Metals

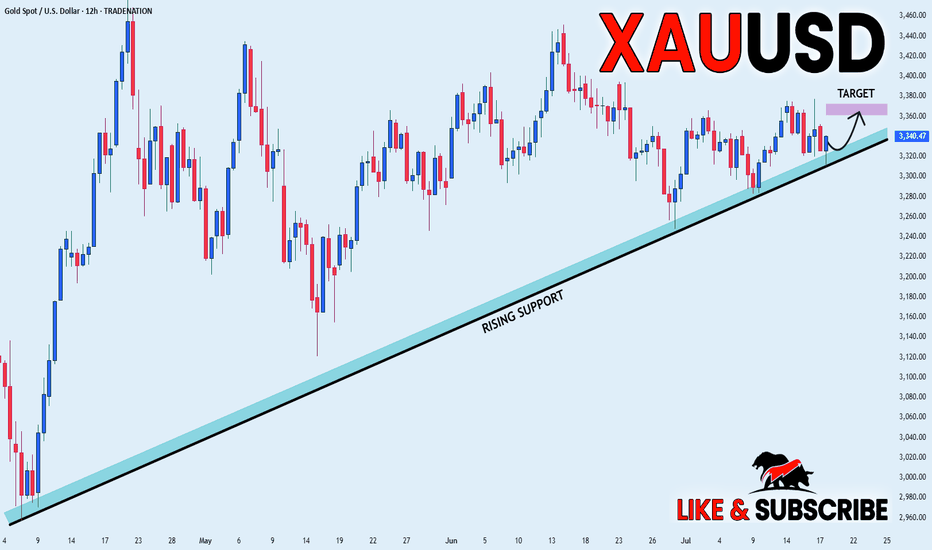

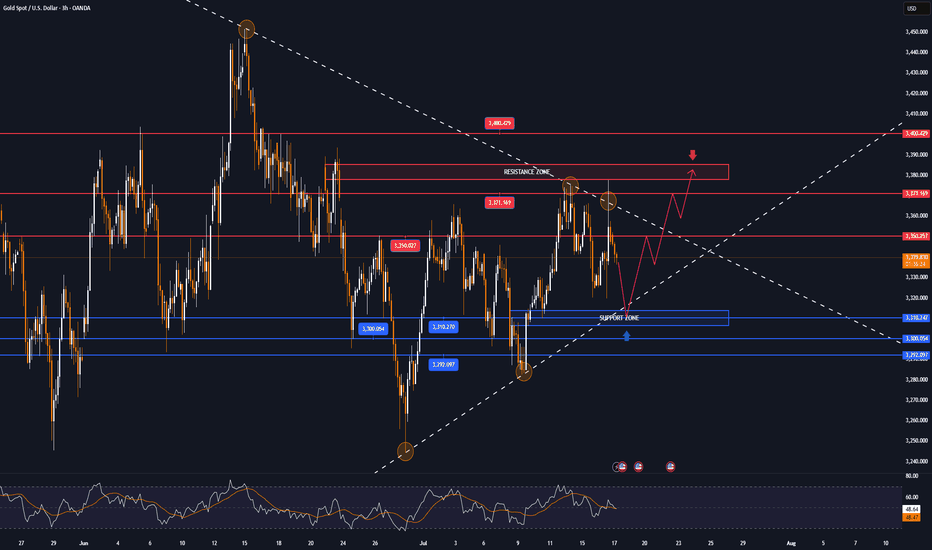

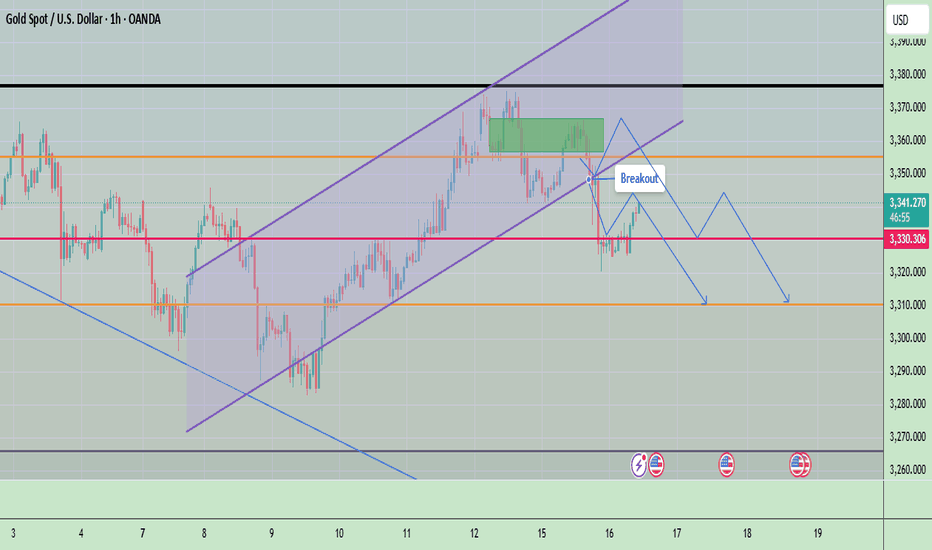

GOLD LONG FROM RISING SUPPORT|

✅GOLD is trading in an uptrend

And the bullish bias is confirmed

By the rebound we are seeing

After the price retested the support

So I think the growth will continue

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

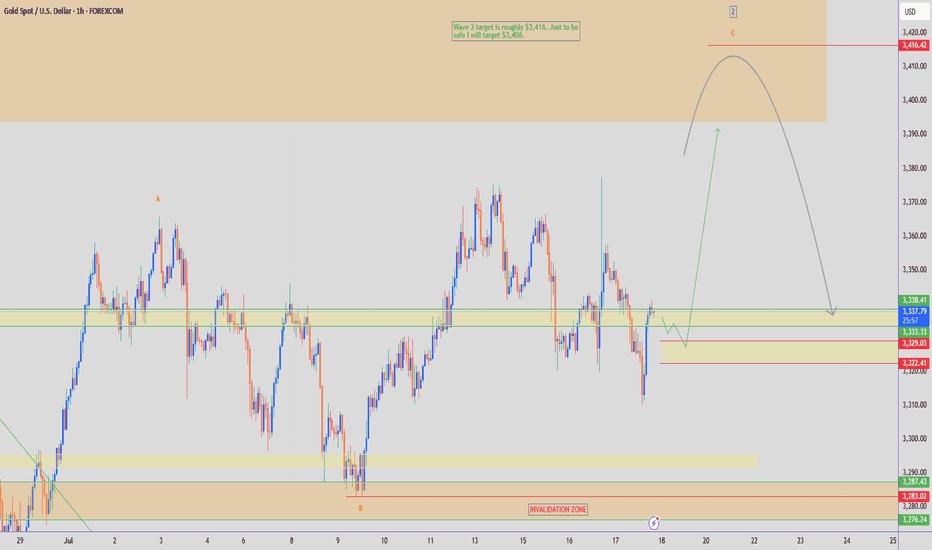

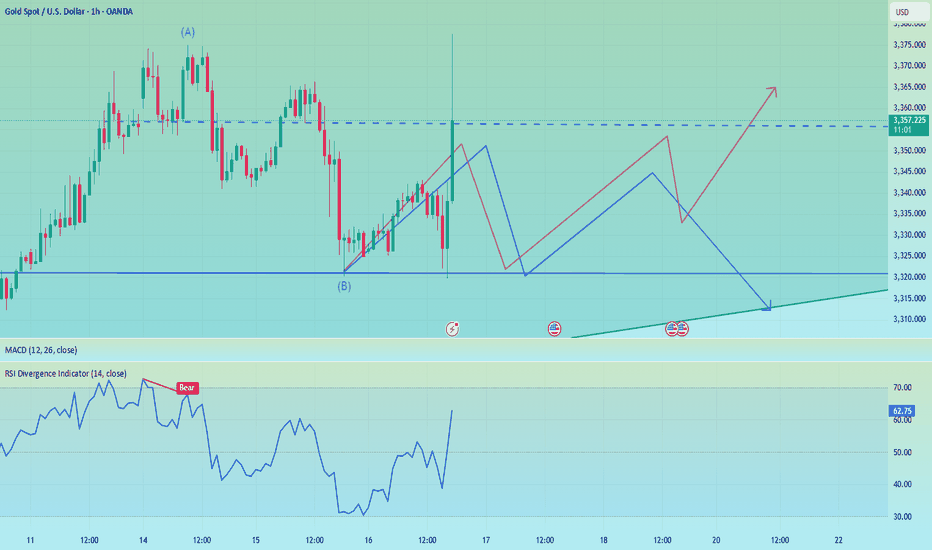

GOLD - Wave 2 Bullish Towards $3,406 (1H UPDATE)I see a possible buy opportunity towards $3,406 on Gold, as part of its bigger Wave 2 correction, before we can consider selling again.

Confluences👇

⭕️Wave 2 Correction Not Complete (2 Sub-Waves So Far).

⭕️Distribution Schematic Forming.

⭕️Early Sellers ($3,377) & Buyers ($3,310) Liquidated In Past 2 Days.

Now we've seen both buyers & sellers liquidated, we can expect to see a cleaner move back towards $3,400 where there is a lot of pending liquidity.

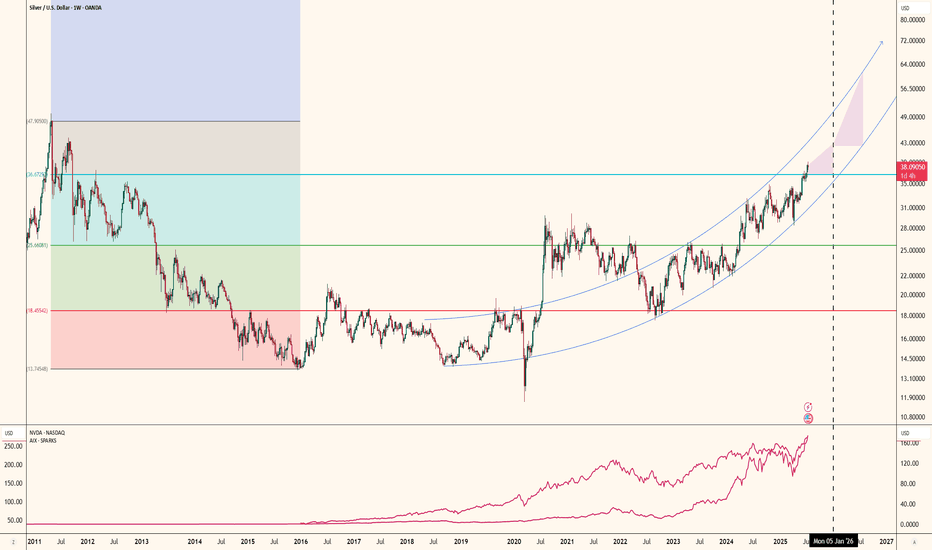

The AI Boom's Unsung HeroThe rise of artificial intelligence isn’t just shaking up tech companies it’s quietly transforming the global silver market in a big way. As major players like NVIDIA, Google and others ramp up their AI infrastructure silver is becoming more critical than ever. Why? Because silver, thanks to its unmatched electrical conductivity, plays a key role in powering the hardware behind AI.

Silver is the most conductive metal on Earth. That makes it perfect for high-performance computing something AI needs a lot of. It’s especially important in data centers and advanced semiconductors, where both electrical and thermal performance are mission-critical.

What’s really interesting is that AI servers tend to use two to three times more silver than traditional data center servers. That’s because AI workloads are more power-hungry, generate more heat and require more complex cooling and electrical systems. Simply put, more AI means more silver.

If there’s one company at the heart of this trend it’s NVIDIA. Analysts at Morgan Stanley expect NVIDIA to consume a staggering 77% of all silicon wafers used for AI accelerators in 2025 up from 51% in 2024. That adds up to around 535,000 300-mm wafers a year each of which contains silver in key components.

All of this AI growth is showing up in the numbers. Industrial silver demand hit an all-time high of 680.5 million ounces in 2024. The electronics industry alone uses around 250 million ounces per year and AI is now the fastest-growing part of that.

Despite all this demand, silver supply just isn’t keeping up. The market’s been in deficit for four straight years, with a total shortfall of 678 million ounces between 2021 and 2024. That’s roughly ten months of global mine output gone missing from the balance sheet.

It’s no surprise, then, that silver prices have been climbing fast. As of July 2025 silver’s up nearly 30% for the year. Looking further ahead I see room for silver to keep climbing:

In the short term (2025): $36–$42 per ounce seems realistic

By 2026: Potential for $50+ as more AI growth stays strong

AI isn’t just changing how we work, communicate, or compute—it’s literally reshaping the commodities that make this technology possible. Silver, once thought of mainly in the context of jewelry or coins, is now a backbone material for the AI revolution.

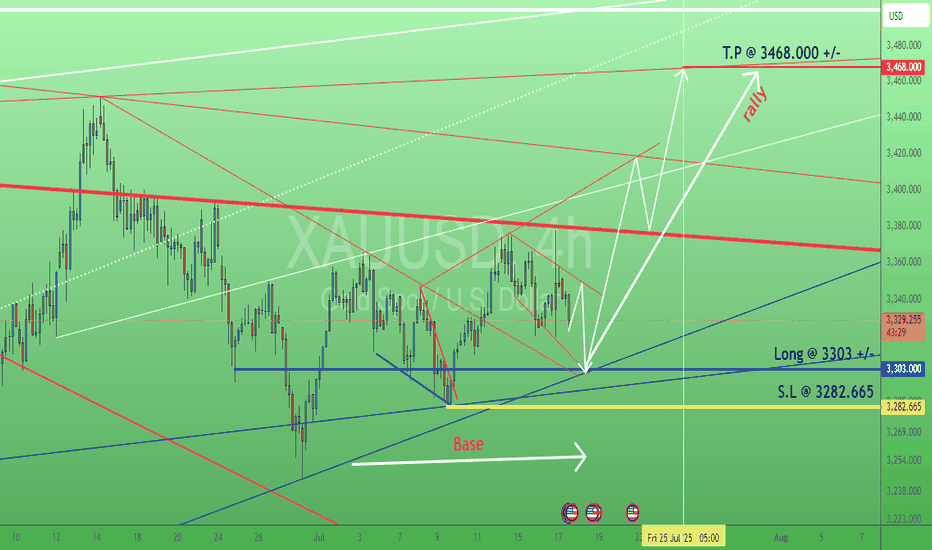

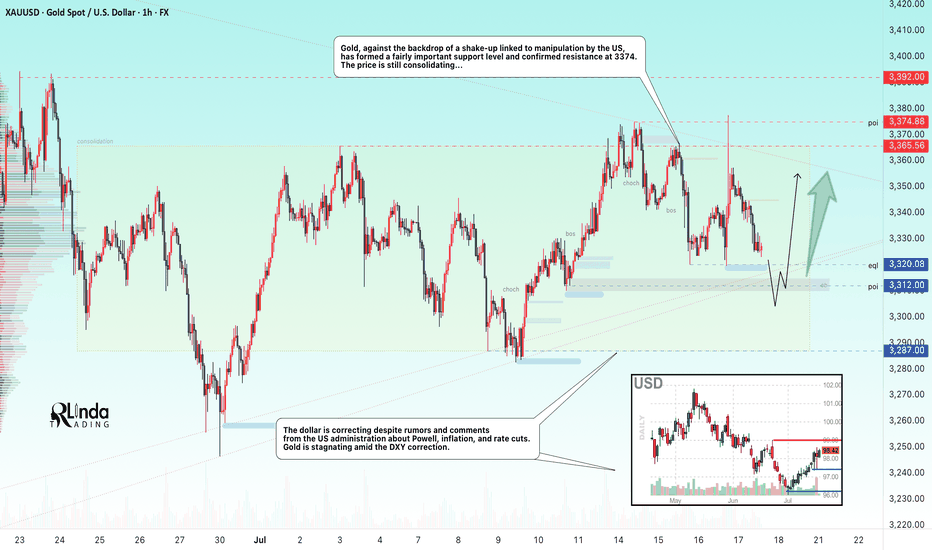

GOLD → The triangle is contracting. Retest of support...FX:XAUUSD tested a local high of 3375 but quickly returned to consolidation. The reason is manipulation by the US administration related to Powell, inflation, and interest rates...

Demand for gold has risen sharply amid global risks: Trump's aggressive tariff plans, strong inflation, and uncertainty about the Fed's actions have increased interest in defensive assets. Despite the temporary strengthening of the dollar, gold remains a popular hedging instrument. Technical analysis also points to a bullish outlook. However, growth potential is limited until the Fed clarifies its interest rate policy

Technically, on the D1 chart, it is clear that the price is consolidating, with the range continuing to narrow. Due to the bullish factors listed above, we can expect growth to continue. However, it is difficult to say where and when the growth will begin due to the uncertainty factor. All attention is on the support at 3320-3312, the triangle support, as well as the consolidation support at 3287.

Resistance levels: 3365, 3375

Support levels: 3320, 3312, 3287

Since the opening of the session, the price has spent part of its daily range, so there may not be enough potential for the decline to continue. A false breakdown of support and consolidation of the price above the key zone may attract buyers, which will trigger growth towards resistance.

Best regards, R. Linda!

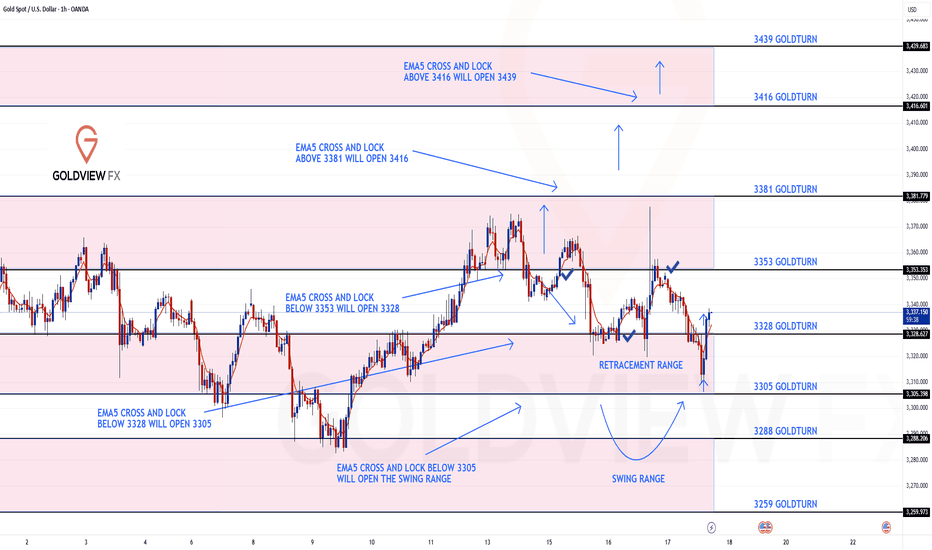

GOLD ROUTE MAP UPDATEHey Everyone,

Quick follow-up on yesterday’s 1H chart update

After hitting 3353, we did not see an EMA5 cross and lock above this level. That lack of confirmation was key and it validated a rejection right at 3353, leading to another drop into the retracement zone.

As per plan, that retracement provided yet another clean bounce, perfectly in line with our dip buying strategy.

We are once again looking toward 3353, and just like before, we will be closely watching for an EMA5 cross and lock confirmation to validate any continuation.

This kind of movement continues to confirm the power of patience, structure, and disciplined execution. No chasing just clean planned executions with high probability setups based on our EMA5 methodology.

We’re also still watching the 3381 gap a key magnet above, and a level we’ve been tracking since the Monday outlook. The roadmap remains unchanged. We’re trading the structure, managing risk, and letting confirmations guide the execution.

Updated Reminder of Key Levels:

BULLISH TARGET

3381

EMA5 CROSS & LOCK ABOVE 3381 opens

3416

EMA5 CROSS & LOCK ABOVE 3416 opens

3439

BEARISH TARGETS

3353 ✅ HIT

EMA5 CROSS & LOCK BELOW 3353 opens

3328 ✅ HIT

EMA5 CROSS & LOCK BELOW 3328 opens

3305

EMA5 CROSS & LOCK BELOW 3305 opens Swing Range:

3288

3259

As always, we’ll continue monitoring and sharing updates, as price reacts around these zones. Thank you all for the continued support, your likes, comments, and follows are genuinely appreciated!

Mr Gold

GoldViewFX

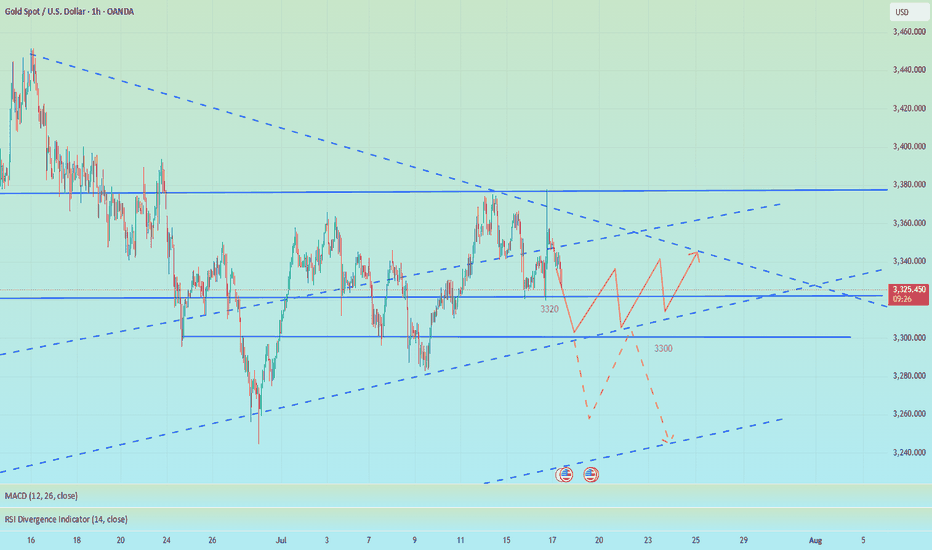

Treat it as a long-short wash-out shock, and go long on pullback📰 News information:

1. Initial jobless claims data

2. June retail data

3. Beware of Trump's remarks about firing Powell

📈 Technical Analysis:

Last night, the daily line closed at around 3347. The current short-term daily line range is 3355-3300. The short-term support below is still 3320. Once it falls below 3320, it will look to 3310-3300. Short-term trading is still volatile. If the intraday retracement reaches 3320-3310, consider going long, and the defense is 3300, with the target at 3340-3350. Under the current rhythm of long and short wash, don't chase the rise and sell the fall, look at it rationally, and brothers who trade independently must bring SL.

🎯 Trading Points:

BUY 3320-3310

TP 3340-3350

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

FXOPEN:XAUUSD OANDA:XAUUSD FX:XAUUSD FOREXCOM:XAUUSD PEPPERSTONE:XAUUSD TVC:GOLD

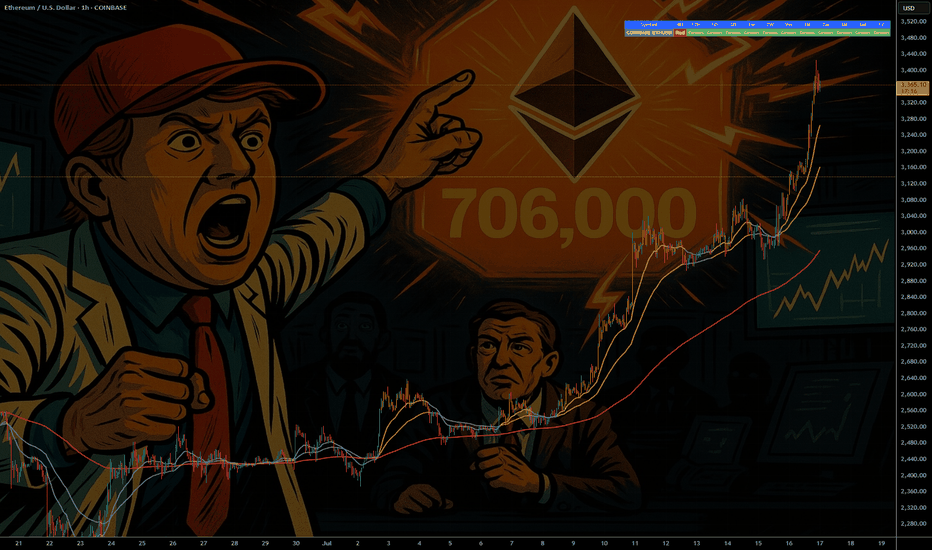

ETH - If You Know ...... You Know whats Coming

NYSE:BLK $BUIDL tokenized U.S.-Treasury fund launched on COINBASE:ETHUSD in Mar 2024—Wall Street is already settling real dollars on-chain.

NYSE:JPM JPMD stablecoin just went live on Base (an COINBASE:ETHUSD L2), piping wholesale payments from a $4 T balance-sheet straight through COINBASE:ETHUSD rails.

COINBASE:ETHUSD isn’t just riding the next crypto cycle—it’s becoming Wall Street’s settlement layer. From BlackRock’s on-chain Treasury fund to JPMorgan’s and soon Bank of America’s dollar tokens, a tidal wave of institutional stable-coin flows is lining up behind ETH. Fewer coins, more real-world volume—if you know, you know what’s coming.

NYSE:BAC CEO says they’ll issue a dollar-backed token the moment regulators nod—another tier-1 bank boarding the Ethereum train.

Stablecoin cap has blasted past $230 B , with 80 %+ of all on-chain transfers riding Ethereum (plus BSC) blocks.

Corporate settlements via stablecoins grew 25 % YoY in 2024 as multinationals replaced SWIFT with instant on-chain clearing.

Daily stablecoin throughput averages $7 B—each hop burning ETH and tightening supply.

BCG projects tokenized real-world assets to exceed $16 T by 2030 , with EVM chains as the default plumbing.

Over 500 M wallets already interact with stablecoins , a 30 % YoY surge led by emerging-market demand.

L2s like BINANCE:ARBUSDT & BINANCE:OPUSDT cut transaction fees 35 % yet still settle back to mainnet—meaning ETH captures the fee stream and the burn.

Bottom line: a tidal wave of bank-grade stablecoins + tokenized assets is lining up behind ETH; supply shrinks, demand soars—if you know, you know what’s coming.

quote] Marty Boots | 17-Year Trader — smash that , hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

GOLD's narrowing range, tariffs, Trump's political dramaOANDA:XAUUSD is still trading in a narrowing range, affected by the tariff game and the political drama that Trump is building. Currently, the price of gold is trading around 3,339 USD/oz, equivalent to a small decrease of about 7 dollars on the day.

Tariff Game

On July 16, US President Donald Trump announced that he would send letters to more than 150 countries, with tariffs expected to be 10% or 15%, to promote trade. He said these countries are not major US partners and will be treated equally, but left open the possibility of negotiating exemptions. The tariffs are similar to those proposed in April but were postponed due to concerns about market volatility. The resumption of the tariffs continues to destabilize financial markets and surprised partners such as the European Union, as they hoped to reach an early agreement with the US.

Political Play

Also on July 16, global financial markets were shaken by rumors that President Trump intended to fire Federal Reserve Chairman Jerome Powell. Many major news agencies such as the New York Times, Bloomberg and Reuters reported that Trump had prepared a letter of dismissal and consulted with Republican lawmakers, receiving positive feedback. Removing Powell before his term was believed to undermine confidence in the US financial system and the safe haven status of the USD. Trump later denied the plan, saying it was unlikely to happen unless there was serious wrongdoing. Markets reacted strongly: the USD fell and then recovered after Trump's statement, while gold lost most of its previous gains by the end of the session.

The gold market in particular, and the financial economy in general, are being affected by the activities of Trump, the creator of the global trade war, and the plays of Trump and the FED leading the market. Therefore, the basic formula in the current market context is best to follow Trump, and make sure not to miss any of Trump's status lines.

Technical outlook analysis of OANDA:XAUUSD

On the daily chart, the technical structure has not changed with the trend not yet clear and the price action clinging to the EMA21.

The technical conditions do not favor an uptrend or a downtrend, typically the RSI moves around the 50 level, indicating a hesitant market sentiment.

On the upside, gold needs to achieve the condition of breaking above the 0.236% Fibonacci retracement level of the price point of 3,371 USD then the target level will be around 3,400 USD in the short term, more than 3,430 USD.

Meanwhile, on the downside, gold needs to break below the 0.382% Fibonacci retracement, which would confirm a loss of the $3,300 level, then target around $3,246 in the short term, more than the 0.50% Fibonacci retracement.

Intraday, the sideways trend of gold price accumulation will be noticed by the following technical positions.

Support: $3,310 – $3,300 – $3,292

Resistance: $3,350 – $3,371 – $3,400

SELL XAUUSD PRICE 3381 - 3379⚡️

↠↠ Stop Loss 3385

→Take Profit 1 3373

↨

→Take Profit 2 3387

BUY XAUUSD PRICE 3309 - 3311⚡️

↠↠ Stop Loss 3305

→Take Profit 1 3317

↨

→Take Profit 2 3323

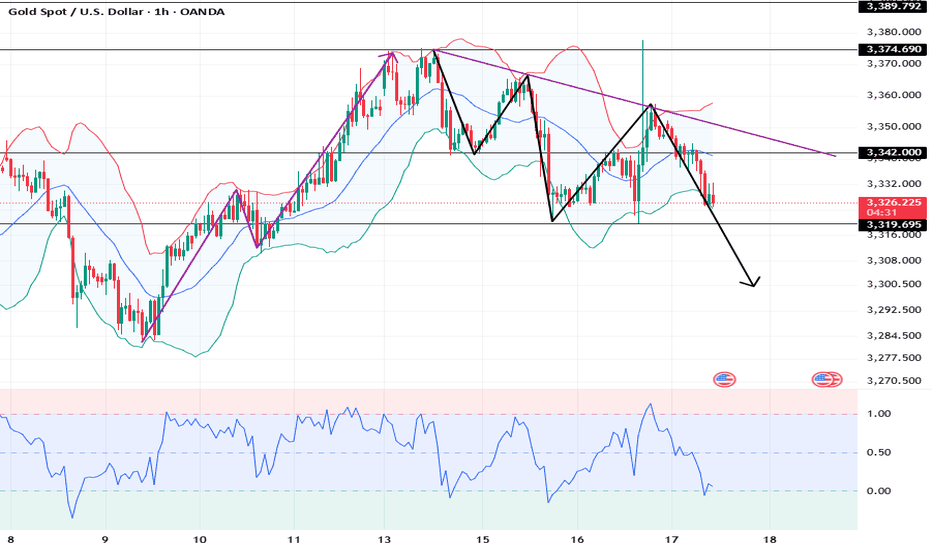

XAUUSD: Market analysis and strategy for July 17.Gold technical analysis

Daily chart resistance: 3382, support below 3300

Four-hour chart resistance: 3375, support below 3320

One-hour chart resistance: 3352, support below 3320.

Trump's remarks in the NY market on Wednesday ignited the market. First, it was reported that Powell would be fired, and then it was reported that Trump denied the news. Gold quickly rose to 3375 and then quickly fell back. Under the impact of the news, the price fluctuated very quickly, jumping up and down quickly.

From the current market trend, the day before yesterday, it fell to 3319 and stopped falling and rebounded. Yesterday, it tested 3319 again and quickly pulled up. Yesterday, the price hit the high point of this week near 3375 again and fell back quickly. There is support below and resistance above. If it approaches the 3320 support for the third time today, it is likely to fall below, and then trigger a long stop loss, and it may fall rapidly at that time.

If it falls below 3319, it will look at the 3280~3300 range.

SELL:3319 SL:3324

SELL:3352 SL:3357

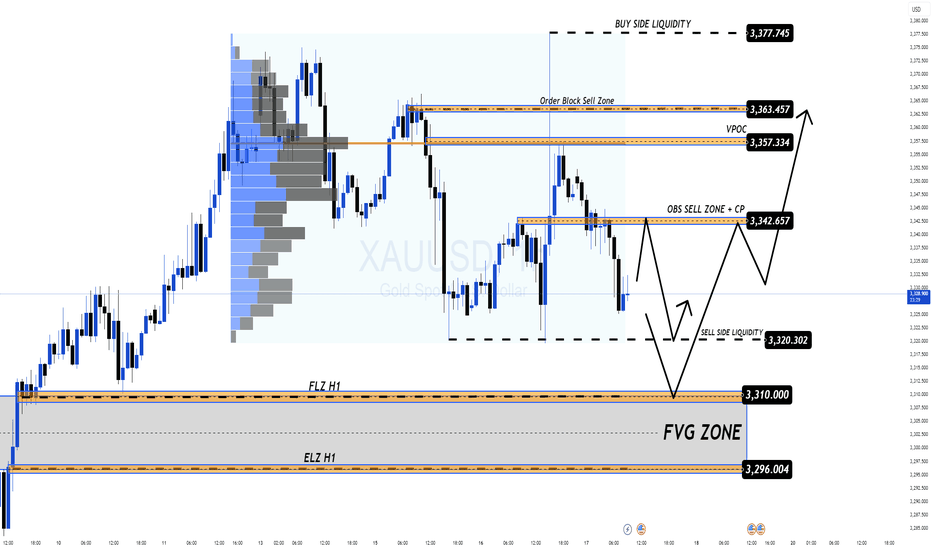

Market Volatile Amid Geopolitical Tensions & Fed Rumors Gold 17/07 – Market Volatile Amid Geopolitical Tensions & Fed Rumors

🌍 Macro Sentiment: Uncertainty Continues

The global gold market opened Thursday with high volatility following headlines that former U.S. President Donald Trump was considering firing Fed Chair Jerome Powell. Though Trump later denied the claim, the initial rumor spiked fear in financial markets.

At the same time:

🇮🇱 Israel launched airstrikes on Syria, escalating regional tensions.

🇪🇺 The EU proposed new tariffs on U.S. imports, increasing global economic friction.

🏦 Inflation concerns persist as BlackRock warns about delayed price pressures from earlier tariff hikes.

📉 These factors have turned gold into a temporary safe haven, but investors should remain cautious as the market is still undecided about direction.

🔎 Technical Outlook – Key Patterns to Watch

The H1 chart reveals price action respecting a wide consolidation range with visible liquidity sweeps on both ends. The market is forming a clean structure of lower highs, hinting at bearish bias unless bulls reclaim upper resistance zones.

Sell-side liquidity has been swept around the 3,320 level.

Order Block Sell Zone remains active at 3,342 – 3,344, potentially leading to a short-term drop.

If price breaks above 3,357 – 3,363 (VPOC & OB zone), a new bullish leg may form.

🎯 Trade Plan for Today

🟩 Buy Opportunity Zone

Entry: 3,312 – 3,310

Stop Loss: 3,306

Take Profits:

→ 3,316 → 3,320 → 3,324 → 3,328 → 3,335 → 3,340 → 3,350

📌 This zone has shown strong demand historically. Look for bullish candle confirmation on the lower timeframe (M15–H1).

🟥 Sell Opportunity Zone

Entry: 3,362 – 3,364

Stop Loss: 3,368

Take Profits:

→ 3,358 → 3,354 → 3,350 → 3,345 → 3,340

📌 This area overlaps with a VPOC level and prior order block – watch for price rejection patterns (e.g., bearish engulfing, fake breakouts).

⚠️ Risk Note

With geopolitical and monetary policy headlines dominating sentiment, price may spike erratically. Avoid overleveraging and always respect your SL/TP.

💬 What’s Your Take?

Do you think gold will break below 3,300 and head toward deeper FVG zones?

Or will bulls regain control and aim for 3,377 liquidity?

👇 Drop your analysis and let’s build the best gold trading community together!

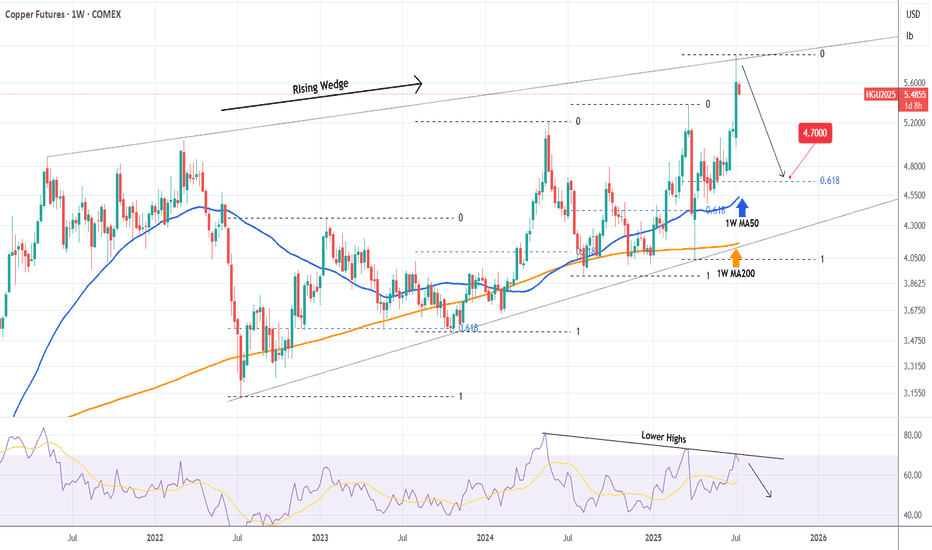

COPPER Top of 4-year Rising Wedge. Sell.Copper (HG1!) eventually followed the bearish break-out signal we gave on our last analysis (April 03, see chart below) and within 2 days it hit our 4.1250 Target:

Right now the price sits at the top of the 4-year Rising Wedge pattern and on the 1W time-frame it is a textbook technical sell signal.

With the 1W RSI also rejected on a Lower Highs trend-line, we are looking to aim for the 1W MA50 (blue trend-line) at least. Every Bearish Leg since the July 11 2022 Low, reached at least its 0.618 Fibonacci retracement level before rebounding again.

As a result, our Target is 4.700, which given a fair 3-month time-frame, should be at the time marginally below the 1W MA50, in line with all previous bottoms of the Rising Wedge.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold Futures ($GC1!) — US Session Setup: Bearish Retest from 618🟡 Gold Futures ( COMEX:GC1! ) — US Session Setup: Bearish Retest from 0.618 Fib in Bullish Breakout Context

⏳ Pre-US Session Playbook

We're currently watching Gold Futures ( COMEX:GC1! ) for a potential short opportunity into the US session open. While the broader structure has broken bullish, we're anticipating a bearish retest scenario from a key Fibonacci level — aligning cleanly with last week’s breakout structure.

No positions have been taken yet — we are setting up for the US session — and are closely monitoring price action near the 0.618 retracement zone before committing.

📍 Setup Breakdown

• 0.618 Fib Retracement from the last bearish impulse aligns with:

○ Recent volume shelf resistance

○ Retest zone from prior breakout

○ An overextended local push into thin volume above 3380

• Bullish Context:

○ HTF breakout from descending wedge structure remains valid

○ Macro buyers still in control

○ Upside continuation risk is high if sellers don’t show up

• Short Bias Conditions:

○ Rejection or absorption in the 3385–3390 zone

○ Weak follow-through above 0.618 (failed breakout scenario)

○ Breakdown of LTF higher low structure post-test

🧠 Strategy Commentary

Although we’re in bullish breakout mode, this is a tactical short setup — a fade into prior structure with clear invalidation. We're not fighting trend, but looking to short into exhaustion at a defined level, with tight risk parameters.

Confluence Factors:

• 0.618 fib alignment

• VRVP volume shelf

• Prior breakout structure retest

• LTF divergence or absorption confirming the fade

🎯 Trade Parameters (Planned)

• Entry Zone: ~3385–3390

• Stop Loss: Tight, 3395–3400

• Target Zone: 3342–3337 (full structure retest)

📌 Patience is key — this remains a setup until confirmed. We'll post live if and when conditions are met.

Let the market come to you.

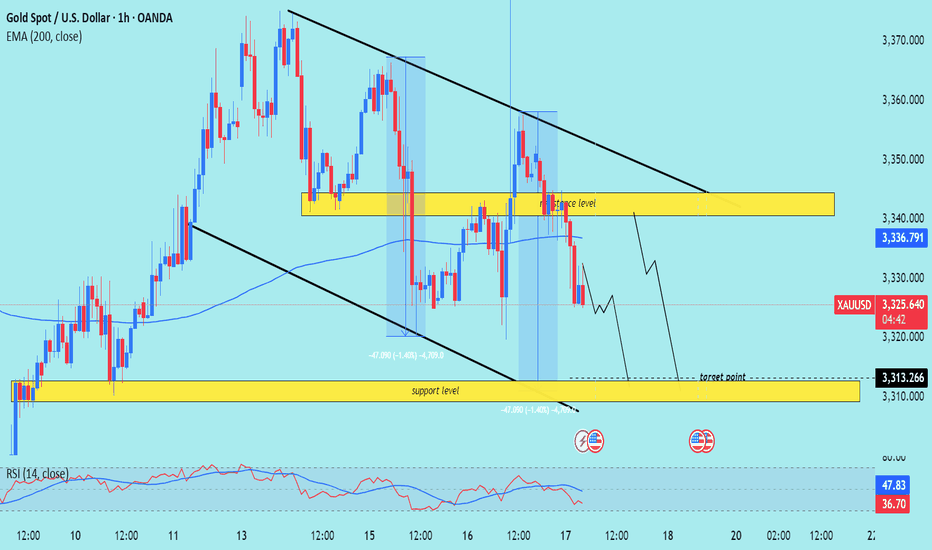

XAU/USD) bearish Trend Read The captionSMC trading point update

Technical analysis of XAU/USD (Gold Spot vs US Dollar) on the 1-hour timeframe. Here's a breakdown

---

Technical Breakdown:

1. Descending Channel:

Price is trading within a clearly defined downward-sloping channel (black trendlines).

This suggests a short-term bearish trend.

2. Resistance Zone (Yellow Box at 3,335–3,340):

Price recently rejected from this resistance area.

This zone aligns with both the 200 EMA and previous structure, strengthening its validity.

3. EMA Confluence:

The 200 EMA (3,336.798) is acting as dynamic resistance.

Price is currently below the EMA, confirming the bearish bias.

4. Support/Target Zone:

The projected target zone is around 3,313.266, labeled as a support level.

This level has acted as previous structure support, increasing its significance.

5. RSI Analysis:

RSI is at 37.18, close to the oversold region, but not yet fully exhausted.

Suggests there’s still room for a downside move before any potential bounce.

Mr SMC Trading point

---

Trade Idea Summary:

Bias: Bearish

Entry: Below the resistance zone (~3,335–3,340)

Target: 3,313 (support zone)

Invalidation: Break and hold above 3,340–3,345

Risk Note: Watch for potential consolidation or fakeouts before continuation.

Please support boost 🚀 this analysis)

Gold Rejected Post-CPI – Bearish Momentum Building Below $3,365Gold is currently trading near $3,338, continuing to show signs of rejection after testing the key $3,365–$3,392 resistance zone. The market has reacted to the July 15 U.S. CPI release, and despite initial volatility, gold failed to break above its major diagonal trendline, forming a lower high, a strong technical sign of weakening bullish momentum.

If price breaks below $3,330, it could trigger a wave of selling pressure down to $3,303 and $3,248 in the coming days. Traders should monitor price behavior around these zones for short-term entry opportunities.

📌 Technical Breakdown

Resistance Zone:

- $3,365–$3,392 remains the critical ceiling where gold got rejected for the third time in recent sessions.

- This zone aligns with the top of the descending wedge, long-term black trendline.

Bearish Structure Forming:

- After multiple attempts, gold could not sustain above the resistance.

- A series of lower highs and a weakening bullish push suggest a bearish continuation is likely.

Support Levels to Watch:

- Immediate: $3,337

- Mid: $3,320

- Strong: $3,303 (0.382 Fib) and $3,293

- Final Target: $3,248 → $3,220 → $3,193

🔺 Bullish Invalidation Scenario

If gold manages a clean breakout and close above $3,392, this bearish setup will be invalidated. In that case, upside targets would include:

- $3,412

- $3,434

- $3,490 (macro trendline)

But at the moment, that seems unlikely unless driven by unexpected fundamentals.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

GOLD | Testing Key Support at 3320 — Breakdown or Rebound Ahead?GOLD: Futures Dip as Dollar Strengthens, Eyes on 3320 Support

Gold futures declined as the U.S. dollar gained strength following President Trump’s denial of plans to fire Fed Chair Jerome Powell. While concerns over central bank independence persist, gold remains up over 26% YTD, supported by strong central bank demand and ongoing macro uncertainty.

Technical Outlook:

The price is now approaching the 3320–3312 zone.

A break below 3312 would trigger a bearish move from 3315 toward 3297 and 3281.

However, if the price stabilizes above 3320 on a 4H close, a bullish rebound may follow toward 3333 and 3342.

Key Levels:

Support: 3312, 3297, 3281

Resistance: 3333, 3342, 3363

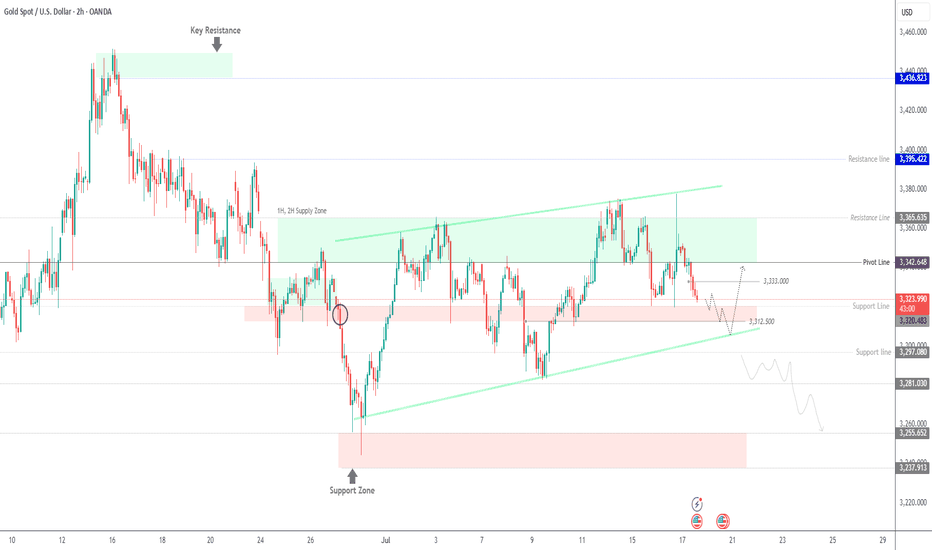

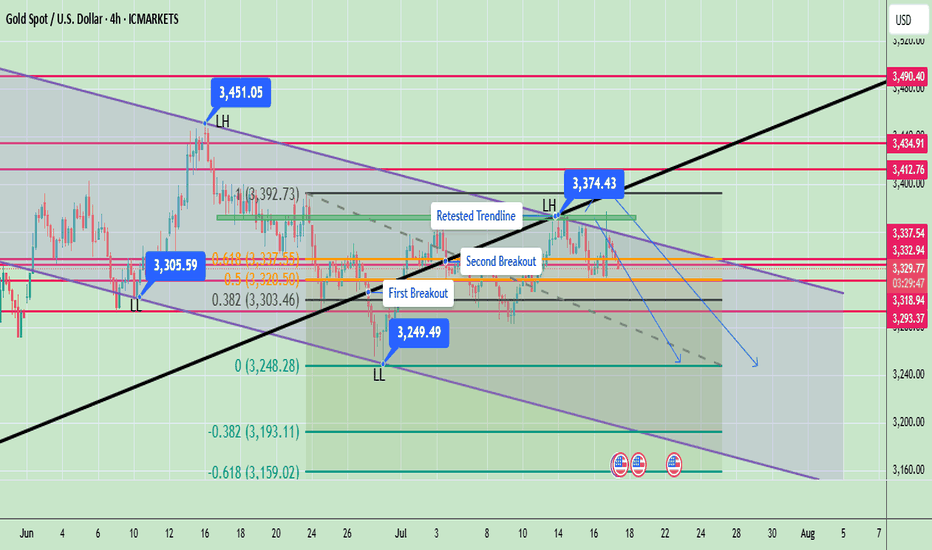

Gold Rejects Resistance Again – Gold Rejects Resistance Again ?Gold is currently trading near $3,335, showing signs of exhaustion after a failed breakout above the recent consolidation range. The market attempted to push higher but lacked strong momentum, leading to a pullback and possible shift in bias. The price is forming lower highs, indicating bearish pressure building up on the 4H timeframe. Gold is showing weakness after a second breakout followed by a possible retest failure. The market structure indicates a bearish bias

🔍 Market Structure Overview:

- Two Breakouts: Price attempted two bullish breakouts recently. The first breakout gained some traction, while the second failed to hold above resistance.

- Failed Retest: Price has now returned back near the previous breakout zone (~$3,332), signaling a potential bearish reversal pattern.

- The chart structure suggests a distribution phase, with price struggling to hold gains, and sellers slowly gaining control.

🧭 Key Support and Resistance Levels:

✅ Resistance Zones:

- $3,337.54 – Immediate resistance (recent rejection zone)

- $3,348.03 – Strong resistance if price pushes above $3,337

- $3,412.76 – Major resistance from previous swing high

- $3,490.40 – Long-term psychological resistance

🔻 Support Zones:

- $3,318.94 – Immediate support (just below current price)

- $3,303.46 – Key fib retracement (0.382 level)

- $3,248.28 – Strong horizontal support (major zone)

- $3,193.11 – Fibonacci extension level (-0.382)

- $3,159.02 – Next support zone (Fibo -0.618 level)

🟠 Current Bias:

Bearish to Neutral – as long as price remains below $3,337.

If price breaks and holds above $3,337 with volume, short-term bullish reversal is possible.

Yeterday there was a fake news and gold was pumped but after clarification it was dumped. It means buyers are not much interested till fed next meeting and the high price of the gold. Sellers will short the gold on every rise while buyers will wait for low price of the gold for long term trade.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

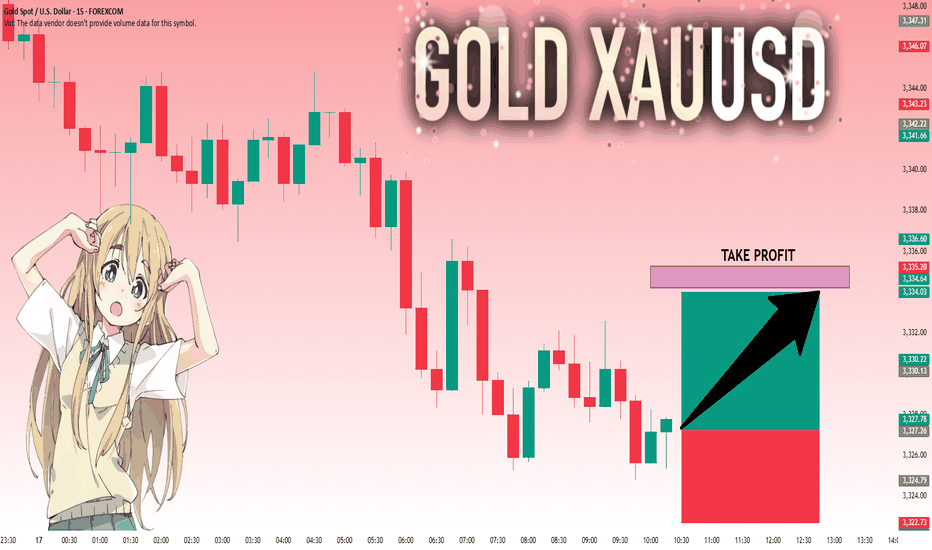

GOLD: Move Up Expected! Long!

My dear friends,

Today we will analyse GOLD together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 3,327.26 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

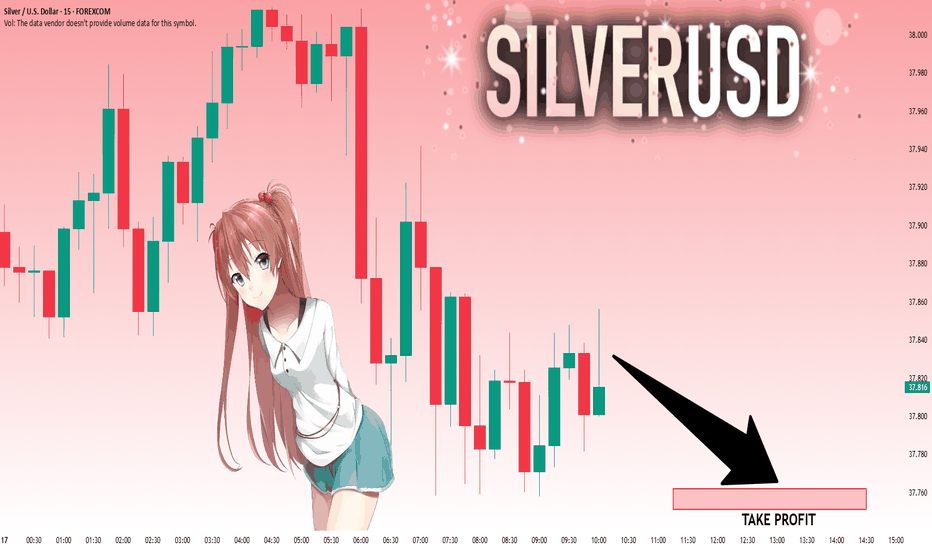

SILVER: Local Bearish Bias! Short!

My dear friends,

Today we will analyse SILVER together☺️

The market is at an inflection zone and price has now reached an area around 37.832 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 37.762..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

The firing of Powell set off the market, don't chase the longsTrump showed a draft of the letter to fire Powell, but whether Powell will be fired in the end remains to be seen, but the impact on the gold market is undoubtedly huge. The wolves have now smelled a very dangerous scent. Don’t chase high prices. Don’t chase high prices! ! ! After all, the impact of the news comes and goes quickly, and there is a high possibility of a reversal later in the evening. The final suppression position of the current gold daily line is 3340. If the closing line today can maintain above 3340, then gold will usher in a real bullish trend in the future.

OANDA:XAUUSD

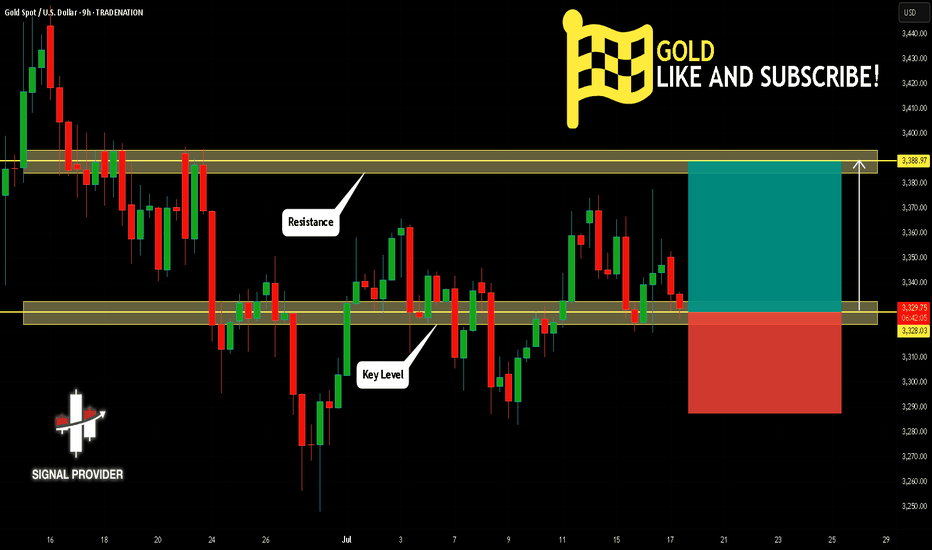

GOLD Is Very Bullish! Buy!

Please, check our technical outlook for GOLD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 3,328.03.

Considering the today's price action, probabilities will be high to see a movement to 3,388.97.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

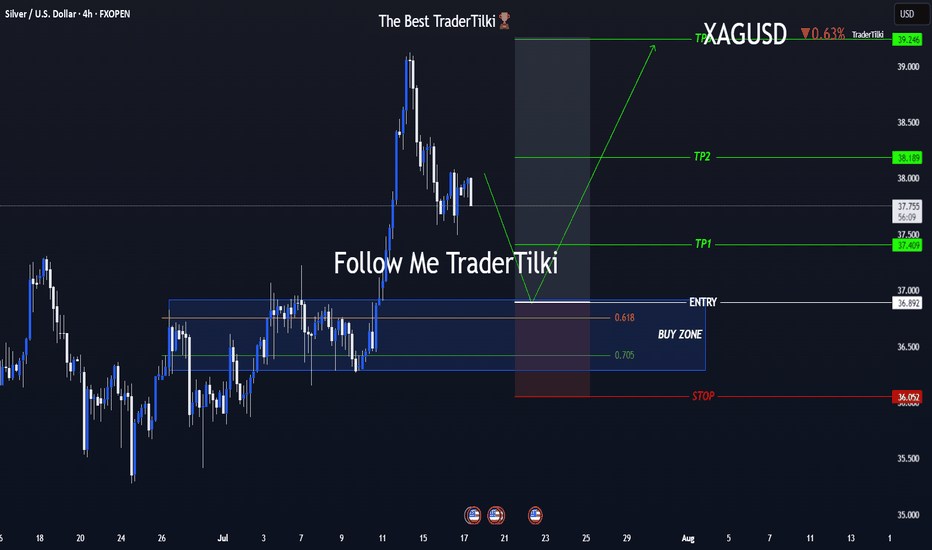

One Shot, Clear Strategy – Silver Buy Zone in SightHey everyone 👋

📌 BUY LIMIT ORDER / XAGUSD-SILVER Key Levels

🟢 Entry: 36,892

🎯 Target 1: 37,409

🎯 Target 2: 38,189

🎯 Target 3: 39,246

🔴 Stop: 36,052

📈 Risk/Reward Ratio: 2,79

I double-checked the levels and put together a clean, focused analysis just for you. Every single like seriously boosts my motivation to keep sharing 📈 Your support means the world to me! Huge thanks to everyone who likes and backs this work 💙 Our goals are crystal clear, our strategy is solid. Let’s keep moving forward with confidence and smart execution!