ALPHA Structure Analysis - 50-day EMA breakoutYesterday, BINANCE:ALPHAUSDT cleanly broke and closed above the 50-day EMA, which it hadn't been able to reclaim since December 2024. It also retested the previous $0.042-$0.052 demand zone, which acted as resistance.

Check the weekly chart below for more context:

Key Levels

• $0.024-$0.034: Main demand zone, dating back to October 2020

• $0.042-$0.052: Previous demand zone and current resistance

• ~$0.070: Previous key S/R, currently reinforced by 1-year EMA, and potential resistance

• $0.115-$0.137: Main supply zone

Trigger

I am looking for a retest of the 50-day EMA (~0.035) as support for a long entry, with a clear invalidation below the recent $0.025 swing low, targeting the main supply zone with the other key levels outlined above as partial TP targets.

Moving

KASPA Structure Analysis – Downtrend BreakoutAfter retesting the $0.05 demand zone (previous resistance dating back to August 2023), BITGET:KASUSDT reclaimed the 50-day EMA (yellow) and tested the 200-day EMA (orange), before a brief pullback with the 50-day EMA acting as support.

Key Levels

• $0.050-$0.060: Main demand zone

• $0.083: Current support, reinforced by 50-day EMA

• $0.105: Current resistance, reinforced by 200-day EMA

• ~$0.120: HVN and potential resistance

• $0.155-$0.160: HVN, previous S/R and potential resistance

• $0.180-$0.200: Main supply zone

Here's a weekly chart with volume profiles for more context:

Considerations

• The breakout from the recent downtrend, and the break above the 50-day EMA followed by a retest as support, is a good sign for the bulls.

• If the 200-day EMA is successfully reclaimed, it could offer a good shot at retesting the main supply zone in the $0.180-$0.200 area.

• Conversely, a sustained break back below the 50-day EMA could lead to another test of the $0.050-$0.060 main demand zone.

Neutral outlook until a break above 200-day EMA or below 50-day EMA.

SPX 1D 200 EMA Retest? As the 9&21W EMAs cross and a new local low printing after a SFP top, could the S&P500 be getting its first major correction since Jan 2022?

From a TA standpoint this kind of setup looks to be high probability with good R:R for the bears. Targeting the 1W 200 EMA is the most logical area as it remains major support and whenever tested holds strong.

From a bulls standpoint this is worrying but could be rectified with a reclaim of the 9&21 EMAs preventing a "death cross" from there acceptance above the high would be the next step to maintain the rally.

Fundamentals play a major role and the geopolitical world shows no signs of slowing down, perhaps the tariffs angle is introducing uncertainty in American companies? Or the index is just exhausted from 2.5 years of climbing? Either way the chart is an interesting one to monitor for now.

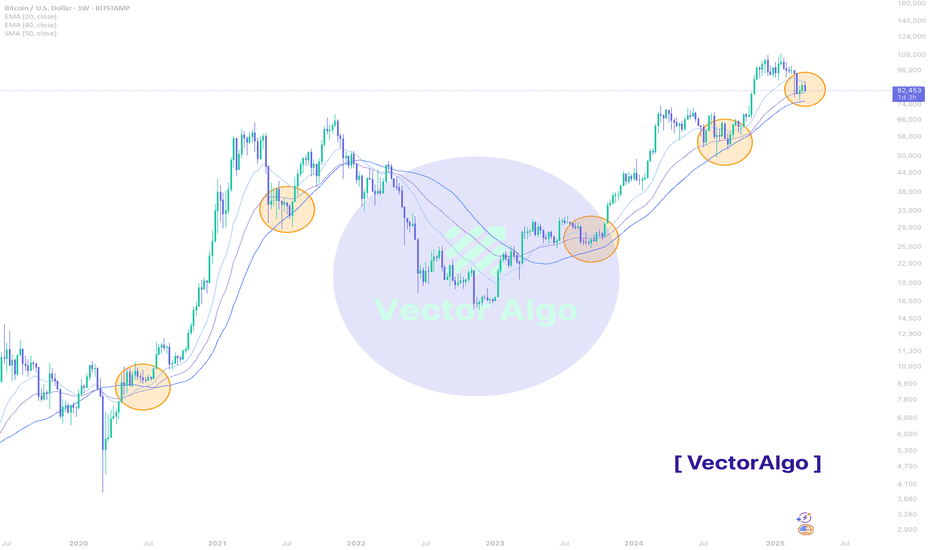

Bitcoin - EMA Support Holding Strong!#BTC/USD #Analysis

Description

---------------------------------------------------------------

BTC/USD – Weekly Chart Analysis

📉 Current Price: $82,239 (-4.47%)

📈 Key Moving Averages:

🔹 EMA 20: 88,143

🔹 EMA 40: 81,116

🔹 SMA 50: 76,230

EMA Support Holds Strong – The chart highlights multiple historical instances where BTC found support at the 20-40 EMA zone (orange circles). This pattern has played out consistently in past market cycles.

- Bullish Trend Continuation – Each time BTC has tested this EMA region on a pullback, it has led to strong recoveries and further bullish momentum.

- Current Market Structure – BTC is once again testing this key EMA support zone. A bounce from here could signal a continuation of the uptrend.

- Historical Patterns Repeat – The blue shaded region and Vector Algo's AI-optimized signals indicate that similar setups have resulted in upward moves.

✅ Bullish Scenario: If BTC holds above the EMA 40 ($81,000) and forms bullish confirmation candles, we could see a move toward previous highs ($96,000) and possibly $100,000+.

❌ Bearish Scenario: A breakdown below $81,000 could lead to further downside towards the 50 SMA ($76,000) and lower demand zones.

Bitcoin remains in a strong uptrend, and the current EMA support test is crucial for trend continuation. Keeping an eye on price action around this zone is key for potential long opportunities!

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

BTC: MACD Signals Aligning for a Potential Buying OpportunityLooking at several factors in parallel, BTC’s MACD is showing promising signs. The fast-moving average has started to curl up, suggesting a possible bullish cross above the slower line—typically a strong buy signal. The histogram has also been in the red for several weeks but is now curling upward, and we could be looking at our first green week.

However, the lack of a significant volume increase means there’s no clear confirmation of a trend reversal just yet, and we aren’t seeing the momentum required for new higher highs or all-time highs. But if these signals continue to align, this could turn into a fantastic buying opportunity.

The question is: will you take buying or selling actions based on these signals?

Mastering Moving AveragesMastering Moving Averages: A Statistical Approach to Enhancing Your Trading Strategy

Moving averages (MAs) are one of the most popular tools used by traders and investors to smooth out price data and identify trends in the financial markets. While they may seem simple on the surface, moving averages are rooted in statistical analysis and offer powerful insights into price behavior over time. In this article, we will break down the concept of moving averages from a statistical viewpoint, explore different types of MAs and their benefits, and discuss how they can be effectively used in trading and market analysis.

⯁What is a Moving Average from a Statistical Standpoint?

A moving average is a statistical calculation that smooths out data points by creating a series of averages over a specific period. In trading, it is applied to price data, where it helps remove short-term fluctuations and highlight longer-term trends.

The core idea behind a moving average is to capture the central tendency of a price over time, providing a clearer picture of the market’s overall direction. By averaging the price over a period, it helps traders see the general trend without being distracted by the noise of daily market volatility.

Mathematically, a simple moving average (SMA) can be expressed as:

SMA = (P1 + P2 + ... + Pn) / n

Where:

P1, P2, ..., Pn represent the price points for each period.

n represents the number of periods over which the average is taken.

The moving average "moves" because as new prices are added to the calculation, older prices drop off, creating a rolling average that continually updates.

Types of Moving Averages and How They Are Calculated

Different types of moving averages use varying methods to calculate the average, each offering a unique perspective on price trends.

Simple Moving Average (SMA) : The SMA is the most basic type of moving average and is calculated by taking the arithmetic mean of the prices over a specified period. Every data point within the period carries equal weight.

SMA = (P1 + P2 + ... + Pn) / n

For example, a 5-day SMA of a stock’s closing prices would be the sum of the last five closing prices divided by 5.

Exponential Moving Average (EMA) : The EMA gives more weight to recent price data, making it more responsive to price changes. The EMA calculation involves a smoothing factor (also called the multiplier) that increases the weight of the most recent prices. The formula for the multiplier is:

//Where n is the number of periods. The EMA calculation follows:

Multiplier = 2 / (n + 1)

EMA = (Closing price - Previous EMA) × Multiplier + Previous EMA

For example, for a 10-period EMA, the multiplier would be 2 / (10 + 1) = 0.1818. This value is then applied to smooth the recent prices more aggressively.

Weighted Moving Average (WMA) : The WMA assigns different weights to each data point in the series, with more recent data given greater weight. The formula for WMA is:

WMA = (P1 × 1 + P2 × 2 + ... + Pn × n) / (1 + 2 + ... + n)

Where n is the number of periods. Each price is multiplied by its period's number (most recent data gets the highest weight), and then the total is divided by the sum of the weights.

For example, a 3-period WMA would assign a weight of 3 to the most recent price, 2 to the price before that, and 1 to the earliest price in the period.

Smoothed Moving Average (SMMA) : The SMMA is similar to the EMA but smooths the price data more gradually, making it less sensitive to short-term fluctuations. The SMMA is calculated using this formula:

SMMA = (Previous SMMA × (n - 1) + Current Price) / n

Where n is the number of periods. The first period's SMMA is an SMA, and subsequent SMMAs apply the formula to smooth the prices more gradually than the EMA.

⯁Comparing Benefits of Different MAs

SMA : Best for identifying long-term trends due to its stability but can be slow to react.

EMA : More sensitive to recent price action, making it valuable for shorter-term traders looking for quicker signals.

WMA : Offers a middle ground between the EMA’s sensitivity and the SMA’s stability, good for balanced strategies.

SMMA : Ideal for longer-term traders who prefer a smoother, less reactive average to reduce noise in the trend.

⯁How to Use Moving Averages in Trading

Moving averages can be used in several ways to enhance trading strategies and provide valuable insights into market trends. Here are some of the most common ways they are utilized:

1. Identifying Trend Direction

One of the primary uses of moving averages is to identify the direction of the trend. If the price is consistently above a moving average, the market is generally considered to be in an uptrend. Conversely, if the price is below the moving average, it signals a downtrend. By applying different moving averages (e.g., 50-day and 200-day), traders can distinguish between short-term and long-term trends.

2. Crossovers

Moving average crossovers are a popular method for generating trading signals. A "bullish crossover" occurs when a shorter-term moving average (e.g., 50-day) crosses above a longer-term moving average (e.g., 200-day), signaling that the trend is turning upward. A "bearish crossover" happens when the shorter-term average crosses below the longer-term average, indicating a downtrend.

3. Dynamic Support and Resistance Levels

Moving averages can also act as dynamic support or resistance levels. In an uptrend, the price may pull back to a moving average and then bounce off it, continuing the upward trend. In this case, the moving average acts as support. Similarly, in a downtrend, a moving average can act as resistance.

4. Filtering Market Noise

Moving averages are also used to filter out short-term price fluctuations or "noise" in the market. By averaging out price movements over a set period, they help traders focus on the more important trend and avoid reacting to insignificant price changes.

5. Combining with Other Indicators

Moving averages are often combined with other indicators, such as the Relative Strength Index (RSI) or MACD, to provide additional confirmation for trades. For example, close above of two moving averages, combined with an RSI above 50, can be a stronger signal to buy than either indicator used on its own.

⯁Using Moving Averages for Market Analysis

Moving averages are not just for individual trades; they can also provide valuable insight into broader market trends. Traders and investors use moving averages to gauge the overall market sentiment. For example, if a major index like the S&P 500 is trading above its 200-day moving average, it is often considered a sign of a strong market.

On the contrary, if the index breaks below its 200-day moving average, it can signal potential weakness ahead. This is why long-term investors pay close attention to moving averages as part of their overall market analysis.

⯁Conclusion

Moving averages are simple yet powerful tools that can provide invaluable insights for traders and investors alike. Whether you are identifying trends, using crossovers for trade signals, or analyzing market sentiment, mastering the different types of moving averages and understanding how they work can significantly enhance your trading strategy.

By integrating moving averages into your analysis, you’ll gain a clearer understanding of the market’s direction and have the tools necessary to make more informed trading decisions.

(JASMY) JASMY The price is maintaining nicely, the graph shows an indicator that measures moving averages and overlapping information. Circles are progress signals, crosses are negative signals. The recents show crosses around the same time the price was falling. Also I modified my indicator's colors and adjusted things to be more starry to look at. Sometimes it's more for the sake of knowing I'm going to stare at the same indicator for a long time. Many indicators outside BTC, ETH, Jasmy, are showing signals of cryptocurrency overall reaching a well point surpassing the crossunder length of the longest running moving average lines. Jasmy is not showing long moving average lines crossing and is maintaining a strong price increasing inertia. Long lines will have big circles or big cross and short lines will have small circles or small cross in this indicator. The 10 and the 50 is the yellow line.

EURUSD H4 StrategyAfter a large decline last week, there is a greater chance of a rebound this week, but there is still resistance above 1.0780-1.0840. Recommended operation for this week: buy low, sell high strategy. But the operation of buying low can be more active.

Strategy:

Buy Zone (positive) @ 1.0640 - 1.0710

SL: 15-25

TP: 40-80

Sell Zone @ 1.0780 - 1.0840

SL: 15-25

TP: 30-60

(BTC) bitcoinHere is a perspective that is different than a long view that is always optimistic. A lot of the time due to so much optimism in cryptocurrency for BTC to determine when the price will actually decrease is a lot more difficult. From what I can see in the image the pink dot line appears to reveal a pattern where when the line is flat certain factors in cryptocurrency occur. Whether or not those factors are necessarily happening now is really up to the viewer of the chart. This is a combination of moving averages and adding a sixth line which is a combined average of averages with a time period of 150 the sum of all the smaller lines. The chart is with vwma.

AVAX Kimbo Meme coin could of bottom out from hereLooking at the charts and volumes it done it's 3rd leg wave down in volumes (OBV chart at the bottom) and $0.0003992 US price could of been the next bottom for these waves. If so, Kimbo poised to be big for AVAX meme coin

The OBV volumes showing less selling presure now and good chance in the days ahead great buying pressure

Some of the fundamentals:

Avalanche Foundation Snaps Up KIMBO, COQ, and Three Other Tokens as First Meme Coin Investment

www.coindesk.com

I when to dexscreener to evaluate what moving fast for meme coins - dexscreener.com - Clicked on LIQUIDTY and when sort by descending order, Kimbo is number 2 spot. The number 1 spot doesn't have much value but Kimbo has long term potential for big gains

Their website is IMPRESSIVE!! So much community work on this meme coin A++ www.kimboavax.com

This the big one - they actually "burning" the "token supply" so Kimbo becomes more scarce. What think going to happen with the prices when reduce the token supply? Prices go up and up and faster!

If scroll down the bottom of the page for Kimbo website you see "Kimbo Merchandise" - These meme coins have VALUE! and can buy NFTs for it too

Fundamentals is good, AVAX team buying into this meme coin for exchange liquidity. Most likly be listed on KuCoin and then Binance. This has pretty good volumes too and I like the charts for this great opportunity

On twitter they going to expose this project to the masses on Facebook, Instragram i believe very soon. It has 18,000 twitter followers and can go pass the 50 to 100,000 followers

twitter.com

This poised to be the next Shib Inu, Dodge meme coin where billon and billon of dollars flood through this project

Do you like Kimbo, do you think it has so much potential?

Long opportunity on GOLDSTRATEGY RULES:

- ALL MA'S MUST BE IN ORDER AND ALL IN THE SAME COLOUR

- PRICE MUST BE BREAKING OUT AND REJECTING KEY LEVEL

We see 1hr candle close to closing above all Moving Averages and is pushing higher. A clear break out and retest of trend lines gives us some momentum pushing up.

If candle closes above these moving averages then we can certainly see price push higher with stops below recent low and targets at the major highs.

📉📈 all to soonWith the current economy and other factors considered. We might see a deep pull back the technical side shows a few indications of that being true. But we could also see a short pull back followed with a large move to the up side. with all factors considered its a waiting game.

Tuesday 📨 we will see what transpired. Have a nice trading week

A Novice's Handbook to Trading Triumph

-----

🙏

In an era where financial landscapes evolve rapidly, venturing into the dynamic domain of foreign exchange (Forex) trading need not be an intricate odyssey. This novella of wisdom unveils the rudiments, steering you through the intricate labyrinth of setting up your financial fortress, handpicking the tools of the trade, deciphering the enigmatic timelines, and sculpting entry strategies with the finesse of an artisan.

Navigating the Terrain of Account Setup:

Your journey commences by selecting the sturdy vessels of financial exploration, the likes of Coinbase, revered for transmuting mundane currency into the futuristic realms of cryptocurrency. Navigate the seas of connectivity, tethering your accounts to the steadfast anchors of Visa, Mastercard, or the versatile iDeal. Venture further into the undiscovered territories with a seasoned guide – Tradersway, an oracle in the realm of brokers, beckoning with bespoke options for an authentic trading saga.

Sculpting the Trading Landscape: Platforms and Tools as Your Artistic Palette

Forge your path with MetaTrader 4 (MT4), the canvas for your live trading masterpiece. Unveil the ethereal allure of a Virtual Private Server (VPS), akin to a mythical power-up, enriching your automated trading endeavors. Wander into the meadows of TradingView, where user-friendly charts bloom, and ideas spring forth from a convivial community of traders. Consider wielding the nNouSign indicator, a magical wand for crafting diverse trading strategies.

Chronicles of Time: Timeframes for Poetic Analysis

For decisions swift as the flutter of a butterfly's wing, gaze upon the 5-minute (5M) and 15-minute (15M) charts, where markets pirouette in perpetual rhythm. Should your ambitions soar higher, ascend to the 1-hour (1H) chart, where profit potential unfurls like a tapestry woven with the threads of time.

Crafting Entry Strategies: The Artistry of Navigating Waves

In the realm of 5M and 15M, embrace the mystique of the nNouSign indicator on TradingView, intertwining with the 21 Linear Weighted Moving Averages (MA) on the sacred grounds of MT4. Enlist the Williams Percent Range (WPR) at 40, a beacon illuminating shifts and retests. Draw lines, as an artist sketches contours, on both your chart and the WPR canvas for heightened insights. Decipher the harmonies between MA and WPR, directing the symphony of buying and selling. Set the crescendo with Take Profit (TP) at favored peaks or where echoes of prices linger in the corridors of time.

The sonnet of 1H unfolds with kindred strategies, casting TP anchors where your heart desires or where the echoes of prosperity resonate. Anticipate the ballet of trends, choreographed by the highs/lows of yesteryears or the harmonious convergence of MA and WPR.

Risk Management: Navigating the Seas of Uncertainty

As the helmsman of your financial vessel, chart the waters of risk with sagacity. Know the depths you are willing to plunge for the elusive treasures of profit. Let stop-loss orders be the vigilant guardians against tempests, strategically placed to avert colossal losses. For instance, on a £300 expedition trading XAUUSD with a 1:500 leverage, let the StopLoss, a guardian set at 200 pips, stand steadfast at 1987.00 for a buy trade anchored at 1989.00. As you navigate, survey the constellations of currency pairs—those that pirouette in unison and those that waltz in opposing directions.

Educational Alchemy: The Chronicles of Wisdom

Embark on an odyssey through the scrolls of easily decipherable Forex education platforms. Join the symposiums of Forex communities, where sages share their sagas and novices glean the pearls of insight. Chronicle your journey, the trials, and the triumphs in the scrolls of a journal, an atlas mapping the uncharted territories of your evolving knowledge.

Epilogue: 🌹

In the grand tapestry of Forex trading, the loom is not as daunting as it may seem. Armed with the artisan's tools, weave your narrative, learning with every stroke of the quill. Navigate the seas of risk with the astuteness of a seasoned mariner, adjusting your course with each gust of the trading winds. In the realm of Forex, the adventure unfolds not as a tumultuous tempest but as a voyage guided by the stars of knowledge. Bon voyage, intrepid trader! May your odyssey be as prosperous as the markets are ever-changing.

-----

❣️

🔥 Watch These Make Or Break Bitcoin Moving Averages 🚨Historically speaking, the 200-week moving average was always the main support for BTC and has marked the bottom on 4 different occasions.

As of this cycle, things have changed. The 300-week was the main support during the COVID dump and indicated an important area during the FTX collapse.

In previous analyses I've stated that I think BTC will likely go down over the next few months. My main target is 20.000, which coincides with the 300-week SMA support area.

If 20.000 fails to hold, my next big support area is the FTX low, which should be around the 400-week SMA.

Put these moving averages on your chart to get a good overview of historically important areas of support and resistance.

🔥 Are the Bulls Losing? Decoding Bitcoin's Recent Market TwistAfter the initial dump around the 17th, I made an analysis on BTC where I discussed the fact that this token was the most oversold on the daily RSI since the COVID dump. My short-term expectation was more edged towards the bullish side than towards the bearish.

My target area for the bounce lied between the 0.382 and 0.618 Fibonacci retracements. This area is often an area of strong resistance and will nearly always signal a continuation of the trend if it can hold.

To make things worse for the bulls, the 200-week average lies around 27.500. This moving average is historically the most important moving average. Given the fact that a lot of traders will look at this indicator makes it worthwhile to look at it as well.

I'm not convinced that the bulls will push through. With the ETF not even being approved yet it's essentially "news before the news". Sure, it's good news, but is it enough to start a long-term trend reversal?

Like mentioned before, I'm not convinced yet. If BTC can close the day above the 0.618 Fibonacci retracement (~28.300), I will switch my short-term bias to bullish. If not, we're still in bearish territory.

The Fall of the Titans: Crypto Downtrend Unfolding on the 4hAre we witnessing the Fall of the Titans? Is crypto, the digital currency titan that has been dominating the financial landscape for over a decade now, showing signs of slowing down? The recent data on the 4h chart reveals an unfolding story - a Crypto Downtrend that may have significant implications for investors and enthusiasts alike.

In this modern era of finance, cryptocurrencies have morphed from being an underground secret of the tech world into an open powerhouse that shapes financial markets globally. However, they have not been without their share of unpredictability and turbulence. The recent activity on the 4h chart, particularly, paints a picture of a potential shift in momentum - a Crypto Downtrend.

Understanding The 4h Chart

Before we delve into the specificities, it's crucial to understand what a 4h chart signifies. The 4h chart, as the name implies, represents price movements over 4-hour periods. Traders often use this intermediate timeframe to discern the medium-term trends in the crypto market, which allows them to plan their strategies accordingly. The 4h chart gives a more comprehensive view of market dynamics as compared to the shorter timeframes, without getting drowned in the long-term noise of the daily or weekly charts.

Indicators of a Crypto Downtrend

In crypto trading, several indicators suggest a potential downtrend. Key among them are lower highs and lower lows, which hint at a declining price momentum. Other indicators such as the moving averages, the Relative Strength Index (RSI), and the MACD can further support these observations.

In the current scenario, the 4h chart shows a pattern of lower highs and lower lows, which is a tell-tale sign of a Crypto Downtrend. Additionally, the moving averages have seen a bearish crossover, while the RSI is hovering in the lower regions. These all point to a potential reversal of the bullish trend we've been experiencing.

Impact of the Crypto Downtrend

This potential Crypto Downtrend has significant implications. For one, it indicates a period of price correction, where the overvalued prices return to more realistic levels. While this could be a cause of worry for some investors, it could present an opportunity for others.

For investors who have been waiting on the sidelines, this could be their chance to get in, to buy the dip. On the contrary, those who are heavily invested might want to brace themselves for potential losses, or consider hedging their investments.

The Way Forward

While the current observations from the 4h chart do point towards a Crypto Downtrend, it is essential to remember that the world of cryptocurrencies is known for its volatility. In the world of crypto, trends can reverse quickly and unexpectedly. Therefore, investors and traders should always stay vigilant and responsive to the changing market dynamics.

Also, it's important to note that a downtrend isn't necessarily a bad thing. In fact, it can serve as a healthy correction in an otherwise overheated market, paving the way for sustainable growth in the long run.

So, is this the fall of the digital titans, or merely a small bump in the road? Only time will tell. For now, though, it’s a good time to stay alert, plan your strategies, and tread with caution in the fascinating world of crypto.

---------------------------

This article is for informational purposes only and does not constitute financial advice. Always do your research and consult with a professional before making any investment decisions. Crypto trading involves risk and is not suitable for all investors.