MTCH possible head and shoulders, high short interestMATCH possible head and shoulders on daily chart, high short interest at 45%. Below $69.9 would enter short with puts. The lawsuit is over fake accounts duping customers into buying subscription. This was similar to $meet stock couple years ago, where they had fake accounts or rumour of using site for sex workers. My stocktwits @hockeysniper

MTCH

Exclamation Points for the End of Oversold Trading ConditionsAbove the 40 (November 7, 2018) – Exclamation Points for the End of Oversold Trading Conditions

November 8, 2018 by Dr. Duru

AT40 = 40.5% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 37.4% of stocks are trading above their respective 200DMAs

VIX = 16.4

Short-term Trading Call: bullish

Commentary

Financial markets made their votes very clear after the U.S. 2018 midterm election.

Apparently, today’s rally in the S&P 500 (SPY) was the index’s largest one-day post midterm election rally since 1982. This exclamation of a data point does not take into account the gains (or losses) preceding the big day, but I suppose an extreme reaction makes sense on the heels of what was an extreme struggle with oversold conditions that included a declining 200-day moving average (DMA) for the first time in 2 1/2 years.

{The S&P 500 (SPY) gapped up and soared 2.1% with a bullish breakout above 200DMA resistance. The index closed right at the peak following the first oversold period in October.}

The S&P 500 closed at its high of the day, broke out above its 200DMA, and sliced through the 2800 level that proved so important starting in June (see the dark horizontal line in the above chart). The index is in a bullish position and looks ready to challenge its downward sloping 50DMA resistance directly overhead. The index will only flag the “all clear” after it finishes reversing all its losses from the big 50DMA breakdown that launched the market’s struggles with oversold trading conditions.

The NASDAQ and the Invesco QQQ Trust (QQQ) also gapped into 200DMA breakouts, adding to the market-wide exclamation points. Both tech-laden indices still have considerable headroom before challenging the first post-oversold high in October.

{The NASDAQ surged 2.6% and sliced right through 200DMA resistance.}

{The Invesco QQQ Trust (QQQ) gained 1.3% after opening with a gap up that perfectly coincided with 200DMA resistance.}

The iShares Russell 2000 ETF (IWM) lagged the bigger indices with a 1.8% gain. Small caps have the biggest challenge ahead as downtrending 50 and 200DMAs converge to provide what should prove to be stiff resistance. I am holding my core position of call options that I accumulated during the oversold period in anticipation of a rally into resistance by the end of next week.

{The iShares Russell 2000 ETF (IWM) did not cross any critical technical milestones with its 1.8% gain. Still the rally confirmed the current upward momentum.}

The volatility index, the VIX, featured prominently in my oversold trading strategy. The last tranche worked out spectacularly with one of the loudest exclamation points for this post-oversold period. I was focused on a post-election volatility implosion (again, without any prediction on the specifics of the outcome), and the market delivered. The VIX collapsed 17.8% and effectively reversed ALL its gains since the first oversold period began. This milestone is another bullish development. With a Federal Reserve pronouncement on monetary policy coming the next day, I did not want to take the risk of holding overnight my ProShares Ultra VIX Short-Term Futures (UVXY) put options which expire in just two days. In the near-term, I expect volatility gains to be more short-lived than during the oversold periods, so I am ready to continue fading the VIX.

{The volatility index, the VIX, lost 17.8% on the day. It is perched right at a critical juncture with almost a month of gains from oversold churn now lost.}

{The ProShares Ultra VIX Short-Term Futures (UVXY) lost 10.7%, a much smaller loss than I would have expected given the size of the VIX’s loss.}

As I wrote in the last Above the 40 post, long-term passive index investors should now feel comfortable returning to their regularly scheduled programming (a break of the oversold lows would change things of course). In the coming days, weeks, and months there will be a blitz of narratives and attempts to back into explanations of the market’s on-going machinations. The mid-term elections are over, but the same catalysts that the market has alternatively ignored and then obsessed over this year are largely still in place. This dynamic will provide plenty of fodder for distracting chatter that will open up short-term trading opportunities (swing trades) in what I expect to be an overall bullish trading environment through at least the end of the year.

AT40 (T2108), the percentage of stocks trading above their respective 40DMAs, soared today from 31.2% to 40.5% in a resounding confirmation of the bullish end to oversold trading conditions. AT40 rocketed off its historic low and kept slicing higher after the last oversold period ended. Even the conservative oversold trading strategy that triggers buys after the oversold period ends would have worked like a wonder. Note that between 40 and 60%, AT40’s level matters a lot less as it will be off the lower and upper extremes.

{AT40 (T2108) is now a rocketship shining the path higher for the stock market. It closed at a 5-week high and wiped away all its October losses.}

AT200 (T2107), the percentage of stocks trading above their respective 200DMAs, remains important as it still bears the scars of all the technical damage done through the two oversold periods in October. AT200 closed at 37.4% and has yet to pass its high following the first October oversold period. This longer-term breadth indicator still has a LONG way to go to wipe out October’s damaging losses.

{AT200 (T2107) printed a V-bottom from the epic lows of the last oversold period, but it is far from repairing the technical damage from October.}

The Australian dollar (FXA) versus the Japanese yen (FXY) is confirming the bullish tone with flashing green lights. AUD/JPY has rocketed right past the previous high. I ended my hedge going short the currency pair and will soon flip to ride the tiger (I also want to collect the carry and not pay it anymore!)

{AUD/JPY is in full bull mode as it has already sliced through resistance from its downtrending 200DMA and the previous highs.}

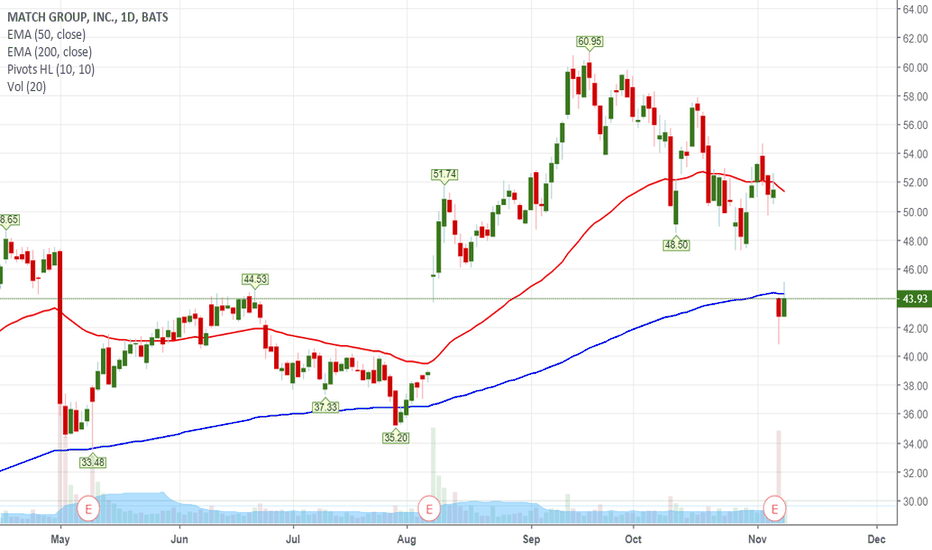

MTCH Stock dropping towards 31 handleSetup:

It was noted that MTCH stock could drop to the 31 handle.

Our setup is complemented by the following:

1. Multiple timeframe trend analysis

2. Divergence on H1.

Approach:

Our trade strategy is as follow: We will open two consecutive trades, they will both have the same stop loss but different take profits.

Trade 1:

Entry: 41.83

SL: 44.79

TP: 37

Trade 1:

Entry: 41.83

SL: 44.79

TP: 31.53

It should be noted that once TP1 is hit, we will move the stop loss of trade 2 to breakeven.

Risk & Reward:

Total Risk:

2%

Total Reward:

5 %

MTCH: Online Dating leader setting up long entry after FB scareMTCH: Online Dating leader Match.com took a nosedive with the announcement that Facebook will begin competing in its space. The technicals suggest a good buying opportunity is setting up as the major correction of the high degree 3 completes.

Match Group MTCH formed a pin barMatch group MTCH slowstoch is oversold and yesterday the stock formed a pin bar .

Slowstochastic is below 20 so oversold: pin bar could be a good signal for reversing the trend.

Stock strenght is above 85!

Watch the stock and lets see on lower timeframes if there is a entry signal (for example at 4h TF).

Disclaimer:

This is just my tought: don't invest based on this idea.

$MTCH Match Group Oversold - finding support around $37.50$MTCH Match Group Oversold - finding support around $37.50

Disagree with this steep sell-off. Facebook DAU demographics have shifted more and more toward middle aged adults. Most people of dating age, 20s & 30s, are using FB less and less. The type of people who would use Facebook to meet people to date are already using Facebook to meet people to date. This new functionality just formalizes it. Not too mention Match works on a subscription model with most customers fairly committed to the brand for the foreseeable future.

Buy the fear and panic selling

MTCH Inside day after new high long opportunityI don't really know too much about this company, but my sister says that all of her single friends are using their product.

Often times, a good trade comes from our daily lives!

Let's go back to the chart.

An inside day after historical new high is one of my favorite trade as there are not really much upside resistance, it's a classic momentum trade!

Let's see how it goes!