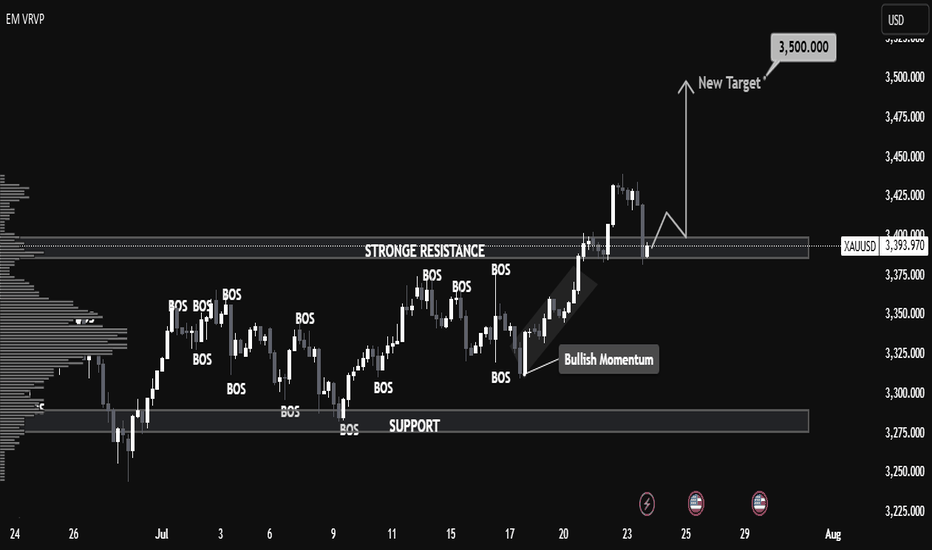

XAUUSD Monthly Technical OutlookMarket Structure Overview:

• The chart reveals consistent Breaks of Structure (BOS) to the upside, confirming a strong bullish market trend.

• Price has successfully reclaimed and retested the strong resistance zone (~3390–3400), which now acts as new support.

• A series of higher highs and higher lows show clear bullish intent, supported by sustained bullish momentum after each correction.

⸻

📈 Volume & Price Action:

• The Volume Profile (VRVP) on the left shows strong historical accumulation near the current breakout zone.

• After the breakout from resistance, the price retested this zone—validating it as support—and is expected to continue its bullish leg toward $3,500, the next psychological and technical target.

⸻

📍 Key Levels:

• Support Zone: $3,375 – $3,390 (previous resistance turned support)

• Immediate Resistance: $3,425

• Target Level: $3,500 (Monthly High Projection)

⸻

📘 Educational Note:

• This setup aligns with classic market structure theory: BOS + Retest + Continuation.

• The pullback into the breakout zone is a textbook bullish continuation signal often used in institutional trading strategies.

• Traders watching this pattern should combine it with confirmation entries such as bullish engulfing candles, FVGs, or order block rejections for safer entries.

⸻

🎯 Projection:

• As long as the price holds above $3,375, the bullish scenario toward $3,500 remains valid.

• Expect possible consolidation or minor pullbacks before continuation.

⸻

📌 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research before entering the market.

Monthlyanalysis

NIFTY to start falling more than S&P500 from next week onwardsNIFTY/SPX chart has hit the upper trendline of ASCENDING WEDGE this week. it had hit the upper trendline 2 TIMES and the lower trendline 3 TIMES till now and has reversed every time since 2020

we can clearly see that whenever the price has reversed from the LOWER TRENDLINE , NIFTY has started performing better than S&P500 and whenever price has reversed from the UPPER TRENDLINE S&P500 has started performing better than NIFTY

Now that the REVERSAL is imminent in the WEDGE pattern and global markets are VERY BEARISH , hence we can expect that the BEAR RALLY of indian market is over and it will become MORE BEARISH than the USA market from the next week onwards

SP:SPX

NSE:NIFTY

Thanks a lot for reading...

GBPCHF I Brief pullback and more upsideWelcome back! Let me know your thoughts in the comments!

** GBPCHF Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

NASDAQ PRICE ACTION AND CHART ANALYSIS w/ ORDER FLOW AND NEWSWelcome back to another video, today's video is about analysing the NASDAQ (NAS100) using the monthly, weekly and daily timeframe to understand and see price movements for possible next direction (either downwards or upwards trend).

P.S NOT A FINANCIAL ADVISOR... JUST EDUCATIONAL AND LEARNING PURPOSE ONLY...

USDJPY ELLIOT PRICE ACTION BREAKDOWNFrom my own perspective, it portrays to me like we're in a correction phase. I mean, a general rectangular correction wave looking at the bigger picture on a monthly timeframe. Currently, we are in primary wave of wave C in micro wave of wave 4 and wave 3 got completed making a 78.6% retracement from the all time high. Moreover, wave 4 just go started which contains 3 waves i.e. ABC wave correction after making or attaining a 50.0% fibs level, expect price to push up to the overall time high. Then, from there we can look for selling opportunities to the down side.

lets watch and see how the market plays out.

TIPS:

WAVE A = 3 WAVES

WAVE B = 3 WAVES

WAVE C = 5 WAVES

Ethereum: weekly analysis overviewWhat I found out in Ethereum price it's crashing too their price and it's below of $1,900 USD.

I hope a crash to $1,100 USD approximately in their price, that will be the first support, And to take note, we could to see a chance to see Ethereum price round to $785 USD if the key and first support breaking down the zone of $1,100 USD.

And then, this it's the monthly analysis timeframe and I see a bearish perspective in the price showing this model of chart that I draw.

Also, Ethereum price it's very key to look their rally in the next year and starting to accumulate Ethereum to make compound interest by year to accumulate enough Ethereum by long term and use them Ethereum to create another portfolio in cryptocurrencies.

One of my favortie altcoin that I want to accumulate it's Cardano by long term.

ADA/USD: To the road to 0.50 centsWe see the bear trend in Cardano in monthly timeframe and I believe that this cryptocurrency will start this bearish movement to find down price around 0.50 cents. Also, I mark a yellow key support around of $0.41 cents

Do you agree with this idea?

Also, if Cardano reach $0.50 cents. I will adjust a good plan to accumulate Cardano by my trading app to accumulate a lot of this coin by long term. And also some cryptocurrencies that I consider like opportunities to the long term.

BTC/USD: Monthly overview in the Bitcoin macrotrendBitcoin it's forming a possible bearish movement that could to lead to the previously price around to $29,387 USD in this support line. Meanwhile, we expect that Bitcoin continue descending this market structure to find up sell during the next month to sell

Remember to know what happen in the global economy in the influence of U.S. Dollar about the interest rates hikes and tightening in the U.S. monetary policy and interest rates hikes in the global economy to take in note in Forex market.

Vechain outlook analysisVechain it's look bullish from this point on monthly timeframe. As we ended the month March 2022. Vechain show us that this it's a good moment to buy this cryptocurrency and invest in it. Also, I admire a lot this cryptocurrency like investment. But I want to share some screenshot that I fond out in this cryptocurrency

First, in monthly timeframe we forming a bullish rising wedge clearly and this cryptocurrency could to blow up in the next months.

In weekly timeframe, we forming this bearish channel, in the previously candlestick, Vechain it's look with a sentiment bullish. And also, we see a bullish crab harmonic pattern formed.

You can to view here this harmonic pattern formed.

So guys, my conclusion will be it's that Vechain it's ready to blow up and I prefer to make a swing trading. But I can to hold a lot swing trading posiiton as I'm in two in Dogecoin and Tron (but Tron it's so ready to take my target that you can to view in my link to related idea below of this anaysis.). But, I'm so bullish in Vechain, if you invest in this cryptocurrency, you make a good choice.

I hope that this analysis support you. But as I prefer, I can't to hold a lot swing position as I have my risk calculated until I make a break even in one of my trades in Tron or Dogecoin to cut the loss in zero and protect my position. But I will consider this analysis in case that I want to make a swing trading in Vechain.

ADA/USD: Monthly timeframe analysisCardano still in this bull rally to long term. But in monthly timeframe, we see that Cardano could to start this bull rally soon to mark a new all time high in this year.

So guy, if Cardano closed up this monthly candlestick at end 11:59 p.m. on March, 31, 2022. Depend how the Candlestick closed up in this month. So, we could to look a bull rally.

XAUUSD Will it break the historical high?If we take a look in the monthly time frame, we can see a very bullish price action. We have an impulse correction pattern which can lead the price ti create a higher high. Also, if we take the fibonacci from low to high the price has clearly respect the .618 of the fibonacci level.

Everything look bullish but to break the historical high the technical analysis is not enough. The fundamentals will be crucial for this to happen.

BTC/USD: Possible accumulation zone toward new ATHBitcoin could to continue bullish forming this Elliot Wave Analysis. Maybe, I thinking that Bitcoin it's in the phase #4 in development

.

Also, we could to forming a ascending triangle that it's in formation to take in our radar!!!

This it's just my idea!!!

ABBOTINDIA - LONG ENTRYThe Stock takes support on weekly basis, where it faced resistance previously.

On monthly chart it created a hammer candle on the support zone.

Good Swing Entry for a couple of months, hoping to see new all time high

Trade Details:

Buy Below : 19600

Stop Loss : 17300

Holding Period: more than 2-3 months

NTPC IS MAKING RISING THREE METHODS The Stock is currently on the way of making a Rising Three Methods Pattern on Monthly Chart, if the Stock Price Closes above 144.2 this month.

It is a Bullish Continuation pattern, can be hold for couple of months if formed.

I am learning, any critics or comments are welcome.

Happy Investing :)

Ethereum Classic to $1,300 USD in the next monthsI just want to share my idea what I thinking about of this cryptocurrency. There's an interesting sight to look how Ethereum Classic it's preparing to make a new ATH to mark over $1,000 USD in the next months. This it's just my idea. Look, ETC break out the historical maximum price of $46.85 USD and this cryptocurrency could to repeat this pattern multiply x2 the 1,355%. This could to put this cryptocurrency to overpass to $1,000 USD or more.

Now, do you hold this cryptocurrency or you're interesting to trade this cryptoucrrency during this bull rally?

XRP it's leading to the super bull rally!!!I want to show you my 4 targets that I consider for XRP.

1. $10 USD

2. $30 USD

3. $100 USD

4. $300 USD

***And also, I consider the target $200 USD for my reservation like a hide targets for everyone.

So, I thinking that XRP has a big potential and XRP has a lot use of cases for the next financial industry. It's a big giant sleeping that people don't consider to hold. Now, I knew the history of XRP where on 2017 became the 2nd best cryptocurrency after of Ethereum. So, Ethereum and XRP was the best cryptocurrencies on 2017. But, now, XRP down to the top #6, but have a lot potential to recover the ranking. But now, I like more XRP as this cryptocurrency could to be more powerful than any cryptocurrency in the top best hot cryptocurrency. I believe that the next financial industry will work for Blockchain technology, and also XRP it's the protagonist in the economy and financial system. One of my big question it's about: Could XRP become the surprise that will shock everyone and beat the rest of cryptocurrency? Remember, I look that XRP has a strong fundamental and work for the global payments in the world into the financial monetary system.

I'm bullish in this cryptocurrency with over 10k XRP in hold!!! But I thinking to pass my Cardano to XRP. My reason it's that XRP it's undervalued and more cheap in my watchlist of cryptocurrency. If I make it, I can to get like a little more of 29k XRP coins.

ADA/USD: Monthly timeframe analysisI show you my 5 targets that Cardano could to reach in the future.

Targets:

1. $10 USD

2. $23 USD

3. $50 USD

4. $100 USD

5. $300 USD

I'm still so bullish on Cardano.

This it's my just idea in weekly timeframe where I have a period time specific in long term. You can to view my screenshot just click on

BTC/USD multi time frame analysis, WILL BE UPDATED STAY TUNED !Will be Updated During the next days for possible trade opportunity Stay Tuned (BE SURE THAT FOLLOW ME TO GET NOTIFICATION)

If like this and if help you with your trading Please Like, Share, Follow and comment that give me motivation to make another Market analysis and trading ideas

If you have some suggestion, comment or other opinion feel free to write it in comment

Wish you succesfull and consistent trading with profits!

This is not an investment advice.

"CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money."

USD/CAD multi time frame analysis, WILL BE UPDATED STAY TUNED !Will be Updated During the next days for possible trade opportunity Stay Tuned (BE SURE THAT FOLLOW ME TO GET NOTIFICATION)

If like this and if help you with your trading Please Like, Share, Follow and comment that give me motivation to make another Market analysis and trading ideas

If you have some suggestion, comment or other opinion feel free to write it in comment

Wish you succesfull and consistent trading with profits!

This is not an investment advice.

"CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money."