AMZN Struggles at Trend-Barrier and ResistancePrice is still in upward mode.

Why am I bearish?

1. Rejection in the Resistance Zone

2. Second Hagopian

3. Close below the Red Forks 1/4 Line

PTG1 is the Center-Line.

Potential further PTG's below at the 1/4 Line and then of course the L-MLH.

Playing it with Options which give me much more leeway. For a hard Stop I would put it right behind the last high above the TB.

Medianline

DX - USD Index Longterm Outlook Indicates Further DeclineThis long-term chart shows how the USD Index is trading within the boundaries of the Median Line set.

We see the lower extreme, solid support around the Center Line, and the upper extreme acting as resistance.

What’s next?

Well—if it’s not heading higher, it’s likely heading lower—and the rejection at the Upper Median Line (U-MLH) supports that view.

If we revisit the Center Line, my experience tells me it won’t hold—we’ll break through and head even lower.

Buckle up. It’s going to be a rough ride.

Crude Oil Going Higher - TA and fundamentals aligneThe 0-5 count is not over yet.

Sudo 4 and 5 are still lurking.

It's good to see how the Medianline-Set cought the Highs of the swings. Likewise we can see the subborn rejection at the Center-Line at P3.

I will not trade CL to the short side, until it's clear that P4 is engraved in this Chart. Until then, I maybe shoot for some intraday or dayli trades in Crude.

Economy Facts that support a rise, up to P4:

Crude oil refineries typically switch to producing more gasoline (fuel for cars) in the spring, particularly around March to April in the United States and other northern hemisphere countries.

Seasonal demand: Warmer months mean more driving and vacation travel, increasing gasoline demand.

Regulatory change: Refineries begin producing summer-grade gasoline, which has lower volatility and is required by environmental regulations (especially in the U.S. under EPA rules).

The switch to summer-grade gasoline must be completed by June 1st for retail and May 1st for terminals and pipelines in the U.S.

In Summary:

- Switch begins: March–April

- Completed by: May (terminals), June (retail)

- This seasonal shift is often called the "refinery maintenance season" or "spring blend switch."

GC - Gold digging for a possible ShortAfter reaching WL2, we saw a sharp pullback followed by an immediate double top. Price failed to reach the centerline of the yellow fork, instead stalling at the 1/4 line.

Then came the break of the lower median line (L-MLH), a pullback to the white WL1—then the drop began.

If this market can’t push to new highs, we’ll likely fall back into the median line set. A pullback to the upper median line (U-MLH), as indicated by the red arrows, is a probable scenario.

Next stop: the white centerline.

I trade tiny. I trade with extremely high risk-reward setups. I’m fine getting stopped out all the time —because I’m hunting huge moves.

I don’t chase. No FOMO.

It’s how I sleep well, make money from trading and keep my stress level very low.

DAX Take 1 Part 2 – Reloaded but not yet good to goThe first time, we saw the DAX poke the 1/4 line.

This was followed by several attempts (distribution by the big players), and from that point on, it headed south and the DAX rolled down the hill.

Currently, it looks very similar.

I’m watching and observing the break of the trend barrier very closely, even on smaller timeframes than the daily.

The profit targets are indicated by the red arrows.

After the break of the thick white centerline, a strong retest of the CL could be in store.

My main target would then be the red centerline.

Since the markets are behaving completely irrationally, I’ll need more “breathing room” in the trade and will handle this trade using long-dated LEAP options.

...poor little guy §8-)

S&P 500 – Projection to the SouthLooking at the market's behavior using the orange median line/fork, one can clearly see how the market reacts when it touches one of the lines.

Median lines/forks are not an oracle. They simply project the highest probable path of the price based on a mathematical calculation inherent to the tool.

If you follow the rule set, money management, and risk management, you have a wonderful framework that offers a significant advantage in trading the markets.

Let’s take a look at the current situation:

The orange fork:

– Price closes outside the fork (1)

– Multiple retests of the L-MLH (textbook behavior) (2)

– Break of the 1/4 line, heading toward the 1st warning line (3)

Next movement pattern according to the median line framework:

– Drop to the white centerline (4)

– Retest of the centerline (5)

– 1/4 line (6)

– Lower median line parallel (7) with a possible retest

– Orange centerline of the pendulum fork (8)

Wishing everyone a wonderful start to the week.

S&P500 2022 into the Bear Market. Same Pattern 2025In 2022, before the bear market began, we saw the same pattern that we're seeing now:

1. Sine wave pattern

2. Fake recovery

3. Break above the sine wave top

4. Sharp decline

Last week, right after the sine wave top was broken, U.S. bonds were downgraded AFTER OFFICIAL MARKET SESSION!

It’s no surprise that rating agencies are losing confidence in the U.S. government's ability to repay its debts.

Just look at the rising interest payments — if that’s not a wake-up call, I don’t know what is. 😕

I don’t live in the U.S., but I’m genuinely concerned that a collapse — which now seems nearly inevitable — will impact the entire world.

Going long in U.S. markets under these technical and fundamental conditions? Putting all your eggs back into that basket? Really?

I hope this gives some perspective.

Trade safely, trade small, and keep your risks minimal.

CVNA - Carvana at upper extreme. I'm shorting again!I stand by my posts about CVNA.

It's fishiy and it stinks!

Chart wise, price is at the upper extreme again.

A nice short is setting up, and this time for a much larger move...I think, feel, expect.

"...but, isn't there more to say? You MUST explain WHY and WHEN...", I have people saying.

No, it's not a joke.

I leave it with that §8-)

SPY Broke The Sine-Wave Center - Not GoodWe see the 3 tiny arrows—proof that price was rejected by those who knew.

The Trend Barrier, once solid support, cracked without resistance. Price dropped right back into the Medianline set.

The small pullback? Totally expected—just like the Medianline rules suggest. Then came the brutal drop, textbook-style, straight to the Centerline.

The springboard move back up to the U-MLH and the Trend Barrier? No surprise—if you understand the Medianline Framework. Because this is just P2.

Also—watch the white line. That’s what I call the Sine Wave. Why does it matter? Because the center point (where the red pullback arrow is) often gets breached in a fake move... right before price reverses hard. From P2: down, down, down... lower than P1.

AND THAT SHOULD SCARE THE HELL OUT OF YOU!

…if I’m right 😈

But if it fails?

Then we’re looking at a monstrous V-shape recovery—one that could send the indexes skyrocketing.

So there you have it.

What’s your direction?

Let me know—and tell me why! §8-)

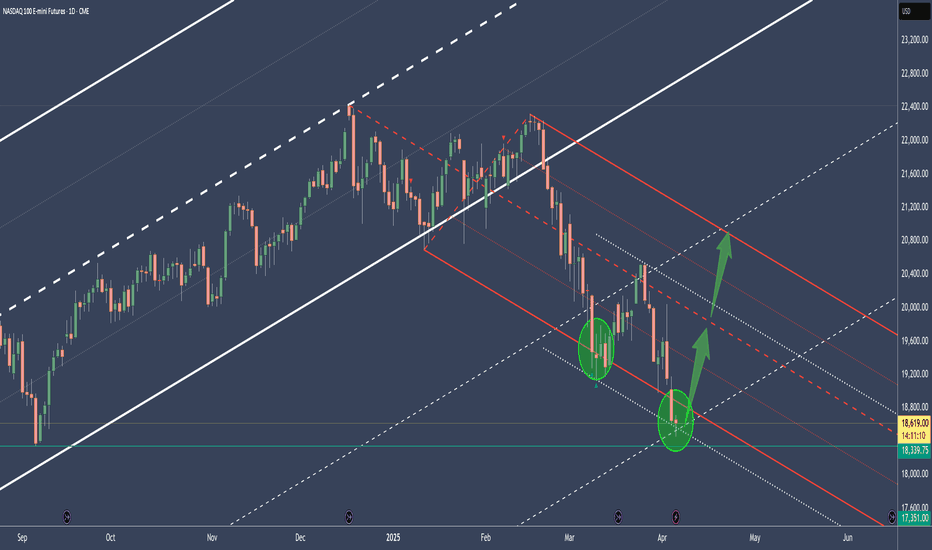

NQ - Nasdaq's potential to reboundThe Median or Centerline:

The Median (Centerline) Line is the central element of the Pitchfork and acts as the equilibrium point. Price tends to oscillate around this line, and it often serves as a strong reference for potential reversals or price targets. A price move back toward the Median Line is common after significant moves away from it.

Pitchfork (Red):

The red Pitchfork, drawn through significant price points, provides the overall trend direction and shows the potential path to the downside. The red line indicates a bearish bias in the current setup, as it has been guiding the price lower.

Green Circles and Arrows:

These represent key areas of support.

The lower green circle and green arrows indicate price has found solid support in this region. The price has been bouncing from this support level, showing that it is reacting to the [ower boundary of the Pitchfork. This behavior aligns with the rule that the price tends to respect these boundaries, creating a foundation for a potential move back toward the Median Line.

Price Action Analysis:

The price recently tested the lower green circle and green arrows, bouncing off this support level, which is a typical reaction in a Pitchfork setup.

According to the Median Line theory , when the price moves too far away from the Median Line, it often returns toward it. Therefore, the bounce off the lower boundary suggests that price may now be setting up for a bullish reversal toward the RED Median Line .

Bottom Line:

The price action is following the general Pitchfork playbook . The bounce from the lower green circle suggests that the price is setting up for a potential bullish reversal toward the RED Median Line .

The next major test will be the upper resistance in the red Pitchfork , after the break of the Centerline. If the price can break through this resistance, a strong move higher is likely.

Keep an eye on this critical point!

ADBE - Adobe at the decision levelIf ADBE is able to jump above the Centerline, it probably will retest it, and then take off to the upside.

If ADBE is not able to crack the CL to the upside, then it's new projection is to the downside.

The natural target is the L-MLH.

But let's not forget the 1/4 lines!

These often act as good support. Specially with a catalyst like good News around the same time, it could bounce from there. So, that's why one of my PTG is always at these 1/4 line levels.

GOLD Reached it's Apex and is ready for a dumpIn my earlier posts I said that Gold has the potential to reach the U-MLH, which has become true.

Up there, the price of Gold is stretched. Yes it can go up even more beyond the Upper-Medianline-Parallel. But the overall numbers of occurrences are small.

So, at this natural stretch, price has a high probability to revert to the mean. And this is supported by the fact, that the overall indexes are heavenly oversold and already showing the signs of a pullback to the North (see my last NQ post).

Why not just watch how it plays out, and make a decision for a trade after the FOMC, or even tomorrow. Don't rush into these unknowing situations. Be patient and wait for clear signs to take action.

Carvana - More Fish To Come? You Bet!After the first post about CVNA, I bailed out on a small loss (see linked Chart). But then Immediately loaded Puts and had a good "Steak & Lobster" time §8-)

Price behaves like textbook when we consult the Medianlines trading framework and rule set.

First price reached the red Centerline, followed by the expected pullback to the white Lower-Medianline-Parallel.

If the "Fish" can't manage to jump back into the white Fork, then I expect much more downside to come. If this is the case, we have two good looking PTG's at PTG1 & PTG2.

To me, this Scam Company (see my first post) is done. It's just a matter of time.

For the longer time frame, I will check out ITM LEAP-Puts and let them profit from the ride to the south.

And for short term trades, I just wait for pullbacks as it did now, and take it short to finance some of my LEAPs, Dinner and Weekend Holidays.

Isn't it nice, how we can find good even in bad? §8-)

May the Fish be with us!

BTCUSD - A fresh look on the current supportIf you understand the mechanics of the Medianlines aka Pitchfork, then you understand the projected movement of the markets.

Whatever you measure with them, the same principal applies.

In the prior analysis, the framework of the Medianlines pointed us in the right direction.

Now it's time to reassess this product.

The 0 to 5 Count:

It's often a good indication when the last sprint happens. After P5, the count starts again from 0, up to 5 again. Here we see that the P5 was reached and we get the bounce, down to the Center-Line aka Medianline, where it finds support.

Could it move upward again? Absolutely, even if it where just for a pullback and the a further continuation to the downside. In fact, I even expect it to bounce up to the red resistance zone.

This would mark P2 before a harder drop down to P3, cracking the Centerline.

Most often after the Centerline is breached, we see a test/retest to it. (P3-P4), an exhaustion of the buyers and then the final hit on the head with a target at P5. In between P4 and P5, there's also the 1/4 line, where we often see a sudo-support. But it's not often that price starts to turn again and negating P5. It's mostly just a try, before the last drop to P5.

So there you have my coffee-ground reading.

Always remember, that even with such an accurate TA-Framework, we only shall trade what we see.

Many thanks to the loyal followers and all likes and sharing. I always love your feedback and constructive criticism. §8-)

ETHUSD Cracked the longterm supportFirst there was the Double-Top.

Then there was no higher close above the last 2 highs, pressing ETHUSD brutally down to fullfill the Medianlines Rule to reach the Center-Line over 80% of times.

Then price not only reached the Center-Line by breaking through the slanted green support, but also cracked through the weekly horizontal Base (grey) which acted as the last support Bastion.

There are two scenarios possible.

a) a pullback, jump above the CL and we will see a moonshot.

or

b) price is retracing the Center-Line as it does most of the time after it's break, and then continues to the downside. Target would be the Lower-Medianline-Parallel.

BTCUSD - Decision Time.As we see, price is at the white L-MLH.

This is a critical level.

On one hand, price showed weakness.

On the other hand, price is stretched to the downside, bearing the possibility to shoot upwards from here.

How can we find out what's happening?

By observation and NOT ACTING!

Just watch, observe, and a good entry Long or Short will uncover. FOMO is your greatest Enemy!

Calm down, wait for the sweet Fruits that will be given to you. §8-)

QQQ - Nasdaq has reached it's firstPrice reached the Warning Line 1.

This is a natural support, because it's a standard deviation stretch. From here, price has a high tendency of mean-reversion.

How far?

Most of the time it shoots back to the Lower-Medianline-Parallel.

Beware of the potential resistnace zone.

This level is a good one to take partial profits.

As for a stop, I would put it below the last swing-long. I may play it with Options (for example a Risk-Reversal), giving me more leeway to the downside if it's not playing out immediately.

Nasdaq Potential Huge BounceI post this again, because from my last post, some only see a confusing picture instead of the chart.

Price nearly reached the L-MLH of the Red Fork.

This is a huge price stretch and chances are super high that we will see a big bounce to the upside.

As for PTG's I focus on the Red, and the Orange Centerline.

DAX - Bullseye! Next Act: The Decline?Whenever the markets are booming, whenever a gardener starts giving stock recommendations, it’s time to brace yourself…

The German Dax has reached it's Centerline.

It's back in Balance - Or has reached it's extreme, depending on how you look at it.

Whenever this happens, we the Market

a) turns and trades in the opposite direction towards the next LIne. In this case the Lower-Medianline-Parallel.

or

b) trades through it, most of the time comes back to it, and continues in the origianl direction, which in this case would be up.

To me, this is the time to watch the DAX more closely. If you are a follower, you now that I have a Bias - which is not always helpful in my trading.

But yes, I tend to lean to the short side. Specially in these over hyped, over invested times.

So I stalk a short, but in the same time be open for a long after a confirmation on the daily time-frame.

Let's see, let's be patient and don't listen to your gardener... 🌱👨🌾 🌿👩🌾

ZINC - Seems it breaks monthly supportThe lanted green support line has a crack.

It's a first indication of a turn in mid-term trend.

Long term Medianline view on ZINC shows that price is battling at the L-MHL. If we get a weekly close and new open below it, it's ripe for a short.

At least I will stalk it on the daily.

PTG1 is the Center-Line.

GC - Golden Rocketship To The U-MLHWe got on the Rocket-Ship earlier and took profit.

If you're still in with a position, or if you can manage to get in with a decent Risk/Reward, you may want to aim for the U-MLH.

The Stars look good and profits are twinkling §8-)

If the 1/4 line is cracked, we will see a follow-through.

SPOT - My Mom Says I Have A short Bias...hmmm...Most of my Charts I analyze are currently showing a short setup. Mom says I'm shorting the whole world.

hmmm...

However, here's another one, just to keep the streak going. §8-)

Spotify is at the U-MLH = At the upper extreme.

The next natural move should be down to the Centerline.

Since I have no magic wand to show me the Future, I lean on my stats and my experience.

Shorting Spotify down to the Centerline or getting stopped out abve the U-MLH.

Simple (...but not easy ;-) )

...have to run, Mom calls for Dinner.

NFLX - NetFlix is overhyped an TA says tooBesides what I think about NFLX (bad for you, poor quality & service, lairs etc.), there is something that can be used to rate and judge a Stocks pricing - The Technical Analysis.

The white Fork projects the most probable path of price. The U-MLH is the upper stretch, the L-MLH the lower and the CL is the Center, where price is in equilibrium.

Where is price now?

It mooned to the upper Warning-Line!

Such moves are insane, crazy, not healthy and produce by manipulation and/or greed that eats Brains.

However - As I follow the rules of the Medianlines (Forks), I know that price is hyper extended up there. So, it can't go further? Of course it could. But Chances are poor that it will.

Instead, Chances are high that price falls down to the U-MLH. At least.

Why?

Besides price is stretched, it failed to move up to the next Warning Line (WL2).

So, there you have it.

I'm shorting NFLX and my target is at least the U-MLH, with further downside potential with PTG2 at the Centerline.