HSI dipping, traders are flipping,stay Zen - Index is yoga-ing!Hello everyone!

Today HK50 PEPPERSTONE:HK50 D open at 25350, Hi:25446 Lo:25164

IMO: Deep retracement is happening with profit taking from futures expiring tomorrow for traders & waiting for catalysts for talks next week.

For 4H - Index moving closer to Gravity Trend Line - look out for entry for swing (using shorter tf to entry).

At point of writing ✍️: the HK50 $PEPPERSTONE uptrend mode is on track and now in the retracing mode.

currently on D Chart -

🗝️ Resistance Level : 25300

Support Level : 24950

Support level 24558 (MA30)

🗝️ Strong Support Level : 24048 (Gravity Trend Line)

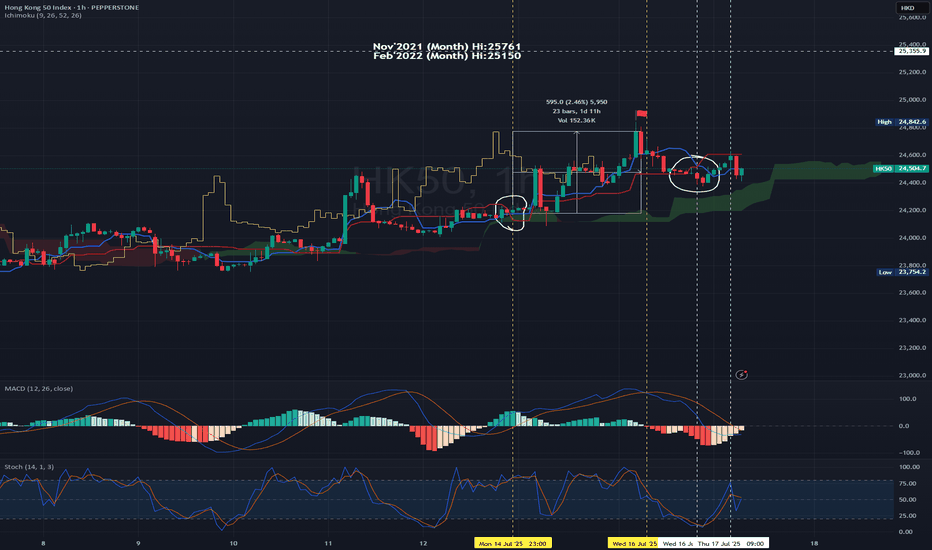

1H Chart HK50 $PEPPERSTONE

If today not able to close 25304 (25335 HSI), it's likely a deep retracement.

Shor term pullback -for swing trade and for mid-longer term it's still on bull track. Most likely people profit taking before the HSI futures expires tomorrow.

Macro view - Index continue to be Bullish. Well, markets cooled a bit waiting for details from the ongoing US-China trade talks early August'25.

Higher Hi🚩point marked in Chart HK50 $PEPPERSTONE

21May2025 -23909

11June2025 -24430

25June2025 -24531

16Jul2025 - 24842

18Jul2025 - 25052

24Jul2025 - 25729

?? ??2025 - 26163 Revised Target

The HSI Index HSI:HSI

At point of writing ✍️ Index is being sucked towards to D GravityLine - 24085; it fall below the sideway box.

If it doesn't close above the key support level this week, the deep retracement is happening.

🧨🧨🧨Pay attention and cautious.

🗝️ Next Resistance Level : 25350

🗝️ Next Support Level : 24900-25200

🗝️ Strong Support Level : 24300-24750

Let's follow your own zentradingstrategy , continue to trade; Observe your emotions as you would the clouds—passing, shifting, never you.— Mindfulness helps you respond, not react, in volatile markets and moments.

Be ease at trading!

** Please Boost 🚀, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!

Share your trading journey here to encourage the community and friends who pursing the same journey.

Mindfultrading

Dont predict&anticipate the market - ask indicators for hints! Hello everyone! how was the HSI trade so far?

Apologies for not updating as I was allowing myself to take a pause journaling my trade also to pay attention on my own personal growth journey. However, am continue to trade HSI in sustainable and profitable way and have had trying and test using different combination of indicators that bring quite positive results since.

Sharing this with anyone that reading this.

Please note that this is just for my own experiences and please DYODD.

For Swing Trade Test: (some steps to consider for entry set up - setting your time frame)

E.g using 1H Chart - 14Jul2025 23:00

MACD - entering the above zero line - it breaks above zero level on the next candle. Turned bullish confirmation.

Using Ichimoku Cloud for trend confirmation.

Once the MA9>MA26 the blue line crosses above red line (circled in white). This is a bullish confirmation and it is trading above green cloud.

You may pay attention to set your entry point.

Set Up : on the next candle open - you may open Long position - 24204.90 Set SL with R/R Ratio 1:1 or 1:1.1-1.25 (or in accordance to your risk appetite or carry out backtest and to be realistic)

Taking Profit : You may pay attention to be more aggressive to TP only when the MACD is forming DeadCross i.e 16Jul2025 11:00 (using the same timeframe chart).

For the reversed side it's the same methodology. But it's recommended to Short if and only if when the candles are closed below cloud + MACD is on the bearish zone.

So, in this case, I will not open short position as it's not the normal underlying HSI trading hour, so we wait till the underlying normal trading hour commence.

Today HK50 PEPPERSTONE:HK50 open at 24567, you may decide if you would to short and setting SL and TP.

From chart, you may open short position with R/R : 1.1.1 (TP : 24:400; SL : 24772) Entry: 24596 (the next hour candle at 10:00, of course you may cross check with shorter time frame to 'catch the high' 😂)

Trade for profit requires persistency and consistence.

There is quite a wide range to trade in between the movement.

Buy into Support Sell at resistance.

Set your TP/SL & protect your capital.

at point of writing ✍️: the Index uptrend mode is on track.

currently on D Chart -

🗝️ Resistance Level : 24600-24700

🗝️ Support Level : 24370-24400

🗝️ Strong Support Level : 24030-24300

Higher Hi🚩point marked in Chart

21May2025 -23909

11June2025 -24430

25June2025 -24531

16Jul2025 - 24842

?? ??2025 - 25907 Target

Opinion: continue Bullish and shall breaks the recent Hi of 24900 and target could break 25200-25750 pretty soon (the Gravity Line upper band).

The Index is now on the intermediate bullish trend (not far off from Gravity line and not yet touch the Gravity Upper band or beyond for D chart) - Shall publish this indicator.

From previous posts:-

W Chart:- HSI continues its Bullish mode with strong pullback! Recovery could expected to see in end Jun - early Jul'25.

14Jul2025 -

at point of writing ✍️:

Perhaps it shouldn't been said as recovery but continue the uptrend.

As we can notice from the latest chart it seems to continue its uptrend momentum even MACD have had curving down after deadcross formed 12May25.

The MACD signal line staying above zero level.

Continue the Long call for HSI with the forecast and repetitive of history the next 4-6 weeks might be a good profit to hold Long position.

🚨However, please take note that the index is moving beyond the Gravity upper brand on W chart which we should monitor closely to TP and enter again for healthy retracement.

🎯 Reminder: For long term (6-18 months) continue to accumulate China & HKG for the potential upside for the year! All retracement is a good entry point. Again, everything is impermanence. Manage your risk, position sizing. Take only the risk that you can afford.

For HSI HSI:HSI

Recent Hi : 16Jul2025 - 24867.81 (trying to test the resistance at 19March2025@24874)- this ¬6.58pts seems took quite a while to break. Let's be patience.

🔎 DYODD and don't listen to anyone.

Invest in yourself, do some study and learn along the way while you trying to verify or finding the answer if to start invest in CHN/HKG markets.

If you don't know how or where, you may ask Deepseek/Chatgpt for most reputable Trading courses nearest to you.

Let's follow your own zentradingstrategy , continue to trade; a strategy is a raft—cross the river, but do not carry it on your back forever — Stay flexible. No method is permanent. Adapt, let go, grow.

** Please Boost 🚀, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!

Share your trading journey here to encourage the community and friends who pursing the same journey.

Untangling the Web of Confirmation Bias in Trading 🕵️♂️🔄💭

Confirmation bias is a common psychological phenomenon that can significantly impact trading decisions. This article delves into the depths of confirmation bias in trading, unraveling its influence, implications, and strategies to mitigate its effects.

Understanding Confirmation Bias

Confirmation bias occurs when traders favor information that confirms their existing beliefs or biases, ignoring contradictory data, thereby influencing their decision-making process.

Selective Perception:

Disregarding Contrary Signals:

Mitigating Confirmation Bias

Strategies to counter confirmation bias include maintaining an open mind, seeking diverse sources of information, and critically evaluating one's analysis.

Understanding and addressing confirmation bias is crucial for traders to make informed decisions, fostering a more objective and balanced approach to trading. This article sheds light on this psychological hurdle and offers strategies for a more discerning trading mindset. 🕵️♂️🔄💭

Please, like this post and subscribe to our tradingview page!👍

Anchoring Bias in Forex and Gold: Unshackling the Trader's Mind

Anchoring bias is a psychological trap that subtly influences decision-making in forex and gold trading. This cognitive bias anchors traders to specific reference points, hindering rational analysis and leading to skewed perceptions. In this article, we'll explore the pervasive impact of anchoring bias in trading, shedding light on its effects and strategies to overcome it.

Understanding Anchoring Bias

Anchoring bias occurs when traders rely heavily on specific price points, past trends, or perceived market norms as reference anchors for making trading decisions. It influences their perceptions of value and potential market movements, often leading to erroneous assessments.

Reliance on Historical Highs:

Attachment to Round Numbers:

Mitigating Anchoring Bias

Overcoming anchoring bias involves deliberate efforts to detach from fixed reference points and embrace a more holistic and analytical approach to trading.

Adopting Technical Analysis:

Anchoring bias is a subtle yet potent force affecting traders in the forex and gold markets. Recognizing its influence and employing strategies to mitigate its effects is pivotal for making informed and unbiased trading decisions. ⚓️📈✨

Please, like this post and subscribe to our tradingview page!👍