THE WEEK AHEAD: NVDA, AMAT EARNINGS; MJ, USO, SLV, EEMAs of Friday close, NVDA and AMAT appear to have the volatility metrics I'm looking for in earnings-related volatility contraction play (>70 rank/>50 implied).

NVDA (70/67) announces on Thursday after market close. The iron condor pictured here pays 1.73 credit with break evens wide of the expected move.

AMAT (68/48) announces on Thursday after market close, with the Dec 21st 31/37 short strangle paying 1.64 (50% take profit of .82) and the 34 short straddle paying 3.89 (25% take profit of .97).

On the exchange-traded front: USO (100/35), SLV (99/22), EEM (85/26), XOP (76/38), and OIH (75/36) round out the top symbols by rank, with USO, XOP, and OIH being no surprise given the beating oil has take over the past several weeks. Although I am mostly selling premium in XOP here, I could see also taking a bullish directional shot in OIH, which has broken through long-term horizontal support; XOP and XLE have yet to close in on the bottom of their long-term ranges. Alternatively, I could see doing a similar, bullish assumption play in one of the higher volatility petro underlyings that have earnings in the rear view mirror: OXY (75/30), COP (74/33), or BP (70/36), for example.

ASHR (74/33) is worth a passing mention here, but if I'm going to play China, it's going to be via the more liquid FXI (65/28).

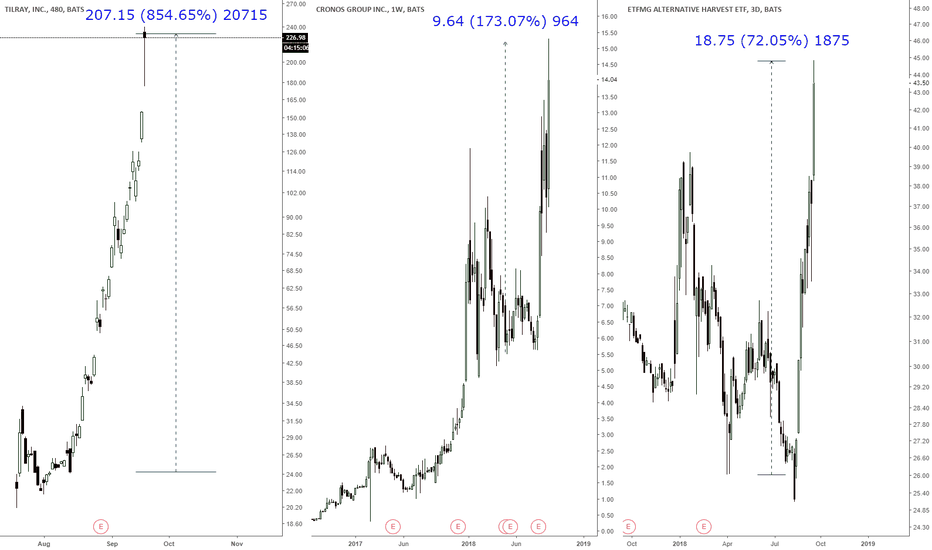

MJ (--/64)* is also worth an honorable mention, with the more recognizable cannabis underlyings -- CRON, CGC, and TLRY -- all announcing earnings this week. The currently unfortunate thing about MJ is that it's not getting decent volume yet, so options liquidity isn't the best for those who'd rather not be on the single name roller coaster.

As far as the majors are concerned, some volatility came out of the broad market post-mid-term elections: SPY 30-day's now at 15.3%; QQQ at 24.6%; and IWM at 22.8%, so if I'm going to add broad market short premium here, it's going to be in the Q's and/or RUT/IWM.

Lastly: UNG. Last week marked a kind of WTF, weather forecast-related spike in natty, with UNG printing a new 52-week high. I was previously looking at 27.5 as an area of interest for short with 31-ish being the next stop, but thought November was too early in the natural gas seasonality cycle to be putting on a short play (usually, a downward put diagonal (See Post Below)* with the back month in April or later). Now that it's whipped through 31 in three seconds flat, I'm going to be patient here and see if it grinds higher throughout December, even though forecasts are generally calling for a "meh" winter temperature-wise.

* -- It doesn't currently have a 52-week rank, since it hasn't been around that long.

** -- Naturally, that setup's no longer good. I'll post a revised setup here shortly.

Mj

$DAVC Low Float Israeli Real Estate Company Expecting Deal Close$DAVC Has been in the process of closing a $2 million Israeli Real Estate contract.

CEO has over 30 Years working in the field and $DAVC's subsidiary Bengio has over 400+ Apartments

DD click here: investorshub.advfn.com

$HIPH One To Watch $KGKG $PURA $NBEV $TLDY $IGC $DTEAwww.networknewswire.com

UpComing Catalysts Reiterated:

1. 4 Acquisitions 3 CBD/MJ Sector and 1 in Unrelated Sector

2. Major Distribution Deals

3. THC Beverage Prototype

4. CBD Beverage distribution into major retail

5. Share Reductions

6. New Website

7. Uplistment to the OTCQB

8. Gents Clothing line infiltration into the Asian Market Overseas

9. Much more...

Boom MJ bubble Imploding to Earth's CoreExpecting a retest of the 382 from most previous leg up, eventually bearish pressure will start to show again and this market will begin to panic. Traders will take profit and investors will show their weak hands. Looking for a retrace of around $3. SL above the 382 level.

Boom MJ bubble Imploding to Earth's CoreExpecting a retest of the 382 from most previous leg up, eventually bearish pressure will start to show again and this market will begin to panic. Traders will take profit and investors will show their weak hands. Looking for a retrace of around $3. SL above the 382 level.

THE WEEK AHEAD: PEP, COST EARNINGS; EWZ, CRON, NIO, IQ, MJPEP announces earnings on Tuesday before market open; COST, on Thursday, after. Neither presents a particularly compelling earnings announcement-related volatility contraction play, with PEP's rank/30-day implied coming in at 30/18, and COST's at 35/23.

With Brazilian elections taking place a week from today (October 7th), it seems to me that an EWZ play is in order if you haven't already got something on: the November 16th 29/39 short strangle is paying 1.59 at the mid with break evens around one standard deevy -- 27.41/40.59. You can naturally go with an October setup, but implied was over 20% higher out in November (44.0% versus 53.2%) as of Friday close, so you're likely to get a little more juice if you go a touch farther out in time.

On the exchange-traded fund side of things, EWZ comes in at the top of the board, with a rank/30-day implied at 79/50, followed by USO at 65/28, and GDX at 50/27.

Non-earnings high implied: CRON: 71/124; NIO: ~/106; MJ: ~/68.0, and IQ: -/61.4.*

Broad Market Majors Background 30-Day: QQQ: 17.2%; IWM: 15.0%; DIA: 13.6%; EFA: 13.3%; SPY: 11.8%.

* -- Neither NIO, MJ, nor IQ have been around for 52-weeks, so they don't currently have a 52-week range to evaluate. I would note that the options liquidity for MJ isn't the greatest, but figured I would throw it in there since weed is hot, and not everyone enjoys paying the single name roller coaster. The MJ November 16th 40 short straddle is paying a whopping 7.45 at the mid, with break evens at 32.55 and 47.45 ... .

Bullrun started...;)

www.ccn.com

No one gives a rat's ass about MJ stocks. Go try talking about it in a crypto chat... They are so obsessed with crypto dead market that they joined late :)

Should have bought a few months ago, but it probably just started.

Sell at +5000% in a few months to years to the monkeys in bitcoin reddit and /biz right now (they will leave Bitcoin reddit to join the MJ stocks reddit when they see it went up 10000% in the news).

* I am not following this actively, don't count on me to post when to exit.

We probably drop soon lol.

ETFMG AH earnings are so high.... Wtf did I read that wrong?

About to get stoned...Shares of TLRY, and many other pot stocks for that matter, have been on fire lately. While I've made good money along the ride, its just getting ridiculous at this point.

This company went public exactly 2 months ago today.. the IPO price was $17. In 8 weeks time, it's up over 1300%! That's incredible for those that got in early, but its a clear sign of ignorance to be chasing it up here now. If you aren't taking at least some profits, you're either greedy or mentally ill.

While I think there's a lot of growth potential in the weed space, as evidenced by companies like STZ and KO getting invested, people need to be patient and let the prices come back down to earth.

I'm actually shorting this thing via long put options (the options are pricey, too!). Specifically, I bought Sept. 28 $55's in one account, and longer dated October $120's in another. Yes, it's ballsy move, but this blowout volume today may be a capitulation point.

Take a step back and smoke a blunt or 6 while you wait for this thing's buzz to wear off! And please don't be an idiot and chase this thing up here!

$HIPH Breaks out on Massive coverage by Respected MJ News SourceHYDRO INFUSED CBD WATER: Huge Potential Benefits For Millions of Athletes

NEW YORK, Sept. 11, 2018 (GLOBE NEWSWIRE) -- Cannagreed.com News Commentary

American Premium Water, Corp. (OTC:HIPH) BREAKING NEWS: LALPINA HYDRO CBD WATER can go a long way towards administering doses of cannabinoid (CBD) for those who deal with chronic ailments such as, inflammation, pain and anxiety disorders. There are also huge potential benefits for athletes who may not only use LALPINA to hydrate, but also to minimize the inflammation, pain, and stress that physical activity places on the body.

The Company began selling its LALPINA Hydro CBD product August 27th on its website. The Company has been able to procure a domestic manufacturer who can provide the supply to meet the growing demand of LALPINA Hydro CBD.

“With a new product like LALPINA Hydro CBD, there were some teething issues in the ramp up to production. This product is a market frontrunner right out the gate considering the lack of a comparable product currently on sale. Unlike the other CBD waters that are currently at retail, the molecular structure of LALPINA Hydro CBD allows for greater bio availability which leads to a greater & quicker absorption rate compared to regular CBD oil or CBD water. The Company will need to use less CBD to create a greater benefit, which will allow for a higher gross margin per unit,” added CEO Ryan Fishoff.

LALPINA HYDRO CBD could improve workouts by providing hydration and muscle relief. Several studies have shown CBD could provide workout recovery health benefits thanks to its analgesic, anti-inflammatory and neuroprotective properties that include:

Anti-Inflammatory

Muscle Spasm Relief

Protection of the Heart, Lungs and Brain

Reduction of Nausea

Increases in Appetite

Sleep Aide

Recent reports indicate that the CBD market is estimated to grow 700% by 2020. Hemp Business Journal, a market intelligence research firm, projects that the CBD market will grow to $2.1 billion by 2020, an astronomical jump in value compared to the 2017 CBD market value of $202 million. Athletes, amateur and professional, are a segment that is helping drive this exponential growth. Research has shown that in addition to physical effects, CBD could have positive effects on well-being, reduction in anxiety, and a tangible impact on mental recovery, all traits that have appeal to athletes at all levels and could lead to CBD infused water becoming part of athletes regimen.

The Company has been working with The Brewer Group (www.thebrewergroup.com) and CEO Jack Brewer to help recruit current and retired professional athletes to promote LALPINA Hydro and LALPINA Hydro CBD beverages. Studies have shown that there are many potential health benefits from ingesting hydro nano infused products, including short term benefits to enhance workouts and aid in recovery. The Company is also working with Mr. Brewer on initiatives with current and former NFL players with the Company’s LALPINA Hydro CBD beverage. Mr. Brewer, a 6-year National Football League veteran and CBD proponent, has the network to assist the Company’s efforts to educate the public about the benefits of hydrogen and hydrogen infused CBD. Mr. Brewer was instrumental in getting LALPINA placed at events and parties at the Super Bowl in Minneapolis earlier this year. The Company and Mr. Brewer see the potential for LALPINA Hydro CBD to be an all-natural replacement for opioids, which would benefit retired players, whose struggle with opioid addiction has been well documented. And with the removal of CBD from the World Anti-Doping Agency’s list of banned substances, in addition to the imminent passage of the Farm Bill Act, large scale CBD use by current athletes is not very far away.

“Working with Jack (Brewer) and the Brewer Group has been great for the Company. He has opened many doors for the Company, specifically in distribution and exposure. I am excited to work with all the athletes that are in his network to promote and educate the public on the benefits of CBD infused beverages. Incorporating retired and active athletes will be a game changer in my opinion, and I’m excited about all the content that Jack’s team will be creating to help us achieve this goal,” added Mr. Fishoff

Based on the demand that the Company has received for it’s LALPINA HYDRO CBD beverage, the Company has had exploratory discussions about developing a THC infused hydrogen infused beverage. Developing a THC infused beverage would allow the Company to enter the exploding cannabis market.

www.otcmarkets.com

THE WEEK AHEAD: ORCL, KR EARNINGS: EWZ, TSLA, CRONEarnings:

ORCL: Announces Thursday after market. Rank/IV: 74/31. Sept 21st 68% Probability of Profit 20 delta 45/50.5 short strangle: .79 credit.

KR: Announces Thursday before market. Rank/IV: 54/37. Sept 21st 72% Probability of Profit 20 delta 30/35 short strangles: .60 credit.

Non-Earnings:

EWZ: Rank/IV: 97/48

TSLA: Rank/IV: 95/57

GDX: Rank/IV: 68/30

USO: Rank/IV: 62/26

FXE: Rank/IV: 53/8

Others of Note:

CRON: Background IV at 138% on volume of 24.1 million shares. Oct 19th 70% Probability of Profit 9/19 short strangle: 1.30 credit.

See also (for other cannabis-related underlyings):

TLRY: Background IV at 135% on volume of 9.02 million shares.

CGC: Background IV at 98.5% on volume of 13.1 million shares.

MPXEF is bargain compared to CRON, TLRYMPXEF is now the third largest publicly traded cannabis operation by quarterly sales. Only WEED and ACB have higher sales. It leaves CRON, TLRY, and TRST in the dust when it comes to already-reality sales. It also trades at a nice discount to those other more famous names on a sales-basis. It also has not yet run much this MJ season. If you want something top-notch quality with very real revenues and profits, this seems like a good option.

The pennant on the green flagpole is a continuation pattern. There are a million different ways you can draw this pennant and for some of them, it tried to break downward out of the pennant today. However, I like the strong bounce from that failed attempt by the bears. After taking a look at this, I'm buying some more at open.

Here are a few tweets/articles with useful further info:

- third largest by sales

- comparison to peers price-wise

- investor call and expansion plans

- more peer comparison and SS

- peer comparison

CANB falling wedgeI've warned in multiple venues (here, on Twitter, on iHub, and in private groups) to not chase MJ movements at this extremely early stage of the season. (This is true even during peak mania; the only difference is in peak mania you may be rewarded for making a stupid move rather than being punished, which makes for bad and dangerous habits.) These pops in OTC* are premature, a result of accumulation gone wild or overeager noobs chasing. There are not enough eyeballs and $s to sustain a true MJ season run. Yes, headlines are starting to pop up, but it's not really gotten to the level needed yet. This is the pre-party. I am taking some profits on big spikes and I expect them to retrace and buy back lower. If they don't, I am moving that money into stuff that's still not run.

CANB is a classic example of this. I am very glad I took a big chunk of profits at 10 cents. I've been buying back more and more the lower it gets. Right now the tape is painting a beautiful falling wedge, a generally very bullish pattern that likes to break upward. I have bids sprinkled between $0.041 and $0.046. There's pretty strong horizontal support around the 4 cent mark and I expect that to be a decision point whether it's going to break up out of the falling wedge or whether it needs to retrace further to 3 cent support.

Thanks to @Chuck_Buffet for noticing this falling wedge pattern.

* This is true of OTC. However, because NASDAQ, TSX, et. al. are both more mainstream and have fewer MJ options, this may not be true of MJ tickers on those exchanges. This is basically a first for those larger exchanges having MJ, so no known history to go on. So stuff like TLRY and CRON may be in their real run.

Long NEPT (NYSE) NEPT.ca (TSX)broke out of the recent downtrend her in a hot sector. volume rising as well $CGC $MJ $HMMJ.ca $ACB.ca

Long ALEF.ca (TSX)This cannabis stock is finally breaking out after an early entry and patience. Cannabis sector hot right now. $CGC $MJ