Beautiful Uptrend.1830 - Closed at 144.7 (04-08-2025)

Beautiful Uptrend.

Hidden Bullish Divergence on Bigger tf.

Strong Supports are 140 - 141 & then

around 111 - 112 (in case of extreme

selling pressure).

Upside targets can be around 160 - 162

initially.

Stoploss for a Swing Trade is 138; & those

who believe in split buying may keep a

Stoploss of 110 on closing basis.

Monthlystructure

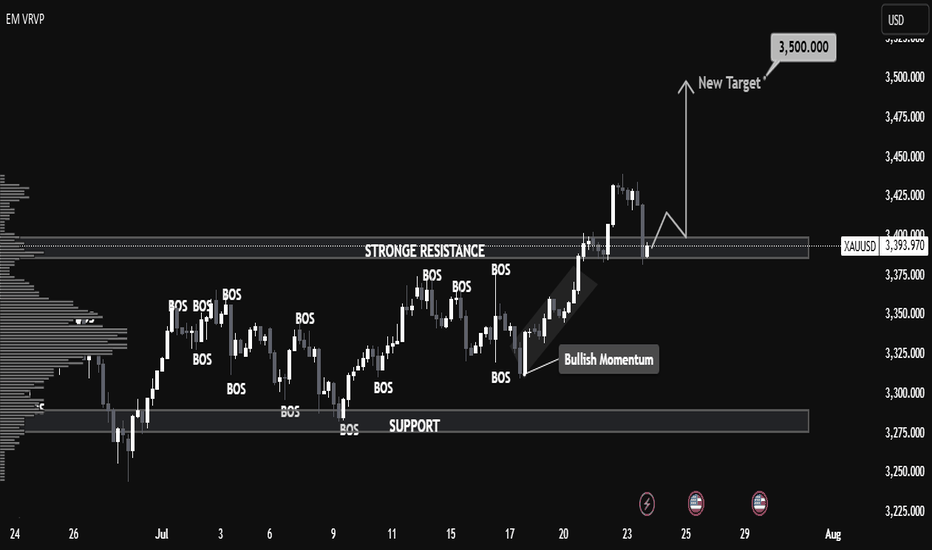

XAUUSD Monthly Technical OutlookMarket Structure Overview:

• The chart reveals consistent Breaks of Structure (BOS) to the upside, confirming a strong bullish market trend.

• Price has successfully reclaimed and retested the strong resistance zone (~3390–3400), which now acts as new support.

• A series of higher highs and higher lows show clear bullish intent, supported by sustained bullish momentum after each correction.

⸻

📈 Volume & Price Action:

• The Volume Profile (VRVP) on the left shows strong historical accumulation near the current breakout zone.

• After the breakout from resistance, the price retested this zone—validating it as support—and is expected to continue its bullish leg toward $3,500, the next psychological and technical target.

⸻

📍 Key Levels:

• Support Zone: $3,375 – $3,390 (previous resistance turned support)

• Immediate Resistance: $3,425

• Target Level: $3,500 (Monthly High Projection)

⸻

📘 Educational Note:

• This setup aligns with classic market structure theory: BOS + Retest + Continuation.

• The pullback into the breakout zone is a textbook bullish continuation signal often used in institutional trading strategies.

• Traders watching this pattern should combine it with confirmation entries such as bullish engulfing candles, FVGs, or order block rejections for safer entries.

⸻

🎯 Projection:

• As long as the price holds above $3,375, the bullish scenario toward $3,500 remains valid.

• Expect possible consolidation or minor pullbacks before continuation.

⸻

📌 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research before entering the market.

a Bounce is expected from the Current level but Resistance aheada Bounce is expected from the Current level.

but 21 - 21.20 is a Very Strong Resistance.

as of now. & if it is Crossed with Good Volumes

& Sustained, we may see the price touching 22.50 - 23.50

& lets enjoy further upside above 24 - 25.

However, Monthly Support is around 16 - 16.50.

... Pure Technical Tukka ... KHADIM INDIA LTD ... NSE:KHADIM

as per Studies Thought by Institutions ... we are assuming -6.6 % of SL and Going for the Target of +24.15% ...

That means ... we are Maintaining around 1:4 RR (Risk Reward Ratio)

This Trade is Pure Tukka ...

Fundamental Ratio's Are Not Satisfying ... Every Analyst Would Say that Stay Away From Khadim India Ltd ...

Then Why Our Page is Sharing This Stock As Buying Suggestion ?

Entering a Trade with a STOP LOSS ... SL of -6.6% .... is not a Bad Practice ....

if anyone is Afraid of SL then He/She should stop or quit Trading ...

Momentum Trading Picks - Dr.Lal Path LabsAs the chart clearly shows a breakout with the significant volume on a monthly time frame it's clear that we can see the great opportunity in the long side and since the market and sector both are in a bullish phase we can see the target will be achieved in no time.

GOLD [XAU/USD] Sell Structure for the Month of MayAnalysis of Gold Price Movement in May 2024

For the daily timeframe in May 2024, Gold has opened at a high level, indicating potential seller activity. The initial target for price movement is the open price of 2321.07 , serving as the primary take-profit point for the monthly structure. Utilizing Fibonacci analysis, the first take-profit level is identified at 2339.56 , followed by the open price of 2321.07 .

Key rules to follow when trading this structure include:

1. Market Structure (OHLC/OLHC)

2. Divergence

3. TDI Cross

When these conditions align, the likelihood of a successful trade increases. Remember to practice patience and apply proper risk management techniques.

Kindly support this idea, Follow, Share and like :)....

NFL :ATH/ CUP BreakoutNFL is currently trading around its all-time high (ATH) and presents an opportunity for a long trade with a promising risk-reward profile. The strategy involves entering a position at 4% above the ATH and employing a dynamic stop-loss approach to manage risk and maximize potential gains.

Entry: Enter a long position at NFL's ATH price + 4% (155.15)

Initial Stop-Loss: Set an initial stop-loss at 20% below the entry price (124.00) or Weekly Swing Low

Targets:

First Target: 232.30 (Fibonacci 1.618 level)

Second Target: 283.70 (Fibonacci 2 level)

Third Target: 418.20 (Fibonacci 3 level)

Position Sizing: Limit the trade size to ensure that no more than 5% of your capital is at risk. In case the stop-loss is triggered, the maximum capital loss will be limited to 1%

The dynamic stop-loss adjustment after reaching the first target further protects capital and locks in profits.

The position sizing ensures that you are not risking more than you can afford to lose.

Disclaimer:

This trading strategy is for informational purposes only and should not be construed as financial advice. Please conduct your own research and due diligence before making any trading decisions.

Additional Notes:

Consider using technical indicators and chart patterns to refine your entry and exit points.

Monitor market conditions and adjust your strategy accordingly.

Practice risk management techniques to protect your capital.

Please let me know if you have any other questions.

USTEC SELL Monthly Structure Analysis and Trade SetupThe USTEC monthly structure on the daily timeframe is represented by OHLC, indicating a Sell Setup . We are currently waiting for a bearish TDI cross on the daily chart to confirm the presence of sellers in the market. Additionally, the candle formation at the high is an evening star pattern, which signals a potential reversal .

If the trade moves in our favor, I have identified three take profit targets:

1. First Take Profit: 18,485.24

2. Second Take Profit: 18,193.98

3. Third Take Profit: 17,958.57

Trade with caution. If you find this post useful, please like, follow, share, and leave a comment.

Bullish move on reversalPoints of Ethics :-

1) Strong selling at level 441 if price Falls below this level lower level AT 408.30 can be seen and also we have strong buying area at the same level AT price 408.30 so we can see another reversal for the price to move near resistance around 496 to 517

2) If the price does not cross 438.40 then we can see further reversal and we can go long with the target between 75 to 80 points, 496 to 517 considered as retracement zone we also have small resistance near 441 so we can plan our trades accordingly as per the levels

3) short term time period of 30 days

Reversal seen at support on monthly candle , price is forming a descending pattern, be cautious.

*** Views are personal and not a advise, DYOR ***

Rain Industries Boom Above 200Stock with huge upside forming base

Rain Industries CMP 179.85

Breaking triangular range on monthly charts

Leading producer of Calcined Petroleum Coke

Largest Coal tar distiller in the world

Huge upside pending for stock

Cyclic stock needs lots of patience

Accumulation zone 176-185, Above 200 we can witness the opening of a new range. Strong Fundamentals, from a sector of petrochemical, management working on reducing Debt

Like & Retweet for max. reach

Weekly/Monthly Overview on Nasdaq DirectionAs price took higher liquidity, my focus would be to retrace lower before making a move higher, highlighted red as premium and green as discount, looking to see if nasdaq retrace back into the FVG highlighted in yellow, to officially see if it plays as an inversion FVG during the upcoming week.

"Bullish Momentum Persists: BTCUSD Eyes Target at $47,477.50""In the current BTCUSD market, a bullish trend is underway, with a specific target set at $47,477.50. The optimism is grounded in the anticipation of a revisit to the previous high of $47,477.50, as it has been successfully targeted before. The analysis suggests a risk level at $41,697.61 as the market strives to reclaim and surpass the established target."

Nailing Market Bottoms with Precision! 🎯📉Cryptocurrency markets are notorious for their volatility, making it challenging to identify the perfect entry points, especially during bearish cycles. However, a game-changing tool has emerged, the Investor Tool BTC Indicator, renowned for its remarkable accuracy in pinpointing true market bottoms. In this post, we'll explore the incredible capabilities of this indicator and its astounding track record of never missing the mark. Its next target? A staggering $150,000 per Bitcoin!

Cracking the Code: Investor Tool BTC Indicator

The Investor Tool BTC Indicator is a cutting-edge tool designed to decipher market sentiment and identify optimal entry points.

What sets this indicator apart is its exceptional accuracy in recognizing the true bottom of a bearish cycle.

Unveiling the Power: How It Works

The Investor Tool BTC Indicator employs a complex algorithm that considers various market factors, sentiment analysis, and historical data.

Its unique methodology filters out market noise, providing crystal-clear signals during uncertain times.

The Unparalleled Track Record: Never Misses the Mark

Perhaps the most astonishing aspect of the Investor Tool BTC Indicator is its impeccable track record.

Historically, it has accurately identified market bottoms without fail, instilling confidence in traders and investors.

Setting Sights on the Future: $150,000 per Bitcoin!

With its uncanny ability to call market bottoms, the Investor Tool BTC Indicator has set its next target: a jaw-dropping $150,000 per Bitcoin.

Traders and investors are watching closely, eagerly anticipating this remarkable price milestone.

Leveraging the Indicator: A Game Plan

Timing: Keep a watchful eye on the indicator's signals and act swiftly when it identifies a market bottom.

Risk Management: Despite its accuracy, always employ sound risk management strategies to protect your investments.

Continuous Monitoring: Stay updated with the indicator's signals and be ready to adapt to changing market conditions.

In conclusion, the Investor Tool BTC Indicator has revolutionized the way we approach cryptocurrency trading by consistently identifying market bottoms with unparalleled precision. As it sets its sights on the ambitious target of $150,000 per Bitcoin, traders and investors are eager to capitalize on its next remarkable prediction. Remember to combine this tool with comprehensive analysis and prudent risk management for a well-rounded trading strategy. 🚀💰🚀