Multiple Time Frame Analysis

End-of-Session Market ReviewToday was a solid trading day with some interesting moves across the markets:

S&P 500: The market trended upwards from the open, gradually moving into and above the prior day’s value area, closing near the high of that range.

NASDAQ 100: After some initial back-and-forth, it climbed above the prior day’s high and value area, showing strength into the close.

Russell 2000: This market was quite choppy and balanced for a good part of the session, but eventually pushed up to close near the prior value area high.

Gold: It stayed range-bound, moving between the CVA high and the prior day’s value area without breaking out.

Crude Oil: We saw a significant drop right from the start, with prices falling about 1.5 points and ending the day lower, though still within the prior day’s range.

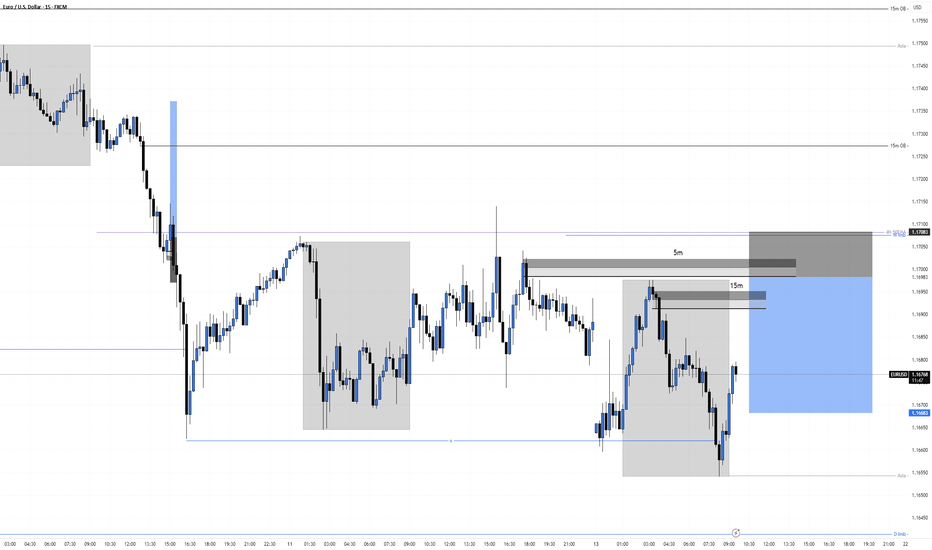

Euro Dollar: It tested the CVA low, dipped below the prior day’s low, and then bounced back to close around that level.

Yen Dollar: It started near the prior value area low, accepted below it by midday, and remained balanced in that lower range.

Aussie Dollar: Initially, it held above the CVA area and tested a higher level before sharply dropping below the prior day’s low and then balancing in that lower area.

In total, I took eight trades today. Two of them were in the Yen, both valid setups that didn’t work out and ended in stop-outs. I also took some long trades in the Aussie Dollar that I probably could have avoided since the market was choppy.

On the positive side, I managed risk well and ended up with two winning trades that put me in the green by about $1,200. Overall, I’d rate today as an A- day. Moving forward, I’ll focus on staying out of choppy markets, paying attention to the developing value area, and possibly using Heikin Ashi bars for better clarity.

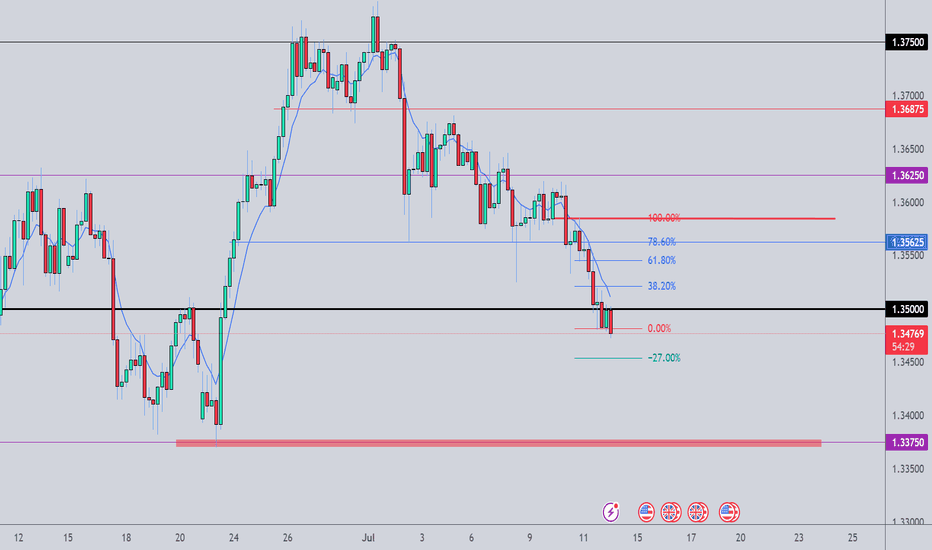

GBPCAD SHORTMarket structure bearish on HTFs DH

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Daily EMA retest

Previous Structure point Daily

Around Psychological Level 1.85500

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.04

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

WIF/USDT: Dog back on track?WIF is building a "Cup And Handle" pattern alongside a (hopefully) last trendline, Trendline 1.

That breakout would lead back to the main keylevel, which is also the neckline of a H&S formation on a higher timeframe. To make it even more funny, that H&S is "the handle" of a even bigger cup n handle pattern on the next HTF.

So the break of trendline 1 might bring us to the keylevel, and that might start the H&S being "priced".

USD/JPY sell opportunity approaching?USD/JPY is approaching previous swing high and resistance zone.

Bullish closure above the swing high (148.031) could indicate further push up.

Failure to close above swing high (bullish candle tapping into it, but only with the wig) and second bearish candle closing below the previous bullish opens sell opportunity.

SELL IDEA

entry: 147.928

SL: 148.196

TP: 145.970 (around 0.618 Fib retracement)

Potential second TP at 145.378 (0.5 Fib retracement).

PLEASE NOTE THIS IS ONLY AN IDEA

I am not a professional trader, but learning to analyse and looking to share ideas and get feedback.

Mid-Session Market InsightsMid-Session Market Insights

In today's session, I'm closely monitoring eight different futures markets: S&P 500, NASDAQ 100, Russell 2000, Gold, Crude Oil, Euro Dollar, Yen Dollar, and Aussie Dollar.

S&P 500: We're seeing a rotational pattern within the prior day's value area and the CVA. I'm eyeing long opportunities from the prior value area low up to the high.

NASDAQ 100: The market is a bit choppy around the PVA and CVA highs, with a slight upward intraday trend. I'm staying cautious here.

Russell 2000: Also choppy, but we've got acceptance within the CVA. I'm looking for long opportunities from the CVA low, which aligns with the prior day's low.

Euro Dollar: I'm currently short from the CVA high, with the first target at the prior day's low. We've broken below the prior value area, so I'll trail this trade and see how it develops.

Yen Dollar: It’s been a bit of a mixed bag. I took a short below the CVA and prior day's low, got stopped out, but it was still a decent setup.

Aussie Dollar: I took some long positions that weren't the best setups, as it was quite choppy near the CVA high and prior day's low. Lesson learned for next time.

Crude Oil: I took a short from the CVA and PVA highs, hit my target at the low of those areas, and we’re currently hovering around that level.

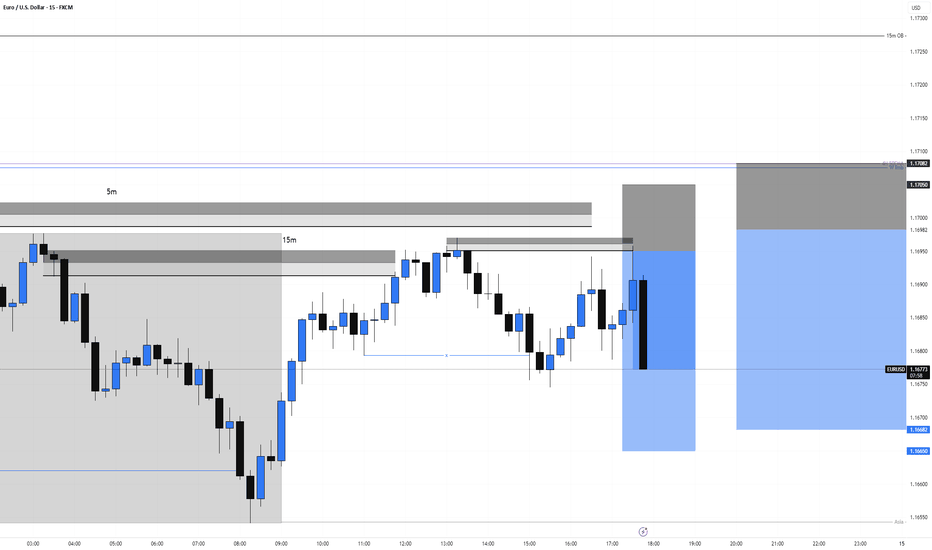

EURUSD Short re entry, 14 JulyHTF Downtrend with Clean LTF Setup

Bias remains bearish with HTF downtrend, W imbalance resting above, and 4H 50EMA close to our zone.

📉 Confluence:

Textbook LTF structure, expecting LH → LL

DXY reacting from 15m POI + Asia low to fill

15m Extreme OB + 5m OB as entry zone

Clean 1m BOS confirming sellers stepping in → add another 50%

🎯 Entry: 50% tap of 5m OB after 1m BOS

🛡️ SL: Above LH structure

📌 TP: At least 1:3 RR down to Asia low

⚠️ Minor risk with W imbalance above, but strong trend and confirmations to support the trade.

3 hours ago

Trade active

We got an 1mBOS from the 15m POI

Got 2 entry points now : The one from the 5m OB marked out on the photo and one at the lower 5m that created the break. Will see what happens

EURUSD Short, 14 JulyHTF Downtrend with Clean LTF Setup

Bias remains bearish with HTF downtrend, W imbalance resting above, and 4H 50EMA close to our zone.

📉 Confluence:

Textbook LTF structure, expecting LH → LL

DXY reacting from 15m POI + Asia low to fill

15m Extreme OB + 5m OB as entry zone

Clean 1m BOS confirming sellers stepping in → add another 50%

🎯 Entry: 50% tap of 5m OB after 1m BOS

🛡️ SL: Above LH structure

📌 TP: At least 1:3 RR down to Asia low

⚠️ Minor risk with W imbalance above, but strong trend and confirmations to support the trade.

Verizon May Be Rolling OverVerizon Communications has been rangebound for more than a year, and now some traders could think it’s rolling over.

The first pattern on today’s chart is the May 2022 low of $45.55. VZ fell below that level in late 2022 and rebounded to it by mid-2024. The stock has been stuck below the same level since, including a rejection in March. Has old support become new resistance?

Second, prices have slipped below the 50- and 200-day simple moving averages (SMAs). The two SMAs are also close to each other. Those points may reflect weakening longer-term trends.

Third, the telecom stock has made lower highs since April -- even as the broader market broke out to new all-time highs.

Next, VZ just had its lowest weekly close since February. The 8-day exponential moving average (EMA) is also below the 21-day EMA. Those points may suggest that bearishness is taking hold in the short term.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

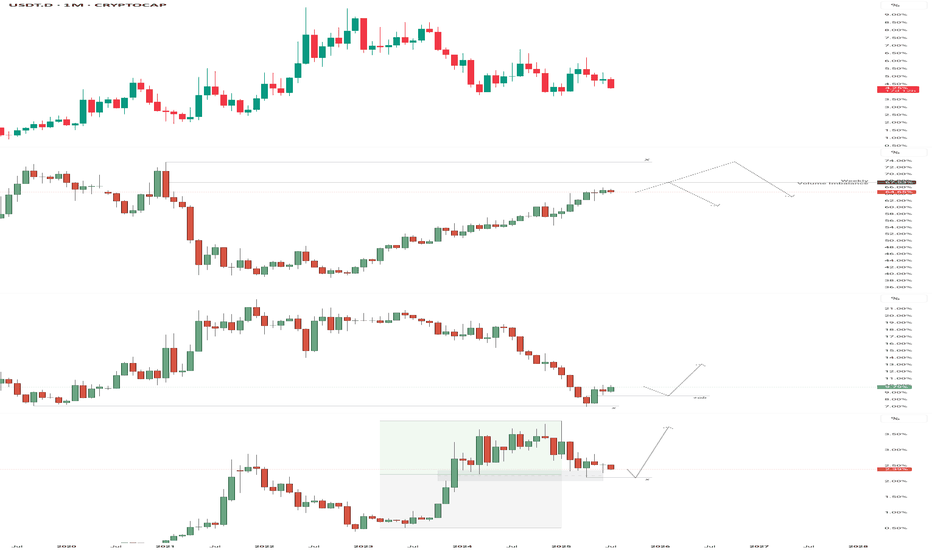

Capital Flow Outlook – BTC Leads, Alts Await a SignalOver the past two quarters, Tether's (USDT) market cap has expanded by over 66%, rising from ~$95B in late 2024 to ~$159.5B by mid-July 2025. This confirms a strong capital injection into the crypto space — reminiscent of early bull market cycles.

But where that capital flows tells the deeper story:

USDT.D is in a clean downtrend, showing that capital is actively rotating out of stables — a risk-on signal.

BTC.D continues climbing, confirming Bitcoin as the primary recipient of inflows. While the current move hasn’t reached exhaustion, the nearest potential reversal point is the weekly volume imbalance at ~67.5%.

Should that level fail to trigger a reaction, the next major reversal zone lies near 73% — the last known macro ceiling for dominance.

ETH.D has shown a structural shift, bouncing from a key macro low with a clear Change in State of Delivery (CSD). A revisit to the April high around 8.55% is looking increasingly likely.

SOL.D is fighting for structure, having reacted to a mid-point imbalance situated in the discount zone. This positioning is favorable for buyers, but structurally it still leans toward sweeping the April low at 2.13% before a valid CSD can form.

---

🧠 Conclusion:

While capital is clearly flowing back into the market, Bitcoin remains the primary destination. Until we see:

A reaction or rejection at BTC.D reversal zones

ETH.D continuing upward toward prior range highs

And SOL.D confirming a structural shift from discount

...a full altseason expansion remains premature.

> The capital is here — but the rotation isn’t.

Altseason is still brewing — and could take the rest of the year to fully materialize.

— Silent Edge

Bitcoin Fractal, increase to $116k Hi Everyone☕👋

BINANCE:BTCUSDT

Been such a long time since I posted. Today I'm looking at BTCUSDT, and I'm looking at the previous all time high cycle and what we were seeing (the pattern aka fractal).

Here's why we're likely going a little higher.

First correction of -32%

Followed by first peak, ATH

Correction, then the second peak and the REAL ath. Which is where we likely are:

Interesting to note that the previous time, the second ath was NOT THAT MUCH HIGHER. This should be considered to manage expectations in terms of how high we can go. Anything above +6% is a bonus.

XAU/USD 14 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

GBPUSD| - Bullish BiasHTF Overview (4H): Strong bullish structure in play, with multiple highs being broken and momentum firmly to the upside. Price is clearly respecting bullish order flow, suggesting continuation.

MTF Refinement (30M): Identified a 30M OB aligned with the trend. Waiting for price to mitigate this zone, as it could serve as the springboard for the next impulsive leg up.

Execution Plan: Once the 30M OB is mitigated, I’ll drop to LTF (1M/5M) to watch for confirmation — CHoCH, BOS, or microstructure shift — before executing longs.

Mindset: Bull momentum is intact — patience and confirmation are key to riding it with precision.

Bless Trading!

USDJPY| - Bullish Play Within Bearish HTF ContextHTF Overview (4H): Structure is still technically bearish, with buy-side liquidity (BSL) untouched and a major 4H supply OB unmitigated above. Expecting price to seek out that zone before any full reversal.

MTF Refinement (30M): Refined structure shows a potential bullish leg forming to push toward the 4H supply. Price is reaching for nearby sell-side liquidity (SSL), acting as inducement.

Execution Plan: Waiting for a clean sweep of SSL. Once that occurs and the 30M OB is mitigated, I’ll drop to LTF (1M/5M) to confirm bullish intent with CHoCH or BOS before executing a long.

Mindset: Playing the internal bullish wave with precision while respecting higher timeframe narrative. Quick to react if the HTF bias reasserts itself.

Bless Trading!

XAUUSD (GOLD) - Bullish BiasHTF Overview (4H): Structure remains bullish after a recent break of highs. Liquidity above was taken, followed by a clean mitigation of a 4H OB — signaling strength and smart money continuation.

MTF Refinement (30M): Aligned with the bullish narrative, 30M shows price is likely reaching for nearby sell-side liquidity before resuming the upward move. Watching for price to sweep that liquidity zone next.

Execution Plan: Once the 30M OB is mitigated, I’ll drop to the 1M/5M for internal structure shifts — CHoCH or BOS — to confirm long entry.

Mindset: Not chasing — letting liquidity play its role and waiting for the OB + confirmation confluence before executing.

Bless Trading!

GBPJPY - Bullish BiasHTF Overview (4H): Price broke bullish structure with clean directional intent. Order flow remains aligned to the upside with no immediate signs of weakness.

MTF Refinement (30M): Zoomed into 30M for deeper structure clarity. Observing price actively reaching for sell-side liquidity (SSL) below a key low — a classic inducement setup forming.

Execution Plan: Waiting for a liquidity sweep below the SSL. Once swept, I’ll monitor the nearby 30M OB for mitigation. LTF confirmations (1M/5M CHoCH or BOS) will be needed before committing to a long entry.

Mindset: Patience over prediction — let liquidity do its job, then ride with smart money.

Bless Trading!

NASDAQ - Bullish BiasHTF Overview: 4H shows strong bullish intent with momentum driving price higher. Clear upside direction supported by sustained breaks in structure.

Liquidity Note: Noticed a key liquidity zone beneath current price (marked in blue). Although deeper mitigation was possible, price remained bullish.

MTF Refinement (30M): Dropped to the 30M for structural clarity and saw an earlier reaction. A bullish OB was formed and respected — now monitoring it for a potential mitigation.

LTF Execution Plan: If the 30M OB is revisited, I’ll be looking to the 1M/5M for confirmation (CHoCH or BOS) before executing long positions.

Mindset: Momentum is with the bulls — just waiting for smart money to confirm their next move.

Bless Trading!