Moon Phases

ETH Last resistance before BESSA! END of dumbs? LEVERS 🧐🧐🆘🆘 Hello everyone!

People still haven't learned, the market is still overflowing.

This can result in high volatility.

After further drops, we landed below my target from the previous analysis.

I didn't expect such a descent, but the profits were realized and it is time for the next move.

In my next strategy, I used the moon phase indicator. Maybe it's nice to tell me when the accumulation will end.

After it, I will take the long position if it goes as planned and there is no further disturbing news from the world.

Possibly when I see a doublebottom signal. Then I will share it with you.

Another drop to the last support is possible, but less likely. A quick wick to remove STOPLOSS may also be formed.

Why do I think so? The on-chain data shows that, a lot of leveraged orders appeared on the market again.

If you have one, you should be careful!

My target is the yellow trend line, I'm counting on new ATH. If it breaking trendline, I'm realizing some profits, counting on further increases.

Comment and like,

Greetings

#BTC big move coming January 2nd or 3rd! High Time FrameMoving Averages:

- Using the 400D EMA as support, which was held during the June/July 2021 markdown. By held I mean that we have not closed below it on the weekly TF since March 2020.

Patterns:

- Markdown structure is almost identical to last year's at a slightly smaller scale. Bitcoin will recover when most of the retail traders will (at least psychologically) capitulate as most of the support classic patterns and geometrical shapes will have been broken.

Fibonacci:

- Fib levels self explanatory (July 2020 bottom to ATH) we might ultimately hit the 0.702 level on full retracement or maybe below it at yearly RVL

Volume profile for the yearly range:

- Value area low could be touched in theory without breaking the ultimate support (39k). This is the REAL DEMAND zone, a zone where people will buy like there's no tomorrow.

We're just under yearly POC (48000) which is not great as it acts as massive resistance.

Black Magic:

- if you believe in moonphases.... there will be a New moon on the second of January. (It' annoyingly accurate for major moves)

If we break 39k....30k is the next support well... and see you in a few years. Don't forget to DCA.

Meanwhile we trade up and down.

BTC to $39k by mid-January, then to $70k in 3 weeks?I use astrological indicators so if that's not your speed, this one isn't for you...

Mercury Retrograde - January 14, 2022

The Mercury retrograde cycle often has a huge impact on BTC. The 3 weeks before Mercury goes retrograde are often marked by falling prices, with the bottom coming in about the time Mercury goes retrograde. There is usually an initial drop with a few weeks of sideways action before the second drop.

Mercury goes retrograde January 14 so we are now within that several week period and we've already seen falling prices.

Full Moon - January 17, 2022

Over 80% of the time, the full moon coincides with the local price bottom and the new moon coincides with the local top (+- 2-3 days). The full moon is January 17th, which is a Monday and also MLK Day in the USA. I would expect to see the local bottom with a few days of January 17th.

Analysis

I think the current downward trend will continue another 2-3 weeks until around the weekend of January 14th. Dropping to around $39k will complete the head and shoulders pattern that started July 21, 2021.

After that I think we'll see a strong rebound...maybe even up 80% to $70k during the 3 weeks of the Mercury retrograde period. Last year we had about a 90% pump during the first Mercury retrograde of the year.

Jupiter in Pisces - December 28, 2021 WARNING!

This is the one astrological factor that may screw up the strong rebound in mid-January. Jupiter in Aquarius was very strong for BTC most of 2021. But Jupiter slipped into Pisces for almost 3 months during 2021 from May 13 to July 28. I think this is what caused the 50% price drop at the end of spring. If we don’t see a good rebound in the third week of January, Jupiter in Pisces may be putting a damper on things like it did for the May 30, 2021 Mercury retrograde. There is even the possibility of a repeat of the 50% drop we experienced the second half of May 2021, perhaps falling to $29k. I don’t anticipate this, but it’s worth keeping in mind.

This is not financial advice...just some astrological indicators to use in your own trading.

ETHEREUM MOON INDICATIONS“The moon is a loyal companion.

It never leaves. It’s always there, watching, steadfast, knowing us in our light and dark moments, changing forever just as we do. Every day it’s a different version of itself. Sometimes weak and wane, sometimes strong and full of light. The moon understands what it means to be human.

Uncertain. Alone. Cratered by imperfections.”

AUDUSD Weekly Forecast >>> Correction on New MoonAUDUSD potentially going up to 0.72140 on Internal Retracement 0.786, and retest the Exponential Moving Average 162 (green line), after make a turning point on last New Moon .

Sell potential on 0.72140 >>> wait for confirmation trade using Stop Order,

with Stop Loss above 0.72380 and Price Target around 0.70210,

Time Geometry Forecast

Price will be hit December 19th on Full Moon - December 21th on Sun Ingress .

If Price don't make turning point or any sell signal around entry level, then wait on 0.7300 on yellow line for Short Selling with the same target price and Stop Loss 50 pips above entry level, price may make turning point on full moon and sun ingress period , either peak or trough

FX:AUDUSD

The X/Time Factor of KLCI. Where Time/Price Meet. 2/Dec/21KLCI's cycle based on Moon Phase - Most human body (≈60%) AND Earth Surface (≈70%) is water... "our brain which "control" our "mind/thinking" Consist of "80–85%.. AND Finally Our Ocean Tides/ Waves - Cause by Moon's Gravity....

1)On Charts : Charts consist of 3-Dimensions - The X-factor ( Time or Cycle ), The Y- factor ( Price Geometry ), AND The Z-factor ( The Speed ).. 2)On Elliot Wave / Market Structure : Unlike Textbook written rule : ALL Impulsive wave comprise of ONLY a-b-c sub-waves NOT 1,2,3,4,5 waves.. AND there is NO Truncated 5th wave BUT ONLY wrong wave counts...

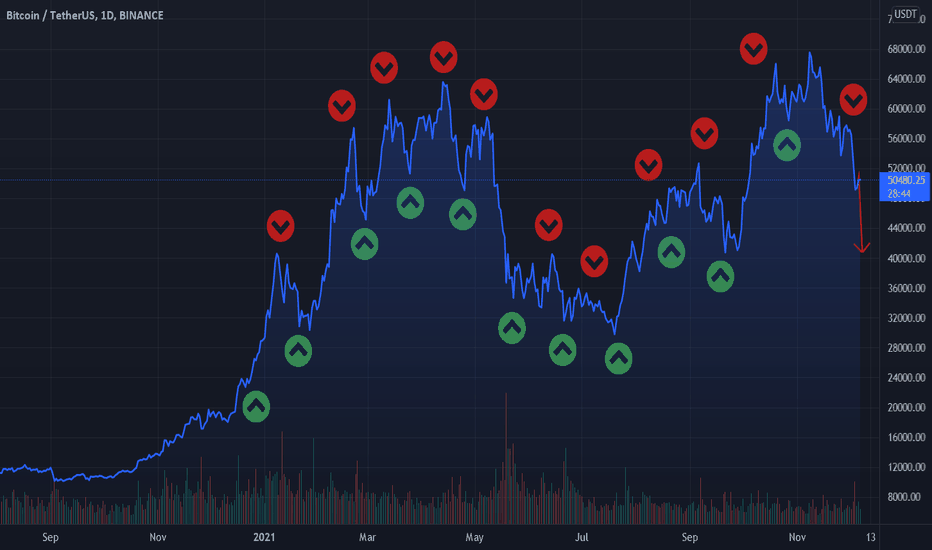

BTC - Moon Cycle TA (Financial Astrology Overview & Prediction)It was covered before, but if you backtest Bitcoin's 2021 correlation to the moon cycle, you find an approximately 80% success rate if you laddered long entries during the week of a full moon, or laddered shorts over the week of a new moon. Basically the moon cycle is more accurate than almost everyone reading this.

Background : astrology has an interesting relationship with crypto and other speculative markets. Many traders don't realize that one of the most famous traders in history, W.D. Gann, was a major proponent of financial astrology, and wrote many volumes on the subject. It also turns out that financial astrology is much more complex than you realize, to include:

measuring positions of planets through the day

the phase of the moon, the zodiacs

the positions of planets relative to each other

the effect sometimes varies per market (for example, stocks affected differently than crypto)

..and much more!

So what does the current pattern say about Bitcoin? Well admittedly I am a complete amateur at financial astrology. There are qualified financial astrologist (though I suspect extremely few are well studied). So this chart is only looking at the correlation between Bitcoin price action and the moon phases, specifically the full moon and new moon. As I stated above, if you laddered longs during the weeks with full moons, you would have around an 80% success rate entering near the local bottom in the pattern.

Note : I never rely on only a single data point or indicator, so I'm also referencing on-chain data (Bitcoin netflows and exchange supply), as well as a basic fibonacci retracement (fibonacci is another trading science that works in mysterious ways). I want to find confluence here, where on-chain data appears neutral to bullish, allowing the moon's influence to further rally the bulls for a proper breakout.

Prediction : on-chain data currently appears neutral (with a weak bullish bias) to overwhelmingly bullish with clear signs of continued accumulation, although a small uptick in supply means we are shaking some profit-taking/paper hands from the market.

Given the full moon presented on 19 November, within less than a week we should see a strong move to the upside as the full moon weakens bear's resolve and rallies bulls. Of course we want to validate this along the way with continued bullish on-chain data.

AUDUSD Nearly Reach The Strong Cluster >> BuyLong position (Buy) instead of short selling

AUDUSD now had drop till about 90 pips heading to the cluster area , as shown on the analysis chart above, price action shows that AUDUSD likely to end it's bearish trend and begin to build a strong bullish movement , once it's hit the cluster area.

Considering in the weekly time frame, we see AUDUSD is on a bearish trend now, and we were trading in a minor Bearish Flag Pattern on weekly, there's potential for AUDUSD to break the chart pattern and continue drop and build a very strong bearish movement .

We never side with one direction, there can be bullish or bearish, but we know bullish is the higher probability and be ready to stop and reverse, once price move otherwise and break the flag pattern to develop a strong bearish trend

Analysis as shown on the chart above, we calculate the price cluster area using fibonacci and time geometry to see when probably price will make a pivot point using square of nine , combine with geocosmic cycle and financial astrology to get more accurate prediction.

AUDUSD Heading to A Strong Cluster : Buy SignalSIGNAL FOR TODAY

BUY >>> 0.72724

STOP LOSS >>> 0.72220

TARGET 1 >>> 0.73940

TARGET 2 >>> 0.74821

TARGET 3 >>> 0.75630

Disclaimer On, Trade at your own risk !

Buy Signal is NOT a Buy Limit Order, but a Buy Stop Order , because we need to wait and see the market action after touching the target cluster area...

Buy Stop Signal may be changed or even canceled later, if price doesn't move like our trading plan

We never take sides of one market direction, follow what big guys want to do, "Forecast can be wrong, Trades must Win"

Use a proper risk management, my trade had about 81% win rate

TIME GEOMETRY ANALYSIS :

Price may make a Lower Low and a pivot point to prevent a changing direction of bearish trend on 14th November 2021, consider from the latest extreme pivot, we calculate the time support that most likely to affect the market using Square of Nine and Gann Cycle

AUDUSD Forecast : Prepare for a Strong Bullish TrendAUDUSD now has break the Falling Wedge Pattern after completely finish the 5th Wave of Elliot Wave , like I publish before...

Start today on New Moon 5 November 2021, and will end the strong trend probably on 14 November 2021 if we calculate the date using square of nine from the history pivot , and maybe on the day between 19 November until 21 November 2021 on Full Moon that make a cluster with Sun Ingress.

Consider from Financial Astrology on planetary harmonic cycle, this week is Mercury Retrograde that will make XAUUSD on a bullish trend with probability more than 75%, and we know that AUDUSD has a positive correlation with Gold Market, because Australia has an effect to build a trend in Gold Market.

From Technical Analysis , I see that a big major Falling Wedge has been retested, and form a minor falling wedge that has been break by a bullish movement. 0.75627 can be our target price, but we must also consider that in weekly time frame, AUDUSD already break a bearish chart pattern.

Disclaimer on, no holy grail or nearly perfect set up, follow the market, do stop and reverse if it's needed. My forecast have a win rate about 81%

Follow me on Instagram @jaysen.xav

First matured & clear Technical Analysis for BitCoin as long as we stay above this ma, and we creep a lil bit higher and higher to allow the moving averages to align themselves correctly. We will be ready for 100k soon. Although if that yellow crosses above the lighter yellow on daily, and this MFI indicator is at that dangerous level. GET OUT

Bitcoin and the Infamous Mercury RetrogradeMost people don't know this about me, (and 100% won't care) but I love astrology. The stars, the unknown, the mystery, all shrouded in darkness. I have questions and nobody has the answers. Probably part of the allure, I'd imagine.

I also love Technical Analysis. I don't consider myself amazing by any stretch but I'd like to think I'm a level above wasting anyone's time.

Data. Numbers. Math. Patterns. Time. Theory... I love em all.

This analysis will focus on a period of time that generally happens 3 but sometimes 4 times a year and it has to do with the planet Mercury.

Very quickly, Mercury Retrograde is simply when Mercury passes Earth on its way around the Sun. Because Mercury has an inner track and can complete an orbit in around 88 days, there will be times when Mercury cruises right by Earth. From our view on Earth, it would almost appear as if Mercury is moving backwards.

Don’t take my word for it, look it up yourself if you’re interested but they say that Mercury Retrograde leads to a lot of negative action, specifically regarding expression, communication, technology and other misfortunes including financial disruptions.

It should be said that there are also two weeks before Retrograde and two weeks after Retrograde, give or take, and these are Shadow periods. I’m not going into detail about those as this intro is already far too long.

So, what better way to see what type of affect Mercury Retrograde has on trading Bitcoin then looking at the chart, plotting the retrograde periods and taking a few simple measurements?

I started with 2016 as this should give us enough data to get started with. 2016 had 4 Periods but the last one started in 2016 and ended in 2017.

2016:

January 5 – January 25, 2016

April 28 – May 22, 2016

August 30 – September 22, 2016

Dec 19 2016 – Jan 8, 2017

Below you will see a chart with the 4 periods and their relevant data. This data includes the amount of days, the % gain or lost and the equivalent dollar value of that gain or loss.

2017:

Dec 19, 2016 to Jan 8, 2017

April 9 – May 3, 2017

August 12 – Sept 5, 2017

December 3 – December 22, 2017

Below you will see a chart with the 4 periods and their relevant data. This data includes the amount of days, the % gain or lost and the equivalent dollar value of that gain or loss.

2018:

March 22 – April 15, 2018

July 26 – August 18, 2018

November 16 – December 6

Below you will see a chart with the 3 periods and their relevant data. This data includes the amount of days, the % gain or lost and the equivalent dollar value of that gain or loss.

2019:

March 5 – 28, 2019

July 7 – 31, 2019

October 31 – November 20, 2019

Below you will see a chart with the 3 periods and their relevant data. This data includes the amount of days, the % gain or lost and the equivalent dollar value of that gain or loss.

So, obviously we got some results that seem to be all over the place. A 28% Gain in 2017 but a 38% loss in 2018.

Surely we can find a way to make more sense out of this. Yes, we will add a moving average and then see if we make gains while in up-trending markets and losses while in downtrending markets to give confluence to the idea that maybe Mercury Retrograde goes with the trend.

Below you will see a 200 Simple Moving Average on the Daily chart for overall trend Bias.

Price above the 200 = Uptrend

Price below the 200 = Downtrend

The idea here was to see if the Mercury Retrograde followed the overall trend. As we can see, it's not perfect. We can see trend following more often then it doesn't but no concrete conclusion can be derived from the 200 DMA.

The last one is Neutral because Retrograde starts above the 200 DMA and ends Below the 200 DMA.

This was the longest part of the thesis. I tried a few dozen indicators to see if there was any type of “signal” prior to the Retrograde that could give a good leading indication. Unfortunately, from the Aroon to the Whadda I just could not find something that was 100%. It always came down to the two in 2016 and that rise in 2019. And I really tried a lot. MACD, OBV, MFI, RSI, Stoch, Ichi, even faster MA/EMAs, a few oddball indicators, momentum, etc…

But then it dawned on me. Retrograde. Moon Phases. Huh… Let’s See

New Moon in the Cycle:

2016:

January 5 – January 25, 2016 - Down

April 28 – May 22, 2016 - Down

August 30 – September 22, 2016 - Up

Dec 19 2016 – Jan 8, 2017 - Up

2017:

Dec 19, 2016 to Jan 8, 2017 - REPEAT

April 9 – May 3, 2017 - Up

August 12 – Sept 5, 2017 - Up

December 3 – December 22, 2017 - Up

2018:

March 22 – April 15, 2018 – No New Moon = DOWN

July 26 – August 18, 2018 - Down

November 16 – December 6 – No New Moon = DOWN

2019:

March 5 – 28, 2019 - Up

July 7 – 31, 2019 – No New Moon = DOWN

October 31 – November 20, 2019 – No New Moon = DOWN

So, this is pretty interesting. Not perfect but interesting. When there is No New Moon Present in the Retrograde Cycle - Price ALWAYS declines.

When there is a New Moon present we get 6 up and 3 down. Need to investigate further.

Full Moon in the Cycle:

2016:

January 5 – January 25, 2016 - Down

April 28 – May 22, 2016 - Down

August 30 – September 22, 2016 - Up

Dec 19 2016 – Jan 8, 2017 – No Full Moon = UP

2017:

Dec 19, 2016 to Jan 8, 2017 - REPEAT

April 9 – May 3, 2017 – Up

August 12 – Sept 5, 2017 - No Full Moon = UP

December 3 – December 22, 2017 - Up

2018:

March 22 – April 15, 2018 - Down

July 26 – August 18, 2018 - Down

November 16 – December 6 - Down

2019:

March 5 – 28, 2019 - Up

July 7 – 31, 2019 - Down

October 31 – November 20, 2019 - Down

Another very interesting piece of information.

When No FULL MOON is present in the cycle, Price goes up.

In the presence of a Full Moon, price declined 7 to 4. Again, not really great findings here. The more interesting is definitely the lack of presence from a Full Moon.

Both a New and a Full Moon in the Cycle:

2016:

January 5 – January 25, 2016 - Down

April 28 – May 22, 2016 - Down

August 30 – September 22, 2016 - Up

Dec 19 2016 – Jan 8, 2017 – No Full Moon = UP

2017:

Dec 19, 2016 to Jan 8, 2017 - REPEAT

April 9 – May 3, 2017 – Up

August 12 – Sept 5, 2017 - No Full Moon = UP

December 3 – December 22, 2017 - Up

2018:

March 22 – April 15, 2018 – No New Moon = DOWN

July 26 – August 18, 2018 - Down

November 16 – December 6 – No New Moon = DOWN

2019:

March 5 – 28, 2019 - Up

July 7 – 31, 2019 – No New Moon = DOWN

October 31 – November 20, 2019 – No New Moon = DOWN

When we have both a New Moon and a Full Moon, the results are just about Random. 4 Up and 3 Down. I even checked the placement of which moon came first but again, nothing consistent from the 7 Cycles left to look at.

Here is what we do have.

No New Moon = Price goes down 4 for 4 Cycles

No Full Moon = Price goes up 2 for 2 Cycles

The presence of Both a New Moon and Full Moon = Random 4 Up and 3 Down

The question then becomes, what does this Cycle have or better yet… Not Have.

And therein lies an unforeseen problem. There is a New Moon and on the very last day of the cycle, there is a Full Moon.

Now, depending on where you are in the world, will the Full Moon count when the trading ends on March 9th, 2020 at 00:00 UTC? I suppose that is up to you to decide. If it was a New Moon only, then 2 out of 2 times in the past we had price go up.

Just to really jab the knife in a little deeper… The Full Moon on March 9th, the last day of the upcoming Mercury Retrograde cycle, is a SUPER FULL MOON. It’s considered a SUPERMOON when it is at its closest to EARTH so it will look Bigger and Brighter. There will only be one other Super Full Moon in 2020 it will be April 7th.

Stats:

2016:

January 5 – January 25, 2016

20 Days

-8.60%

Loss of $37.10

April 28 – May 22, 2016

24 Days

-191%

Loss of $8.50

August 30 – September 22, 2016

23 Days

3.75%

Gain of $21.50

Dec 19 2016 – Jan 8, 2017

20 Days

15.87%

Gain of $125.60

2017:

Dec 19, 2016 to Jan 8, 2017

---Same as above---

April 9 – May 3, 2017

24 Days

28.00%

Gain of $331.10

August 12 – Sept 5, 2017

24 Days

21.65%

Gain of $794.40

December 3 – December 22, 2017

19 Days

27.27%

Gain of $2973.10

2018:

March 22 – April 15, 2018

24 Days

-5.81%

Loss of $515.70

July 26 – August 18, 2018

23 Days

-21.61%

Loss of $1764.70

November 16 – December 6

20 Days

-38.37%

Loss of $2139.00

2019:

March 5 – 28, 2019

23 Days

8.48%

Gain of $313.80

July 7 – 31, 2019

24 Days

-10.18%

Loss of $1144.10

October 31 – November 20, 2019

20 Days

-11.79%

Loss of $1080.80

Total UP = 6 Periods

Total Down = 7 Periods

Average Gain when up = 17.50%

Average Loss when down = -14.03%