Modified Schiff Pitchfork

WHEAT FUTURES Weekly Technical AnalysisZW1! Weekly - No RECOMMENDATION or ADVICE Status / EDUCATIONAL only - Support, Resistance, Trend Lines, Cluster, Confluence, Rectangles, Pitchfork, Modified Schiff Pitchfork, Fibonacci Extension - Hope it Helps, Good Luck

DISCLAIMER - This communication is not trading or investment advice, recommendation or solicitation to buy, sell or hold any investment product is provided for informational, educational and research purposes only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The author or persons involved in the conception, production and distribution of this material cannot be held responsible for transactions or any financial loss or damages resulting directly or indirectly from the use or application of any concepts or information contained in or derived from this material. Past performance is not indicative of future results. Any person who chooses to use this information as a basis for their trading assumes all the liability and risk for themselves.

CORN FUTURES Weekly Technical AnalysisZC1! Weekly - No RECOMMENDATION or ADVICE Status / EDUCATIONAL only - Support, Resistance, Trend Lines, Cluster, Confluence, Pitchfork, Modified Schiff Pitchfork - Hope it Helps, Good Luck

DISCLAIMER - This communication is not trading or investment advice, recommendation or solicitation to buy, sell or hold any investment product is provided for informational, educational and research purposes only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The author or persons involved in the conception, production and distribution of this material cannot be held responsible for transactions or any financial loss or damages resulting directly or indirectly from the use or application of any concepts or information contained in or derived from this material. Past performance is not indicative of future results. Any person who chooses to use this information as a basis for their trading assumes all the liability and risk for themselves.

S&P 500 Daily Technical AnalysisES Daily - No RECOMMENDATION or ADVICE Status / EDUCATIONAL only - Support, Resistance, Trend Lines , Parallel Channel, Cluster, Confluence, Pitchfork, Modified Schiff Pitchfork - Hope it Helps, Good Luck

DISCLAIMER - This communication is not trading or investment advice, recommendation or solicitation to buy, sell or hold any investment product is provided for informational, educational and research purposes only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The author or persons involved in the conception, production and distribution of this material cannot be held responsible for transactions or any financial loss or damages resulting directly or indirectly from the use or application of any concepts or information contained in or derived from this material. Past performance is not indicative of future results. Any person who chooses to use this information as a basis for their trading assumes all the liability and risk for themselves.

S&P 500 Weekly Technical AnalysisES Weekly - No RECOMMENDATION or ADVICE Status / EDUCATIONAL only - Support, Resistance, Trend Lines , Parallel Channel, Cluster, Confluence, Fibonacci Retracement, Pitchfork, Modified Schiff Pitchfork - Hope it Helps, Good Luck

DISCLAIMER - This communication is not trading or investment advice, recommendation or solicitation to buy, sell or hold any investment product is provided for informational, educational and research purposes only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The author or persons involved in the conception, production and distribution of this material cannot be held responsible for transactions or any financial loss or damages resulting directly or indirectly from the use or application of any concepts or information contained in or derived from this material. Past performance is not indicative of future results. Any person who chooses to use this information as a basis for their trading assumes all the liability and risk for themselves.

XAUUSD Weekly Technical AnalysisXAUUSD Weekly - No RECOMMENDATION or ADVICE Status / EDUCATIONAL only - Support-Resistance Zones, Modified Schiff Pitchfork, Pitchfork, TrendLines - Hope it Helps, Good Luck

DISCLAIMER - This communication is not trading or investment advice, recommendation or solicitation to buy, sell or hold any investment product is provided for informational, educational and research purposes only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The author or persons involved in the conception, production and distribution of this material cannot be held responsible for transactions or any financial loss or damages resulting directly or indirectly from the use or application of any concepts or information contained in or derived from this material. Past performance is not indicative of future results. Any person who chooses to use this information as a basis for their trading assumes all the liability and risk for themselves.

VET/USD - UpdateAs I mentioned in my previous VET post in March, there was always a possibility that VET would drop out of the Bottom Trend-line of its Ascending Wedge and Invalidate that Ascending Wedge Pattern, which has happened. VET also failed to get back above its 0.236 Trend-Based Fib extension Level on that previous chart so we know that $0.087 is the price that VET needs to close a daily candle above solidified with a successful re-test as support.

So let’s move on.

Using a longterm Modified Schiff Pitchfork Pattern (A,B,C), you can see that VET is still below its Modified Schiff Pitchfork Pattern Median Line.

At the moment VET has found some support from its Lower Green Pitchfork Support Line.

Let’s take a closer look at this 1 day VET USD chart with the Bollinger Bands, LSMA and VPFR POC.

At the moment VET is fighting to stay back above its Bollinger Bands Middle Band Basis 20 Period SMA for this 1 day timeframe. Not that the Upper and Lower Bands are moving sideways at the moment. Using the VPVR, you can see that the Upper and Lower Bands are located roughly above and below an area of large volume.

At the moment VET has found some support from its Least Squares Moving Average (LSMA) level. A daily close ABOVE the LSMA is crucial for continued upwards momentum.

At the moment VET is trying to stay back above its Volume Profile Fixed Range Point of Control (VPFR POC) for the Fixed Range of 22x daily candles i have selected.

For your viewing pleasure i have added various support and resistance lines (Black Solid Lines and Black Dotted Line) as well as various support areas as highlighted by the horizontal black lines with yellow shading.

As you can see, VET is now in a Descending Triangle Pattern (Bearish) as well as a Descending Wedge Pattern (Bullish). Note that the APEX of the Descending Triangle is located around Nov 2022 and the APEX of the Descending Wedge is located around March 2023. Note that a pattern can easily become invalidated with the price drop below and successful re-test as resistance of the bottom trendlines.

Looking at the Average Directional Index (ADX DI) we can see that Positive Momentum is still downwards with the +DI (Green Line) dropping to 14.17. Note that Negative Momentum is also down with the -DI (Red Line) dropping to 20.00. Note that the Trend Strength is still strong but has dropped with the ADX (Orange Line) dropping to 30.52 and the ADX is also back under its 9 Period EMA (Black Line) at 33.84 which is further confirmation of a weakening of Trend Strength at the moment.

Looking at the Moving Average Convergence Divergence (MACD), we can see that Momentum is upwards at the moment with the MACD Line (Blue Line) pointing upwards and is still back above its Signal Line (Orange Line) on this 1 day timeframe. Note that the MACD Line (Blue Line) is still BELOW the 0.0 Base Line in the Negative Zone.

Looking at the bottom Volume indicator we can see that overall traded volume is still low especially compared to what VeChain was getting from around October 2019 to May 2021. This is similar to Bitcoin’s daily chart which possibly means that while big money might actually be accumulating crypto assets like BTC, but there hasn’t been a constant inflow of big money actually trading crypto like BTC on a regular basis since around May 2021.

Using the Volume Profile Visible Range (VPVR) indicator, you can see where the Volume Profile Visible Range Point of Control (VPVR POC) is for this VeChain Chart is. Using the entire charts range we can indicate at what price range was the most volume was traded at. At the moment the Crypto market is following BTC so if BTC drops to $20k or $12,400 then we may see a wick down to around $0.009 which would offer a real great buying opportunity for most crypto. If BTC doesn’t drop to $20K then we will see VeChain eventually break back above its Descending Triangle, its Descending Wedge and eventually back above its Modified Schiff Pitchfork Median Line.

I hope this post is helpful with your trading or hodl-ing.

LINK - What can happen to it?As a long term view, i cannot say with high probability what's going on but there is a energy point in view and a triangle created in between that area that can be a price target, there's no clear area of support or resistant in that area that fits perfectly but the best shot would be 19.522 since it's a valid swing high and must be broken if we want to see higher prices in future.

The swing has created an energy point too but not as valid as the next one since it has confluence with other pivots on the chart as well two bigger picture forks which one of them is a strong valid one and the other one isn't confirmed yet BUT we use it as confluence not for trade

to summerize, we can watch for 20.800 which is a round number too, to get short OR use it as a take profit target.

Have nice day

Ask me any questions you might have

Short Opportunity on BTCUSDI though of sharing my current technical analysis with all of the interested people. We have a few things lining up nicely.

First of all we have a downsloping trendline from the ATH over the last two peaks of the BTC price action ( 52k and 43k) lining up with a .618 fibonacci retracement . Additionally this .618 fib retracement lines up with two key levels which cannot be seen in the picture. the first one being the low of the previous year's value area low, next to this we had a beautiful range last June/July from which the POC lies around 39.5k creating the key level.

Sharing your thoughts on the analysis would be appreciated.

SOLANA is back on track!I've used Modified schiff pitchfork with the markings ( ABC ) seen on the chart and since the outside trendlines mark potential support and resistance , solana managed to take support at pitchfork .

Pitchforks are used as part of a popular analysis and trading technique. In essence, there are 3 key elements to it: 2 outside parallel lines that provide support and resistance and a median line in between them. To use a pitchfork correctly, identify 3 points that are consecutive highs and lows, where the first point represents the start of a trend. The median line connects the first point to the midpoint of the other 2. Additional lines can be added at a set number of standard deviations from the median, forming parallel trend channels.

Pitchforks can be used to identify buying and selling opportunities at those lines (for trading bounces or breaks), depending on the specific rules of entry and exit a trader may have. Conservative traders will look for additional confirmation. Apart from Andrew's Pitchfork there are variations like the Schiff Pitchfork , the Modified Schiff pitchfork and the Inside Pitchfork . TradingView has smart drawing tools for all of these techniques and there is a popular chat where users share pitchfork-based ideas.

BTC : Modified Schiff PitchforkPitchforks create a type of trend channel.

The trend is considered active as long as the price stays within the channel.

Reversals occur when price breaks out of the channel.

There is a center median line (trend line), as well as sets of lines above and below that median line.

The additional lines are set a specified number of standard deviations away from the median...

in this example, the additional lines are derived from the numbers 0.25, 0.382, 0.5, 0.618, 0.75, and 1.

Each individual line represents a support/resistance level.

Note the way that price action interacts with the various lines :

Lastly, here are multiple modified schiff pitchfork channels applied :

// Durbtrade

$LINK: Shifting from an original pitchfork to a Modified Schiff.Both of these charts are the same except for the change from an original Pitchfork on the left to a Modified Schiff on the right. I think it's pretty fascinating to see how the different level's we're seeing are captured perfectly by these different versions of the same tool. I'll try and list things that I think are interesting on the left and right and compare the two.

- On the left chart the ATH wick of $35.78 comes very close to touching the purple 2.0 deviation on the standard pitchfork. Compared to the modified pitch on the right who's 1.0 deviation acted as resistance. However, the wick didn't come nearly as close on the right than it did the left.

- After the test and rejection of the 2.0 and 1.0 deviations, we saw price action retrace back to that S/R level of $32 and we established a higher low. Notice how on both the left and right, the 1.0 and the median lines both act as pretty clear support, while the standard left doesn't quite touch the 1.0, while the right modified pitch median allows the wick to pass through a tiny bit.

- Now we're looking at this last 4 hour candle. On the left standard, we see the price action starting above the 1.0 median line, but when we look closely at the right hand modified pitch chart? You can see how it perfectly bounces and starts off that median line.

- Finally we're looking at the two red support lines that I drew in parallel on the charts. They're both at the exact same level. If the price action were to test that line in the future? On the right hand chart you'd see pretty clearly that it was breaking below the median and that might be concerning... but if you use both charts you'd see that if the price action were to touch that support line? It would be perfectly captured by the standard pitch's 1.0 blue deviation line on the left.

- If you look at price action that doesn't quite hit on a certain support or level, quite often you're able to see that PA captured perfectly on the other chart.

TL:DR - Using both standard on the left and modified schiff on the right, we can use the slightly different versions of the charting tool to see a lot of confluence between the areas of support that $LINK is respecting on its monster climb towards $100 dollars. I'm very very bullish on Chainlink fundamentals, and the technicals are truly awesome to chart as they follow these fib and pitchfork levels to a tee. I won't ever give financial advice... but I will say that I personally, am buying and holding as much $LINK as I possibly can in these next few years. The future is bright with the possibilities that decentralized verifiable data provides. Good luck marines :)

$LINK + Modified Schiff Pitchfork = Dead-on accuracyI love $LINK on the 4hr chart. I've been experimenting with fans and pitchforks, and this one is AWESOME for identifying pivots. I used the Modified Schiff pitchfork on this. Which is good for sideways market action, as it moves the median 50% up and 50% over in terms of price and time. Just look how it touches the .5 and the 1 deviations, but then wicks PERFECTLY down to the 2.0 deviation. Chainlink has been consolidating for what seems like forever now. I think this is just a matter of time before it breaks through the lower .5 resistance and the median. I'd look for a strong move in the next couple weeks? But I'll say it again. $LINK is a buy and hold for me. Long term investment and waiting for staking to be implemented before this thing goes to the moon.

GBP/USD :DSimilar setup for the GU, as you can see it is forming a "Head and shoulders pattern" (I don't trade chart patterns) . Price is moving in a very organized way and that's curious to see. Hope you like me analysis even though it is hard to understand xD.

Feel free to ask me anything about my analysis :D.

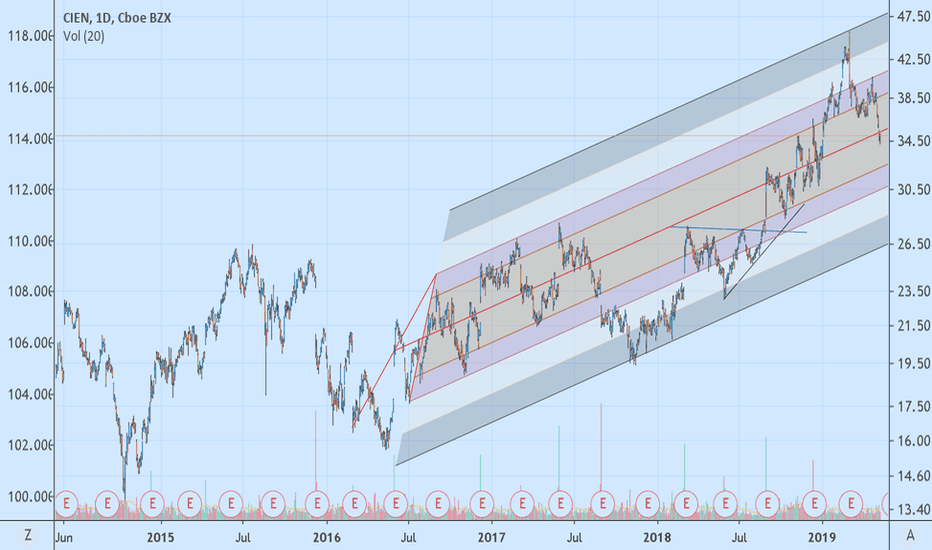

CIEN Trend Analysis with Modified Pitch ForkAlthough the short term signal is SHORT, look for a reversal to LONG around $31.

When using Modified Pitchforks, it's important that the projected lines provide multi-sigma coverage of the linear regression slope. In the case of CIEN, a Modified Pitchfork from the 2017 lows provides almost perfect symmetry and gives the trader several levels to trade Ciena. It's important to note CIEN had been in a flat range since 2002, however, it's a very wide range from $10 to $40, with two outliers that extend the range to $50 (1/03-1/04) on the high-end of the range and $5 on the low-end of the range (11/08-02/09).

Once a leader in networking hardware, Ciena lost tremendous market share to Motorola Solutions (MSI) , Arista ANET and Cisco CSCO by not recognizing the importance of 4G early enough. That mistake led them to invest heavily in 5G and the company is benefiting from this as it emerges as a potential leader in the crucial migration to 5G. With US sanctions pressuring their lead international competitor, Huwei, Ciena is poised for a massive repricing of its market cap, which at $5.5B ranks it amongst the smallest amongst its peer group: MSI: $25B, ANET: $20B, CSCO: $232B. CIEN's market cap is roughly equal to Lumentum LITE ($4.9B) but the latter trades at a PE of 130 compared to CIEN's PE of 23. If CIEN was priced at the same earnings multiple as LITE, the stock would be trading around $200/sh.

For a long position, look for a convergence of technical zones. Looking at a monthly chart, you'll see that the high end of 2010-2018 range is $30. The 50p EMA is crossing above the 100p EMA and the 24p EMA crossed above both slower EMA's last October.

On the weekly scale, the 100p EMA is at $30 with the 200p EMA just below around $27.

On the daily scale, a Fibonacci fan of the May 2018 to March 2019 move projects the 3rd fan line around $32, with prices presently hugging the 2nd fan line at $35, which also coincides with the 200p EMA. RSI is close to penetrating the lower band, confirming the stock is getting oversold, but there is still downside left before CIEN finds a floor. When it does, load the boat.

I also use a proprietary short term price predictor overlaid against a linear regression slope. When the predicted price forecast moves above the linear regression slope, it's generally a good time to step in. To create a similar 'indicator', you can use a Time Series Forecast (similar to a MA) with a periodicity of 9 overlaid against a Linear Regression Indicator with a periodicity of 18. When the TSF crosses above or below the LRI, it's a powerful buy/sell signal, but use the slope itself as a filter to avoid chop in sideways markets and this technique will help you capture very large moves. As of this writing, this method is in a sell signal with the linear regression slope pointing down. Look for when the slope levels off, and the TSF crosses above/below the LRI, as happened in early February just before the move from $38 to $46 for a buy signal, and in late February for a sell signal as the slope leveled off and the crossover occurred near $45 for a short trade that remains open. Using the linear regression slope as a filter for the TSF/LRI crossover would have avoided the chop from March to late April, and then the current short trade would have been validated at the end of April at $40.

MTHBTC : 4 Bull ScenariosEvery times the price touched purple line the price jump powerful. At this time price touched EMA200 and median of pitchfork and we can expect modification of price and after that price will go up. if price can stay above EMA200 Bull run will continue.

USOIL Bears Fail Yet AgainThere's a constant inflow of demand for USOIL. Dips are being bought by trend continuation players without hesitation and the overextended state of this market is not scaring bulls away. Given the HHs and HLs , it seems reasonable to buy around 7150 with tight stops under recent lows around 7120 . Lower probability set up with decent R:R.