MCD (McDonalds) with signals to the downsideMcDonalds looking like it is getting close to a pull back. First sell signal triggered with yesterdays closing on my SSG trading system.

Ideally would like to sell Calls with a strike of 300, however the premium not high enough. Looking into building up a long put position instead.

Mcdonaldssignal

McDonald's stock presents a small level double top shape!McDonald's stock presents a small level double top shape!

This figure shows the weekly candle chart of McDonald's stock from the end of 2019 to the present. The graph overlays the low point of 2020 against the golden section. As shown in the figure, the high points of the past two months have been suppressed by the 2.618 position of the golden section in the figure, and the low point in early June has just stepped back on the 2.382 position of the golden section in the figure! So, in the future, we can use these two positions (280-299) as the key ranges for McDonald's stocks, with a fluctuating approach within the range and a unilateral breakthrough approach outside the range!

Mc Donalds showing strong upside with a Falling Wedge - SMCFalling Wedge has formed on Mc Ds

The price broke up showing strong upside.

7>21>200 - Bullish

RSI >50 = Bullish - Higher lows

Target $289.50

SMC:

Sell Side Liquidity was swept at the very strong support. Once this happened, Smart Money bought into the orders pushing it up.

Now it's clearly showing strong upside to come.

MCDonalds Analysis + Trade Setup

In my opinion, this is one of the best sales deals on the current market.

In the monthly chart, this stock has a 5-wave trend, which is currently the end of wave 3 and we are at the starting point of wave 4. This wave will be in the form of A B C and it will be a big and rapid wave. The reason for its rapidity is the end of a 5-wave in the weekly time frame and a 5-wave in the daily time frame.

It is worth noting that wave A will start with a high initial acceleration and then take an oscillatory form with large fluctuations

Note: If you buy a transaction at this price, please be patient and focus more on your psychology so that you don't exit the market when emotional fluctuations start and save your profit completely.

Be successful and profitable.

3 Amazing Lessons I learnt from McDonaldsI love McDonalds.

There was a time where I was ranking different burgers from around the world. UK, France, South Africa, Dubai, America, Switzerland and Greece.

And I only ranked about 4 burgers an 8 out of 10.

I know you’re going to hate but…

McDonalds Big Mc remains one of them I ranked 8 out of 10 – Delicious!.

Anyway, so I love the burger, I love the story – if you’ve seen “The Founder” movie.

And I love the lessons learned from the success story.

And since 2013, I always enjoy writing articles on how other companies, entities and even individuals can teach you indirectly about trading.

McDonalds is the one in the spot light for today!

3 lessons I learnt from McDonalds!

The fast-food giant has been able to achieve massive success by keeping things simple, sticking to a proven system, and adapting to changes in the market. These same principles can be applied to trading the financial

Lesson #1: Less is more…

The company has built its success on a relatively small menu of simple, easy-to-understand options. Also the way to make the meals are so simple with easy ingredients you probably have at home.

Well, traders can achieve better results by focusing on:

• Small number of markets or securities

• One or two systems

• One or two time frames

• One to three money management rules

• Less time trading and more time holding

Lesson #2: Find a System to Repeat

The company has built a highly efficient and repeatable system for making and delivering food.

Remember the scene in the movie “The Founder” where Ray Croc organised his system within a tennis court until mastered?

It’s simple, it works – and it’s never died out.

This has allowed them to replicate their success across thousands of locations worldwide.

With trading, you should also look for a system that you can repeat and stick with it.

I mean, by now my MATI Trader System – must feel like child’s play to you because of how I have taught you the system in and out. And I have shared with you hundreds of trade line ups already with Trading View.

And with you seeing it the system everyday, it must feel second nature for spotting a trade by now right?

Well, just like Rocket Science isn’t rocket science to a rocket scientist – That’s why you feel that way about my MATI Trader System…

And if you have a system that you swear by, you’ll feel the same way I do.

This can help you to avoid the pitfall of constantly switching strategies and missing out on long-term gains.

Lesson #3: Adapt to Change

McDonald's has also been able to adapt to changes in the market, such as:

• Environment concerns

• Consumer demand for healthier options

• Relevant and trendy toys in Happy Meals

• New neutral colour style restaurant catering to all nations and cultures around the world

• More options for vegans and vegetarians

They have and has been able to stay relevant and successful for decades.

Similarly, traders need to be able to adapt to changes in the markets, whether it:

Adding new markets to your watchlist

Adjusting your Risk to Reward during favourable and unfavourable environments

Shifts in economic conditions or changes in consumer preferences.

This might mean adjusting your trading strategy slightly or seeking out new opportunities in different markets.

You need to be able to adapt to change which is crucial for long-term success in the financial markets.

And so, McDonald's has been successful by keeping things simple, sticking to a repeatable system, and adapting to change.

Apply these principles to your own trading and you’ll find trading to be a walk in the park in the medium to long run…

Do you like McDonalds and what would you rate the Big Mc? I won’t judge.

Trade well, live free.

Timon

MATI Trader

(Financial trader since 2003)

$BTC Down We Go Again | Trade Idea

Yesterday, the BTC daily didnt appeal to me as much as the ETH chart did but today is a different story. Same factors that are against ETH are against BTC:

13 EMA

50 EMA

200 EMA

McDonald's Arches are present pattern here

All in all I see this easily retracing back to the support zone highlighted. The question though is will it hold?

MCD to close all 850 locations inside RussiaIf you haven`t sold the forming of the Head and Shoulders bearish Chart Pattern:

Then you should know that McDonald’s owns around 84% of its 847 restaurants in Russia, which accounts for 9% of its total revenues and less than 3% of its operating income globally.

They will continue paying its 62,000 employees in Russia.

Considering the facts above, my buy area is around $212.

Looking forward to read your opinion about it.

Short on open: 220.24 or higher

Real-Time Algorithmic Trading Signals. All trades are based on a Geometric HMM.

The Ingenuity Trading Model is a Geometric Hidden Markov Model with specific inputs related to Price, Time, Volume, and Volatility.

Our Algorithmic Trading Model offers real-time buy or sell signals with specific entry and exit prices. This affords you the freedom to successfully trade across all markets and market regimes. We are not interested in biased economic research or opinions on the latest Wall Street narratives. We do not trade based on conventional financial analysis. Our signals prove the power of taking a more scientific approach to trading the market.

MCD Bullish BreakoutA consumer staple defensive, unaffected by tariffs. ER May 1, but would need big miss (like Jan 18) to drop, and in any event lower revenues already in guidance and therefore estimate. Indebted, so benefits from no-hike policy, not really affected if USD falls.

Just broke out, so buy retest of breakout line for top of channel. 2% SL below last low.

BUY 191 SL 187 TP 214 RR 5.75 RISK 2.09%

MCD Public sentimentI know shorting this is not wise, however MCD public sentiment has been steadily declining despite its still incredible popularity, MCD has been in a HUGE bull run, however in my opinion we will see the rise of healthier alternatives and more traditional fast food chains, (Subway, Pizza restaurants)

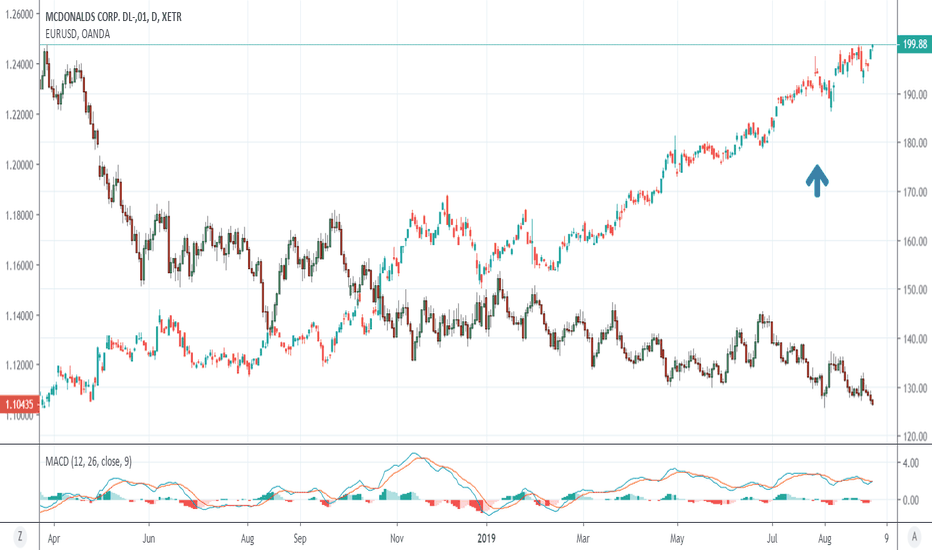

Analysis on MCDONALDS 30.08.2019The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero lines.

The oscillator Force Index is above the zero lines.

If the level of resistance is broken, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 222.00

• Take Profit Level: 225.00 (300 pips)

If the price rebound from resistance level, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 219.00

• Take Profit Level: 218.00 (100 pips)

USDJPY

A possible long position at the breakout of the level 116.70

EURUSD

A possible short position in the breakdown of the level 1.1030

USDCHF

A possible long position at the breakout of the level 0.9900

GBPUSD

A possible short position in the breakdown of the level 1.2150