XMRUSD formed bullish Shark | Upto 29% bullish movePriceline of Monero / US Dollar cryptocurrency has formed bullish Shark pattern and entered the potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this zone.

I have used Fibonacci sequence to set the targets:

Buy between: 52.949 to 49.193

Sell between: 56.295 to 63.804

Regards,

Atif Akbar (moon333)

Monerodollar

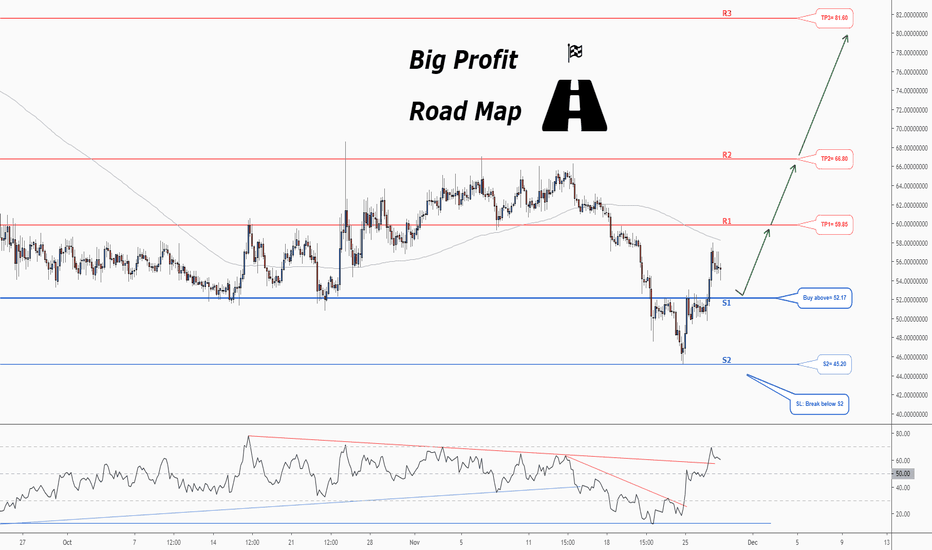

Don't miss the great buy opportunity in XMRUSDTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (52.17). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

. The price is below the 21-Day WEMA which acts as a dynamic resistance.

. The RSI is at 60.

Take Profits:

TP1= @ 59.85

TP2= @ 66.80

TP3= @ 81.60

SL= Break below S2

XMRUSD formed bullish Shark | A good buying opportunity21 minutes ago

Priceline of Monero / US Dollar cryptocurrency has formed bullish Shark pattern and entered the potential reversal zone.

This PRZ area should be used as stop loss point in case of complete candle stick closes below this zone.

I have used Fibonacci sequence to set the targets:

Buy between: 62.106 to 61.143

Sell between: 63.099 to 65.151

Regards,

Atif Akbar (moon333)

Monero: a successful scalp trading is here! Hello, dear Traders!

Monfex is at your service and today we overview XMR/USD .

Monero broke the resistance line of the descending channel, but we have the key level for confirmation of a further growth !

XMR is suspiciously the most passive in recent time and now it starts to growth.

The great resistance zone ~ $ 57 .

This long idea also supports the positive volumes.

Also Monero has a bullish divergence with realization of it and for now with the bearish divergence by RSI with influence of which can rebound the price to the $ 53.5 .

But we remember about money-risk management and limit ourselves of possible losses!

Supposed Trade Signal by XMR/USD

Long with confirmation of breakout near $ 58.7

Take profit ~ $ 65 - 66

Stop loss at $ 56.1

Market Cap

$991 836 816 USD

Volume (24h)

$147 798 879 USD

Circulating Supply

~17 262 257 XMR

Share your thoughts, ideas about the market under the chart.

Watch for our Updates to be the first who gets well-timed signals !

GOOD LUCK AND LOTS OF PROFITS !!

Disclaimer

This report is for information purposes only and should not be considered a solicitation to buy or sell any trading assets. Monfex accepts no responsibility for any consequences resulting from the use of this material. Any person acting on this trade idea does so entirely at their own risk.

XMRUSD formed a bullish BAT upto 119% expectedPriceline of Monero / US Dollar cryptocurrency has formed a bullish BAT pattern and entered in potential reversal zone to hit the sell targets soon insha Allah.

This PRZ area should be used as stop loss in case of complete candle stick closes below this zone.

Price action is hitting the lower band of bollinger bands after Dec 2018 therefore we can expect a bounce from here, but volume profile is showing still interest of the traders even below the PRZ level and MACD is strong bearish and Stochastic is oversold but in bear cross so for secure trade we should wait for MACD to turn weak bearish or for stochastic to give bull cross then buy from the potential reversal zone.

I have used Fibonacci sequence to set the targets:

Buy between: 56.193 to 47.953

Sell between: 75.903 to 105.462

Regards,

Atif Akbar (moon333)

XMRUSD has formed shark pattern | A good long opportunityPriceline of Monero / US Dollar cryptocurrency has formed a bullish shark and entered in potential reversal zone.

I have defined targets using Fibonacci sequence as below:

Buy between: 81.23500000 to 79.22000000

Sell between: 83.88172959 to 88.81193575

Regards,

Atif Akbar (moon333)

XMRUSD has formed bullish shark | Upto 24% profit potentialPriceline of Monero / US Dollar has formed bullish shark and entered in potential reversal zone.

RSI is oversold.

Stochastic has given bull cross.

I have used Fibonacci sequence to set the targets as below:

Buy between: 79.020 to 74.088

Sell between: 83.276 to 92.993

Regards,

Atif Akbar (moon333)

Don't miss the great buy opportunity in MONEROTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (86.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 45.

Take Profits:

TP1= @ 97.00

TP2= @ 106.25

TP3= @ 120.87

SL= Break below S2

Don't miss the great buy opportunity in MONEROTrading suggestion:

. There is a possibility of temporary retracement to suggested support line (86.00). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Technical analysis:

. XMRUSD is in a range bound and the beginning of uptrend is expected.

.The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 45.

Take Profits:

TP1= @ 97.00

TP2= @ 106.25

TP3= @ 120.87

SL= Break below S2

Critical moment, Cup and handle or not ???See my related idea below.

I think Monero has the best fundamentals over any other crypto.

Monero is one of the best crypto project. Low fee, untraceable, fungible, deflationary etc.. Monero is the real synonym of decentralization. Monero is what bitcoin was supposed to be in first hand, and it works.

Do not miss your chance to grab some xmr at such price. ( SERIOUSLY) You will regret it someday.

technical analysis looks clean with a possible cup and handle pattern. Volume is slowly growing. Here is my tip : watch for the volume. It will be your sign. If we break out 120$ish, do not hesitate and BUY.

You shouldn't even wait for a breakout. This is electronic untraceable cash. It has a value that you can't even imagine. We are finally our own bank.

A second Chance to Buy in XMRUSDMidterm forecast:

98.50 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 74.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (98.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If you missed our first HUNT, you have a second chance to buy above the suggested support line (98.50).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing", "Hammer" or "Valley", in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 14 BUY trade(s) @ 49.70 based on '2-Day Hammer' entry method at 2019.03.12.

Total Profit: 74244 pip

Closed trade(s): 20380 pip Profit

Open trade(s): 53864 pip Profit

Closed Profit:

TP1 @ 56.70 touched at 2019.03.31 with 700 pip Profit.

TP2 @ 65.50 touched at 2019.04.02 with 1580 pip Profit.

TP3 @ 76.30 touched at 2019.04.02 with 2660 pip Profit.

TP4 @ 88.65 touched at 2019.05.15 with 3895 pip Profit.

TP5 @ 100.00 touched at 2019.06.19 with 5030 pip Profit.

TP6 @ 114.85 touched at 2019.06.22 with 6515 pip Profit.

700 + 1580 + 2660 + 3895 +5030 + 6515 = 20380

Open Profit:

Profit for one trade is 117.03 (current price) - 49.70 (open price) = 6733 pip

8 trade(s) still open, therefore total profit for open trade(s) is 6733 x 8 = 53864 pip

All SLs moved to Break-even point.

Take Profits:

TP7= @ 137.95

TP8= @ 149.10

TP9= @ 168.70

TP10= @ 230.10

TP11= @ 298.90

TP12= @ 372.35

TP13= @ 447.10

TP14= Free

A second Chance to Buy in XMRUSDMidterm forecast:

98.50 is a major support, while this level is not broken, the Midterm wave will be uptrend.

Technical analysis:

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index ( RSI ) is 74.

New trading suggestion:

*There is still a possibility of temporary retracement to suggested support line (98.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

*If you missed our first HUNT, you have a second chance to buy above the suggested support line (98.50).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing", "Hammer" or "Valley", in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 14 BUY trade(s) @ 49.70 based on '2-Day Hammer' entry method at 2019.03.12.

Total Profit: 74244 pip

Closed trade(s): 20380 pip Profit

Open trade(s): 53864 pip Profit

Closed Profit:

TP1 @ 56.70 touched at 2019.03.31 with 700 pip Profit.

TP2 @ 65.50 touched at 2019.04.02 with 1580 pip Profit.

TP3 @ 76.30 touched at 2019.04.02 with 2660 pip Profit.

TP4 @ 88.65 touched at 2019.05.15 with 3895 pip Profit.

TP5 @ 100.00 touched at 2019.06.19 with 5030 pip Profit.

TP6 @ 114.85 touched at 2019.06.22 with 6515 pip Profit.

700 + 1580 + 2660 + 3895 +5030 + 6515 = 20380

Open Profit:

Profit for one trade is 117.03 (current price) - 49.70 (open price) = 6733 pip

8 trade(s) still open, therefore total profit for open trade(s) is 6733 x 8 = 53864 pip

All SLs moved to Break-even point.

Take Profits:

TP7= @ 137.95

TP8= @ 149.10

TP9= @ 168.70

TP10= @ 230.10

TP11= @ 298.90

TP12= @ 372.35

TP13= @ 447.10

TP14= Free

XMR Bear Cycle CompletedWelcome back!

Today I wanted to go over one of the large caps because they are the ones that lead the market.

XMR is a great long term cycle because it has proven itself with Bitcoins bear cycles previously.

I like this set up for a couple reasons...

First off, we have a very strong trend that went uber parabolic in the last cycle. This created a 1,3,5 Elliott Wave sequence,

and with the breakout of major descending resistance we have now made the first indications that this bear cycle is over.

From where were at now, I would expect us to continue higher to my target at $150.

I also noticed a pattern thats playing out compared to the last bear cycle that is almost exactly the same.

These cycles often repeat the same cycles in different forms but the resemblance is near exact.

Will history repeat itself? Only time will tell but, I am bullish.

XMR Day TradeWelcome Back!

Today I am watching XMR for a potential breakout of a bull pennant. This pattern comes after a breakout of major descending resistance which signals the end of the bear market.

Currently prices are tagging resistance of the pennant which is why I am waiting for confirmation one way or the other.

For a bull break to occur the best entry will be the retest of resistance now acting as support.

Another option I am watching is for price to reject off this resistance and fall back to trending support one last time before a break.

Either way I am bullish with how this is accumulating and will be watching for my target to be met.

Target-$82

There is a possibility for the beginning of an uptrend in XMRUSDMidterm forecast:

While the price is above the support 38.50, beginning of uptrend is expected.

We make sure when the resistance at 76.30 breaks.

If the support at 38.50 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 56.

Trading suggestion:

There is still a possibility of temporary retracement to suggested support zone (48.00 to 38.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (48.00)

Ending of entry zone (38.50)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words, NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone. To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons :

Trade Setup:

We opened 14 BUY trade(s) @ 49.70 based on '2-Day Hammer' entry method at 2019.03.12.

Total Profit: 3682 pip

Closed trade(s): 0 pip Profit

Open trade(s): 3682 pip Profit

Open Profit:

Profit for one trade is 52.33 (current price) - 49.70 (open price) = 266 pip

14 trade(s) still open, therefore total profit for open trade(s) is 266 x 14 = 3682 pip

Take Profits:

TP1= @ 56.70

TP2= 65.50

TP3= 76.30

TP4= 88.65

TP5= 100.00

TP6= 114.85

TP7= 137.95

TP8= 149.10

TP9= 168.70

TP10= 230.10

TP11= 298.90

TP12= 372.35

TP13= 447.10

TP14= Free

#XMRUSD (#MONERO) Looking for the next destinationOn the daily chart, we crossed the 200 moving average line which is a positive sign for further gains on the Monro price, you can see that once the price touched a moving average, it fell but immediately Rose and bypassed the old price and this time broke the moving average 200, one more step forward confirming the strength of buyers and the high demand.

From the point of view of indicators, we use the Ichimoku and Stochastic

Ichimoku-All the positive signs support the continued strengthening of the Monero

Stochastic- we are approaching Overbought which means that there could be a correction of the upward movement.

If we turn to the weekly chart, there seems to be strong resistance at 80 in the price of the Monroe and on the monthly chart another resistance in the 90.

Since all the signs are positive we recommend buying signals in the long term, for those looking to be more active and not stay too long on a long term position can buy Monroe until the price reaches 80 and then turn a position into a sell position

Buy Monero: 72.11

Stop Loss: 65

Take Profit: 80

There is a possibility for the beginning of an uptrend in XMRUSDMidterm forecast:

While the price is above the support 38.50, beginning of uptrend is expected.

We make sure when the resistance at 76.30 breaks.

If the support at 38.50 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 63.

Trading suggestion:

. There is still a possibility of temporary retracement to suggested support zone (48.00 to 38.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (48.00)

Ending of entry zone (38.50)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Trade Setup:

We opened 14 BUY trade(s) @ 50.70 based on 'Hammer' entry method at 2019.03.12.

Total Profit: 3962 pip

Closed trade(s): 0 pip Profit

Open trade(s): 3962 pip Profit

Open Profit:

Profit for one trade is 53.53(current price) - 50.70(open price) = 283 pip

14 trade(s) still open, therefore total profit for open trade(s) is 283 x 14 = 3962 pip

Take Profits:

TP1= @ 56.70

TP2= 65.50

TP3= 76.30

TP4= 88.65

TP5= 100.00

TP6= 114.85

TP7= 137.95

TP8= 149.10

TP9= 168.70

TP10= 230.10

TP11= 298.90

TP12= 372.35

TP13= 447.10

TP14= Free

A trading opportunity to buy in XMRUSDMidterm forecast:

While the price is above the support 38.50, beginning of uptrend is expected.

We make sure when the resistance at 76.30 breaks.

If the support at 38.50 is broken, the short-term forecast -beginning of uptrend- will be invalid.

Technical analysis:

While the RSI support line #1 is not broken, bullish wave in price would continue.

Price is above WEMA21, if price drops more, this line can act as dynamic support against more losses.

Relative strength index (RSI) is 52.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (48.00 to 38.50). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (48.00)

Ending of entry zone (38.50)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 56.70

TP2= @ 65.50

TP3= @ 76.30

TP4= @ 88.65

TP5= @ 100.00

TP6= @ 114.85

TP7= @ 137.95

TP8= @ 149.10

TP9= @ 168.70

TP10= @ 230.10

TP11= @ 298.90

TP12= @ 372.35

TP13= @ 447.10

TP14= Free

A second Chance to Buy in XMRUSD ...

Midterm forecast:

There is no trend in the market and the price is in a range bound, but we forecast resumption of uptrend.

Technical analysis:

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

The price is above the 21-Day WEMA which acts as a dynamic support.

Relative strength index (RSI) is 50.

New trading suggestion:

The price is in a range bound and we forecast the uptrend would resume.

There is still a possibility of temporary retracement to suggested support line (110). if so, traders can set orders based on Price Action and expect to reach short-term targets.

If you missed our first HUNT, you have a second chance to buy above the suggested support line (110).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 11 BUY trade(s) @ 89.47 based on ' Valley' entry method at 08.15.2018.

Total Profit: 25712 pip

Closed trade(s): 5606 Profit

Open trade(s): 20106 Profit

Closed Profit:

TP1 @ 105.00 touched at 08.27.2018 with 1553 Profit.

TP2 @ 130.00 touched at 08.27.2018 with 4053 Profit.

1553 + 4053 = 5606

Open Profit:

Profit for one trade is 111.81 (current price) - 89.47 (open price) = 2234

9 trade(s) still open, therefore total profit for open trade(s) is 2234 x 9 = 20106

All SLs moved to Break-even point.

Take Profit:

TP3= @ 149.00

TP4= @ 170.00

TP5= @ 192.00

TP6= @ 227.00

TP7= @ 258.00

TP8= @ 298.00

TP9= @ 378.00

TP10= @ 469.00

TP11= Free

A second Chance to Buy in XMRUSD ...

Technical analysis:

While the RSI uptrend #1 is not broken, bullish wave in price would continue.

The price is above the 21-Day WEMA which acts as a dynamic support.

Relative strength index (RSI) is 50.

New trading suggestion:

The price is in a range bound and we forecast the uptrend would resume.

There is still a possibility of temporary retracement to suggested support line (110). if so, traders can set orders based on Price Action and expect to reach short-term targets.

If you missed our first HUNT, you have a second chance to buy above the suggested support line (110).

Entry signal:

Signal to enter the market occurs when the price comes to "Support line" then forms one of the reversal patterns, whether "Bullish Engulfing" , "Hammer" or "Valley" , in other words,

NO entry signal when the price comes to the zone BUT after any of reversal patterns is formed in the zone.

To learn more about "Entry signal" and special version of our "Price Action" strategy FOLLOW our lessons:

Trade Setup:

We opened 11 BUY trade(s) @ 89.47 based on ' Valley' entry method at 08.15.2018.

Total Profit: 25712 pip

Closed trade(s): 5606 Profit

Open trade(s): 20106 Profit

Closed Profit:

TP1 @ 105.00 touched at 08.27.2018 with 1553 Profit.

TP2 @ 130.00 touched at 08.27.2018 with 4053 Profit.

1553 + 4053 = 5606

Open Profit:

Profit for one trade is 111.81 (current price) - 89.47 (open price) = 2234

9 trade(s) still open, therefore total profit for open trade(s) is 2234 x 9 = 20106

All SLs moved to Break-even point.

Take Profit:

TP3= @ 149.00

TP4= @ 170.00

TP5= @ 192.00

TP6= @ 227.00

TP7= @ 258.00

TP8= @ 298.00

TP9= @ 378.00

TP10= @ 469.00

TP11= Free