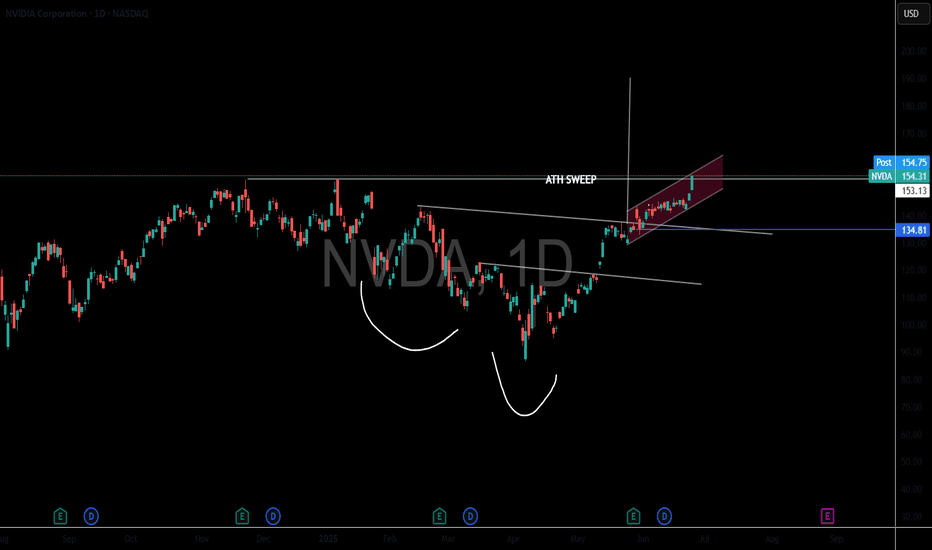

Nvidia & Nasdaq History - What you need to know!Record-high share price: NVDA hit a new all-time high as U.S. stock markets rallied and Wall Street analysts forecast continued upside

Nvidia is pushing towards the first ever $4 Trillion market cap.

Today it surpassed MSFT as the largest company in the world closing up over 4% on the session.

Micron earnings are adding extra fuel to the fire for semi conductors.

Short term picture for semis - they're very extended and need some consolidation.

Micron earnings: Revenue: $8.05 billion, up ~38% YoY, beating the ~$7.89 billion consensus

Data‑center revenue: Tripled YoY, powered by surging demand for high‑bandwidth memory (HBM)

HBM sales: Exceeded $1 billion, growing over 50% sequentially

Strong margin and revenue beat; robust cash flow (~$857 million free cash flow) with a solid balance sheet ($9.6 billion in liquidity)

Micron

Micron Technology (MU) – Powering the AI Memory SupercycleCompany Overview:

Micron NASDAQ:MU is a crucial player in the AI infrastructure stack, providing advanced DRAM, NAND, and NOR flash memory solutions that fuel everything from data centers to mobile edge devices.

Key Catalysts:

AI-Driven Memory Demand ⚙️

High-Bandwidth Memory (HBM) adopted in AI accelerators from Nvidia, AMD, Broadcom, and Marvell.

Positions Micron at the core of the AI supply chain, reducing exposure to chip cycle volatility.

Data Center Surge 📈

Data center DRAM revenue tripled YoY in Q2 2025, driven by hyperscaler AI infrastructure upgrades.

Strengthens revenue diversification and margin profile.

Technology Leadership 🔬

Launch of 1-gamma DRAM node and LPDDR5X samples enhances mobile, cloud, and auto capabilities.

Keeps Micron on the cutting edge of memory innovation.

Investment Outlook:

Bullish Case: We remain bullish on MU above $95.00–$97.00.

Upside Target: $155.00–$160.00, supported by AI compute growth, hyperscale momentum, and next-gen product launches.

💡 Micron is not just riding the AI wave—it’s building its memory core.

#Micron #MU #Semiconductors #AI #HBM #DataCenter #DRAM #NAND #Nvidia #AMD #Hyperscalers #TechLeadership

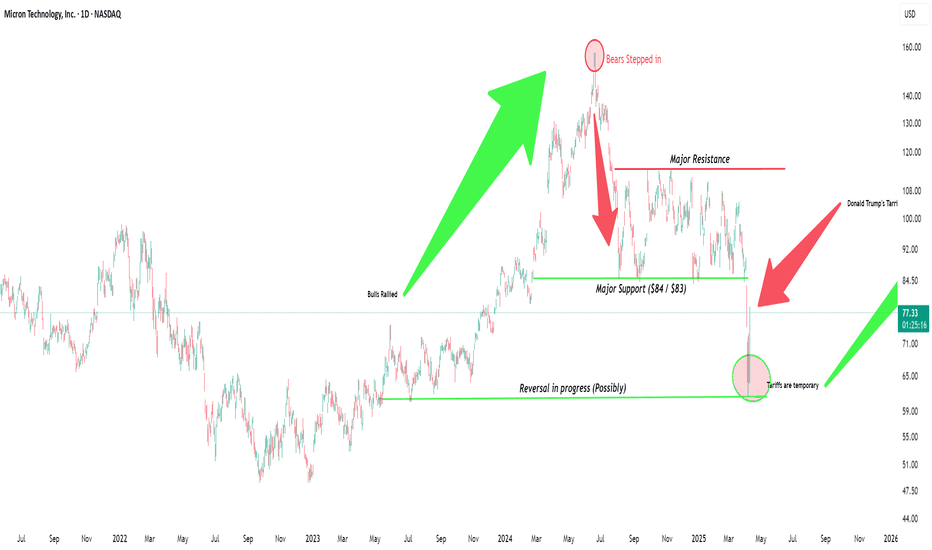

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

Micron Technology (MU): AI Powerhouse Trading at a 40% Discount!1️⃣ AI Boom: Micron’s advanced DRAM and NAND solutions are fueling growth in AI and cloud computing, with Nvidia’s ecosystem showcasing its critical role.

2️⃣ Analyst Targets: With 42 ratings averaging $131.47 and highs of $150, Micron offers over 50% upside from current levels.

3️⃣ Automotive Growth: As the top memory supplier for autonomous vehicles, Micron dominates a market set to grow at a 27% CAGR.

4️⃣ Technical Momentum: Breaking $75 resistance, a golden cross and rising volume confirm strong bullish signals.

💹 Trade Setup:

TP1: $100

TP2: $110

TP3: $120

SL: $80

Micron is a top-tier AI play at a deep discount. With massive growth catalysts, it’s primed to soar! 🚀

Micron Technology - Fully Resisting The Stock Market Crash!Micron Technology ( NASDAQ:MU ) is one of the few bullish stocks:

Click chart above to see the detailed analysis👆🏻

Despite the stock market kind of "crashing" lately, Micron Technology is one of the few stocks which remains in a rather bullish environment. Following the uptrend, the bullish break and retest and the beautiful cycles on Micron Technology, this strength will soon become reality.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

MU, bound for more significant RISE ahead this 2025! from 100.Micron Technology, Inc. is an American producer of computer memory and computer data storage including dynamic random-access memory, flash memory, and solid-state drives. It is headquartered in Boise, Idaho.

Based on latest metrics, MU is now at basing zone finally after experiencing heavy downtrend since last years peak at 153 on June 2024.

The stock is currently on a massive SHIFT in trend hinting of a weighty reversal to the upside. It already bounced more than 20% from its lows at 80 levels since late last year.

Fridays' closing price of +6% is already conveying its directional context for the rest of the year -- more RISE ahead.

Also factoring its last QTR Results which are all in greens.

(USD) Nov 2024 Y/Y

Revenue 8.71B 84.28%

Net income 1.87B 251.54%

Diluted EPS 1.67 249.11%

Net profit margin 21.47% 182.23%

Operating income 2.17B 292.73%

Net change in cash -355M 30.39%

Cash on hand - -

Cost of revenue 5.36B 12.6%

----------------------------------

Spotted price at 100.

Interim target at 150

Mid at 200.

TAYOR. Trade safely.

Micron (MU) Stock Update: Correction or Collapse?Morning Trading Family

Here's what's up with Micron (MU): If it bounces back at 92, cool. But if it keeps going down, it might hit 89-90 before it stops. If it drops past that, we might see it go to 84 or even 80. This could be a big moment for MU, so keep watching!

Kris/Mindbloome Exchange

Trade What You See

Micron Technology ($MU): Strategic Buy with AI-Driven UpsideMicron Technology ( NASDAQ:MU ): Strategic Buy with AI-Driven Upside

Trade Setup:

- **Buy Price:** $98.66

- **Stop-Loss:** $84.68

- **Take-Profit:** $160 to $180

**Rationale:**

Micron Technology, a leader in memory and storage solutions, is poised to benefit from the growing demand in artificial intelligence (AI) applications. The company's advancements in high-bandwidth memory (HBM) position it favourably within the semiconductor industry.

**Financial Performance:**

In fiscal Q4 2024, Micron reported revenue of $7.75 billion, a significant increase from $4.01 billion in the same period last year. The GAAP net income was $887 million, or $0.79 per diluted share, marking a substantial turnaround from the previous year's loss.

**Analyst Insights:**

Analysts have set a 12-month average price target of $146.28, with estimates ranging from $90 to $250, indicating a potential upside of approximately 48% from the current price.

**Risk Management:**

The stop-loss at $84.68 helps mitigate downside risk, while the take-profit range of $160 to $180 offers a favorable risk-reward ratio.

When the Market’s Call, We Stand Tall. Bull or Bear, Just Ride the Wave!

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Traders should conduct their own due diligence before making investment decisions.*

MU going for goldAt the third double bottom teasing 114.17 breakout to gap fill, it would be nice to see continuation here and what happens at 107.94 (monthly pivot). This one started with a breakaway gap September 25th and has recently filled the runaway gap, but the bullish trend is still intact from the current double bottom. I'm looking for 01/17/25 105c here, with a stop-loss at 99.05 (monthly pivot).

Difference between candles and barsHey traders and investors!

What is the difference between using candles or bars on a chart?

This example clearly shows the key difference. Take note of the closing price of the candle on September 26 (point 8 of the range). On a candlestick chart, this is impossible to understand. On a bar chart, the closing price is clearly visible. The closing price is below the range boundary of 111.34, the trading volume is enormous, and the buyer was unable to break above the range.

Now, the price has reached the range boundary of 111.34 for the second time on increased volume, and the seller has absorbed the buyer, forming a buyer's zone at the upper boundary of the range. There is a high probability of further price decline within the short vector 8-9 of the range (potential target 85.92). However, there are threats along the seller's path.

You might consider buying at the 98.7 level (if buyer will protect it) or around 84-86.

Good luck with your trading and investments!

Micron Stock Soars 15% on Robust AI Demand and Strong OutlookMicron Technology (NASDAQ: NASDAQ:MU ) has made waves in the market following its fiscal fourth-quarter earnings, signaling a powerful comeback driven by robust demand in the AI sector. As a major supplier of memory chips, especially for Nvidia, Micron's performance not only beat Wall Street expectations but also positioned the company to achieve record-breaking revenue in the upcoming quarter. Shares surged more than 15% in premarket trading as global chip stocks rallied in response to the earnings report.

AI Fuels Micron's Impressive Growth

Micron's fourth-quarter revenue skyrocketed, reaching $7.75 billion, a nearly twofold increase compared to the same period last year. This growth can be directly attributed to the soaring demand for AI-driven technologies. The company swung to a profit of $887 million, or $0.79 per share, a stark contrast to last year’s $1.43 billion loss. The results exceeded analysts’ estimates, signaling a strong foothold in the AI market.

CEO Sanjay Mehrotra confirmed that the surge in demand is primarily from the AI sector, propelling Micron into fiscal 2025 with the "best competitive positioning in the company’s history." Looking ahead, the company expects first-quarter revenue to land between $8.5 billion and $8.9 billion, surpassing analyst expectations. The projected earnings per share (EPS) for Q1 between $1.46 and $1.62 also highlights Micron's potential to sustain this impressive growth trajectory.

Micron’s partnerships with AI giants like Nvidia, alongside the launch of its HBM (High Bandwidth Memory) chips, have been pivotal. These memory chips are essential for AI data centers and machine learning processes, further cementing Micron's role in the future of AI technologies. Notably, the company reiterated that its HBM chips are sold out through 2024 and 2025, showcasing the robust demand and limited supply of key memory components.

Global Chip Rally: Micron’s Surge Sparks Global Optimism

Micron's stellar results sent ripples through the global semiconductor market. Shares of rival firms Samsung Electronics and SK Hynix rose sharply in South Korea, with gains of over 4% and 9%, respectively. SK Hynix further boosted market confidence by announcing the mass production of its own HBM chips, designed for AI applications. The positive outlook extended to Europe as well, where Dutch semiconductor equipment maker ASML saw shares jump 4%, along with other industry players like Be Semiconductor and STMicro.

This surge highlights that Micron's strong earnings report is not just a victory for the company but also a signal of sustained AI demand, driving optimism across the semiconductor space.

Technical Outlook: (NASDAQ: NASDAQ:MU ) Breaks Through Key Levels

On the technical front, Micron's stock is showing strong bullish momentum. In premarket trading, NASDAQ:MU is up 15.44%, pushing it above its recent resistance levels and one-month high. The stock has now crossed its support pivot, positioning it to target the next significant resistance level around $130.

The Relative Strength Index (RSI) indicates that NASDAQ:MU still has room to run, as it remains neither overbought nor oversold. The daily price chart is also signaling a gap-up pattern, which is a key bullish reversal indicator. This pattern suggests that NASDAQ:MU may have successfully transitioned out of its recent downtrend, with the potential for further gains as the stock forms a more balanced and sustained upward trajectory.

Moreover, the stock's strong earnings report and upbeat future guidance provide fundamental backing for this technical breakout. As NASDAQ:MU breaks through these key levels, it opens the door for a sustained rally, especially with the AI demand narrative continuing to dominate the semiconductor sector.

Micron Poised for a Bull Run

Micron Technology's robust earnings, driven by its crucial role in the AI supply chain, have propelled the stock to new heights. Micron Technology (NASDAQ: NASDAQ:MU ) is poised for continued growth, especially as AI demand shows no signs of slowing down. With a record-breaking revenue forecast for the current quarter and strong technical signals pointing toward further gains, investors can look forward to a promising future for Micron in the booming AI era.

As the AI revolution continues, Micron's positioning as a key supplier of memory chips for AI applications will likely drive sustained growth, making NASDAQ:MU a stock to watch closely in the coming months.

What You Need to Know Ahead of Micron Technology Earnings ReportMicron Technology Inc. (NASDAQ: NASDAQ:MU ) is set to release its fiscal fourth-quarter earnings report after market close today, Wednesday, September 25, 2024. Investors are eagerly anticipating this report, as it could provide crucial insights into the state of the memory chip industry and the broader tech sector.

Key Takeaways:

- Analysts expect Micron (NASDAQ: NASDAQ:MU ) to swing to a profit this quarter, with year-over-year revenue expected to almost double.

- Key metrics to watch include inventory levels and guidance for the next quarter.

- Micron's relationship with Nvidia ( NASDAQ:NVDA ) and its role in the AI hardware space is expected to be a central focus.

Earnings Expectations:

For Q4 2024, analysts are forecasting revenue of $7.65 billion, a substantial jump from the $4.01 billion reported in Q4 2023. This rise is largely driven by the growth of Micron’s memory chips used in AI data centers and high-performance computing systems. Earnings per share (EPS) are expected to come in at 84 cents, a significant improvement from last year’s loss of $1.31 per share.

1. Revenue Growth:

Micron (NASDAQ: NASDAQ:MU ) is expected to post significant year-over-year revenue growth, fueled by strong demand for AI-related memory chips. The company's partnership with Nvidia has been a key driver in this sector, as high-bandwidth memory (HBM) used in AI data centers continues to see robust demand. Analysts believe Micron’s growth trajectory will be further accelerated by the ongoing AI boom.

2. Profitability:

After reporting losses last year, Micron (NASDAQ: NASDAQ:MU ) is anticipated to return to profitability with net income of $1 billion for the quarter. This marks a major turnaround, thanks to increased demand for high-performance memory and storage solutions used in AI, edge computing, and data centers.

3. Inventory Levels:

One key area to watch will be Micron’s inventory levels. The company has been dealing with growing inventories as demand for legacy memory chips has waned. Both Citi and Morgan Stanley recently lowered their price targets for Micron (NASDAQ: NASDAQ:MU ) due to concerns about high inventories and weak demand for older memory components. However, analysts expect inventory issues to ease by the end of the year, with improvements in gross margins and revenue in the coming quarters.

Business Outlook:

Looking ahead, analysts are optimistic about Micron’s potential growth. The AI-driven upgrade cycle is expected to drive demand for edge devices and data center memory solutions, while a possible server refresh could also provide tailwinds. Analysts estimate that Micron (NASDAQ: NASDAQ:MU ) will generate $8.4 billion in revenue in the first quarter of fiscal 2025, with EPS expected to rise to $1.45.

Market Sentiment:

Despite these positive views, some caution remains in the market. While Micron’s stock has gained about 10% year-to-date, it has also faced volatility, especially in the wake of mixed earnings reports from its competitors, such as Broadcom and Nvidia. This has led to reduced enthusiasm for the AI trade, though a positive earnings report today could reignite investor interest in AI-related semiconductor stocks.

Technical Analysis:

From a technical standpoint, Micron Technology stock (NASDAQ: NASDAQ:MU ) is showing signs of bullish momentum. As of today, the stock is up 1.50%, rebounding from a presumed downtrend. It is trading within a falling wedge pattern on the daily chart, a bullish reversal indicator. If Micron Technology stock (NASDAQ: NASDAQ:MU ) delivers a positive earnings surprise, the stock could break through the upper boundary of this pattern, leading to a potential rally toward its 200-day moving average around $105 and possibly higher toward the $130 resistance pivot.

Key Technical Indicators:

- Relative Strength Index (RSI): Currently sitting at 52.00, the RSI indicates a neutral stance, but given the earnings catalyst, the stock is poised for a potential breakout.

- Support Levels: The stock has solid support around $86. A drop below this level could signal further downside risk.

- Resistance Levels: Overhead resistance is found near $100, with the 200-day moving average acting as the next significant level to break around $105.

Investor Sentiment:

Investor sentiment in the options market has grown increasingly bullish in recent weeks. Call options far outweigh put options, with large positions held at the $95, $100, and $155 strike prices, expiring shortly after the earnings report. This suggests that traders are betting on a positive earnings outcome that could propel the stock higher.

Conclusion:

Micron’s earnings report later today is shaping up to be a pivotal moment for the company and its investors. Strong results driven by demand for AI-related memory chips could not only send the stock higher but also restore broader enthusiasm for the AI trade, which has faltered in recent months. However, traders will need to keep a close eye on inventory levels, management’s guidance, and market sentiment to assess the stock's future direction.

In short, Micron Technology stock (NASDAQ: NASDAQ:MU ) may stand at the cusp of becoming one of the biggest bargains in the semiconductor space, with upside potential fueled by AI and data center demand, but tempered by near-term concerns over inventories and legacy products.

Double Bottom Is Forming on MicronMicron is in an interesting position after shedding a great amount of value in the last 3 months. The Fundamentals are great and Microns Balance Sheet has very few problems! with the double bottom forming this could be signaling a very bullish sentiment with a possible reversal towards the upside. Micron is currently being forecasted with Revenue and EPS Growth.

----------------------------------------------------------------------------------------------------------------

Balance Sheet: Micron has a decent Debt to Equity Ratio while having more then 3 Assets for every 1 Liability which is personally important to me when looking at stocks, Debt is Manageable especially should Micron beat all forcasts

Cash: US$8.38b

Debt: US$11.33b

Total Liability: US$22.03b

Total Assets: US$66.26b

Debt to Equity Ratio is: 25.6%

----------------------------------------------------------------------------------------------------------------

Resumed its Share Buy-Back Program

----------------------------------------------------------------------------------------------------------------

Highly Important Industry Supplier and Affiliates: Being Extremely Important with Industry Titans like Nvidia, Apple, Intel, MPS/Monolithic Power Systems, AMD, Texas Instruments, Microsoft, Gigabyte, Broadcom.

----------------------------------------------------------------------------------------------------------------

Diversified Business Model: Micron is not just a memory business its highly Diversified in

23.46% of there Revenue is derived from Microns -> "Mobile Business Unit"

23.4% of there Revenue is derived from microns -> "Embedded Business Unit"

36.74% of there Revenue is derived from Microns -> "Networking and Business Unit"

16.43% of there Revenue is derived from Microns -> "Storage Unit Business"

----------------------------------------------------------------------------------------------------------------

While Micron is in another uptrend in Revenue growth I think personally this time it could be more permanent growth, Micron is Extremely Undervalued compared to market peers such as Nvidia, and Micron with PE Ratios being well above 50 while Micron is extremely important within the Artificial Intelligence industry it benefits from a wide range of industries such as Artificial intelligence, Automotive, Computers, Memory, ETC.

----------------------------------------------------------------------------------------------------------------

Disclaimer: I am not a financial expert or have any certifications I just trade stocks as a personal hobby and I greatly encourage you to do your own research and not just take words at face value to make extremely risky investments. Please do your own Research I am not giving Buy, Sell or Hold Signals, This is just for healthy conversation and nothing else.

----------------------------------------------------------------------------------------------------------------

Idea:

MU Micron Technology Options Ahead of EarningsIf you haven`t bought the dip on MU:

nor calls ahead of the previous earnings:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report this week,

I would consider purchasing the 140usd strike price Calls with

an expiration date of 2024-6-28,

for a premium of approximately $9.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Micron Technology - 100% in 6 months!Hello Traders and Investors, today I will take a look at Micron Technology.

--------

Explanation of my video analysis:

Back in 2018 we saw a beautiful break and retest on Micron Technology which indicated even more continuation towards the upside. For over 5 years Micron Technology has also been trading in a quite nice rising channel formation and is now approaching the upper resistance trendline. I do expect a pullback and a retest of the previous all time highs and then just more continuation towards the upside.

--------

Keep your long term vision,

Philip (BasicTrading)