Strategy $MSTR hits resistance, what will it do?

NASDAQ:MSTR has rebounded from the bottom fairly fast compared to other stocks and indexes. It's even performed better than Bitcoin itself. It is up about 65% from the low we set a few months ago. However it should be hitting heavy resistance now near 395-400 and above is only heavier resistance. It's time for a pullback and a breather for MSTR. Target is the Point of Control near $350, before going higher. However we could turn bullish again before reaching $350.

I personally know someone who played with fire by buying NASDAQ:MSTR options calls while it was dropping before, meaning he was trying to catch a falling knife and got burnt finally. He lost nearly $500,000 because of it. So I don't mess with options personally, however I will margin trade with stocks and trade futures, forex and leverage trade cryptocurrencies.

MSTR

The Bitcoin Illusion: Why $300K or $1M Is a Pipe DreamBitcoin enthusiasts love throwing around wild price predictions—$300K, $1M, even $5M per BTC—as if these numbers are inevitable. But let’s break down the math and expose the delusion behind these claims:

Bitcoin at $300K or $1M? Let’s Do the Math

- $300,000 is a number pulled out of thin air by Michael Saylor and Robert Kiyosaki, either deliberately misleading or financially illiterate. They fail to grasp that this would require a market cap of $6 trillion.

- $1 million, as Cathy Wood foolishly claims, would require Bitcoin’s market cap to exceed $20 trillion—more than the entire GDP of the United States.

- The idea that Bitcoin will magically absorb trillions in global wealth is pure delusion.

Now, let’s put this into perspective:

- Bitcoin reaching $100K was relatively easy because it required a market cap of just $2 trillion—a fraction of global liquidity.

- But pushing Bitcoin to $300K or beyond requires trillions more, which is mathematically impossible without a massive influx of new capital—capital that simply does not exist.

Your $100K to $1M Fantasy—Let’s Run the Numbers

- Some Bitcoin holders believe their sub-$100K investment will make them multimillionaires.

That's a lie and delusional:

- If you bought 100k worth of Bitcoin at 83K per BTC, it would need to hit $830K per coin for you to even reach $1M.

- That’s not financial genius—it’s blind faith in an impossible scenario.

You’re Living in "The Matrix" of Crypto Lies

- You’re not stacking wealth—you’re stacking HOPIUM.

State Adoption Won’t Skyrocket the Price

- Even if six U.S. states were considering Bitcoin treasuries, those purchases would be OTC (over-the-counter)—meaning they wouldn’t significantly impact market price.

- Governments negotiate deals strategically; they don’t flood markets like retail investors hoping for price surges.

The End of Bitcoin’s Accumulation Phase

Bitcoin’s early adopters—the billionaires who pumped it up—have already made their money. The accumulation phase is over.

- To push Bitcoin higher, these whales would need to inject substantial amounts of new capital—but they are overleveraged and drowning in debt.

- Borrowed money must be repaid, and we're already past Bitcoin’s peak mainstream adoption which means there are no new waves of buyers to sustain the illusion.

- Bitcoin is now entering a distribution phase, where early holders cash out, leaving retail investors holding the bag.

The Rise of ETFs and Real Investments

The world is moving on. Investors are waking up to the fact that:

- ETFs offer real projects with actual purpose, unlike Bitcoin.

- ETFs pay dividends, generate revenue, and contribute to real economic growth.

- Newer crypto projects—like Stamps, art collections, gaming tokens, and smart contracts—are gaining traction and pulling capital away from Bitcoin.

Bitcoiners will get left behind, holding worthless, declining bags of old-school crypto, while the future thrives in better technologies.

The Harsh Reality: Bitcoin’s Future Is Bleeding Out

Bitcoin isn’t the future—it’s a fading illusion.

- The crypto cartel thrives on believers, feeding them fantasy while they cash out.

- The idea that Bitcoin will replace fiat, become the global payment rail, and make every holder rich is a marketing illusion designed to keep people holding bags.

- The longer people ignore reality, the harder the crash will be for them.

Many think they’re ahead of the curve, but they’re just loyal believers in an unsustainable illusion. When this unravels, it won’t be Bitcoin’s future collapsing—it will be theirs.

MSTR Strategy Incorporated Options Ahead of EarningsAnalyzing the options chain and the chart patterns of MSTR Strategy Incorporated prior to the earnings report this week,

I would consider purchasing the 390usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $81.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

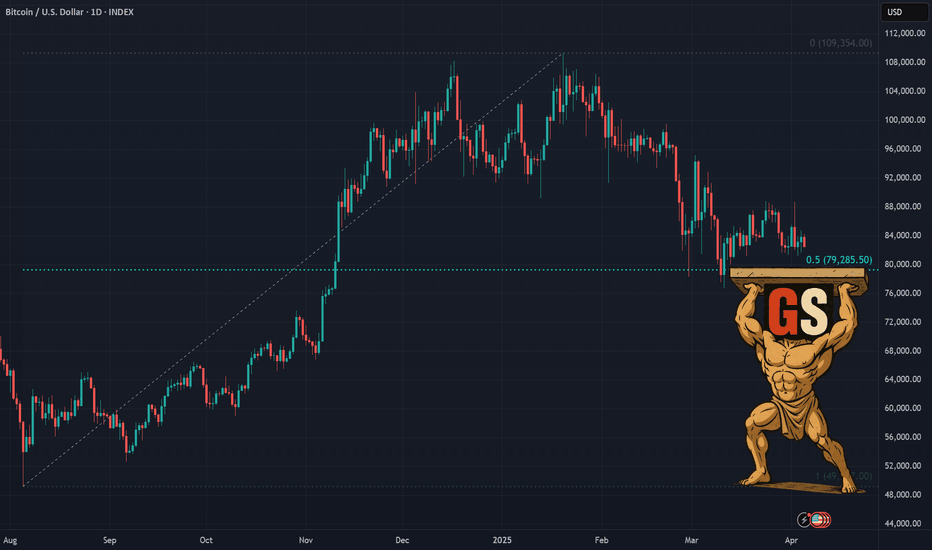

BTC - 4 Cycles Repeating Itself!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

The picture says it all!

🔄Is history about to repeat itself?

If so, we are currently in Phase 2. 📈

What’s next? A dip toward the $75,000 zone is expected before the next impulsive move begins. 📉🚀

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

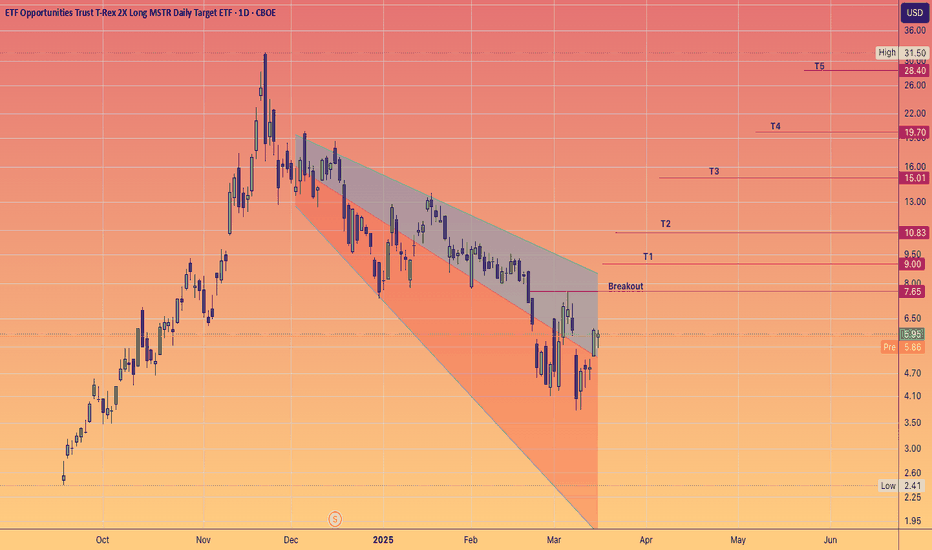

WNTR is Coming and the bears will be roam like white walkersPicture this, my pretties: it’s late 2025, and the crypto market’s a ghost town, ravaged by the icy claws of a crypto winter. Bitcoin, that sanctimonious coin-king, stumbles like a peasant I’ve drained dry, and MicroStrategy (MSTR), that Bitcoin-stuffed hog will collapse under its own greed. Enter the WNTR ETF, the YieldMax MSTR Short Option Income Strategy ETF, a sinister brew designed to fatten my coffers when MSTR’s pulse fades. This ain’t just an ETF; it’s a blood oath to thrive when the crypto market bleeds.

Why should you care, you nocturnal nibblers? Because WNTR is my bear market hard on. As MSTR and Bitcoin crumble, WNTR rises like a bat from the shadows, its inverse magic turning their death throes into a banquet of tendies. But beware, my lovely bears, in the sunlit days of a bull market, WNTR wilts like me at dawn. As of April 2025, with crypto still riding a post-halving high, WNTR’s slumped to $46.76, down from $50.94. Yet, when the winter winds howl, this beast could soar, a phoenix of profit rising from the market’s frozen ashes.

Crypto winters... Those glorious epochs when the market’s veins run cold, and the weak are culled like lambs at my altar. These ain’t mere dips; they’re prolonged bear markets, dripping with double-digit price drops and the sobs of retail mortals and disconnected high tower boys in white shirts. Remember the long night of late 2017 to December 2020? Bitcoin plunged from $20,000 to $3,000—an 85% descent into my crypt. Another hit in 2022, sparked by TerraUSD and Celsius Network imploding, leaving a trail of bankruptcies tastier than a virgin’s neck.

These winters stalk the heels of Bitcoin’s halving events and those quadrennial rites where mining rewards are slashed, tightening the supply and sparking bull runs… until the inevitable crash. If history’s my grimoire, the market peaks around late 2025 to early 2026, then plunges into the next crypto winter. Mark your calendars, my fiends, is when the feast nears.

What’s WNTR mean in this gothic tale? It’s a two-faced fiend, my darlings. In the first year post-halving, as bulls charge and Bitcoin soars, WNTR’s a shriveled husk, its dividends a mere trickle of blood. But when the winter descends, and bears roam free, WNTR transforms into a gushing vein, its value swelling as MSTR and Bitcoin bleed out.

Think of WNTR as your income hedge, a way to sip the market’s essence no matter the season. In bull markets, I wanna reinvest WNTR’s dividends into YBIT or other crypto toys, letting them fatten on mortal optimism. When the winter bites, I wanna shift your fangs: use WNTR’s income to buy Bitcoin on the cheap as it sinks, or sell off WNTR shares in profit if you are above various % of average cost basis. The cold deepens, pocketing gains while the bulls cry into their blockchain Kool-Aid. It’s a dance of darkness, and I’m an undead maestro.

The Blood Ritual: How to Feast

Here’s how you, my fellow nightwalkers, can join the carnage:

Track the Halving Pulse: The next crypto winter looms around late 2025 or early 2026. Watch Bitcoin’s post-halving strut—when the euphoria peaks, the fall is nigh. Listen for the cracks in coinbase, mstr, for the unraveling of the great tarrif tsar era.

Stock the Crypt with WNTR when the trend reverses: As the market cracks, hoard WNTR shares. Its price may be low now, but in winter’s depths, it could spike like my fangs on a full moon.

Reinvest Like a Leech: In bull markets, funnel WNTR’s dividends into crypto gains. In bear markets, buy the Bitcoin dip or cash out WNTR for profit.

Flee the Dawn: WNTR’s a creature of the night. When bulls return, its power fades. Time your exit, lest you burn in the sunlight.

This ain’t for the faint-hearted, my pretties. WNTR’s a leveraged beast, riskier than a sunrise stroll. Volatility decay can stake your gains, and if MSTR rallies, your losses’ll hit faster than a hedgie fleeing a margin call. Do your own necromancy and scour the ancient texts (or a financial advisor) and never YOLO your entire crypt. The market’s feral, crypto winters are feraler, and WNTR’s the feralest of all.

So, as the crypto winter looms, heed this, my degens: the bears are coming, and they hunger. With WNTR in your claws, you can turn their feast into yours. Snort wisely, or crumble to dust.

Disclaimer: This is unholy entertainment, not mortal advice. Investing in WNTR is dicier than a daylight dash, and you could lose your blood money. Do your own research, don’t YOLO your crypt, and maybe consult a living advisor instead of a WSB vampire. Feast at your own peril.

$MSTR sub $200 before $1000+?NASDAQ:MSTR looks pretty bearish here. We're trading under a key support and it looks like it wants lower. I think if the next candle turns red, then we're likely to see a large selloff all the way down to the lower supports.

If we can make it back up above this support level at $363, and close above it, it would be a trigger long. Then I think we're likely to see a large run all the way up to the upper resistances to 1000+.

Let's see how the price action unfolds here.

You Won't Believe Who Saved Bitcoin: GMEThis last week was interesting to say the least but the most interesting thing to watch was the incredibly influx of volume into INDEX:BTCUSD

As the week progressed into Thursday and Friday and equity markets sold off big the volume of trading in Bitcoin more than doubled... yet the price remained stagnant.

A month ago I did a study of correlation and relative movements between stocks and Bitcoin to answer the question: "What would happen to Bitcoin if Stocks Crash?" The TL;DR was that 75% of all weeks exhibited a positive correlation with nearly 50% a "high" correlation. Also, when equities have sold off big over the past decade Bitcoin had sold off at least two times or more.

Correlations are not an absolute and can change but this week something unique was clearly going on. If the standard correlation had been allowed to play out on Thursday INDEX:BTCUSD would have fallen more than -8% and Friday more than -11%. It would have triggered mass liquidations. But that did not happen.

This was a critically important Support for Bitcoin to hold and someone knew it... enter Ryan Cohen.

Michael Saylor with NASDAQ:MSTR is definitely NOT the one deploying cash to prop up Bitcoin.

His buys have been entirely NOT-Strategy-ic and has mostly bought highs. He has made a virtue out of being a really bad "trader" uncaring about price and timing. That plan has not worked to push Bitcoin to new a new All Time High nor saved it from the bear trend in 2025.

Cohen, however, is a renowned trader/investor that should know market structure and would have the sense to deploy cash at the perfect time. Just this week two things happened: Cohen took out a loan backed by his NYSE:GME shares and GameStop completed a convertible note offering, like Microstrategy has done, to raise 1.4 Billion in cash to buy Bitcoin. That gave him lots of cash at the critical point at the end of the week.

So do they get to win? Very possible. It depends on equities. If stocks rise in the coming week then the Bitcoin correlation may resume and INDEX:BTCUSD be lifted. If the U.S. economy enters a recession, the stock market route deepens, or if they used all of their available cash to exhaustion then the plan could fail and Bitcoin will fall in sync.

MSTR: Mid-term and Macro Price Structure As price holds below $344, odds favor a continuation lower to retest February lows, with later potential bounce and one more push to macro-support levels: 160/150-120 (with a potential extension to 105)

(see. recent idea on BTC price structure)

If BTC and broad market indexes show signs of stabilization and short-term strength over the coming weeks with MSTR price rising above 344, the odds are shifting to a more pronounce bounce to 400-460 resistance levels.

Weekly chart:

From a macro perspective:

as long as price remains below the 460 level, I consider the bullish trend since 2008 lows to have topped in November 2024, with current price action unfolding as part of a larger corrective Wave c.4 structure. Otherwise, If price reclaims ATH the door opens for an extension to 780-1280 resistance levels.

Monthly chart

Recent idea on BTC:

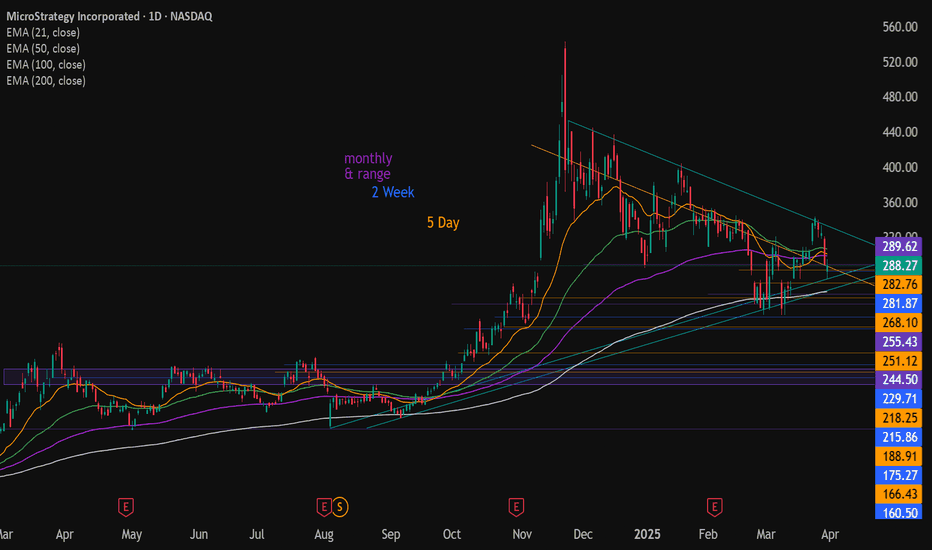

monthly and 2week @255.43 i doubt MicroStrategy will be able to hang on when all other crypto and stocks are breaking structure. the yellow trendline is the most touches i could get. all trendlines are on daily.

just broke below 100ema today. look where 200ema is. ???

since its going2b that kinda party, imma gonna stick my dikc in the mashpotatos~

Double down like Michael Chad Saylor - MSTR ----> MSTU 2X"Are you convicted?"

Of Bitcoin achieving a new All time high if so Saylor will greatly rewarded and lauded.

MicroStrategy's unwavering focus on acquiring Bitcoin through unconventional financing methods, rather than building a sustainable revenue-generating business, carries significant risks, especially if a major bear market were to hit the cryptocurrency sector again. This exposure to Bitcoin offers a distinctive investment opportunity for those looking to gain leverage in the crypto space without direct participation.

While MicroStrategy's inherent volatility may deter more traditional investors, it also provides a platform for those eager to engage with market dynamics. The MSTU adds an additional layer of volatility, but unlike options, it does not have an expiration date.

Investors should closely monitor Bitcoin's market fluctuations, as these directly influence MSTR's stock price, potentially creating advantageous entry points for savvy traders.

MSTR - MicroStrategy : Long Strategy

This stock Microstrategy Inc is showing some good recovery price action here on the 1Hr chart. It is a triple bottom and this is strong market structure, typical of a reversal sequence

The neckline is about 314 which will soon be taken. The chart has a very popular indicator FBB, Fibonacci Bollinger Bands. The middle line is derived from volume moving averages.

It is also bullish on the daily and weekly.

Fundamentals are good, I did hear they burnt through stacks of cash but this was for inventories. Future is bright for this techy and its these companies, Nvidia, Apple, Google etc that lead the markets bullish out of corrections.

Strategic $MSTR Accumulation: $340 Break for Macro ContinuationDecided to start buying back some $MSTR. I’ve been waiting since late December to begin accumulating, and I initially thought it would stay above $300, forcing me to jump back in.

Now that it's in an optimal buy area with enough confluence on the weekly timeframe, I’m accumulating under $250. I’ll add the last chunk once it breaks above $340.

Just keep in mind there’s a strong weekly downtrend in play, but it’s already hit the first target, so I expect a bounce. If it reclaims the POC at $340, it would invalidate the downtrend. So, I'm taking my chances on a possible invalidation and a continuation of the macro trend.

MSTR | Back to 120s / Double Digits | FractalPrice action blew off to a high around $540 and since then closed back under the historical close.

The goal here is to see price action consolidate under resistance in the preparation for a major sell-off

To invalidate all of this I would like to see more of an accumulation pattern back above major resistance, but if we see an increase in aggressive selling then price will be hunting for at least $120.

Price action also looked a bit familiar to the 2021 sell-off with the same blow-off-top and a ABC pattern breakdown

After the C sell-off price retraced back to B and then finally flushed out back to major support

Current price action has pretty much done the first phase and we should expect some consolidation before the next big move.

MSTR📊 MicroStrategy (NASDAQ: MSTR) – Technical & Simple Fundamental Analysis

1️⃣ Technical Analysis

🔍 Overall Trend Analysis

Long-term uptrend remains intact, but the stock is currently in a pullback phase from its $500 peak.

Testing 50-day EMA support ($238.91) – a key level for bulls to defend.

Short-term momentum is bearish, with declining RSI and a bearish MACD crossover.

📌 Key Levels

✅ Support Zones:

$230 - $240 → Testing 50-day EMA, crucial support.

$180 - $200 → Stronger demand zone if $230 fails.

$120 - $140 → Near 200-day EMA ($118.00), deeper correction level.

Below $120 → Supports at $100, $80, $60, $40 (historical levels).

🚀 Resistance Zones:

$280 - $300 → Immediate resistance after rejection.

$340 - $360 → Next resistance from recent peaks.

$420 - $500 → All-time high resistance.

📉 Indicators & Volume

📊 Moving Averages:

9-day EMA: $297.18 (short-term resistance).

20-day EMA: $297.58 (confirming short-term bearish trend).

50-day EMA: $238.91 (being tested as support).

200-day EMA: $118.00 (long-term uptrend remains intact).

📉 RSI (43.94) → Approaching oversold territory.

📉 MACD → Bearish crossover, showing downward momentum increasing.

📊 Volume → Selling volume increasing, but not extreme yet.

🔭 What to Watch Next (Technical)

✅ Bullish case: Price holds $230-$240 & reclaims $280.

⚠️ Bearish case: Break below $230 → Potential drop to $200 or lower.

2️⃣ Fundamental Analysis NASDAQ:MSTR (Simplified)

📌 Revenue: $57.53M (-3% YoY), Net Loss: -$670.8M in Q4 2024.

📌 Bitcoin Holdings: 478,740 BTC (~$45.1B market value, acquired for $31.1 billion).

📌 Capital Raising: Issuing $21B in preferred securities to fund further Bitcoin purchases.

📌 Stock Performance: Down last 3 months

📌 Workforce Cuts: Laid off 20.7% of employees in 2024.

📌 Rebranding: Now officially called "Strategy", symbolizing its Bitcoin-focused direction.

🔭 What to Watch Next (Fundamental)

✅ Bitcoin price movement – heavily influences MSTR.

✅ Earnings improvements – need to reduce losses.

✅ Institutional buying trends – support or sell-off?

🔥 Final Thoughts: MSTR is at a critical support zone. If Bitcoin remains strong, a bounce is possible. However, a breakdown below $230 could trigger deeper downside. 🚀📊

BTC, Fibs, Market Psychology, and You: A Primer The Setup

I've identified a compelling technical setup that suggests BTC could be heading toward the $9,000-$9,850 range. This isn't just another bearish call - it's based on a rare convergence of multiple technical factors that I've rarely seen align so perfectly in my 18 years of trading markets.

Technical Confluence Zone

What makes this setup particularly compelling is the convergence of multiple independent technical factors around the same price zone:

1. Unfilled CME Gap : The Bitcoin futures chart shows a persistent unfilled gap from 2020 between $9,655 and $9,850. This gap has survived multiple market cycles without being filled, making it increasingly significant.

2. Key Fibonacci Level : The 0.382 Fibonacci retracement level sits at $9,024.11, remarkably close to the lower bound of the CME gap when accounting for the typical futures premium over spot.

3. Elliott Wave Structure : The current price action suggests we're in Wave 4 of a larger Elliott Wave pattern. Wave 4 corrections often retrace to previous Wave 1 territory, which aligns with this target zone.

4. Fibonacci Time Cycles : The time component is equally important - Fibonacci time extensions suggest we're approaching a potential inflection point in the current cycle.

Market Context Supports the Technical Picture

The technical setup doesn't exist in a vacuum. Several market conditions increase the probability of this scenario playing out:

1. Market Saturation : The crypto ecosystem has expanded dramatically, with thousands of tokens diluting liquidity that was once concentrated in major cryptocurrencies.

2. Retail Exhaustion : Retail investors who entered during previous hype cycles feel unrewarded despite price recoveries, leading to diminished enthusiasm and buying pressure.

3. Institutional Distribution: Wall Street and institutions have made their presence known, which historically signals they've distributed their high-priced holdings to retail while preparing short positions.

4. Concentrated Leverage Risk : MicroStrategy's position of 499,500 BTC at a $66,000 average purchase price, funded almost entirely by massive debt issuance, creates a significant systemic vulnerability. A move toward our target zone would put extreme pressure on their balance sheet.

Broader Market Context

This analysis also coincides with what looks to be a tired stock market following the 2024 US presidential election. With Donald Trump winning his second term, we have seen significant policy shifts that are actively impacting both traditional and crypto markets. Historically, markets often experience increased volatility during transitions of power, and the confluence of this political shift with our technical setup creates an even more compelling case for caution.

Additionally, price precedes news. The news is created on price. If you're hearing about an event, the trade has already been made. There is too much talk of unprecedented institutional participation. This is another sign that retail is being distributed to for the next meltdown. Bags were already offloaded. It's time to drop the anchor.

Historical Perspective

Having traded through multiple market cycles since 2007 I've seen this pattern before. Large players often target overleveraged positions to acquire assets at distressed prices. Michael Saylor experienced a leveraged meltdown once before during the dot-com crash - history doesn't repeat, but it often rhymes. Saylor is a designated whipping boy. A patsy. He will be rewarded well for his participation in fleecing you, so don't worry about what kind of skin he has in the game.

With that said, I believe an undetermined Black Swan event will be necessary to complete the rug pull. What that is, I cannot know.

Trading Implications

This analysis suggests several potential trading strategies:

1. Risk Management : Reduce exposure to Bitcoin and high-beta altcoins until this technical target is reached or invalidated.

2. Opportunity Preparation : Build dry powder positions to capitalize on what could be an exceptional buying opportunity if BTC reaches the $9,000-$9,850 zone.

3. Watch for Triggers : Monitor for breakdowns below key support levels that could accelerate the move toward our target zone.

4. Time-Based Entries : Use the Fibonacci time cycle extensions to refine entry timing if the price approaches our target zone.

Conclusion

While Bitcoin's long-term prospects remain strong, the confluence of technical factors pointing to the $9,000-$9,850 range suggests a significant correction may occur before the next sustained bull run. The catalysts to reach what should be a $250k range this cycle simply do not exist, and with waning macroeconomic strength, the odds of this cycle being anything other than a massive bulltrap are low. This setup represents one of the strongest technical cases I've seen. I also don't care to share my ideas often, but with everyone expecting a typical crypto market cycle, I feel compelled to offer my take on a public forum--for whatever it may be worth.

I am not shorting this market. I have removed my capital and taken an observant position. While I feel strongly about my idea--Clown World has fully taken hold and I don't dare test its resolve to break me.

Remember that no analysis is guaranteed - always manage risk accordingly and be prepared to adapt as the market evolves.

*Disclaimer: This analysis represents my personal view of the markets based on technical analysis and market observations. It should not be considered financial advice. Always do your own research and trade responsibly.*

$SPY Short Term Bullish atm.. idea for BullsWell... seeing is we hit my target, I thought I might bless the Bulls with a little bit of Eye Candy.... This is what you want...

The Fib breakdown of the Golden Pocket above at the 1.61... we hit the retracement... and now back to the .78

We hold here and it can get bullish quick.

Bearish Path in Next post... otherwise we make a lower high and fall to $525 and fast.

Can MicroStrategy Save Bitcoin's Destiny?MicroStrategy’s dramatic stock decline has become a bellwether for the broader digital asset market. As its share price plunges, the company’s deep ties to Bitcoin spotlight a precarious balance between corporate strategy and the volatility inherent in the crypto space. This unfolding scenario challenges investors to reconsider the intertwined fates of traditional finance and digital innovation.

The company’s approach to using Bitcoin as a primary treasury reserve has been revolutionary and risky. Aggressive accumulation strategies, including debt financing and Bitcoin-backed loans, have magnified the impact of market fluctuations. With critical support levels now under threat, the risk of forced asset sales looms large—an event that could cascade through the crypto ecosystem and undermine confidence in digital currencies.

Amid these challenges, MicroStrategy is also pursuing bold financing initiatives to stabilize its operations. Plans to raise $21 billion through a preferred stock offering signal a dual objective: securing necessary capital and further investing in Bitcoin. This move reflects an ongoing commitment to a Bitcoin-centric strategy, even as recent transactions have resulted in significant unrealized losses.

In parallel, the cryptocurrency landscape faces unprecedented headwinds from regulatory pressures, geopolitical tensions, and emerging technological vulnerabilities. Financial professionals are compelled to balance risk with opportunity, rethinking investment strategies amid an environment where innovation meets uncertainty at every turn.

The looming threat of quantum computing adds another layer of complexity. As quantum technologies advance, their potential to break current cryptographic standards—on which Bitcoin’s security fundamentally relies—poses a significant risk. Should quantum computers overcome encryption protocols like SHA-256, the very foundation of blockchain technology could be compromised, forcing the industry to adopt quantum-resistant measures rapidly. This challenge not only underscores the volatility of the digital asset market but also inspires a deeper exploration into safeguarding the future of decentralized finance.