Mcdonalds

MCD. McDonalds: Daily chart setting bearish divergencesMCD has been raising alongside the market but, while the whole market (as well as XLY fund) added around 30% since 2016 lows, MCD was only able to push up a half of it.

On one side, the stock potentially is underperforming but technicals say it has a very strong resistance to break. Daily chart shows bearish divergence, same as Weekly timeframe, and we are very close to the Median Line of the Fork.

I believe shorts are welcome once the price goes to a double-top formation in 132-134 area. SL can be set at 136.5 with TP1 at 121 and TP2 at 111

McDonalds entering buy zoneThe home of the big mac is entering levels that I believe would be a good place to initiate long positions. Say b/w 105-115.

I would stop out under 102.50

They also support a dividend yield of 3.27%

Link: www.google.com

Their dividend payout has been rising at a nice clip, so it seems pretty safe.

Link: www.nasdaq.com

As always, have a plan before you enter a trade. Write down, I am buying X because I believe Y.

TARGET DA TARGETHoliday sales this November for Thanks giving would suck for sure. And also same for X-mas and New Year for Target.

TGT TARGET FROM 2015 July high $85 it is slowly trickling down. If you draw a line from that high to 2016 march high you will get a better clear picture. It may not get bankrupt but stock will be in a good position to buy if it breaks 2 support level either @ $52 or $47 range. A good target to buy would be sub $10

McDonalds H&S confirmationWe have quite the H&S confirmation signal here with the weekly close below the weekly 50/60 ema aswell as the neckline. Obvious short play and should be an easy 3.3%

Stop is protected behind daily 200/250 ema + fib retrace. If price pulls back into the week for a retest of daily resistance I may add to the position.

$MCD help with fibonacci theory.I am just now learning how to use the Fibonacci theory and need some help.

I am very interested in buying MCD and am trying to find a good entry point.

I have heard somewhere that reversal usually happens when the 127.2% mark is crossed on the way down. Can someone confirm that this is accurate or correct me if I am wrong.

Thanks!

At McDonald’s, All-Day Breakfast Cools

If Macydy breaks the light green support line, guess what? Free fall zone till $30ish area and possible strong bounce. Or the next support zone would be the dark green support line.

Red line is a possible resistance line but it may change as the month goes by.

www.wsj.com

McDonald's looking for a pop $MCDI like the look of $MCD at the moment it is looking quite healthy and ready for another pop. first target for Monday 123-124. But I am hoping for a gap above that on open.

Hate the food but I'll happily get into their stock if its going to pay off! No entry until good confirmation though.

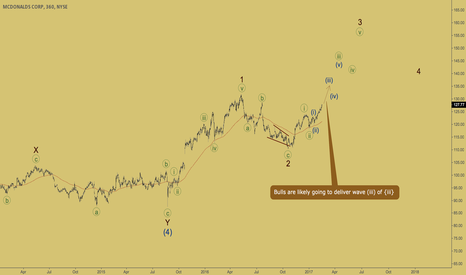

McDonalds at key resistance, expecting a correction MCD is at its Elliott Waves monthly time frame target in the $132 area.

5 waves completed

RSI14 is showing bearish divergence.

MCD is testing the upper band of its rising channel.

$132 area is corresponding to the 1.5x the height of its previous channel projected on its breakout point in 2008.

Minimum target in the $101 area, then possibly $82.