SMC Trap = Clean CHoCH + OB Long, Targeting Liquidity Sweep!We’re tracking a textbook Smart Money Concept (SMC) long setup on EURJPY, 30M timeframe, with clear structure shift and clean OB entry. Here's the full breakdown for traders:

🔄 Market Structure Shift:

Major bearish trend visible from previous candles.

Sharp rejection followed by a Change of Character (CHoCH) indicating possible bullish reversal.

🧱 Order Block Zone:

Price swept liquidity to the downside and tapped into a marked Bullish Order Block at 162.195–162.266.

Entry triggered within this OB zone, with tight risk placement below Strong Low.

🔁 Entry Setup:

Entry: Inside OB at 162.266

Stop Loss: Just below the OB at 162.195 (Strong Low protected)

TP1: 70.50% retracement near 162.650

TP2: Full Buy Side Liquidity sweep @ 162.768 (Weak High Targeted)

🧮 RRR (Risk-to-Reward):

Approximate RRR: 1:6+ — High probability trade if market structure follows through.

🧲 Key Levels Highlighted:

🔹 CHoCH confirms shift to bullish

🔹 OB Zone: High confluence with liquidity grab + candle imbalance

🔹 Buy Side Liquidity: Obvious target for institutions

🔹 Weak High: Ready to be taken out

📈 What To Watch For:

Bullish continuation towards 162.768

Strong impulsive move breaking above minor resistance

Potential re-entries on lower TF OBs (5M–15M)

🧠 Pro Tip for Traders:

Don’t chase—wait for CHoCH + OB confirmation combo. This type of setup works best when confluence aligns: OB + CHoCH + liquidity sweep = 🔥

Marketstructure

Supply Zone Rejection & BOS Confirm Downtrend ContinuationAfter a clean shift in structure marked by a CHoCH and subsequent BOS, price retraced into a clear supply zone—offering a high-probability short setup. Here's how the setup unfolded:

🧠 Trade Rationale

Break of Structure (BOS): Price broke below a key higher low, confirming a bearish structure.

Change of Character (CHoCH): Signaled the end of bullish momentum earlier in the sequence.

Supply Zone: Price retraced into a well-defined supply area (aligned with imbalance and prior support turned resistance).

Entry: Short taken as price tapped into the supply and failed to make a new high—further confirmed by a lower timeframe CHoCH.

Target: Aiming for the next BOS level below, aligning with clean equal lows/liquidity draw.

🔍 Key Concepts Highlighted

Structure-based trading with CHoCH and BOS labeling.

Supply zone entries based on price action confirmation.

Risk-to-reward driven decision-making (tight SL above supply, TP near next demand).

💬 What do you think? Do you wait for confirmation within supply, or enter at touch?

Let’s discuss—drop your thoughts and feedback!

USDCHF 30M | Fair Value Gap Sell Setup Inside Bearish Channel📊 USD/CHF Smart Money Breakdown — May 16, 2025

Here’s a clean SMC-driven setup where price respects the bearish order flow, taps a Fair Value Gap (FVG) and rejects right at liquidity inducement levels.

Let’s break it down 👇

🔍 1. Context

Price is respecting a descending channel structure

Clean internal liquidity run up into:

✅ FVG zone from prior imbalance

✅ Top of bearish channel trendline

This is a classic liquidity sweep before expansion lower

🎯 2. Entry Plan

Entry zone: 0.8375–0.8391 (FVG zone shaded in red)

Stop loss: Just above 0.8391 (invalidates FVG zone)

Target zone:

🟢 TP1 → 0.8340 (minor inefficiency fill)

🟢 TP2 → 0.8327 (liquidity resting at the low)

➡️ RR ratio is about 1:3 on full target — clean sniper range!

📉 3. Smart Money Logic

Retail likely triggered buy orders into that FVG zone

Institutions tap FVG for premium entry

Price already printing rejection wicks — early signs of displacement

Watch for confirmation via:

Bearish engulfing candle close

Break of minor bullish structure on 5m

⚠️ Risk Notes:

Watch out for USD fundamental news that might cause a fakeout spike

Let price confirm breakdown before stacking entries

💬 Do you trust the FVG? Or think price will smash through?

🧠 Drop your confluence in the comments below and follow @ChartNinjas88 for precision setups like this every day.

S&P500 - The bottom we have been waiting for!The S&P500 - TVC:SPX - officially created the bottom:

(click chart above to see the in depth analysis👆🏻)

This month we officially saw one of the craziest stock market fakeouts of the past decade. With a drop and reversal rally of about +15%, the S&P500 is about to even close with a green monthly candle, which then indicates that the stock market bottom was created.

Levels to watch: $120, $250

Keep your long term vision!

Philip (BasicTrading)

XAU/USD 15 May 2025 Intraday AnalysisHi everyone, thanks for stopping by.

I’m Amin, a London-based technical analyst-in-training, currently preparing for the CMT Level I exam (June 2025) and building towards a career as a Market Strategist/Analyst.

I post daily/weekly analysis using Smart Money Concepts (SMC) soon to be blended with CMT-aligned tools like RSI, Moving Averages, trend structure, and market phase models.

My Goal: To secure a strategist or analyst role in London.

Recent highlight: One of my TradingView ideas was featured by an editor.

If you're in the industry, a fellow learner, or hiring, feel free to reach out — I’m open to opportunities and connections.

Let’s keep growing and learning!

Amin.

H4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

Analysis and bias remains the same as analysis dated 23 April 2025

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bearish.

In my analysis from 12 May 2025, I noted that price had yet to target the weak internal high, including on the H4 timeframe. This aligns with the ongoing corrective bearish pullback across higher timeframes, so a bearish internal Break of Structure (iBOS) was a likely outcome.

As anticipated, price targeted strong internal low, confirming a bearish iBOS.

While a bullish Change of Character (CHoCH) has printed, I am exercising discretion and not marking it as such, given the shallow nature of the pullback.

Additionally, another bullish CHoCH has printed, with price now trading within a defined internal range. I will continue monitoring this closely, particularly in relation to the depth of pullback.

Intraday Expectation:

Price to continue bullish, react at either premium of internal 50% EQ or M15 demand level before targeting weak internal low priced at 3,120.765

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance and persistent geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

What Makes a Chart Tradable – Part TwoIn the previous post , we explored the foundations of technical trading. We examined how market behavior can appear structured even when it results from randomness, how bias affects interpretation and how volatility persistence helps explain why certain moves tend to cluster rather than appear in isolation. This post builds on that foundation by focusing on how to recognize meaningful movement and determine whether a chart structure is tradable.

Technical charts often present a wide range of setups, patterns, and interpretations. But a core distinction must be made between coincidental formations and actual price behavior driven by imbalance. Not all movements are equal, and recognizing the difference between random fluctuation and purposeful structure is essential.

A common assumption in technical analysis is that certain patterns or shapes inherently provide a specific outcome. This assumption is problematic without a defined context. The ability to recognize a flag or wedge does not imply statistical validity. For a price movement to be tradable, there should be characteristics that suggest underlying buying or selling pressure.

Unusual Movement

To determine whether a price move is meaningful, it must be assessed in relation to what is typical for that market. All assets have their own average range, pace and rhythm. When price breaks from that baseline through unusually strong or sustained movement, it can signal momentum or imbalance.

What makes these moves relevant is not their size alone, but the fact that they differ from normal behavior. This kind of shift may reflect changes in supply and demand or a reaction to new information. Such movements could mark a change in behavior and can serve as reference points. Their value lies in being statistically uncommon, which may suggest that market conditions have changed.

Pullbacks as Rebalance

Following strong directional movement, price tends to enter a state of reversion or pause. This is known as a pullback, a controlled retracement .It is not merely a pause. It reflects a psychological reset and the temporary rebalancing of order flow in response to imbalance.

Not all pullbacks are viable. For a setup to be considered tradable, the retracement must occur in the context of a meaningful prior move. When the underlying trend is intact and the pullback is controlled, the structure can offer a more reliable opportunity.

The Role of Standardization

Trading should be based on discretion. It involves interpretation, context and deliberate decision-making. But without structure, it risks becoming inconsistent and reactive.

Therefore movement and momentum should be measurable. What appears meaningful must be evaluated relative to the asset’s own historical behavior, not assumed based on surface-level appearance. Without a reference, the evaluation may lack foundation.

Measurement supports model building. Standardization supports disciplined execution. A trader might believe a move is strong based on visual cues or pattern familiarity, but if it lacks historical context or fails to meet defined criteria, that evaluation could be flawed.

Framework and Models

There are categories of tools that can be incorporated to support standardization. The choice is not fixed and should be based on personal preference, methods and research. Example:

Volatility Measure: Could be used to confirm when price moves outside a volatility-based envelope, indicating movement beyond the average range.

Momentum Measure: Could be used to confirm whether current price action is faster or stronger compared to recent historical behavior.

Such models are used to define context, not to predict outcomes. They help standardize analysis and filter out questionable movements and patterns.

Conclusion

The textbook patterns often referenced on their own do not create edge. Tradable charts are those where meaningful movement, defined by momentum, imbalance and structure, can be observed and evaluated using standardized methods. The purpose is not precision but repeatability. Discretionary trading is built on contextual evaluation supported by consistency and objective tools.

EURCHF Sell - May 12, 2025Risk : Full 1%

🧠 Reasoning:

Price reacted from Daily EMA, with a strong wick rejection and bearish engulfing.

Entry at 15m imbalance left behind inside a 15m POI.

🎯 TP:

First TP at Asia lows, 1:3 RR → take off 75%

Final TP at second Asia low or gap, close to 6RR

📉 Bias: Bearish | Risk Management: Partial close at 3RR

Micron Technology - The Chart Is Still Perfect!Micron Technology ( NASDAQ:MU ) will reverse right here:

Click chart above to see the detailed analysis👆🏻

If you actually want to explain technical analysis to somebody, just show them the chart of Micron Technology. Almost every structure makes perfect sense, with this stock respecting all major trendlines and horizontal levels and with the current support area, the bottom is now in.

Levels to watch: $70, $210

Keep your long term vision,

Philip (BasicTrading)

Litecoin (LTC) - Long Setup📋 Context:

🔵 Open Interest stable or slightly increasing → healthy position building.

🔵 Top Traders Ratio strongly rebounding → top traders are re-accumulating long positions.

🔵 CVD Spot rising → real spot buying support is coming back.

🔵 CVD Futures rebounding → shorts being squeezed and absorbed.

🔵 Funding Rate neutral → no immediate risk of short squeeze against longs.

🔥 Liquidations:

🔵 95% of potential liquidations are shorts → strong imbalance to exploit.

🔵 Optical Map shows a wall of short liquidations just above the current price → objective is to grab them.

📈 Technical Structure:

🔵 Clean bullish structure on the 15-minute timeframe.

🔵 Stop Loss placed just below the recent swing low.

🎯 Trade Plan

Entry: Current price zone 85.7

Immediate Target (TP1): 87 $ → grabbing short liquidations.

Extension Target (TP2): 88 $ → if momentum remains strong.

Stop Loss (SL): Below 84 $ → invalidation if clean break of structure.

Gravions IG: Why Apple's Shift to India Could Trigger a Drop in Apple is betting heavily on changing its production geography, planning to move a significant portion of iPhone assembly from China to India by 2026. Analysts at Gravions IG have assessed the situation and concluded that this move could negatively impact the company’s stock value in the near term.

Key Risks of Production Relocation

Indian manufacturing facilities, although growing rapidly, have not yet achieved the level of quality and logistical efficiency seen at Chinese plants. Gravions IG emphasizes that reconfiguring production processes takes time, and potential disruptions in supply chains or reduced quality in the early batches could trigger dissatisfaction among consumers and partners.

According to their analysis, the transition could increase product costs and squeeze profit margins, putting pressure on Apple’s financial results over the next few quarters.

Investor Reactions

Current market behavior reflects investor caution: Apple's share price has already fallen nearly 17% since the start of the year, with technical indicators suggesting further declines. The formation of a "death cross" — where the 50-day moving average crosses below the 200-day moving average — heightens concerns about a prolonged downtrend.

Gravions IG stresses that until the Indian production lines are fully operational and stable, Apple's stock will likely remain under selling pressure.

Strategic Perspective: Opportunity or Risk?

In the long run, diversifying manufacturing could benefit Apple by reducing its dependence on China and insulating it from potential geopolitical or economic shocks. Additionally, the Indian government's efforts to bolster its manufacturing sector could provide Apple with a stronger foundation for future expansion.

Still, Gravions IG insists that until Indian facilities reach consistent quality and scale, Apple will be vulnerable to market sentiment swings and potential reputational risks.

Conclusion

Relocating production is a strategically sound but high-risk move for Apple in the short term. Gravions IG advises investors to closely monitor product quality and supply chain stability in India before making long-term investment decisions regarding Apple's stock.

Long setup on AAVE📈 Funding rate is rebounding strongly → bullish sentiment returning, no overheating signs.

📊 Open Interest is rising again after a flush → healthy new market engagement.

⚖️ Top Traders Long/Short Ratio around 1.9 → slightly bullish but still neutral, no extreme greed.

🛒 Spot CVD shows a strong rebound → real spot buyers stepping in (very bullish).

📉 Futures CVD starts recovering slowly → futures are expected to follow the spot trend.

🔥 Kingfisher Data shows heavy short positioning → potential for a powerful short squeeze.

Conclusion:

✅ Confirmed entry after alignment across Open Interest, CVD, Funding, and Long/Short Ratio.

✅ Monitoring Open Interest and CVD for squeeze confirmation.

✅ Managing the position with a tight stop below local structure to minimize risk.

Setup: Long on SOL/USDT🚀 Setup: Long on SOL/USDT Perpetual (15m timeframe)

📈 Context:

Strong divergence between Perp CVD (down) and Spot CVD (up).

_Top Traders accumulating long positions.

_Open Interest stable to slightly rising.

_More than 90% of positions are short — strong imbalance favoring a squeeze.

🎯 Trade Plan:

_Entry: around 148.20 USDT

_Stop-Loss: 145.70 USDT

_TP1: 150.38 USDT (partial profit)

_TP2: 152.30 USDT (full close)

🧠 Notes:

Plan to secure partial profits at TP1.

Will monitor for continuation if breakout occurs.

Market Structure Shift (MSS) & Break of Structure (BOS) - GuideIntroduction

Understanding market structure is fundamental to becoming a consistently profitable trader. Two key concepts that Smart Money traders rely on are the Break of Structure (BOS) and the Market Structure Shift (MSS) . While they may seem similar at first glance, they serve different purposes and signal different market intentions.

In this guide, we will break down:

- The difference between BOS and MSS

- When and why they occur

- How to identify them on your charts

- How to trade based on these structures

- Real chart examples for visual clarity

---

Break of Structure (BOS)

A Break of Structure is a continuation signal. It confirms that the current trend remains intact. BOS typically occurs when price breaks a recent swing high or low in the direction of the existing trend .

Key Characteristics:

- Happens with the trend

- Confirms continuation

- Can be used to trail stops or add to positions

Example:

In an uptrend:

- Higher High (HH) and Higher Low (HL) form

- Price breaks above the last HH → BOS to the upside

---

Market Structure Shift (MSS)

Market Structure Shift signals a potential reversal . It occurs when price breaks a significant swing level against the prevailing trend and is often followed by a shift in the internal structure (e.g., lower highs after higher highs).

Key Characteristics:

- Happens against the trend]

- Signals possible trend reversal

- Often occurs after a liquidity grab or stop hunt

- Optional: is created by a displacement candle

Example:

In an uptrend:

- Price takes out a significant high (liquidity grab)

- Then aggressively breaks the most recent HL → MSS to the downside

---

How to Identify BOS and MSS

For BOS:

1. Determine the current trend.

2. Identify swing highs/lows.

3. Look for price breaking past these levels in the same direction as the trend .

For MSS:

1. Look for signs of exhaustion or liquidity grabs near swing highs/lows.

2. Watch for price to break against the trend structure .

3. Confirm with a shift in internal structure (e.g., lower highs start forming in an uptrend).

---

Using BOS and MSS in Your Trading Strategy

With BOS:

- Use it to confirm trend continuation

- Add to your position after a retracement into an OB or FVG

- Trail your stop-loss below the most recent HL or above LH

With MSS:

- Look for confluence (liquidity sweep + MSS = strong signal)

- Use it to spot early reversal entries

- Wait for a confirmation candle or structure shift on LTF (1m, 5m, 15m)

- If the displacement candle is too big you can wait for the retest

---

Common Mistakes to Avoid

- Confusing BOS with MSS

- Ignoring higher timeframe context

- Trading MSS too early without confirmation

- Chasing BOS without waiting for a proper retracement

Pro Tip: Use BOS/MSS with confluences like SMT Divergence, IFVGs, or key session times for higher probability setups.

---

Final Thoughts

Mastering BOS and MSS will give you an edge in understanding price delivery and anticipating market moves. BOS confirms strength in the current trend, while MSS warns of a possible reversal and new trend forming. Combine these with smart money tools, and you’ll be equipped to enter the market like a pro.

Happy Trading!

Google - Fantastic Bullish Break And Retest!Google ( NASDAQ:GOOGL ) just looks amazing:

Click chart above to see the detailed analysis👆🏻

For more than a decade, Google has been trading in a rising channel formation, perfectly respecting all market structure. Now, Google is about to retest the previous all time high once again and with a sharp correction of about -25%, this offers a significant bullish reversal setup.

Levels to watch: $150

Keep your long term vision,

Philip (BasicTrading)

$XAUUSD Gold | Are We Looking at a Local Top Here?Looking at Gold again, I’m going a bit out on a limb and saying: There’s a good chance we’ve just seen a local top — at least for the coming weeks.

Last time I was pretty spot on with my target after being wrong about the top. I wanted to see $2,955, and Gold ended up reaching $2,956.5 — missing my level by just $1.50. Totally fine, especially considering the huge rally that followed.

But now it looks like that rally might be losing steam. We’re currently trading between the 127.2% and 138% Fibonacci extension levels, specifically between $3,225 and $3,250. That’s a zone I see as highly likely for a short-term correction.

Possible downside targets?

First $3,146, then lower at $3,034, and ideally even a move back toward $2,900.

Of course, a lot will depend on macro news, especially from the US — tariffs, geopolitical risks, and overall market sentiment. If Gold pushes above $3,300, then this whole scenario gets invalidated and I’d switch to an alternative setup that I haven’t detailed here yet.

The RSI is also sitting deep in overbought territory, with multiple bearish divergences building — which supports the idea of a pullback.

But as always: Just because the RSI is overbought doesn’t guarantee an immediate drop. We still need price confirmation.

Dow Jones - Value Is The King Of 2025!Dow Jones ( TVC:DJI ) withstands all bearish struggles:

Click chart above to see the detailed analysis👆🏻

All major U.S. indices have been weakening lately but the Dow Jones is clearly the strongest of all. It seems like big institutions are shifting back to value stocks and therefore the Dow Jones remains very strong. Looking at technicals, this trend is rather likely to continue during 2025.

Levels to watch: $40.000, $50.000

Keep your long term vision,

Philip (BasicTrading)

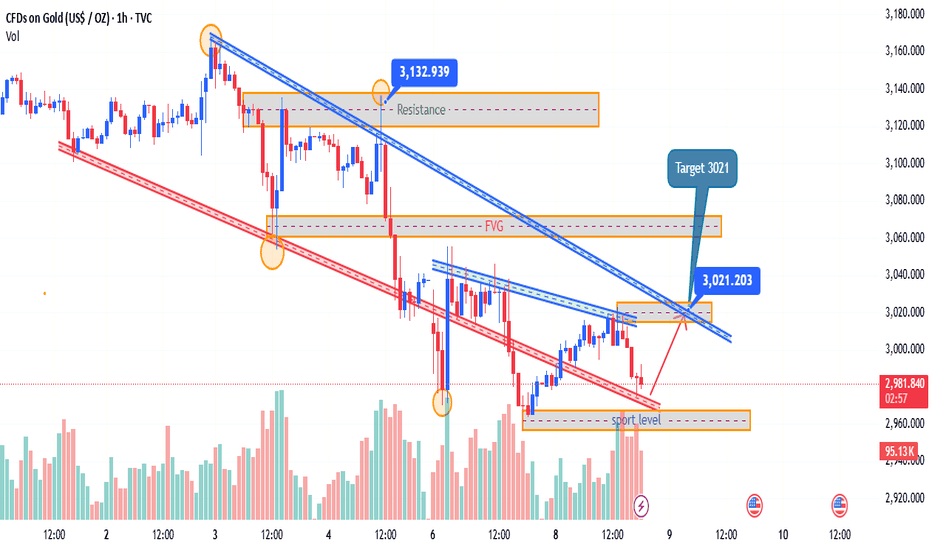

Gold ChatGPT: Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe

Key Observations:

1. Trend and Price Action:

- The price of Gold is currently in a downtrend, as indicated by the red trendline showing lower highs and lower lows. The price has recently broken below the previous support level, signaling a continuation of the bearish movement.

- The resistance zone near 3,141.64 remains a significant barrier for any upward movement, while the support level at 2,960.00 is holding the price from falling further.

2. Order Block and FVG (Fair Value Gap):

- The order block located at 3,138.95 to 3,141.64 has been a key area where price rejection occurred. The price approached this area but failed to break above, indicating strong selling pressure. This …

ChatGPT: - The target for the current bearish setup is 3,021, which aligns with the support level near 2,987.47. If the price continues to decline, this target could be reached soon, with further downside movement expected.

- If the price holds at the support level and forms a bullish reversal pattern, it may head back towards the resistance zone. However, until the support level holds, the price is likely to continue the downward trajectory.

4. Volume and Market Sentiment:

- The volume shows a consistent decline, confirming the selling pressure. The recent spikes in volume near the support level suggest that the market is reacting to the critical support area.

- Market sentiment remains bearish, with the price currently below its recent highs and the resistan…

ChatGPT: - Bullish Reversal Scenario: If Gold finds support at 2,960 and forms a bullish pattern (such as a reversal candle or engulfing candle), the price might move towards 3,141.64 again.

Conclusion:

The price of Gold is currently in a downtrend, facing resistance around 3,141.64 and support near 2,960. Traders should watch for price action near these levels to assess the next move. The target of 3,021 is the key level to focus on, and a breakout below this could lead to further downside. If the support level holds, there could be a potential for a bullish rebound towards resistance.

Foundation of Technical Trading: What Makes a Chart Tradable?The Foundation of Technical Trading

There is an abundance of information on price charts, technical methods, indicators, and various tools. However, the required first step is to understand basic market structure. Without this foundational knowledge, technical applications risk becoming inconsistent and disconnected from broader market behavior.

It is also important to question whether technical charts and tools are effective at all. What makes the market responsive to a trendline, a pattern, or an indicator? And why, at other times, do these tools seem entirely irrelevant? Is the market random? If certain events are predictable, under what conditions can such occurrences be expected?

Experiment: Random Charts

Here is an illustration of four charts; two showing real price data and two randomly generated. While some visual distortion gives away subtle differences, there are more refined methods to construct this experiment that makes telling the difference between real and random almost impossible.

All these charts show viable patterns and possible applications. When presented with these, even experienced people tend to construct narratives, whether or not structure is present. This raises a fundamental question; how can one distinguish real occurrences from coincidental formations on a chart? In case all movements are considered random, then this should indicate that applied methods perform no better than coincidence?

Bias and Distortion

It’s also important to comprehend the influence our perception. As humans we are wired to find patterns, even in random data, which can lead to various cognitive biases that distort our interpretation. For example, confirmation bias may lead us to focus only on evidence that supports our expectations, while apophenia causes us to see patterns where none exist. Similarly, hindsight bias can trick us into believing past patterns were obvious, which can develop overconfidence in future decisions. Awareness of these biases allows us to approach technical tools and charts with greater objectivity, with more focus on probabilistic methods and calculated risks.

Experiment: Random Levels

Perform the following experiment; open a chart and hide the price data. Then draw a few horizontal lines at random levels.

Then reveal the price again. You’ll notice that price can touch or reverse near these lines, as if they were relevant levels.

The same thing can happen with various indicators and tools. This experiment shows how easy it is to find confluence by chance. It also raises an important question, is your equipment and approach to the markets more reliable than random?

Market Disorder

Financial markets consist of various participants including banks, funds, traders and algorithmic systems. These participants operate with different objectives and across multiple timeframes resulting in a wide range of interpretations of market behavior. Trades are executed for various reasons such as speculation, hedging, rebalancing, liquidation or automation; directional intent could be unclear. For instance, the prior may serve to offset exposure, and portfolio rebalancing could require the execution of large orders without directional intent.

Technical and chart-based trading likely makes up a minor segment of the overall market; even within this subset, there is considerable variation in perception and interpretation. There could be differences in timeframe, reference points, pattern relevance and responses to similar information. The market is broader, more complex and less definitive than it appears. The point is that markets contain a high degree of structural disorder, which means most assumptions should be questioned and perceived as estimative.

The effect of buying and selling pressure on multiple timeframes sets the foundation for oscillation in price movements, rather than linear and monotonic movements. This pattern of rising and falling in a series of waves sets the points for where the current structure transitions between balance and imbalance. An overall equilibrium between buying and selling pressure results in consolidative price movement, whereas dominance leads to trending or progressive movement.

Volatility Distribution

To answer the main question: What differentiates real market behavior and charts from random data, and ultimately makes it tradable, is the distribution of volatility. This forms the basis for the phenomenon of volatility clustering, where periods of high volatility tend to follow high volatility, and low volatility follows low volatility. It is rare for the market to shift into a volatile state and then immediately revert to inactivity without some degree of persistence. Research supports the presence of this volatility persistence, though with the important caveat that it does not imply directional intent.

Volatility Cycles

These phases tend to occur in alternation, known as volatility cycles, which set the foundation for tradable price structures. This sequence consists of a contractive phase, marked by compression in price movements, followed by an expansive phase, characterized by increased volatility and directional movement. The alternation reflects shifts in underlying buying and selling pressure. This behavior offers a practical approach to interpret market behavior. A more detailed explanation of the concept could be explored in a future post.

Conclusion

While the idea of profitability through technical trading is often questioned, it remains a viable approach when based on sound principles. The edges available to the average trader are smaller and less frequent than commonly presumed. The concepts of volatility and the ability to locate areas of imbalance forms the basis for identifying conditions where market behavior becomes less random and more structured. This sets the foundation for developing technical edges.

The content in this post is adapted from the book The Art of Technical Trading for educational purposes.