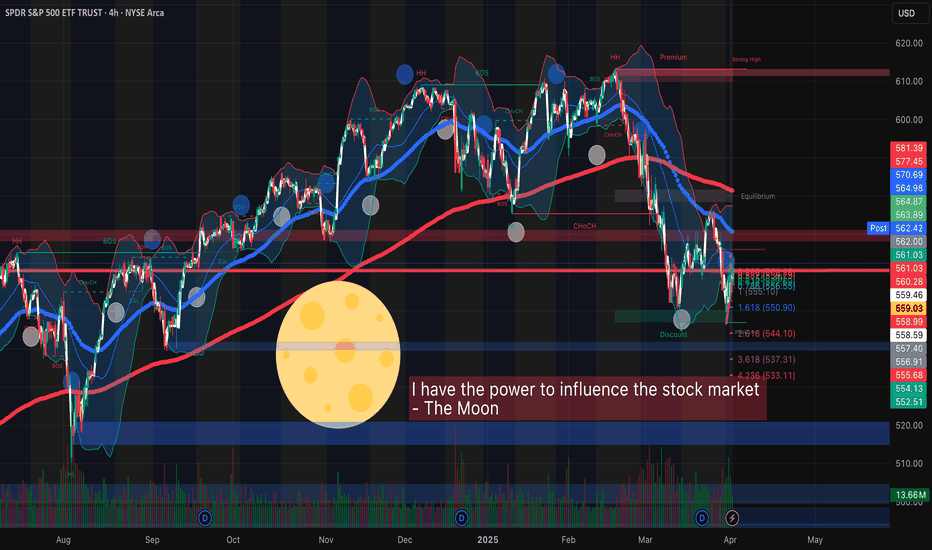

FULL MOON and SPYHello traders! One of the great legends, OSHO, explains that if the moon has enough power to cause turbulence in the oceans, then why can't it affect human beings thinking and behaviors when the human body is made up of roughly 60% water? OSHO further explains that in history many people have been enlightened and many become mentally disturbed on days like a FULL MOON, and he explained that there must be a connection between planets positions and human behaviors.

Now, if it comes to trading SPY based on the moon phases, then I have backtested a few full-moon dates, and I have found something interesting that makes me think of incorporating a full-moon strategy while trading SPY/SPX or any other major index. I am not promoting astrology or abnormal ideas, but I want to share my research with you all because I found a connection and patterns in the behavior of SPY and the full moon. You are not forced to think about astrology in trading, but having knowledge and the ability to see patterns in the world can help you build your intuitive thinking and deep subconscious knowledge.

This year, taking Los Angeles as a reference, full moon dates were on Jan 13, Feb 12, and March 13. On January 13, the price showed a bullish run all day with low and high points of about 575.36 and 581.69, respectively. The similar bullish run was observed on February's full moon day, i.e., on 12th February, when SPY showed a low of 598.41 and a high of 604.52, making the market bullish all day. In contrast, we have observed a sharp decline in SPY on March 13, 2025 (full moon), which could seem to invalidate the full-moon strategy, but in the long run, SPY and the SPX Index remain bullish most of the time.

Carefully observing previous year (2024) full-moon dates, I have found that SPY opened 4 times gap-up on full moon dates (May 23 2024, July 21 2024 (market off but gap-up next session), October 17 2024, December 15 2024 (market off but gap-up next trading session). 5 times out of 12 were classified as bullish to strongly bullish: January 20 2024 (Bullish after 11:00 AM PST), March 25 2024 (sideways market but bullish overall), April 23 2024 (Bullish), August 19 2024 (bullish), and September 18 2024 (bullish after 9:00 AM PST). The market remains gap-down and bearish two times on February 24 2024, and on November 15 2024.

Now, since I have found that the SPX Index remains bullish on most of the FULL MOON dates, and the chances of a gap-up opening on or the next day of the FULL MOON (in case the market is closed on the FULL MOON) are very high based on the results obtained from the PY 2024 and 2025 previous months. The next FULL MOON is on Saturday, 12th April 2025, and the market is closed on this date; therefore, on 14th April 2025, if the market repeats itself, then I can expect SPY to open gap-up, and it would be interesting to see if FULL MOON really has the power to influence the stock market. Let’s give it a try, and on 11th April, 2025, if the market gives signs of huge buying pressure, then I will be buying some calls expiring April 14th, 2025, to test the full moon strategy.

I am the only writer of this article, so there are high chances that I might have made some mistakes while publishing. Therefore, I would be happy to see if you can correct me if I'm wrong or if you can share your own knowledge and insights about the relationship between MOON and SPY. Thoughts and comments?

Moon Phases

Continuing the Moon Phase Vs Nifty chart further. Yesterday in the message we understood how The dark circle resonates with the dates of no moon day and Grey circle indicates the day when we saw a full moon. Invariably in most of the no moon days as can be seen in the chart index is at the peak near no moon day. Then there is a fall seen in Nifty. Recovery starts in few days of Full moon day and then again Nifty makes a peak near no moon day. We were trying to contemplate if it is a coincidence. Now we saw a small turnaround today. We do not know if this will hold and if the recovery will start from here and now but we will juxtapose Moon Phases Vs Nifty chart with our Mother, Father and Small Child theory, RSI and Bollinger bands and see what levels we get for support and resistances further.

RSI is currently on daily chart is at 41.27 having taken support near 37 zone. This seems to be a good support zone for RSI as it as bounced from there and there about several times. Nifty took baby steps to recovery on Friday as Full Moon is done. Lowest RSI on daily chart was around 32 that was exactly one year back so we can expect either of these two levels to hold fort.

Father line support is near 23404. Bollinger band shows a support zone near 24373 range in case Nifty takes a dip from here. Mother line resistance is near 25026 and Bollinger Median resistance is near 25372. Resistance for nifty based on Bollinger band top seems to be at 26372.

Mother, Father and Small Child theory is explained in my book Happy Candles Way to Wealth creation. The book is available on Amazon in Paperback and Kindle version. Do read it as many reviewers on Amazon consider it as a Hand book to equity investment.

In this way we have tried to deduce support and resistance levels of Nifty with the help of Mother, Father and Small Child theory, Bollinger band, RSI. We tried to predict the turnaround phases for Nifty’s upward and downward runs by juxtapositioning it with phases of Moon. To a normal eye all this looks a little complicated and difficult but when you dissect it and spend time with the chart you will be able to deconstruct it bit by bit, frame by frame and level by level.

Disclaimer: There is a chance of biases including confirmation bias, information bias, halo effect and anchoring bias in this write-up. Investment in stocks, derivatives and mutual funds is subject to market risk please consult your investment advisor before taking financial decisions. The data, chart or any other information provided above is for the purpose of analysis and is purely educational in nature. They are not recommendations of any kind. We will not be responsible for Profit or loss due to descision taken based on this article. The names of the stocks or index levels mentioned if any in the article are for the purpose of education and analysis only. Purpose of this article is educational. Please do not consider this as a recommendation of any sorts.

Bitcoin Analysis: The Lunar Influence and Price TargetsAs of the latest data, Bitcoin began its ascent at exactly 16:00 Dubai time , coinciding with the formation of the full moon. Is this a coincidence? Absolutely not! The correlation between Bitcoin and moon phases is a pattern observed by seasoned analysts. Historically, after every full moon, Bitcoin has shown bullish momentum lasting 3 to 4 days on average.

At present, Bitcoin is hovering around the $67,000 mark, showing strength in its recent movements. The major support level stands firmly at $56,800 , a critical point that has held over several market cycles. On the upside, we are focusing on the major resistance at $69,329, a level that we believe could be broken this week. If this resistance breaks with confirmation, a slight rejection might occur, but the continuation of the upward momentum is highly probable.

Our first target lies within the golden zone, ranging from $75,008 to $76,747 , where we expect Bitcoin to consolidate before potentially pushing higher.

The moon phase phenomenon has drawn attention from both technical and scientific communities, as similar market movements have been recorded in the past. Many traders and analysts follow this lunar cycle to align their strategies with Bitcoin’s behavioral trends. With Bitcoin’s price behavior showing such predictability, it reinforces the importance of alternative analysis techniques that integrate both natural cycles and traditional technical indicators.

Supporting Media and Insights

Lunar Phase Correlation with Market Trends: Research papers and market reports suggest a pattern in price movements aligning with lunar cycles, particularly full and new moons. These natural events seem to trigger psychological market responses, possibly rooted in historical trader sentiment or behavioral finance models.

Crypto Sentiment Studies: Numerous media sources have reported on Bitcoin's uncanny alignment with natural cycles, especially after full moons. Bitcoin tends to rally within days following these phases, often igniting bullish sentiment across crypto communities and news outlets. Analysts point to multiple instances where moon phases triggered temporary, yet significant, market boosts.

Current Market Sentiment: As we approach key technical levels, many institutional traders and investors are watching Bitcoin’s reaction closely. With the macroeconomic factors in play and rising institutional interest, breaking the $69,329 resistance will attract significant volume. Social media platforms, forums, and market analysts are buzzing with discussions on Bitcoin’s next move as it edges closer to critical resistance levels.

This analysis confirms that alternative insights such as moon phases can provide additional layers of understanding when timing trades, particularly in a volatile market like Bitcoin.

Stay tuned for further updates, and keep a close watch on these price levels as the week unfolds.

Disclaimer : The information provided in this article is for educational and informational purposes only and should not be construed as financial advice. Always conduct your own research and consult with a licensed financial advisor before making any investment decisions. Cryptocurrency markets are highly volatile, and past performance is not indicative of future results.

Moon Phases and BTC/CRYPTO correlation (nov 2022 /dec 2024)Charts shows us the people collective psychology and emotions. We all know that the Moon and her phases reflecting on people psychology, directly or indirectly, more or less. Then, let's combine the Charts and Moon phases to see what we will find and how this can help us to be a better traders. Enjoy!

ETH/USD POSSIBLE BEAR TRAP?!?!BITSTAMP:ETHUSD

🚀 Ethereum Update: Breaking Free from the Bear Trap! 🌕

Hey Crypto Traders! 🌐

Exciting times in the Ethereum market as we witness a breakout from the recent bear trap. 🐻 But don't fret, Hodlers – the charts are flashing some compelling bullish signals!

📈 Key Technical Indicators:

Waning Moon Bullish Signal: The waning moon is casting its bullish glow, signaling a period of consolidation before a potential upward swing. 🌙

100 Day EMA Bounce: Ethereum bounced off the 100-day EMA, showcasing strong support.

MACD Cross Confirmation: A bullish MACD cross adds weight to the positive outlook.

💡 What's Next?

Keep a keen eye on the green trend line. If Ethereum breaks above it, we might be looking at new heights. The waning moon, coupled with technical indicators, paints a promising picture.

🌐 Stay Informed, Stay Ahead!

#Ethereum #Crypto #Bullish #ToTheMoon #Breakout

This is what might happen next for XRP 🚀This is a quick update on our previous chart

As mentioned, prices exactly touched the price volume target (blue line). From that point we got rejected and headed back to exactly 0.4375 cents, which we also coined as a possibility.

The big question is what will happen next 🔮

ANALYSIS

Technicals:

- The RSI is still above it's center-line on the 1H chart, which is bullish.

- The stochastic RSI is oversold on the 1H, which suggests a potential reversal in the immediate short-term.

- However price is currently below the BB center-line on the 1H chart. So the bears might be pulling the price towards BB center-line on the 4H around 0.4315.

If we we're to come back down to 0.43 cents I'm not convinced we will be going much lower than that, however anything is possible. The market loves to target stoplosses🐻

Energetically:

The situation remains unchanged. (bullish)

Disclaimer: Non-Financial Advice

The information provided in this analysis is for informational purposes only and should not be considered as financial or investment advice. The analysis presented here is based on historical and current data, market trends, and personal interpretation, and it may not accurately predict future market behavior.

A potential big move for XRP is loomingA potential big move for XRP is looming with a slight bias (60%) towards the upside. If prices do come down to retest lower levels I expect a move up shortly after.

Although it looks like XRP is bottoming out around 0.41 cents take note that short-term spikes towards 0.37 cents are not out the realm of possibilities due to high volatility in the market.

ANALYSIS

Technicals:

- XRP has formed a symmetrical triangle

- Currently ranging in the middle of 2 big volume price targets (blue lines).

- Increasingly tight consolidation (BB is narrowing).

Energetically:

A new moon is set to happen on the 19th of May. Prices are more likely to move upwards within a 5-day range around the new moon (between 15-24 May), right before crashing down or consolidating.

News:

Odd behaviour by the SEC since they just dropped crypto firm LBRY's fine from 22M to 111K. Is there a possible settlement/court decision for the SEC-Ripple lawsuit on the horizon?

Disclaimer: Non-Financial Advice

The information provided in this analysis is for informational purposes only and should not be considered as financial or investment advice. The analysis presented here is based on historical and current data, market trends, and personal interpretation, and it may not accurately predict future market behavior.

Moon cycles - what will the Bull Moon bring?Illustrated here are the Bull and Bear moons since the start of the Bitcoin recovery, one bear moon appearing in Equinox was invalidated into crab pa with all other bull/bear moons being successful.

Lunar cycles are approximately 80% succesful.. The question is, what will this May 5th bull moon bring? Invalidation or pump?

Let me know your thoughts in the comments.

Did you buy the Luna dip?This surely isn't advice, but I'm curious who the other degenerates by my side did?

Humans have done worse things than Luna. Who doesn't like a good comeback story?

UBER SHORT, STOCK MARKET ANALYSISHello everyone, it has been some time since my last post but I do plan on making some more content. Here is my analysis of why I believe it is a good time to short UBER. Some other stocks may be worth shorting, but for me, this is the one that I feel the most confident in trading as of now.

Please let me know if you have questions,

~Master Chef

BTC to retest bottom of triangle at $35K?BTC has been in a huge triangle since the end of December. For a while it appeared to be a bullish symmetrical triangle, but after the last two breakout attempts it doesn't look like the market is bullish enough to really pump it out of the triangle. Now it is looking more like a bearish descending triangle.

Full moons generally indicate the beginning of downtrends and you can see that this has been the case the last 2 full moons as indicated by the orange arrows. The full moon is exact in a few hours and I believe we've headed into a downtrend.

BTC will probably retest the bottom of the triangle at around $35K. It may well also breakout on the downside and test the monthly S2 pivot point at $29600.

If it bounces at the triangle bottom, it will confirm a more bullish outlook. In that case I'd expect a nice pump up out of the triangle to test the R1 pivot point at $48K around the end of the month near new moon on March 31.