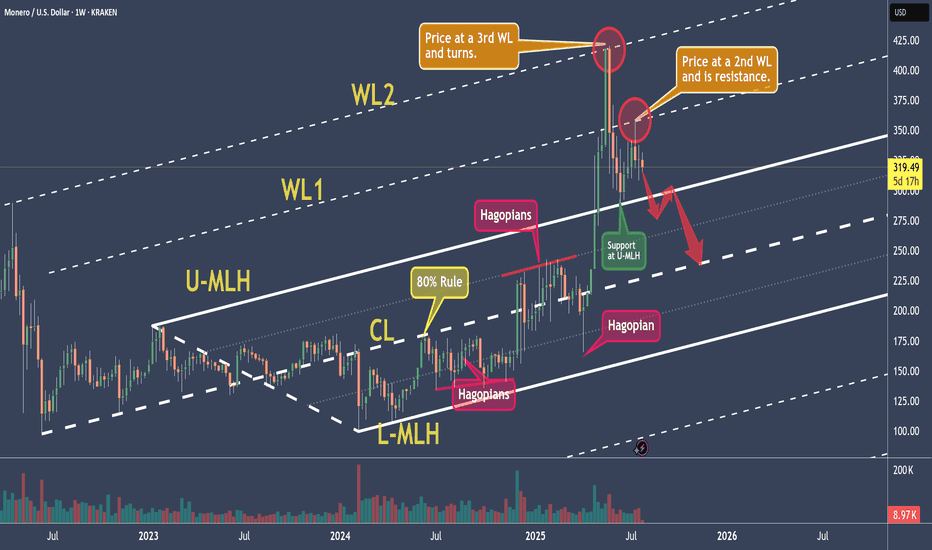

XMRUSD - Monero And It's Warning-LinesToday we’re analyzing Monero, with a focus on a new aspect of Median Lines — the Warning Lines, or WL for short.

Warning Lines are simply extensions of the distance between the Center Line (CL) and one of the Median Line’s outer boundaries, either the Upper Median Line Parallel (U-MLH) or the Lower Median Line Parallel (L-MLH).

So why are they important for us in our trading?

As you can see, WL1 and WL2 mark important price levels. WL2 is where price reversed, while WL1 acts as resistance.

Just like with the standard lines, our full trading rule set applies to Warning Lines too. This includes scenarios like a Hagopian, a breakout or "Zoom Through," and the Test and Re-Test.

Now, looking at the current analysis:

The price was rejected at WL1 after falling from WL2. This shows strong resistance at WL1, and now the price is heading toward the U-MLH.

If the price breaks below the U-MLH and starts opening and closing within the Fork again, there’s a strong chance it will move back toward the Center Line in the near future.

That could be your signal to take more profits, close the position, or possibly even short Monero.

Personally, I find it difficult to short crypto due to the high risk of manipulation by whales in the market. I prefer not to get caught in a short position if the price suddenly gaps to the upside. So I probably look to take a new position or add to an existing one, since it is a fair level where price found it's center.

That’s it for today.

Did you learn something new?

Great. See you next time, and trade safe.

Monero

Monero: The Ultimate Financial Survivor or a Digital Illusion?Introduction: The Search for an Unbreakable Asset

In an age marked by escalating global tensions, fragile supply chains, and unprecedented monetary policies, the question of where to store wealth for the long term has taken on a new urgency. The traditional playbook of stocks, bonds, and real estate feels increasingly vulnerable, tied as it is to the very systems that appear to be under strain. For centuries, physical gold was the undisputed answer—a tangible, scarce, and universally accepted store of value, independent of any government or corporation.

However, the digital revolution has introduced a new class of assets, and with it, a radical new thesis. This argument posits that in a true societal collapse—a scenario of hyperinflation, widespread conflict, or the rise of an oppressive surveillance state—only one form of value would prove truly resilient, functional, and safe: the cryptocurrency Monero. The claim is audacious: that when the world as we know it ceases to function, Monero will not just survive but will become the only viable medium of exchange. This report delves into the powerful arguments underpinning this belief, examining the unique technology that sets Monero apart, the perceived failures of all other asset classes in a crisis, and the significant, practical challenges that confront this "doomsday investment" theory.

The core of the argument rests on a return to first principles. In a world without stable governments or trusted institutions, the essential properties of money—privacy, fungibility, security, portability, and decentralization—become paramount. Proponents contend that while other assets, including the cryptocurrency pioneer Bitcoin, compromise on one or more of these critical features, Monero’s fundamental design makes it uniquely suited for the ultimate test of survival.

The Architecture of Anonymity: What Makes Monero a Digital Ghost

To grasp the Monero thesis, one must first understand the cryptographic innovations that make it the undisputed leader in financial privacy. Unlike transparent cryptocurrencies where every transaction is a public entry on a permanent ledger, Monero was engineered with mandatory, unbreakable privacy as its default setting. This is not an optional feature; it is the very fabric of the network, woven from a combination of three core technologies.

1. Ring Signatures: Erasing the Sender. When a user sends Monero, their transaction is not signed with a single, identifiable digital signature. Instead, the protocol automatically gathers a number of past transaction outputs from the blockchain to act as decoys. The sender’s true signature is mixed into this group, creating a "ring" of plausible signers. To an outside observer, any one of the participants in the ring could be the actual sender, making it computationally impossible to prove which one it was. This provides powerful plausible deniability, effectively severing the link between an individual and their specific expenditures.

2. Stealth Addresses: Shielding the Recipient. Monero ensures the privacy of the receiver through the use of stealth addresses. In most cryptocurrencies, a user has a public wallet address that can be reused, allowing anyone to see all the payments sent to that address. This creates a public history of one's income. Monero eliminates this. For every single transaction, a new, unique, one-time address is generated on behalf of the recipient. This address cannot be publicly linked back to the recipient's main wallet or to any other transaction they have received. Only the sender and receiver, using their private keys, can make the connection. This prevents the mapping of a user’s financial network and the calculation of their total wealth.

3. Ring Confidential Transactions (RingCT): Concealing the Amount. The final piece of the privacy puzzle is the concealment of the transaction amount itself. Through a cryptographic proof system, Monero is able to validate that a transaction is legitimate—ensuring no new currency is created out of thin air—without ever revealing the actual numbers involved. The amounts are encrypted on the public ledger. This prevents financial surveillance, where large or unusual transactions could draw unwanted attention from hostile actors, be they desperate governments or opportunistic criminals.

These three pillars work in concert to create a truly opaque financial system. When combined with network-level obfuscation techniques that hide the IP address of a transaction's origin, the result is a system that is not merely pseudonymous, but anonymous. This leads to its most critical economic property in a crisis: true fungibility. Fungibility is the quality of an asset where every unit is identical and interchangeable with every other unit. A dollar bill is fungible, but a diamond is not. In transparent cryptocurrencies, coins can become "tainted" by their history; if they were previously used in a crime, they can be blacklisted by exchanges or vendors. With Monero, this is impossible. Since no coin has a traceable history, every Monero is clean, equal, and freely exchangeable, just like cash.

A World in Flames: Why Other Havens Fail

The case for Monero is built as much on the inherent weaknesses of its competitors as on its own strengths. In a true systemic breakdown, every other major asset class reveals a fatal flaw.

• Fiat Currencies, Stocks, and Bonds: These are the first casualties. They are not assets in themselves, but rather claims on the health and stability of governments and corporations. In a hyperinflationary depression or a civil war, the paper promises of a failed state or a defunct company become worthless. Their value is entirely dependent on a complex legal and financial infrastructure that would no longer exist.

• Real Estate: Property is tangible, but it is also immobile and illiquid. In a lawless environment, property rights are only as strong as one’s ability to physically defend them. A house or a plot of land can be seized, destroyed, or rendered inaccessible, making it a liability rather than an asset. One cannot flee a collapsing city with a building in their pocket.

• Gold and Precious Metals: Gold is the timeless hedge against chaos. It is physical, carries no counterparty risk, and has been valued for millennia. However, it suffers from severe practical limitations in a modern collapse. It is heavy and difficult to transport securely. It is not easily divisible for small, everyday purchases. Verifying its authenticity requires specialized tools and knowledge, making transactions slow and risky. Storing it safely makes you a target.

• Bitcoin: As the original cryptocurrency, Bitcoin offers portability, divisibility, and digital scarcity. It is often called "digital gold." However, its transparent ledger is a catastrophic vulnerability in a world of turmoil. A desperate government or a sophisticated criminal organization could use blockchain analysis to identify large holders, track their every transaction, and target them for expropriation or violence. Having a permanent, public, and unchangeable record of your entire financial history is the opposite of what one would want when trying to maintain a low profile and survive.

• Stablecoins: These digital tokens are pegged to fiat currencies like the U.S. dollar. They are designed for price stability within the current system, not for surviving its demise. They are centrally issued and controlled, requiring complete trust in the entity holding the reserves. In a scenario where the dollar itself is collapsing, a stablecoin is merely a digital reflection of that failure.

Monero, its advocates claim, elegantly solves these dilemmas. It combines the portability and divisibility of Bitcoin with the privacy and fungibility of untraceable cash. It is more easily secured and transported than gold. And it exists entirely outside the control of the failing institutions that underpin all traditional financial assets.

The Sobering Reality: Counterarguments to the Digital Savior

Despite the compelling logic, the theory of Monero as the ultimate doomsday asset faces a series of harsh, practical realities that may prove to be its undoing. These challenges question the very foundation of its utility when the lights go out.

1. The Paradox of Infrastructure. The greatest challenge to any digital currency is its absolute dependence on modern technology. Monero transactions require electricity to power devices and a functioning internet to connect to the network. In a true "world blows up" scenario—characterized by a grid-down event, an electromagnetic pulse (EMP), or the destruction of core internet infrastructure—the Monero network would become fragmented at best, and completely inaccessible at worst. While niche solutions like satellite uplinks, radio broadcasts, and local mesh networks are theoretically possible, they are far from being robust, widespread, or easy to use. For the average person, their digital wealth would be trapped behind an insurmountable wall of dead technology.

2. The Human Factor and the Usability Gap. Even under normal conditions, securely managing cryptocurrency is a complex and unforgiving task. It requires a significant degree of technical literacy to handle private keys, seed phrases, wallet software, and cold storage protocols. Now, imagine trying to do this in a high-stress, post-collapse environment while concerned with finding food, water, and shelter. The cognitive burden would be immense. The risk of making a single, irreversible error—losing a seed phrase, sending funds to the wrong address, or having a device compromised—is extraordinarily high. The operational security required to safely manage digital assets is simply beyond the reach of the vast majority of the population, especially in a crisis.

3. The Last Mile Problem. An asset’s value is ultimately determined by its ability to be exchanged for essential goods and services. While a small, dedicated community of users may transact purely in Monero, this is a microscopic niche. In a widespread crisis, the fundamental challenge would be converting digital value into physical necessities. One must find a counterparty—a farmer, a doctor, a mechanic—who not only possesses the required goods but is also willing and able to accept a purely digital currency. In the immediate aftermath of a collapse, the primal logic of barter would likely take precedence. A can of beans or a box of ammunition would hold more immediate, tangible value than a string of encrypted code.

4. The Specter of Security Flaws. While Monero's cryptographic foundations are widely considered to be state-of-the-art, no system is perfect. The network is a constant target for researchers and adversaries seeking to break its privacy guarantees. Theoretical attacks have been proposed that, while complex and difficult to execute, suggest that under certain conditions, a highly sophisticated and well-funded adversary could potentially de-anonymize some users. Furthermore, the health of the network itself is a concern. In a global crisis, a significant drop in the number of people running nodes and mining could make the network more susceptible to disruption or a "51% attack," where a malicious actor could gain control of the ledger.

Conclusion: An Imperfect Hedge for an Uncertain Future

The proposition that Monero would emerge as the sole functioning investment from the ashes of a global catastrophe is a fascinating and powerful thought experiment. It correctly identifies the profound fragility of our current financial system and even exposes the critical privacy flaws in mainstream cryptocurrencies like Bitcoin. Monero’s technological design offers a truly remarkable and unparalleled combination of privacy, security, and fungibility in the digital world. It is the closest humanity has come to creating a weightless, borderless, and untraceable form of cash.

However, the thesis ultimately overreaches, mistaking technological elegance for practical invincibility. The absolute reliance on a functioning technological infrastructure is a fatal flaw in any true doomsday scenario. The immense complexity of its use creates a barrier that would exclude the majority of people precisely when they would need a safe haven the most. The fundamental challenge of exchanging digital code for physical survival goods remains largely unsolved.

Therefore, while Monero is an exceptionally powerful tool for preserving wealth and privacy in an era of increasing surveillance and financial instability, it is not a silver bullet. To declare it the only viable investment in a total collapse is to succumb to a form of digital idealism that ignores the messy, physical realities of survival. A more prudent approach to preparing for such a future would involve diversification across asset classes that address different failure points. Such a strategy might combine the digital privacy of Monero with the timeless, tangible security of physical precious metals, the practical necessity of storable goods, and, most importantly, the acquisition of real-world skills. Monero may well be the digital ghost that survives the crash of the global machine, but its utility would be severely limited in a world where the machine itself has been unplugged.

The invisible coin club (Monero $XMR)Setup

The price has pulled back to a formerly significant price pivot at 300 after hitting a 4-year high over 400 in April. The price is well above its up-sloping 30-week moving average.

Signal

The daily chart shows a potential breakout from a base formed above 300 with RSI also confirming the bullish turn with a break over the 50 level.

XMR 3 Month Heikin Ashi Trend ChartWe have here a trend outlook chart for Monero on a 3 monthly timeframe (Heikin Ashi candlestick chart). XMR is one of a handful of high market cap coins which have showed signs of strength on a variety of indicators (despite high volatility with various other high market cap coins), including the positive MACD and RSI indicators as shown in this chart.

In addition, there has been significant buy volume in the 170 - 277 price range, as can be seen in the Price-Volume indicator to the right of the chart, keeping the price up.

Monero has withstood the political and economic turmoil in recent months making it a strong contender against some of the largest market cap coins. With the current price sitting at approximately USD$315, there is potential for further upside in the long-term.

_____________

This publication and the information contained in it are for educational purposes only, and is not meant to be nor does it constitute financial, investment, trading or other types of advice or recommendations.

His name is Monero- Despite numerous attempts by various projects to create private coins or tokens, none have succeeded meaningfully.

- Monero is the Bitcoin of the darknet. They can delist it or try to kill it, but Monero is here to stay.

- With rising concerns over privacy and the inevitable push toward CBDCs, the next bullish cycle could drive XMR to a new ATH, $1,000 is a realistic target, not a fantasy.

- Everything you need is in the chart. This is not financial advice, buy only when you believe the time is right.

Happy Tr4Ding !

Case for Monero ContinuesTL;DR:

Monero is used as a currency giving it a relatively stable value during all seasons

There has been and will continue to be large transfers of Bitcoin to Monero creating supply shocks and XMRUSD RIPs

I have been heavily focused on sharing my bull case for Monero for over two years now. That made for a very disturbing morning on February 4th, 2024 when I woke up to see KRAKEN:XMRUSD down more than -30%. My first thought was, "oh no... someone cracked its privacy!" Then I read the details; it had been delisted from Binance for "being impossible for government to track and therefor banned in many countries." So... Monero was actually "working as intended." Buy!

There are only 3-4 cryptocurrencies that matters to me: Bitcoin, Monero, and which wins between Ethereum/Solana. These cryptocurrencies represent the established use cases thus far respectively in Store of Value, Currency, and Smart Contracts. I have been writing about Monero for several years now relating my observations about its uses, price performance, and future predictions. Recent events have proven my thesis to be accurate and I am confident will continue to be.

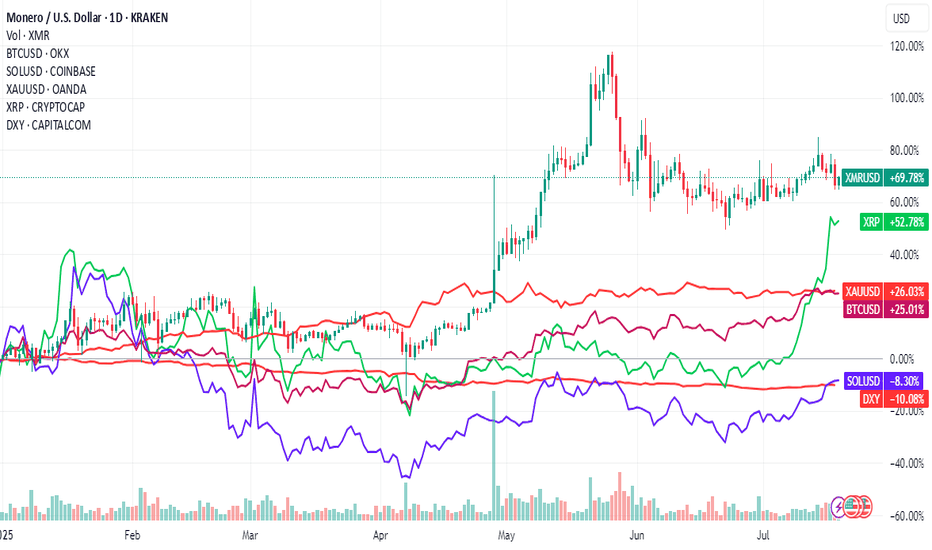

Performance versus Bitcoin:

One criticism of observing recent or past outperformance of BITFINEX:XMRBTC is "zoom out bro" where the full decade plus price trend it noted. This is undeniable. However, one should remember the investing adage: "past performance is not indicative of future results." One should also not be ignorant of the facts leading to extended periods of outperformance and what they mean for future market conditions.

During the crypto winter of 2022 Monero outperformed Bitcoin as a product of Monero holding its value, presumably because of its continued use as a medium of exchange (currency), while Bitcoin fell precipitously.

The same outperformance happened again when Bitcoin had a less dramatic decline in value during 2024. Again, Monero maintained a relatively stable valuation.

Year to Date as a product of Monero's prior stability and the catalyst event (I will talk about later) have driven a period of outperformance yet again.

Store of Value

Bitcoin's use case as a Store of Value is well established. Prior to the last Halvening event Bitcoin was actually MORE inflationary than Monero. Now the inflation rate for Bitcoin and Monero is 0.83% and 1.7% respectively. Monero has an inflation rate known as a "tail emission." The inflation rate actually declines over time as the amount of new Monero being added (432,000 annually) is fixed. There will actually be a point where they are close again around late 2027 when the rates will be 0.83% and 0.82% respectively. As Bitcoin rewards continue to decrease there will never be a point where Monero's inflation is less than Bitcoin's.

However, being inflationary or deflationary alone does not grant or guarantee value. Bitcoin will always hold the title of "most deflationary" between the two. Having limited supply and being scarce is not enough to give something value. Intrinsic value is derived from many potential factors and one that is common between both of them is: use as a medium of exchange. Monero is actually proving to be more used as a medium of exchange.

"Monero is what people think Bitcoin is."

I have been observing over the last two years a shift on the Darknet markets that there are two primary currencies: Bitcoin and Monero. What is interesting is that some Darknet markets have ceased transacting in Bitcoin entirely and rely exclusively on Monero. This is one of the reasons that Monero has maintained its value over this time. The reason is Monero's primary use case: private money. Monero is built upon privacy by default. This is originally what Bitcoin was perceived to be. Now, the public nature of Bitcoin is seen as a value proposition for state and corporate adoption to the benefit of NGU (Number Go Up) but it provides no security for those that value privacy.

"What about Zcash?"

There are other privacy coins, sure. Often times when I talk about Monero these competing coins are brought up in the context of "interesting technology." Tech matters less to use. You can have amazing tech that is worthless if no one uses it. This is analogous to the platform war between Betamax and VHS. Betamax arguably had better technology but the consumer market chose VHS and that became the standard.

As long as Monero "has privacy" then any other cryptocurrency that "has privacy" has only equal use case. What matters then is the market; the consumer. And the market and consumers have already decided to use Monero. The network effect has already taken over. It will be incredibly unlikely that any other privacy coin can reach the same network effect and supplant Monero.

Bitcoin is worthless without state approval

In 2023 and 2024 hackers that had somehow broken into the Darknet market of Silk Road and the Cryptocurrency exchange Bitfinex were captured, prosecuted, deprived of freedom, and forced to surrender their Bitcoin many years after their crimes were committed. We are talking billions of USD worth of Bitcoin that were rendered worthless to their ill gotten owners. What should have been realized then was that all Bitcoin, despite being permissionless, is worthless to its owner without full state approval. You can hold it, send it, and trade it but if government does not approve it will find you and take your freedom. That is, of course, unless you hand it over to them and they might give you some of that freedom back.

So it became rather obvious that should a hacker acquire copious amounts of Bitcoin they would invariable seek to privatize these gains. Just such an event happened in April. Allegedly, a hacker gained access to a very old Bitcoin private key containing nearly $330 million worth of Bitcoin and then proceeded to convert it to Monero irrespective of transaction costs and liquidity. This created an acute supply shock leading to a huge RIP. Many smaller exchanges "ran out" of Monero exacerbating the supply shock and leading to further appreciation.

This is a catalyst that is founded upon rational actions albeit not ethical. We can presume that such catalysts will continue to happen into the future.

Technical Analysis

Monero has been very hard to trade using my standard methods. Because of its normal stability of value it lacks clear and robust trends to play pullbacks. However, there is a definite recent trend to look at now. I am very interested to see where and if Monero establishes a new trading range because then I can look at the lows of this range to accumulate more. The potential 50% Retracement level of the present price action is 292.

Conclusion

During all seasons both bullish and bearish Monero will continue to be used as a medium of exchange and maintain its Store of Value. Monero has already reached adoption level in the use case of privacy which establishes a moat of competitive advantage versus any other privacy coins. As long as humans use cryptocurrency they will value the privacy advantage of Monero versus Bitcoin and periodically and unexpectedly convert between the two leading to huge supply and price shocks.

XMR/USDT Monero super cycleWarning: LONG READ

TL;DR: Monero is going to encapsulate a similar growth cycle to Bitcoin's, Privacy, agency and its extremely decentralized nature will create a FOMO storm, a new narrative for the next many years, an uprising against the control and attack on our free will as citizens.

_________________________________________________________________________________

These past few years we've seen an incredible surge in surveillance, government intervention, banks freezing funds, the list goes on, of which has led many people into deep frustration and dissatisfaction with the system.

However, what it really boils down to is the lack of agency, and within that, the lack of privacy.

This coming storm of rebellious action against the system of surveillance and control, will mean new market possibilities, and Monero is an obvious pick.

Despite its headwinds throughout the years, Monero has had incredible resilience, likely due to its very nature, providing exactly what it means to provide, privacy, agency, and decentralization.

Bitcoin has led the frontier of agency and decentralization, but an ever increasing concentration of mining power, means that its decentralization is being partially eaten away at, losing some of its initial pull of being "The people's money"

Slowly turning into a transaction-less store of value, where more and more people simply hold on without actually using it, Bitcoin was never going to have any future as a sort of day-to-day cash or money that some people were hoping for.

This should have been obvious all along, even in earlier days, that the adoption would eventually lead to stagnating transaction count, aswell as miner & ASIC concentration, meaning an ever, not increasing, but instead decreasing decentralization.

Bitcoin in its earlier days was also seen as a private, but this is simply a lack of studying Bitcoin, because its always been clear as day that we would eventually run our heads against the wall.

With states having tools to track everything, and firms like Arkham who recently uncovered Strategy's (MicroStrategy) Bitcoin wallets, where Michael Saylor prior had stated he would never unveil the adresses or location of said Bitcointo preserve privacy, well, of course someone was inevitably going to find out, Bitcoin is after all, a fully transparent blockchain, which is also good in its own sense, but that brings us to the exact problem we're facing now.

And no, i don't think Bitcoin is going anywhere.

But how are we going to take back that decentralization, take back our privacy (we never had it on Bitcoin but it certainly pushed the value thinking it did) take back our agency AND have an actual day-to-day use case where we can transact without being taxed in gigantic fees for even the smallest sums?

Monero, and it has been Monero for over a decade now.

Monero ticks all the boxes that people are so desperately trying to figure out, and Monero is slowly creeping up again, seeing impressive price increases despite its recent scrutiny, with the EU set to ban it in 2027.

Whitewashing, crime, all kinds of illegal activity, that's what the nations and states see Monero as, and for the vast majority of people, it keeps them from buying the asset, in fear of being punished for owning or using it.

Do you remember the early days of Bitcoin? I certainly do

Countries & influential people would hang Bitcoin out for being only used for criminal activity, and being nothing more than a pyramid scheme.

Again, it should be obvious that it would never be the case, a completely transparent blockchain, crime? really? the smartest criminals are not THAT stupid.

Yes, many criminals probably use Monero, the same way as criminals use dollar bills for crime, because its for a large part untraceable.

But is that untracability a feature or a flaw?

In Monero's case, its a FEATURE

A feature so undervalued, you can't even begin to comprehend the sheer size of its importance

And no, I don't support criminal activity, but Monero being used for it simply means that it is doing exactly what it sets out to be, private and untraceable.

Its not the form of money's job to fix crime, that's the job of the government and politians we "elect" in our "democracy"

It is crystal clear to me, that Monero will create a throne for itsself in the top, claiming the original purpose of Bitcoin, The people's money.

Untraceability, Privacy, Decentralization, Agency.

These key features aswell as the scrutinty it is facing on the national level, will nothing but fuel the FOMO.

The ultimate resilience, the ultimate cryptocurrency.

If you're still this early, i sincerely salute you, and congrats on life changing wealth and privacy.

BINANCE:XMRUSDT.P KRAKEN:XMRUSD CRYPTO:XMRUSD

Will XMR tripple top?Monero / XMRUSD has been seeing amazing gains since the April 7th Low, despite this week's natural technical correction.

There is a massive Rising Resistance originating from the December 18th 2017 High that price also the 2021 Cycle Top, which poses as the next most probable target.

We expect to test it around 580.

If it breaks, it is not impossible to see the uptrend complete a +1000% rise from the bottom as it did in 2021.

Follow us, like the idea and leave a comment below!!

Privacy Coins Surge: Monero & Zcash Lead $10B Rally In the ever-dynamic and often boisterous world of cryptocurrency, where hype cycles can inflate and deflate valuations with breathtaking speed, a particular sector has been making significant strides, albeit with less fanfare than its more mainstream counterparts. Privacy coins, designed with the core tenet of offering users enhanced anonymity and transaction confidentiality, have been steadily gaining traction. Recently, this burgeoning niche has quietly crossed a significant milestone: a collective market capitalization exceeding $10 billion. Spearheading this charge are two of the most established and technologically distinct players in the privacy space: Monero (XMR) and Zcash (ZEC), both of which have recently shown notable activity on price charts, signaling growing investor interest and a potential re-evaluation of their intrinsic value.

The concept of financial privacy is hardly new, yet its application in the digital realm, particularly on inherently transparent blockchains like Bitcoin’s, presents unique challenges. While Bitcoin transactions are pseudonymous (linked to addresses, not directly to real-world identities), the public nature of the ledger means that with enough analytical effort, transactions can often be traced and linked. Privacy coins aim to solve this by employing sophisticated cryptographic techniques to obscure sender and receiver identities, transaction amounts, and other metadata that could compromise user anonymity.

Monero (XMR): The Standard-Bearer for Obligatory Privacy

Monero, launched in 2014, has long been considered one of the most robust and uncompromising privacy coins. Its core philosophy revolves around the principle that privacy should be default and mandatory for all users and transactions. This is achieved through a multi-layered approach to obfuscation:

1. Ring Signatures: This technique allows a sender to sign a transaction amongst a group of other possible signers (decoys pulled from the blockchain), making it computationally infeasible to determine which member of the group actually authorized the transaction. The size of this "ring" enhances the ambiguity.

2. Stealth Addresses: For every transaction, a unique, one-time public address is generated for the recipient. This prevents linking multiple payments to the same recipient address, a common method for deanonymizing users on transparent blockchains.

3. Ring Confidential Transactions (RingCT): Implemented in 2017, RingCT obscures the amounts being transacted. While the network can cryptographically verify that no new coins are being created out of thin air (i.e., inputs equal outputs), the actual values remain hidden from public view.

This combination ensures that Monero transactions offer a high degree of unlinkability (difficulty in proving two transactions are related) and untraceability (difficulty in determining the sender/receiver). This commitment to always-on privacy has made Monero a favorite among those who prioritize true financial anonymity, believing it essential for fungibility – the property where each unit of a currency is interchangeable with any other unit. If some coins can be "tainted" by their transaction history (as can happen on transparent ledgers), true fungibility is compromised.

The recent positive performance of Monero on the charts could be attributed to several factors. There's a persistent underlying demand from users who genuinely require its privacy features. Furthermore, in an environment of increasing discussion around Central Bank Digital Currencies (CBDCs) and heightened digital surveillance, assets that offer an alternative path to financial confidentiality may be seeing renewed interest.

Zcash (ZEC): Optional Privacy with Cutting-Edge Cryptography

Zcash, launched in 2016, takes a different approach to privacy, offering it as an option rather than a default setting. It utilizes a groundbreaking cryptographic technique known as zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge). This allows one party (the prover) to prove to another party (the verifier) that a statement is true, without revealing any information beyond the validity of the statement itself.

In Zcash, this translates to the ability to conduct fully "shielded" transactions. When a transaction moves from one shielded address (a "z-addr") to another, the sender, receiver, and amount are all encrypted on the blockchain, yet zk-SNARKs are used to prove that the transaction is valid according to the network's consensus rules (e.g., the sender had the funds, no double-spending occurred).

Zcash also supports "transparent" addresses (t-addrs), which function similarly to Bitcoin addresses, with all transaction details publicly visible. Users can choose to transact transparently, from transparent to shielded, from shielded to transparent, or fully shielded. This optionality aims to provide flexibility and potentially cater to a broader range of users and regulatory environments, allowing for auditable transparency when desired, while still offering robust privacy when needed.

The recent chart activity for Zcash might reflect growing appreciation for its sophisticated technology and its unique positioning. The development and improvement of zk-SNARKs are at the forefront of cryptographic research, and Zcash is a prime example of their real-world application. As the crypto space matures, there may be an increasing demand for solutions that can offer strong privacy while also providing pathways for selective disclosure or compliance, a balance Zcash aims to strike.

Why the Quiet Surge to $10 Billion?

The collective rise of privacy coins to a $10 billion market capitalization, while "quiet" relative to mainstream crypto narratives, is significant. Several undercurrents could be contributing to this growth:

1. Growing Awareness of Blockchain Transparency: As more individuals and institutions interact with cryptocurrencies, the implications of permanently public ledgers are becoming better understood. High-profile cases of blockchain analysis being used to track funds (for both legitimate and questionable purposes) highlight the lack of inherent privacy in many popular cryptocurrencies.

2. Desire for Financial Sovereignty: For some, the ability to transact privately is a fundamental aspect of financial freedom and sovereignty, akin to using physical cash. Privacy coins offer a digital equivalent.

3. Concerns Over Digital Surveillance: The increasing digitization of finance, coupled with discussions around government-issued digital currencies, has raised concerns about potential mass financial surveillance. This may drive some users towards privacy-preserving alternatives.

4. Maturation of Privacy Technology: The cryptographic techniques underpinning coins like Monero and Zcash have been developed, battle-tested, and refined over several years, increasing confidence in their efficacy.

5. Niche Use Cases: While sometimes controversial, privacy coins serve legitimate niche use cases, such as individuals in oppressive regimes needing to protect their financial activities, or businesses wanting to keep sensitive commercial transactions confidential from competitors.

6. Market Diversification: As the overall crypto market grows, investors may look to diversify into sub-sectors like privacy coins, especially if they perceive them as undervalued relative to their utility or technological innovation.

The "Quiet" Aspect and Lingering Challenges

Despite their technological sophistication and growing market cap, privacy coins operate in a somewhat contentious space, which contributes to their "quiet" ascent.

1. Regulatory Scrutiny: The primary challenge comes from regulators worldwide. Concerns that privacy coins can be used to facilitate illicit activities like money laundering or terrorist financing have led to increased scrutiny. Several exchanges have delisted privacy coins in certain jurisdictions to comply with KYC/AML (Know Your Customer/Anti-Money Laundering) regulations. This regulatory pressure can stifle adoption and create uncertainty.

2. Perception Issues: The association, whether fair or not, with illicit activities has created a perception challenge for the sector. While proponents argue that any financial tool can be misused and that privacy is a fundamental right, this narrative can be difficult to overcome.

3. Complexity: The advanced cryptography involved can make these coins less accessible to the average user compared to simpler cryptocurrencies. Explaining the nuances of ring signatures or zk-SNARKs is more challenging than explaining Bitcoin.

4. Development and Governance: Like all crypto projects, ongoing development, robust governance, and maintaining network security are crucial and require significant resources and community effort.

The Significance of the $10 Billion Milestone

Reaching a $10 billion collective market capitalization is a testament to the resilience and perceived value of the privacy coin sector. It indicates that despite regulatory headwinds and perception challenges, there is a substantial and growing demand for financial privacy in the digital age. While still a relatively small fraction of the total cryptocurrency market, it's a clear signal that a significant number of users and investors believe in the importance of these tools. This milestone provides a degree of validation for the developers, communities, and users who have championed the cause of digital financial privacy.

Future Outlook

The path forward for privacy coins like Monero and Zcash will likely remain complex. They will continue to navigate a challenging regulatory environment, engaging in an ongoing dialogue about the balance between privacy and law enforcement. Technological innovation will be key, not only in enhancing privacy features but also in improving user experience and potentially developing solutions that can address regulatory concerns without compromising core principles (as Zcash attempts with its optional transparency).

Education will also play a vital role – helping the public and policymakers understand the legitimate needs for financial privacy and the capabilities and limitations of these technologies. The debate over financial privacy is far from over, but as Monero and Zcash move up and the sector surpasses the $10 billion mark, it's clear that the demand for confidential transactions is a persistent and growing force in the digital economy. The quiet surge may be a prelude to a louder conversation about the future of money and the fundamental right to privacy in an increasingly interconnected world.

XMR LOOKS SUPER BULLISH (1W)Before anything else, pay attention to the timeframe of the analysis; it’s weekly.

It seems that wave C of the weekly triangle has ended, and the price has entered wave D.

Wave D could progress up to the ATH or even slightly exceed it.

For wave E, we will have a rejection, and then the main upward move will form.

On the chart, we have marked a green line as our KEY LEVEL. As long as the price stays above this line, XMR is super bullish.

A weekly candle closing below the invalidation level will invalidate the analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Zcash (ZEC) Explodes 12% Amidst Privacy Coin Rally: Is $300 the With ZEC recovering from $30 to hit $50 and the privacy sector gaining momentum, we delve into the catalysts, challenges, and the bold analyst prediction for Zcash's future.

The cryptocurrency market, a realm of perpetual motion and often unpredictable surges, has recently cast its spotlight on a specific niche that champions user anonymity: privacy coins. Leading this charge, Zcash (ZEC) has registered an impressive 12% gain, a move that has not only gladdened the hearts of its holders but also signaled a broader resurgence in coins designed to obscure transactional data. This rally, which has also seen contemporaries like Monero (XMR) post decent gains, underscores a growing interest or perhaps a renewed appreciation for financial privacy in the digital age.

Zcash, in particular, has demonstrated robust recovery. After languishing at a low of approximately $30 in February, the ZEC token has battled its way back to the significant $50 mark. This psychological and technical level is often viewed by traders as a crucial pivot point. The bullish sentiment is further amplified by a crypto analyst's bold prediction: should Zcash manage a sustained breakout, its price could target an ambitious $300. Such a forecast, while speculative, invites a deeper examination of Zcash's fundamentals, the current market dynamics for privacy coins, and the potential trajectory for ZEC. What exactly is fueling this ascent, and what hurdles might Zcash face on its path to potentially higher valuations?

Understanding Zcash: The Science of Shielded Transactions

To appreciate the current price action and future potential of Zcash, it's essential to understand its core value proposition. Launched in October 2016 by the Electric Coin Company (ECC), spearheaded by Zooko Wilcox, Zcash emerged from the Zerocoin protocol, aiming to address the privacy limitations inherent in Bitcoin. While Bitcoin transactions are pseudonymous (linked to addresses, not direct identities), the public nature of its blockchain means that with enough analysis, transactions can often be traced back to individuals or entities.

Zcash offers a solution through its pioneering use of zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Arguments of Knowledge). This advanced cryptographic technique allows one party (the prover) to prove to another party (the verifier) that a statement is true, without revealing any information beyond the validity of the statement itself. In the context of Zcash:

• Shielded Transactions: Users can send ZEC through shielded addresses (z-addresses). When a transaction occurs between two z-addresses, the sender, receiver, and amount are all encrypted on the blockchain. Zk-SNARKs are used to prove that the transaction is valid (e.g., the sender has sufficient funds, no double-spending) without disclosing the sensitive details.

• Transparent Transactions: Zcash also supports transparent addresses (t-addresses), which function similarly to Bitcoin addresses. Transactions between t-addresses, or between a t-address and a z-address, will have some or all transaction details publicly visible.

•

This optional privacy is a key differentiator for Zcash. Users can choose the level of privacy they require for each transaction. While this flexibility can be seen as an advantage for regulatory compliance and exchange listings, it has also been a point of debate, with some privacy purists arguing that optional privacy is not as robust as mandatory privacy (like Monero's).

The development of Zcash is primarily driven by the Electric Coin Company, with funding initially derived from a "Founder's Reward" where a portion of the block rewards for the first four years was distributed to founders, employees, advisors, and the non-profit Zcash Foundation. This model has since evolved, with community governance playing an increasing role in funding development through new development funds.

The Recent Price Surge: Deconstructing the 12% Jump and the Road from $30 to $50

Zcash's recent 12% price increase is significant not just in its magnitude but also in its context. The climb from a February low of around $30 to the current $50 level represents a more than 66% increase in a relatively short period. This recovery can be attributed to several

interconnected factors:

1. Broader Market Recovery: The entire cryptocurrency market has seen periods of bullish sentiment in recent months. As market leaders like Bitcoin and Ethereum gain, investor confidence often spills over into altcoins, including Zcash. A rising tide tends to lift all boats.

2. Privacy Coin Sector Momentum: There's a discernible trend of renewed interest in privacy coins. Monero, often seen as the flagship privacy coin, has also experienced positive price action. This collective movement suggests a sector-specific catalyst.

o Regulatory Concerns & Censorship Fears: Increased discussions around Central Bank Digital Currencies (CBDCs), financial surveillance, and potential censorship of non-custodial wallets or certain types of transactions may be driving users towards tools that offer greater financial anonymity.

o Geopolitical Instability: In times of global uncertainty or conflict, individuals may seek ways to protect their assets and transact without oversight from potentially unstable or authoritarian regimes. Privacy coins can be perceived as a tool for financial sovereignty.

o Desire for Fungibility: True fungibility means that each unit of a currency is interchangeable with any other unit of the same currency. Bitcoin's transparent ledger means that coins can be "tainted" if they were previously involved in illicit activities, potentially leading to them being rejected by exchanges or merchants. Shielded Zcash aims to provide stronger fungibility.

3. Technical Breakout: The move above key resistance levels on price charts can trigger further buying. For ZEC, overcoming resistance points between $30 and $45 likely attracted technical traders. The $50 mark itself is a significant psychological level. If ZEC can firmly establish $50 as support, it could build a base for further upward movement.

4. Narrative Resurgence: The "privacy narrative" in crypto tends to ebb and flow. It appears to be currently in an upswing, with influencers and media outlets paying more attention to the sector. This increased visibility can attract new investors.

5. Zcash-Specific Developments (Potentially): While not explicitly mentioned in the prompt, ongoing development work by the ECC and the Zcash Foundation, such as improvements to zk-SNARKs (like the Halo Arc upgrade which removed the need for a trusted setup for shielded transactions using the Orchard shielded pool), wallet usability enhancements, or progress on scalability solutions like Proof-of-Stake research, can contribute to positive sentiment over time.

The Analyst's Call: Can Zcash Realistically Target $300?

The prediction that Zcash could target $300 represents a 500% increase from its current $50 level. While such gains are not unprecedented in the volatile crypto market, achieving this target would require a confluence of highly favorable conditions.

Factors that could support such a rally:

1. Sustained Crypto Bull Market: A $300 ZEC is highly improbable without a broader, powerful bull run across the entire cryptocurrency asset class. If Bitcoin were to reach new all-time highs and altcoin season truly kicks in, ZEC could be a significant beneficiary, especially if the privacy narrative remains strong.

2. Major Adoption Catalysts:

o Institutional Interest: If institutions begin to see value in privacy-preserving digital assets, either for their treasuries or for offering privacy-focused financial products, Zcash could attract significant capital inflows.

o Merchant Adoption: Increased acceptance of ZEC (particularly shielded ZEC) for payments would enhance its utility and demand.

o DeFi Integration: If Zcash can be effectively and privately integrated into the Decentralized Finance (DeFi) ecosystem, it could unlock new use cases and demand.

3. Technological Breakthroughs: Further advancements in Zcash's technology that enhance privacy, scalability, or user experience could make it more attractive. For instance, reducing the computational requirements for generating shielded transactions or enabling private smart contracts could be game-changers.

4. Regulatory Clarity (Favorable): This is a double-edged sword. While crackdowns are a risk, clear and favorable regulations that acknowledge the legitimate uses of privacy coins could remove uncertainty and encourage investment. If Zcash's optional privacy model is seen as a compliant way to offer privacy, it might thrive.

5. Weakening of Competitors or Strengthening of ZEC's Unique Selling Proposition: If Zcash can more effectively articulate its advantages over other privacy solutions or if competitors face significant setbacks, ZEC could capture a larger market share.

6. Supply Dynamics: Like Bitcoin, Zcash has a finite supply (21 million coins). As issuance decreases over time due to halvings (Zcash had its first halving in November 2020), reduced new supply coupled with increased demand can lead to price appreciation.

Challenges and Headwinds on the Path to $300 (and Beyond)

Despite the bullish outlook, Zcash faces significant challenges:

1. Regulatory Scrutiny and Delistings: This remains the most significant threat to privacy coins. Governments and regulatory bodies worldwide are wary of technologies that could facilitate money laundering, terrorist financing, or tax evasion.

o FATF "Travel Rule": The Financial Action Task Force (FATF) guidelines require virtual asset service providers (VASPs) like exchanges to collect and share sender and receiver information for transactions above a certain threshold. This is difficult to implement for inherently private transactions.

o Exchange Delistings: Several major exchanges have delisted Zcash (especially its shielded functionality) or restricted its trading in certain jurisdictions due to regulatory pressure or an abundance of caution. Further delistings would severely impact liquidity and accessibility.

2. Competition: The privacy coin space is competitive.

o Monero (XMR): Monero uses a different approach (ring signatures, stealth addresses, RingCT) to provide mandatory privacy. It has a strong community and is often favored by privacy advocates for its "always-on" privacy.

o Newer Privacy Technologies: Other projects are exploring different privacy solutions, including Layer 2 privacy protocols on more scalable blockchains (e.g., zk-rollups on Ethereum that can offer privacy).

3. The "Optional Privacy" Dilemma: While intended as a feature for flexibility, Zcash's optional privacy means that the actual "anonymity set" for shielded transactions (the number of other shielded transactions yours is mixed with) can be smaller if most users opt for transparent transactions. This can, in theory, make shielded transactions less private than if privacy were mandatory and universally adopted on the network. The Zcash community and developers are actively working to encourage greater shielded adoption.

4. Perception and Misinformation: Privacy coins are often unfairly associated solely with illicit activities. Overcoming this negative perception and highlighting legitimate use cases (e.g., protecting commercial trade secrets, personal financial security, dissidents in oppressive regimes) is an ongoing challenge.

5. Scalability and Usability: While zk-SNARKs are powerful, generating shielded transactions has historically been more computationally intensive than transparent ones, leading to slower transaction times or higher fees on less powerful devices. Significant strides have been made with upgrades like FlyClient and the Orchard shielded pool, but continuous improvement is needed for mass adoption.

6. Development Funding and Governance: Ensuring sustainable funding for ongoing research, development, and ecosystem growth is crucial. The Zcash community's ability to effectively govern and allocate resources from its development fund will be key to its long-term success.

What Next for ZEC? Key Areas to Watch

Given the current momentum and the ambitious price targets, several factors will determine Zcash's trajectory:

1. Shielded Adoption Rate: The most critical internal metric for Zcash is the proportion of transactions that are shielded. Increased shielded usage strengthens the network's privacy guarantees and demonstrates the utility of its core technology. Initiatives like the ECC's focus on wallet usability for shielded transactions are vital.

2. Regulatory Developments: Any news related to regulations concerning privacy coins will heavily impact ZEC. Investors should closely monitor pronouncements from major regulatory bodies (SEC, FATF, European regulators, etc.).

3. Technological Roadmap Execution: The successful implementation of planned upgrades, particularly those related to scalability (like potential Proof-of-Stake implementation, which the ECC is researching), interoperability, and enhanced privacy features, will be crucial. The Zcash community recently approved a new roadmap focusing on making Zcash a proof-of-stake chain and introducing Zashi, a new Zcash-focused wallet.

4. Exchange Landscape: The willingness of major exchanges to continue listing ZEC and support its shielded withdrawals/deposits is paramount for liquidity and accessibility. Any new listings or, conversely, delistings will be significant market-moving events.

5. Broader Crypto Market Sentiment: Zcash's fate is still largely tied to the overall health of the cryptocurrency market. A sustained bear market would make significant price appreciation very difficult, regardless of Zcash's individual merits.

6. Institutional Narrative: If a narrative emerges where institutions begin to value or require on-chain privacy for certain operations, Zcash could be well-positioned if it can navigate the regulatory complexities.

7. Community Engagement and Development Activity: A vibrant and active community, along with consistent development contributions, signals a healthy project. Tracking developer activity, community discussions, and governance proposals can provide insights into the project's long-term viability.

Technical Analysis Snapshot (Hypothetical)

While a deep dive requires real-time charts, here's a general technical outlook based on the described price action:

• Current Level ($50): This is a key psychological and potential resistance/support level. A sustained break above and holding this level as support would be bullish.

• Next Resistance Levels: If $50 is overcome, traders would look for previous swing highs or Fibonacci extension levels. These could be in the $60-$70 range initially, then potentially $90-$100 (a previous significant area of activity for ZEC).

• Support Levels: If ZEC fails to hold $50, previous resistance levels around $40-$45 might act as support, followed by the $30 low.

• Moving Averages: Traders will watch if ZEC can stay above key moving averages (e.g., 50-day, 200-day). A "golden cross" (50-day MA crossing above 200-day MA) would be a strong bullish signal.

• Volume: Increased trading volume accompanying price rises is a sign of strong buying interest and validates the move.

• Relative Strength Index (RSI): An RSI moving into overbought territory (>70) might suggest a short-term pullback is due, but in strong uptrends, assets can remain overbought for extended periods.

The analyst's $300 target would likely involve breaking through multiple significant resistance zones established during previous bull markets.

Conclusion: Cautious Optimism for Zcash in a Privacy-Aware Future

Zcash's recent 12% price jump and its recovery to $50 are encouraging signs for the project and the broader privacy coin sector. The renewed interest in financial privacy, coupled with a generally improving crypto market, provides a favorable backdrop. The analyst's $300 price target, while ambitious, highlights the explosive potential that well-positioned altcoins can exhibit during strong bull cycles, especially those with unique and compelling technology.

However, the path forward for Zcash is fraught with challenges, predominantly regulatory uncertainty. The very feature that gives Zcash its value – privacy – is also its greatest vulnerability in the eyes of many global regulators. The project's ability to navigate this complex landscape, potentially by emphasizing its optional privacy as a compliant solution or by fostering a decentralized ecosystem resilient to censorship, will be paramount.

Investors and enthusiasts should monitor the adoption of shielded transactions, the progress on Zcash's technological roadmap (including the move to Proof-of-Stake and Zashi wallet development), the evolving regulatory environment, and the overall health of the crypto market. While $300 remains a speculative target, Zcash's robust technology and the enduring human desire for privacy ensure it will remain a significant and closely watched player in the digital asset space. The "what next" for ZEC will be a dynamic interplay between technological innovation, market sentiment, and the global conversation around financial privacy and freedom.

Random Monero God Candle??The "reason" KRAKEN:XMRUSD RIPPED to $339 overnight was because of a hack:

Nine hours ago a suspicious transfer was made from a potential victim for 3520 BTC ($330.7M)

Theft address

bc1qcrypchnrdx87jnal5e5m849fw460t4gk7vz55g

Shortly after the funds began to be laundered via 6+ instant exchanges and was swapped for XMR causing the XMR price to spike 50%.

Apparently it was an OG Bitcoiner that had funds on a CEX (Centralized Exchange). The hacker spent upwards of 7 figured in fees across different exchanges to convert the Bitcoin into Monero.

This event is in line with Bullish thesis:

Very public arrests of the Bitfinex and Silk Road hackers from tracing their surveillance chain (Bitcoin) makes it obvious that privacy is of highest value.

Monero has low liquidity: expect more random god candles.

The relative outperformance of Monero versus Bitcoin BITFINEX:XMRBTC continues this year:

Monero: What is the "Fair Value"?Crypto investors need to be aware of Monero and its historic performance tendencies especially on a day like today. It has become the only cryptocurrency in which I think has actual USEFUL value in terms of being used as an '"currency".

KRAKEN:XMRUSD for the last several years has functioned much like a stablecoin albeit with a lot of volatility. It trades within a range but one that has been steadily increasing over time. The old range used to present a fair value of around 156 within the middle of the range. The new bottom of the range sits at 196. As this bear cycle continues I will look to these supports to hold $KRAKEN:XMRUSD.

I do not promise that one should expect the 10x, 100x, etc. from investing in $KRAKEN:XMRUSD. That is not what the cryptocurrency is for. Its value is in its privacy by default. Those values are; resistance against surveillance, true sovereign money, and the actual ideals of being a tool for human freedom that began cryptocurrency over a decade ago. Monero today has actually replaced Bitcoin as the currency of choice on the Dark Web... that was what gave Bitcoin its value in the early days.

Besides the afore mentioned fundamental value of Monero it is important to understand what recent price history has shown about Monero versus Bitcoin during the bull/bear price cycles:

Cryptocurrency Cycles

The relative performance of Monero to Bitcoin (which is, basically, the crypto market) at different points over the last few years can be charted using KRAKEN:XMRBTC

Since November 16, 2024 XMRBTC has performed +64%. This has happened while the price of Bitcoin has mostly stagnated by Monero has steadily appreciated in value.

The period prior was from April 2024 through September 2024, again when the price of Bitcoin stagnated by Monero held and increased in value.

The most important period to study for now, when Bitcoin has likely entered its bearish cycle phase, is the period between December 2021 and January 2023; the last Bitcoin bear cycle. XMRBTC outperformed by about 150% as Bitcoin went down but Monero depreciated less. This period ended when the recent Bitcoin bull cycle began.

Critics will rightly point out though that "Bitcoin over time has outperformed" and they would be correct, historically. Within this truth though crypto investors need to look for a correlation that works anywhere close to this; where when Bitcoin goes down that cryptocurrency consistently holds its value against Bitcoin. There is no other major cryptocurrency that behaves this way. Knowing the cycles can provide investors with a "safe haven" potentially.

Trade wisely!

Epic Cash = Satoshi's vision for Peer-to-Peer Digital CashEPIC CASH is what Satoshi Nakamoto would build today, using modern technology — and the valuable insights learned during Bitcoin’s (and other altcoins’) journey over the past 15 years.

EPIC offers a robust and decentralized financial system that will exist for future generations, immune from geopolitical turmoil and banking crises.

With a limit of just 21 million coins, EPIC follows 100% of Satoshi’s Bitcoin DNA scarcity formula. It has ALL the needed features of a decentralized, current, P2P, digital currency.

Below are just some of the unique feature that make EPIC CASH superior digital cash:

Scarcity

with a fixed supply of only 21 million coins: EPIC maintains Bitcoin’s identical hard cap of 21 million coins — With 84% of the supply already in circulation, its ownership trajectory aligns with BTC’s, to reach 20.3 million coins by 2028.

Mineable by Anyone

EPIC employs a multi-algorithm mining system that allows ordinary computers to mine it with their laptops or desktops using CPU and GPU, making it accessible to over 6.4 billion devices worldwide, allowing for broad usage and continued decentralization. In contrast, BTC can only be mined on ASICs, which are large cumbersome industrial computers that need frequent replacement and have obvious onerous environmental repercussions.

Privacy and Fungibility

EPIC leverages Mimblewimble blockchain compression to ensure that ALL transactions are commercially private, requiring no extra steps. This ensures that EPIC is fully fungible—and every coin is indistinguishable from another, so there are no "tainted coins,” which is an Achilles’ heel of BTC. Absolute privacy is achieved via Mimblewimble technology as no wallet addresses and no transaction amounts are ever stored on the blockchain.

LEARN MORE - epicash.com

MOST Bullish Crypto Now? MoneroThis may come as a surprise considering how little attention it is paid but according to my most time tested analytic; the Daily Ichimoku Cloud + Chikou Confirmation, KRAKEN:XMRUSD is showing more bullish than the top cryptocurrencies.

I have written for years about this study of when price versus the Ichimoku cloud is in line with Chikou (purple line, AKA Lagging Span) versus cloud. I will include a few links below to past Tradingview ideas.

Let's look at some of the major cryptocurrencies that most pay attention to for comparison:

INDEX:BTCUSD

Bitcoin is at a precarious place. The bull trend has weakened and moved through the Ichimoku cloud. Price has breached it to the downside but that does not make it bearish yet. The final step would be Chikou to cross. At this point downward movement and/or time passing will make this true and the trend will flip bearish. Bitcoin's Ichimoku Daily analysis is what I have written most about. If followed, I have demonstrated that applying this simple strategy out performs pure HODL by a factor of 7x.

KRAKEN:SOLUSD

Solana is to me the next most interesting cryptocurrency at present because its use case is the most prevalent: meme coins. Solana just does them better and most of the popular meme coins that end up on the news go through this chain. SOLUSD is sitting in purely neutral territory like Bitcoin.

CRYPTO:ETHUSD

Ethereum is in objectively the worst shape. It has already flipped confirmed bearish.

I think people sleep on Monero because it is not considered a "get rich quick" cryptocurrency. Unfortunately, the cryptocurrency market has devolved into a space for fraud and fast wealth. Monero, being privacy focused, is the leading cryptocurrency that actually facilitates the original use case of cryptocurrency which is... a currency. It has largely acted like a stablecoin the past 3 years while slowly appreciating. Don't ignore it... but also please don't pump it. I don't want the volatility.

Trade wisely.

Monero's 'Basing Pattern' Breakout Points to Price Gains AheadMonero (XMR), the leading privacy-focused cryptocurrency, has recently shown signs of renewed strength, breaking above the $200 mark and confirming a bullish shift in market trend.1 This upward movement is particularly significant as it follows a prolonged period of consolidation, during which XMR formed a classic "basing pattern."2 This article will delve into the details of this technical pattern, explore the factors contributing to Monero's current momentum, and analyze the potential for further price gains in the near future.

Understanding the Basing Pattern

In technical analysis, a basing pattern, also known as a consolidation pattern, represents a period of price stabilization after a downtrend or a significant price drop.3 During this phase, the price trades within a relatively narrow range, forming a base for a potential future breakout.4 This pattern typically indicates that selling pressure is weakening, and buyers are beginning to accumulate the asset.5

Key characteristics of a basing pattern include:

• Consolidation Range: The price trades within a defined range, bounded by support and resistance levels.6

• Decreasing Volatility: Price swings become less pronounced as the pattern develops.7

• Increased Volume on Breakout: A breakout above the resistance level is often accompanied by a significant increase in trading volume, confirming the strength of the new uptrend.8

Monero's recent price action has exhibited these characteristics. After a period of decline, XMR's price consolidated within a range, demonstrating decreasing volatility. The recent break above $200, accompanied by increased trading volume, signals a potential breakout from this basing pattern, suggesting a shift towards bullish momentum.9

Factors Contributing to Monero's Momentum

Several factors could be contributing to Monero's current positive trajectory:

• Increased Demand for Privacy: In an increasingly surveilled world, the demand for privacy-preserving technologies is growing.10 Monero, with its strong focus on anonymity and untraceable transactions, is well-positioned to benefit from this trend.11

• Technological Developments: Ongoing development and improvements to the Monero protocol, such as advancements in its privacy features and scalability solutions, enhance its value proposition and attract users.

• Growing Adoption: While adoption of privacy coins is still relatively niche compared to mainstream cryptocurrencies, Monero has a dedicated community and sees usage in various applications where privacy is paramount.

• Broader Market Sentiment: The overall cryptocurrency market has shown signs of recovery recently.12 A positive market sentiment can have a ripple effect on various cryptocurrencies, including Monero.

The Significance of the $200 Breakout

The break above the $200 resistance level is a crucial technical development for Monero. This level has acted as a significant barrier in the past, and breaking above it suggests a strong shift in market sentiment. This breakout confirms the potential validity of the basing pattern and opens the door for further price appreciation.

Potential for Further Price Gains

With the breakout confirmed, several potential price targets can be identified using technical analysis. Common methods include:

• Measuring the Height of the Basing Pattern: The height of the consolidation range can be projected upwards from the breakout point to estimate a potential price target.

• Identifying Fibonacci Retracement Levels: Fibonacci retracement levels can be used to identify potential resistance levels and price targets based on previous price movements.13

• Analyzing Long-Term Trends: Examining long-term charts can provide insights into potential long-term price targets.

Based on these methods, potential price targets for Monero could be significantly higher than current levels. However, it's crucial to remember that these are just potential targets, and market conditions can change rapidly.

Challenges and Risks

While the current outlook for Monero appears positive, it's essential to acknowledge potential challenges and risks:

• Regulatory Scrutiny: Privacy coins like Monero face increased regulatory scrutiny due to their potential use in illicit activities.14 Increased regulation could negatively impact their price and adoption.

• Competition: Other privacy-focused cryptocurrencies and privacy-enhancing technologies are emerging, posing competition to Monero.

• Market Volatility: The cryptocurrency market is inherently volatile, and even with positive technical indicators, price corrections and unexpected events can occur.15

Conclusion

Monero's recent breakout above $200, following a well-defined basing pattern, suggests a potential shift towards bullish momentum.16 Factors such as increased demand for privacy, technological developments, and positive market sentiment contribute to this positive outlook. While potential price targets can be identified using technical analysis, it's essential to acknowledge the inherent risks and challenges associated with the cryptocurrency market. As always, thorough research and caution are advised when making investment decisions. The confirmation of the basing pattern and the break of the $200 resistance level does provide a strong signal for those interested in the privacy coin space.

Monero - The Best Privacy Coin Im going to be breaking-down what I feel are the best long-term holds in each sector/category of crypto. This is the privacy sector. I will tell you the pros and cons of each project.

Monero

When looking at the chart for Monero, we can see that it looks very bullish. It has successfully broken out of & retested a long channel that it has been between for years. We can see that the last time Monero broke out of a multi-year channel it went on to rise 500%. Monero price action has been extremely steady compared to other cryptocurrencies over the years. In my opinion this chart looks very similar to XRP prior to it going from 0.40 to 2.50.

Pros:

Obviously Monero is the king of privacy coins and is the most used P2P crypto even more than Bitcoin.

Monero is what Bitcoin was meant to be, and as more concerns about privacy arise, Monero will garner even more market share.

Cons:

Tough to buy in some countries. Monero has been heavily supressed over the years, and is often delisted from Central Exchanges. Making it difficult to purchase.

All in all, this is not financial advice but instead just my opinion.

Thanks for viewing my post! And make sure to check out my other posts for the top crypto in other sectors!

#Monero $XMRUSD One Year AnalysisCRYPTO:XMRUSD

Keylevels / Range

$120: Lowest trend price. If the price closes below this level, it would signal a bearish trend.

$163: Lowest range price. A close below this level would unlock a new lower zone extending down to $120.

$203: Current price.

$233: Upper limit of the current channel/wedge.

$370: Long-term target.

Analysis:

Monero has been trading within a range of $183 to $206 for the past two weeks. The price has closed above $197 for the first time since May 2022. This move potentially unlocks a new range, reaching at least $233, where the upper limit of the current channel/wedge and a monthly/weekly supply zone are located.

A weekly close above $237 would strongly indicate the unlocking of a new charted zone extending from $237 to $370.

Coin Bio:

Monero (XMR), is a privacy-focused cryptocurrency launched in April 2014. It was originally forked from the Bytecoin blockchain. Unlike many other cryptocurrencies, Monero's primary focus is on ensuring the anonymity and untraceability of transactions.

Key features include:

Ring Signatures: Obfuscate the sender's identity.

Ring Confidential Transactions (RingCT): Hide the transaction amount.

Stealth Addresses: Create unique, one-time addresses for each transaction, obscuring the receiver's identity.

These features make Monero attractive to individuals seeking financial privacy and are a core differentiator in the cryptocurrency space. It's developed by an anonymous community of developers and has gained significant traction for its commitment to private and fungible transactions. While its focus on privacy can be controversial, it remains a prominent cryptocurrency with a dedicated user base. XRMUSD specifically refers to the trading pair of Monero against the US Dollar.

#CRYPTO #MONERO #XMRUSD #XMR #CRYPTOCURRENCY #AHMEDMESBAH

Monero (XMR)Monero is one of the first crypto project which focused on privacy and anonymously. After a big ascent, XMR entered into a long oscillation period in a wide side way channel. Recently, due to the Ripple (XRP) court ruling that caused pump in crypto market, XMR broke the consolidation triangle pattern upward. Could this be the start of an impulse upward wave to the channel's upper line, or even beyond? Let's see what happens.

Note that this the weekly chart.