Monday

#analysis 59 - Weekends endSo the weekend has finally come to an end, and we can see there's not much altcoin flied far. Now Bitcoin has come to a consolidation phase.

Not pretty sure how it go, so flat now. But I did check the chart of FTT. It seems that pretty good if we reach the lower part inside the range. Look forward to going to the range high if we made a bounce down below. However, the SL should be at around the range low, not below the OB for safety.

Why?

The range low has already tested for 3 times, which is not pretty good for general cases. Also, now not pretty sure how Bitcoin go in the new week. We'll set it when Monday ends.

So let's take a rest for another day.

BANKNIFTY MONDAY 8 AUGUST ANALYSISPrice is still trading in the same range for 7 days now , price is trying to move upside but getting rejections from same resistance for the third time . Monday ,if price breaks triangle channel and moves downwards immediate target would be 37600 and next will be 37250.

If price gapsup above triangle channel and tests 38150 level for the fourth time then there are possibilities of price breaking the trend line (if price hits trend line multiple times ,it will become weak) our next target would be 38400.

AUDUSD Monday Analaysis Update, Bearish for Equity Open EntrySo it took the buyside liquidity high as you can see, we are still in the 4H OB, and we can see the bearish momentum and the inner Break of structure in the 5M Timeframe.

if you are fimiliar with ICT Model you can apply it now

we are targeting the 2 liquidity lines as seen, SL will be moved to entry and partials will be taken upon the first Liquidity line being hit, overall really confident with the analysis and i will be taking the trade

in the inner small timeframe range, enter at the EQ ( 50% ) and Sl above the high and target the liquidity lines.

Morning Analysis - 07/03/2022Good morning traders, Hope everyone had a wonderful weekend.

Are we ready for another week of trading?

GBP has started to breakout of structure now and had a very convincing bear run, we seem to be pulling back now.

USD/CAD has broken back into consolidation. However, with the rejection from resistance and GBP starting to pullback we could see USD/CAD continue back down to support.

I have traded a break and retest from a key level on the M15 and I am expecting momentum to continue now we are starting to see cross USD pairs begin to move to the upside.

What are your thoughts on this and what are you looking to trade for the day?

Let me know in the comments below.

MONDAY LIVE: SPX500 and Forex Overview - JAN 24Hi Traders,

This is my view for this week on:

- SPX500

- EURUSD

- AUDJPY

- NZDJPY

- USDJPY

I remind you that this is only a forecast based on what current data are.

Therefore the following signal will be activated only if specific rules are strictly respected.

If you follow my strategy you will be able to identify the right filters and triggers to enter correctly the market and avoid fake signals.

I really hope you liked this video and I would like to know what do you think about this analysis, so please use the comment section below this video to give me your point of view.

Thank You

———————————

Pit from Trading Kitchen

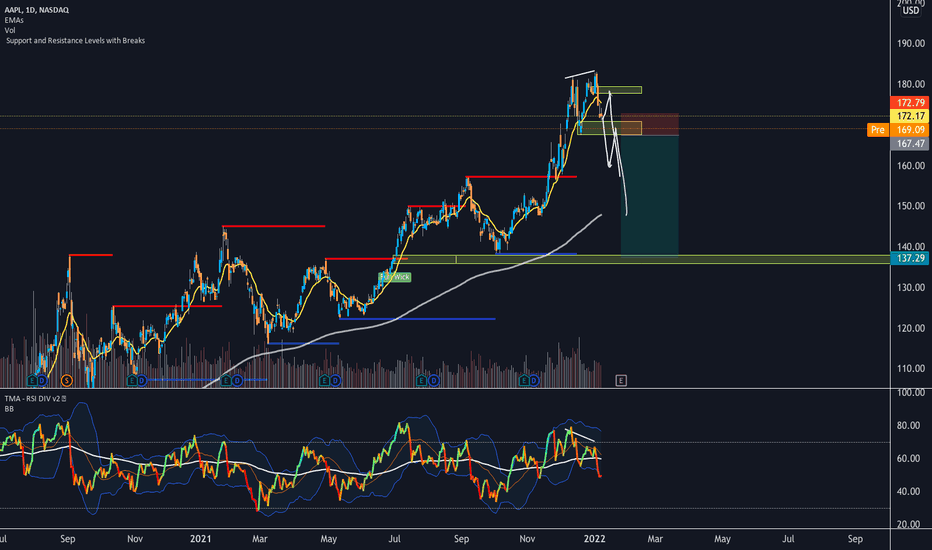

MONDAY LIVE: SPX500, EURUSD, USDCAD and APPLEHi Traders,

This is my view for this week on:

- SPX500

- EURUSD

- USDCAD

- APPLE

(I’ve just shared my fully explained 81strategy on Tube)

I remind you that this is only a forecast based on what current data are.

Therefore the following signal will be activated only if specific rules are strictly respected.

If you follow my strategy you will be able to identify the right filters and triggers to enter correctly the market and avoid fake signals.

I really hope you liked this video and I would like to know what do you think about this analysis, so please use the comment section below this video to give me your point of view.

Thank You

———————————

Pit from Trading Kitchen

USD/JPY - 22/11/2021(H4) - Price forming bearish structure creating lower lows and lower highs, we have approached a level of support around 113.783 which we do need to be mindful of. Previous candle closed as an indecision showing no control from buyers or sellers. Based on this candle we could see the next push phase begin here (we are also sat around 618 fib level). I expect price to create a wick to the upside before reversing. This could look like a break out break back in or a retest of resistance before reversing.

(M15) - Clean trendline formed on this pullback. Ideally I want to see a break of 114.032 to look for a short entry.

EURUSD 4 hour breakdownEURUSD 4 hour expectational order flow still intact and still bearish.

I did think price was going to grab the liquidity at 1.6200 before tuesday/wedensday bearish impulse, but its a good lesson of just because you know where the liquidity is, it doesn't mean you know when the market is going to take it.

But yes we reacted to the 4 hour order block and broke structure nicely leaving some imbalanced price. we are now sat at an daily order block which we could see a reaction from taking price back into discount market.

again the new 4 hour structure and order block at 1.5900 will be vital in holding structure.

probably won't try and trade Monday and just let price develop and see if we are going to continue straight bearish or retrace into the range.

let the market make its mind up and follow the money

GBP/USD - 01/11/2021GBP/USD (H4) - sat on support here at 1.36713 we are consolidating along this level with multiple wick rejections coming in pushing price down. Usually when we see consolidation on support/ resistance it is usually followed by a break. We could also see a retest back up to 1.37229 so just be mindful of that!