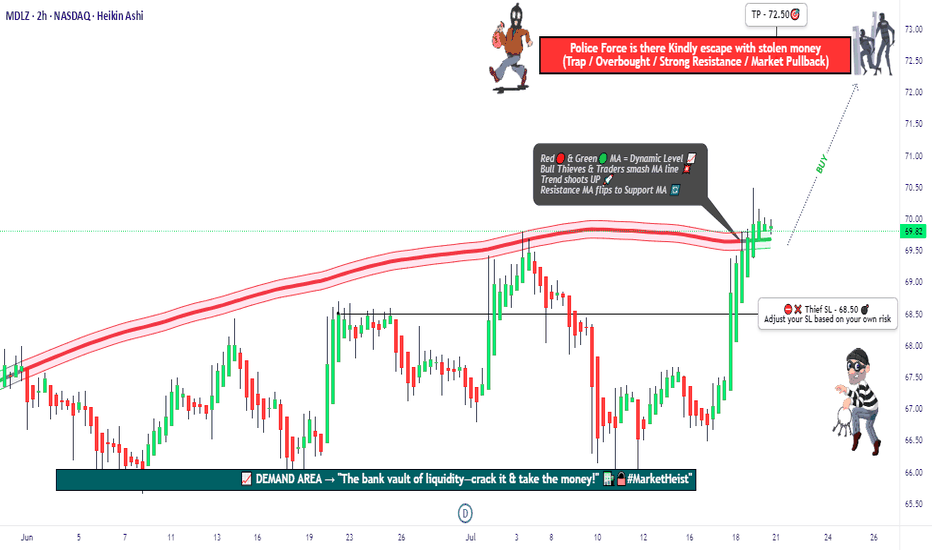

"MDLZ Heist LIVE! Quick Profit Grab Before Reversal!"🚨 MONDELEZ HEIST ALERT: Bullish Loot Zone! (Swing/Day Trade Plan) 🚨

Thief Trading Strategy | High-Risk, High-Reward Play

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba!

To all Money Makers & Strategic Robbers 🤑💸—this is your blueprint to plunder "MONDELEZ INTERNATIONAL, INC" with precision.

🔎 THIEF TRADING ANALYSIS (Technical + Fundamental)

The Vault is Open! Bullish momentum detected, but caution—this is a high-risk police barricade zone (resistance level).

Overbought? Consolidation? Reversal? Yes. Bears lurk here, but we’re stealing profits before the trap snaps.

🎯 Target: 72.50 (or escape earlier if momentum fades).

🚨 Scalpers: Long-only! Use trailing stops to protect gains.

📈 ENTRY: How to Swipe the Loot

"Buy the Dip" Strategy: Optimal entries on pullbacks (15m/30m timeframe).

DCA/Layering Tactics: Spread limit orders for better risk control.

Aggressive Robbers: Enter now. Patient Thieves: Wait for retests.

🛑 STOP LOSS: Survival Rules

SL at 68.50 (nearest swing low wick on 2H chart).

Adjust based on risk/lot size—protect your capital!

⚡ CRITICAL ALERTS

📰 News Volatility: Avoid new trades during major releases. Lock profits with trailing stops!

📊 Fundamental Drivers: Check COT reports, macro trends, and sector sentiment Klick the 🔗.

⚠️ Reminder: This is NOT financial advice. DYOR and manage risk!

💥 BOOST THE HEIST!

Like 👍 + Boost 🔄 to fuel our next market robbery plan. Together, we trade smarter, steal bigger, and profit faster!

🚀 Stay tuned—more heists coming soon! 🤑🔥

MDLZ

MDLZ - Bullish Flag patternBullish Flag pattern

The Bull Flag pattern forecasts in the near future. Currently, it's just early planning with small profits and a reminder to set a stop loss if the pattern cannot breakout upwards.

Both the M50 and MACD indicators suggest the potential for price increase.

The volume is still low so it cannot break out yet.

The price now (Closed on 05.23.2025): $66.14

Price target: $70.11/ $74.64/ $84.60.

Stop loss: $63.43

IMO, amateur trader.

Mondelez at the Edge: Can Bulls Hold the Line?A Pivotal Moment for Mondelez – Will the Bulls Step Up?

Mondelez International (NASDAQ: MDLZ) is trading at $58.05, clawing back some ground but still down 26.1% from its all-time high of $78.59. The stock has been oscillating near a critical resistance level at $58.40, testing the patience of both bulls and bears. Technical indicators suggest a market at a crossroads: the 50-day MA sits at $57.63, while the RSI hovers at 52.97, keeping the stock in neutral momentum. Meanwhile, Money Flow Index (MFI) remains weak at 38.09, signaling a lack of strong accumulation.

Adding to the tension, the last few sessions have flashed sell-heavy VSA patterns, with a significant increase in selling volume on January 31st. This raises an important question: Is Mondelez on the brink of a breakdown, or will buyers defend the $57 zone and push for a breakout above $58.40?

The answer may come from broader market forces. Inflation remains a key macro factor, and any shifts in consumer sentiment could dictate the next leg for Mondelez. Traders should watch for confirmation: if bulls fail to reclaim ground above $58.40, the path downward toward $56.50 support may accelerate. But if the stock finds strength, a breakout could set sights on the next resistance near $59.86 and beyond.

One thing is certain—this is a defining moment for MDLZ. Are you ready for what’s next?

MDLZ Roadmap: Tracing the Footsteps of Market Makers

Mondelez (NASDAQ: MDLZ) has been dancing on the edge of key price levels, with a series of Volume Spread Analysis (VSA) patterns defining its trajectory. The past few sessions reveal a battle between buyers and sellers, but the roadmap is becoming clearer. Let’s break it down.

January 27 – Sell Volumes Max: This pattern signaled an aggressive sell-off, closing at $58.37 from an opening of $58.595. Given the magnitude of the sell pressure, it was crucial to watch the next sessions for validation.

January 28 – Buy Volumes Max: A reversal attempt came in with increased buy volumes, pushing the stock up to $56.88 from a low of $56.68. This bounce hinted at possible accumulation, but the lack of follow-through kept the market on edge.

January 29 – Sell Volumes: Sellers regained control, pushing MDLZ to $57.13, marking another bearish shift. This played into the broader downtrend, reinforcing that buyers weren’t ready to step in just yet.

January 30 – VSA Sell Patterns Dominate: The day saw a series of manipulation-based sell patterns, with MDLZ closing at $57.695. These patterns typically indicate smart money positioning for further downside.

January 31 – Sell Volumes Max Returns: Another spike in sell volumes appeared, reinforcing the previous direction and closing at $58.00. This was a strong confirmation that the previous bearish signals were working.

Key Takeaways: The main direction has remained bearish, and each sell-based VSA pattern has been validated by subsequent price action. Bulls attempted a fightback on January 28, but weak follow-through suggested it was merely a liquidity grab. Until we see a buy pattern confirming with sustained upward movement, the path of least resistance remains downward.

MDLZ traders should keep an eye on support zones near $56.50, as breaking this could trigger further downside momentum. Will buyers finally step in, or are we looking at another leg lower? Stay tuned.

Technical & Price Action Analysis: Key Levels to Watch

Mondelez (NASDAQ: MDLZ) is moving in a tight range, and key levels are setting up for potential breakout or breakdown plays. Whether you’re scalping the swings or positioning for a bigger move, here’s what matters right now.

Support Levels: If buyers want to step up, they’ll need to hold $56.51 and $55.72—otherwise, expect them to flip into resistance, making the path even harder for bulls.

Resistance Levels: The first roadblock for upside sits at $58.40, followed by $59.86 and $60.71. If these levels don’t hold sellers back, expect them to become the next battle zone for bulls trying to break through.

Powerful Support Levels: The real lifeline sits way higher at $65.27 and $69.65—far from current prices, but if the stock ever reclaims these zones, the trend structure could shift bullish again.

Powerful Resistance Levels: The ultimate ceiling remains $75.68, but let’s be real—MDLZ has a long way to go before challenging that zone again.

If support fails, those same levels will be a brick wall on the next bounce attempt. Traders should be watching price reactions closely—levels don’t break without a fight, and smart money is always one step ahead.

Trading Strategies Based on Rays: Optimistic & Pessimistic Scenarios

The "Rays from the Beginning of Movement" method provides a dynamic approach to market structure, using Fibonacci-based rays to map out price movements. Unlike static support and resistance, these rays adapt in real time, helping traders react to the market instead of predicting exact levels.

Each price interaction with a ray indicates one of two scenarios:

Reversal – A bounce off a ray signals a potential turn in trend.

Continuation – A breakout or clean movement along the ray suggests an extension toward the next key zone.

Trade entries are only valid after price interacts with a ray and confirms movement in the expected direction. The first ray hit acts as the initial target, with subsequent rays marking extended take-profit levels.

Optimistic Scenario: Bulls Take Control

If price holds $58.40 resistance and breaks above, we look toward $59.86 as the next target.

If momentum continues, $60.71 becomes the secondary take-profit zone.

If buyers manage to push beyond $66.07, we could see a structural shift towards the powerful resistance zone at $69.22.

Pessimistic Scenario: Bears Regain Control

A rejection at $58.40 or a break below $56.51 signals downside pressure.

If sellers dominate, the next key level is $55.72.

A further breakdown could push MDLZ toward the $54.72 absolute low, a must-hold zone for bulls.

Dynamic Moving Averages as Confirmation

Moving averages (MAs) will play a key role in defining momentum:

50 MA at $57.63 – A flip above this level supports bullish continuation.

100 MA at $57.45 – A break below signals a short-term bearish trend shift.

200 MA at $57.33 – The ultimate line in the sand; a loss here opens the door for deeper declines.

Potential Trade Setups Based on Ray Interactions

Long on Break Above $58.40 → Target $59.86, Stop Below $58.00

Short on Rejection from $58.40 → Target $56.51, Stop Above $58.70

Long on Bounce from $56.51 → Target $58.40, Stop Below $56.00

Short on Breakdown Below $56.51 → Target $55.72, Stop Above $56.80

As always, these setups work in confluence with the VSA rays already mapped out. Each move from ray to ray defines a structured trade, and positioning should only occur after confirmation of movement.

Let’s Talk: Your Thoughts & Custom Analysis Requests

Trading is all about levels and reactions, and now it’s your turn—drop your questions in the comments! Let’s discuss how MDLZ moves next, and whether the price will respect these mapped-out levels.

Hit Boost and save this idea so you can check back later—watch how the market moves exactly along the rays. That’s the key to profitable trading: knowing where price action matters before it happens.

By the way, my private indicator automatically plots all rays and key levels, but it’s only available in Private Access. If you’re interested in using it—send me a message.

Need an analysis for a different asset? No problem! I can chart any market—some setups I post for free, while others we can arrange privately. If you have a specific request, let me know in the comments and hit Boost—I’ll do my best to include it in upcoming ideas.

And of course, follow me here on TradingView so you don’t miss future updates. Let’s trade smart! 🚀

MDLZ Potential Buy setupReasons for bullish bias:

- Price is making new Highs

- Price is near all time high, hence Buy stop order above it

- SL will be updated to new HL once the order gets triggered

- TP will be set accordingly using Fib extension

Entry Level (Buy stop): 77.68

Stop Loss Level: 68.63

Last cycle of Mondelez International ( Neowave Forecast)Hi Everyone

This another trading form US Stocks, This is an medium term forecast of Mondelez International. Currently its medium term bullish cycle is just started but it is the last leg. Therefore do not hold, wait or average if invalidation level is broke.

Thank You

Seeing a possible blow off on Mondelez. MDLZMondelez is in an upgoing zigzag. Just confirmed through passing the most recent high. I like to draw channels to guide my Fib projections and other things, never mind in this case that we are overbought - every single is situational. That is why trading is more than a science, but an artform.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

The Flag Pattern is 100% ready on MDLZ Today, we will speak about Mondelez International. Let's check what we can see on the chart:

a) The major structure is an ascending channel, where the price is about to make content with. There we expect a bullish reaction

b) Currently, we can observe a flat pattern that is 100% ready. From a technical perspective, flat patterns are continuation structures which means that after the confirmation breakout, we tend to observe movements in the same direction as the previous impulse.

c) Based on this context, we have defined an activation level (green horizontal line). The idea here is: IF the price reaches the activation level, we will expect a bullish movement towards the Fibo Targets. The maximum target is the higher trendline of the expanding channel

d) If the price keeps falling and breaks the ascending channel, we will cancel our view. Also, if the price reaches the activation level, we will define an invalidation level below the flag pattern.

e) The expected duration of the bullish movement is between 150 and 200 days

f) Another important element is the confluence between the ascending channel and the support/resistance level where we expect the Flag Pattern to be finished and not surpass that area (otherwise, we will consider that the pattern has failed)

Thanks for reading!

How we will trade MDLZ. Full explanationToday we will speak about Mondelez International.

Let´s see the conclusions we can make on the chart:

a) The price is inside an ascending channel

b) Currently, the price is close to a key support/resistance level which makes convergences with the ascending channel

c) That's a key level we want to observe contact. That would mean for us that the current Flag Pattern is perfect

d) If that happens, we want to observe a bounce. The green horizontal line represents our activation level, where we think it's a confirmation of the bullish movement. The main target we will use is the 2nd fibo extension level which is the same as the higher trendline of the expanding channel.

e) the First level of the fibo extension in our experience is a good place to move the stop to the entry-level if reached. (risk-free situation)

f) The risk we will take on this setup is 1% of our trading account on the stop loss area.

g) This movement can take between 150 - 200 days.

Our Stock of the Day / MDLZToday, we have a short setup to share. Here is a full explanation

a) The price has found resistance on the All-time highs zone

b) After reaching the zone, we saw a breakout of the ascending trendline

c) Now, we have a clear corrective structure (ABC pattern), which is considered a bearish pattern

d) Our Entry Stop and Take profit are the ones you can see on the chart / Break Even level is the horizontal yellow line

e) The risk Reward Ratio of this trade is 1.7 / We will risk 1% of our capital on this setup

f) Remember: Trade safe, protect your capital, and always understand what you are doing.

MDLZ Daily Gartley Pattern and 40 fig support combinationMDLZ has a daily Gartley Pattern, and 40 figure showed great support for over a year,

it may give a potential long opportunity;

I got to wait for reversal sign in smaller time frame to get in the long position, if it breaks 40.00 before any reversal sign, this trade doesn't exist anymore.

* Educational use only.

MDLZ - Breakdown trade from $40.37 to $32 area MDLZ seems forming a declining neck head & shoulder formation. It is also running within a channel formation. Technically it looks weak & it had recent insider selling. We think it will decline to 32 area shortly.

Trade Criteria

Entry Target Criteria- break of $40.37

Exit Target Criteria- Target 1- $36.43; Target 2- $32.23

Stop Loss Criteria- $42.23

Indicator Notes- Negative Twiggs Moneyflow

Option- $42 Feb-17 Puts

You can check our detailed analysis on MDLZ in the trading room/ Executive summary link here-

www.youtube.com

Time Span- 3:00"

Trade Status: Pending

A quick up...and then drop for MDLZ?Historically when the coppock curve reaches this level the stock moves up an average of 4.93%. While I am tracking another indicator pointing down, both can happen. My conservative call is a move around the top of the wedge/trendline (white) and then a possible drop. A well placed call could fetch around 15-20% in a matter of days.