:CELH ) ZAPS UP 33%—Q4 & ALANI NU IGNITE BUZZ

(1/9)

Good evening, Tradingview! Celsius Holdings ( NASDAQ:CELH ) just surged 33%—Q4 earnings and a $1.65B Alani Nu buyout lit the fuse 📈🔥. Energy drink market’s buzzing—let’s unpack this jolt! 🚀

(2/9) – EARNINGS SNAP

• Q4 Revenue: $332M, topped $329M expected 💥

• Margin: Jumped to 50.2%—beats 47.1% hopes 📊

• EPS: $0.14, above $0.11—solid grit

Growth slowed, but NASDAQ:CELH flexed resilience!

(3/9) – ALANI NU DEAL

• Price: $1.65B—$1.275B cash, $500M stock 🌍

• Alani’s Pull: $595M ‘24 sales, 78% growth 🚗

• Combo: 16% energy drink share—$ 2B ‘25 goal 🌟

NASDAQ:CELH snags a rival—big playtime!

(4/9) – MARKET VIBE

• Surge: 33% to $33-$35—shorts burned 📈

• Vs. Peers: 6x sales, below 9x avg—value?

• X Hype: “Top gainer”—bulls cheer 🌍

NASDAQ:CELH heats up—bargain or buzz?

(5/9) – RISKS IN SIGHT

• Overlap: Alani vs. CELH—cannibal clash? ⚠️

• Slowdown: North Am. down 6%—Pepsi hiccups 🏛️

• Comp: Rivals eye shelf space—tight race 📉

Hot move, but bumps lurk ahead!

(6/9) – SWOT: STRENGTHS

• Deal: $1.65B Alani—growth rocket 🌟

• Margin: 50.2%—profit punch 🔍

• Global: 39% intl. leap—worldwide zip 🚦

NASDAQ:CELH ’s firing on all cylinders!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Q4 dip, overlap risks 💸

• Opportunities: $ 2B sales, $50M synergies 🌍

Can NASDAQ:CELH juice up the doubters?

(8/9) – NASDAQ:CELH ’s 33% zap—what’s your vibe?

1️⃣ Bullish—$40+ in sight.

2️⃣ Neutral—Growth’s cool, risks hover.

3️⃣ Bearish—Hype fades fast.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

NASDAQ:CELH ’s Q4 and Alani Nu deal spark a 33% leap—$332M, $1.65B buy 🌍🪙. Resilience shines, but overlap looms—champ or chase?

ETHEREUM’S 2025—$ETH POWERS UP WITH ETFs & DEFIETHEREUM’S 2025— CRYPTOCAP:ETH POWERS UP WITH ETFs & DEFI

(1/9)

Good morning, Tradingview! Ethereum’s flexing muscle—ETFs and DeFi keep CRYPTOCAP:ETH humming 📈🔥. Institutional cash and altcoin grit shine—let’s unpack this crypto king! 🚀

(2/9) – ETF BUZZ

• Inflows: $SEED_TVCODER77_ETHBTCDATA:3B+ into ETH ETFs since July ‘24 💥

• Feb Surge: $500M+ in a week—BlackRock leads 📊

• Outlook: $10-15B by year-end?

Big players bet big— CRYPTOCAP:ETH ’s got juice!

(3/9) – DEFI DOMINANCE

• TVL: $120B locked in Feb ‘25—up from $78B 🌍

• Share: 60%+ of DeFi’s action 🚗

• Goal: $200B by Dec? Steno says maybe 🌟

Ethereum’s the DeFi backbone—unshaken!

(4/9) – ALTCOIN EDGE

• Altcoin Cap: $1.6T— CRYPTOCAP:ETH holds 10-12% 📈

• ETH/BTC: Climbing to 0.06—alt season whispers

• Vs. BTC: 57% dominance— CRYPTOCAP:ETH stands tall

Resilient king—altcoins rally behind! 🌍

(5/9) – RISKS ON RADAR

• Regs: Rules could snag ETF, DeFi growth ⚠️

• Rivals: Solana bites at CRYPTOCAP:ETH ’s heels 🏛️

• Price Dip: $2,632—off Jan highs 📉

Solid, but not bulletproof—watch out!

(6/9) – SWOT: STRENGTHS

• ETFs: $ 3B+ inflows—cash keeps flowing 🌟

• DeFi: $120B TVL—ecosystem champ 🔍

• Stake: 54M+ ETH locked—rock steady 🚦

CRYPTOCAP:ETH ’s the muscle in crypto town!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: $ 2,632 lags inflows—sentiment lags 💸

• Opportunities: $ 200B TVL, Pectra lifts 🌍

Can CRYPTOCAP:ETH zap to new heights?

(8/9) – CRYPTOCAP:ETH ’s ETF & DeFi run—what’s your vibe?

1️⃣ Bullish—King keeps ruling.

2️⃣ Neutral—Growth’s cool, risks hover.

3️⃣ Bearish—Rivals steal the crown.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

CRYPTOCAP:ETH ’s humming—$ 3B ETFs, $120B DeFi, altcoin grit 🌍. $ 200B TVL in sight, but rivals lurk. Champ or challenger?