MSTR

MSTR (Strategy) coming up to $395, the smaller resistance levelNASDAQ:MSTR has rebounded from the bottom fairly fast compared to other stocks and indexes. It's even performed better than Bitcoin itself. However it should be hitting heavy resistance now near 395-400 and above is only heavier resistance. It's time for a pullback and a breather for MSTR. Target is the Point of Control near $350, before going higher. However we could turn bullish again before reaching $350

I personally know someone who played with fire by buying MSTR options calls while it was dropping before, meaning he was trying to catch a falling knife and got burnt finally. He lost nearly $500,000 because of it. So I don't mess with options personally, however I will margin trade with stocks and trade futures, forex and leverage trade cryptocurrencies.

MICROSTRATEGY Can $2000 be its next High?Microstrategy (MSTR) followed the exact trading pattern we suggested on our last analysis (December 27 2024, see chart below) as it made its technical correction December through March and rebounded aggressively in April:

Back then we called this a shift to a new paradigm and is no different than the April 1999 bounce than led to the eventual massive rally that made the Dotcom Bubble burst.

Since the recent All Time High (ATH) broke above the (blue) 23-year Channel Up, we applied the Fibonacci Channel levels all the way from its March 2000 Dotcom High. The fractal we mentioned before shows that the stock's next Target, and possibly this Cycle's High, can be on the 0.618 Fib at $2000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin: The Robot Taxi Driver We Didn’t NeedWhy Blockchain Is Driving the Future Without It

In the 1990 sci-fi classic Total Recall, Arnold Schwarzenegger’s character hails a futuristic taxi only to be greeted by “Johnny Cab”—a creepy, clunky robot driver that awkwardly talks while struggling to navigate.

Back then, audiences imagined a future where robotic taxi drivers would be commonplace. But instead, we got something far superior: fully autonomous, self-driving cars that render robot drivers unnecessary.

The same is happening with Bitcoin. It was revolutionary, sure—but much like Johnny Cab, it’s outdated, inefficient, and rapidly becoming irrelevant in a world driven by advanced blockchain technology.

Bitcoin: The Nostalgic First Step

When Bitcoin burst onto the scene, it felt groundbreaking—just like the idea of robot taxi drivers in the Total Recall era. It gave us a new way to transact, free from centralized banks. People were thrilled, seeing it as the future of money.

But here’s the problem: Bitcoin was never the endgame. It was merely the proof-of-concept—like Johnny Cab showing that, yes, you can put a robot behind the wheel… but does that mean we should?

As financial systems evolved, Bitcoin’s shortcomings became glaringly obvious:

✅ Slow transaction speeds

✅ High fees

✅ Lack of scalability

✅ Energy inefficiency

Meanwhile, blockchain technology—the real revolution—kept advancing, proving that we don’t actually need Bitcoin any more than we needed Johnny Cab.

Enter Blockchain: The Self-Driving System

Self-driving cars didn’t need robot taxi drivers, and blockchain doesn’t need Bitcoin.

Blockchain is the foundation—an autonomous, self-sustaining system that underpins everything from finance to supply chains to digital assets.

In fact, precious metals, equities, and commodities are all moving toward digitization—but not through Bitcoin. Instead, they’re being integrated directly into blockchain-based ecosystems that offer seamless, smart contract-driven transactions.

The result?

💨 Faster

💡 More efficient

🛠️ Scalable & adaptable

Bitcoin, on the other hand, is stuck in the past. It’s clunky, expensive, and increasingly unnecessary—just like a robot taxi driver frantically punching buttons while self-driving cars smoothly navigate the streets.

Why Bitcoin Will Be Left Behind

Much like how we skipped the “robot taxi driver phase” and went straight to autonomous vehicles, the financial world will soon skip Bitcoin entirely as blockchain technology takes over.

Everything digital is moving toward streamlined, automated systems—systems that don’t require Bitcoin as an intermediary.

So the real question isn’t, “Will Bitcoin survive?”

It’s: “Why would we even need it?”

Just like Johnny Cab in Total Recall, Bitcoin might be fun to look back on—but it’s not the future.

Blockchain is the self-driving car. Bitcoin is the unnecessary robot driver.

And in a world that values efficiency, guess which one we’re leaving behind? 🚗💨

INDEX:BTCUSD CRYPTO:BTCUSD NASDAQ:COIN NASDAQ:MSTR NASDAQ:MARA TVC:GOLD TVC:SILVER TVC:DXY SP:SPX NYSE:BLK NASDAQ:TSLA NYSE:GME INDEX:ETHUSD CRYPTO:XRPUSD CRYPTO:ADAUSD

MICROSTRATEGY: Big 1W MA50 rebound targeting $845 at worst.MicroStrategy is on excellent bullish technicals on its 1D outlook (RSI = 67.412, MACD = 25.350, ADX = 58.097), capitalizing on the double bottom rebound on the 1W MA50 four weeks ago. Technically that was also a HL bottom on the 2 year Channel Up. The minimum rise it delivered on a bullish wave was +263.38%. Based on that, the trade is long, TP = $845.

## If you like our free content follow our profile to get more daily ideas. ##

MSTR Bull Trap!In my BKC charting, I’ve identified a pattern I call "tight! tight! tight!" typically paired with a bull trap. Prices surge as traders FOMO in, then collapse. It’s a straightforward trade: enter on the breakdown, set a stop above the prior high. Offers solid risk/reward.

Click like, follow, subscribe! Let me help you navigate these crazy markets. Lets get to 5,000 followers,

MSTR–Institutional Bitcoin Proxy with Conviction and Leverage ₿Company Snapshot:

MicroStrategy NASDAQ:MSTR remains the largest corporate holder of Bitcoin, positioning itself as a leveraged equity proxy for BTC exposure—while still operating a profitable enterprise software business.

Key Catalysts:

Massive Bitcoin Treasury Strategy 💰

Recently acquired $1.42 billion in BTC, reinforcing commitment

Total holdings exceed 200,000 BTC, making it the most visible and transparent institutional crypto holder

Acts as a high-beta vehicle for Bitcoin bulls, especially as ETF flows drive demand

Financial Engineering = Firepower for More BTC 🚀

$722 million in refinanced fixed-income notes, lowering costs and extending maturity

Provides capital flexibility to accumulate BTC at opportunistic levels

Reflects strong capital market access and investor confidence

BTC ETF Tailwind + Institutional Validation ✅

Bitcoin ETFs provide broader adoption and liquidity, indirectly benefiting MSTR

MSTR offers a regulated, equity-based alternative to direct BTC ownership

Ideal for funds restricted from holding digital assets directly

Dual Business Model Stability ⚙️

Core enterprise software business contributes revenue and operational stability

Reduces perceived risk relative to pure-play crypto companies

Investment Outlook:

✅ Bullish Above: $325.00–$326.00

🚀 Upside Target: $490.00–$500.00

🔑 Thesis: High-conviction BTC accumulation + balance sheet optimization = leveraged upside for Bitcoin-focused investors

📢 MSTR: The go-to equity for institutional Bitcoin exposure—with built-in leverage and transparency.

#Bitcoin #MSTR #CryptoStocks #DigitalAssets #MichaelSaylor #InstitutionalCrypto

Bitcoin Hype vs. Reality: A Breakdown of Bitcoin DelusionBitcoin enthusiasts often dream of mass adoption, corporate treasuries, and state-backed investments driving its price to astronomical levels. But let’s examine the actual numbers behind these claims.

🔹 The $1M Bitcoin Fantasy

Many believe Bitcoin will reach $300K, $500K, or even $1M. But what does that actually require?

💰 Bitcoin’s current circulating supply is approximately 19.5 million coins.

💰 At $830K per coin, the total market cap would be $16 trillion—which is:

✅ More than China’s entire GDP ($6T)

✅ 5x the market cap of Apple, Microsoft, Amazon, Google & Tesla combined

To put this into perspective, the entire global crypto market cap is currently around $2.99 trillion. Expecting Bitcoin alone to hit $16 trillion is beyond unrealistic.

🔹 Why Government & Corporate Adoption Won’t Skyrocket Price

Bitcoin believers often cite governments and corporations buying Bitcoin as proof it will moon. But here’s the reality:

⚠️ State & corporate purchases are OTC (Over-The-Counter) deals—they do not impact market prices like retail speculation.

⚠️ Governments negotiate strategically, they don’t impulsively buy at public prices to pump the asset.

⚠️ Treasury holdings do not guarantee higher prices—they only serve as reserves, not market drivers.

State adoption might increase legitimacy, but it won’t magically push Bitcoin past gold or global GDP levels.

🔹 Bitcoin’s Volatility vs. Gold’s Stability

Bitcoin is often compared to gold as a store of value, but its history tells a different story:

📉 Bitcoin has crashed over 80% multiple times—far from a stable asset.

📉 Extreme volatility makes it unreliable for wealth preservation.

📉 Liquidity issues create uncertainty, making it impractical for widespread adoption as money.

Gold, by contrast, has proven stability for centuries, with intrinsic value, industrial use, and universal acceptance.

🔹 Bitcoin Will NOT Absorb the Global Economy

Some claim Bitcoin will replace fiat, surpass gold, and absorb trillions in wealth. But the economic reality is:

❌ Bitcoin remains speculative, driven by market sentiment, not intrinsic value.

❌ No nation will abandon fiat for Bitcoin—they will regulate, integrate, but never replace sovereign currency.

❌ Bitcoin lacks industrial utility—gold has actual use in electronics, medicine, and aerospace.

🔹 The Crypto Dream vs. Financial Reality

Crypto thrives on believers, feeding them narratives that sound appealing but don’t match real-world economic fundamentals.

Bitcoin is not overtaking gold.

Bitcoin is not absorbing global wealth.

Bitcoin is not making every holder a millionaire.

Numbers don’t lie, but ignoring them won’t change reality. When the hype fades, speculative investors will face the harsh truth: Bitcoin is not a guaranteed path to riches—it’s a high-risk, volatile asset that operates in an unpredictable market.

Strategy $MSTR hits resistance, what will it do?

NASDAQ:MSTR has rebounded from the bottom fairly fast compared to other stocks and indexes. It's even performed better than Bitcoin itself. It is up about 65% from the low we set a few months ago. However it should be hitting heavy resistance now near 395-400 and above is only heavier resistance. It's time for a pullback and a breather for MSTR. Target is the Point of Control near $350, before going higher. However we could turn bullish again before reaching $350.

I personally know someone who played with fire by buying NASDAQ:MSTR options calls while it was dropping before, meaning he was trying to catch a falling knife and got burnt finally. He lost nearly $500,000 because of it. So I don't mess with options personally, however I will margin trade with stocks and trade futures, forex and leverage trade cryptocurrencies.

The Bitcoin Illusion: Why $300K or $1M Is a Pipe DreamBitcoin enthusiasts love throwing around wild price predictions—$300K, $1M, even $5M per BTC—as if these numbers are inevitable. But let’s break down the math and expose the delusion behind these claims:

Bitcoin at $300K or $1M? Let’s Do the Math

- $300,000 is a number pulled out of thin air by Michael Saylor and Robert Kiyosaki, either deliberately misleading or financially illiterate. They fail to grasp that this would require a market cap of $6 trillion.

- $1 million, as Cathy Wood foolishly claims, would require Bitcoin’s market cap to exceed $20 trillion—more than the entire GDP of the United States.

- The idea that Bitcoin will magically absorb trillions in global wealth is pure delusion.

Now, let’s put this into perspective:

- Bitcoin reaching $100K was relatively easy because it required a market cap of just $2 trillion—a fraction of global liquidity.

- But pushing Bitcoin to $300K or beyond requires trillions more, which is mathematically impossible without a massive influx of new capital—capital that simply does not exist.

Your $100K to $1M Fantasy—Let’s Run the Numbers

- Some Bitcoin holders believe their sub-$100K investment will make them multimillionaires.

That's a lie and delusional:

- If you bought 100k worth of Bitcoin at 83K per BTC, it would need to hit $830K per coin for you to even reach $1M.

- That’s not financial genius—it’s blind faith in an impossible scenario.

You’re Living in "The Matrix" of Crypto Lies

- You’re not stacking wealth—you’re stacking HOPIUM.

State Adoption Won’t Skyrocket the Price

- Even if six U.S. states were considering Bitcoin treasuries, those purchases would be OTC (over-the-counter)—meaning they wouldn’t significantly impact market price.

- Governments negotiate deals strategically; they don’t flood markets like retail investors hoping for price surges.

The End of Bitcoin’s Accumulation Phase

Bitcoin’s early adopters—the billionaires who pumped it up—have already made their money. The accumulation phase is over.

- To push Bitcoin higher, these whales would need to inject substantial amounts of new capital—but they are overleveraged and drowning in debt.

- Borrowed money must be repaid, and we're already past Bitcoin’s peak mainstream adoption which means there are no new waves of buyers to sustain the illusion.

- Bitcoin is now entering a distribution phase, where early holders cash out, leaving retail investors holding the bag.

The Rise of ETFs and Real Investments

The world is moving on. Investors are waking up to the fact that:

- ETFs offer real projects with actual purpose, unlike Bitcoin.

- ETFs pay dividends, generate revenue, and contribute to real economic growth.

- Newer crypto projects—like Stamps, art collections, gaming tokens, and smart contracts—are gaining traction and pulling capital away from Bitcoin.

Bitcoiners will get left behind, holding worthless, declining bags of old-school crypto, while the future thrives in better technologies.

The Harsh Reality: Bitcoin’s Future Is Bleeding Out

Bitcoin isn’t the future—it’s a fading illusion.

- The crypto cartel thrives on believers, feeding them fantasy while they cash out.

- The idea that Bitcoin will replace fiat, become the global payment rail, and make every holder rich is a marketing illusion designed to keep people holding bags.

- The longer people ignore reality, the harder the crash will be for them.

Many think they’re ahead of the curve, but they’re just loyal believers in an unsustainable illusion. When this unravels, it won’t be Bitcoin’s future collapsing—it will be theirs.

MSTR Strategy Incorporated Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MSTR Strategy Incorporated prior to the earnings report this week,

I would consider purchasing the 390usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $81.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC - 4 Cycles Repeating Itself!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

The picture says it all!

🔄Is history about to repeat itself?

If so, we are currently in Phase 2. 📈

What’s next? A dip toward the $75,000 zone is expected before the next impulsive move begins. 📉🚀

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

WNTR is Coming and the bears will be roam like white walkersPicture this, my pretties: it’s late 2025, and the crypto market’s a ghost town, ravaged by the icy claws of a crypto winter. Bitcoin, that sanctimonious coin-king, stumbles like a peasant I’ve drained dry, and MicroStrategy (MSTR), that Bitcoin-stuffed hog will collapse under its own greed. Enter the WNTR ETF, the YieldMax MSTR Short Option Income Strategy ETF, a sinister brew designed to fatten my coffers when MSTR’s pulse fades. This ain’t just an ETF; it’s a blood oath to thrive when the crypto market bleeds.

Why should you care, you nocturnal nibblers? Because WNTR is my bear market hard on. As MSTR and Bitcoin crumble, WNTR rises like a bat from the shadows, its inverse magic turning their death throes into a banquet of tendies. But beware, my lovely bears, in the sunlit days of a bull market, WNTR wilts like me at dawn. As of April 2025, with crypto still riding a post-halving high, WNTR’s slumped to $46.76, down from $50.94. Yet, when the winter winds howl, this beast could soar, a phoenix of profit rising from the market’s frozen ashes.

Crypto winters... Those glorious epochs when the market’s veins run cold, and the weak are culled like lambs at my altar. These ain’t mere dips; they’re prolonged bear markets, dripping with double-digit price drops and the sobs of retail mortals and disconnected high tower boys in white shirts. Remember the long night of late 2017 to December 2020? Bitcoin plunged from $20,000 to $3,000—an 85% descent into my crypt. Another hit in 2022, sparked by TerraUSD and Celsius Network imploding, leaving a trail of bankruptcies tastier than a virgin’s neck.

These winters stalk the heels of Bitcoin’s halving events and those quadrennial rites where mining rewards are slashed, tightening the supply and sparking bull runs… until the inevitable crash. If history’s my grimoire, the market peaks around late 2025 to early 2026, then plunges into the next crypto winter. Mark your calendars, my fiends, is when the feast nears.

What’s WNTR mean in this gothic tale? It’s a two-faced fiend, my darlings. In the first year post-halving, as bulls charge and Bitcoin soars, WNTR’s a shriveled husk, its dividends a mere trickle of blood. But when the winter descends, and bears roam free, WNTR transforms into a gushing vein, its value swelling as MSTR and Bitcoin bleed out.

Think of WNTR as your income hedge, a way to sip the market’s essence no matter the season. In bull markets, I wanna reinvest WNTR’s dividends into YBIT or other crypto toys, letting them fatten on mortal optimism. When the winter bites, I wanna shift your fangs: use WNTR’s income to buy Bitcoin on the cheap as it sinks, or sell off WNTR shares in profit if you are above various % of average cost basis. The cold deepens, pocketing gains while the bulls cry into their blockchain Kool-Aid. It’s a dance of darkness, and I’m an undead maestro.

The Blood Ritual: How to Feast

Here’s how you, my fellow nightwalkers, can join the carnage:

Track the Halving Pulse: The next crypto winter looms around late 2025 or early 2026. Watch Bitcoin’s post-halving strut—when the euphoria peaks, the fall is nigh. Listen for the cracks in coinbase, mstr, for the unraveling of the great tarrif tsar era.

Stock the Crypt with WNTR when the trend reverses: As the market cracks, hoard WNTR shares. Its price may be low now, but in winter’s depths, it could spike like my fangs on a full moon.

Reinvest Like a Leech: In bull markets, funnel WNTR’s dividends into crypto gains. In bear markets, buy the Bitcoin dip or cash out WNTR for profit.

Flee the Dawn: WNTR’s a creature of the night. When bulls return, its power fades. Time your exit, lest you burn in the sunlight.

This ain’t for the faint-hearted, my pretties. WNTR’s a leveraged beast, riskier than a sunrise stroll. Volatility decay can stake your gains, and if MSTR rallies, your losses’ll hit faster than a hedgie fleeing a margin call. Do your own necromancy and scour the ancient texts (or a financial advisor) and never YOLO your entire crypt. The market’s feral, crypto winters are feraler, and WNTR’s the feralest of all.

So, as the crypto winter looms, heed this, my degens: the bears are coming, and they hunger. With WNTR in your claws, you can turn their feast into yours. Snort wisely, or crumble to dust.

Disclaimer: This is unholy entertainment, not mortal advice. Investing in WNTR is dicier than a daylight dash, and you could lose your blood money. Do your own research, don’t YOLO your crypt, and maybe consult a living advisor instead of a WSB vampire. Feast at your own peril.

$MSTR sub $200 before $1000+?NASDAQ:MSTR looks pretty bearish here. We're trading under a key support and it looks like it wants lower. I think if the next candle turns red, then we're likely to see a large selloff all the way down to the lower supports.

If we can make it back up above this support level at $363, and close above it, it would be a trigger long. Then I think we're likely to see a large run all the way up to the upper resistances to 1000+.

Let's see how the price action unfolds here.

You Won't Believe Who Saved Bitcoin: GMEThis last week was interesting to say the least but the most interesting thing to watch was the incredibly influx of volume into INDEX:BTCUSD

As the week progressed into Thursday and Friday and equity markets sold off big the volume of trading in Bitcoin more than doubled... yet the price remained stagnant.

A month ago I did a study of correlation and relative movements between stocks and Bitcoin to answer the question: "What would happen to Bitcoin if Stocks Crash?" The TL;DR was that 75% of all weeks exhibited a positive correlation with nearly 50% a "high" correlation. Also, when equities have sold off big over the past decade Bitcoin had sold off at least two times or more.

Correlations are not an absolute and can change but this week something unique was clearly going on. If the standard correlation had been allowed to play out on Thursday INDEX:BTCUSD would have fallen more than -8% and Friday more than -11%. It would have triggered mass liquidations. But that did not happen.

This was a critically important Support for Bitcoin to hold and someone knew it... enter Ryan Cohen.

Michael Saylor with NASDAQ:MSTR is definitely NOT the one deploying cash to prop up Bitcoin.

His buys have been entirely NOT-Strategy-ic and has mostly bought highs. He has made a virtue out of being a really bad "trader" uncaring about price and timing. That plan has not worked to push Bitcoin to new a new All Time High nor saved it from the bear trend in 2025.

Cohen, however, is a renowned trader/investor that should know market structure and would have the sense to deploy cash at the perfect time. Just this week two things happened: Cohen took out a loan backed by his NYSE:GME shares and GameStop completed a convertible note offering, like Microstrategy has done, to raise 1.4 Billion in cash to buy Bitcoin. That gave him lots of cash at the critical point at the end of the week.

So do they get to win? Very possible. It depends on equities. If stocks rise in the coming week then the Bitcoin correlation may resume and INDEX:BTCUSD be lifted. If the U.S. economy enters a recession, the stock market route deepens, or if they used all of their available cash to exhaustion then the plan could fail and Bitcoin will fall in sync.

MSTR: Mid-term and Macro Price Structure As price holds below $344, odds favor a continuation lower to retest February lows, with later potential bounce and one more push to macro-support levels: 160/150-120 (with a potential extension to 105)

(see. recent idea on BTC price structure)

If BTC and broad market indexes show signs of stabilization and short-term strength over the coming weeks with MSTR price rising above 344, the odds are shifting to a more pronounce bounce to 400-460 resistance levels.

Weekly chart:

From a macro perspective:

as long as price remains below the 460 level, I consider the bullish trend since 2008 lows to have topped in November 2024, with current price action unfolding as part of a larger corrective Wave c.4 structure. Otherwise, If price reclaims ATH the door opens for an extension to 780-1280 resistance levels.

Monthly chart

Recent idea on BTC:

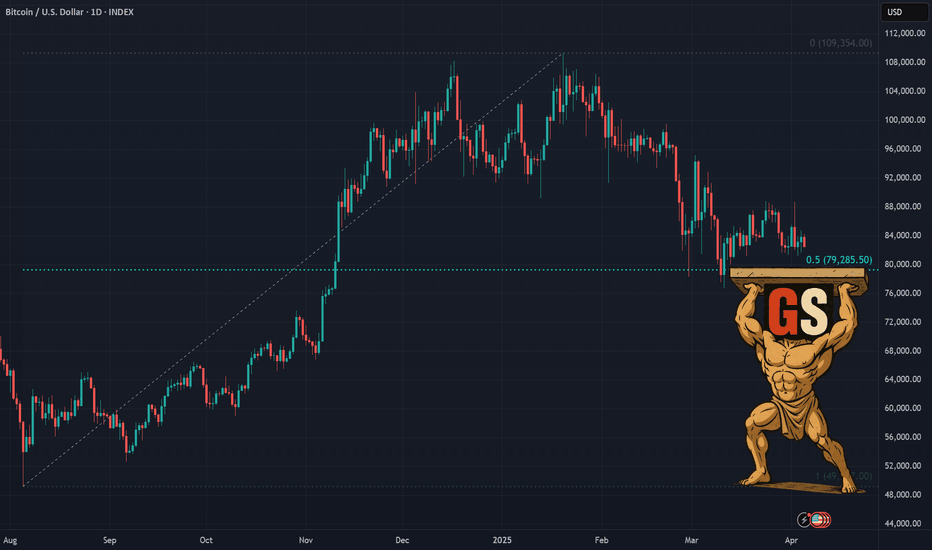

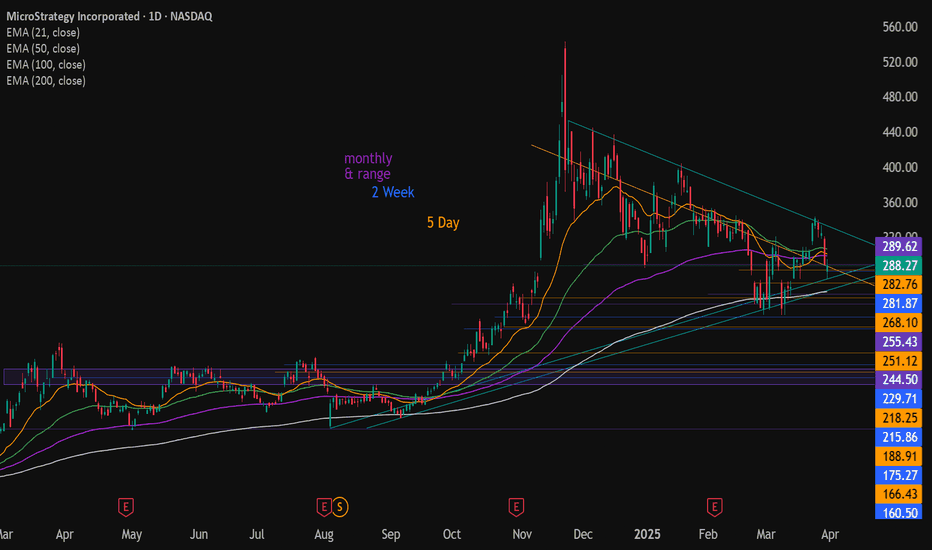

monthly and 2week @255.43 i doubt MicroStrategy will be able to hang on when all other crypto and stocks are breaking structure. the yellow trendline is the most touches i could get. all trendlines are on daily.

just broke below 100ema today. look where 200ema is. ???

since its going2b that kinda party, imma gonna stick my dikc in the mashpotatos~