Mcxgold

Sideways between 2000 and 1900 levelsNotes

1. 1941 stands in good support level. Breaks below that may catch 1910 and 1900 levels.

2.Gold seems easily won't go down because of global economic pressures.

3. We can wait for the breaking news for further decisions.

4. Indian traders please close your position within a day either profit or loss to avoid opening bell losses for the next day.

GOLD LONG-TERM TREND ANALYSIS, TIPS, & CHARTAs per the chart above, gold is trying to take a U-Turn. It can slip for 47460 – 46760 – 46260 levels.

As per the S-RSI, it will start running upside soon for the dynamic resistance level of 53900. Hence, targets: 49560 – 50000 – 52000 – 53000+

Don’t forget to keep your eyes on downtrend level 46260 .

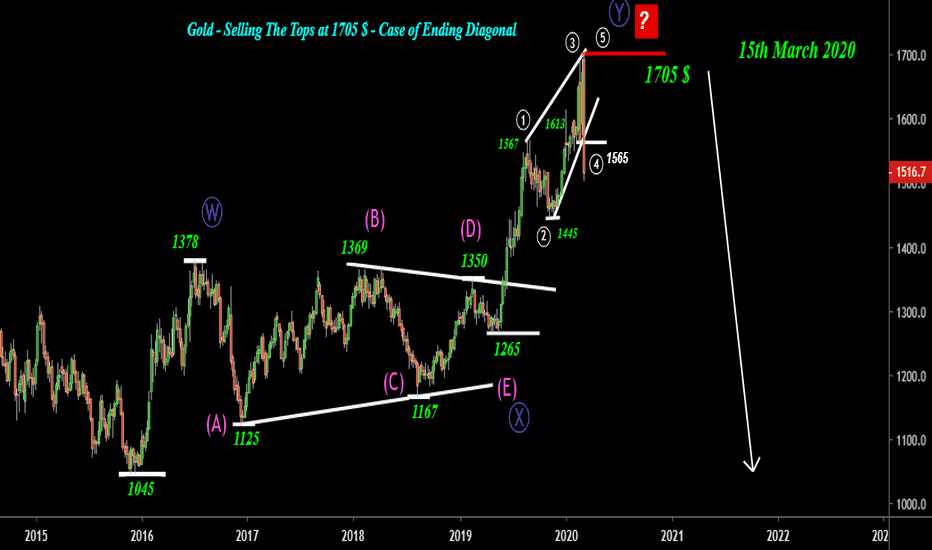

Comex Gold - Selling The Tops at 1705 $-Case of Ending DiagonalDisclaimer

-----------------------------

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Happy to get the clue straight from the yellow metal & to see it unfolding as expected on 7th March 2020 video idea which was published on Indian Version - Nifty / Gold / USDINR - The important Juncture.

Video Idea (Click the Idea Below)

------------------------------

Long Term Outlook

-------------------------------

A possible case of Ending Diagonal which suggest that the rally which started from 1045$ to 1705$ has completed & we look for downside Targets - 1045$ / 900$ / 750$

Short Term Outlook

Wait for some bounce above 1500$ in the zone 1590 - 1625$ zone - If you see the commodity getting rejected in the suggested zone then putting stops above 1635$ could be an opportunity for selling the commodity for

Targets - 1500$ / 1445$

Thanks for watching the video & stay classy till next idea.

What's in Gold Now?Hello Everyone,

So, as per the previous posts, We are on the short side in Gold & now it important to watch that Will the gold give today's closing below $1304 or not. If below $1304 then $1285 will be the next stop.

#stocks #trading #tradingstrategies #equities #technicalanalysis #markets #stockmarket #chart #bloomberg #chat #strategy #shares #lessons #traders #research #training #pattern

Utsav Babbar

Swiss gold referendum - A bear trap ???Gold (01.12.2014) reverse from $1207 mark which we mention as first resistance for bulls. However fall from mention level should taken as correction or profit booking but swiss gold referendum added more fuel & created panic selling.

Now gold is trading around $1275 & we have witness a sharp bounce from recent low $1142 made just after a NO answer from swiss gold referendum. The bounce producing a major among trader that how actually this NO going to react. Here is the most possible answer.

Swiss gold referendum YES would force swiss banks to buy tonnes of gold to increase the gold holding from 8% to 20% but a NO answer is actually not going to change anything for gold normal trading. The panic selling come in first trading session was not supported by volume (see chart), while the NO answer avoided the immediate buying from swiss banks but now it is mandate for central bank to buy gold from open market or off market.

Coming to technical picture, gold made a low of $1142 & now trading above $1169 which represent the 61.8% fibonacci retracement of last upside move till $1207. A stability above this mark with volume & a very positive divergence on day chart suggest that gold already digested swiss result & a technical upside move will continue for coming trading session. A break above $1207 will provide more strength & we may witness a quick move towards $1247.

MCX GOLD traded lower with spot gold however the correction more deeper due to removal of 80:20 rule by indian government & low volume. Still on technical front gold was able sustain above previous low. This particular move forming a double bottom pattern which is well supported by positive divergence as shown in the chart. Channel resistance situated around 26780 & if this is broken we may witness a sharp move 26900 & more.

Swiss gold referendum could prove a big bear trap if above technical picture stay alive.

Best of luck

Note - Above technical analysis is not a buy/sell recommendation. For recommendations Contact Us

Call Us : 088890 34986

Gold broken major resistance Gold(17.11.2014) moved higher in last week on profit booking as well as on challenging fundamental growth of major economy. However branching the strong resistance zone with volume could change long term scenario.

Now gold is trading around $1187 & we can see on charts, friday gold rally more than 3% & provided a closing above $1182-1172 resistance which where able to stop gold momentum many times. Technically after breaking $1180 mark gold made a low of $1131 while unable to close below $1138 mark which represent the 161.8% Fibonacci retracement level. This area was very close to the lower trendline of current descending channel too. An elliott wave bearish pattern completion also suggest for 3 corrective wave pattern ahead.

On fundamental side, upcoming swiss bank referendum on 30th nov could play major role for gold price. A voting result in favor of swiss referendum will force swiss banks to buy big quantity of gold which will never come back in market for liquidation.

Based on above studies , there is a major probability that gold will provide a corrective move towards support zone & then move upside for possible targets around $1207 & then $1225 atleast. A day close below $1272 will delay the forecast.

Note - Above technical analysis is not a buy/sell recommendation. For recommendations Contact Us

Call Us : 088890 34986

MCX levels -> S2(26160) S1(26300) cmp(26425) R1(26650) R2(27000)

www.mantracommodity.blogspot.in