Divergence Since 2020 - What Happens When Bonds Continue?When Stocks & Bond Move Opposite Direction what does it mean?

We have observed a divergence between the stock and bond markets since 2020. While U.S. Treasury bonds entered a bear zone, the stock markets continued their upward climb. What are the implications of this decoupling?

Will the stock market resume its uptrend and hit new highs? Or is this merely a retracement before further downward pressure?

A healthy, three-way interdependent relationship occurs when the economy, bonds, and stocks move in the same direction. When investors have confidence in the U.S. economy, they tend to invest in long-term bonds, which it usually will benefits the stock market.

This alignment was evident between 2000 and 2020, during which bonds and stocks moved largely in tandem.

However, from 2020 onward, bonds began declining—signaling a loss of investor confidence in the economy. Technically, this should exert downward pressure on stocks as well.

Yet, we are witnessing a divergence: Where U.S. Treasury bonds have fallen while stocks have continued to rise.

When such a divergence surfaces, it signals the need for caution in our approach in the stock markets.

What could be the other reasons why US T-bond has peaked in 2020 and depreciated by 44% since then?

Micro E-mini Nasdaq Futures and Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

Mnq

MNQ Trade Idea Continuation (3)Continuation into the trade idea we were sharing, we traded through the Daily high level we were targetting of 21,404.75 then rushed lower under the Trendline Phantom line and under the IFVG that was used as support for price to reach 21,419.75.

Will this be another manipulation below 21,362.00 lows before continuation higher, or should I have set a TP at the 21,404.75 highs and called it a day?

Continuation to MNQ trading 5.14.25 (2)Continuation into my MNQ trading day, would like to see price continue higher, we have been pumping alot lately which cautions me to worry if we will see some sort of fast retracement sometime soon.

We took yesterday's daily highs, so I am a little confused if we will continue to take the current daily candle's high or if we will see some sort of retracement today into a bullish FVG from the daily to then continue trading higher.

The key aspect of trading that we are learning is when a candle/price will do something. Still alot to learn but have been making some decent choices with our trades. If we are stopped out we are still in profits for the day and maybe we call it.

The key thing I regret this trading session is not taking that $500 profit on NQ on that very first entry we took. Would've offset our losses and helped us stay secure profits for the day.

Continuation into MNQ trades 5.14.25Continuation into my MNQ trading day, would like to see price continue higher, we have been pumping alot lately which cautions me to worry if we will see some sort of fast retracement sometime soon.

We took yesterday's daily highs, so I am a little confused if we will continue to take the current daily candle's high or if we will see some sort of retracement today into a bullish FVG from the daily to then continue trading higher.

The key aspect of trading that we are learning is when a candle/price will do something. Still alot to learn but have been making some decent choices with our trades. If we are stopped out we are still in profits for the day and maybe we call it.

The key thing I regret this trading session is not taking that $500 profit on NQ on that very first entry we took. Would've offset our losses and helped us stay secure profits for the day.

ChopFlow ATR Scalp Strategy (OBV EMA) on MNQThe ChopFlow ATR Scalp Strategy combines a low choppiness regime filter, on-balance volume with EMA confirmation, and ATR-based exits to capture quick micro-trends on the NASDAQ-100 E-mini (MNQ).

Strategy Logic

1. Choppiness Filter:

-Calculate the Choppiness Index over 14 bars.

- Trade only when chop < 60 (trending or mildly trending market).

2. Order-Flow Confirmation:

- Compute OBV and its 10-period EMA.

- Long when OBV > OBV EMA and chop < threshold.

- Short when OBV < OBV EMA and chop < threshold.

3. ATR-Based Exit:

- Exit at a fixed multiple of ATR (stop and profit target both = 1.5 × ATR).

How to Trade It

1. Confirm time chart with MNQ , preferably1-min chart.

2. Enable only the 17:00–16:00 CME session.

3. Look for low choppiness (< 60), then wait for OBV cross.

4. Enter with one-contract size, tight 1.5× ATR stops/profits.

5. Monitor DOM for liquidity shifts around entry levels.

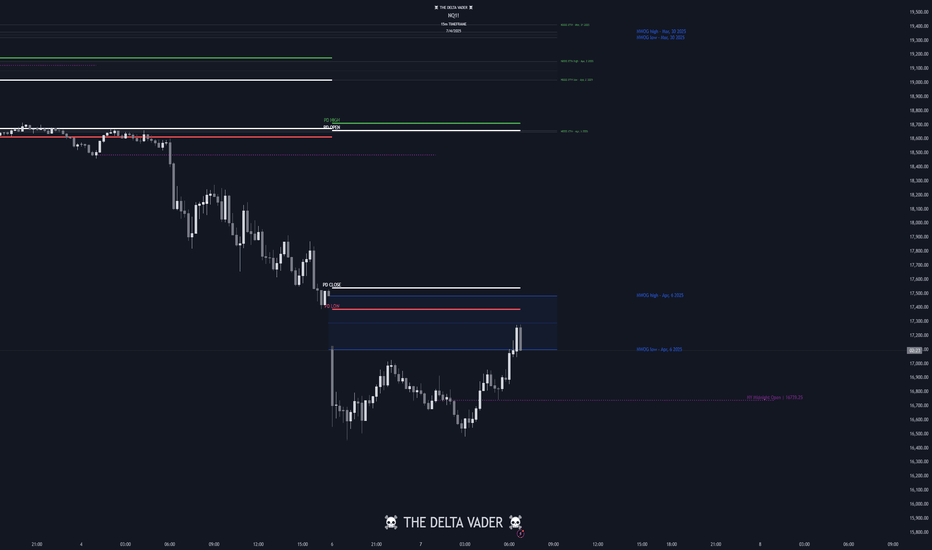

MNQ Sell Idea 5.2.2025Hey Everyone, Welcome back! I am here posting a trade idea we caught, hopefully our final terminus is hit! But in this video I share with you guys my confluences and bias for this trade.

We took out BSL with the 8:30am open and NFP news. I am targetting 19,829 levels as a potential area of interest because I believe the market will want to trade into it for buying opportunities as I do believe the market is bullish.

MNQ Outlook 4-21-25Toying around with posting publicly welcome back folks.

MNQ still is yet to pick a direction following the big run on wednesday 2 weeks ago. long term I think path of least resistance is for price to continue to chase sellside liquidity. However that high that was put in on that wednesday may be cleared out first.

In any case my trade bias is always day by day and what is offered to me during my trading window.

Please note this is not investment advice.

NASDAQ Futures Long Setup: Pullback Entry After Tariff BoostMarket Outlook – April 13, 2025

Quick recap: In my last public analysis, I mentioned watching the 18,350–18,000 zone for signs of support — a level stacked with confluence (50–61.8% Fib, EMA, VWAP, pivot). Price broke down deeper than expected but responded beautifully:

✅ Tagged 18,000 almost to the tick

✅ Rejected hard at the 61.8 Fib

✅ Respected the 50 Fib on the way back up

All solid signs of strength.

Now with tariff exemptions announced today (bullish for tech/Nasdaq), I’m opening the door to more long setups this week.

Here’s What I’m Watching:

🔹 Scenario A: Pullback into the 18,575–18,500 zone (first dotted white line). If price reclaims structure or gives me something clean — EMA bounce, VWAP tag, candle pattern — I’ll look for longs.

🔹 Scenario B: If that level breaks or I miss the first shot, I’ll look for a second chance around 18,000–18,300. Same deal: not jumping in blindly, waiting for a setup to form.

To be clear — these are areas of interest, not automatic trades. I want clean structure and confirmation before entering.

Let’s see how it plays out. Will update if/when I take a position. Stay sharp. 📈

MNQ 9:30 Open Trade Idea 💡 Trade Idea shown live here, beautiful setup that was respected very nicely during the 9:30 open.

The area we pointed out on the previous video:

Where I stated price was likely trading up to fill in that FVG before dropping lower was respected perfectly. I was rendering the video above when it happened. Hence, why you see me enter late here.

I could have been more patient and waited to enter at the 50% of the bearish fvg level. But regardless, I was able to profit $31 and make back the $30 I was in drawdown for. Had this been NQ we would've made over $695 on this one trade.

This is teaching us discernment in our decision making and how to trust our bias and trade ideas.

We caught over 130 points on this one MNQ trade and the potential was over 400 points as shown on this video.

We were targeting the bullish 1h fvg and sellside liquidity (equal lows)

If you guys found this insightful give it a like and comment down below. I would also love to know if any of you guys would like me to share any specific ideas or go over anything in particular. Let me know!

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Missed trade opportunity on MNQ due to Tight SLOnce again, we shifted sl too soon and got stopped out of a good trade. It was nice to see the outcome, it ended up tapping inside of that Volume imbalance once again before falling over quickly for the remaining sellside liqudity.

If my SL was kept at the highs we would've captured the whole move. This week I have been feeling a little tired and my birthday is this thursday guys!! lol I would hate to have a bad trading week on my BDAY 😢. I don't know if that's why I am being so cautious, I wanna enjoy my week. haha

Anyways, I will post any new trades if I get into another one. But I might call it here depending on where price is at after I post this video.

If you guys enjoyed this give it a like and share with your friends(:

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

My Trading mistakes 3.17.25This video was a prime example of good trades taken just poor management.

As you guys can tell from my dialog, I was clearly not level headed when it came to my decision making today. I was trying to follow ICT's commentary but I was getting confused as I was also trying to interpret it with my own understanding of the current levels on my charts.

As I stated in previous videos, I was feeling lots of anxiety and emotions today because I tend to go through that after a very good trading week. I feel like it's personal confidence after a good trading week gets affected due to me striving for perfection.

We see several mistakes in this trade, I was buying at premium levels, 19,750 - 19,798.50. Till ICT commented that he would not be long here (Thanks ICT, idk what i was thinking 😂 )

I then revised my idea and saw we had traded under the Bullish fvg from 9:51am, once price trades through it that is usually one of my favorite trades to take because price tends to react very quickly to those areas.

If you're right or wrong, you will find out quickly usually.

Once price reversed, I caught a beautiful trade of over 300 points, but because it was MNQ and I had already taken several losses from forcing my trades, I needed many more points to make back the money I had lost to prior trades.

This leads to a flawed thinking of mine, I tend to target trades over 300 - 600 points..

And the problem is that often times I will be right and catch those trades, but its unrealistic of me to always expect myself to catch these trades as not every trading day will present me those price moves.

So some things I have learned today through my trading mistakes and losses:

1. Place SL above the highs when I enter a trade (the volume imbalance tapping me out made me want to cry 😢 lol) sl was hit at 10:25am.

Plan of action, be more patient with my trades and if I enter a trade, trust it fully, calculate my risk and accept the trade for what it is.

2. We failed to take profit at the 9:30am lows. It was a clean profit, inside of the 1st presented FVG. I most definitely should have taken profits there, despite my trade entry being above where price traded to and continuing lower. I most likely would've not wanted to hold through the trade or might have trailed my sl past BE causing me to get stopped out with minimal profits.

Below is the trade where we can see we could've simply risked 40 points to mave over 300.

Its better to just take the profit at the liquidity area (the lows) and then watch to see if price will continue lower or reverse for learning purposes.

There is no need to always catch 300+ moves BRUNA. Come on. Lets keep it simple.

Anyways guys, this is my attempt of analyzing my mistakes today. I am wholeheartedly in this trading journey and I wanna share all the mistakes and losses and problems with you guys in hopes that if someone is also struggling with these issues, that you might learn from my mistakes and maybe learn something from my mark ups.

If you guys enjoy this type of content I would appreciate you guys giving it a like, share with your friends. There is more to come (:

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

MNQ 12:00PM Trade EntryThis is one of the trades we took today which was very good trade, however due to me targetting the buyside liquidity all the way at 19,788.75 caused me to not realize my profits at the 16:00 mark. I was full of emotions today and I believe its just old patterns that I am working on breaking.

We had a great trading week last week, so we must remain level headed and focused. I can see here that my problem today was just not taking profits due to wanting to hold for bigger trades.

This is something we must break from and fix in our trading. When I am more focused on quick trades targeting near term liquidity pools it is when I am most confident. But I realize as I start getting better trades I tend to try to hold on to them more, specially after last week where we caught over 800+ points.

We were able to catch over 1,000+ points today, the sad part is... I was at work and did not enter on my funded challenge, I entered it on paper demo just to see the results of the trade and let me tell you, it broke my heart to not have entered because it FLEW to my TP.

This is part of the journey though, and I realize I must get a hold of these emotions and anxiety to get into trades and make money.

3/17/2025 - 12:01pm -12:14pm (13 minute trade)

3:00 was our entry

16:00 Should have been our TP.

(We should've realized that the next 1h candle that opened at 1pm would have a manipulation lower)

We could've utilized the IFVG once again at 12:46pm for the entry for the perfect trade idea. This was around the area where I entered on my DEMO.

- We used the 1H FVG which was used as support near its 50%

- Volume Imbalance from 11:33am -11:34am candles. It was used as support

- We also respected the Bearish FVG (turned IFVG) from the 11:33am candle.

We can also see that we create a inverse head and shoulders pattern 2 times near this area.

The first one we caught the trade, just failed to take TP at 16:00 mark at the 19,741.50 high.

The second Inverse head and shoulders pattern occurred 1:03-1:05pm. This was also a slight tap above the 1h bullish fvg which was the final piece needed to take price higher to fill in the 4h SIBI from the March 10, 2025 6:00am candle.

We ended up taking a total loss of $214 on our Top step account today after all trades.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

US Market Reversal Emerged? This Week's Closing is CrucialThe final trading day of February. I always take the opportunity to analyze the monthly chart closely.

We saw an inverted hammer. From the cash chart, clearly, we can see the inverted hammer. Beyond that, it also appears to be a potential double top for the Nasdaq.

E-mini Nasdaq Futures & Options

Ticker: NQ

Minimum fluctuation:

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme/

Trading the Micro: cmegroup.com/markets/microsuite.html

US Market Reversal EmergedLast Friday marked the final trading day of February. I always take the opportunity to analyze the monthly chart closely.

We saw an inverted hammer. From the cash chart, clearly, we can see the inverted hammer. Beyond that, it also appears to be a potential double top for the Nasdaq.

E-mini Nasdaq Futures & Options

Ticker: NQ

Minimum fluctuation:

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

2.27.25 Continuation showing reversal trade (Pt.4)Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

2.27.25 MNQ Trade Ideas with my bias (Pt. 3)

^ Outcome of trade snapshot is here, we were stopped out after we took our first partial.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

MNQ 2.27.25 Trade ideas (Pt. 2)Continuation of first video.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

MNQ Practicing Trades with ICT commentary (2.27.25)Hey everyone! I have been MIA, I know, I am currently recuperating my mental headspace and getting some things sorted before starting the next funded challenge. Last week on the 18th I blew the Funded account Challenge on Topstep, but that is okay. We will restart again March 15th and we will be coming back stronger. I have been testing some new ways to implement my strategy to give my trades more space and allow me to act more patiently.

We will be posting 3 videos today, Hopefully it loads up, I have been having trouble with my Tradingiew recordings posting & The last time it happened I forgot to save the videos. I believe this time we saved it so if there is an issue i will repost it manually.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

Tracking Crisis with Stocks/Gold RatioGold Surges with Three Major Crises

Over the past 25 years, we have witnessed three significant financial crises: the Dot-Com Bubble, the 2008 Financial Crisis, and the recent 9% inflation crisis. In each of these events, a distinct pattern emerged—gold surged before the crisis reached its full intensity.

Historically, gold's price has experienced notable gains before economic downturns:

• Dot-Com Bubble: +34% surge

• 2008 Financial Crisis: +89% surge

• Inflation Crisis (2022): +24% surge

Currently, gold has surged 83% from its trough in November 2022. Given this historical correlation, could we be on the verge of another financial crisis?

Why Are Central Banks Stockpiling Gold?

This current gold rally bears similarities to past surges but also has a crucial distinction. While demand for gold remains strong, this time around, central banks are leading the charge in purchasing gold at an unprecedented rate since 2022.

Gold serves a dual function:

1. Inflation Hedge – A safeguard against inflation.

2. Currency Hedge – Protection against currency devaluation.

Central banks' aggressive gold acquisitions suggest expectations of prolonged inflation and currency instability. As fiat currencies weaken, inflationary pressures mount, reinforcing gold’s attractiveness as a safe haven asset.

Fundamental Indicators Paint a Cautionary Picture

A deeper dive into key economic indicators suggests a challenging outlook. Here are some red flags:

• Treasury Bonds in a Downtrend – Indicating a loss of confidence in long-term debt

securities.

• Interest Rates Remain High – Despite inflation cooling from 9% to 3%, borrowing

costs remain significantly higher than pre-2022 levels. Elevated interest rates place

pressure on businesses and, eventually, stock prices.

• Inflation Remains Stubborn – The lowest recorded inflation since the peak was 2.4%,

but it has now ticked back up to 3%. With ongoing tariff escalations, inflation could

reignite.

These fundamental factors indicate that financial markets remain vulnerable to shocks, reinforcing the case for cautious positioning.

The Technical Outlook: A Bullish Trend Still Holds

Despite fundamental concerns, technical analysis suggests that the current AI-driven market rally, which began after the introduction of ChatGPT, remains intact. A strong uptrend line connecting all major troughs continues to act as a support level.

Timing the Bear with the Crisis

The bond market is already signaling distress. If equity markets break below this well-established uptrend line, my strategy will shift dramatically. Instead of looking for buying opportunities on dips, I will pivot to selling on strengths, anticipating a market downturn.

My Trading Strategy: Still Buying on Dips

I have provided a daily chart with updated trendlines, marking key support and resistance levels. My trading approach will be guided by these levels to manage risk effectively.

Preferred Instruments: Outright futures and call options.

Market Outlook: Cautiously bullish.

While economic conditions warrant vigilance, technical indicators suggest that the bullish trend remains intact—until proven otherwise. Happy trading!

Please see the following disclaimer and information that you may find useful:

E-mini Nasdaq Futures & Options

Ticker: NQ

Minimum fluctuation:

0.25 index points = $5.00

Micro E-mini Nasdaq Futures & Options

Ticker: MNQ

Minimum fluctuation:

0.25 index points = $0.50

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• My mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

Trading competition: www.tradingview.com

Trading the Micro: www.cmegroup.com

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com