Comprehensive Research - McDonald’s Stock Set to SoarQuick read:

McDonald's stock is poised for a bullish move, with Wave 3 likely starting and strong support near 290.50–295.00. Traders should long on dips within this range, for next resistance levels, 326.00 and 348.00 with a invalidation below 276.00. This setup offers a solid risk-to-reward in a long-term uptrend. Alternative safe entry is possible after the break of corrective channel breakout of wave (2).

Elliott Wave Forecast:

TF - Daily

The chart suggests that McDonald’s stock is in the middle of a larger upward move known as Wave C, which comes after completing a complex correction. Wave C is expected to unfold in five smaller waves, a pattern that usually points to a strong uptrend. It appears the correction is behind us, and a fresh bullish phase is underway.

Starting from the low at 276.53 , marked as Wave B, the price climbed to 326.32 , forming Wave one. After that, the stock pulled back to 290.50 , forming Wave two. This pullback followed a typical ABC pattern within a corrective channel, which often signals the end of a downturn and the beginning of an upward move.

Now, Wave three seems to be starting, and this is usually the strongest part of Wave C. The price is expected to move above 335 , take a small pause for Wave four, and then rise again to complete Wave five somewhere around 345 to 350 dollars. This positive outlook remains intact as long as the price stays above 290.50 . With the breakout from the corrective channel, the setup looks strong and clear for buyers.

Fibonacci levels:

Fibonacci Extension Targets:

1.000 extension: 326

1.618 extension: 348

Correction Retracement Levels:

Wave 2 retracement: 78.6%

A = C in A-B-C correction: 289.21

Price Action & shifting of value:

TF: Weekly

McDonald’s stock has been steadily climbing inside a rising channel since late 2020, showing a clear long term uptrend. The price has respected both the top and bottom edges of this channel very well, and interestingly, the middle line has acted like a pivot, providing support or resistance multiple times over the years.

Recently, the stock made a higher low at 276.53 and bounced back strongly, keeping the bullish structure intact. It then pulled back to 290.50 , right around the middle line of the channel, and held above an upward sloping trendline. This kind of price action shows strength and suggests buyers are stepping in.

The sharp move from 276.53 up to current levels looks like a strong bullish leg, possibly driven by accumulation. If the stock can break above its recent high of 326.32 , it could head toward the upper end of the channel. As long as the price stays above 290.50 and especially above 276.53 dollars, the bulls remain in control. Even if the price dips a bit, the long term trend stays positive unless the lower boundary of the channel breaks down.

I will update more Information here.

Mcdonaldsstock

McDonald's Earnings Miss For the First Time Since 2020McDonald's second-quarter earnings report fell short of analysts' expectations as higher prices contributed to a decline in foot traffic and comparable store sales. Despite efforts to boost sales with promotions like the "$5 Meal Deal," the fast food giant faced challenges in maintaining revenue and profitability.

Key Takeaways:

- Revenue and Profits: McDonald's reported $6.49 billion in total revenue for Q2, nearly identical to the same period in 2023, but fell short of the $6.63 billion projected by analysts. Net income dropped 12% year-over-year to $2.02 billion, missing expectations of $2.24 billion.

- Comparable Sales Decline: Global comparable sales fell 1% from last year, with U.S. locations experiencing a drop in foot traffic due to higher prices. Sales decreases in France and China offset improvements in Japan and Latin America.

- Impact of Promotions: The recent "$5 Meal Deal" promotion provided a late-quarter boost, though its full impact will be more evident in the third quarter.

Detailed Analysis:

Revenue and Profit Performance

In the second quarter of 2024, McDonald's revenue remained flat at $6.49 billion compared to the same period in 2023. Analysts had anticipated a growth in revenue to $6.63 billion, but the reality fell short. This stagnation in revenue was accompanied by a notable decline in net income, which dropped 12% year-over-year to $2.02 billion, compared to analysts' expectations of $2.24 billion.

Comparable Sales and Foot Traffic

The global comparable sales decline of 1% highlighted the challenges McDonald's faced in maintaining customer engagement amid rising prices. In the U.S., higher menu prices led to reduced foot traffic, contributing to a 0.7% decline in same-store sales. Internationally, sales fell by 1.1%, driven by weaknesses in markets like France and China, which overshadowed gains in Japan and Latin America.

Promotional Efforts and Market Response

In response to the declining sales, McDonald's launched the "$5 Meal Deal" promotion in an effort to attract price-sensitive customers. While this promotion only impacted the final days of the second quarter, it is expected to have a more significant effect on third-quarter earnings. Early reports suggest that the promotion has been successful, potentially continuing into August to sustain momentum.

McDonald's CEO Chris Kempczinski emphasized the company's commitment to delivering "reliable, everyday value" and accelerating growth drivers such as chicken and loyalty programs. Despite these efforts, the broader economic environment and consumer price sensitivity have posed substantial challenges.

Market Reaction

Shares of McDonald's have experienced a 15% decline in value so far this year. However, the stock showed a slight recovery, up 3.77% in Monday's trading session following the earnings announcement. This reflects a cautious optimism among investors that the company's strategic initiatives may eventually pay off. The stock has a Relative Strength Index (RSI) of 57.83, indicating potential for further growth. Adding to the potential growth is the bullish flag pattern depicted on the chart.

Conclusion

McDonald's second-quarter performance underscores the difficulties faced by the fast food industry amid rising prices and shifting consumer behaviors. While the "$5 Meal Deal" and other strategic initiatives show promise, the company must navigate a complex landscape to regain growth and profitability.

McDonald’s Misses Profit Estimates Amidst Middle East Conflict:McDonald's Corporation (NYSE: NYSE:MCD ) falls short of quarterly profit estimates for the first time in two years. Amidst a backdrop of geopolitical tensions in the Middle East and evolving consumer preferences, the iconic fast-food chain faces challenges in maintaining its market dominance. This article delves into the factors behind McDonald's recent performance and the broader implications for its global operations.

Growing Consumer Landscape:

In an era where consumers are becoming increasingly budget-conscious, McDonald's, known for its affordability, is witnessing a shift in consumer behavior. CEO Chris Kempczinski acknowledged that consumers are becoming more discerning with their spending, signaling a departure from traditional consumption patterns. This shift underscores the need for McDonald's to reassess its pricing strategy and value proposition in the face of changing market dynamics.

Impact of Middle East Conflict:

The ongoing conflict in the Middle East has cast a shadow over McDonald's international sales, particularly in regions where geopolitical tensions are high. With CFO Ian Borden's warning of a sequential decline in international sales, the company faces headwinds in key markets such as China, where economic sluggishness compounds the challenges posed by geopolitical unrest. Western brands like McDonald's find themselves embroiled in controversy, facing protests and boycott campaigns over perceived political affiliations, further exacerbating the situation.

Franchise Disputes and Public Relations Challenges:

McDonald's recent controversies, including backlash from franchises in Muslim-majority countries and legal disputes in Malaysia, highlight the complexities of operating a global brand in a politically charged environment. The company's acquisition of its Israeli franchise and legal actions against boycott movements underscore its efforts to manage reputational risks and safeguard its business interests. However, navigating geopolitical sensitivities while maintaining a consistent brand image remains a delicate balancing act for McDonald's.

Looking Ahead:

As McDonald's grapples with the fallout from missed profit estimates and geopolitical tensions, the road ahead remains uncertain. The company must adapt to evolving consumer preferences, mitigate geopolitical risks, and navigate public relations challenges to regain its footing in the global market. Strategic adjustments in pricing, marketing, and corporate governance will be crucial as McDonald's seeks to restore investor confidence and sustain long-term growth.

Technical Outlook

Despite the miss in profit estimates, McDonald's stock ( NYSE:MCD ) is up 1.02% trading with a moderate Relative Strength Index (RSI) of 53.12.

MCDONALDS $MCD | MCDONALDS RANGE BEFORE EARNINGS - Apr. 15, 2024MCDONALDS NYSE:MCD | MCDONALDS RANGE BEFORE EARNINGS - Apr. 15, 2024

BUY/LONG ZONE (GREEN): $270.00 - $276.50

DO NOT TRADE/DNT ZONE (WHITE): $266.00 - $270.00

SELL/SHORT ZONE (RED): $259.00 - $266.00

Weekly: Bearish

Daily: Bearish

4H: Bearish

I wanted to create a post for the initial bullish trend breakdown and the first range, but decided to wait until we got closer to the earnings release. The earnings report for NYSE:MCD is on Apr 30th and I am looking to take advantage of volatile price movement, either up or down. Bulls should seek a breakout above level 270.00 and bears should seek a breakdown below level 266.00. Previous trends, structure, momentum, and ranges are all labeled.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

EDUCATIONAL/ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technical indicators, support and resistance, mcdonalds, mcd, mcdonaldsstock mcdstock, mcdonaldslong, mcdlong, mcdonaldsshort, mcdshort, mcdcall, mcdput, mcdonaldstrend, mcdonaldstrade, mcdonaldsidea, mcdonaldsearnings, earningsreport, earningsrelease, mcdonaldsprice, mcdonaldsrange, mcdonaldschart, mcdonaldspatterns,

McDonald's stock presents a small level double top shape!McDonald's stock presents a small level double top shape!

This figure shows the weekly candle chart of McDonald's stock from the end of 2019 to the present. The graph overlays the low point of 2020 against the golden section. As shown in the figure, the high points of the past two months have been suppressed by the 2.618 position of the golden section in the figure, and the low point in early June has just stepped back on the 2.382 position of the golden section in the figure! So, in the future, we can use these two positions (280-299) as the key ranges for McDonald's stocks, with a fluctuating approach within the range and a unilateral breakthrough approach outside the range!

McDonald’s: Dig In! 🍴🐻After a long period of bullish appetite, the bears should dig in now. McDonald’s has thoroughly tapped the magenta-colored zone between $291.18 and $287.84 and also touched at the green zone between $294.18 and $290.10, completing wave in magenta as well as wave B in turquoise. Now, the share should drop out of the zone-compound in magenta and green and fall back below the mark at $282.43. Thus, the stock should gain enough downwards momentum to make it below the support at $259.51, where it should finish wave C in turquoise and wave (2) in magenta before turning upwards again. There is a 35% chance, though, for McDonald’s to continue climbing, leaving the green zone on the northern side. In that case, we would consider wave alt.(2) in magenta to be already finished.

MCDonalds Analysis + Trade Setup

In my opinion, this is one of the best sales deals on the current market.

In the monthly chart, this stock has a 5-wave trend, which is currently the end of wave 3 and we are at the starting point of wave 4. This wave will be in the form of A B C and it will be a big and rapid wave. The reason for its rapidity is the end of a 5-wave in the weekly time frame and a 5-wave in the daily time frame.

It is worth noting that wave A will start with a high initial acceleration and then take an oscillatory form with large fluctuations

Note: If you buy a transaction at this price, please be patient and focus more on your psychology so that you don't exit the market when emotional fluctuations start and save your profit completely.

Be successful and profitable.

3 Amazing Lessons I learnt from McDonaldsI love McDonalds.

There was a time where I was ranking different burgers from around the world. UK, France, South Africa, Dubai, America, Switzerland and Greece.

And I only ranked about 4 burgers an 8 out of 10.

I know you’re going to hate but…

McDonalds Big Mc remains one of them I ranked 8 out of 10 – Delicious!.

Anyway, so I love the burger, I love the story – if you’ve seen “The Founder” movie.

And I love the lessons learned from the success story.

And since 2013, I always enjoy writing articles on how other companies, entities and even individuals can teach you indirectly about trading.

McDonalds is the one in the spot light for today!

3 lessons I learnt from McDonalds!

The fast-food giant has been able to achieve massive success by keeping things simple, sticking to a proven system, and adapting to changes in the market. These same principles can be applied to trading the financial

Lesson #1: Less is more…

The company has built its success on a relatively small menu of simple, easy-to-understand options. Also the way to make the meals are so simple with easy ingredients you probably have at home.

Well, traders can achieve better results by focusing on:

• Small number of markets or securities

• One or two systems

• One or two time frames

• One to three money management rules

• Less time trading and more time holding

Lesson #2: Find a System to Repeat

The company has built a highly efficient and repeatable system for making and delivering food.

Remember the scene in the movie “The Founder” where Ray Croc organised his system within a tennis court until mastered?

It’s simple, it works – and it’s never died out.

This has allowed them to replicate their success across thousands of locations worldwide.

With trading, you should also look for a system that you can repeat and stick with it.

I mean, by now my MATI Trader System – must feel like child’s play to you because of how I have taught you the system in and out. And I have shared with you hundreds of trade line ups already with Trading View.

And with you seeing it the system everyday, it must feel second nature for spotting a trade by now right?

Well, just like Rocket Science isn’t rocket science to a rocket scientist – That’s why you feel that way about my MATI Trader System…

And if you have a system that you swear by, you’ll feel the same way I do.

This can help you to avoid the pitfall of constantly switching strategies and missing out on long-term gains.

Lesson #3: Adapt to Change

McDonald's has also been able to adapt to changes in the market, such as:

• Environment concerns

• Consumer demand for healthier options

• Relevant and trendy toys in Happy Meals

• New neutral colour style restaurant catering to all nations and cultures around the world

• More options for vegans and vegetarians

They have and has been able to stay relevant and successful for decades.

Similarly, traders need to be able to adapt to changes in the markets, whether it:

Adding new markets to your watchlist

Adjusting your Risk to Reward during favourable and unfavourable environments

Shifts in economic conditions or changes in consumer preferences.

This might mean adjusting your trading strategy slightly or seeking out new opportunities in different markets.

You need to be able to adapt to change which is crucial for long-term success in the financial markets.

And so, McDonald's has been successful by keeping things simple, sticking to a repeatable system, and adapting to change.

Apply these principles to your own trading and you’ll find trading to be a walk in the park in the medium to long run…

Do you like McDonalds and what would you rate the Big Mc? I won’t judge.

Trade well, live free.

Timon

MATI Trader

(Financial trader since 2003)

MCD to close all 850 locations inside RussiaIf you haven`t sold the forming of the Head and Shoulders bearish Chart Pattern:

Then you should know that McDonald’s owns around 84% of its 847 restaurants in Russia, which accounts for 9% of its total revenues and less than 3% of its operating income globally.

They will continue paying its 62,000 employees in Russia.

Considering the facts above, my buy area is around $212.

Looking forward to read your opinion about it.

MCD Public sentimentI know shorting this is not wise, however MCD public sentiment has been steadily declining despite its still incredible popularity, MCD has been in a HUGE bull run, however in my opinion we will see the rise of healthier alternatives and more traditional fast food chains, (Subway, Pizza restaurants)

Mcdonald's Corp bullish continuationAs per the Chart

Abbreviations;

ND=No demand

NS= No supply

DW= Demand Wave

RFSB= Resistance from Supply Bar

SFDB support from Demand Bar

SLK= Stop Loss killer

SLKB= Stop Loss Killer Bottom

DB= Demand Bar

SB= Supply Bar

EVRB= effort vs Result Bottom

My Mentors and Inspiration

Volume Analysis - Oleg Alexandrov

Money and risk Management - Dmitriy Lavrov

Mcdonalds to the bottom !Hello, Traders!

Monfex is at your service and today we overview MCDONALDS Corporation.

Mcdonalds fired their CEO, with which the company's capitalization doubled.

The first downward movement was in early September, at the same time as the "The Game Changers" popular film about vegetarianism was released. Perhaps this is connected, but not exactly.

This year, the United Nations called on people to eat less meat.

Generally, the news background is negative for MCD.

Also at this chart we see Elliott Waves (12345-abc) and how MCD in an uptrend movement so long. But recently, it broke the support line of the ascending channel and wedge.

The local resistance zone ~ $200

The local support zone ~ $190

Target zone ~ $160

Market Cap

$145.941B

Share your thoughts, ideas about the market under the chart.

Watch for our Updates to be the first who gets well-timed signals !

GOOD LUCK AND LOTS OF PROFITS !!

Disclaimer

This report is for information purposes only and should not be considered a solicitation to buy or sell any trading assets. Monfex accepts no responsibility for any consequences resulting from the use of this material. Any person acting on this trade idea does so entirely at their own risk.

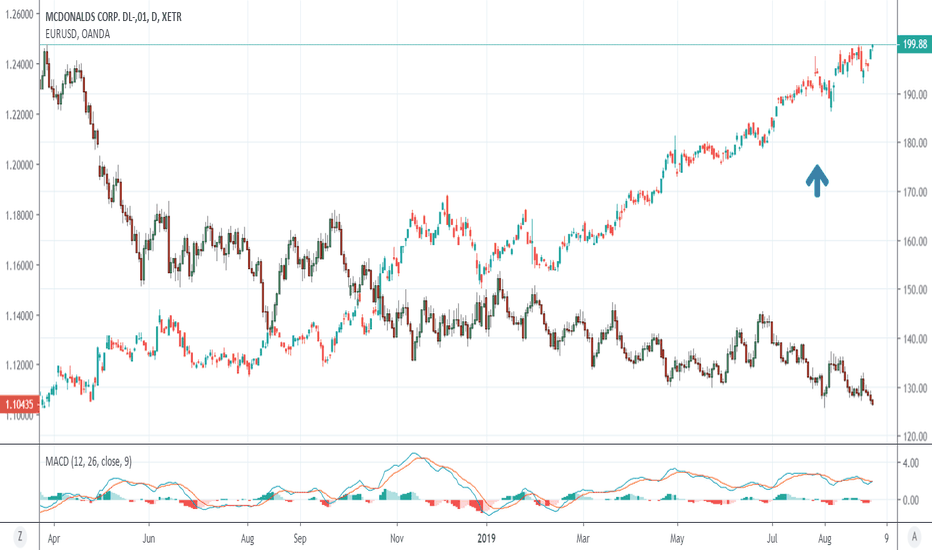

Analysis on MCDONALDS 30.08.2019The price above 200 MA, indicating a growing trend.

The MACD histogram is above the zero lines.

The oscillator Force Index is above the zero lines.

If the level of resistance is broken, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Long Position

• Entry Level: Long Position 222.00

• Take Profit Level: 225.00 (300 pips)

If the price rebound from resistance level, you should follow the recommendations below:

• Timeframe: H4

• Recommendation: Short Position

• Entry Level: Short Position 219.00

• Take Profit Level: 218.00 (100 pips)

USDJPY

A possible long position at the breakout of the level 116.70

EURUSD

A possible short position in the breakdown of the level 1.1030

USDCHF

A possible long position at the breakout of the level 0.9900

GBPUSD

A possible short position in the breakdown of the level 1.2150

Mcdonalds Short? Hey everyone, this is my first post and im still fairly new (2-3 months in) but heres my two cents.

As you can see, mcdonalds is quite a slow mover, however; I also believe that because of the apparent double top/ shoulder forming, we could potentially see a peak as high as the area I have shadowed (at best case for bulls, a third retest of the resistance to form a triple top). The technical analysis, along with an overall slowing-down of popularity amongst fast-food, shows if this move plays through mcdonalds could easily fall to the previous support as indicated.

Let me know what you think.