Mcdonalds

Mcdonald's Corp bullish continuationAs per the Chart

Abbreviations;

ND=No demand

NS= No supply

DW= Demand Wave

RFSB= Resistance from Supply Bar

SFDB support from Demand Bar

SLK= Stop Loss killer

SLKB= Stop Loss Killer Bottom

DB= Demand Bar

SB= Supply Bar

EVRB= effort vs Result Bottom

My Mentors and Inspiration

Volume Analysis - Oleg Alexandrov

Money and risk Management - Dmitriy Lavrov

McDonald's trade planLooks like a sell off in wave a is finished. Looking at potential H&S pattern formation as divergence is starting to emerge. This was can capture a long of wave b, before shorting again into c.

Best to wait for the pattern to make a right shoulder at least for more confirmation.

Good Luck!

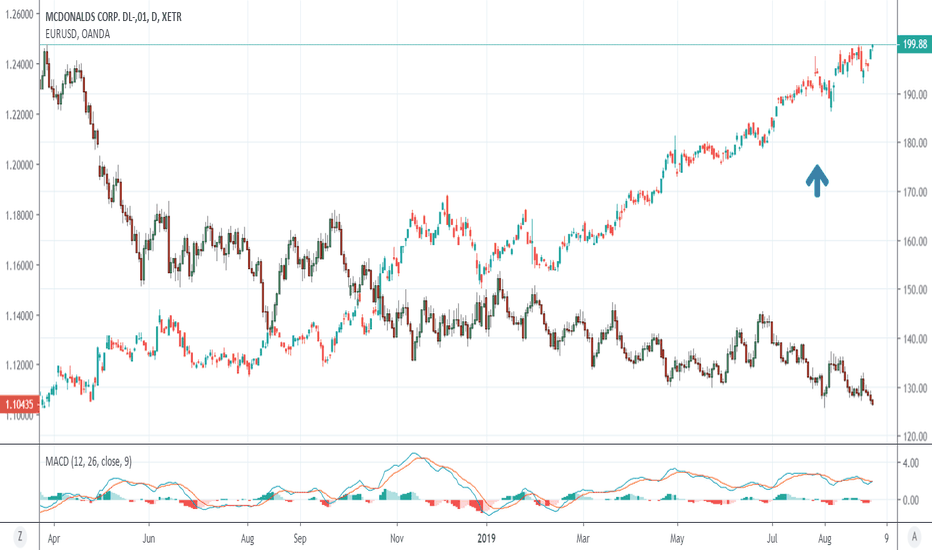

Mcdonalds to the bottom !Hello, Traders!

Monfex is at your service and today we overview MCDONALDS Corporation.

Mcdonalds fired their CEO, with which the company's capitalization doubled.

The first downward movement was in early September, at the same time as the "The Game Changers" popular film about vegetarianism was released. Perhaps this is connected, but not exactly.

This year, the United Nations called on people to eat less meat.

Generally, the news background is negative for MCD.

Also at this chart we see Elliott Waves (12345-abc) and how MCD in an uptrend movement so long. But recently, it broke the support line of the ascending channel and wedge.

The local resistance zone ~ $200

The local support zone ~ $190

Target zone ~ $160

Market Cap

$145.941B

Share your thoughts, ideas about the market under the chart.

Watch for our Updates to be the first who gets well-timed signals !

GOOD LUCK AND LOTS OF PROFITS !!

Disclaimer

This report is for information purposes only and should not be considered a solicitation to buy or sell any trading assets. Monfex accepts no responsibility for any consequences resulting from the use of this material. Any person acting on this trade idea does so entirely at their own risk.

McDONALDS 1D BULLISH WEDGEWedges are repeatable trading chart patterns.

Wedges are a form of Triangle chart pattern and will have a specific directional breakout bias.

A descending wedge has a bullish long breakout bias.

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

What ever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending Volume bars and descending ATR line (which indicates volatility) this shows

a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of average volume for a full position size.

b - If 75% of average volume then ½ position size. (To find 75% of Volume

look at the charts volume settings – divide smaller # into larger # = 75%+)

2 - Enter two trades.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 – After Breakout candle – if price closes back into chart pattern close trade

*9 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

McDonald’s: Where to buy for a long term investment.MCD (McDonald’s Corporation) has been trading within a very strong 1M Channel Up (RSI = 70.206, MACD = 17.720, Highs/Lows = 10.6514), which as seen by its technical action is on the Higher High zone.

Based on its historic volatility within the Channel Up, we expect MCD to pull back for a Higher Low towards 190 before resuming the uptrend. A potential Death Cross (MA50 under MA200) should come as confirmation of a sideways phase (bottom is in) and a Golden Cross (MA50 over MA200) as confirmation of the next bullish leg.

The RSI pattern seems to also be cyclical and in that sense we have hit the Higher High and are in anticipation of the Higher Low. Our long term Target is at least 240.00.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Analysis on MCDONALDS 30.08.2019The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero lines.

The oscillator Force Index is above the zero lines.

If the level of resistance is broken, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 222.00

• Take Profit Level: 225.00 (300 pips)

If the price rebound from resistance level, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 219.00

• Take Profit Level: 218.00 (100 pips)

USDJPY

A possible long position at the breakout of the level 116.70

EURUSD

A possible short position in the breakdown of the level 1.1030

USDCHF

A possible long position at the breakout of the level 0.9900

GBPUSD

A possible short position in the breakdown of the level 1.2150

McDonald's updateMcDonald's has been having a great run, with price rarely selling off even during economic cycles and turmoil. Now in a channel with confirmed levels. Over the past year price made it 35.57% up with all time high at $222. Creates great options to trade when the price tests the low side of the channel. Long trade with a good risk-reward or wait for the potential break to sell. Majority of banks and investment funds see this stock as 'overweight'. Watch for the next test of the channel lows. Good Luck!

$MCD McDonald's Weekly True Bearish HaramiMCD McDonald's has just completed printing a true Bearish Harami two candle pattern. True Harami's are explained in linked diagram below. The body of the second, inner candle needs to be no bigger than 25% the size of the preceding candle, in which case this one qualifies. A true large bullish candle at the top of an uptrend, followed by a 75% smaller bodied bearish candle that gaps down from the previous closing price, and is fully contained by the preceding bullish candle. That's a reversal indicator and a good spot to get short MCD if you've been looking to. I believe we could see the 202's area on a pullback. This is a stock that generally outperforms when the markets are in true turmoil, and has been on a tear lately. I wouldn't want to stay short for very long personally. I like August 30th P205, currently trading for .40 per contract for this play. Happy hunting and GLTA!! a.c-dn.net

Shorting MCD SharesOn the daily chart of McDonalds`shares the price has formed a bearish divergent bar which is amplified by Elliott waves structure, where, with high probability, we have finished the 5th Elliott wave of a bullish period. In addition, there is an AO indicator divergence. Going short using levels that are marked on the chart.

$MCD 7/5 Short Iron Condor: profit [201.03, 206.47], LIMIT RISKThis nearly ATM July 5th IC on McDonald's is technically driven. For the past 10 trading days, MCD's open and closes have both stayed within the parallel channel range of 203.73 and 206.16. With a great risk/reward ratio, we are entering into a short iron condor on the July 5th contracts, 8 trading days away, with a maximum profit of 147 with a mere, limited max loss of 103, per contract. This spread is constructed by taking a long position in the 207.5 calls and 200 puts, while simultaneously writing the 205 calls and 202.5 puts. Being an iron condor, we will collect the theta premium as maturity nears. This trade is done for a credit of 1.47, so there is a profit between 201.03 and 206.47.

Technical indicators buttress our neutral sentiment, as the MACD has been extremely close to zero over the past two weeks, the DI+ and DI- components of the DMI are very close to each other (within 26.5 and 27, respectively), the ADX reads an extremely low 14, the Stochastics read 50.5 and the RSI and MFI are both within the range of .